Meet David Tepper, one of the greatest hedge fund managers of our time: this superstar investor has amassed a shocking net worth of $16 billion. But the burning question is – what’s the secret behind his remarkable wealth? And how can an investor like you emulate his triumphs?

In this article, I’ll dissect Tepper’s awe-inspiring career and the razor-sharp investment strategies that led to his monumental success. You’ll discover how to harness these techniques to your financial advantage, empowering you to navigate the market and rake in earnings beyond your wildest dreams.

So, if you’re an investor with a thirst for financial freedom, buckle up and delve into the master’s playbook!

Key Takeaways

- David Tepper is an American investor and hedge fund manager with a $16 billion net worth.

- His strategy consists of investing in distressed debt and undervalued companies.

- From 1993-2010, Appaloosa Management returned $12.4 billion for its clients, earning it a sixth-place spot on a list of total returns to clients by hedge funds.

- He is the owner of the Carolina Panthers football team and Charlotte FC Men’s soccer team.

Early Life and Education: From Sports Fan to Finance Legend

David Tepper, born on September 11, 1957, is a Pittsburgh, Pennsylvania native. He grew up in the bustling Stanton Heights neighborhood, rooted in a middle-class Jewish family. From a young age, Tepper had an undeniable passion for sports. He possessed a photographic memory, a superpower that allowed him to memorize baseball stats from the cards his grandfather gifted him.

But Tepper was not just a baseball enthusiast. His heart also beat for football, and he was a die-hard Pittsburgh Steelers fan. However, he didn’t let his sports obsession overshadow his academics. Tepper attended Peabody High School in Pittsburgh’s East Liberty neighborhood, where he was a shining academic star.

Moving forward, Tepper attended the University of Pittsburgh. Here, he dove into economics, graduating with honors in 1978. He worked at the Frick Fine Arts Library to finance his education, juggling books and bucks.

Tepper’s journey into the investment world really began in college. Admittedly, his first two investments went belly-up. But did this knock him down? Absolutely not!

With a steely determination to carve a niche in finance, Tepper enrolled at Carnegie Mellon University Business School. His goal was to bag an MBA, or as it was known then, a Master of Science in Industrial Administration.

In 1982, Tepper graduated college and found himself in the heart of Ohio, working as a credit analyst for Republic Steel’s treasury department. Here, he discovered a hidden gem – the junk bond market. It was a wild, untamed frontier, and he realized he had a knack for trading these high-risk, high-reward bonds.

Day by day, deal by deal, he sharpened his skills, eventually landing him a spot at his next job.

Investing Career Highlights: A Remarkable Journey

In 1985, David Tepper began working at Goldman Sachs. But Tepper wasn’t your average credit analyst. He swiftly climbed the ranks, and within six months, he was the head trader. His specialty? Distressed debt investing. His playground? The high-yield debt team in New York.

However, after seven years and being overlooked for partner twice, Tepper quit Goldman Sachs in 1992. Post-Goldman Sachs, Tepper continued trading. He shared a desk with Goldman client Michael Price. This brief stint lasted a few months before Tepper decided to take the plunge and start his own hedge fund.

The Birth of Appaloosa Management

Then, in 1993, Tepper and former colleague Jack Walton launched Appaloosa Management. They started with $57 million in capital, focusing on distressed debt securities of companies in trouble.

Their strategy? Buy low and sell high, even if it means investing in struggling companies. And this approach worked like a charm. Within six months, they had a 57% return on assets.

But exactly how does this strategy work? Let’s look at an example. In 1998, the world was stunned when Russia defaulted on its debt. Among the shocked was Tepper, who had invested hundreds of millions in Russian bonds only to lose a whopping $80 million. But did this setback stop him? Not a chance.

Tepper, with his sharp instincts, quickly recognized an opportunity. He saw that the market was drowning in pessimism about Russian bonds, pushing their value down to rock-bottom levels. They were a steal.

So, what did he do? He jumped back into the fray, reinvesting with gusto. The result? A staggering 61% gain on his bets. Not only did he recoup his losses, but he also pocketed a tidy profit for his hedge fund. Fast forward to 2022, and Appaloosa managed a whopping $3.82 billion worth of assets.

Tepper’s knack for spotting undervalued and distressed assets during market crashes and recoveries led to some of the most legendary trades in history. His first investment was in the debt of Algoma Steel, a bankrupt Canadian steel company. He bought the bonds at pennies on the dollar and made a massive profit when the company restructured.

In 2001, Tepper saw opportunity in disaster, buying Enron’s bonds after the energy giant collapsed. He sold them at a profit before they became worthless.

But his interests didn’t stop there. Having grown up watching sports, Tepper also bought stakes in sports teams, such as the Carolina Panthers, an NFL team, and Charlotte FC, an MLS team.

Performance History

David Tepper’s success is not just impressive—it’s downright extraordinary. His hedge fund, Appaloosa Management, has earned $12.4 billion return to its clients since its inception, earning a sixth-place ranking of total returns to clients by hedge fund managers.

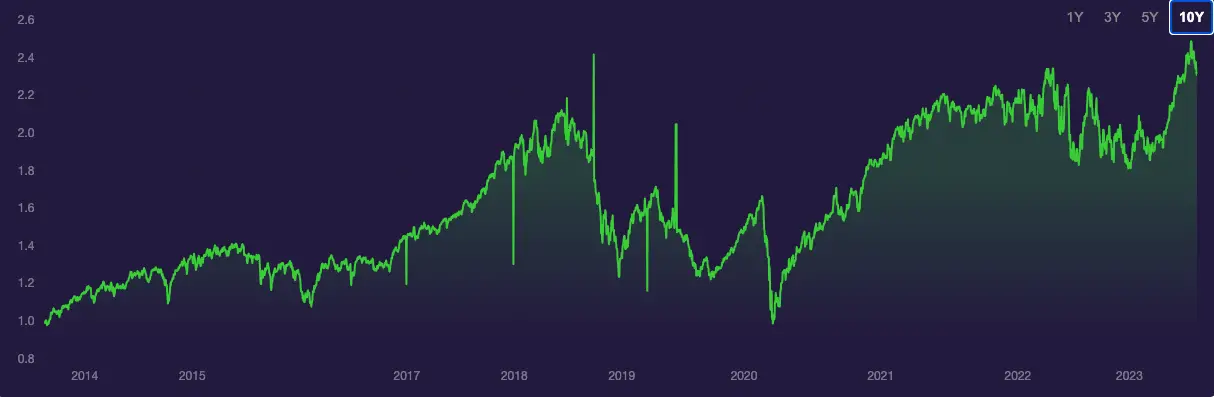

See the chart below to track how Appaloosa Management has performed in the past decade:

And David Tepper? He pocketed a cool $2.2 billion in 2012 alone through his wise investments. That whopping figure catapulted him to the coveted position of the world’s highest-earning hedge fund manager. Fast forward to 2018, and Forbes ranked Tepper third place on their list of the highest-earning hedge fund hotshots with a tidy $1.5 billion in his pocket.

Tepper’s journey from a humble credit analyst to a billionaire hedge fund titan is a shining example of his razor-sharp financial savvy, eagle-eyed ability to spot golden opportunities, and gutsy willingness to take big risks.

A Breakdown of Tepper’s Key Investment Strategies

Let’s dive headfirst into the powerhouse investment strategies that catapulted David Tepper into the billionaire’s club!

The Art of Distressed Debt Investing

David Tepper has carved out a niche for himself with a unique strategy – investing in distressed debt. So, what’s the magic formula behind this technique? It’s all about snapping up debt securities from companies teetering on the brink of financial collapse or bankruptcy at a steal. When these companies bounce back or restructure, Tepper cashes in, selling the securities for a substantial profit.

Tepper’s distressed debt strategy has unearthed some golden opportunities. Ever heard of Algoma Steel, Enron, Worldcom, Marconi Corp, or Williams Co? These are just a handful of the companies that Tepper invested in when they were on the ropes financially.

But let’s be clear. Being a distressed debt investor isn’t for the faint-hearted or inflexible. It demands a hefty dose of patience and adaptability. Why? Because turning around a company’s financial fortune is no overnight affair. It’s like nurturing a seedling. You can’t force it to grow, but with the right conditions and care, it will eventually flourish.

Mastering Value Investing

David Tepper has a secret weapon up his sleeve. It’s a strategy called value investing – a companion to distressed debt investing.

The brainchild of Benjamin Graham and a favorite of Warren Buffett, value investing is all about snapping up stocks from companies whose market price is lower than their actual worth. The goal? Sell them when they hit their true value or even higher. Sounds like a piece of cake, doesn’t it? But there’s a twist.

Tepper’s approach isn’t just about grabbing bargain stocks. It’s about unearthing top-notch companies that the market has undervalued. We’re talking about companies with robust fundamentals, a competitive edge, and a bright future.

But why are they underrated? The reasons are as varied as they are intriguing. It could be down to negative vibes, temporary hiccups, or market quirks. According to Tepper, understanding the reason a stock is undervalued is crucial in determining when the market will finally catch up and reflect its true value.

Let’s dive into some examples. Bank of America, AIG, Amazon, Facebook, and Netflix. These are all companies that Tepper backed when they were underpriced by the market. And what happened? He raked in the big bucks when their stocks bounced back.

So how can you find undervalued companies? Tepper’s secret sauce is fundamental analysis. He scrutinizes a company’s financial health, its standing in the industry, and the market’s mood.

While value investing requires a dose of patience, a load of research, and a sharp eye, it’s a tried-and-tested method that has raked in millions (and even billions) for investors.

Diversification is Key

David Tepper’s investment strategy also involves a masterful blend of diversification, which is like a safety net for your investments.

His approach is simple yet effective – he doesn’t stack all his chips on one number. Instead, he spreads his bets across a wide range of assets and industries. This way, if one investment takes a nosedive, others might soar. It’s like having a lifeboat ready when one side of the ship starts to sink.

Take a peek at Tepper’s investment portfolio. From energy to healthcare, tech to sports teams, Tepper’s investments span across sectors like a rainbow. He’s even got his fingers in the pie of financial instruments like stocks and bonds. This diverse portfolio isn’t just a show of his investment prowess; it’s a strategic move to spread the risk.

Invest With a Large Margin of Safety

One of the secret ingredients to David Tepper’s success recipe is his rock-solid risk management strategy. He always plays it safe, investing only when there’s a wide safety margin. This means he only buys assets when their market price is a bargain, way below their real worth.

Moreover, Tepper never, ever uses leverage: he steers clear of borrowed money to boost potential returns. This way, he keeps the risk of sinking into debt from a failed investment at bay. In fact, when quizzed about leverage in an interview, Tepper quipped, “What do you need leverage for?”

Be a Contrarian Investor

David Tepper is a master of jumping off the bandwagon and bucking the trend. For example, when the market was in a frenzy and selling off Russian bonds like hotcakes, Tepper dared to be different. He scooped up these undervalued assets and ultimately made a killing.

This bold move underlines an important lesson: While it’s smart to keep an eye on market trends, sometimes the real gold lies in going against the tide. So what’s the takeaway? Don’t be afraid to adopt a contrarian approach. As Warren Buffett once said, “Be fearful when others are greedy. Be greedy when others are fearful.”

A Long-Term Approach

David Tepper has another secret weapon: Patience. But what makes patience so critical to his winning streak? Tepper invests in companies with high growth potential, keeping his grip firm until they hit their peak. He doesn’t jump the gun to sell at the first glimmer of profit. Instead, he bides his time, waiting for the perfect moment.

So, what’s Tepper’s secret to mastering this patience? It boils down to emotional discipline.

Investing isn’t just a numbers game. It’s a mental marathon. Tepper counsels investors to flex their emotional discipline. It’s about resisting the urge to sell when the market wobbles. It’s about standing firm and trusting in the growth potential of your investments.

The David Tepper Effect on Modern Investing

David Tepper, the mastermind who revolutionized investing, has left an indelible mark on the world of finance. His groundbreaking strategies and audacious approach have lit a fire under a whole generation of investors.

Tepper’s investment tactics aren’t for the meek. They’re a roller-coaster ride of high-stakes, high-reward scenarios. He’s famous for diving headfirst into distressed assets, placing his bets on their comeback when most would run for the hills. This daring approach has blazed a trail for many to follow, cementing his status as a renegade in the industry.

But wait, there’s more! Tepper generously gifted a whopping $67 million to his alma mater, Carnegie Mellon University. This monumental donation was used to construct the “David A. Tepper Quadrangle,” a vibrant hub for the Tepper School of Business. So, it’s not just David and his trustees who reap the rewards of his investments. Future students also get a slice of the pie.

His influence is so potent that Simon Ree even penned a book, “The Tao of Trading: How to Build Abundant Wealth in Any Market Condition,” dedicating a section to Tepper’s investment strategies. This book offers readers a golden opportunity to peek into the mind of this investing virtuoso.

So, are you ready to take a page from Tepper’s playbook and revolutionize your investing game?

Conclusion

Ultimately, there’s a goldmine of wisdom in David Tepper’s success story, a tale that speaks volumes about the power of strategic investment. His savvy approach, rooted in distressed debt investment and hunting for undervalued gems, is a testament to the might of meticulous fundamental analysis and relentless effort.

So, if you’re dreaming of joining the billionaire’s club, it’s time to tune into Tepper’s sage advice: seek out golden opportunities and diversify your investment landscape. In doing so, you’ll not only amass a fortune but also unlock the door to financial freedom.

Frequently Asked Questions

Now let’s answer some frequently asked questions investors have about hedge fund manager David Tepper!

How did David Tepper get so rich?

David Tepper earned a fortune through his hedge fund Appaloosa Management.

How much does David Tepper make annually?

While David Tepper’s annual income is unknown, his net worth is estimated to be over $16 billion.

Is David Tepper the richest owner?

According to Forbes, David Tepper is the world’s eighth-richest sports team owner.

What companies does David Tepper own?

David Tepper owns Appaloosa Management, the Carolina Panthers football team, and the Charlotte FC soccer club.

Do hedge fund managers make a lot of money?

Yes, successful hedge fund managers earn millions and sometimes even billions of dollars.