A bond is a loan to a company or government. Bond investors lend money for a set period, with the promise of repayment of that money plus interest. The most common types of bonds include corporate bonds and municipal bonds. Bonds are safer than stocks, but still have risks.

How a bond works is a bit more complicated, and it’s what we’ll talk about in this post. Specifically, we’ll look at the many elements of a bond, types of bonds, and the various advantages and disadvantages of bonds. We’ll also look at how bonds relate to other investment vehicles and the economy. And if you’re interested, you can learn all about how bonds originated.

Before we go any further, though, we’ll take a moment to go over some of the basics.

Bond Basics

When a large entity, such as a corporation, city, or even the federal government, needs to raise capital, it can do so by issuing a bond. In one respect, bonds function like any other type of loan. The entity receives money from lenders and then must pay the money back plus interest. What makes a bond different from a loan is that the lender isn’t a bank. With a bond, the lenders are the investors. This means that when you purchase a bond, you are lending your money to the bond issuer who will pay you back with interest at a predetermined date in the future.

While the issuing entity must pay the loan back at a certain point, an investor is not required to hold onto the bond until that point. There is a secondary market for bonds, which means investors can buy and sell bonds just like they would stocks. This secondary market adds an extra layer of complexity to bonds since it means the bond price on the secondary market, which is known as the market price, may rise and fall. When a bond has a market price that is more than the bond’s face value, that bond is said to be selling at a premium. When a bond has a market price that is less than its face value, it is said to be selling at a discount.

One of the aspects of bonds that differentiate them from other investment vehicles, such as stocks, is that they’re fixed-income investments. With fixed-income investments, the investor receives a specific (fixed) amount of principal and interest.

Elements of a Bond

As we’ve seen, the basics of bonds are relatively straightforward. What makes investing in bonds a bit more challenging is all the various elements of a bond. Many different types of bonds exist, and they’re all a bit different. The following are the critical elements of a bond that all investors should understand.

Maturity

Maturity is the lifetime of the bond. It’s when the issuing entity is required to pay back all of the principal and any interest. Bonds typically fall into one of three maturity categories: short-term, medium-term, and long-term. Short-term bonds typically have a maturity of fewer than five years. Medium-term bonds have a maturity of about five to ten years. Long-term bonds have a maturity of ten to thirty years. As a general rule, the longer the maturity rate of a bond, the higher the return.

Secured/Unsecured

A bond is either secured or unsecured. With a secured bond, issuers pledge of a specific asset as collateral. If the bond issuer defaults, the collateral’s ownership passes to the bondholder. For example, mortgage-backed securities (MBSs) are secured by home titles. With an unsecured bond, there is no collateral. Therefore, unsecured bonds have a higher level of risk than secured bonds.

Payment Priority

Bonds may be classified as either senior or junior debt. If a company goes bankrupt, there’s a specific order in which investors are paid as the company sells its assets. Senior debt is paid first, followed by junior and subordinated debt, and then those who own equity.

Coupon

The coupon, also known as the coupon rate or nominal yield, is the amount of interest you earn on a bond.

Call Provisions

Some bonds have something called a call provision, which allows the issuing entity of the bond to pay off the bond earlier than the maturity date. Companies that choose to call (pay off the bond earlier) typically do so because they can receive a lower interest rate.

Taxable or Tax Exempt

Finally, a bond may be either taxable or tax-exempt. Most bonds issued by companies are taxable, but some municipal bonds and government bonds are tax-exempt. On tax-exempt bonds, income and capital gains are not taxed.

Yields

Another aspect of bonds that’s key to understanding how they work is the yield of a bond. Typically, yield refers to the yield to maturity, which is how much you would earn if you held the bond until it matured. While yield to maturity is the most common type of yield, it is not the only type.

The current yield is another type of metric, which is calculated by taking the bond’s annual coupon and dividing it by the bond’s current price. The current yield only considers the present income provided by the bond.

The nominal yield is the coupon rate of the bond or the amount the issuer agreed to pay in interest. The nominal yield may not be the same as the actual returns an investor earns, because the nominal yield is calculated using the par, or face value, of the bond. The par value may not be the amount the investor paid for the bond, since as mentioned previously, bonds may trade below or above their face value. If an investor pays a premium for a bond or buys it at a discount, the nominal yield will not be the same as the yield to maturity (how much the investor earns on the bond).

As the name implies, the yield to call is the yield if the issuing company decides to call its bond. Finally, there is realized yield. If an investor sells a bond before its maturity date, the return the investor earns is the realized yield.

Bonds and Other Investments

One of the best ways to understand bonds is to consider them with other investment options. Therefore, we’ll quickly see how bonds compare relative investments in the other three main asset classes; equities, cash, and real estate.

Since the only way to lose all of your principal when you invest in bonds is for the issuing entity to default, bonds have a reasonably low-risk profile. When you invest in equities or real estate, you run the risk of losing some or even all of your principal investment, which is why investing in equities and real estate is considered riskier than bonds. However, bonds do still come with some risks, and bond investors have the potential to lose out on their principal if the issuing entity defaults. This makes bonds riskier than cash or cash equivalents since with these investments, you don’t run the risk of losing the principal.

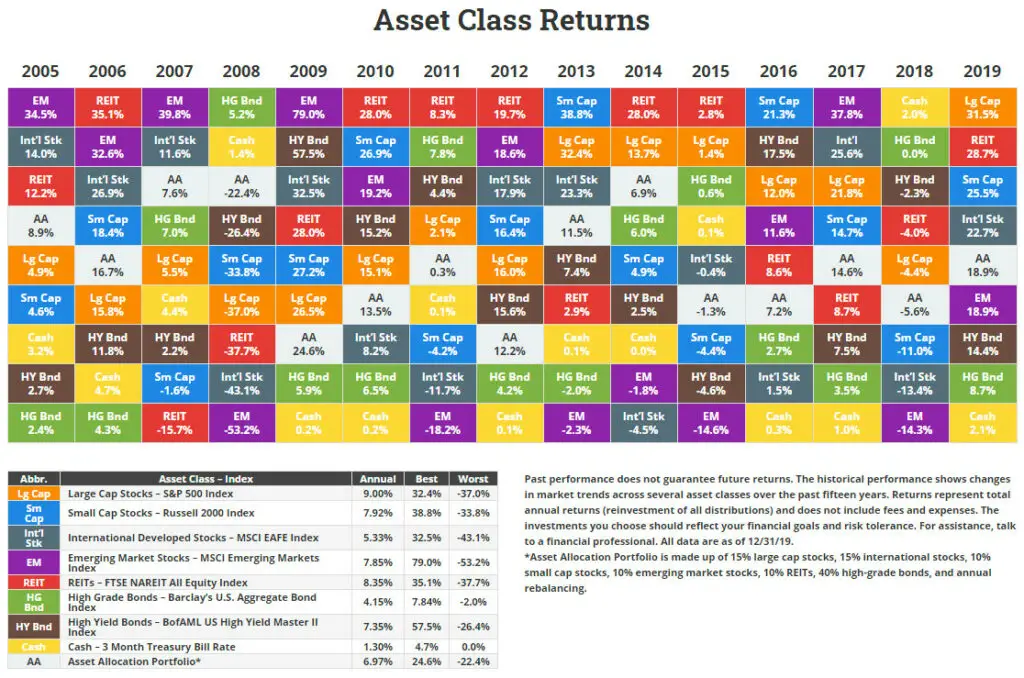

While past performance does not guarantee future results, looking at the past returns of each asset class can provide some guidance on how their returns compare.

Between 2005 and 2019, the annual return for high cap stocks (as measured by the S&P 500 index), was 9%. Real estate investment trusts (REITs) were 8.35% (as measured by the FTSE NAREIT All Equity Index). For cash, it was 1.3% (as measured by the three-month treasury bill rate). Finally, high-grade bonds (as measured by Barclay’s U.S. Aggregate Bond Index) came in at 4.15%.

As we can see, bonds performed better than cash, but nowhere near large-cap stocks or real estate. This may not be the case every year, but over the long term, this pattern has historically remained consistent.

Types of Bonds

Now that we understand the characteristics of bonds and how they compare to other asset classes, we’ll look at the various types of bonds. Many types of bonds exist, but we’ll focus on the four main types: U.S. Treasuries, corporate bonds, municipal bonds, and junk bonds.

U.S. Treasuries

The U.S. government issues U.S. Treasuries. They’re typically considered one of the safest investment options since the U.S. government backs them. There are three main types of U.S. Treasuries: treasury bills (T-bills), treasury notes, and treasury bonds. The difference between the bonds is based on their maturity. Treasury bills have the shortest maturity, followed by treasury notes, and then treasury bonds. One benefit of U.S. treasuries is that though you have to pay federal income tax on them, you do not have to pay state or local income tax. The downside to U.S. treasuries is that they have some of the lowest yields.

Corporate Bonds

These are bonds issued by corporations. These bonds are taxable and have a higher level of risk than U.S. Treasuries, but they also generally have higher yields. These bonds vary dramatically in maturity terms.

Municipal Bonds

Municipal bonds, also known as muni bonds, are issued by state or local governments. Most municipal bonds are tax-exempt at both the state and local levels, though this is not always the case. Generally, municipal bonds are considered safer than corporate bonds but riskier than U.S. treasuries. They also typically have a lower yield than most corporate bonds, but a higher yield than U.S. treasuries.

Junk Bonds

The term “junk bonds“, also known as high-yield bonds, are bonds rated below investment grade. Junk bonds come with higher risk and high potential returns. These bonds are issued by corporations that have a higher risk of default.

Risks

Though bonds have considerably less risk than many other investments, like all investments, bonds come with certain risks.

Credit Risk

Credit risk is one of the most significant risks you face when investing in bonds because a bond’s price can change dramatically to the downside if investors perceive a higher default risk. If a bond’s price changes, its yield will also change. Bonds have an inverse relationship with their interest rates, which means that when interest rates rise, the value of bonds drops, and vice versa.

Interest Rate Risk

Rising interest rates will result in existing bond prices/yields falling/rising. This is due to investors selling current lower-yielding bonds for newer, higher-yield bonds.

Inflation Risk

Inflation reduces a currency’s purchasing power. It also erodes the return on a bond as a dollar in the future is worth less than a dollar today. Some bonds are inflation-adjusted and protect against this risk.

Reinvestment Risk

Often, investors have a target interest rate that they would like to achieve. When interest rates are declining, the capital from a bond maturing may have to be reinvested into a similar bond with lower rates.

Liquidity Risk

Like stocks, illiquid bonds have an increased risk of slippage.

Ratings

Bonds receive ratings from three major rating agencies: Moody’s, Standard & Poor’s, and Fitch. All firms use letters to create the main rating categories and then subcategorize further using numbers and symbols. For the sake of this post, we’ll stick with the main categories.

Standard and Poor’s and Fitch both rate bonds from highest to lowest using the following rating system:

- AAA

- AA

- A

- BBB

- BB

- B

- CCC

- CC

- C

- D

Moody’s rating system is similar, but not the same. It rates bonds as follows, from highest to lowest:

- Aaa

- Aa

- A

- Baa

- Ba

- B

- Caa

- Ca

- C

In general, the higher the credit rating, the safer the bond. Though a higher rated bond may be safer, that does not mean no risk is involved, only that it has comparatively less risk than lower-rated bonds. As is often the case in investing, the trade-off for a safer investment is often a lower potential for returns—generally, the higher the bond rating, the lower the yield.

Interest Coverage Ratio

Rating agencies factor in a multitude of variables to determine the rating of a bond. The primary goal, however, is to assess the likelihood of repayment. The interest coverage ratio is a good proxy for repayment potential and can be used to calculate a synthetic credit rating.

Advantages and Disadvantages of Bonds For investors, one of the most significant advantages of bonds is that they will not lose their principal, as long as the issuing entity does not default. Investors also benefit from the income they earn from the interest paid on the loan. Furthermore, investors also can sell their bonds and make a profit. These benefits combine to allow investors to potentially earn money while taking on far less risk than they would by trading other investments.

Investors looking to limit their risk further may choose to invest in a bond mutual fund. A bond fund provides investors with more diversification and, therefore, also reduces risk.

The comparative safety of bonds comes with the risk of earning a lower return. Especially in lower-risk bonds, Inflation may outpace returns. If this happens, in terms of purchasing power, you’ve lost money. Those looking to invest to save for retirement may have difficulty achieving their goals through only investing in bonds without using leverage.

One of the best ways to take advantage of the benefits of bonds while avoiding some of their drawbacks is to make bonds only a part of your portfolio. A diversified approach that includes bonds and investments in other asset classes can help limit the risk and improve risk-adjusted returns.

Bonds and the Economy

We’ve focused mainly on bonds in relation to investors, but to conclude this post, we’ll look at how bonds impact the economy.

Bonds allow the economy to continue running smoothly. Why is that? Remember that bonds are loans for organizations. These organizations, either corporations or the government, often need more money than a bank could provide. By issuing bonds, organizations can raise capital without needing to go through a bank.

Access to capital allows organizations to start projects they may otherwise not be able to. For corporations, access to capital provides opportunities to fuel growth and expansion. When organizations have more projects and expand, they can employ more individuals, pay their existing employees more, hire more third-party providers, etc. Everyone receiving this capital then has more money to spend, which helps stimulate the economy, creating more jobs and opportunities for expansion. And the cycle continues. In short, bonds provide access to capital, and more capital means more money, potentially stimulating the economy.

The Bottom Line

A bond is a loan for a large organization. But it’s also a lot more. Bonds provide opportunities for investors, capital for organizations, and help fuel the economy. While more attention is often paid to stocks or other, more exciting investment vehicles, it’s difficult to overstate the value of bonds to both investors and the economy.