The boom and bust cycle, also referred to as the business cycle, is an economy’s alternating periods of growth and decline. During the boom period of the cycle, the economy grows, jobs are plentiful, and the stock market provides high returns. During a bust cycle, the opposite is true; the economy shrinks, there are fewer jobs, and the stock market loses value.

But why do boom and bust cycles exist? Are there ways to predict the timing of boom and bust cycles? And how should investors react to booms and busts?

These are the questions this post will answer, but first, let’s look a little closer at the boom and bust cycle. Also, if you have 30 minutes to spare, Ray Dalio explains it best.

Phases of the Boom and Bust Cycle

Periods of boom and bust are a natural part of capitalist economies. While the length and severity of the boom or bust varies, every cycle has the same pattern.

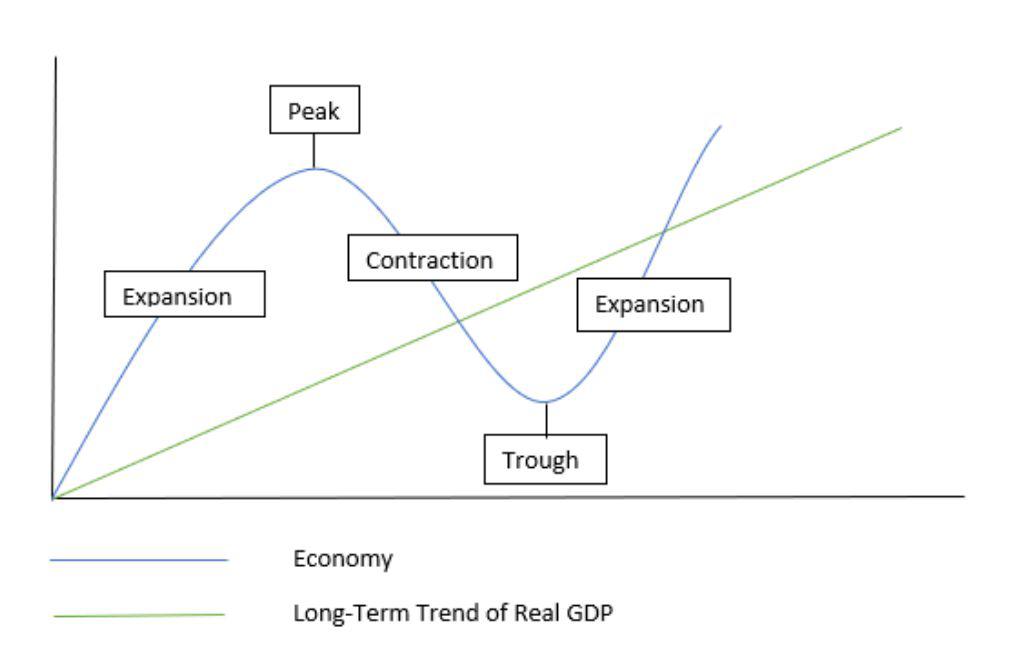

The figure below shows the boom and bust cycle.

As you can see, the cycle begins with a period of economic expansion, which could also be considered a recovery from the previous bust. This is the boom period. Eventually, the cycle hits its peak. The economy then begins to retract, eventually causing a recession. After the economy has contracted as much as it’s going to, it’s reached the trough. The cycle then starts all over again with another period of economic expansion.

There are a few important points related to this graph that merit further discussion.

The first is the long-term trend of real GDP, which trends steadily upward. What this means is that though the economy will see ups and downs, economic growth will continue when viewed over the long term. This is especially important to keep in mind when the economy contracts. Since the market is an indicator of the economy, the market will fall during a bust period. If you’re a long-term investor, this is simply part of the process. As scary as it may be to see gains disappear, keep in mind the long-term trend of the economy has always been up.

The second point worth mentioning is that though every boom and bust cycle will include a period of expansion, a peak, contraction, and a trough, each cycle will also look a bit different. Some boom periods may see rapid economic development and last a long time, and some may last a shorter time and see less rapid expansion. The same applies to bust periods. Though bust periods are typically much more concise than their preceding boom period, their exact length and severity will always vary.

The final point I’ll make before we move on is that this graph is oversimplified. It shows the general trend of the economy throughout a boom and bust cycle. The market will not reflect such a simplified arc. During a period of expansion, markets will not always trend upward in a perfect line, and during periods of contraction, markets will not always move steadily downward. Historically, periods of expansion have seen plenty of days with massive drops in the market, and periods of contraction have seen plenty of days with large gains.

Why is this worth mentioning? Because it means it’s challenging to time the market.

History of Boom and Bust Cycles

We’ve touched on what boom and bust cycles look like in theory, but let’s see how they’ve played out in real life.

In the United States, there have been 14 boom and bust cycles since 1929. The average boom has lasted about two years and three months, while the average bust period has lasted about one year and five months. While the averages are worth noting since they highlight the shorter nature of busts, they should not be taken as the typical length. To show just how much booms and busts can vary depending on the cycle, let’s look at the shortest and longest booms and busts.

Since 1929, the most prolonged economic contraction (bust) lasted 43 months. This specific economic contraction is also known as the Great Depression. The shortest economic contraction occurred in 1980 and lasted for only six months. In contrast, the most extended period of economic expansion (boom) was previously 120 months, lasting from March 1991 to March 2001. However, the most recent economic expansion exceeded this, lasting from July 2009 until March 2020 (128 months). The shortest economic expansion lasted for 12 months, from July 1981 to November 1982.

Why Does the Boom and Bust Cycle Exist?

A question you may have at this point is why the boom and bust cycle exists at all. If the long-term general trend of the economy is to grow, then why does this growth need to be interspersed with periods of bust?

Many theories attempt to explain why business cycles exist. The reality is that no one theory fully explains the boom and bust cycle, but instead, the cycle is caused by a combination of factors. For this post, to better understand why the boom and bust cycles exist, we’ll look at the cycle through the lens of supply and demand, financial capital, and human behavior.

Supply and Demand

The increase or decrease in either supply or demand is both a cause and an effect of boom and bust cycles. To see what that means, let’s look at a boom and bust cycle in the context of supply and demand.

During a period of economic expansion, there’s strong consumer demand. Consumers have jobs and money and they feel positive about the future. In order to meet this demand, companies hire more workers. More workers means more employment opportunities, which means more money that consumers can spend. And not only are there more jobs during this period but since companies are making money and there’s more demand, they’re often willing to pay more. More jobs that pay better mean even more money consumers can spend, which drives demand even higher.

In theory, this self-perpetuating cycle could continue forever – but it never does. At some point, the economy typically becomes too hot. With so much economic output, even a small dip in demand will cause inventories to build supply. With less demand, the economy starts to contract.

Now everything happens in reverse. There’s more supply than demand. Companies aren’t making as much money and, therefore, aren’t hiring. Less jobs means less money which means less spending. Which, of course, drives demand down even further. The bust period finally stops when the lack of demand drives prices down enough that there’s once again demand meets supply.

Financial Capital

The boom and bust cycle can also be viewed through the lens of access to financial capital.

When in a period of economic expansion, more investment opportunities exist. Both businesses and individuals want to take advantage of these opportunities, and banks allow them to do so with lower lending standards. This easy access to capital means even more opportunities and more money for banks. Banks continue to take advantage of this opportunity by providing even lower lending criteria.

At some point, credit becomes too easy to get. Risky investments start not to pan out, which means people lose money. Banks aren’t making as much money and need to protect themselves, so they increase leading requirements, making capital harder to get. Fewer individuals and companies have access to capital, leading them to spend less, and eventually, people begin losing their jobs.

Human Behavior

Supply and demand and financial capital are both parts of standard economic theory. Still, to truly understand the boom and bust cycle, it’s also worth considering the many psychological elements in play in economics.

Human behavior during boom and bust cycles is all about people’s confidence in the future. When people feel good about the future, they take more risks. They’re more willing to spend because they currently have money, and they extrapolate that they’ll have more money in the future. Companies that feel good about the future are typically more willing to hire more employees or pay their employees more.

The reverse is also true. When fear causes people to lose confidence in their economic future, they’re more risk-averse. Fear and uncertainty about the future often cause people to spend less and save more. Companies are also typically less willing to take on risks, hire new employees, or pay employees more.

But what causes people to have confidence in the future or not?

Part of this relates to current events. The list of 6 events that have caused people to feel fearful about the future and led to a recession include drought, drop in demand, rising oil prices, changes in monetary policy, diseases, and more. But this fails to explain economic contractions that don’t have a specific event preceding them.

One theory applies what most of us learned in high school – trends spread, and most people jump on board quickly. When applied to behavioral economics, this means that as some people have a positive outlook about the future, this outlook will spread to more and more people. This can then help cause a period of economic expansion. Conversely, as some people begin feeling more fearful about the future, this feeling spreads. More and more people spend less and avoid risk, and this leads to the start of an economic contraction.

Putting It All Together

Thinking about boom and bust cycles in relation to these themes helps explain why these cycles exist, but no factor occurs in isolation. All of these factors act upon each other. And while, in theory, these three factors explain why the boom and bust cycle exists, in the real world, many other factors come into play as well. That’s why even though there have been dozens of boom and bust cycles; each one has been unique.

One excellent example of how these and other factors create a boom and bust cycle is the events leading up to the financial crisis of 2008. Though 2008 was a perfect storm of multiple factors coming together, we’ll specifically look at the catalyst for the 2008 financial crisis: the housing market.

The Boom and Bust of the Housing Market

The foundation upon which the financial crisis rested was built long before the events of 2008. Starting in the late 1990s, lenders made it incredibly easy to get a home loan. Even if you had a low credit score, you could often still get a loan. This was fueled in part by the idea that every American deserved to own a home and that home values would continue to increase over time. This created easy access to capital.

As more people gained access to capital, demand for homes continued to increase, so the supply increased as well. Demand increased faster than the available supply, and home prices soared. Behavior and expectations also fueled the lending and purchasing process. Everyone felt confident that real estate was always a good investment, so they kept on buying.

As we know, the housing bubble eventually popped. Too many people had received access to capital, and they began defaulting on their loans. Suddenly, demand began to drop, and there was too much supply, buyers were upside down on their houses, and defaults continued to increase. People stopped purchasing real estate. They no longer felt confident that it was a good investment.

It’s worth noting that this is the explanation for what happened to the housing market. The reason the financial crisis became as bad as it did was because banks created mortgage-backed securities. When people began defaulting on their mortgages en masse, this impacted mortgage-backed securities, which led to an implosion of the financial sector, which soon impacted just about everyone.

Indicators of Boom and Bust Cycles

Now that you understand the cycle that creates economic booms and busts, you may wonder if there’s a way to see them coming. We’ve already addressed the fact that there is no consistent timeline. Still, while no one can predict the future of the economy, there are a few economic indicators that suggest the approach of a boom or bust.

One of the signs that a bust is coming is that economic growth expands beyond the long-term rate. Remember, over the long-term, the economy has always trended upward, but it’s not a straight shot up. Healthy growth of an economy is 2-3%. When it exceeds that for too long, it corrects itself (AKA a bust occurs). If growth has exceeded this 2-3% threshold for a while (typically four percent or more in consecutive quarters), a bust is likely not too far away.

Other indicators that an economic recession may be on the way include high-interest rates, falling stock market prices, a decrease in manufacturing jobs, and fewer building permits. These all suggest that the economy is beginning to slow. In contrast, lower interest rates, rising stock market prices, and an increase in manufacturing jobs and building permits suggest the economy is once again picking up steam.

Predicting the exact timing of a boom or bust cycle is nearly impossible, but the ending of a boom cycle is often especially difficult to predict. This is in part because there’s always an explanation for why this period of economic expansion will continue forever. Ironically, assurances of never-ending economic expansion is often a sign that a bust is approaching.

Preparing for Boom and Bust Periods

You can’t know the exact timing of a boom or bust period, but if the indicators suggest a new phase of the cycle is approaching, how should you financially prepare? If you’re taking a long-term approach to investing, the best thing you can do is refuse to let your emotions drive your investment decisions.

When the economy is doing well, the stock market often sees good returns. You probably feel optimistic about future returns, and you don’t want to miss out. The natural response is usually to invest more.

During periods of economic contraction, it’s natural to feel fearful about the future. During this time, you typically see market prices dropping. You tell yourself you’d better pull your money out of the market before it all disappears. Once things are better, you’ll invest more again.

This emotional investing means you’re buying high and selling low – the opposite of what you want to be doing. Feeling this way is natural, but it doesn’t mean you have to act on it. One way to avoid the trap of emotional investing is to change your perspective. For example, when the market is down, think of it as a sale on stocks.

“Be fearful when others are greedy, and be greedy when others are fearful” — Warren Buffett

The Bottom Line

Boom and bust cycles are part of the nature of the economy, and they occur for a variety of reasons. History has shown that boom times won’t last forever, but neither will bust times. And even accounting for bust times, the general economic trend has always been up. Keeping this big picture perspective in mind may help you weather the storm of economic busts and avoid the potential pitfalls of economic booms.

If you’re interested in learning more about boom and bust cycles, the best resources that I’ve read are Mastering the Market Cycle by Howard Marks, and Big Debt Crises and Why Countries Succeed and Fail by Ray Dalio.