Investing in the stock market can be confusing. It doesn’t have to be. Here’s my attempt at creating clarity out of the chaos.

What Is Investing?

Investing is putting money away today to make more money in the future. Instead of paying a bank interest for the money you borrow, you become the bank and get paid for the money you lend out.

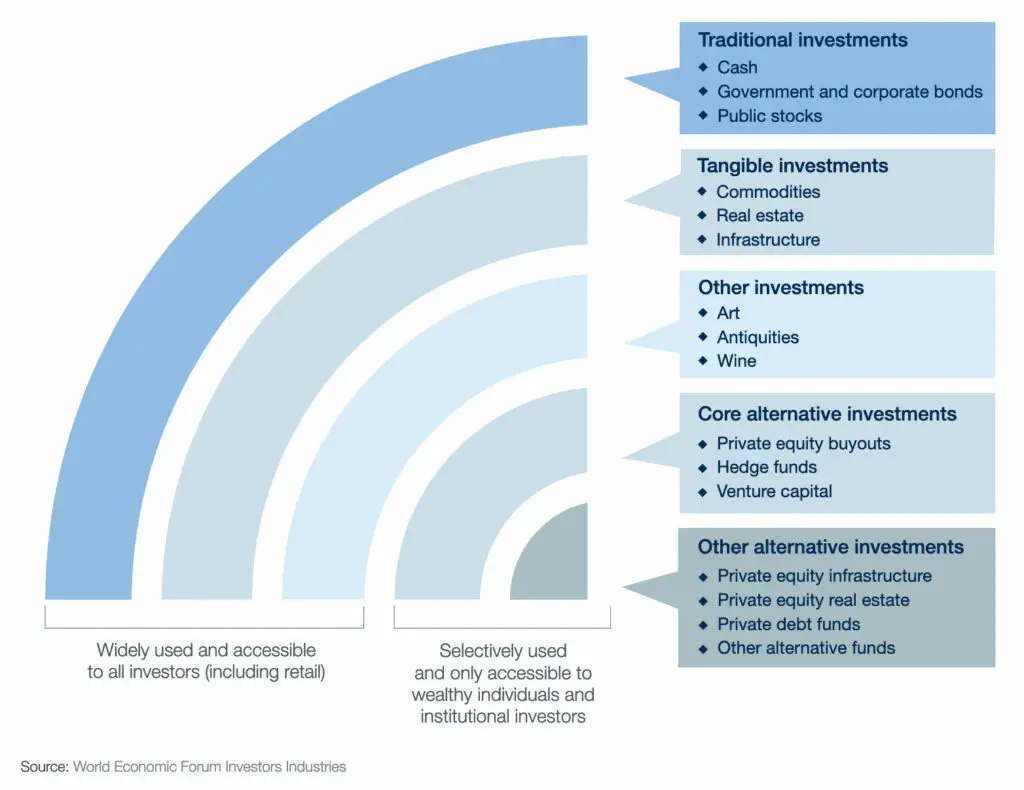

There are many ways to invest your money. When most talk about investing, they’re generally talking about traditional or tangible investments; however, there are a lot of ways to make money in investing:

The four traditional and tangible investments that are easily accessible to most investors are:

- Stocks

- Bonds

- Real Estate

- Commodities

Stocks

When you buy a stock, you’re buying a little piece of a company. For example, if you buy a share of the famous coffee maker Starbucks, you become a part-owner and are entitled to its earnings. Companies issue stock to the public markets to raise money to grow or pay down debt. Stocks are also known as equities.

- Learn more: How to Invest in Stocks

Bonds

Bonds are a form of borrowing. You give a company or government entity money, and they give you more money in the future. There are different types of bonds, but bonds are generally are less risky than stocks because you know in advance when and how much you’ll get paid, assuming the company doesn’t default.

- Learn more: How to Invest in Bonds

Real Estate

While homeownership and house flipping can be considered a form of investing, when I discuss real estate investing, I am referring to owning a property that you rent out is another form of real estate investing. Having a tenant pay the mortgage of your property while it appreciates can be an attractive option for many.

- Learn more: How to Invest in Real Estate

Commodities

Commodities are goods that are uniform in quality and utility regardless of source. For example, corn, wheat, flour, gold, silver, and oil are all examples of commodities. Commodities fall into two categories: soft and hard. Things that grow, such as corn, wheat, and flour, are considered soft commodities. Gold, silver, and oil are considered hard commodities. You can invest in the commodities in various ways, but you’re betting that the price of the commodity will go up or down, and you’ll profit from the difference.

- Learn more: How to Invest in Commodities

Why Should You Care About Investing?

Putting your money to work by investing can give you back years of your life. How? Just like a bank, your money makes money for you 24/7. Instead of putting hours in and getting dollars out, you change that connection. Heck, you even make money while you sleep. Investing is really about “working smarter and not harder.” It gives you the freedom to spend more time with your loved ones or watch that show on Netflix everyone is raving about. I remember the first time I invested in the stock market. I got lucky and made almost exactly one month’s salary from doing nothing with the money I probably would have blown on takeout and useless other random stuff. I was hooked.

How Quickly Can You Make Money Investing?

It is rumored that Albert Einstein once stated the most potent force in the universe is compound interest. While we can’t definitively prove or deny that he said this, one thing is for sure: Compound interest is compelling.

So what is interest, anyway? Using a bank loan as an example, it’s the money we pay to the bank for borrowing money, or it’s the money we earn by lending our money to the bank. It is conventional to state interest rates in annual terms. If you borrow $100 from the bank at a 1% interest rate, you would owe the bank $101 to fully repay everything after one year. The total money includes the original amount of $100 borrowed, called the principal, and $1 in interest, which is the charge for borrowing money at a 1% rate, which is the interest stated in percentage terms generally over one year. Earning interest is the same in reverse. If you lend $100 to the bank at 1% interest annually, the bank would pay you $1 for borrowing the money and owe you the original $100 principal amount after one year. While compound interest has a fancy name, it is merely taking the interest earned, in our case $1, and letting the bank lend that out, too. Using the above example:

- In year one, we would lend out $100 and earn $1.

- In year two, we would lend out the $100 and the $1, earning $1.01.

- In year three, we would lend out the $100, $1, $0.01, and earn $101.01.

What ends up happening is our interest on top of interest. Now let’s step it up a notch. What happens if we earned 25% interest on our money instead of 1%. What do you think our $100 will turn into after 40 years?

Let’s do the first three years together:

- In year one, we would lend out the $100 and earn $25.

- In year two, we would lend out the $100 and the $25 and earn $32.25

- In year three, we would lend out the $100, $25, and the $32.25 and receive $39.06.

After 40 years, our $100 would have turned into $752,316.38. Were you close on your estimate? It’s tough for our brains to process this type of math. Thankfully, there’s a shortcut called the Rule of 72. You divide the interest percentage, 25%, into 72, which tells us how long it would take for the money to double. This shortcut tells us that at an interest rate of 25%, our cash would double just under every three years, and 10% would double only every seven years. You can use this compound interest calculator to verify.

Each percentage point of interest has a massive effect on interest earned or lost. In fact, according to the Center for American Progress, many are losing more than 20% of their retirement savings due to 1-2%. This is extremely disheartening to me as many of my friends and family have to work years longer than they should because of these hidden fees. If I have my way, all of my readers will gain years back to spend with their loved ones by understanding compound interest and how small percentages make a big difference.

Should You Invest or Pay Off Debt First?

Many experts say you should pay off debt if the interest rate is higher than the return you’ll gain from investing in the stock market. I’m afraid I have to disagree. We are human. Sometimes we choose what we want right now instead of what we want long term. The problem with delaying our investing until we pay down debt is that there’s a genuine danger of extra spending that prevents us from ever gaining the benefits of having our money work for us, or at least pushing out those benefits much further into the future. That’s why you have to know yourself.

If you are the type that can’t stick to paying down your credit card and other high-interest loans on a very consistent basis, it may be wise to start investing a small amount each month to get started. If that’s not a problem for you, you’ll want to: Pay down debt if your after-tax cost of debt is higher than your after-tax return on investment and invest if your after-tax returns are higher than your after-tax cost of debt.

Calculating both your after-tax cost of debt and your after-tax returns is easy. To calculate the after-tax cost of debt, you take the rate at which you can borrow money and reduce it by the tax bracket you are in because interest is tax-deductible. For example, if you are in the 25% tax bracket and can borrow money at 6%, your after-tax cost of debt is 6% * (100%-25%) = 4.5%. Even though your bank loans you money at 6%, the effective rate is cheaper because you can deduct that interest from your taxes. There are some stipulations when deducting interest, so you will want to check with a tax accountant on specifics.

To calculate investment returns, you follow the same formula. If you expect to make 7% on your stock investments and are in the 25% tax bracket, your after-tax returns would be 7% * (100%-25%) = 5.25%. Regarding investment returns, you need to keep in mind that different returns are classified differently, such as short-term vs. long-term capital gains.

The steps for most are easy:

- Match your 401k. This match is an immediate 100% return.

- Pay down any credit cards and very high-interest loans.

- Fully fund a Roth IRA.

- Pay down any interest rate that is above the market’s expected return.

- This is 7% as of today, and I’ll show you how to calculate this later when we get to equity risk premiums.

- Invest in a non-retirement account.

Keep in mind that you should always have a reserve account if the worse happens.

Should You Invest Directly or Hire a Professional?

Most people shouldn’t invest for themselves. Remember, every time you buy an investment, there’s someone on the other end selling, thinking you are wrong. Many times that person on the other end of the transaction is someone who invests professionally and spends all day researching investments. For most, the options are straightforward:

- Hire a professional

- Invest in a low-cost index fund.

Hire an Investment Professional If you’re not interested in learning to manage your own money and want someone to handle it for you, make sure you verify them at https://www.investor.gov/.

Invest in a Low-Cost Index Fund If you do want to manage your own money, most should invest in a low-cost index fund (1st choice) or a roboadvisor (2nd choice). Don’t try to beat the market and pick stocks unless you have a passion for investing.

Warren Buffett, who is arguably the most successful and well-known investor of all time, states it best in this video. “Consistently buy an S&P 500 low-cost index fund. I think it’s the thing that makes the most sense practically all of the time. Keep buying it through thick and thin, and especially through thin.” I’m going to agree with Warren here. Investing in a low-cost index fund is still the best way for most people to invest. This includes financial advisors and newer roboadvisors such as Betterment and Wealthfront.

While roboadvisors are better than higher-cost mutual funds, I also do not recommend roboadvisors due to the same reason 90% of active managers underperform the market: fees.

To see this clearly, let’s take a look at a fictitious portfolio gaining at 7% where the index fund has a 0.09% free, the roboadvisor has a 0.25% fee, and the financial advisor has a 1% fee.

| Years | Portfolio Value | Index Fund | Robo Advisor | Financial Advisor |

|---|---|---|---|---|

| 5 | $14,025.52 | $13,966.63 | $13,862.43 | $13,382.26 |

| 10 | $19,671.51 | $19,506.68 | $19,216.70 | $17,908.48 |

| 20 | $38,696.84 | $38,051.05 | $36,928.16 | $32,071.35 |

| 30 | $76,122.55 | $74,224.95 | $70,963.74 | $57,434.91 |

| 40 | $149,744.58 | $144,788.20 | $136,368.90 | $102,857.18 |

As you can see, the fees add up extremely quickly. Now, if you’re familiar with roboadvisors, I can hear what you’re saying already: What about tax-loss harvesting?

Tax-loss harvesting is an automated feature of many roboadvisors that sells your losing investments and buys similar assets, so you can reduce your taxable income by deducting those losses. First, it doesn’t work in a retirement account. Second, you can do this yourself with index funds to take advantage of tax-loss harvesting. And third, the $3,000 deduction is pre-tax. If you’re in a 25% tax bracket, the real benefit is $750. Now I’m not entirely negative on roboadvisors. There are many benefits, such as that it’s completely automated, you can automatically invest when your bank balance reaches a certain threshold, it’s super easy, and you have someone to talk to when you have questions. For someone who wants these benefits, it may be a perfect choice.

Example: Become an Index Fund Millionaire Let’s follow Warren Buffett’s advice to invest in an index fund. You can follow along with me using this compound interest calculator.

If you’re 25 years old, at 7.7% annual returns, you will need $0 down and $300 a month to retire with over a million dollars at 67 years old. This number changes significantly based upon an initial amount, how many years you have to invest, and the return on your investments. For instance, if you’re 35 years old, putting $0 down and investing $300 a month turns into $414,000, which is more than 50% less than the 25-year-old but still a ton of money. The points I’m trying to make here are that you don’t need to try to swing for the fences or have a huge salary to get rich. You need to budget the amount of money to save each month that gets you to your goals, and you should start saving as soon as possible. I wish someone would have shown me this when I was younger, so hopefully, I have a few younger readers this resonates with, but I digress.

There are only three steps to becoming “easy rich” in the markets:

- Understand the power of investing and compound interest.

- Know when to pay down debt and when to invest.

- Come up with a budget based on how much money you want to have when to retire.

- Invest in a low-cost investment vehicle monthly through thick and thin, especially through thin.

So You Want to Try to Beat The Market?

So you’re crazy enough to want to try to beat the market by picking individual stocks and bonds? Me too.

Why are we crazy? According to Dalbar, Inc, in a report they published in 2014 titled Quantitative Analysis of Investor Behavior, individual U.S. equity investors achieved an annualized return of 5.02% over the past 20 years. This is 4.2% less than the 9.22% average annualized return of the S&P Index. Most individual performance is worse than passive, robo, or even active management.

Beating the market is extremely challenging. Think about it. To best the market, you have to outperform hedge funds and professional money managers at their own game. They likely have more time and resources at their disposal to kick your butt. Remember, there’s always a winner and a loser in every trade. How can you be so sure you’ll be on the right side? So with investing being so challenging, why do I like to invest?

Investing challenges me intellectually to better understand the world around me and emotionally better understand myself and the quirks of pre-programmed human behavior. I also like to keep score, and investing always pays dividends. If I’m right, there’s a significant payoff through compounding, and if I’m wrong, I learn something valuable about the world or myself.

That’s why I like investing, and if you plan on investing directly in the market, you have to enjoy the journey.

So, where do you start if you want to invest directly in the stock market? If you’re starting from scratch, you need to learn accounting, which is the language of business, and you need to learn how to value a company.

Why start there?

I believe if you pick the right company, the returns take care of themselves.

Think about it. Even if your timing were poor, your results would have been more than satisfactory if you had invested in Facebook, Amazon, Netflix, or Google.