Ethereum is a decentralized platform for applications that runs with minimal chances of censorship, fraud, or third-party interference. The history of Ethereum is less than a decade old and involves several stages of technical upgrades. Here’s how the eventful Ethereum history paves the way for its great future.

Ethereum is an open-source blockchain that allows developers to deploy decentralized apps and cryptocurrency trading without third-party involvement. It has a unique functionality called a smart contract. These contracts are nothing but blockchain-based programs executed on meeting predetermined conditions. Ethereum also allows for creating and exchanging non-fungible tokens or NFTs, non-interchangeable tokens connected to digital works of art or other real-world items and sold as unique digital property.

Ether (ETH) is the native cryptocurrency of the platform. Even though Bitcoin remains the most popular cryptocurrency, Ethereum’s aggressive growth has many speculating it will soon overtake Bitcoin in usage.

With a market capitalization of $513.29 billion, Ethereum is now the second-largest cryptocurrency after Bitcoin. It also accounts for 18% of the cryptocurrency market as of October 2021.28

This article will trace the history of Ethereum and decode its path to success in such a short span.

2011: Vitalik Buterin Visualizes a Blockchain Beyond Bitcoin

In 2011, blockchain technology intrigued Vitalik Buterin, a 17-year-old Russian-Canadian programmer involved in Bitcoin and co-founded the Bitcoin Magazine. However, he envisioned a platform beyond the financial use cases that Bitcoin allowed. Buterin wished that the functionality includes programmable apps and not be limited only by peer-to-peer electronic cash transfers.

2013: The Ethereum Project Is Born

Buterin wanted to execute his idea by adding a layer of advanced scripting language to Bitcoin and its distributed ledgers to process smart contracts. But the Bitcoin community rejected the idea. Eventually, Buterin decided to create an entirely new blockchain technology to bring this vision into effect.

In late 2013, Vitalik Buterin published the Ethereum white paper, describing Ethereum as “a next-generation smart contract and decentralized application platform.” 1. The whitepaper gave a detailed description of the technical design and the rationale for the Ethereum protocol and smart contracts architecture.

2014: Ethereum Is Formally Introduced

In January 2014, Vitalik Buterin formally introduced Ethereum at The North American Bitcoin Conference in Miami, Florida, USA. The platform’s ability to trade more than just cryptocurrency was the key differentiating factor from Bitcoin.

Vitalik made an association with Dr. Gavin Wood to co-found Ethereum. By April 2014, Gavin published the Ethereum Yellow Paper as the technical specification for the Ethereum Virtual Machine (EVM).2 Based on the specification of the Yellow Paper, the Ethereum client was implemented in several programming languages such as C++, Go, Python, Java, JavaScript, Haskell, and Rust — envisioning a blockchain-based world computer.

2014: Initial Ether Allocation and DEVCON 0

At the beginning of July 2014, Ethereum raised $18,439,086 for about 60,102,216 Ether.3 The initial allocation of the new cryptocurrency happened via a 42-day public ether presale. The funds raised through the sale were utilized to repay rising legal debts, developer efforts and finance the continued formal development of Ethereum.

In 2014, the first Ethereum conference called DEVCON 0 was hosted by Ethereum founders. It was held in Kreuzberg, Berlin, from November 24-November 28.4. This meeting, discussion, and brainstorming practice have continued ever since, and DEVCON has become the annual conference for all Ethereum developers, researchers, thinkers, and makers.

December 2015: Formation of MakerDAO

In 2015, MakerDAO was created by Danish entrepreneur Rune Christensen, Nikolai Mushegian, and others.5 It was one of the autonomous organizations to launch on the Ethereum blockchain. MakerDAO aims to build an entire Defi ecosystem permitting loans and savings on Ethereum’s blockchain network. This project connects a DAO with another crypto-collateralized stablecoin known as the DAI. The protocol’s first iteration, Single Collateral DAI, only used ETH as collateral.

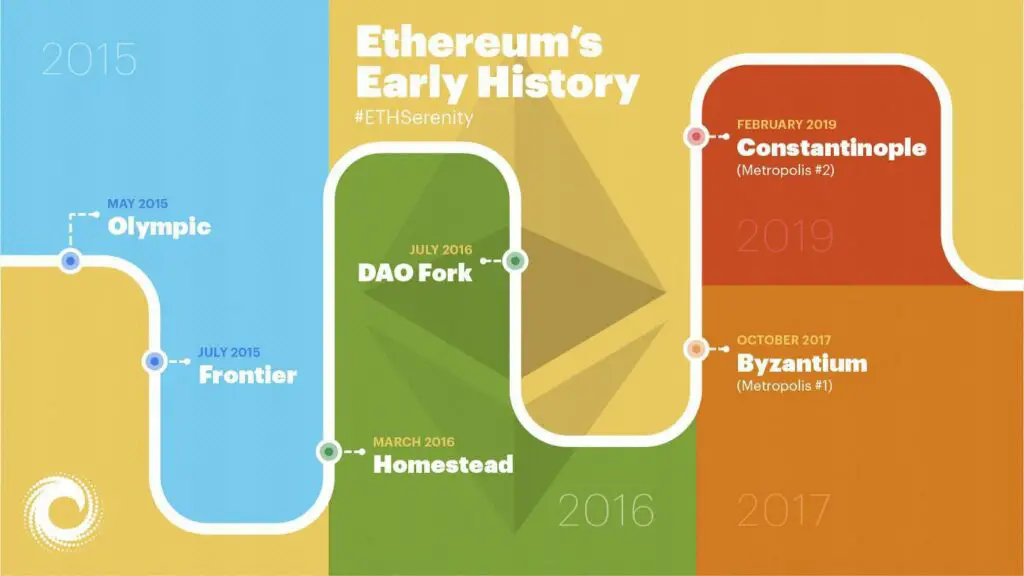

May 2015: The Olympic Phase

The Olympic phase happened before the Ethereum blockchain’s public launch in July 2015.6 It was the ninth and final proof of concept open testnet that allowed developers to explore the functionality of the Ethereum blockchain after it was released.

Buterin sought advice from the developers to check if the protocol could handle high traffic. The four categories under which the developers were asked to perform testing were: Transaction Activity, Mining Prowess, Virtual Machine Usage, and General Punishment. Olympic also announced a total prize of up to 25,000 ether to the developers for stress-testing the protocol.

July 2015: Frontier Phase

On July 30, 2015, Ethereum 1.0, or the first version of Ethereum called Frontier, was released.7 The two primary functions of Frontier were facilitating intelligent contracts and processing transactions through distributed computing, also called miners compensated for their processing power via Ether digital assets.

This initial stage aimed at getting the network started to enable miners to arrange their mining processes and for developers to test their decentralized applications (DApps). The launch featured the Genesis block, including 8893 transactions of those who purchased Ether during the official presale. There were slightly over 72 million “pre-mined” ETH. 12 million from this amount was allotted to the Ethereum development fund.8

Frontier featured canary contracts to notify users when a particular chain was found to be faulty or vulnerable. These contracts were given either a 0 or a 1. Contracts with an issue were marked as one, and clients were given notification to avoid mining off that broken chain.

Initially, Ethereum had a hardcoded gas limit per block of 5,000 gas. The main objective was to hinder usage and keep the transaction fee low.

This led to a minor fork called Frontier Thawing. 5 days after the release of Ethereum, the limit was altered to 3,141,592 gas targets per block. The network could now handle transactions and smart contracts adhering to the core idea.9

March 2016: The Homestead Update

The first planned hard fork of the Ethereum network was the Homestead upgrade, and it was implemented on May 14, 2016, with block number 1,150,000. The Homestead upgrade brought in three significant improvements to Ethereum. Firstly, it removed the canary feature, thus discarding centralization on the network. Secondly, it introduced new codes in Solidity, Ethereum’s primary programming language. Thirdly, it introduced the Mist wallet, enabling users to hold or transact ETH and write or deploy smart contracts.

June 2016: Formation of Ethereum Classic

The DAO fork resulting in Ethereum Classic was one of the most significant developments in the history of Ethereum. A decentralized autonomous organization, or the DAO, was launched in 2016 on the Ethereum blockchain.11 An innovative idea enabled users to crowdsource funds through a token sale on Ethereum. It even raised $150 million worth of Ether, but a bug in its smart contract code led to its failure. In June 2016, hackers stole $50 million worth of organization funds June 2016.

Ethereum’s security issues drew immense public criticism due to this hack.12 As a result, the Ethereum Community conducted a split or hard fork to secure the network and return the stolen Ether. Much of the Ethereum community believed “code is law” and the funds should be returned, and in response, they created Ethereum Classic, which continues to exist. After the split, Ethereum Classic’s ticker is ETC, while Ethereum continues to go by ETH.

February 2017: The Enterprise Ethereum Alliance

Technology behemoths are leveraging Ethereum to develop bespoke blockchain technology models. The formation of the Ethereum Enterprise Alliance in February 2017 was a significant step.16

Microsoft Corporation, JP Morgan Chase, Intel Corporation, and Bank of New York Mellon Corp are notable names. Subsequently, the alliance was rolled out to 116 members.

October 2017: Tangerine Whistle and Spurious Dragon

Ethereum suffered from various DoS (denial-of-service) attacks, after which two sub-upgrades called Tangerine Whistle and Spurious Dragon were launched.13 The objective behind these upgrades was to deal with security issues and improve the network’s efficiency by adjusting gas fees and implementing state clearing or removing empty Ethereum accounts.

Tangerine Whistle was a hard fork of the Ethereum blockchain, which occurred at block #2,463,000. This upgrade addressed immediate network health issues due to the attacks.14 Tangerine Whistle was done to alter the gas calculation for certain I/O-intensive operations and clear the accumulated state from a potential denial-of-service attack.

“Tangerine Whistle Spurious Dragon” is the second hard fork of the two-round hard fork in response to the DoS attacks on Ethereum that happened in September and October.15 It addresses critical matters such as taking preventive and reactive responses to attacks in the future.

2017: Collapse of EtherDelta

EtherDelta was one of the first decentralized exchanges built on Ethereum as EtherDelta. Based on an order book, EtherDelta was one of the most popular exchanges for trading different ERC20 tokens, especially during the popular Initial Coin Offerings phase.

Unfortunately, at the end of 2017, the hacker gained access to EtherDelta’s front-end and diverted the traffic to a phishing site, robbing users of around $800 000. Adding to the woes, in 2018, the SEC also filed a charge against the founder of EtherDelta, Zachary Coburn, for running an unregulated security exchange in 2018.27

2018: The Term ‘DeFi’ is coined

Defi, or decentralized finance, was coined during a Telegram chat in August 2018.17 This chat happened between the Ethereum developers and entrepreneurs such as Set Protocol’s Inje Yeo, 0x’s Blake Henderson, and Dharma’s Brendan Forster.

Even with the platform’s technical limitations, DApp developer activity on Ethereum continues to gain momentum. Defi is one of the dominating features of Ethereum today. It is an open distributed network that empowers people to control their assets and transfer them without the assistance of any intermediary. The setup is quite similar to an internet connection, but the transmission object is money.

The Defi movement consists of DApps modeled after traditional financial players such as banks, exchanges, derivatives markets, and lending services. As of July 29, 2020, crypto assets worth $3.68 billion are earmarked by users into various Defi protocols.

2017-2020: The Metropolis Phase

The Metropolis phase played a critical role in improving Ethereum’s security, privacy, and scalability.18 It addressed most of Ethereum’s scaling process challenges by bringing in a more efficient process. Due to its complexities, the upgrade was released in two steps: Byzantium and Constantinople.

The Byzantium hard fork was implemented in October 2017 at block 4,370,000. It consisted of nine Ethereum Improvement Protocols (EIPs) for improving Ethereum’s privacy, scalability, and security attributes. These protocols included essential features such as zk-SNARKs3, account abstraction4, and the ice age difficulty bomb.19

Constantinople, the other hard-fork, was launched in mid-2018 but was delayed for a few months as a critical bug was discovered just ahead of its planned launch. Constantinople was the solution to the problems arising out of Byzantium’s implementation. It also laid the transition from proof-of-work to proof-of-stake-a move to minimize Ethereum’s energy consumption.19

2020: Ethereum 2.0 “Serenity”

Also known as Ethereum 2.0, the Serenity stage is still in development. This version aims to elevate Ethereum to a level that has no security lapses or high-volume issues. A clogged network can only handle a limited number of transactions per second, and the enormous energy consumption of the proof-of-work mechanism.

For several years, it’s been building Ethereum 2.0, which is expected to be ready by the first quarter of 2023. The first phase, the Beacon Chain, had already gone live in December 2020. The Eth2 Beacon Chain has grown steadily, block by block every 12 seconds.

The makeover will move Ethereum to a less energy-intensive consensus mechanism, mining, and block reward process. According to network founder Vitalik Buterin, it could increase throughput by over 7,000-fold to 100,000 transactions per second.20 Experts believe that each phase of Serenity will be completed in roughly six to eight months. Beacon Chain was launched in Phase 0 in December 2020, and the Serenity is expected to be completed sometime in 2023.

April 2021: The Berlin Update

In April 2021, the “Berlin update” was launched on the Ethereum network. This was an update aimed at reducing the ETH gas prices. The Ethereum Foundation had officially announced this upgrade on March 8, 2021. This hard fork was named after the first Ethereum DevCon in Berlin, Germany. 21

The Berlin Hard Fork went live on April 15, 2021, after the Istanbul and Muir Glacier upgrades on the Ethereum main net at block 12,244,000 happened.2223 The Berlin Hard Fork implemented a series of four Ethereum Proposals (EIPs) that introduced new transaction types and adjusted the gas costs of complex transactions.

May 2021: Ether Prices Cross $4000

Ether, the native cryptocurrency of the Ethereum protocol, marched past $4,000 for the first time on May 10, 2021. Ether yielded more than 450% in this year alone. The surge of Ether is due to fundamental factors and the role of Ethereum being central to decentralized finance or Defi. This digital platform breaks the monopoly of banks and institutions for financial transactions.24

August 2021: The London Upgrade

The London Hard Fork update was a major revamp for Ethereum. This upgrade aims to lower the transaction fees on Ethereum and signal a new mining pattern for the Ether. This stands to solve a significant problem for the miners due to an increase in NFTs and the growth in Defi. Formally called Ethereum Improvement Protocol 1559 (EIP-1559), the London hard-fork plans to address the issue by burning or destroying Ether coins.29

September 2021: Ether Price Continues Rising

Ethereum has risen above $4,000 for the first time since May 2021. Until now, over 183,000 eths worth $600 million have been burned so far in less than a month.25 More than $140 million ether has been burned since the Ethereum fee system revamp on August 5, 2021.

The Ethereum upgrade, codenamed EIP-1559, boosted investor sentiment after introducing a “fee burn.” Instead of the previous auction system, users now pay a base fee to process their transactions through miners.

Miners don’t receive the base fee, or else they would congest the network superficially to keep a higher fee. To address the issue, it’s burned instead. The EIP-1559 has resulted in Ether’s price appreciation by 17%.

Jesse Proudman, co-founder and CEO of crypto Robo-advisor Makara said, “The DeFi sector, as a whole, has 7.5M ETH (~$94B) locked in various protocols. This, combined with more than 529,000 ETH being burned, should create upward pressure on the price as increasing amounts of ETH supply are removed from the liquid markets,” he stated.30

The Final Block

Ethereum is still in its formative stages, but it has almost limitless potential and applications. With thousands of smart contracts, apps, tokens, and more Ethereum addresses than any other blockchain, Ethereum has built a formidable ecosystem, and some believe it will become the most prominent cryptocurrency. Over the years, its infrastructure has been enhanced, and it has surmounted various challenges related to security issues. Also, Ethereum is not as rigid as Bitcoin; it is more open to network upgrades making it a strong contender.

The Ethereum 2.0 update, likely to happen in early 2022, will migrate Ethereum from a proof-of-stake (PoS) algorithm to proof-of-work (PoW). Shard chains will also be merged with the Beacon chain during the POS migration. This upgrade aims to lower the transaction fee and make the blockchain more environment-friendly and scalable. As a result, analysts expect a bullish sentiment among Ether investors and more adoption by the corporates.

Ethereum commands a dominant position in the Defi space, which is proliferating. As a result, it could see some competition from platforms like Solana, Binance Smart Chain, and Avalanche.

Sources: 1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16, 17, 18, 19, 20, 21, 22, 23, 24, 25, 26, 27, 28, 29, 30