Dark pools are an alternative trading system (ATS) that allows institutional investors to conduct massive trades without disclosing details on the public exchange unless executed. They are legal and regulated by the Securities and Exchange Commission under Regulation ATS of 1998. Dark pools are believed to provide additional liquidity to the markets to make them function more efficiently.

What Is a Dark Pool

Dark pools, also known as Black pools, are private forums or Alternative Trading Systems (ATS) for trading securities beyond the access of the investing public. These securities are typically equities, derivatives, and other alternative investments. The name ‘Dark Pool’ reflects the opacity with which they operate. Interestingly, leading global banks and brokerages such as JPMorgan Chase, Barclays, UBS Group, and Credit Suisse Group run Dark Pools.

They are also referred to as “dark pools of liquidity” sometimes. Dark Pools primarily exist to facilitate the trading of massive blocks of securities by institutional investors so that their large-scale orders don’t impact the markets. The prominent players conduct their gigantic trade behind closed doors and ensure no disclosures until the transactions are entirely executed. They do, however, need to report information about trades that occur. As a result, dark pools do not contribute to the public “price discovery” process until after trades are executed.

In contrast, if such massive trades are executed in public exchanges like the New York Stock Exchange or NASDAQ, it would cause a significant movement in the share prices.

Imagine an institutional investor like Warren Buffett or Carl Icahn buying a massive stake in a company. There would be a sharp jump in the stock price, isn’t it? However, with Dark Pools, such trades are entirely hidden, and thus there are no significant fluctuations.

Dark pools are sometimes looked upon with a lot of doubt, but dark pools are are legal, regulated by the SEC, and serve a distinct purpose.

However, the complete secrecy in which they operate makes them susceptible to many risks. These include exploitative practices by high-frequency traders or disharmony among their other stakeholders.

History of Dark Pools

Dark Pools primarily came into existence to offer complete privacy to large institutional traders who wanted to execute enormous trades at favorable prices.

1979: Dark Pool has its roots in the United States Securities and Exchange Commission’s financial regulation called SEC reg 19c3 effective from April 26, 1979. This new regulation allowed off-exchange trading of the securities listed on a particular exchange. This marked the birth of Dark Pools.

1980: As a result, Dark pools slowly began to emerge through the 1980s and allowed investors to conduct massive block trading while maintaining complete secrecy and avoiding market impact.

1986: It was a landmark year in the history of Dark Pools. The very first Dark Pool trading venue known as “After Hours Cross” .was launched by Instinet. The following year, ITG created “POSIT,” the first intraday dark pool.

1987-2004: During these two decades, Dark Pools accounted for only 3%-5% of the trades executed on the market. In some cases, this was also known as “upstairs trading.”

2005: This year was a milestone for Dark Pools. The SEC passed Regulation NMS (National Market System), which encouraged investors to discover a better price by bypassing the public exchange. As a result, a large number of dark pools came into existence. With technological disruption and high speed of execution, Dark Pools became a coveted space for high-frequency traders.

2009: The Securities and Exchange Commission proposed to amend the Exchange Act of 1934 regulations that apply to non-public trading in Regulation National Market System (Reg NMS) stocks. This also includes dark pools.

2014: Financial Industry Regulatory Authority (FINRA) made new rules to make certain information in Dark Pools publicly accessible to traders. Weekly trading information for each equity ATS, security-wise, is publicly available on FINRA’s website following a two-week lapse to four-week, based on the type of stock. This is a significant step to enhance transparency in that market.

Here’s a goldmine of information by Paddy Hirsch who explains the operation of the Dark Pools and how the SEC plans to regulate them:

Present Situation of Dark Pool

In the present situation, Dark Pools’ prominence has increased more than ever before. Dark Pools came into existence to address the need of the big institutional investors or traders. The brokers and banks are leveraging Dark Pools by finding the best match for their clients’ orders in their venues.

According to SmartAsset, almost 39% of U.S. stock market trades were executed on dark pools and other off-market vehicles in April 2019. The latest numbers as of February 2020 suggest that there were over 50 dark pools registered with the Securities and Exchange Commission (SEC).

Amid the pandemic-led market meltdown, the off-exchange trading jumped to an all-time high share of 44.93% of the United States stock market on April 27, stated Rosenblatt Securities. This includes everything from dark pools to proprietary trading. Rosenblatt also said that equity trading volume on dark pools ticked up in March and represented roughly 14.16% of the total market.

Large institutional investors are flocking to dark pools to scoop up massive chunks of thousands of shares or offload them at the same time as well. As they do not have to publicly display live data about trading on their venues, dark pools offer a haven for block trading as institutional investors do not have to worry about spooking the market and driving a stock price in the opposite direction.

Why Use a Dark Pool?

When an institutional trader places a massive order in public exchange, there is a possibility of enormous change in the market price of the financial instrument. Therefore, a large buy-order can push the price through the roof before the order is filled. Now, this is not something that the institutional trader would want.

The following few examples would help us to understand the consequence if Dark Pools were absent:

Consider an institutional investor involved in takeover bids. When they start buying large blocks of stock in a company, market participants might see the new order flow and anticipate a deal. That could lead to the mass purchase of the stock by retail investors, resulting in a sky-high takeover price.

Take another example of a company conducting a share buyback with the sole intention of lowering its cost of capital. But just as it begins to buy its shares off of the market, the stock prices would rise through the roof, spiraling the expenses and potentially the debt too.

On the flip side, a gigantic sell order can bring down the market price way before the order is filled. For institutional investors intending to sell the security, this is a significant drawback.

Let’s say a mutual fund wants to offload 20 million shares of a company. Naturally, it won’t sell off all the shares at once and chose to execute the transaction in blocks. However, as the word spreads about the mutual fund liquidating its shares, the prices would plunge sharply. Additionally, the decline in confidence might pressure the stock price more.

Thus, institutional investors would use Dark Pools to avoid such unwanted situations. The security pricing on a public exchange can get distorted in the presence of a large order in the open market. The transaction is processed in secrecy, and the institutional player has an avenue for realizing a dream price for the trade with no worries about massive slippage.

The main objective of a dark pool is to provide big-pocketed traders with the ability to have their orders filled according to the ideals outlined in the National Best Bid and Offer (NBBO) regulation.

Dark Pools and High-frequency Trading

The primary motive behind the existence of Dark Pools is to facilitate massive trading for big institutions behind closed doors. These private exchanges have seen tremendous growth in a short period, and high-frequency trading plays a significant role in it.

Originally, dark pools were established to facilitate massive transactions for institutional investors without making a considerable price impact on the market. However, that isn’t the case anymore. Just like stock exchanges, Dark pools require more people to participate in their trading activities.

To fill in the ever-increasing demand for pool liquidity, certain dark pools began allowing high-frequency traders to participate in their venue to match more trades.

Unfortunately, in some cases, the entry of high-frequency traders leads to the same outcome that the institutional traders want to avoid in public markets. HFTs often use predatory algorithms to front-run and capture big orders and act against the interests of the prominent players.

HFT became such a blatant phenomenon that it became very challenging to execute massive trades through a single exchange. As large HFT orders had to be distributed among several exchanges, trading competitors got alerted and would front-run the order shooting up share prices. All these actions happen within seconds of placing the initial order.

The markets got a glimpse of Algo trading’s manipulative effect in the “Flash Crash” of 2010, caused by illegal spoofing and layering. Dow Jones Industrial Average witnessed a decline of 1000 points in a day, the most significant intraday point decline in its history.

Michael Lewis’s 2014 book, Flash Boys, captured the intriguing incident in detail. Similarly, Dark Pool, a book by Scott Patterson, portrays the hijacking of modern markets and secretive exchanges by Robo trading.

The relatively confidential information about large volumes of trades executed away from the public eyes and the market information empowers computer algorithms to identify opportunities to make money from the price differential between these markets.

Regulation of Dark Pools

Though there is a lot of ambiguity around Dark pool trading, they are regulated under the Regulation ATS of 1998. This regulation launches a two-tier system for alternative trading systems. Under this, ATSs have the option to register as broker-dealers or as national securities exchanges, with minimal compliance reporting.

The Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) are the financial authorities that monitor the business of Dark pool trading. The FINRA operates the Trade Reporting Facility (TRF) in association with NYSE and NASDAQ, allowing dark pools to report trades for a consolidated data feed. The growth in dark pools has led regulators and legislators to take a more profound interest and enforce strict legislation on their trading practices.

Types of Dark Pools

The trading venue provider classifies dark pools. Each dark pool is unique and offers unique advantages according to the market participant’s demography. Although each venue is supposed to offer a service to the trader and create liquidity, every kind of dark pool has a few unique attributes that may or may not offer advantages to all customers.

There are three basic types of dark pools.

Independent

Individual companies run independent dark pools. Independent providers routinely offer lower transaction costs and reduce costs associated with inferior liquidity. Instinet, ITG, and Smartpool are examples of independent dark pool providers.

Broker-Dealer Owned

Investment banks usually run these dark pools. These pools are involved in price discovery through NBBO, and their trade execution involves other banks or “buy-side” traders. A few examples of this dark pool are Credit Suisse’s CrossFinder, Morgan Stanley’s M.S. Pool, JPMorgan Chase, and Barclays Capital.

Agency Broker or Exchange Owned

Exchange-owned dark pools allow retail traders to participate in off-exchange trading. They primarily act as agents and not principals. Exchange-owned Dark Pools are known to offer a high level of liquidity and are pretty sensitive to high-frequency trading practices.

As prices are derived from exchanges, for instance, the National Best Bid and Offer (NBBO) midpoint, price discovery has no scope. NYSE Euronext, BATS Trading, and the International Securities Exchange (ISE) are examples of exchange-owned dark pools. In contrast, some of the agency broker dark pools include Instinet, Liquidnet, and ITG Posit.

Electronic Market Makers Dark Pools

Electronic Market Makers are professional traders acting as proprietors engaged in trading strategies. These dark pools are offered by independent operators such as Getco and Knight, operating as principals for their accounts. Just as the broker-dealer-owned dark pools, the Exchange Market Makers do not offer price discovery as their transaction prices are not calculated from the NBBO.

List of Dark Pools

| BROKER-DEALER-OWNED DARK POOLS: DOMESTIC | CONSORTIUM-OWNED DARK POOLS | EXCHANGE-OWNED DARK POOLS | INDEPENDENT DARK POOLS: DOMESTIC | INTERNATIONAL DARK POOLS |

|---|---|---|---|---|

| Barclays Capital-LX – Liquidity Cross | BIDS ATS | ISE Stock Exchange-Midpoint Match | Instinet CBX | BlocSec |

| BNP Paribas-BIX | Level ATS | NYSE Euronext- Match Point | ITG-POSIT | Instinet KoreaCross. |

| BNY ConvergEx- VortEX | Liquidnet | Instinet JapanCross | ||

| Citi- Citi Match | NYFIX Millennium | NYFIX Euro Millennium | ||

| Credit Suisse -CrossFinder | SWX Europe-SWX Swiss Block | |||

| Fidelity-CrossStream. | Turquoise | |||

| Goldman Sachs-SIGMA X | Chi-X | |||

| Knight-Knight Match. | Liquidnet | |||

| BlockCross | Virtu Financial | |||

| UBS -PIN Cross | TORA Crosspoint | |||

| Interactive Brokers ATS (IATS) |

Dark Pool Indicies

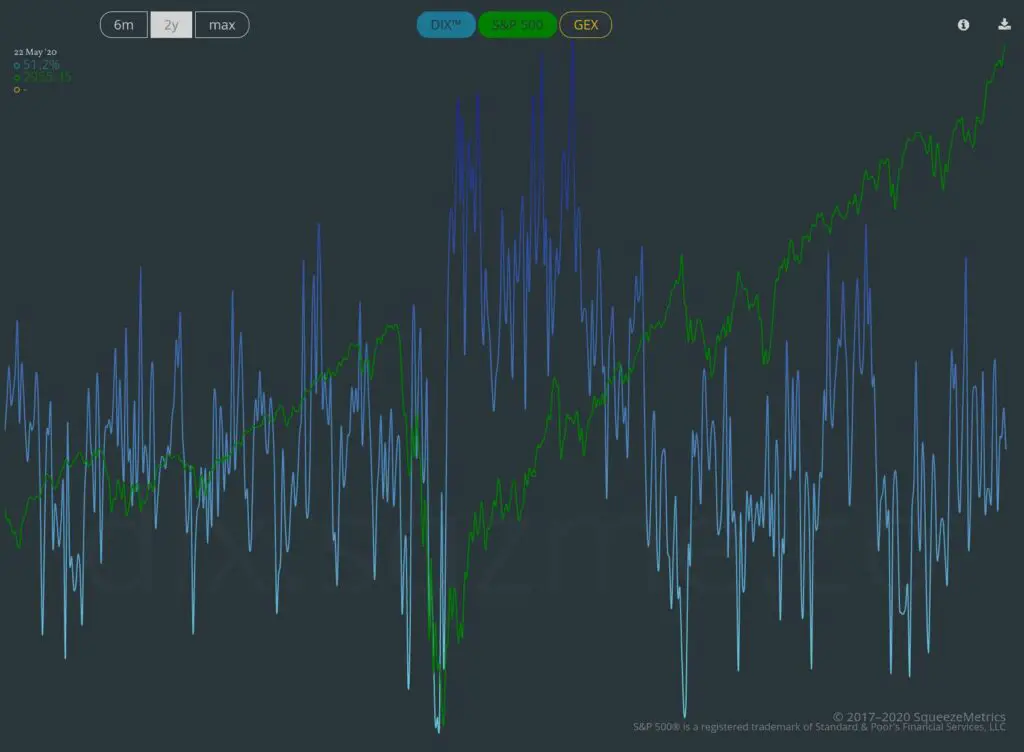

Most of this volume of Dark Pool trading happens at the midpoint of the NBBO, which masks the direction of the trade. This also makes it extremely difficult to interpret dark pools’ pre-and post-trade data. There is a pressing need to visualize and decipher the data, and Dark Pool Indicators are the best way to do so. Squeeze Metrics has designed two specific metrics: The Dark Index (DIX) and Gamma-Exposure Index (GEX).

The Dark Index (DIX)

DIX is a way of scrutinizing the Dark Pools and assessing the hidden sentiment by calculating an aggregate value of several dark pool indicators on the S&P 500 index. If the value of this indicator is higher than usual, it implies that the buying activities in the Dark Pool are more than usual. DIX has a tendency to rise into corrections, which may reflect a broad willingness of investors to pick S&P 500 stocks at attractive valuations. When DIX is low, it implies that people are selling. The DIX uses dollar-weighted trading volume to calculate the ratio of dark pool buying to selling.

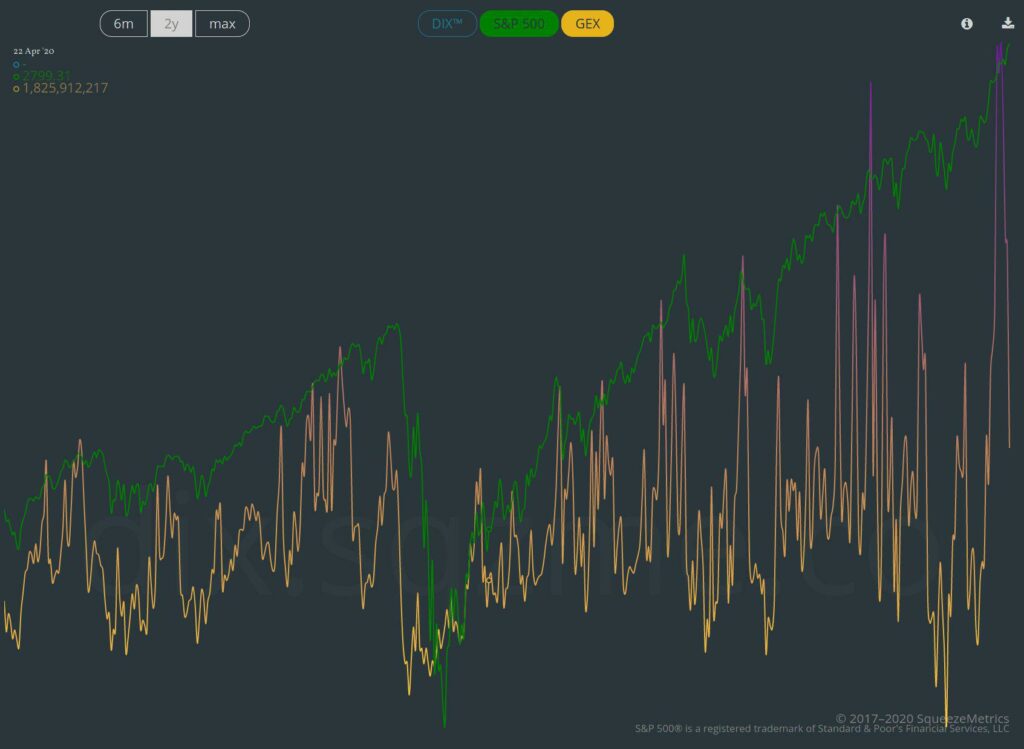

Gamma Exposure Index

The gamma exposure index highlights the sensitivity of options contracts to fluctuations in the underlying price. The absolute value of the GEX index is the number of shares that would be purchased or sold for shifting the price in the opposite direction of the trend in the event of a 1% absolute move.

The GEX acts as a brake on the prices when it reaches too high within a rising market. In contrast, when the price is low, the GEX acts as an accelerator for the market.

FINRA and BATS / CBOE both publish total and short volume data on a daily basis in the dark pools, which can be used for analyzing the indicators. The DIX is negatively correlated with the S&P 500, while the GEX is positively correlated. Hence, the combination of the powerful GEX-DIX might provide powerful and more conviction-filled trading signals.

Dark Pool Pros & Cons

Benefits

Dark pools offer many advantages to institutional investors. They offer additional liquidity to the markets to make them function more efficiently. However, the biggest benefit of dark pools is the market impact being significantly lower for large orders. Here are all the prime advantages of Dark Pool that make it appealing for traders to place traders away from the public eye.

Limited Market Impact

The biggest advantage of Dark Pools to large institutional investors is the limited market impact of their massive block orders. These buyers are always skeptical about sharp market moves as a result of their large trades. Due to this, they have to shell a higher price while purchasing the share while receiving a lower price while conducting the sales. Naturally, these investors are averse to the idea of complete transparency.

Dark pool caters to their interest as the retail investors are absolutely oblivious to the execution details of the massive trade. Thus, there isn’t an overreaction or underreaction that can trigger major share price movements. Also, there is minimal front-running due to this.

Lower Cost Structure

Transactions that take place through dark pools have a significant cost advantage over those that take place through traditional settlements on an exchange. Limited reporting and disclosure obligations, no exchange fees, lesser intermediaries, and a lean operational structure are the main reasons behind these cost savings.

Better Price Discovery

One big factor that tilts in favor of Dark Pool is its ability to facilitate better price discovery. Typically, such exchanges are only open to large players; thus, the pool operators match the prices that are more competitive than that of conventional stock exchanges. Also, the chances of large players finding a buyer for his block trades are higher in Dark Pool.

The benefit of price discovery is primarily offered by the Broker-Dealer-Operated or the Electronic Market-marker dark pools. They derive their own execution prices based on the limit prices of submitted orders, thus leading to price discovery. The primary prerequisites for price discovery are the absence of information leakage or predatory tactics by the HFTs.

In contrast, the exchange-operated or block-crossing Dark pools do not typically offer price discovery. These dark pools derive the price from the transactional price prevailing in the lit pools. These prices include the midpoint of the national best bid and offer (NBBO) or the VWAP.

Helps Bypass Price Devaluation

Massive trades can be made on Dark Pools while avoiding the risks of front-running. These private exchanges allow traders to break large deals into a few smaller deals, with the execution happening before the price devalues. This is a sharp contrast to the public exchanges, where there is a possibility of the price devaluing while large orders are being executed.

Information Asymmetry

Dark pool exchanges are made for institutional investors who are looking to act in advance of market knowledge. These traders with a lot more experience than retail investors and have access to valuable information about the stocks they are buying and selling. There is a decent amount of risk involved because of this, but the information asymmetry also gives them an edge.

Tradeoffs

The fact that a lot of things are hidden about Dark Pools also enhances its riskiness. When massive pool trades happen behind closed doors, it indeed hampers the market efficiency and equilibrium. Let’s understand some of the drawbacks of Dark Pool:

Lack of Transparency

While large participants find the dark pools ideal due to the complete secrecy of operations, this opacity might result in other problems. The lack of transparency leads to disharmony if a broker-dealer’s proprietary traders place trades that conflict with the interest of pool clients. For example, the pool operator’s proprietary traders could end up trading against pool clients.

Because of this, the Securities and Exchange Commission has raised concerns and taken punitive action against banks operating as dark pools. In other cases, the broker-dealer might also provide high-frequency traders unsolicited access to the dark pools.

In October 2011, the SEC settled a case against a comparatively small dark pool, Pipeline. After operating for five years, Pipeline allegedly ran a prop desk through its subsidiary, which provided an unethical informational advantage. The prop desk participated in nearly 95% of all trades happening in Pipeline’s dark pool and siphoned off approximately $32 million from investors on the venue.

Fragmented Information and Liquidity

Dark pools operate according to their own set of rules and regulations, thus offering more personalization. However, it also calls for unnecessary fragmentation of information and liquidity.

Because of this, traders need to spend significant time and money to discover the information about price as well as the regulations to obtain a desired degree of liquidity. This fragmentation caused by Dark Pools might result in improper decisions that could lead to losses for the trader.

Detrimental to Overall Price Discovery

Many experts believe that Dark Pools can result in a lot of price manipulation and hamper the price discovery process. In 2013, an article in the New York Timeshighlighted the concern of regulators that an impairment of the price discovery process could ultimately discourage ordinary investors from participating in the markets.

Therefore, regulators speculate that dark pools could negatively impact trading liquidity. Fighting fraud and manipulation leads to increased costs for brokers who might drop the idea of operating multiple venues. In 2015, Wells Fargo and Citigroup discontinued their off-exchange trading venues due to these reasons.

No Guarantee of Execution

An investor engaging in private trading activity faces an execution risk as Dark Pools do not guarantee trading executions. Thus when there is a high intraday price volatility, the investor would prefer trading in public exchanges than Dark pools.

Vulnerable to Predatory Practices

An HFT firm places small orders to search for large hidden orders in dark pools. The firm has plans to front-run once it detects such an order and makes profits by exploiting the pool participant.

The Bottom Line

Dark pool trade execution holds a lot of significance for institutional investors and companies. When large-scale investors plan to buy or sell a substantial amount of stock, it could influence other investors to do the same and impact the entire market significantly. Dark pool trading plays a crucial role in preventing that. Nevertheless, there is still a substantial risk that accompanies this type of execution.

That said, dark pools can be of immense advantage for institutions and companies seeking both price improvements and minimal price impact when operated fairly with clear rules. That brings me to the regulatory part of the Dark Pool, and I believe there is still a long way to go. A lot of work remains to be done on making the disclosures available to investors to empower them to make well-balanced decisions. Failure to do so could have serious implications on the price discovery, liquidity, as well as integrity of the markets.