Stocks and bonds represent different ways to invest in a company or government. A bond usually offers interest income and the return of the principal investment, whereas a stock represents partial ownership in a company and is typically designed for capital appreciation. Bonds tend to be more appropriate for conservative investors, while stocks are well-suited for more aggressive investors.

For most investors, a mix of both is often the best solution.

When it comes to investing, we often hear that it is prudent to diversify, or spread out, our hard-earned money into various bonds and stocks. And while this makes intuitive sense, it is essential to understand the main differences between bonds and stocks before building a portfolio.

Like items on a grocery store shelf, bonds and stocks are considered products in the world of investing. Having a thorough understanding of the purpose and characteristics of these products is extremely valuable for novice investors. Let’s dive in and explore some of the key differences you’ll want to know before putting bonds and stocks into your shopping cart.

What are Bonds & Stocks?

Bonds and stocks exist because many institutions around the globe want to raise funds for various purposes. Businesses and governments seek out investors that are willing to provide those funds with the expectation that they will be compensated for putting their money at risk. They use the proceeds from a bond or stock offering for immediate needs like operating expenses or longer-term growth plans such as store expansion.

The primary sellers, or issuers, of bonds, are governments, government agencies, and corporations. In the U.S., government bond issuers include the federal government and state and local governments. State or local government authorities issued bonds are municipal or “muni” bonds. When we purchase a bond, we become a bondholder, or creditor, to the bond issuer.

On the other hand, stocks are typically issued by public corporations. Governments are not issuers of stock, but many corporations issue bonds and stocks. Stocks represent ownership in a business and are also referred to as shares. When we invest in a company’s stock, we are said to become stockholders or shareholders. We participate in the profits and losses of the company and ride the ups and downs of the stock’s price.

A stockholder is generally considered to own a minority stake in the corporation, which often comes with voting rights related to certain corporate governance matters. In cases where a controlling interest is obtained, becoming a shareholder does not mean we have a say in the day-to-day operations of a business.

Remember, Bonds = Loans, Stocks = Owns

A critical distinction between becoming a bondholder as compared to a stockholder is the concept of lending versus ownership. A bondholder essentially lends money to the bond issuer for an established period. The loaned money is referred to as the principal. The principal amount invested in the bond is returned when the period ends. Like that gallon of milk in the grocery cooler, a bond has an expiration date known as its maturity. Bond buyers agree to lend money to bond issuers for days, months, or years.

Conversely, with stocks, there is no finite period. After purchasing shares, the stockholder can choose when to sell the shares. Shareholders can hold stocks for many years or even generations as long-term investments. They can also be bought and sold in as little as one minute, as in the case of [experienced day traders/types-of-trading#trading-frequencies) who enter and exit a stock position on the same day to make a quick profit.

Interest versus Dividends

Bonds and stocks share in that they can both provide income or cash payments to their respective investors. The names and characteristics of these income payments, however, do differ.

Bonds provide the investor with interest payments paid periodically or factored into the principal sum. The bondholder sacrifices a principal amount for a given period and expects to be compensated for the risks involved. When a bond is offered to the market, the bond issuer specifies an interest rate in percentage terms. This outlines the amount and frequency of interest that the bondholder receives.

For example, the XYZ Corporation may issue a 5-year bond at a principal amount of 10,000 that pays a 4% annual interest rate quarterly. If we purchased this bond, we would fork over 10,000 and receive 400 annually (paid out in 100 quarterly increments) over the next five years. At the five-year mark, we would receive our final quarterly interest payment and our initial $10,000 investment return.

Stocks can also generate income for investors. The income payments made by stock issuers to stockholders are called dividends. Dividends usually come from a company’s profits. Like bonds, the dividend payments often occur periodically, most often quarterly. But unlike bonds that must pay interest based on the bond agreement, corporations can choose to increase, decrease, and even eliminate the dividend based on company performance.

Dividends can also come in the form of stock dividends rather than cash dividends. A company that chooses to distribute stock dividends to its stockholders gives additional shares in the company at a rate that is commensurate with the stockholder’s level of ownership. Not all companies offer dividends. Some choose to hang on to all their income to reinvest in the growth of the business.

Capital Preservation versus Capital Appreciation

Bonds and stocks typically serve different purposes in an investment portfolio. Bond investment is made to generate an income stream while protecting the value of the initial principal investment. As such, bonds are a means of capital preservation. They are best suited for investors who wish to preserve their funds and are content with a limited return on investment.

Stock investment is generally riskier than a bond investment and, on average, will do better over time. Stocks are a means to achieve capital appreciation. The stock buyer wants to see their investment grow over time in conjunction with the growth of the underlying company.

Bond and Stock Risk Differences

The notion of capital preservation versus capital appreciation goes hand in hand with a discussion of investment risk. It is important to remember that all investments, regardless of their perceived safety, carry some level of risk.

In the context of bond and stock investing, risk can be defined as the probability of loss or the fluctuation of an investment’s value. This fluctuation is also called volatility.

Stocks generally involve more risk than bonds. With most bonds, the investor knows how things will play out. The bondholder will receive periodic interest payments and a return of their principal at maturity. The daily fluctuations in bond prices are less of a concern unless it is traded for capital appreciation. The bond issuer is bound by the covenant made with the bond buyer and must make interest payments and return principal even if the business is struggling.

However, a bond issuer can default on a bond payment if they enter bankruptcy. If this happens, the bondholder may receive a lesser amount than expected or may lose the principal entirely in a worst-case scenario. The bond default risk varies by the type of bond issuer and the issuer’s financial strength. While losing money on bonds is possible, it occurs less frequently than in other asset classes. Therefore, bonds are considered lower-risk investments.

Stocks are on the other end of the risk spectrum. Shares have an inherently higher level of investment risk because a structured agreement does not bind them as with bonds. Stock prices move up or down based on company performance and outlook. It is not uncommon for a stock to move up or down by 5%, 10%, or more in a single day. On the flip side, a bond’s price may not move 5% for the whole year and are much less volatile.

Stocks are riskier because they are on the bottom of the totem pole regarding their claim on a corporation’s assets. In the event of bankruptcy, lenders, i.e., bondholders, receive first dibs on any money the company can scrape together from the sale of assets like land and equipment. There are often various levels of bondholders, secured or unsecured, based on the presence of collateral. Common stock investors have the last claim on company assets after paying the lenders and bondholders.

What is the Average Return on Bonds? After getting a good grasp of what bonds and stocks are, many new investors want to know how much they can expect to make investing in bonds and stocks. There is no clear-cut answer to this question because bonds and stocks have historically performed differently in various economic environments. And at the risk of sounding like the speed-talking disclaimer at the end of an investment advisor’s TV commercial, keep in mind that past performance does not predict future returns. But with this said, returns on bonds are typically lower than stock returns.

But bond returns are more consistent, meaning they do not vary as much from year to year. It is the relative stability of bonds that attracts some investors. These are often investors who are in or nearing retirement or have lower risk tolerance.

According to a recent study by Vanguard, the U.S. bond market had an average annual return of 5.3% from 1926 to 2019. The best return year occurred in 1982, with a 33% return, while the worst return year was an 8% decline in 1969. Bonds finished in negative territory in only 14 of those 94 years, or 15% of the time.

Why Do Stocks Have Higher Returns?

The bright side for stock investors is that with higher risk, being paid last often comes with higher rewards in higher returns. The term returns refer to the gain or profits made from a dollar investment, or more commonly, percentage terms.

We’ve learned that there is a direct relationship between risk and return. Stocks offer more significant potential for increasing value than bonds because they involve higher risk. Stock investors require a higher rate of return based on the risk of equities in general and the individual company’s risk.

For instance, we expect higher volatility and potential returns from money-losing technology companies than a more mature, low-risk consumer staples company. When a company exceeds expectations, the stock price increases, and stockholders are happy. When a company underperforms, investors deem that the company is not worth the risk, and the stock price goes down.

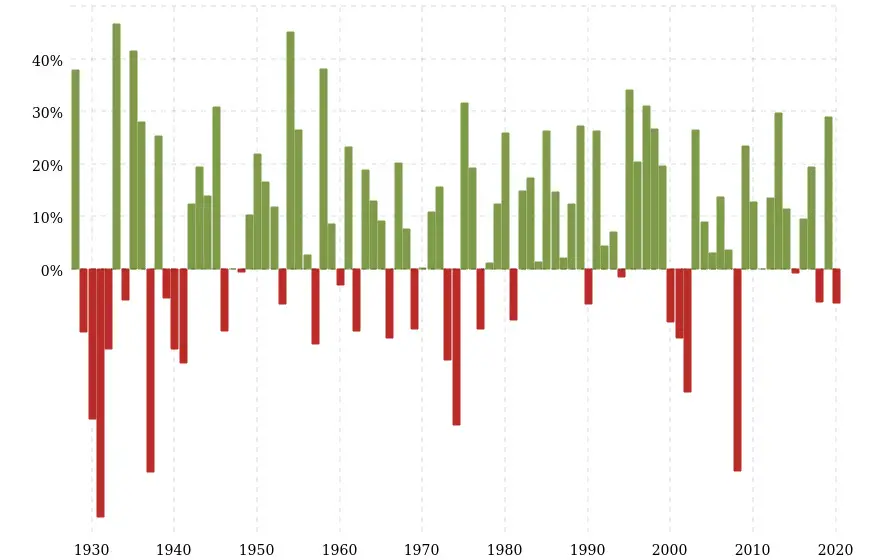

Over the long term, stocks have provided higher returns to investors than bonds. The Vanguard study also showed that the average annual return on U.S. stocks from 1926 to 2019 was 10.3%. As we’d expect, with that higher return has come higher variability. The best year was a 54% surge in 1933, and the worst year was a 43% plunge in 1931. In 2019, the stock market, as defined by the S&P 500 index, advanced 29%. Stocks suffered a loss in 26 of the 94 years, or 28% of the time. This shows that despite finishing down more than a quarter of the time, U.S. stocks have generated a 10% annualized return in route to setting record highs.

S&P 500 Historical Annual Returns (1927-Present)

Asset Allocation: How Much Should I Have in Bonds?

So, we know that bonds are for relative safety and income, while stocks equate to risk-bearing growth. But how do we decide which one is best for our situation? This brings us to the concept of asset allocation. Asset allocation is the process of how to divvy up your investment dollars into bonds, stocks, and other investments.

While some circumstances may dictate that a 100% bond or 100% stock portfolio is appropriate, a mix of both is often prudent. Many factors go into building a bond-stock portfolio, including investment purpose, time horizon, financial flexibility, and liquidity needs. Let’s generalize these factors as one combined measure of risk.

An investor’s risk level combines the ability to incur risk and the willingness to take on risk. The ability relates to one’s financial situation, and the readiness is more about the investor’s personality. There can be many reasons to limit or take on risks. Most importantly, an investor’s risk level should be consistent with their asset allocation choices.

For example, a low-risk, conservative investor would be better suited with an 80% bonds/20% stock asset allocation. A 20% bonds/80% stocks portfolio would match the profile of a high-risk, aggressive investor. As investors, our asset allocation pie is not a fixed thing; it can vary over time as our financial needs and circumstances evolve.

Should You Buy Bonds in a Recession?

With the stock market near all-time highs and frequent market chatter about whether a recession is looming, many investors wonder if they should buy bonds rather than stocks. A recession is a period of decline in economic activity, more precisely defined as two consecutive quarters of negative gross domestic product (GDP) growth.

Investing in bonds can be an excellent way to lock in stock market profits and protect wealth regardless of a recession. But it can be a brilliant move in a confirmed recession. A recessionary period marked by a slowdown in business activity means corporations are earning less. This can reduce the value of companies’ stocks and lead to a downturn in the stock market. Stocks and bonds are often negatively correlated. This means when stocks go up, bonds go down and vice versa.

Bonds can play the role of protector by limiting a downward move in your portfolio value. This scenario reinforces the importance of diversifying an asset allocation by including bonds and stocks. Some bond allocation in a portfolio can help soften the blow during a dip in the stock market. This doesn’t necessarily mean that we should instantly go 100% into bonds. There are also many excellent stocks to consider in a recession. A non-cyclical food and beverage company with a long track record of enduring recessions is an example of an outstanding stock.

Trading Aspects of Bonds and Stocks

We know that stocks trade in the form of shares on major stock exchanges such as the New York Stock Exchange or Nasdaq Stock Exchange. But what about bonds? While many investors purchase bonds to earn interest and hold on until maturity, bonds can also be actively bought and sold in the bond market. Bonds do not trade in shares, though. Instead, they trade in specific dollar amounts.

An investor may choose to sell a bond before its maturity date if they need to liquidate the security due to an unforeseen emergency or if they prefer to rotate the funds into a more attractive bond or stock. With stocks, an investor’s choice to sell all or some of a company’s shares may be based on a similar need for liquidity, a decision to take profits off the table, or cut losses.

Stocks vs. Bonds vs. Gold Over Time Visualization

The Bottom Line

Stocks and bonds are a way for companies and governments to raise capital. Stocks are riskier than bonds because bondholders have a claim on a company’s assets before stockholders. Since stocks are riskier, they generally have a higher return than bonds. Most investors should consider a mixed portfolio of bonds and stocks. Sophisticated traders can utilize bonds to secure a profit or protect gains in the likelihood of an earnings downturn or recession, as stocks and bonds are often negatively correlated.