The following are the most important historical and current Forex statistics for anyone researching the markets or industry.

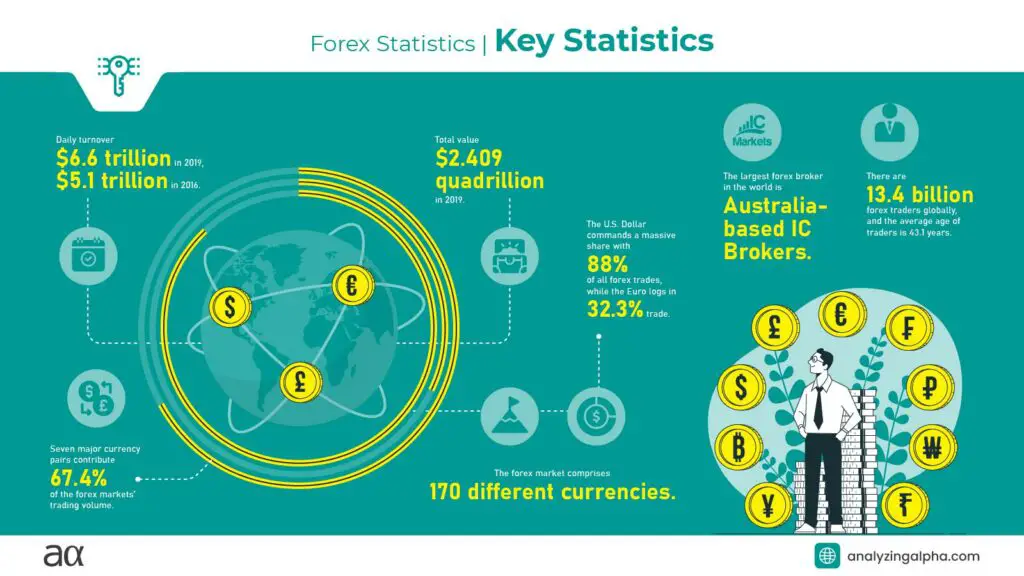

Key Statistics

- The daily turnover of foreign exchange markets has increased to 6.6 trillion as of 2019, from 5.1 trillion in 2016.1

- The total value of the forex industry stands at $2.409 quadrillion in 2019.1

- The forex market comprises 170 different currencies.1

- The U.S. Dollar commands a massive share with 88% of all forex trades, while the Euro logs in 32.3% of trade.1

- Seven major currency pairs contribute 67.4% of the forex markets’ trading volume.1

- There are 9.6 million forex traders globally, and the average age of traders is 43.1 years.1

- The largest forex broker in the world is Australia-based IC Brokers.2

Though the broader market has witnessed many volatility and downturns due to the COVID-19 pandemic, [the Forex market/forex-market-history) was relatively unaffected. On the contrary, the increased volatility has boosted forex trading activities.

A report by trading broker IronFX revealed a significant uptick in trading volumes between March and June, surging by approximately 300%.

The growth rates were more prominent in developing nations, as Africa, Eastern Europe, and Southeast Asia comprised 60% of the new trading accounts.

I have compiled an exhaustive list of exciting forex statistics that you will love to learn.

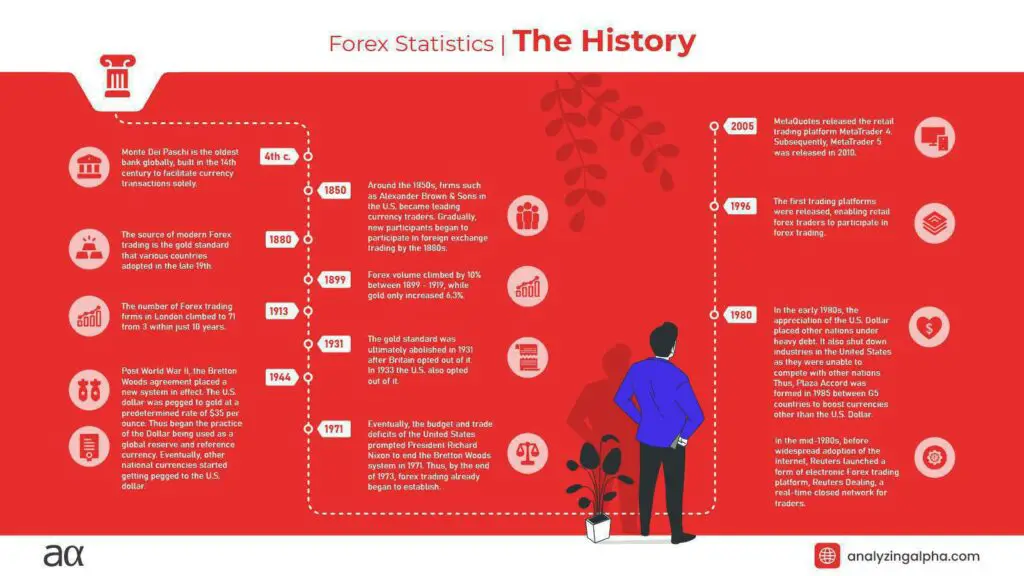

Forex History Statistics

- Monte Dei Paschi is the oldest bank globally, built in the 14th century to facilitate currency transactions solely.5

- However, the first Forex market was established in Amsterdam, close to 500 years ago.6

- Exchanges occurred primarily between agents and merchants who represented nations like England and Holland.6

- The source of modern Forex trading is the gold standard that various countries adopted in the late 19th and early 20th centuries. However, many believe that the gold standard was established in 1880 and is the beginning of modern forex.7

- Around the 1850s, firms such as Alexander Brown & Sons in the U.S. became leading currency traders. Gradually, new participants began to participate in foreign exchange trading by the 1880s.8

- Forex volume climbed by 10% between 1899 and 1919, while gold only increased 6.3%.9

- By 1913, the number of [Forex trading firms/top-proprietary-trading-firms) in London climbed to 71 from 3 within just 10 years.23

- The gold standard was ultimately abolished in 1931 after Britain opted out of it. In 1933 the U.S. also opted out of it.10

- Post World War II, the Bretton Woods agreement placed a new system in effect. The U.S. dollar was pegged to gold at a predetermined rate of $35 per ounce. Thus began the practice of the Dollar being used as a global reserve and reference currency. Eventually, other national currencies started getting pegged to the U.S. dollar.11

- Eventually, the budget and trade deficits of the United States prompted President Richard Nixon to end the Bretton Woods system in 1971. Thus, by the end of 1973, forex trading had already begun establishing.12

- In the early 1980s, the appreciation of the U.S. Dollar placed other nations under heavy debt. It also shut down industries in the United States as they were unable to compete with other nations. Thus, Plaza Accord was formed in 1985 between G5 countries to boost currencies other than the U.S. Dollar.13

- In the mid-1980s, before the widespread adoption of the Internet, Reuters launched a form of electronic Forex trading platform, Reuters Dealing, a real-time closed network for traders.14

- In 1996, the first trading platforms were released, enabling retail forex traders to participate in forex trading.15

- 2005: MetaQuotes released the retail trading platform MetaTrader 4. Subsequently, MetaTrader 5 was released in 2010.16

Forex Market Statistics

Foreign exchange is traded in an over-the-counter market where brokers/dealers negotiate directly with one another, so there is no central exchange or clearinghouse.

- The Forex market is the largest financial market globally compared to the stocks, fixed income, and commodity markets. The global forex trading market is worth $2.4 quadrillion.1

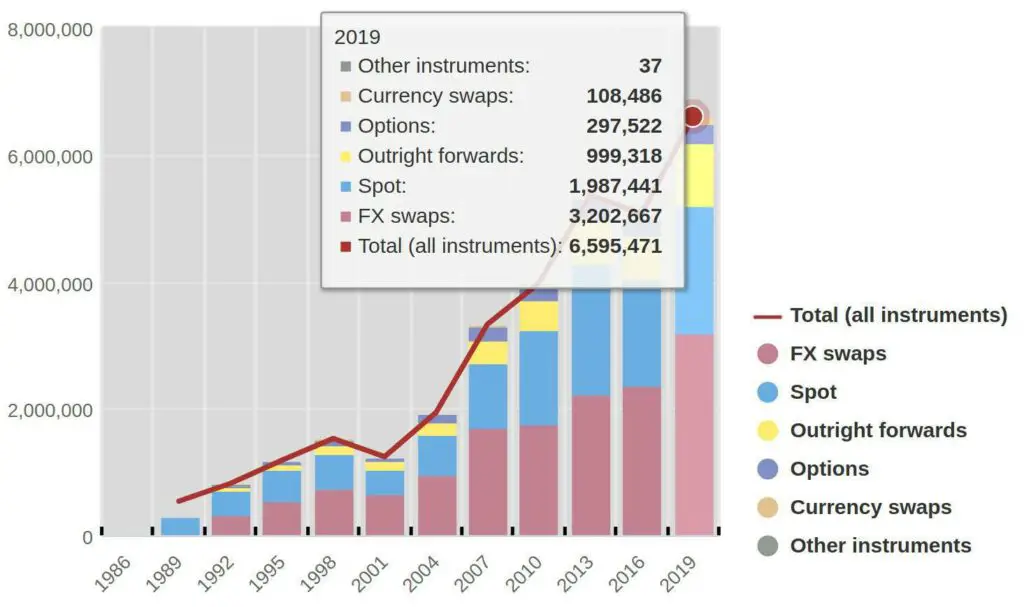

- The daily activity in the Forex market has increased from 1.2 trillion in 2001 to 6.6 trillion in 2019. The break-up of the daily activities was as follows.1

- The forex market operates 24 hours a day, starting from 5 p.m. EST on Sunday up to 4 p.m. EST on Friday.17

- Usually, Forex trades have a higher leverage ratio that can be as high as 200:1 in some countries.18

- The daily volume of Forex trading is close to 53 times that of the New York stock exchange.19

- JP Morgan is globally the largest foreign exchange dealer with a 9.8% market share, followed by Deutsche Bank with 8.4%.1

- 79% of the global forex trading in 2019 was collectively facilitated by the sales desks in the United Kingdom, the United States, Hong Kong SAR, Singapore, and Japan.1

- In April 2019, The collective share of forex trading in the central Asian financial centers, including Hong Kong SAR, Singapore, and Tokyo, dropped to 20%.1 Mainland China recorded an 87% surge in trading activity since 2016to $136 billion in 2019.1

U.S. Forex Market

- The share of forex trading in the United States dropped to 17% in 2019, from 20% in 2016.1

- The U.S. dollar features in almost 88% of all the Forex trades.1

- The Euro is the second most traded currency in the U.S. market.1

- 36% percent of U.S. transactions include the Euro.1

- The U.S.’s share of global turnover was 31% in 2016.1

- The net daily average turnover as of April 2019 in the U.S. was $1.370 billion.1

U.K. Forex Market

- The United Kingdom has a massive share of 43.1% in the global forex turnover.1

- In 2016, the percentage of the U.K. in the worldwide turnover was 37%.1

- The net daily average turnover as of April 2019 in the U.K. was $3.576 billion.1

Australian Forex Market

- The U.S. dollar, the most traded currency in the Australian market, comprises nearly 93% of all trades.20

- The second most popular currency is the Australian Dollar and accounts for 52% of trades.20

- The USD/AUD pair also called the Aussie, accounts for 47% of the average daily turnover of $66.1 billion.20

- The USD/EUR is the third most popular, accounting for 11% of turnover, with a daily average turnover of $15.04 billion.20

Forex Market in Japan

- Japanese Yen, the most traded currency, accounts for 38.9% of trades, and its average daily turnover stands at $292.3 billion.21

- The U.S. Dollar, the second most traded currency, is involved in 38% of trades, with an average daily turnover of $285.6 billion.21

- The third most familiar currency in the Japanese forex market is the Euro. It accounts for 9.9% of trades with a daily turnover of $74.6 billion.21

- The British pound accounts for 3.4% of trades in the Japanese market. Its turnover amounts to $25.9 billion.21

Canadian Forex Market

- Canada stands 6th in turnover in the forex market, contributing 5% to the average daily turnover.1

- The IMF reports that the Canadian Dollar ranked 7th among currencies held by central banks and made up 1.8% of global central bank reserves in Q4 2019.22

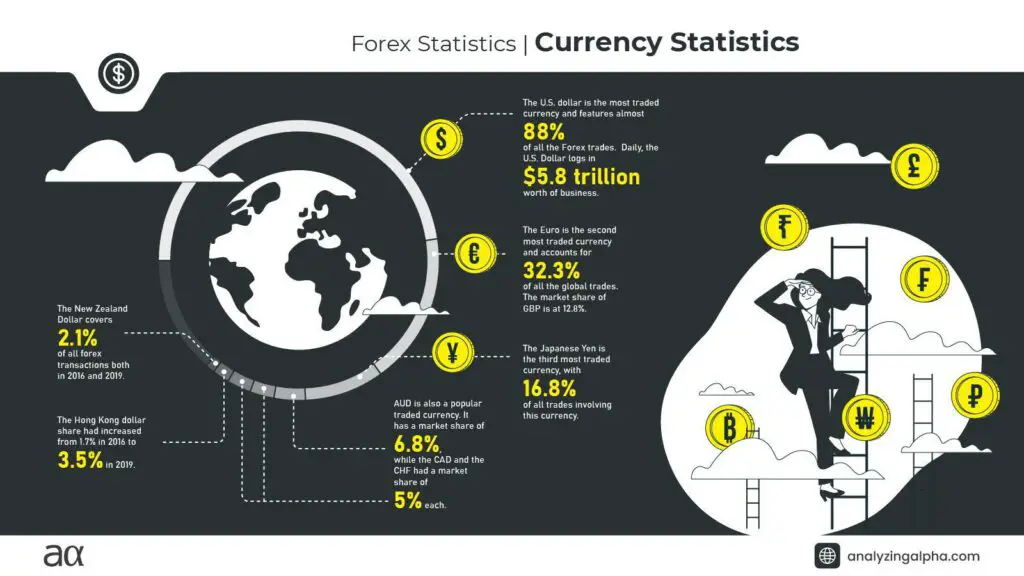

Forex Currency Statistics

- The U.S. dollar is the most traded currency and features almost 88% of all Forex trades. Daily, the U.S. Dollar logs in $5.8 trillion worth of business.1

- The Euro is the second most traded currency and accounts for 32.3% of all global trades. The market share of GBP is at 12.8%.1

- The Japanese Yen is the third most traded currency, with 16.8% of all trades involving this currency.1

- AUD is also a popular traded currency. It has a market share of 6.8%, while the CAD and the CHF had a market share of 5% each.1

- Currencies of emerging market economies (EMEs) account for almost 25% of overall global turnover.1

- The Hong Kong dollar share had increased from 1.7% in 2016 to 3.5% in 2019.1

- The New Zealand Dollar covers 2.1% of all forex transactions both in 2016 and 2019.1

Forex Currency Pairs Statistics

Currency pairs depict the value of one currency against another. They comprise a base currency and a secondary quote currency.

Each pair has a bid and ask price. The bid price is the maximum price a buyer is willing to pay for the currency. In contrast, the asking price is the minimum price a seller is willing to accept. The difference between the bid-ask ratio causes price change in the currency pairs.

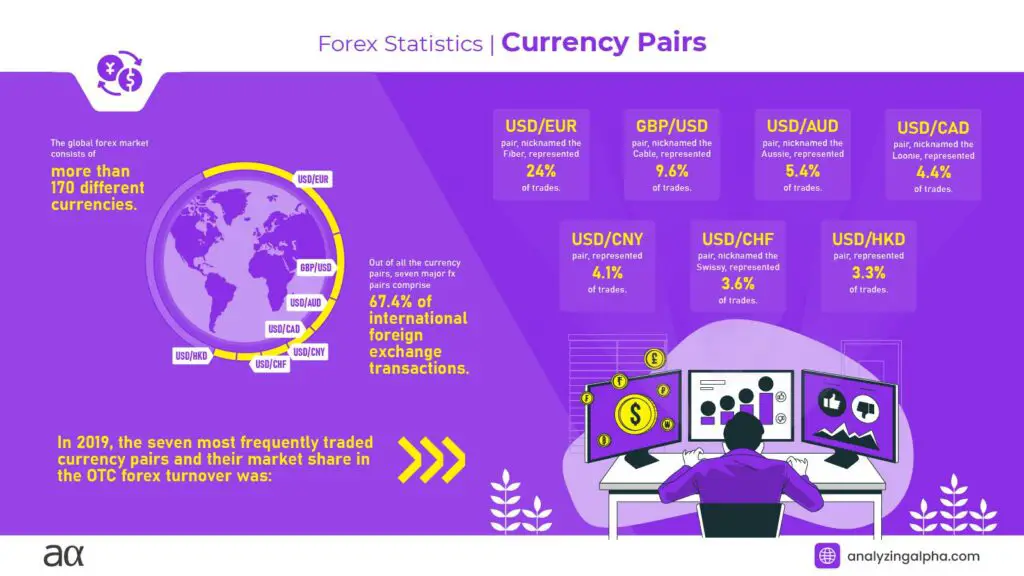

- The global forex market consists of more than 170 different currencies.1

- Out of all the currency pairs, seven major fx pairs comprise 67.4% of international foreign exchange transactions.1

- In 2019, the seven most frequently traded currency pairs and their market share in the OTC forex turnover were:

- The USD/EUR pair, also called Fiber, accounted for 24% of trades in 2019.1

- The GBP/USD currency pair is known as the Cable, and the pair contributed 9.6% of forex transactions in 2019.1

- The USD/AUD pair nicknamed the Aussie, accounted for 5.4% of transactions in 2019.1

- The USD/CAD pair, famous as the Loonie, represented 4.4% of trades in 2019.1

- The USD/CNY pair comprised 4.1% of daily trades last year.1

- The USD/CHF pair, nicknamed the Swissy, made up 3.6% of forex transactions in 2019.1

- The USD/HKD logs in 3.3% of forex transactions in 2019, up from 1.5% in 2016.1

Forex Risk Statistics

Forex trading is available in the form of CFD trading or spreads betting. Both of these forms are leveraged products. This implies that there exists an opportunity to multiply profits; chances of losses are also equally significant. This is because traders need to place a percentage

- 99.6% of retail Forex traders cannot achieve more than four back-to-back profitable quarters.24

- Less than 5% of the traders spend 63.75% of their overall budget on trading forex, while 25%-50% spend 2.1% of their budget on forex trading.25

Forex Demographic Statistics

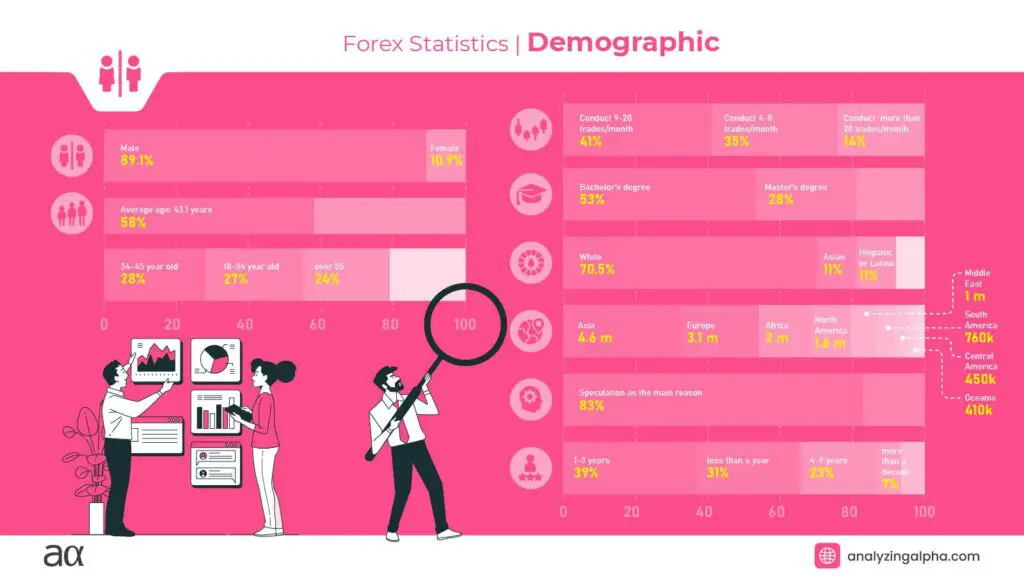

- Male forex traders dominate with an 89.1% share, while females comprise the remaining 10.9%.25

- The average age of a forex trader is 43.1 years, representing 58% of the population.26

- 28% of traders are aged between 34 and 45 years.27

- 27% of forex traders are millennials aged between 18-34.27

- 24% of forex traders are over 55.27

- 41% of traders conduct 9-20 trades per month, while 35% place 4-8 transactions per month.27

- 14% executes more than 20 trades per month.27

- 53% of the forex traders hold a Bachelor’s degree, while 28% hold a Master’s degree.26

- As per ethnicity, forex traders who are White comprise 70.5%, while 11% of the traders are Asian. A forex trader with Hispanic or Latino ethnicity is amongst 11% of the total traders.26

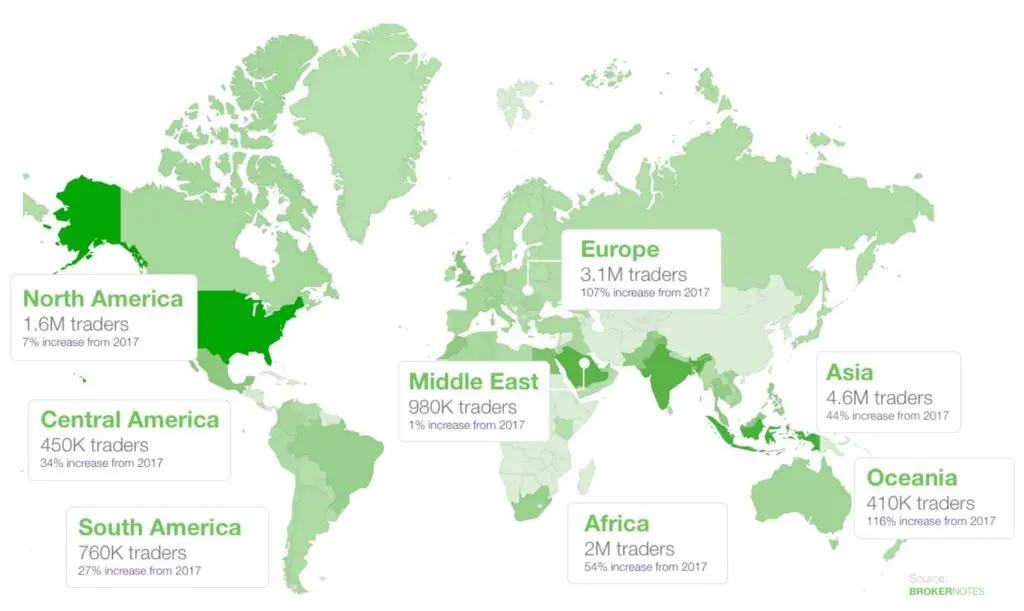

- There are approximately 13.9 million online traders in the world.28

- Of those 13.9 million, 4.6 million belong to Asia, 1.6 million in North America, and 3.1 million in Europe.28

- There are 2 million traders in Africa, nearly a million in the Middle East, and close to 760,000 in South America. Meanwhile, about 450,000 traders are there in Central America and 410,000 in Oceania.28

- As for countries, the U.K. is the world’s leading node of forex trading, with over 730,000 online traders.28

- 83% of the traders cite speculation as to the main reason for their forex trading.29

- 7% of all traders have been trading forex for more than a decade, 39% have been trading for 1-3 years, while 31% of traders have been trading for less than a year. Traders who have been trading for 4-9 years account for 23%, while those that account for only 7%.27

Forex Broker Statistics

To trade forex, you require online forex brokers. A trusted forex broker is critical for success in the global currency market trades. Every currency trader has specific needs related to which platform, tool, or research requirements they use.

- Australian Broker I.C. Markets is amongst the largest forex brokers globally, with an average daily trading volume of $18.9 billion.2

- With an average daily trading volume of $13.4 billion, XM is the largest forex broker, regulated by a range of financial authorities, including CySEC in Cyprus.2

- The second-largest forex broker in Europe is Saxo Bank, with an average trading volume of $12.3 billion.2

- The largest broker in the U.S. is Forex.com, owned by GAIN Capital Holdings. It has an average daily trading volume of $15.5 billion.2

Forex Technology Statistics

- For retail investors, MetaTrader 4 is the most popular trading platform currently available. MetaTrader 5 is also an equally well-accepted MetaQuotes Software.30

- 85% of all retail CFDs were traded using MetaTrader 4, while 6% use MetaTrader 5. The MetaQuotes are advanced tools designed to assist day traders or Expert Advisers in executing trading strategies.27

- When looking for a new broker to trade forex with, 35% of traders use their mobile to research account types and trading features. Android is 3% more popular than iPhones leveraging iOS software. Samsung is more popular among the devices23.

- 65% of traders feel that machine learning and artificial intelligence are critical for optimizing trade execution.25

- 70% of the traders use a live account, while the remaining 30% use demo accounts.27

Sources: 1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16, 17, 18, 19, 20, 21, 22, 23, 24, 25, 26, 27, 28, 29, 30