Stock trading involves the price prediction of equities. Forex trading attempts to profit from the moves in currency exchange rates. While it is true that currencies are less volatile than share prices, leveraged trading can increase potential forex profit enabling it to be traded alone or as a part of a diversified portfolio.

In this post, we will discuss what forex is and how it compares to stock trading.

Foreign exchange, or “forex”, and stocks are two of the most popular investment choices. They both offer the potential for profits, but each comes with unique characteristics and risks.

Please see the summarized table where each item will be expanded below.

| Stock Market | Forex Market |

|---|---|

| Moderate Market Size / Volume | Largest Market Size / Volume |

| Separate Buy & Sell Transactions | One Exchange Transaction |

| Volatile / Moderate Volume | Low Volatility / High Volume |

| 8 Hour Markets | 24 Hour Markets |

| High Capital Commitment | Low Capital Commitment |

| Wide focus | Narrow Focus |

Each has its investment merits and represents dynamic ways to participate in the capital markets. There are, however, critical differences in their purposes and trading mechanics. But before we hit the enter button on our trade orders, let’s better understand what makes forex and stock trading so different.

It’s All Euros to Me

Stock investing may be more intuitive as compared to forex investing. It makes sense that we buy stocks to receive partial ownership in a company that we think will have excellent future financial performance. We scoop up shares that we believe are good bargains and can increase our wealth.

Forex may be more of a foreign concept. We typically think of international currency as “funny money” we exchange our dollars for when traveling abroad. But people invest in it? They sure do, and in great magnitude.

Believe it or not, the foreign exchange market is much bigger than the stock market. It is the world’s largest financial market, with trillions of dollars in daily transaction volume. It has become an increasingly popular trading venue for new and experienced traders alike.

See Spot Run

Forex trading is also known as spot trading. The word spot refers to an agreement between two parties to exchange two currencies at a specific price on a specified date. The specified date is when the transaction settles, and two days is the standard. The exchange rate of the transaction is the spot exchange rate.

When we enter a forex spot trade, we agree to sell one currency and, at the same time, buy a different currency. Thus, the term foreign exchange.

In contrast, we hand over currency for a different financial instrument — equity when we buy stocks. When we decide to sell a stock, we receive money in return. This is a crucial distinction between stocks and forex.

A Pair Primer

In forex, the financial instrument is a currency pair. A currency pair quotes the price of one currency in terms of another. For instance, if one U.S. dollar is the equivalent of 107.5 Japanese yen, this would effectively be the price of the dollar in yen. If we were interested in exchanging (selling) our dollars to receive (buy) Japanese yen, this would be the price per dollar.

Their exchange rate links currencies in the forex market. This rate is the exact exchange rate we see when exchanging money at a bank or one of those odd airport kiosks. Every currency pair has two sides to the story, meaning it can be flipped upside down to get the value of one currency in terms of the other. In our example, one dollar equals 107.5 Japanese yen, and one Japanese yen would equal 0.0093 dollars.

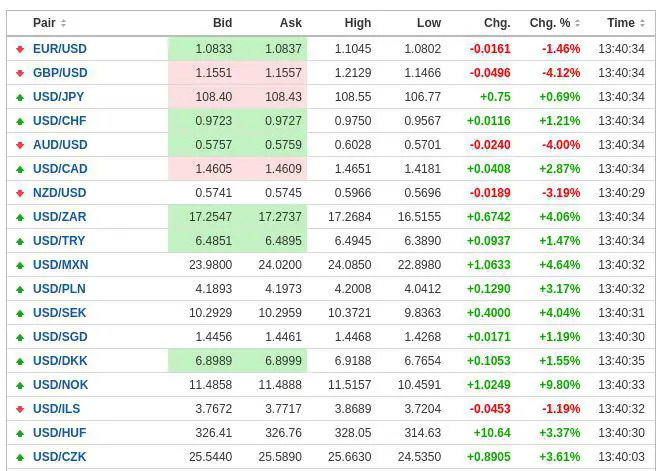

Foreign Currency Pairs Example

Why Invest in Forex?

We may choose to invest in foreign currency not just because we need it for that well-deserved vacation destination but because we think it will increase in value. This is the same rationale behind stock investing. We buy stocks because we believe they’ll go up in value.

The difference with forex is that the investor thinks one currency will go up in value relative to the other currency. You can think of this relativity as a seesaw. When one currency increases in value, the other decreases by the same percentage. If the British pound appreciates 2% against the U.S. dollar, then the U.S. dollar has depreciated 2% against the British pound.

Betting on currency direction is considered speculative investing because the investor essentially bets another investor that one currency will go up or down relative to another. Stock investments can also be regarded as speculative, although this term is typically reserved for investing in high-risk securities such as penny stocks.

Systematic momentum strategies often incorporate forex as a diversifying, positive-expectancy return stream.

Another purpose of forex investing is to hedge an existing financial position. Say you are a U.S investor that owns an investment in a French company denominated in euros. The value of that investment would be directly affected by the euro’s value. To protect against an adverse movement in the euro, you may establish a dollar/euro forex position that would benefit from a fall in the euro. This position would help offset the loss from a decline in the euro. This protection is called forex hedging and is another reason an investor may enter the foreign currency market.

Exchanges Vs. OTC Markets

Stocks are bought and sold at significant exchanges such as the New York Stock Exchange (NYSE), the world’s largest stock exchange located on famous Wall Street in lower Manhattan. There are similar stock exchanges worldwide, including the London Stock Exchange, Toronto Stock Exchange, and the Australian Securities Exchange. It is here that the nuts and bolts of stock trading get done.

While investors can buy and sell stocks from the comfort of their living room, a stock trade must go through one of the physical exchanges. These official exchanges provide a level of safety to the investor because they supervise the stock trading process to ensure that order execution is fair and orderly. Investors get to see a record of the transactions made in a company’s stock through trading logs known as order books.

On the other hand, foreign currency trading occurs in an off-exchange or over-the-counter (OTC) market. Not unlike over-the-counter medicines, forex is exchanged directly between two parties without the need for special permission or oversight. There is not an entity that supervises the buying and selling of currencies. Forex transactions are performed through digital sites privately between a buyer and a seller. There is a higher risk that one of these people will not hold up their end of the bargain, also known as counterparty risk. This risk is the chance that a forex trader may default on their contractual obligation.

Trading Availability

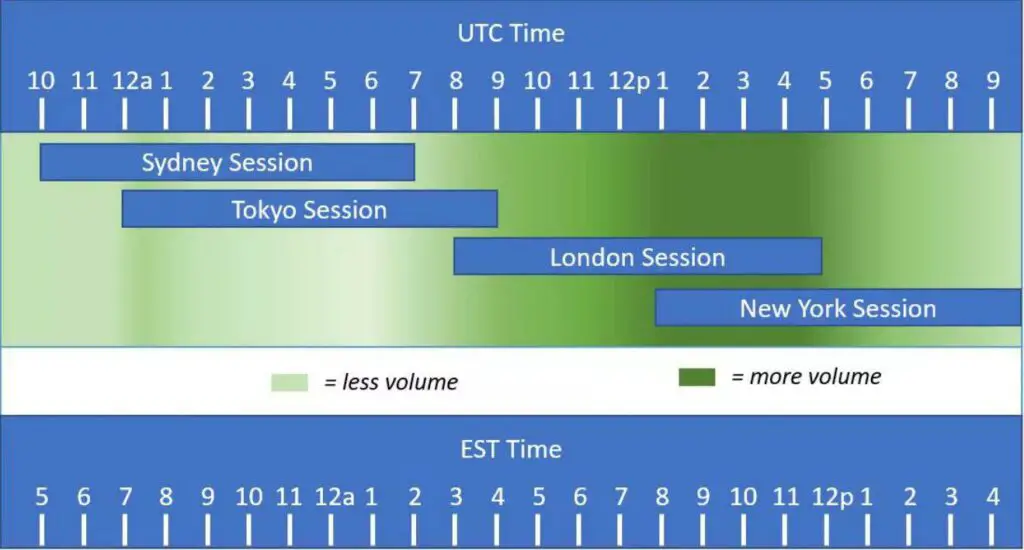

Another key difference between stocks and forex is trading availability. The world’s major stock exchanges set their daily trading hours that are usually nine hours in duration. The regular session of the NYSE goes from 9:30 am EST to 4:00 pm EST. After-hours trading takes place from 8:00 am to 9:30 am and 4:00 pm to 5:00 pm. A stock trader in the U.S. generally trades within these hours and takes nights, weekends, and holidays off to recover (especially in the current market environment).

On the other hand, Forex trading is available 24 hours a day. This availability is because the global currency demand is continuous. Many multinational businesses operate around the clock and need to access foreign currencies. Forex trades happen around the clock on the OTC market.

The Capital Commitment

Does investing in stocks or forex typically require more money? The answer is stocks. This is because the price of a company’s equity shares can be 10, 100, or even $1,000 each.

The second reason stocks require more money is due to volatility. Stock prices and stock portfolio values fluctuate more daily.

There is a lower capital requirement involved with forex as the market is much less volatile, which appeals to many new investors.

When you place a forex trade, you price it in pips. A pip is a unit of measurement for currency movement and is the fourth decimal place in most currency pairs. If the EUR/USD moves from 1.0922 to 1.0923, that’s a one pip move. Most brokers provide fractional pip pricing, so you’ll also see a fifth decimal place, such as in 1.09227, where the seven is equal to seven-tenths of a pip, or seven pipettes.

Forex offers a way to become involved in the capital markets without needing as much capital as stocks, but it also contains some additional risks.

Trading with Leverage

More seasoned forex investors often take on debt as leverage to multiply their gains. This leveraging can create significant risk. If leveraged currency bets go wrong, losses can mount rapidly and eat away at the initial capital investment. On the flipside, outsized gains can be achieved if forex trades are executed successfully with leverage.

Leverage refers to establishing a position in an asset that exceeds the amount of an account’s capital by borrowing money. More commonly called margin trading, a broker may offer an investor the opportunity to place trades at a certain multiple of their account size. For example, a trader with a 10,000 account with 50:1 leverage can put up to 500,000 worth of trades. Of course, the account owner remains on the hook for the money borrowed to trade.

Forex traders can be very dependent on leverage. This is because, compared to stocks, foreign currency prices don’t move that much. A one-day move of 0.5% can be a lot in the foreign currency. It is not uncommon for a foreign currency to budge less than $0.001 throughout an entire trading day. Forex traders, therefore, employ leverage to increase their trade power to account for the limited fluctuation in currency prices.

Leverage still very much exists in the stock market, but as stock prices are more volatile, it is relied on to a lesser extent. Brokerages tend to offer lower margin ratios in stock market trading, usually closer to 2:1.

How Do Spreads Compare?

In the world of investing, we often hear the term spread. This is not referring to the buffet in the advisor’s break room but rather the difference between the bid and ask price of a financial security. The asking price is how much a buyer is willing to pay for the asset. The bid price is how much a seller requires to part with it.

With stocks, these spreads can be rather large comparatively. There is often a wide gap between the bid and ask price, especially for smaller, thinly-traded stocks. More prominent stocks, such as those that comprise the S&P 500 index tend to have narrower spreads.

A distinguishing characteristic of forex instruments is their small spreads. This relates to the massive size of the forex market and its high level of liquidity.

This goes doubly for major world currencies such as the U.S. dollar, British pound, euro, and Japanese yen. These are the currencies that have the highest trading volume. With so many people jockeying for currency pair trades, the bid-ask spreads can narrow. Forex spreads are essential to understand because they measure how much of a leap a trader must make from their desired execution price for a trade to happen. Since larger spreads can add up over time for a stock investor, currency traders often find this an advantage of forex.

Stock Versus Forex Trading Platforms

Although the lower capital requirement feature makes it easier to get started in forex trading, finding a brokerage that offers this service can be challenging. Virtually every U.S. brokerage house offers stock trading through the NYSE and Nasdaq. But they do not all offer forex trading. Investors interested in just stock trading have plenty of suitable platforms, but the choices are more limited for forex trading.

Some providers offer both for those not interested in using multiple trading platforms.

Choices, Choices, Choices

Having many investment choices is a desirable trait of a financial market for some of us. For others, this can be overwhelming, and a limited investment menu is considered easier to navigate.

Stock trading platforms have access to thousands of stocks. As most submit trades through both the NYSE and NASDAQ, this gives stock traders more than 5,000 shares to choose from. Throw in exchange-traded funds (ETFs) and American Depository Receipts (ADRs), and the choices are even more significant.

Those who prefer a smaller investment options menu may gravitate to the forex market. Many brokerages offer forex trading as an add-on feature focused on the major currencies. This includes the world’s most traded currencies — the U.S. dollar (USD), Canadian dollar (CAD), euro (EUR), British pound (GBP), Swiss franc (CHF), Japanese yen (JPY), Australian dollar (AUD), and New Zealand dollar (NZD). Platforms like forex.com offer trading in several more foreign currency pairs.

How are Stocks and Forex Similar?

Even though forex trading takes place outside of the traditional exchange environment, as with stocks, trades get executed through brokerage companies. Brokers buy and sell various securities on behalf of the investor for a small fee, although most brokerage platforms have recently adopted zero commission trading policies.

The same macroeconomic forces can affect stock and foreign currency prices. Geopolitical events, economic data releases, and similar broad market factors can affect the perceived stability of entire countries. This affects the perceived value of individual currencies and companies that have exposure to various national economic and political issues.

Many stock and forex traders attempt to profit from their activities using technical analysis to time their entries and exits. Technical analysis studies price and volume patterns in financial securities to determine when to buy and sell.

The Last Word

While there are some similarities between stocks and forex, there are far more differences. Stocks and forex can be traded profitably for long-term investors and short-term traders.