A time series is a sequence of moments-in-time observations. The sequence of data is either uniformly spaced at a specific frequency such as hourly or sporadically spaced in the case of a phone call log.

Having an expert understanding of time series data and how to manipulate it is required for investing and trading research. This tutorial will analyze stock data using time series analysis with Python and Pandas. All code and associated data can be found in the Analyzing Alpha Github.

Understanding Datetimes and Timedeltas

It’s critical to understand the difference between a moment, duration, and period in time before we can fully understand time series analysis in Python.

| Type | Description | Examples |

|---|---|---|

| Date (Moment) | Day of the year | 2019-09-30, September 30th, 2019 |

| Time (Moment) | Single point in time | 6 hours, 6.5 minutes, 6.09 seconds, 6 milliseconds |

| Datetime (Moment) | Combination of date and time | 2019-09-30 06:00:00, September 30th, 2019 at 6:00 |

| Duration | Difference between two moments | 2 days, 4 hours, 10 seconds |

| Period | Grouping of time | 2019Q3, January |

Python’s Datetime Module

datetime supplies classes to enable date and time manipulation in both simple and complex ways.

Creating Moments

Dates, datetimes, and times are each a separate class, and we can create them in a variety of ways, including directly and through parsing strings.

import datetime

date = datetime.date(2019,9,30)

datetime1 = datetime.datetime(2019,9,30,6,30,9,123456)

datetime2_string = "10 03 2019 13:37:00"

datetime2 = datetime.datetime.strptime(datetime2_string,

'%m %d %Y %X')

datetime3_string = "Thursday, October 03, 19 1:37 PM"

datetime3 = datetime.datetime.strptime(datetime3_string,

'%A, %B %d, %y %I:%M %p')

time = datetime.time(6,30,9,123456)

now = datetime.datetime.today()

today = datetime.date.today()

print(type(date))

print(date)

print(type(datetime1))

print(datetime1)

print(datetime2)

print(datetime3)

print(type(time))

print(time)

print(now)

print(today)<class 'datetime.date'>

2019-09-30

<class 'datetime.datetime'>

2019-09-30 06:30:09.123456

2019-10-03 13:37:00

2019-10-03 13:37:00

<class 'datetime.time'>

06:30:09.123456

2019-10-06 22:54:04.786039

2019-10-06Creating Durations

timedeltas represent durations in time. They can be added or subtracted from moments in time.

from datetime import timedelta

daysdelta = timedelta(days=5)

alldelta = timedelta(days=1, seconds=2,

microseconds=3,

milliseconds=4,

minutes=5,

hours=6,

weeks=7)

future = now + daysdelta

past = now - alldelta

print(type(future))

print(future)

print(type(past))

print(past)<class 'datetime.datetime'>

2019-10-12 12:43:26.337336

<class 'datetime.datetime'>

2019-08-18 06:38:24.333333Accessing Datetime Attributes

Class and object attributes can help us isolate the information we want to see. I’ve listed the most common but you can find the exhaustive list on the datetime module’s documentation.

| Class / Object | Attribute | Description |

|---|---|---|

| Shared Class Attributes | class.min | Earliest representable date, datetime, time |

| class.max | Latest representable date, datetime, time | |

| class.resolution | The smallest difference between two dates, datetimes, or times | |

| Date / Datetime | object.year | Returns year |

| object.month | Returns month of year (1 – 12) | |

| object.day | Returns day of month (1-32) | |

| Time / Datetime | object.hour | Returns hour (0-23) |

| object.minute | Returns minute (0-59) | |

| object.second | Returns second (0-59) |

print(datetime.datetime.min)

print(datetime.datetime.max)

print(datetime.datetime.resolution)

print(datetime1.year)

print(datetime1.month)

print(datetime1.day)

print(datetime1.hour)

print(datetime1.minute)

print(datetime1.second)

print(datetime1.microsecond)0001-01-01 00:00:00

9999-12-31 23:59:59.999999

0:00:00.000001

2019

9

30

6

30

9

123456Time Series in Pandas: Moments in Time

Pandas was developed at hedge fund AQR by Wes McKinney to enable quick analysis of financial data. Pandas is an extension of NumPy that supports vectorized operations enabling quick manipulation and analysis of time series data.

Timestamps: Moments in Time

Timestamp extends NumPy’s datetime64 and is used to represent datetime data in Pandas. Pandas does not require Python’s standard library datetime. Let’s create a Timestamp now using to_datetime and pass in the above example data.

import pandas as pd

print(type(pd.to_datetime('2019-09-30')))

print(pd.to_datetime('2019-09-30'))

print(pd.to_datetime('September 30th, 2019'))

print(pd.to_datetime('6:00:00'))

print(pd.to_datetime('2019-09-30 06:30:06'))

print(pd.to_datetime('September 30th, 2019 06:09.0006'))<class 'pandas._libs.tslibs.timestamps.Timestamp'>

2019-09-30 00:00:00

2019-09-30 00:00:00

2019-10-06 06:00:00

2019-09-30 06:30:06

2019-09-30 06:09:00Timedeltas in Pandas: Durations of Time

Timedelta is used to represent durations of time internally in Pandas.

timestamp1 = pd.to_datetime('September 30th, 2019 06:09.0006')

timestamp2 = pd.to_datetime('October 2nd, 2019 06:09.0006')

delta = timestamp2 - timestamp1

print(type(timestamp1))

print(type(delta))

print(delta)

<class 'pandas._libs.tslibs.timestamps.Timestamp'>

<class 'pandas._libs.tslibs.timedeltas.Timedelta'>

2 days 00:00:00Creating a Time Series in Pandas

Let’s get Apple’s stock history provided by an Intrinio developer sandbox.

import pandas as pd

import urllib

url = "https://raw.githubusercontent.com/leosmigel/analyzingalpha/master/ ...

time-series-analysis-with-python/apple_price_history.csv"

with urllib.request.urlopen(url) as f:

apple_price_history = pd.read_csv(f)

apple_price_history[['open', 'high', 'low', 'close', 'volume']].head() open high low close volume

0 28.75 28.87 28.75 28.75 2093900

1 27.38 27.38 27.25 27.25 785200

2 25.37 25.37 25.25 25.25 472000

3 25.87 26.00 25.87 25.87 385900

4 26.63 26.75 26.63 26.63 327900

Let’s review the data types or dtypes of the dataframe to see if we have any datetime information.

apple_price_history.dtypes

id int64

date object

open float64

high float64

low float64

close float64

volume int64

adj_open float64

adj_high float64

adj_low float64

adj_close float64

adj_volume int64

intraperiod bool

frequency object

security_id int64

dtype: object

Notice how the date column that contains our date information is a pandas object. We could have told pandas to parse_dates and read in our column as a date, but we can adjust it after the fact, also.

Let’s change our dataframe’s RangeIndex into a DatetimeIndex. And for good measure, let’s read the data in with a DatetimeIndex from read_csv.

apple_price_history['date'] = apple_price_history['date'].astype(np.datetime64)

apple_price_history.dtypes

id int64

date datetime64[ns]

open float64

high float64

low float64

close float64

volume int64

adj_open float64

adj_high float64

adj_low float64

adj_close float64

adj_volume int64

intraperiod bool

frequency object

security_id int64

dtype: objectapple_price_history.set_index('date', inplace=True)

print(apple_price_history.index.dtype)

print(apple_price_history[['open', 'high', 'low', 'close']].head())

apple_price_history.index[0:10]datetime64[ns]

open high low close

date

1980-12-12 28.75 28.87 28.75 28.75

1980-12-15 27.38 27.38 27.25 27.25

1980-12-16 25.37 25.37 25.25 25.25

1980-12-17 25.87 26.00 25.87 25.87

1980-12-18 26.63 26.75 26.63 26.63

DatetimeIndex(['1980-12-12', '1980-12-15', '1980-12-16', '1980-12-17',

'1980-12-18', '1980-12-19', '1980-12-22', '1980-12-23',

'1980-12-24', '1980-12-26'],

dtype='datetime64[ns]', name='date', freq=None)import numpy as np

import urllib.request

names = ['open', 'high', 'low', 'close', 'volume']

url = 'https://raw.githubusercontent.com/leosmigel/analyzingalpha/master/ ...

time-series-analysis-with-python/apple_price_history.csv'

with urllib.request.urlopen(url) as f:

apple_price_history = pd.read_csv(f,

parse_dates=['date'],

index_col='date',

usecols=['date',

'adj_open',

'adj_high',

'adj_low',

'adj_close',

'adj_volume'])

apple_price_history.columns = names

print(apple_price_history.dtypes)

print(apple_price_history.index[:5])

print(apple_price_history.head())open float64

high float64

low float64

close float64

volume int64

dtype: object

DatetimeIndex(['1980-12-12', '1980-12-15', '1980-12-16', '1980-12-17',

'1980-12-18'],

dtype='datetime64[ns]', name='date', freq=None)

open high low close volume

date

1980-12-12 0.410073 0.411785 0.410073 0.410073 117258400

1980-12-15 0.390532 0.390532 0.388678 0.388678 43971200

1980-12-16 0.361863 0.361863 0.360151 0.360151 26432000

1980-12-17 0.368995 0.370849 0.368995 0.368995 21610400

1980-12-18 0.379835 0.381546 0.379835 0.379835 18362400Adding Datetimes from Strings

Frequently, dates will be in a format that we can’t read. We can use dt.strftime to convert the string into a date. We used strptime when creating the S&P 500 dataset.

sp500.loc[:,’date’].apply(lambda x: datetime.strptime(x,’%Y-%m-%d’))

Time Series Selection

We can now easily select and slice dates using the index with loc.

Datetime Selection by Day, Month, or Year

apple_price_history.index

print(apple_price_history.loc['2018'].head())

print(apple_price_history.loc['2018-06'].head())

print(apple_price_history.loc['2018-06-01': '2018-06-05'])

apple_price_history.loc['2018-6-1'] open high low close volume

date

2018-01-02 165.657452 167.740826 164.781266 167.701884 25555934

2018-01-03 167.964740 169.931290 167.409823 167.672678 29517899

2018-01-04 167.974475 168.879867 167.526647 168.451510 22434597

2018-01-05 168.850661 170.729592 168.470981 170.369382 23660018

2018-01-08 169.736582 170.963241 169.327695 169.736582 20567766

open high low close volume

date

2018-06-01 184.471622 186.697946 184.234938 186.678320 23442510

2018-06-04 188.047203 189.798784 187.767539 188.238552 26266174

2018-06-05 189.450430 190.309049 188.758629 189.690843 21565963

2018-06-06 190.004852 190.446427 188.326867 190.348300 20933619

2018-06-07 190.505304 190.564181 188.734097 189.838035 21347180

open high low close volume

date

2018-06-01 184.471622 186.697946 184.234938 186.678320 23442510

2018-06-04 188.047203 189.798784 187.767539 188.238552 26266174

2018-06-05 189.450430 190.309049 188.758629 189.690843 21565963

open 1.844716e+02

high 1.866979e+02

low 1.842349e+02

close 1.866783e+02

volume 2.344251e+07

Name: 2018-06-01 00:00:00, dtype: float64

Using the Datetime Accessor

datetime has multiple datetime properties and methods can be used on series datetime elements as found in the Series API Documentation.

| Property | Description |

|---|---|

| Series.dt.date | Returns numpy array of python datetime.date objects (namely, the date part of Timestamps without timezone information). |

| Series.dt.time | Returns numpy array of datetime.time. |

| Series.dt.timetz | Returns numpy array of datetime.time also containing timezone information. |

| Series.dt.year | The year of the datetime. |

| Series.dt.month | The month as January=1, December=12. |

| Series.dt.day | The days of the datetime. |

| Series.dt.hour | The hours of the datetime. |

| Series.dt.minute | The minutes of the datetime. |

| Series.dt.second | The seconds of the datetime. |

| Series.dt.microsecond | The microseconds of the datetime. |

| Series.dt.nanosecond | The nanoseconds of the datetime. |

| Series.dt.week | The week ordinal of the year. |

| Series.dt.weekofyear | The week ordinal of the year. |

| Series.dt.dayofweek | The day of the week with Monday=0, Sunday=6. |

| Series.dt.weekday | The day of the week with Monday=0, Sunday=6. |

| Series.dt.dayofyear | The ordinal day of the year. |

| Series.dt.quarter | The quarter of the date. |

| Series.dt.is_month_start | Indicates whether the date is the first day of the month. |

| Series.dt.is_month_end | Indicates whether the date is the last day of the month. |

| Series.dt.is_quarter_start | Indicator for whether the date is the first day of a quarter. |

| Series.dt.is_quarter_end | Indicator for whether the date is the last day of a quarter. |

| Series.dt.is_year_start | Indicate whether the date is the first day of a year. |

| Series.dt.is_year_end | Indicate whether the date is the last day of the year. |

| Series.dt.is_leap_year | Boolean indicator if the date belongs to a leap year. |

| Series.dt.daysinmonth | The number of days in the month. |

| Series.dt.days_in_month | The number of days in the month. |

| Series.dt.tz | Return timezone, if any. |

| Series.dt.freq |

| Method | Description |

|---|---|

| Series.dt.to_period(self, *args, **kwargs) | Cast to PeriodArray/Index at a particular frequency. |

| Series.dt.to_pydatetime(self) | Return the data as an array of native Python datetime objects. |

| Series.dt.tz_localize(self, *args, **kwargs) | Localize tz-naive Datetime Array/Index to tz-aware Datetime Array/Index. |

| Series.dt.tz_convert(self, *args, **kwargs) | Convert tz-aware Datetime Array/Index from one time zone to another. |

| Series.dt.normalize(self, *args, **kwargs) | Convert times to midnight. |

| Series.dt.strftime(self, *args, **kwargs) | Convert to Index using specified date_format. |

| Series.dt.round(self, *args, **kwargs) | Perform round operation on the data to the specified freq. |

| Series.dt.floor(self, *args, **kwargs) | Perform floor operation on the data to the specified freq. |

| Series.dt.ceil(self, *args, **kwargs) | Perform ceil operation on the data to the specified freq. |

| Series.dt.month_name(self, *args, **kwargs) | Return the month names of the DateTimeIndex with specified locale. |

| Series.dt.day_name(self, *args, **kwargs) | Return the day names of the DateTimeIndex with specified locale. |

Periods

| Period |

|---|

| Series.dt.qyear |

| Series.dt.start_time |

| Series.dt.end_time |

dates = ['2019-01-01', '2019-04-02', '2019-07-03']

df = pd.Series(dates, dtype='datetime64[ns]')

print(df.dt.quarter)

print(df.dt.day_name())DatetimeIndex includes most of the same properties and methods as the dt.accessor.

print(apple_price_history.index.quarter)

apple_price_history.index.day_name()0 1

1 2

2 3

dtype: int64

0 Tuesday

1 Tuesday

2 Wednesday

dtype: objectInt64Index([4, 4, 4, 4, 4, 4, 4, 4, 4, 4,

...

3, 3, 3, 3, 3, 3, 3, 3, 3, 3],

dtype='int64', name='date', length=9789)

Index(['Friday', 'Monday', 'Tuesday', 'Wednesday', 'Thursday', 'Friday',

'Monday', 'Tuesday', 'Wednesday', 'Friday',

...

'Wednesday', 'Thursday', 'Friday', 'Monday', 'Tuesday', 'Wednesday',

'Thursday', 'Friday', 'Monday', 'Tuesday'],

dtype='object', name='date', length=9789)

Frequency Selection

Time series can be associated with a frequency in Pandas when it is uniformly spaced.

date_range is a function that allows us to create a sequence of evenly spaced dates.

dates = pd.date_range('2019-01-01', '2019-12-31', freq='D')

datesDatetimeIndex(['2019-01-01', '2019-01-02', '2019-01-03', '2019-01-04',

'2019-01-05', '2019-01-06', '2019-01-07', '2019-01-08',

'2019-01-09', '2019-01-10',

...

'2019-12-22', '2019-12-23', '2019-12-24', '2019-12-25',

'2019-12-26', '2019-12-27', '2019-12-28', '2019-12-29',

'2019-12-30', '2019-12-31'],

dtype='datetime64[ns]', length=365, freq='D')Instead of specifying a start or end date, we can substitute a period and adjust the frequency.

dates = pd.date_range('2019-01-01', periods=6, freq='M')

print(dates)

hours = pd.date_range('2019-01-01', periods=24, freq='H')

print(hours)DatetimeIndex(['2019-01-31', '2019-02-28', '2019-03-31', '2019-04-30',

'2019-05-31', '2019-06-30'],

dtype='datetime64[ns]', freq='M')

DatetimeIndex(['2019-01-01 00:00:00', '2019-01-01 01:00:00',

'2019-01-01 02:00:00', '2019-01-01 03:00:00',

'2019-01-01 04:00:00', '2019-01-01 05:00:00',

'2019-01-01 06:00:00', '2019-01-01 07:00:00',

'2019-01-01 08:00:00', '2019-01-01 09:00:00',

'2019-01-01 10:00:00', '2019-01-01 11:00:00',

'2019-01-01 12:00:00', '2019-01-01 13:00:00',

'2019-01-01 14:00:00', '2019-01-01 15:00:00',

'2019-01-01 16:00:00', '2019-01-01 17:00:00',

'2019-01-01 18:00:00', '2019-01-01 19:00:00',

'2019-01-01 20:00:00', '2019-01-01 21:00:00',

'2019-01-01 22:00:00', '2019-01-01 23:00:00'],

dtype='datetime64[ns]', freq='H')asfreq returns a dataframe or series with a new specified frequency. New rows will be added for moments that are missing in the data and filled with NaN or using a method we specify. We often need to provide an offset alias to get the desired time frequency.

Offset Aliases

| Alias | Description |

|---|---|

| B | business day frequency |

| C | custom business day frequency |

| D | calendar day frequency |

| W | weekly frequency |

| M | month end frequency |

| SM | semi-month end frequency (15th and end of month) |

| BM | business month end frequency |

| CBM | custom business month end frequency |

| MS | month start frequency |

| SMS | semi-month start frequency (1st and 15th) |

| BMS | business month start frequency |

| CBMS | custom business month start frequency |

| Q | quarter end frequency |

| BQ | business quarter end frequency |

| QS | quarter start frequency |

| BQS | business quarter start frequency |

| A, Y | year end frequency |

| BA, BY | business year end frequency |

| AS, YS | year start frequency |

| BAS, BYS | business year start frequency |

| BH | business hour frequency |

| H | hourly frequency |

| T, min | minutely frequency |

| S | secondly frequency |

| L, ms | milliseconds |

| U, us | microseconds |

| N | nanoseconds |

print(apple_price_history.asfreq('BA').head())

apple_quarterly_history = apple_price_history.asfreq('BM')

print(type(apple_quarterly_history))

apple_quarterly_history.head() open high low close volume

date

1980-12-31 0.488522 0.488522 0.486810 0.486810 8937600

1981-12-31 0.315649 0.317361 0.315649 0.315649 13664000

1982-12-31 0.427903 0.433180 0.426048 0.426048 12415200

1983-12-30 0.347742 0.356585 0.345888 0.347742 22965600

1984-12-31 0.415351 0.417205 0.415351 0.415351 51940000

<class 'pandas.core.frame.DataFrame'>

open high low close volume

date

1980-12-31 0.488522 0.488522 0.486810 0.486810 8937600.0

1981-01-30 0.406507 0.406507 0.402942 0.402942 11547200.0

1981-02-27 0.377981 0.381546 0.377981 0.377981 3690400.0

1981-03-31 0.353020 0.353020 0.349454 0.349454 3998400.0

1981-04-30 0.404796 0.408219 0.404796 0.404796 3152800.0Filling Data

asfreq allows us to provide a filling method for replacing NaN values.

print(apple_price_history['close'].asfreq('H').head())

print(apple_price_history['close'].asfreq('H', method='ffill').head())date

1980-12-12 00:00:00 0.410073

1980-12-12 01:00:00 NaN

1980-12-12 02:00:00 NaN

1980-12-12 03:00:00 NaN

1980-12-12 04:00:00 NaN

Freq: H, Name: close, dtype: float64

date

1980-12-12 00:00:00 0.410073

1980-12-12 01:00:00 0.410073

1980-12-12 02:00:00 0.410073

1980-12-12 03:00:00 0.410073

1980-12-12 04:00:00 0.410073

Freq: H, Name: close, dtype: float64Resampling: Upsampling & Downsampling

resample returns a resampling object, very similar to a groupby object, for which to run various calculations on.

We often need to lower (downsampling) or increase (upsampling) the frequency of our time series data. If we have daily or monthly sales data, it may be useful to downsample it into quarterly data. Alternatively, we may want to upsample our data to match the frequency of another series we’re using to make predictions. Upsampling is less common, and it requires interpolation.

apple_quarterly_history = apple_price_history.resample('BM')

print(type(apple_quarterly_history))

apple_quarterly_history.agg({'high':'max', 'low':'min'})[:5]pandas.core.resample.DatetimeIndexResampler

high low

date

1980-12-31 0.515337 0.360151

1981-01-30 0.495654 0.402942

1981-02-27 0.411785 0.338756

1981-03-31 0.385112 0.308375

1981-04-30 0.418917 0.345888

We can now use all of the properties and methods we discovered above.

print(apple_price_history.index.dayofweek)

print(apple_price_history.index.weekofyear)

print(apple_price_history.index.year)

print(apple_price_history.index.day_name())Int64Index([4, 0, 1, 2, 3, 4, 0, 1, 2, 4,

...

2, 3, 4, 0, 1, 2, 3, 4, 0, 1],

dtype='int64', name='date', length=9789)

Int64Index([50, 51, 51, 51, 51, 51, 52, 52, 52, 52,

...

37, 37, 37, 38, 38, 38, 38, 38, 39, 39],

dtype='int64', name='date', length=9789)

Int64Index([1980, 1980, 1980, 1980, 1980, 1980, 1980, 1980, 1980, 1980,

...

2019, 2019, 2019, 2019, 2019, 2019, 2019, 2019, 2019, 2019],

dtype='int64', name='date', length=9789)

Index(['Friday', 'Monday', 'Tuesday', 'Wednesday', 'Thursday', 'Friday',

'Monday', 'Tuesday', 'Wednesday', 'Friday',

...

'Wednesday', 'Thursday', 'Friday', 'Monday', 'Tuesday', 'Wednesday',

'Thursday', 'Friday', 'Monday', 'Tuesday'],

dtype='object', name='date', length=9789)datetime = pd.to_datetime('2019-09-30 06:54:32.54321')

print(datetime.floor('H'))

print(datetime.ceil('T'))

print(datetime.round('S'))

print(datetime.to_period('W'))

print(datetime.to_period('Q'))

datetime.to_period('Q').end_time2019-09-30 06:00:00

2019-09-30 06:55:00

2019-09-30 06:54:33

2019-09-30/2019-10-06

2019Q3

Timestamp('2019-09-30 23:59:59.999999999')Rolling Windows: Smoothing & Moving Averages

rolling allow us to split the data into aggregated windows and apply a function such as the mean or sum.

A typical example of this in trading is using the 50-day and 200-day [moving averages/moving-average) to enter and exit an asset.

Let’s calculate the these for Apple. Notice that we need 50 days of data before we can calculate the rolling mean.

Visualizing Time Series Data using Matplotlib

Matplotlib makes it easy to visualize our Pandas time series data. Seaborn adds additional options and helps us make our graphs look prettier. Let’s import matplotlib and seaborn to try out a few basic examples. This quick summary isn’t an in-depth guide on Python Visualization.

Line Plot

lineplot draws a standard line plot. It works similar to dataframe.plot that we’ve been using above.

import matplotlib.pyplot as plt

import seaborn as sns

fig, ax = plt.subplots(figsize=(32,18))

sns.lineplot(x=apple_price_history.index, y='close', data=apple_price_history,

ax=ax).set_title("Apple Stock Price History")

Boxplots

boxplot enables us to group and understand distributions in our data. It’s often beneficial for seasonal data.

apple_price_recent_history = apple_price_history[-800:].copy()

apple_price_recent_history['quarter'] = apple_price_recent_history.index.year.astype(str)...

+ apple_price_recent_history.index.quarter.astype(str)

sns.set(rc={'figure.figsize':(18, 9)})

sns.boxplot(data=apple_price_recent_history, x='quarter', y='close')

Analyzing Time Series Data in Pandas

Time series analysis methods can be divided into two classes:

Frequency domain methods analyze how much a signal changes over a frequency band such as the last 100 samples. Time-domain methods analyze how much a signal changes over a specified period of time such as the prior 100 seconds.

Time Series Trend, Seasonality & Cyclicality

Time series data can be decomposed into four components:

- Trend

- Seasonality

- Cyclicality

- Noise

Not all time series have trend, seasonality, or cyclicality; moreover, there must be enough data to support that seasonality, cyclicality or a trend exists and what you’re seeing is not just a random pattern.

Time series data will often exhibit show gradual variability in addition to higher frequency variability such as seasonality and noise. An easy way to visualize these trends is with rolling means at different time scales. Let’s import Apple’s sales data to review seasonality and trend.

Trend

Trends occur when there is an increasing or decreasing slope in the time series. Amazon’s sales growth would be an example of an upward trend. Additionally, trends do not have to be linear. Trends can be deterministic and are a function of time, or stochastic where the trend is random.

Seasonality

Seasonality occurs when there is a distinct repeating pattern, peaks and troughs, observed at regular intervals within a year. Apple’s sales peak in Q4 would be an example of seasonality in Amazon’s revenue numbers.

Cyclicality

Cyclicality occurs when there is a distinct repeating pattern, peaks and troughs, observed at irregular intervals. The business cycle exhibits cyclicality.

Let’s analyze Apple’s revenue history and see if we can decompose it visually and programmatically.

import urllib

import pandas as pd

from scipy import stats

url = 'https://raw.githubusercontent.com/leosmigel/analyzingalpha/master/ ...

time-series-analysis-with-python/apple_revenue_history.csv'

with urllib.request.urlopen(url) as f:

apple_revenue_history = pd.read_csv(f, index_col=0)

apple_revenue_history['quarter'] = apple_revenue_history['fiscal_year'].apply(str) \

+ apple_revenue_history['fiscal_period'].str.upper()

slope, intercept, r_value, p_value, std_err = stats.linregress(apple_revenue_history.index,

apple_revenue_history['value'])

apple_revenue_history['line'] = slope * apple_revenue_history.index + interceptTime Series Trend Graph with Trend Line

fig = plt.figure(figsize=(32,18))

ax1 = fig.add_subplot(1,1,1)

apple_revenue_history.plot(y='value', x='quarter', title='Apple Quarterly Revenue 2010-2018', ax=ax1)

apple_revenue_history.plot(y='line', x='quarter', title='Apple Quarterly Revenue 2010-2018', ax=ax1)

Time Series Stacked Graph for Cycle Analysis

fig = plt.figure(figsize=(32,18))

ax1 = fig.add_subplot(1,1,1)

legend = []

yticks = np.linspace(apple_revenue_history['value'].min(), apple_revenue_history['value'].max(), 10)

for year in apple_revenue_history['fiscal_year'].unique():

apple_revenue_year = apple_revenue_history[apple_revenue_history['fiscal_year'] == year]

legend.append(year)

apple_revenue_year.plot(y='value', x='fiscal_period', title='Apple Quarterly Revenue 2010-2018',

ax=ax1,yticks=yticks, sharex=True, sharey=True)

ax1.legend(legend)

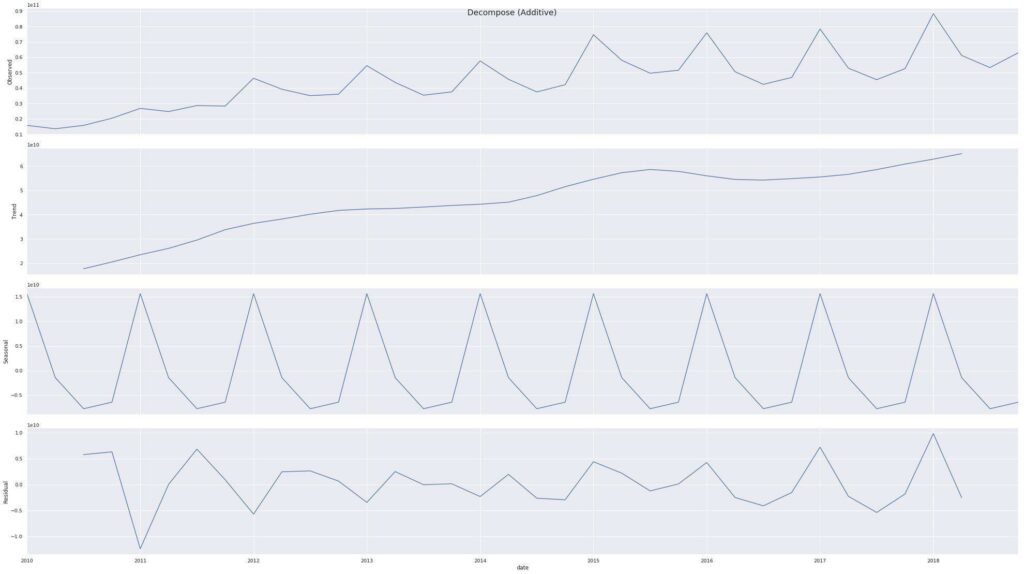

Decomposing Time Series Data using StatsModel

statsmodel enables us to statistically decompose a time series into its components.

from statsmodels.tsa.seasonal import seasonal_decompose

from dateutil.parser import parse

apple_revenue_history['date'] = pd.to_datetime(apple_revenue_history['quarter']).dt.to_period('Q')

apple_revenue_history.set_index('date', inplace=True)

apple_revenue_history.index = apple_revenue_history.index.to_timestamp(freq='Q')

result_add = seasonal_decompose(apple_revenue_history['value'])

plt.rcParams.update({'figure.figsize': (32,18)})

result_add.plot().suptitle('Decompose (Additive)', fontsize=18)

plt.show()

Time Series Stationarity

Time series is different from more traditional classification and regression predictive modeling problems. Time series data is ordered and needs to be stationary for meaningful summary statistics.

Stationarity is an assumption underlying many statistical procedures used in time series analysis, and non-stationarity data are often transformed into stationary data.

Stationarity is sometimes categorized into the following:

- Stationary Process/Model: Stationary series of observations.

- Trend Stationary: Does not exhibit a trend.

- Seasonal Stationary: Does not exhibit seasonality.

- Strictly Stationary: Mathematical definition of a stationary process.

In a stationary time series, the mean and standard deviation of a time series is constant. Additionally, there is no seasonality, cyclicality, or other time-dependent structure. It’s often easier to understand if a time series is stationary to first look at how stationarity can be violated.

# Stationary

vol = .002

df1 = pd.DataFrame(np.random.normal(size=200) * vol)

df1.plot(title='Stationary')

Stationary Time Series

df2 = pd.DataFrame(np.random.random(size=200) * vol).cumsum()

df2.plot(title='Not Stationarty: Mean Not Constant')Not Stationary: Mean Not Constant

df3 = pd.DataFrame(np.random.normal(size=200) * vol * np.logspace(1,2,num=200, dtype=int))

df3.plot(title='Not Stationary: Volatility Not Constant')Not Stationary: Volatility Not Constant

df4 = pd.DataFrame(np.random.normal(size=200) * vol)

df4['cyclical'] = df4.index.values % 20

df4[0] = df4[0] + df4['cyclical']

df4[0].plot(title='Not Stationary: Cyclcial')Not Stationary: Cyclical

How to Test for Stationarity

We can test for stationarity by visually inspecting the graphs above, as we did earlier; by splitting the graphs into multiple sections and looking at summary statistics such as mean, variance and correlation; or we can use more advanced methods like the Augmented Dickey-Fuller test.

The Augmented Dickey–Fuller tests that a unit root is not present. If the time series has a unit root, it has some time-dependent structure meaning the time series is not stationary.

The more negative this statistic, the more likely have a stationary time series. In general, if the p-value > 0.05 the data has unit root and it is not stationary. Let’s use statsmodel to examine this.

import pandas as pd

import numpy as np

from statsmodels.tsa.stattools import adfuller

df1 = pd.DataFrame(np.random.normal(size=200))

result = adfuller(df1[0].values, autolag='AIC')

print(f'ADF Statistic: {result[0]:.2f}')

print(f'p-value: {result[1]:.2f}')

for key, value in result[4].items():

print('Critial Values:')ADF Statistic: -11.14

p-value: 0.00

Critial Values:

1%, -3.46

Critial Values:

5%, -2.88

Critial Values:

10%, -2.57ADF Statistic: -0.81

p-value: 0.81

Critial Values:

1%, -3.47

Critial Values:

5%, -2.88

Critial Values:

10%, -2.58Running the examples prints the test statistic values of 0.00 (stationary) and 0.81 (non-stationary), respectively.

Notice that we can see the likelihood that we can reject that the price series is not stationary. In the first series, we can say the price series is stationary at above the 1% confidence level. In the below series, we can not reject that the price series is not stationary — in other words, this is not a stationary price series as it doesn’t even meet the 10% threshold.

How to Handle Non-Stationary Time Series

If there is a clear trend and seasonality in a time series, then model these components, remove them from observations, then train models on the residuals.

Detrending a Time Series

There are multiple methods to remove the trend component from a time series.

- Subtract best fit line

- Subtract using a decomposition

- Subtract using a filter

Best Fit Line Using SciPy

Detrend from SciPy allows us to remove the trend by subtracting the best fit line.

%matplotlib inline

import matplotlib.pyplot as plt

import pandas as pd

from scipy import signal

vol = 2

df = pd.DataFrame(np.random.random(size=200) * vol).cumsum()

df[0].plot(figsize=(32,18))

detrend = signal.detrend(df[0].values)

plt.plot(detrend)

Decompose and Extract Using StatsModels

seasonal_decompose returns an object with the seasonal, trend, and resid attributes that we can subtract from our series values.

from statsmodels.tsa.seasonal import seasonal_decompose

from dateutil.parser import parse

dates = pd.date_range('2019-01-01', periods=200, freq='D')

df = pd.DataFrame(np.random.random(200)).cumsum()

df.set_index(dates, inplace=True)

df[0].plot()

decompose = seasonal_decompose(df[0], model='additive', extrapolate_trend='freq')

df[0] = df[0] - decompose.trend

df[0].plot()