Proprietary trading occurs when a trader trades stocks, bonds, commodities, and other financial instruments with a firm’s own money. Traders who make these types of traders are often called prop traders, short for “proprietary traders”.

Prop Traders often use advanced trading software and automated platforms to place most of their trades. The traders at Prop firms use various trading strategies like Merger Arbitrage, Global Macro, Volatility Arbitrage, and Index Trading.

Prop Traders earn a base salary that remains almost the same even after career growth. However, they earn handsome bonuses on the profits that they make.

What Is Proprietary Trading?

Proprietary trading is a method by which a commercial bank, financial firm, or independent trading organization targets direct market gains from trading its capital. Also called “prop trading, “it involves trading stocks, bonds, commodities, currencies, or other instruments. The prop trading firm trades these securities in its account, sometimes referred to as a Nostro account, rather than doing so with client money.

This is where the significant difference lies when compared to hedge funds. Hedge Funds use clients’ money and receive payments for generating gains on such investments. Also, hedge funds are accountable to the clients, in contrast to proprietary trading firms.

There are two ways in which a Proprietary Trading firm functions:

Directional Trading

XYZ bank has a dedicated Prop Trading desk. Based on market information and other research methods, the bank purchases many shares of a company, say Corp International, through this trading desk. XYZ buys 20 million shares of the company at $5 each, thus investing $100 million. If the share price goes up, XYZ stands to gain significant returns. However, if the share price drops due to certain factors, XYZ bears the losses. Hence, when the Prop desk decides to trade using its capital, it also exposes itself to many risk factors.

Market Maker

Suppose a corporation wants to trade a massive amount of highly illiquid security. Naturally, there won’t be many buyers or sellers interested in this transaction; therefore, a proprietary trading firm springs into action.

Thus, prop traders act as the buyer or seller, initiating the client’s trade. They become market-maker and take on the risk of holding those securities to facilitate the transaction. The prop trading firm focuses on the core markets, finds liquid investment avenues, and uses sophisticated trading strategies to optimize the trade’s performance. However, the prop trading firm also has to bear the risk in case of adverse price movements.

So, is profit the only reason why firms opt for Prop Trading?

Making an excess profit is one of the main reasons commercial banks and other financial institutions are involved in prop trading. According to How Brokers Can Survive in Mature Markets in WallStreet & Technology, Matt Samelson, principal, and director of equities for Woodbine Associates stated: “Brokers have struggled to keep their offerings competitive and their operations afloat in an environment in which trading commissions have steadily declined and margins have become razor thin.” He also added, “Trading is now more rigorous. The buy-side became empowered, algorithm use exploded, and the use of direct market access mushroomed.”

Due to stiff competition between the broking and financial firms, financial institutions operate on thin margins, which may not be enough for their survival. Hence, these firms go for Prop trading so that the revenue and profit would help them to sustain themselves over the long run. Moreover, the prop firms that were a part of large Investment banks involved in M&A deals were usually privy to insider information, which gave them an edge over the regular retail investor. However, such instances were heavily scrutinized by regulators.

The ability to leverage sophisticated modeling and trading software for critical decision-making also adds to these firms’ advantage. However, I must mention that Proprietary trading is somewhat risky and results in fluctuating returns.

Some of the strategies that Prop traders use for maximizing their profits are index arbitrage, merger arbitrage, volatility arbitrage, global macro-trading, alternative data analysis, and volatility arbitrage.

Here’s a look at how Prop Trading works in the real world:

History of Prop Trading

Prop Trading firms existed three to four decades back; however, they functioned differently from what it is today. There was no retail trading, and investors who wanted to participate in the markets could only do so through intermediaries such as banks or equity managers. Proprietary trading was one of the first employment models wherein a trader would be placed at an institution and use his capital to trade and absorb any possible risk. The stock exchange allows the trader to place orders through an exchange membership and uses the firm’s pool account.

These early prop firms had become extremely popular because of the opportunity they were creating and receiving a consistent flow of experienced traders who were willing to trade for them.

A decade ago, when disruptive technology took over, prop trading firms, especially the quant prop shops, used highly specialized software and trading algorithms to earn high profits. Investment banks and commercial banks in the major financial capitals established a prop trading desk. These financial institutions offered lucrative deals to the prop traders and profit-sharing deals.

In recent years, Wall Street investment banks have witnessed squeezing margins due to the prevalence of Direct Market Access and the decline of full-service equity commissions. Additionally, other low-cost electronic trading platforms pushed the equity commission lower. Investment banks desperately looked for a sustainable business model to counter these trends, and the Prop trading firm was the perfect solution.

The prop trading firms mushroomed as major financial institutions tailored their business model based on the new technology. Today, a proprietary trading firm has made its presence felt in every market, including share trading, commodities trading, index trading, forex trading, etc.

How Does Proprietary Trading Work?

As Prop Trading is highly dependent on high-end software and automated trading platforms, is there still a need for human traders? The answer depends on the kind of trading firm we’re discussing. While some function like high-end tech companies, some function as trading firms supported by tech.

The automated trading software can calculate Option Greeks, quote bid/ask spread, and input the market data. Nevertheless, human traders need to modify algorithmic trades, identify new opportunities, manage overall risk, and hedge their positions.

There is also proper differentiation in the roles of a Quant Trader and a Developer. The latter is wholly involved in the core programming, while the Quant Trader focuses on designing algorithms and limited programming.

Relationships to Banks

Prop trading evolved at the banks, after which several banks involved traders with specialization in proprietary trading, with intentions of earning profits over and above market-making. The proprietary trading divisions in the banks functioned as internal hedge funds within the bank. They were separate from flow trading that was only restricted to executing client orders as per directions. Among all the trading desks a bank has, the Proprietary desks witnessed the highest value at risk.

However, due to stringent financial regulations like the Volcker Rule, several significant banks have separated their prop trading divisions or discontinued them. Thus, Proprietary trading is now offered as an independent service by core prop trading firms.

The Volcker rule was brought into force by the former chairman of the Federal Reserve, Paul Volcker, after the financial crisis in 2008-2009. It is a part of the Dodd-Frank Wall Street Reform and Consumer Protection Act. The rule imposes restrictions on the banks from involving themselves in speculative transactions that have no particular benefit to the depositors. This applies to investing or owning a private equity fund or hedge fund. According to Volcker, when commercial banks get involved in high-speculation investments, it jeopardizes the stability and integrity of the entire financial system. Prop Trading is a relatively high-risk game. Some proprietary trading firms resorted to derivatives as a risk mitigation strategy to circumvent this. However, this only exposed other areas to increased risks.

Separating the proprietary trading division would enable banks to remain objective in conducting activities, keeping customers’ interests in mind, strengthening the bank’s balance sheet, and limiting conflicts of interest.

Critics of the Volcker Rule view it as a rudimentary and meaningless government act unfavorable to the financial industry. They say that the proprietary trading activity offers necessary liquidity for investors, which will be hampered if proprietary trading is restricted.

Conflicts of Interest

Numerous conflicts of interest might arise due to proprietary trading. To profit from the resulting price increase, the sell-side traders often purchase the same stock that their buy-side customers are buying. This adversely impacts their clients.

Another area of conflict that could happen is when the proprietary traders purchase poorly performing securities. Because of this, the investment bank might demand their institutional desk to convince them to buy these shares.

Thirdly, as investment banks play a crucial role in mergers and acquisitions, there is a possibility that the traders might use their power to access inside information and leverage merger arbitrage.

Because of the unwarranted use of insider information in 2007, Australia’s Securities and Investments Commission (ASIC) filed a complaint against Citigroup.

Citigroup was acting as an advisor to Toll Holdings in its attempt to take over Patrick Corporation. At the same time, it also actively traded in the shares of Patrick Corporation. ASIC argues that Citigroup had a duty to disclose to Toll Holdings that it was actively engaged in proprietary trading of Patrick Corporation, its target company. Interestingly, when Toll Holdings launched its bid for Patrick Corporation, Citibank was the fifth-largest holder of Patrick’s shares.

Proprietary Trading Strategies

Prop Traders leverage various trading strategies to make the most of market movements and earn excellent profits. Some traders exclusively use specific techniques, while some use a mix of strategies. Traders in traditional prop firms often bring their trading strategies to the desk. Here are some of the most-used trading strategies that proprietary traders use:

Volatility Arbitrage

Volatility Arbitrage traders bet on the difference between the implied volatility of the option and the actual market price of the underlying asset.

If the trader anticipates that the asset will have greater volatility in the future, they can go long on a call option and short on the underlying asset. In case the volatility rises in the future, the option’s value would also increase. “Vol arb” is riskier than many other types of arbitrage. In case of black swan events or an unforeseen occurrence, the option’s value is affected.

Global Macro

Global Macro trading strategy focuses on several macroeconomic and geopolitical events worldwide. The prop traders who work on global macro strategy operate differently from other traders. To implement this strategy, the prop traders analyze various economic factors such as GDP, interest rates, currency movement, trade imbalances, etc., that impact the entire world. They make informed guesses about how these events can impact security prices.

Merger Arbitrage

Merger Arbitrage, also called “risk arbitrage” is an investment strategy in which traders purchase firms’ stock undergoing mergers and acquisitions. While executing this strategy, the traders can buy and sell stocks of even more than two merging companies that can help to create profitable opportunities with minimal risk. A prop firm faces a significant risk while using the merger arbitrage strategy when the highly anticipated merger doesn’t take place at all or is delayed indefinitely. The target company’s stock sells for a price lesser than that of the merged entity when the deal happens. Prop traders anticipate that the difference between the two prices will help them earn a profit.

Index Arbitrage

Index Trading, or “Index Arb”, seeks profits from the difference between the stock’s actual price and the estimated future price of the same stock. An index is made of a weighted sum of various components. The ones who react to the market instantly are known as Leaders, and the others are known as Laggards. A proprietary trader must identify the leaders and laggards and the opportunity to earn profits if he believes that laggards can overtake the leaders in the future. This statistical arbitrage strategy entails purchasing the lower-priced index and selling off the higher-priced index until the price returns to equilibrium.

Alternative Data

Alternative Data trading involves using hard-to-get or costly data, such as geolocation data or credit card information, to get ahead of investing trends.

Chart Pattern Analysis

Chart Pattern Analysis involves traders analyzing chart patterns looking for confluence, and trading the signal. This type of trading is typically completed at trading organizations by discretionary traders.

Pros & Cons of Proprietary Trading

Proprietary trading has a lot of unique features. While some add to its appeal, others add to its risk.

Benefits

Proprietary trading strengthens the firm’s earning power due to lucrative trades in the financial markets. Simultaneously, not dealing with clients’ funds also allows the people at day trading jobs to take on more risks. Also, the traders are only answerable to their firms. Proprietary trading firms start believing that access to unique and valuable information gives them an edge over others, and they can reap huge profits. Here are some more benefits of Proprietary Trading.

Profits

Instead of being a broker and getting paid commissions for placing client trades, a prop trader enjoys a share of the profits in a broader capital base. In an ideal scenario, a prop trading firm gets another “hopefully” uncorrelated income stream while the prop trader gets more capital to trade, which leads to a larger paycheck. Hence, it is a win-win situation.

A bank can also enjoy speculative transactions as it is not accountable to the clients as a prop trader. Higher profits generated by prop trading translate to increases in annual and quarterly earnings of the parent financial institution.

Inventory Ability

This advantage is related to the Prop firm’s market-making function. Proprietary firms can store securities for future use. Once a firm purchases excess securities during a speculative trade, it can keep selling them to the clients at a reasonable time, earning profit. However, if the bulk securities lose their value, the prop trading firm must bear the losses. The second advantage of stockpiling the shares is that these financial institutions are well-prepared when the market becomes illiquid. This is because the Prop Trader will act as a buyer or seller of securities.

Disruptive Technology

One of the most intriguing parts of being a Prop Trading firm is access to high-end trading platforms, advanced software, and automated trading. These tech-oriented trading platforms open a wide array of opportunities and markets for the traders and empower them to participate in High-Frequency Trading. In most cases, the prop trading firms keep the trading platform for exclusive use and reap massive benefits from it. The support of disruptive technology enables a trader to design an idea, assess its viability, and test the ideas on the same platforms.

Market Liquidity

When large investment banks back a prop trading firm, they can execute gigantic trades. They add a lot of liquidity to the market, making it easier for the other retail traders to purchase and sell securities. Moreover, a firm involved in prop trading also assumes the role of a market maker, which puts it in a position to influence the market to a certain extent.

Drawbacks

Even though there are many benefits for Prop Trading, it is not a bed of roses. We know that it is a risky bet and faces many regulatory hurdles as well.

Money at Risk

A retail trader’s deposit money is insured under the Securities Investor Protection (SIPA) Act by the Securities Investor Protection Corporation (SPIC). However, a Prop Trader’s deposit money is not insured. It is also exposed to a lot of risks and fraudulent activities. The only good part is that the deposit money is not too huge, and you can earn up to 100% profits on your trade.

Limited Regulation

Volcker’s rule called for separating the Proprietary trading desks from the core banking activities. However, there are no stringent governing rules for prop traders. Less regulation and governance might mean lesser operating costs, but a prop trader has no regulatory norms to fall back upon.

If the principal trader is a crook, you might end up losing your entire capital. Not just this, a principal trader who lacks ethics and integrity might put the whole firm at risk. Unfortunately, a prop trading firm wouldn’t have any legal recourse due to the lack of regulation.

Intellectual Property Risk

A trader’s intellectual properties are his ideas and strategies. Suppose a particular prop trading has been performing exceptionally well. In that case, there are chances that someone from the back end can copy his methods or decode the secrets behind his profitable trades. There is always a risk that principals might steal the ideas and the winning formulas.

Prop Trading Careers

The job of a prop trader is very similar to day trading, but it is usually more sophisticated as the trader has to handle advanced software and automated trading systems. A trader working with a proprietary trading firm functions as a contractor and not an employee in many instances.

They shoulder the responsibility of managing financial assets like stocks, currencies, futures, options contracts, etc., on the major global exchanges. Thus, a prop trader is neither a stockbroker nor a financial adviser. They’re only concerned with identifying the current trading trends and acting upon them to earn maximum profits.

While some Prop firms predominantly use automated software, others still use a mix of automation and human involvement. Trading is hard, and relying on automated trading software can brace you for a high failure rate. What sets a highly skilled trader apart from the crowd is his ability to study the nuances and play effortlessly with changing market variables.

Pros

- Compensation depends on merit, i.e., the knowledge gained and skills demonstrated.

- Top-notch school is not mandatory. You must possess solid mathematical and statistical skills. Coding knowledge will be an added advantage if you are specifically into electronic or quantitative trading.

- Ongoing learning as you get an opportunity to draw on the expertise of other professional trader teammates.

- Limited office politics or bureaucracy due to a smaller team structure.

Cons

- Limited exit opportunities; therefore, you need to be sure that you want to be a part of Prop Trading.

- There can be scammers under the garb of less-than-legitimate “prop trading firms” that do not pay you a base salary and demand training or data access cost from you.

- Underperformers may have to switch careers.

- There is little job security because the firm might not employ you for long if you don’t earn enough profits.

If you want a fast-paced trading career that brings in immediate recognition, Prop Trading is for you. You know that the only thing that matters in a career as a prop trader is profit & loss and nothing else. To achieve this, you must be able to sit for extremely long hours, pull through a steep learning curve, and perform in a hyper-competitive environment. This is one of those few career fields where experience and skill sets matter more than formal education.

Prop Trading Firms Jobs

Discretionary Trader

The discretionary trader is responsible for buying and selling the securities and managing the overall risk by simply using judgment and analysis.

Quant Trader

Quant Trader has expertise in understanding the quantitative strategy that they’re trading. They bear direct liability and risk, often control execution, and tweak the strategies in the trading operation.

Quant Researcher

Typically more academic, quantitative researchers collect different kinds of quantitative information or data and inform the analyst.

Quant Analyst

Quant Analyst ensures that the data and the related models are user-friendly, credible, and error-free. It involves a lot of hard work, and the process is truly cumbersome.

Quant Strategist

Quant Strategist usually develops and designs mathematical models for formulating strategies and trading algorithms. They only focus on modeling specialties like risk mitigation, predatory tactics, and optimal liquidation.

Developer

A developer is responsible for executing the model designed by Quant strategists. He is also involved in writing programs and maintaining the code so that the traders can do their jobs smoothly.

Career Progression

Amongst the trader role, the career progression in a Prop firm will be as follows.

Assistant Trader

The role of an assistant trader is like that of a trainee. This is the first stage where the assistant traders are involved in clerical services, answering calls, recording transactions, and financial assessments.

Junior Trader

A Junior Trader is engaged in reporting trades and tracking price fluctuations for a particular investment. The Senior Trader monitors the actions of a junior trader. If the Junior Trader establishes a successful trading record, he can be promoted to a Senior Trader.

Senior Trader

Senior traders are mostly quant traders with a shining track record of implementing proprietary trading strategies. With seniority, these traders gain in-depth experience across asset classes and trading styles such as high-frequency and medium-frequency trading. Over a considerable period, they can also rise to become the Partners of the Prop trading firm.

Types of Prop Trading Firms

According to mergersandinquisitions.com, Primarily there are three main types of Prop Trading firms:

Churn and Burn

These Prop Trading firms require day traders who can join them and spend a considerable sum for ‘training’ instead of the privilege of trading. They do not get any base salary but are allowed to keep all the profits, even above 50%. This type of firm is for ‘go-pro’ day traders and not for the regular ones. Thus, such types of proprietary trading firms are best avoided.

Mostly Legitimate

These proprietary trading firms offer free training. However, they levy a monthly fee on the day traders, which could be as high as thousands of dollars to access their trade and data. At the beginning of each month, the trader starts with debt. These firms also do not pay a base salary to the trader, but they get a considerable percentage of the profits.

Completely Legitimate

These trading firms are far more genuine than the other ones. They offer not only a base salary but also bonuses. They also train the day traders and build a team with skilled and qualified ones. This type of proprietary trading firm is less exploitative than the other ones. They do not allow the traders to take a massive percentage of the profits and restrict it to only 10%-30%. However, the payment of regular salaries and other perks compensate for these factors.

Prop Trading Hours & Lifestyle

The culture and values of each prop trading firm are different. However, on average, it’s about working 50 hours per week. You won’t have a typical 9 to 5 job as a prop trader. There will be some hours that are busier than the others. The time the market opens or close is the busiest time for a day trader. Each day, your working hours could be well past 12-14 hours, peppered with long breaks in the afternoon and late nights.

The fact that you have to work across geographies adds to the challenges. You may be based out of London or New York, but you need to adjust and work according to their time zone to cover the European markets. Your work profile and lifestyle would largely depend on your work profile.

If you are a Quant Trader, you will spend maximum time adjusting trading parameters and working closely with quantitative analysts and developers to design cutting-edge strategies. If you are a discretionary trader, you will spend most of your time discussing and buying, and selling securities with other traders.

On the other hand, if you are working at an entry level, you may also continue after the market closes and wrap up things; Max Ganik from SMB Capital shares his intriguing first-year journey as a Prop Trader and tells us how he found success using a four-pronged approach:

Prop Trading Salaries and Bonuses

Before discussing the salaries and compensation package for Prop Traders, we must understand the key trends or the pattern that the industry follows. As you move up the ladder, your base salary might not change much, but bonuses could get more attractive. As you progress towards seniority, the only difference is that the partners can earn a substantial percentage of the firm’s profit or loss so that the bonus amount can be estimated beforehand.

A Prop day trader may not be as handsomely paid as investment bankers. Still, it has the edge over them for two Parameters (1) Faster progression (2) No stock-based compensation or deferred bonuses, only cash payments.

Starting Phase

If you begin working at a legitimate prop trading firm, you can expect a total compensation of between $100K and $200K as of 2020. The higher end of payment is up to $200K, but it depends on many factors like the market environment and your performance. If you make losses, you receive no bonus, and your continuation with the firm will be questionable.

Middle Phase

If you perform well and move past your initial phase, your base salary will be in the range of $200 K-$500 K.

Seniority

Senior Traders can earn in the range of $500 K to $1 million, and partners can make more than $1 million each year.

Here, I would like to emphasize that a bonus is a highly critical part of a Prop Trader’s compensation package. Bonuses are a percentage of base salaries, which can be in the range of 50-100%.

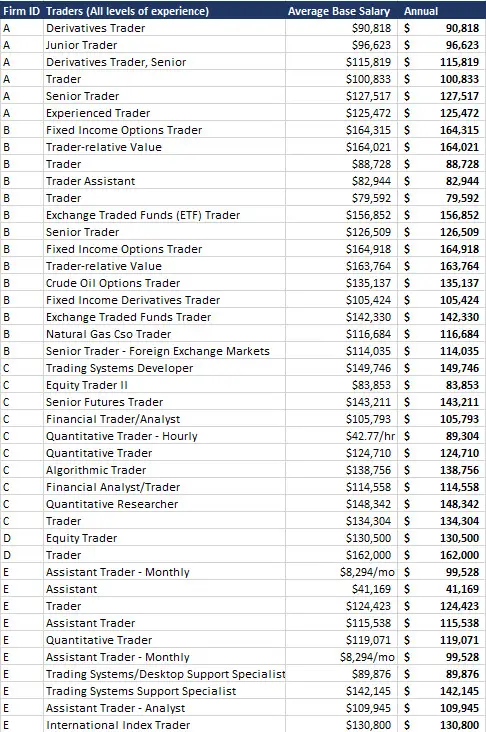

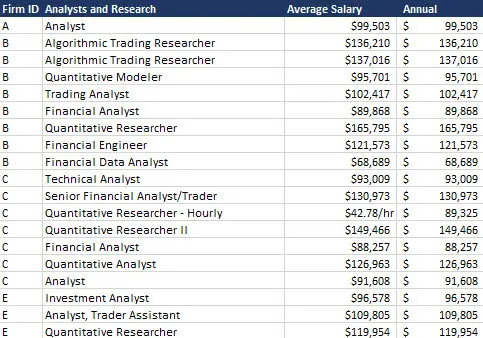

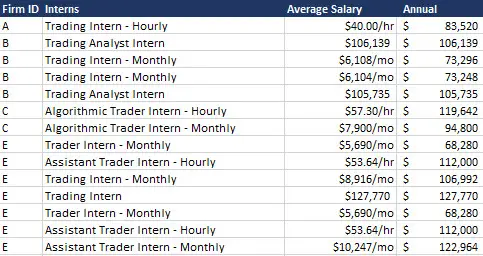

Steve W., on the website Paracurve Trading, has compiled an indicative list of the salaries of a Prop Trader according to their designations. Though the information is slightly dated (2018), it will help you understand the variation in the payments based on grades and the broader range.

Traders Salary

Analyst Salary

Intern Salary

Hedge Fund vs. Prop Trading

| Proprietary Trading | Hedge Funds | |

|---|---|---|

| Meaning | Prop Trading firms trade on their capital. | Hedge Funds raise capital from investors and make a trade using advanced asset management techniques—the primary goal to hedge the client’s portfolio. |

| Compensation | Prop Trading benefits from direct market profits, which may be up to 100%. There are no commission fees involved. | Hedge fund managers charge significant fees for their services besides the management fees. |

| Leverage | Prop Trading uses asset-backed securities, mortgage-related securities, derivatives, commodities, and currencies. | Funds come from endowments, life insurance, or pension funds and high net worth individuals. |

Proprietary Trading vs. Market Making

| Proprietary Trading | Market Making | |

|---|---|---|

| Meaning | A Prop Trader uses the firm’s money to make trades and earn profits. The trader intentionally takes on the risk to gain profits. | Market-makers tend to eliminate directional or notional risks, reduce volatility and ensure complete liquidity in the market. |

| Compensation | Prop Trading benefits from direct market profits, which may be up to 100%. There are no commission fees involved. | Market makers charge a spread on the bid and ask price and operate on buy and sell sides, both. |

Prop Trading vs. Sales & Trading at Large Banks

| Prop Trading | Sales & Trading at Large Banks | |

|---|---|---|

| Meaning | Prop trading implies trading with the financial institution’s money to earn profit for themselves. | Sales & trading is about providing client service and executing trades on their behalf. |

| Presence | Hardly a part of large banks | Exists in large scale banks |

| Leverage | Work with their limited capital. | Have abundant money at their disposal; hence they operate in broader markets. |

| Work Environment | Low regulation. But the absence of office politics due to the smaller scale of operation. | Highly regulated, but office politics is prevalent. |

Best Proprietary Trading Firms

While there are several thousand Prop Trading companies, below is the list of top names amongst the independent Prop trading firms:

- Jane Street

- Hudson River

- Optiver

- Tower Research

- Virtu

If interested in more detail, we independently surveyed the top prop trading firms.

How to Get Into Prop Trading

Your knowledge and expertise as a trader lay the foundation of a career in Prop Trading. Essential educational qualifications are necessary for entry-level positions, but they are hardly decisive.

When we talk of academic qualifications, the trader must hold a bachelor’s or master’s degree in finance, economics, mathematics, statistics, or banking. If the candidate belongs to a low-tier institute, a solid technical program is necessary. Apart from that, each proprietary trading firm offers training and mentorship for traders who are new to this job.

Experience

Most traders start with no experience and get hired into entry-level positions. However, they would have undergone internships at brokerages, trading desks of banks, or asset management companies.

Skills

Some of the desired skillsets for breaking into Prop Trading are:

- Sound trading and analytical skills.

- Astute mathematical skills for scalping, arbitraging, and day trading.

- Experience in implementing several arbitrage trading strategies.

- In-depth knowledge of financial markets and asset management skills.

- Risk management and money management skills

- Ability to conduct independent market research and plan daily trading strategies.

- Expert knowledge of different methodologies for predicting price movements and executing trading strategies.

- Expertise in C++, Python, and Machine Learning.

Most financial firms post their vacancies for prop traders on online job portals like Indeed, Glassdoor, or LinkedIn. However, some big players only post the listings on their websites, so you need to watch that. Sometimes, smaller Prop firms also reach out to potential candidates through career fairs organized by universities.

Each firm has specialization in a particular asset class, ranging from equities and commodities to cryptocurrency. There is also a lot of demand for traders with expertise in derivatives and futures.

You must check the compensation structure before joining the firm, including the fixed compensation and the profit-sharing component.

The Bottom Line

Prop firms present many opportunities for the financial institution to augment their profits by trading their capital. It is gaining a lot of momentum due to its immense earnings potential. We have seen that the volume of prop trading has seen massive growth over the past few years. Not just this, the traders have also begun to accommodate a wide range of assets, including digital currencies.

Proprietary trading firms are also willing to go beyond geographic frontiers to capitalize on lucrative business, arbitrage opportunities, and revenue diversification. A recent survey by Acuiti for a report commissioned by Avelacom revealed that 85% of senior proprietary trading respondents are exploring emerging markets like China, India, and Saudi Arabia.

These trends indicate that Prop trading is standing at the cusp of growth which means more opportunities for Prop traders. However, this space is still unregulated and witnesses many fraudulent activities. Hence, before joining a proprietary trading firm, the new trader must verify its authenticity or consult a reputed job consultant for validation.