Imagine growing a $5,000 trading account to $15 million in 12 years! This isn’t a fantasy; it’s the real-life success story of market wizard Ed Seykota. The pioneer of computerized trading and trend-following strategies, Seykota’s journey is a goldmine of insights for anyone seeking to make a fortune in trading.

In this article, we unpack Seykota’s groundbreaking trading strategies and delve into his career journey. By understanding his trading system and psychology, you can emulate Seykota’s success, paving your way to financial independence. Keep reading to embark on this journey and skyrocket your wealth!

Key Takeaways

- Ed Seykota is an independent trader who uses a computerized trend-following and risk-management strategy.

- Over 12 years, Seykota grew a $5,000 account to $15 million by making profitable trades.

- Ed Seykota penned a book called “The Trading Tribe,” where he delves into his trading secrets.

- He has appeared in “Market Wizards” by Jack Schwager, a book of interviews of the most successful traders.

Ed Seykota’s Early Life and Studies

Born in the Netherlands in 1946, Ed Seykota moved to the United States at a young age. He spent his early years embracing the American dream, a journey that led him to the prestigious Massachusetts Institute of Technology (MIT) years later.

At MIT, Seykota graduated with a degree in electrical engineering, a field requiring high analytical thinking and problem-solving skills. While he never used his degree for electrical engineering, his college years helped him hone the skills that would later prove invaluable in his trading career.

How Ed Seykota Started His Trading Career

Ed Seykota began his financial journey in the egg and broiler markets, working as an analyst for a major brokerage firm. This humble beginning was where Ed Seykota honed his trading skills, preparing him for an illustrious career.

A Career Shift into Commodities Futures

Then, in 1970, Ed Seykota made a daring career leap. He delved into the world of commodities futures trading. But he wasn’t just trading – he was innovating. Seykota designed and coded his own mechanical trend-following system, catapulting himself into the future of trading before tech became a norm in the industry.

What ignited Seykota’s interest in a computerized system? A letter from Richard Donchian, the trailblazer of mechanical trend-following systems. Donchian’s words on the perks of such a system lit a fire in Seykota, sparking his innovative drive.

He was particularly inspired by Donchian’s 5 and 20-day moving average system, which uses the average of a specific number of days to forecast future price trends.

From Clients’ Money to Independent Trading

After managing client accounts using his revolutionary trading system, Seykota made a bold decision. He left his job to become an independent money manager. This move allowed him to fully immerse himself in his own trading strategies and financial growth.

Since then, Seykota’s trading career has been nothing short of extraordinary. His journey from analyzing eggs to becoming a trading innovator is a testament to the power of daring to dream and carve your own path.

Ed Seykota’s Performance Record: The Numbers Don’t Lie

Let’s dive into Seykota’s performance history to understand why his trading strategies are worth learning!

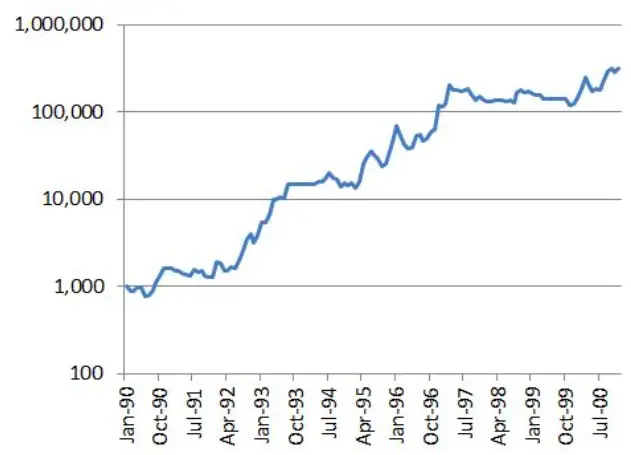

Over 12 years, Ed Seykota transformed a mere $5,000 trading account into an eye-popping $15 million. His trading mastery delivered a staggering compounded annual return of 60%. That’s right, 60%!

And from 1972 to 1988, his account didn’t just grow – it skyrocketed, shooting up by millions of percent. Imagine if liquidity wasn’t a stumbling block; he could’ve made a whopping $100,000,000! No other trader has come close to matching these astonishing returns.

And during bear markets? Seykota proved that his strategy was still a recipe for success. When the S&P 500 index dropped over 20% in the infamous 1987 stock market crash, he navigated the turbulence with a drawdown below 10%. A masterclass in risk management, indeed!

In honor of his extraordinary track record, Trader Monthly magazine crowned him as the 8th greatest trader of all time in 2006, a fitting tribute to a trading legend. He’s also been featured in Jack Schwager’s book of interviews, “Market Wizards,” which I highly recommend grabbing a copy of if you haven’t already.

Ed Seykota’s Winning Formula: How He Trades the Markets

At this point, you might be wondering, “How can I trade like Ed Seykota and amass a fortune?” Strap in, because I’m about to dissect his trading tactics, giving you the tools to mirror his financial triumphs!

Following the Trends

The first step to mastering Seykoda’s trading technique? Trend following! This approach involves identifying the direction of market movements. But how do you crack this code? The secret is in the magic of moving averages.

Moving averages are a sequence of averages extracted from a pool of data. In the trading universe, this data is usually the price of a financial instrument over a defined period. Seykoda uses these averages as a compass to navigate the market’s general direction.

Is the moving average climbing? Chances are, the market is on an upward journey, and it’s time to buy! Is it descending? The market is likely sliding down, and it’s time to sell!

Once the market’s direction is clear, Seykoda shifts gears towards measuring the strength of market movements. This is where the thrill of breakouts comes into play.

A breakout, in trading lingo, is when the price of a financial instrument shatters its previous high or low. Seykoda uses these breakouts as a barometer to gauge the strength of market movements.

Ed Seykota’s silver trade is a shining example of his trend-following strategy. Seykota saw a silver lining when the U.S. treasury halted silver sales in the 1960s. He jumped on board, predicting a roaring bull market on the horizon.

Cutting Your Losses and Managing Risk

Ed Seykoda’s risk management system is a masterclass in precision and strategy. It’s a system that calculates the perfect trade – almost every time. Let’s delve into it.

First, Seykoda’s system determines the optimal position size. This is the number of shares or contracts to trade. The system considers the volatility of the stock or commodity and the trader’s risk appetite. High volatility? The position size shrinks. The reason? A smaller position size can help shield you from potential losses if the market swings against you.

Of course, knowing when to exit a trade is just as crucial. Seykoda’s system uses a moving average to determine when you should sell your position to secure profits and cut your losses. It’s like having a safety net, ensuring that even if the trade doesn’t pan out as planned, your losses are kept at bay.

You can see how cutting your losses works in Seykota’s silver trade! When silver’s value eventually took a nosedive, his use of a stop-loss allowed him to exit his position at the right time and minimize losses. While Seykota didn’t profit from this trade as expected, it had a massive effect on him, enabling him to turn to computerized systems rather than relying on his own instincts.

Riding the Winners

Ed Seykota champions the power of “riding winners” by letting his trades reach their full potential before selling. His secret weapon? Trailing stops.

But what is that? A trailing stop refers to a specific stop loss order that adjusts according to the market price. It’s there to protect your profits by allowing a trade to stay open and keep generating money as long as the market price moves in the right direction. However, the trade closes if the market price shifts in the wrong direction by a certain amount.

So, how do trailing stops work? Let’s say you bought a stock at $50. You set a trailing stop at $5 below the market price. As the stock price increases, the stop price rises too, always maintaining that $5 distance. If the stock price falls, the stop price stays put. It’s like having an automatic profit lock-in system.

Trailing stops are like a secret weapon in your trading arsenal. They ensure you don’t sell too soon, allowing you to ride the profit wave for as long as possible. They’re simple, effective, and can make a world of difference to your trading success.

Keeping Bets Small and Diversifying

Ed Seykota has a golden mantra: “Keep your bets small.” He never stakes a massive portion of his capital on a single trade. Instead, he gambles with only a tiny fraction. This strategy minimizes potential losses, ensuring Seykota remains in the game, even when a trade goes wrong.

Moreover, Seykota spreads his investments across diverse markets and time frames. This way, he’s not gambling with all his chips on one number. If one market stumbles, another might soar, creating a balanced portfolio.

Of course, this isn’t some untested trading theory! Seykota’s track record is a testament to his success. Despite the market’s rollercoaster ride, he consistently churns out remarkable returns, all thanks to his disciplined approach to risk management.

Sticking to the System

Ed Seykota is a titan in the trading universe, famed for his ironclad discipline. He adheres to his trading system with an unwavering dedication, sidestepping the traps of personal bias and emotional reactions. Seykota’s strategy is a testament to the power of steadfast rule-following, applied without a shred of doubt.

In recent times, Seykota’s fascination with the human mind and its problem-solving capabilities has surged. He firmly believes that trading and psychology are two sides of the same coin, and if you can master your emotions, you can become a better, more profitable trader.

After all, in the volatile world of trading, it’s easy to let your emotions take the reins, leading to rash decisions. Fear and greed are two supervillains that have the power to decrease our profits. But Seykota? He’s a rock.

He sticks to his trading systems, grounding his decisions in logic and strategy. He detaches his emotions from his trading, crafting decisions that are as coldly calculated as they are rational.

Knowing When to Break the Trading Rules

Remember how we just said that Ed Seykota always sticks to his trading rules? Well, after decades in the trading trenches, he’s also mastered the art of breaking his trading rules. After all, Seykota recognizes that markets aren’t static. They shift, morph, and occasionally throw a curveball.

Consequently, Seykota isn’t afraid to fine-tune his trading tactics. He scrutinizes the evolving market landscape, learns from past blunders, and adjusts his strategy accordingly.

For instance, when a once-reliable trading pattern loses its mojo due to market shifts, Seykota doesn’t cling to it out of stubbornness. Instead, this market wizard seeks a fresh pattern and creates a new system.

But what’s his secret? With a trading career spanning years, Seykota has cultivated an invaluable asset: intuition. He possesses an uncanny “sixth sense” for the markets, an instinctual pulse on the right moments to buy and sell. This isn’t something you can code into an algorithm. It’s a gut instinct, a feeling he’s sharpened over countless trades.

However, Ed cautions against relying on gut feelings unless you’re a seasoned trader with a deep understanding of the market. If not, stick to the trading system!

How To Master Ed Seykota’s Trading Strategy

So how can you replicate this strategy and become a legendary trader like Seykota? Let’s talk about it!

Learning from Ed Seykota’s Book

First, I recommend checking out Ed Seykota’s FAQ website, where he answers other traders’ burning questions about his craft.

Next, I suggest grabbing a copy of Ed Seykota’s book “The Trading Tribe.” If you’re serious about mastering the art of his trading style and earning millions, this book is your ultimate guide.

In this text, Seykota unveils his secrets, offering priceless insights on how to master the rollercoaster ride of trading. Admittedly, it’s a tad on the expensive side at $240; so if you want to save money, simply read this next section where I break down its essential teachings!

Quick Tips for Trading the Seykota Way

Let’s decode how you can leverage Seykota’s strategies for your own financial success:

- Master Trend Following: Closely study market trends! Learn to spot them, analyze them, and let them guide your trading decisions. Seykota’s strategy thrives on this!

- Ride the Profit Wave: One of Seykota’s golden rules is “ride your winners.” If a trade is going well, don’t rush to cash out! Let your profits grow!

- Cut Losses Swiftly: Conversely, if a trade isn’t performing, don’t cling on hoping for a turnaround. Cut your losses swiftly and protect your capital!

- Embrace Risk: Set your stop-loss orders and risk only a tiny portion of your capital on each trade.

- Harness Mechanical Trading: Consider using or developing a mechanical trading system to automate aspects of your trading, like identifying trends and setting orders.

- Stick to Your Guns: Abide by your trading rules, no exceptions! Don’t let your emotions get in the way of profits.

- Stay Agile: While it’s crucial to follow your trading rules, adaptability is key. Market conditions can flip in a heartbeat, and your strategy should be flexible enough to pivot when necessary.

- Learn from Your Mistakes: Analyze your trades, especially the unsuccessful ones. Use this information to sharpen your strategy.

- Diversify Your Assets: Don’t put all your eggs in one basket. Spread your portfolio across different markets and time frames to minimize risk.

- Bet Small, Win Big: Feeling confident about a trade? Great! But don’t risk too much on it!

The Seykota Effect on Modern Trading

Ed Seykota’s name is etched in the halls of trading history. His groundbreaking influence on the trading world, particularly in the dynamic arena of trend-following and computerized systems, cannot be overstated.

As the father of computerized trading, Ed was the first to see the potential in leveraging a commercial computerized trading system for following market trends.

Seykota’s Influence on Successful Traders

Seykota’s influence is like a tidal wave, sweeping across the trading world, leaving a trail of success in its wake.

Take Michael Marcus, for instance. A successful commodities trader in his own right, Marcus openly credits Seykota as the architect of his success. In a candid interview, he hailed Seykota as a genius and a great trader who helped him get his foot in the door of finance.

Ultimately, Seykota’s groundbreaking work in trend-following has ushered in a new era of trading. It’s like he’s taken the trading world and given it a turbocharged engine.

So, the next time you’re riding the wave of a market trend or leveraging a computerized trading system, tip your hat to Ed Seykota. His vision and innovation have sculpted the trading landscape we navigate today.

Conclusion

Now that we’ve explained the genius of Ed Seykota’s trading system, it’s clear that trend-following, risk management, and a firm grip on your trading psychology are crucial for market success. Seykota’s mantra of accepting losses as part of the game and keeping your eyes locked on the long-term prize is a golden nugget every trader can embed in their strategy.

Remember Seykota’s profound words, “Win or lose, everyone gets what they desire from the market.” So, what’s your heart’s desire on this trading expedition? If you stick to Seykota’s foundational principles, you can unlock the door to financial independence and kiss your 9-5 goodbye. Good luck!

Frequently Asked Questions

Let’s explore some frequently asked questions traders have about Ed Seykota and his trading strategy!

What is Ed Seykota’s strategy?

Ed Seykota developed his own trading style based on trend following and risk management.

How much did Ed Seykota make?

Ed Seykota’s estimated net worth is around $4.2 billion.

Where does Ed Seykota live?

Ed Seykota currently lives in Texas, United States.

Does Ed Seykota use moving averages?

Yes, Ed Seykota uses moving averages to track market trends and determine the best entry and exit points.

What is the most accurate moving average?

Many traders consider the 200-day moving average the most accurate. If the 50-day moving average of a stock remains above the 200-day moving average, traders consider the stock to be in a bullish trend.

Who is the most famous rogue trader?

Nick Leeson, a former derivatives trader, is one of the most famous rogue traders.

Who is the richest trader?

Jim Simons is the richest trader in the world, with an estimated net worth of 28.1b.