Have you ever heard someone on TV saying that a politician or policymaker was being “too hawkish” or “too dovish”? Maybe you know that means something about their views on the money supply, banking, and inflation, but it’s all hazy? If so, this article is for you.

First, we’ll define what it means for an official to be “a hawk” or “a dove” in the financial world. Then we’ll look at how to remember the difference between hawkish and dovish policy, where those terms came from, and how hawkish or dovish policies affect things. We’ll wrap up by looking at some trading strategies for each situation.

What Is the Difference Between Hawks and Doves?

Hawks, also known as “Inflation Hawks”, are usually monetary policy advisors in government or the banking industry who advocate higher interest rates to protect our economy from inflation and increase price stability.

Doves, also known as “Inflation Doves”, are usually monetary policy advisors in government or the banking industry who advocate lower interest rates to stimulate our economy and increase employment rates.

The same person can be hawkish and dovish in different situations or times. They may be called a ” centrist ” if they are always in the middle between the hawks and the doves, they may be called a “centrist”.

How to Remember the Difference Between Hawks and Doves

Here is a silly but effective way to remember the difference between hawkish and dovish monetary policy:

Imagine you want to start a new business. But you need some money to fund your new venture – you need a loan. So you show up at your local bank and see two different loan officers sitting at their desks waiting for customers. Both of them are birds. (We’re imagining, remember!)

At one desk is an austere hawk. The hawk looks noble but a bit scary – not friendly. A soft, innocent-looking dove is sitting there smiling at you at the other desk. Which bird will you ask for the loan: the austere hawk or the friendly dove?

You ask the dove, of course! And you get your loan at a great rate because the dove is a softie (it even has friends who can print money!).

This is an easy way to remember that a “dove” is someone advocating an “easy” monetary policy that increases the total cash available in the economy. In contrast, a “hawk” supports more austere “tight” money policies.

Now, one thing you should not conclude from this little story is that inflation hawks are bad, and inflation doves are good. It’s not that simple, as we’ll see in a few minutes. But first, we’ll discover how these terms came to be applied to monetary policy in the first place.

How “Hawkish” and “Dovish” Came Into Use

Hawks and doves have been contrasted symbols in many cultures since ancient times. Hawks naturally signified aggression, war, and hunting. And doves became a symbol of peace ever since the Hebrew Torah recounted the story where Noah sent out a dove that discovered olive branches – a sign confirming that the flood was subsiding and peace could resume on earth.

Thomas Jefferson first used the term “war hawk” in a letter written to James Madison to describe those calling for war on France in 1798 (Encyclopedia.com). And while there is some debate, it seems clear that the terms “hawkish” and “dovish” gained use as alternate labels during the Vietnam War Era in the US (you can see the Ngram here if you are curious). Eventually, the terms were borrowed to describe a person’s stance on monetary policy and war.

How Is Monetary Policy Set?

In the United States, the terms hawk or dove are most often applied to members of the Federal Open Market Committee (FOMC) at the Federal Reserve. The 12 members of that committee set Monetary Policy for the entire United States. The Federal Reserve System (or “The Fed” for short) is the system of central banks, governing boards, rules, and committees set up by the Federal Reserve Act of 1913 to pursue the following:

- Set monetary policy to promote pricing and currency stability, control inflation rates, and promote employment in the US

- Monitor financial and economic indicators to diminish systemic risks in the US financial system

- Foster the security and efficiency of the US banking system by providing payment and settlement transactions

- Monitor and regulate private banks and Credit Unions to ensure a healthy banking system

At the helm of the Fed is the Federal Open Market Committee. This committee includes all members of the Federal Reserve Board of Governors (FRBOG), seven individuals appointed to staggered 14-year terms by US presidents. The FOMC also consists of five presidents of the 12 Regional Federal Reserve banks.

How to Anticipate Monetary Policy

It would be great if investors had a crystal ball to tell them what direction the Fed is going next. But since we don’t have that, it can be helpful to know a few ways to anticipate policy.

First of all, the Fed releases meeting minutes and makes statements about what direction they anticipate going. When they talk about their future options and plans, this is called “Forward Guidance” and is essentially the Fed’s attempt to be transparent without making any promises. To stay informed, some investors monitor the Fed’s communications directly.

Second, many institutions and news agencies do extensive research and hire experts to offer their opinions on the “Monetary Policy Outlook”. Most investors don’t take the time to read the Fed’s forward guidance; instead, they find a favorite news source that will monitor and summarize it for them. I think it’s wise to have several sources that you compare and synthesize to form your outlook and also to read right from the source.

How the Fed Affects Interest Rates

There are four different ways the Fed can affect the interest rates and the money supply in the US economy. Each of these can be used to implement dovish or hawkish policies:

- Changing the Discount Rate: The Fed can increase or decrease the interest rate at which they will lend their own funds to commercial banks, which affects the rate at which banks can afford to lend to the public. Hawkish policies would raise the discount rate. Dovish policies would lower the discount rate.

- Changing Reserve Requirements: The Fed can tell banks how much of their portfolio needs to be held in the Fed’s Reserves to ensure liquidity and prevent potential bank runs. A Hawkish Fed could increase the amount they require banks to reserve, which would limit the supply of money and combat inflation. In practice, the Fed rarely changes reserve requirements.

- Performing Open Market Operations: The Fed can buy or sell US Government Securities to/from Federal Reserve member banks to affect the money supply. A Hawkish FOMC could sell securities to banks (in return for US Dollars, of course) to reduce the number of Dollars in circulation within those banks. This reduces the likelihood that those banks will have excess reserves to lend to the public or each other, which will push interest rates up in general. On the other hand, a dovish FOMC would buy securities, giving banks more US Dollars. This would increase the money supply and lower interest rates in general.

- Changing Interest on Reserves: The Fed could increase the interest they will pay on excess funds that banks hold in reserve in the central banks to incentivize banks to keep more money in reserve. This would reduce the supply of loans to the public and thus be contractionary or hawkish policy. To implement an expansionary or dovish policy, the Fed could lower the interest rate on excess reserves so that banks are incentivized to lend to the public instead of holding excess reserves.

Note: The Difference between the Federal Funds Rate and the Discount Rate

One important note is that the Federal Funds Rate differs from the Discount Rate. The Federal Funds Rate is the rate at which member banks will lend overnight funds to each other. The Discount Rate is the rate at which the Fed will lend overnight funds to member banks itself. So ironically, the Fed doesn’t set the Federal Funds Rate directly; they set a target for it and influence banks towards that rate using the four tools above.

Is the Fed Hawkish or Dovish Now?

We have been in a low-interest environment ever since December 2008, when the Fed sent rates down toward 0% to combat the 2008 recession. Since lowering the Federal Funds rate to nearly 0% wasn’t enough of an economic stimulus, they began Quantitative Easing (basically “creating” money on their books and buying an even broader array of “assets” from US banks to inject even more US Dollars into the system).

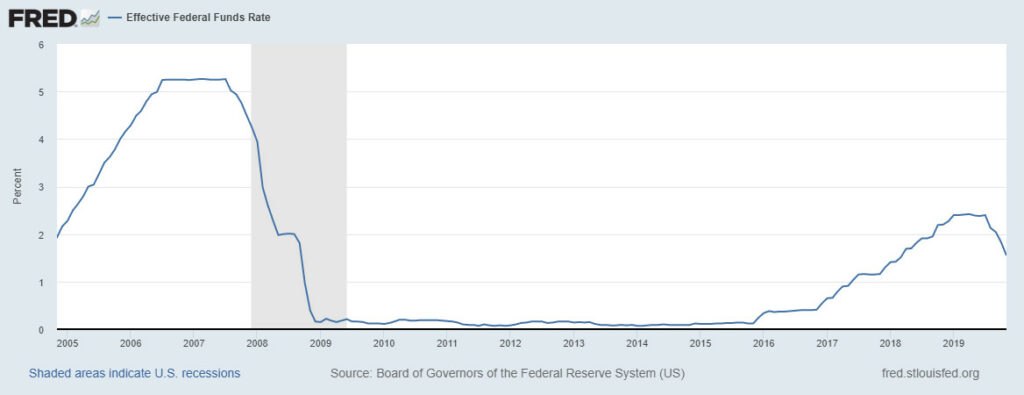

Effective Federal Funds Rate over the last 15 years. Courtesy St. Louis Fed.

As you can see from the chart above, the Federal Funds Rate was kept near 0% for about seven years while the US economy recovered. Then for two years, starting in late 2016, the Fed looked for every opportunity to raise the rates to a more ‘normal’ level. This was the only way that they could have something to drop in the future if needed. That’s how the funds rate got back into the mid 2% range by the end of 2018.

But then they changed to a decidedly more dovish tune in 2019, significantly cutting rates again for the first time in 10 years. This was said to be done to stave off the effects of global trade disputes and a slowing global economy.

All that is to say that the Fed can and will change its minds. There is no way to know how long the Fed will be dovish. I, for one, won’t be surprised if recent drops are not sufficient to prevent the next recession. And I won’t be surprised if we stay in this super-low interest rate environment for years to come. The market expects the same right now, as the 10-year treasury yields are near their historic lows again.

How to Trade a Dovish Outlook

So let’s get to the good stuff. How can you profit when the Fed is lowering interest rates? How can you make the doves your friends?

Go Online with Your Savings Accounts

Everyone needs to keep some assets out of the markets. Experts generally recommend keeping 3-6 months’ living expenses in some form of market independent savings.

In a dovish environment, savings accounts at your local bank likely earn next to nothing. So to make your savings do something for you, you will want to check out high yield savings accounts online. You can earn 10x the interest by taking your savings account to the internet banking world.

(This point also applies in hawkish environments – since online savings accounts tend to out yield brick and mortar savings account offerings no matter which direction the Federal Funds Rate is going.)

Lock in Higher Rates with Long Term Fixed Rate Bonds

If you think rates will go down in the future, it is possible to invest in longer-term bonds that were issued in a higher rate environment. Fixed-rate bonds pay out the exact amount each year regardless of what the Fed does.

One potential problem with this strategy is that the rest of the market might be trying to do the same thing, which will increase the cost of acquiring long-term bonds at reasonable rates. So this strategy works best if you are ahead of the general public in anticipating a dovish outlook.

Consider the Cost of Existing Personal Debt

One consideration many investors don’t think about is how their overall balance sheet is affecting their returns as a whole. Thinking beyond the returns, you may realize in a particular investment account and optimizing your personal balance sheet is wise. For example, let’s say you find an online savings account that yields 2%. You’re excited because the national average for savings accounts is 0.05% APY. So you decide you will save everything you can and stick it in that high yield savings account. Who could fault you?

But here’s the other relevant piece of info: you recently bought a car and are paying 5% interest on your auto loan. So the question is, are you becoming wealthier by “saving” money? No, you’re losing 3% per year on all the funds you put toward your savings account instead of early payments on your car loan!

In a low-rate environment, saving only makes sense if you’ve already cleared all of your higher-interest personal debt. This is even more important with credit card debt, which has higher interest rates than car loans.

Keep One Eye on Equities

Expansionary policy tends to be used only when the Fed is concerned that we are heading into an economic slump or financial crisis. So it isn’t a given that lower interest rates will generally boost the stock market. But in the longer term, buying equities when everyone is worried (including the Fed) makes sense because you are likely to get them at better prices. And if you’re willing to hold them long enough for the Fed’s expansionary policy to take full effect, your investment is more likely to pay off.

Lower interest rates mean that businesses can borrow more affordably to invest in their growth in the long run. And lower interest rates on debt lead to better returns, which boost valuations over time.

Another factor is that once the additional money supply trickles into the economy, some of it ends up in the hands of investors who use it to buy stocks. This also boosts demand for stocks and raises the equity market’s valuation. Some of that money also ends up in the hands of consumers, who use it to (you guessed it) consume – which further boosts equity valuations.

So while there is a more inherent risk in equities, equities provide the most significant opportunity to take advantage of a dovish Fed IF you’re willing to be patient.

You could always buy index mutual funds or ETFs and try to take advantage of general expansionary effects. But you might also consider something industry-specific:

- Look for industries that use cheap capital to produce products that consumers purchase on credit.

- Or look for industries that pay consistently high dividends. Here are some examples.

Homebuilders

One example of this is homebuilder stocks or ETFs. Homebuilders and developers are likely to benefit from lower interest rates. First, homebuilders and real estate developers typically finance their new investments, so lower interest expenses improve profitability. Second, lower interest rates on mortgages boost demand (and reduce price sensitivity) for new homes.

Mining Sector

Also, consider mining equities. Many factors affect the price of precious metals, but a slowing economy and dovish Fed have contributed to increased gold prices. Mining companies are capital intensive, and when the stock market is not doing well in general, demand for Gold as an alternative investment increases. And when Gold prices rise, mining companies often see an even more remarkable rise in valuations than the gold spot itself.

Healthcare and Utilities

Healthcare and utility stocks are also options to consider when the Fed drops rates. They tend to pay steady dividends, which become more enticing in situations that cause the Fed to lower rates. That growth in demand for stability can add share price growth which can combine with the value provided by the dividends themselves for a profitable investment.

How to Trade a Hawkish Outlook

Now let’s take a look at some principles to keep in mind when rates are rising or are about to rise. Remember, rising interest rates mean that inflation is likely or expected to increase in the short term. The Fed usually raises rates to combat inflationary pressures. So any investment strategy needs to consider the combined effect of taxes plus inflation, which can quickly eat into real profits in an inflationary environment.

Short Term Bonds

If you expect rates to rise, then you probably don’t want to lock yourself into existing bonds for a long time. Instead, stick with shorter maturity bonds so you can benefit as rates go up. Alternatively, you can protect yourself by taking advantage of a floating rate ETF or mutual fund designed to take advantage of rising interest rates when they occur. This protects you from the effects of inflation to some extent. You might also consider Treasury Inflation-Protected Securities (TIPS) to achieve the same goal.

Companies with Cash

Companies with lots of cash on their balance sheet earn more interest when interest rates go up. This can boost their margins. Investing in those companies, especially if they have other good things going for them, can be a good play. The flip side of this is that those companies that have to service high debt levels will be less profitable than in the low rate environment. So when rates are about to climb, pay more attention to the debt burdens of the equities in your mix.

Real Estate

Rising rates tend to boost real estate values, so real estate is another option for a hawkish environment. If you don’t want to hassle (and lack diversification) from buying properties yourself, you can also invest in real estate mutual funds, ETFs, or Real Estate Investment Trusts (REITs).

Other Good Industries

Brokers and Banks enjoy better operating margins when interest rates go up. Tech and healthcare stocks also tend to benefit from higher interest rates. You can invest in these sectors in myriad ways.