Are you ready to plunge into the brilliant mind of a financial titan? Prepare to uncover the secrets behind the meteoric success of Bill Ackman, the enigmatic investor who has taken the world of finance by storm!

In this article, we’ll explore Ackman’s extraordinary background, his groundbreaking investment strategies, and his priceless contributions to the financial realm. So, get ready to be enthralled as we dive headfirst into the captivating world of this exceptional investor.

Trust us – you won’t want to miss this opportunity to learn from the best and revolutionize your financial destiny!

Early Life and Education

Let’s dive into the fascinating early life of Bill Ackman and discover how this investing prodigy got his start!

Bill Ackman’s Early Years

Born in 1966, Bill Ackman was raised in the charming town of Chappaqua, New York, by his father, Lawrence Ackman – a real estate tycoon in his own right – and his mother, Ronnie Ackman. Growing up in a family that breathed business, Bill was immersed in the electrifying world of finance and investments from the get-go.

Education: The Harvard Adventure

Bill Ackman’s educational escapade began at Horace Greeley High School, where he soared academically. The ambitious young man then ventured into the hallowed halls of Harvard College, graduating magna cum laude in 1988 with a BA in History. But Ackman’s insatiable thirst for knowledge didn’t end there; he pursued a Master of Business Administration from none other than Harvard Business School, graduating in 1992.

Career Highlights and Milestones

After leaving Harvard Business School, Ackman dove headfirst into the investing world. Let’s explore his awe-inspiring career milestones that have left a lasting impact on the industry.

Starting Out: Gotham Partners

Fresh out of his MBA, Bill Ackman joined forces with fellow Harvard graduate David Berkowitz in 1993 to create Gotham Partners. This dynamic investment firm concentrated on small and mid-sized companies, utilizing Ackman’s expertise in value investing. Gotham Partners rapidly caught the eye of the investment world, boasting impressive returns and amassing over $500 million in assets at its zenith.

But Gotham Partners’ success story took an unexpected twist in 2002 when they placed a high-stakes bet on Pre-Paid Legal Services (PPL), a company offering affordable legal aid to its members. This daring investment became a hotbed of controversy, as Ackman and Berkowitz faced accusations of manipulating PPL’s stock price for their own profit.

The whirlwind of drama surrounding PPL’s investment cast a dark shadow on Gotham Partners, ultimately leading to the firm’s dramatic closure in 2003. But despite its downfall, Gotham Partners remains an invaluable case study for ambitious investors seeking inspiration and insight.

The Birth of Pershing Square Capital Management

But Bill Ackman isn’t one to give up! In 2004, following the dissolution of Gotham Partners, he unleashed his most significant venture yet: Pershing Square Capital Management.

This trailblazing hedge fund focused on activist investing, where Ackman would acquire substantial stakes in companies and advocate for transformative changes to unleash shareholder value.

Some of Pershing Square’s game-changing investments include:

- Municipal Bond Insurance Association (MBIA): Ackman bet against the MBIA in 2002, and when MBIA’s stocks plummeted, Ackman earned over $1 billion in gains.

- Wendy’s: In 2005, Ackman propelled the fast-food chain to spin off its Tim Hortons subsidiary, igniting a remarkable surge in Wendy’s stock price.

- Canadian Pacific Railway: Ackman spearheaded a triumphant proxy battle in 2012, leading to a change in leadership and a subsequent revitalization of the company’s performance.

These are only a few examples of Bill Ackman’s investments that have played a pivotal role in raising Pershing Square Capital Management to the forefront of the investment world.

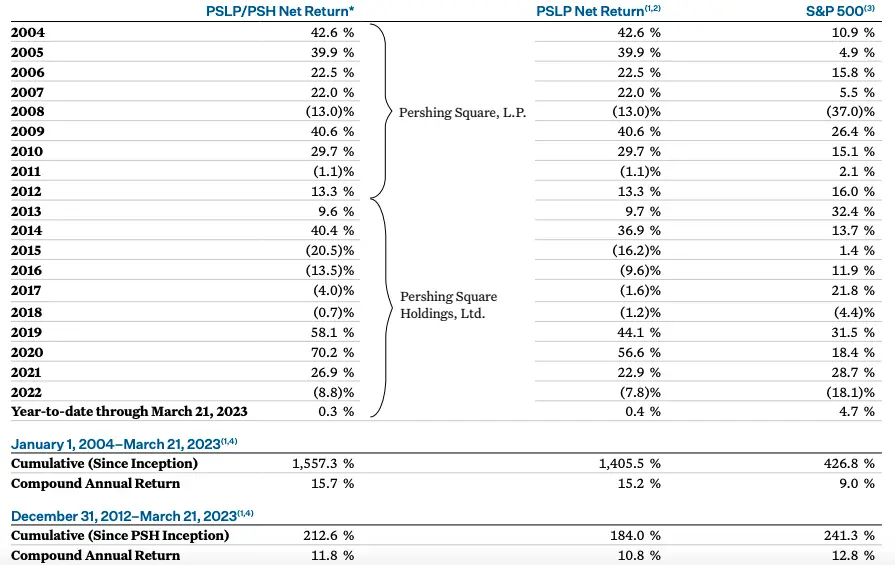

Gain a better understanding of the firm’s performance history by checking out their net returns from 2004-2022, as published in their annual investment report.

Unraveling Bill Ackman’s Investing Strategy

Are you ready to uncover the core investment strategies that catapulted Bill Ackman to success? Buckle up, because we’re about to reveal the masterful techniques that have earned Ackman his billions!

Embracing the Activist Investing Approach

Bill Ackman attributes much of his success to his activist investing approach. But what exactly is activist investing?

It’s a bold strategy where an investor acquires a significant stake in a company and leverages that position to influence dynamic shifts within the board and organization. This tactic is often deployed when the investor senses the company is underperforming and can unleash hidden value through strategic or operational enhancements.

So how do you make activist investments? According to Harvard Law Today, Ackman and his savvy team dive deep into research to uncover companies ripe for improvement. They scrutinize financial statements, market trends, and industry dynamics to identify undervalued or mismanaged organizations.

Once they’ve zeroed in on a target company, Ackman secures a substantial ownership position. This empowers him to have a voice in the company’s operations and strategy. Then, Ackman actively engages with the management and boards of the companies he invests in, pushing for pivotal changes in strategy, operations, or leadership to unleash value and boost performance.

Thanks to Bill Ackman’s activist investing prowess, he’s achieved several high-profile triumphs, including the Canadian Pacific Railway and Air Products & Chemicals. After Ackman swooped in and implemented innovative improvements, their stock prices skyrocketed, showcasing the tremendous potential of his approach.

Mastering the Value Investing Approach

Not only is Bill Ackman a prominent activist investor, but he’s also a champion of value investing – a strategy that uncovers stocks trading at a steal, just waiting to skyrocket.

You see, value investing is all about finding undervalued companies that the market has forgotten. These hidden gems have a value significantly higher than their current stock price. By snapping up these affordable stocks, value investors like Ackman can reap the rewards when the market finally catches on and the stock price soars.

This approach was invented by the famous Benjamin Graham and popularized by the lauded Warren Buffett, who Ackman has learned a lot from. In 1994, 31-year-old Ackman asked Buffett about the positive and negative effects of leverage and business debt at the Berkshire Hathaway Annual Meeting, evidence of his long-term admiration for this investing guru.

But exactly how does Bill Ackman uncover undervalued stocks? Like activist investing, it all starts with meticulous research. Ackman dives deep into financial statements, dissects the company’s business model, and scrutinizes the industry landscape and competition. If his analysis reveals an intrinsic value far surpasses the stock’s price tag, he invests – it’s as simple as that!

Building a Concentrated Portfolio

Bill Ackman also champions building a focused investment portfolio, driven by his unwavering belief in high-conviction investments. This billionaire investor is renowned for taking substantial positions in a handpicked group of companies that he believes possess growth potential.

By zeroing in on a few high-conviction ideas, Ackman can devote more time and resources to comprehending these companies and their industries, empowering him to make wiser investments.

Another compelling reason for Ackman’s laser-focused approach is his aversion to over-diversification. While diversification can help investors manage risk, too much can result in lackluster returns. By honing in on a small number of high-conviction investments, Ackman can achieve stellar returns while still managing risk.

And despite managing a massive portfolio, Bill Ackman isn’t hesitant to place big bets on his high-conviction ideas. According to The Motley Fool, a prime example is his significant investment in Lowe’s hardware store. By taking a sizable position in the company, Ackman showcased his unshakable confidence in the company’s potential for value creation- and he was right.

So, don’t be afraid to replicate this bold approach and enhance your profits while maintaining a margin of safety!

Adopting a Long-Term Approach to Investing

In investing, patience isn’t just a virtue – it’s a game-changer. Bill Ackman knows this all too well, as he consistently plays the long game, focusing on the future to reap astonishing returns that leave short-term traders in the dust.

One of the most potent forces behind long-term investing is the magic of compounding. Brilliant investors like Ackman can watch their returns skyrocket by holding onto investments for years. This core principle is the driving force behind Ackman’s market success, and it can be yours too.

But to truly excel in long-term investing, you must dive deep into the fundamentals of each stock opportunity. This means scrutinizing a company’s financial health, industry position, and growth prospects. With meticulous analysis and unyielding patience, you can conquer the market and achieve investment success.

Embracing the Storm During Market Turbulence

When the market nosedives, it’s all too easy to succumb to panic. But legendary investor Bill Ackman remains cool as a cucumber during tumultuous times, refusing to let fear dictate his decisions. So, what’s his secret?

First and foremost, Ackman steers clear of panic selling. As financial markets plummet, many investors scramble to sell assets in a desperate attempt to avoid losses. But this knee-jerk reaction often results in selling at rock-bottom prices, only to miss the boat when markets bounce back. By keeping his cool and resisting the urge to sell, Ackman ensures he makes calculated decisions rooted in long-term strategy.

But market downturns aren’t just about dodging losses; they’re also a goldmine for excellent investment opportunities. You see, Ackman has a keen eye for spotting undervalued gems and swooping in during market slumps.

Case in point: during the COVID-19 pandemic, he wagered a cool $27 million on the market’s recovery, which ultimately ballooned into a shocking $2.6 billion profit. By staying composed and focusing on hidden opportunities, you too can turn market volatility into a winning hand.

Researching a Company’s Fundamentals

When it comes to investing, Bill Ackman is renowned for his thorough approach to fundamental and financial analysis. Let’s dive into the crucial factors he weighs before making an investment decision.

First and foremost, Ackman favors companies with straightforward business models. Why? Because predicting their future performance becomes a breeze. He steers clear of businesses with convoluted operations or those dependent on uncertain factors.

Additionally, Ackman seeks companies with a competitive edge, boosting their likelihood of long-term success. This includes businesses boasting brand recognition and those armed with patents or intellectual property.

But wait, there’s more! For Ackman, numbers are king. He meticulously examines a company’s valuation to ensure he’s not shelling out too much for an investment. He looks at:

- Price-to-earnings ratio

- Price-to-sales ratio

- Enterprise value-to-EBITDA ratio

- Debt levels

- Cash flow generation

- Profitability margins

Lastly, Ackman hunts for stocks with shareholder-friendly management, allowing him to implement changes and enhance the business’s performance.

Case in point: Ackman’s investment in Chipotle! In 2016, his Pershing Square Capital Management gobbled up a 9.9% stake in Chipotle. The company’s simple business model, substantial competitive advantage, and low stock price (thanks to food safety concerns) made it an irresistible investment opportunity.

So, don’t forget to carefully study a company’s bottom line before deciding whether or not to pull the trigger and invest your money!

Learning from Mistakes: The Bill Ackman Way

Bill Ackman champions the power of embracing one’s mistakes and refining investment strategies as a result. By doing so, investors can consistently evolve and sharpen their decision-making, paving the way for exceptional returns.

One of Ackman’s most notorious investment blunders was his deal with Valeant Pharmaceuticals. His hedge fund, Pershing Square, poured funds into the company, only to witness its value nosedive amidst a whirlwind of scandals and controversies. At the end of this debacle, Pershing Square suffered a staggering $4 billion loss.

Yet, Ackman seized this colossal setback as an opportunity for growth. He acknowledged the critical need to delve deep into a company’s business model and management team before diving into investments. This eye-opening experience also underscored the wisdom of diversifying investments and steering clear of over-concentration in a single stock.

So remember, investing is a rollercoaster ride brimming with highs and lows. By learning from your missteps, fine-tuning your strategy, and staying nimble, you can conquer the market and come back from your failures.

Ackman’s Impact on the Investing Community

Bill Ackman has not only skyrocketed his own wealth through his brilliant investment strategies, but he’s also ignited the passion of fellow investors and contributed to the community in countless ways.

Influence on Modern Investors

For one, Ackman has revolutionized the world of finance as a trailblazer in activist and value investing. Many investors have embraced his groundbreaking approach, including some of the most influential and successful names in the industry:

- Daniel Loeb: As the mastermind behind Third Point LLC, Loeb has earned a reputation for employing Ackman-esque tactics when engaging with companies and championing transformative change.

- Ryan Cohen: As the Chairman of Gamestop and a successful entrepreneur, Ryan Cohen is a fresh-faced activist investor who shares similar techniques with trailblazer Bill Ackman.

- Nelson Peltz: As the visionary founder of Trian Fund Management, Peltz has carved out a formidable niche as an activist investor, zeroing in on underperforming companies and demanding game-changing improvements.

Ackman’s investing techniques have sparked a fire in the hearts of countless financial leaders, and you might just be the next one to catch flame!

Philanthropy: Bill Ackman’s Inspiring Commitment to Giving Back

Bill Ackman, a true philanthropic powerhouse, has also made a remarkable impact on society through the Pershing Square Foundation.

Co-founded with his wife Karen Ackman, this extraordinary foundation empowers leaders and organizations to address critical social issues in fields such as economic development, education, healthcare, and human rights. With a focus on impact investing, the Pershing Square Foundation fuels both left-of-center advocacy groups and for-profit organizations that deliver vital social services.

Ackman’s generosity also extends to organizations like the Innocence Project in New York and Centurion Ministries in New Jersey, which work to provide investigative resources for wrongful conviction cases. His contributions to these organizations exceed a staggering $1 million!

But Ackman’s philanthropic spirit doesn’t stop there. In a remarkable display of support for Ukraine during its defense against Russia’s invasion, he donated an astounding $3.25 million to fund a fleet of ambulances.

Billionaires like Bill Ackman wield immense resources and influence, capable of sparking transformative change in society. Witnessing them harness this power for wealth distribution and social advancement is nothing short of inspiring. By tackling urgent global issues, Ackman paves the way for a brighter future, reminding us all to maximize our wealth from investing for the greater good.

Getting Started with Bill Ackman’s Investment Principles

Eager to dive even deeper into the world of Bill Ackman? You’ve struck gold! As an aspiring investor, you can tap into a treasure trove of resources to learn from Ackman’s triumphs and failures, including captivating books, insightful articles, engaging podcasts, and thought-provoking interviews.

Page-Turners On Billionaire Bill Ackman

While Bill Ackman hasn’t penned any books himself, there are a few page-turners that delve into his investment strategies and victories. These gems include:

- Confidence Game: How Hedge Fund Manager Bill Ackman Called Wall Street’s Bluff by Christine S. Richard: Brace yourself for a thrilling deep dive into Ackman’s investment style and his epic battle against MBIA, a bond insurance titan.

- The Alpha Masters: Unlocking the Genius of the World’s Top Hedge Funds by Maneet Ahuja: Get ready to unlock the secrets of the masters, with a chapter dedicated to Ackman that reveals his investment philosophy and offers a behind-the-scenes look at his most lucrative investments.

Must-Read Articles for Bill Ackman Fans

Craving a quicker read? Dive into these interesting articles that showcase Bill Ackman’s investing prowess:

- The Wall Street Journal’s “How Bill Ackman Stalked J.C. Penney” by Shira Ovide: Get a front-row seat to the gripping tale of how Ackman approached J.C. Penney, seizing the retailer’s stock before regulatory disclosure rules could alert other investors.

- Vanity Fair’s “‘Hell Is Coming’: How Bill Ackman Predicted the COVID Market Crash—And Made a Fortune” by Liz Hoffman: Uncover the thrilling story of how Ackman profited from the stock market plummet during the pandemic.

Videos and Podcasts Featuring Bill Ackman

Dive into these podcasts, stories, and video interviews to uncover Bill Ackman’s investment secrets straight from the mastermind himself:

- William Ackman: Everything You Need to Know About Finance and Investing in Under an Hour: Grab a snack and immerse yourself in this engaging YouTube video, where Bill Ackman divulges essential investment wisdom in just the time it takes to enjoy your lunch break.

- The Knowledge Project: Bill Ackman: Getting Back Up: Pop in your earbuds and revel in this enthralling podcast as Bill Ackman unveils the lessons he’s learned and what fuels his relentless drive to bounce back from setbacks.

By delving into these resources, investors can further grasp Ackman’s investment strategies and absorb his winning mindset.

Conclusion

In conclusion, Bill Ackman’s meteoric rise to financial stardom is a testament to his unwavering dedication, strategic prowess, and innovative thinking. His investment approach, which combines activist investing with value investing, has proven to be a recipe for success. By researching undervalued companies and advocating for transformative changes, Ackman has unlocked hidden value and achieved remarkable returns.

For investors looking to emulate Ackman’s success, the key lies in thorough research, patience, and a willingness to embrace bold strategies. By applying Ackman’s principles and focusing on long-term growth, investors can unlock their own financial potential and revolutionize their portfolios.

So, as you enter the investing world, remember to channel the wisdom and tenacity of Bill Ackman. With his guidance, you can conquer the market and achieve unparalleled success!