You can quickly identify stocks that pay dividends by using screening tools provided by your broker or utilizing free online services. For more detailed information, one should consult the dividend policy disclosure in a company’s annual report.

Dividends and Why We Like Them

A cash dividend is the part of a company’s profits distributed to its shareholders. These distributions most commonly occur quarterly but can happen less frequently or not all. Many companies, such as early-stage technology companies, prefer to reinvest all their earnings in various growth opportunities.

Those companies that do choose to reward shareholders with dividends can elect to distribute them in the form of cash or additional shares in the company. Cash dividends are the more conventional route. Firms often establish a targeted portion of their capital to return to shareholders as dividends and set up a quarterly dividend distribution schedule. This schedule gives us as investors transparency around how much we will receive and when to expect our quarterly bonus.

Some investors utilize dividend reinvestment plans with their brokerage platform. The funds received from dividends are automatically invested in the company’s common stock creating a dividend snowball.

Others may prefer to redeploy the funds in other investments or use the income generated in their portfolio to pay monthly bills or other expenses.

Screening for Dividends

If you don’t have any particular company in mind and want to find stocks that pay dividends, stock screening is the way. There are many free stock screening tools on the web, and most major brokerage platforms offer their own.

A stock screener allows you to find only the companies you are interested in based on various criteria. There are usually multiple fields related to dividends that allow you to generate a list of stocks that pay dividends and meet whatever other measures fit your investment style.

Yahoo! Finance, Zacks, and Finviz are just a few examples of free, user-friendly stock screening tools that can be used to locate dividend-paying stocks.

Specific Company Dividends

Those who are merely interested in whether the company currently pays a dividend may opt to find a financial website that can provide a fast, reliable answer.

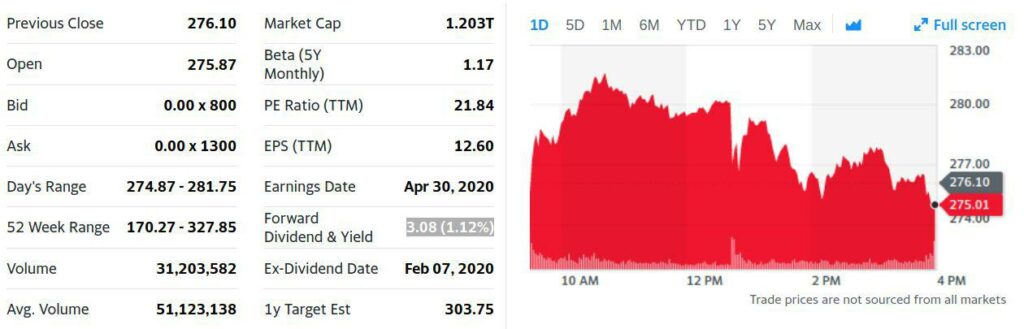

Yahoo! Finance is an excellent place to see if a stock pays a dividend. Entering a company’s ticker symbol in the search box results in basic information about the stock’s price and volume. It also includes a field called “dividend yield”. This is the stock’s dividend in percentage terms, i.e., its annualized dividend divided by its current share price. This will be some non-zero number for dividend-paying stocks and blank or “0.00%” in the case of non-dividend-payers.

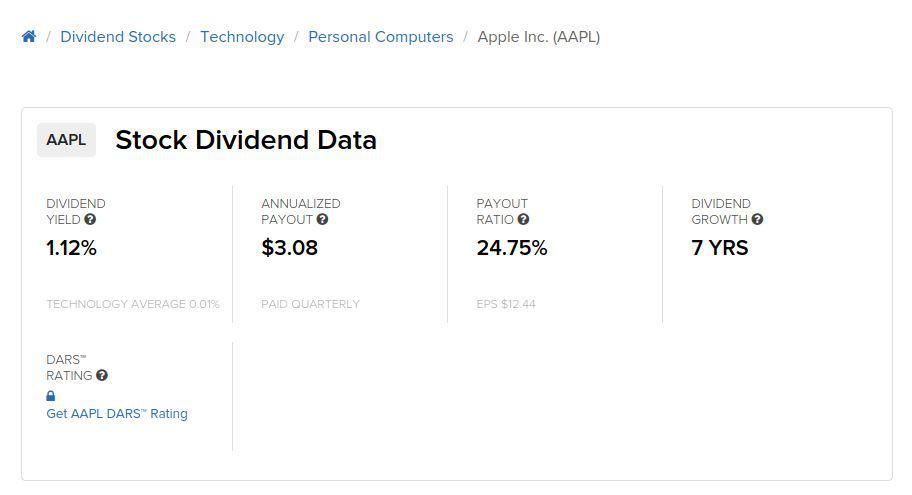

Dividend.com is another excellent tool for finding detailed information about stock dividends. The free sections of this resource show a stock’s dividend payout ratio, annual dividend payout, dividend yield, and the number of consecutive years that a company has raised its dividend.

For example, a quick look at Apple’s stock (AAPL) shows it pays 24.75% of its earnings as dividends, has an annualized dividend payout of $3.08 per share, and a 1.12% dividend yield, and has increased its dividend for seven straight years. Dividend.com also contains interesting articles about dividends from general or company-specific views and other premium data content.

Dividend Disclosure

The investor relations section of a company’s website is an excellent resource for beginner and experienced investors. It contains press releases, quarterly financial results, regulatory filings, presentations, and other valuable information about a company.

A company’s annual report also referred to as form 10-K, can be downloaded or viewed directly from its website. It can also be found online on the U.S. Securities and Exchange Commission’s EDGAR database. The most recent report will contain helpful information about the company’s business model, risks, and, yes, dividend policy. But where exactly do we find the dividend stuff?

You will want to key in on the “Market for Registrant’s Common Equity and Related Stockholder Matters” section. You can often find this section in the table of contents in the 10-K. It is here that a company is required to disclose any dividend payments declared over the past two years.

This part of the annual report can also contain more detailed information about the company’s dividend policy. A dividend policy describes a company’s dividend practices and may provide valuable language about its conviction toward future dividend payments. Management may include a statement regarding its intention to “pay a consistent dividend on a quarterly basis” or note a goal to “increase the dividend in the periods ahead”. Companies that do not pay dividends would explicitly state so in this annual report section.

The tech-savvy among us could also use the “find” function within our web browser or pdf document using “dividend” as our keyword. This may be a bit more time-consuming but would allow us to scroll through anything in the report related to dividends.

Aside from reviewing the annual report, we could also look at a company’s press releases. This will often contain brief stories about the company’s dividend declarations or information about future dividend distributions. A company’s investor relations site usually has a subsection called Press Releases.

Assessing Future Dividend Payments

Just because a company pays a dividend today does not mean it will pay a dividend a year or five years from now. Therefore, many investors prefer to go right to the source and research a company’s annual report to get a comprehensive view of its business related to dividends. It provides detailed information about a company’s financial situation and can offer clues as to whether the dividend payments are sustainable.

If a company does show a history of dividend distributions, we can perform an analysis to predict if these payments are likely to continue. A pattern of regular dividend payments over an extended period is usually the mark of a consistent dividend-paying company that will maintain future dividends. If a company has increased the amount of its dividend over time, this is also a good sign that suggests future distributions will persist and potentially grow. Conversely, if there are gaps in the dividend history, points where a dividend was reduced, or the dividend payout ratio isn’t sustainable, this may indicate a company with a less stable dividend.

The Bottom Line

Many investors consider dividends to be an attractive feature of owning a stock. They offer an added element of direct participation in a company’s profits. Dividends boost the return on a stock and can enhance the long-term growth potential of the investment.

Not all companies offer dividends, though. Dividend-seeking investors can learn more about whether a company pays a dividend by reviewing its annual report, which can be found on the investor relations portion of its website. Leaning on well-known financial data websites can also be a quick and easy way to see if a company pays a dividend. Lastly, stock screening can be valuable when we do not have a company in mind and instead want to generate a list of dividend-paying stock ideas.

All are practical approaches to finding information about stock dividends. It may be helpful to try out several methods to discover which process works best for your purposes. Now you can efficiently get the dividend information you need and even be able to teach others how to do the same!