An investment mandate is a set of instructions for how an investment manager may invest money for a particular fund. A mandate may specify acceptable investments, position risk constraints, other restrictions, and an appropriate benchmark.

If you plan to use investment services or invest in mutual funds, ETFs, or any other pooled investment vehicle, you will be impacted by investment mandates. It’s vital to understand their purpose, the different types of investment mandates, and how to use them to your benefit to protect your portfolio.

Purpose of an Investment Mandate

Investment mandates, also known as mandates or fund mandates, ensure investment managers abide by the desired strategy and stay within specific risk parameters. Investment mandates accomplish this by providing instructions on items, including the portfolio’s priorities and goals, the benchmarks to be used, and any specific investments or types that should be included or avoided.

The term investment mandate most often refers to the instructions for managing pooled capital, such as mutual funds, exchange-traded funds (ETFs), index funds, and university endowments’ portfolios. Investment mandates are also used by individuals who hire an investment manager to oversee their portfolios.

The purpose of an investment mandate for pooled capital investments is to ensure all parties remain on the same page – investors, potential investors, and the investment manager. There is no confusion on the portfolio’s goal, the level of risk, the types of investments included in the portfolio, etc.

Without investment mandates, those interested in investing in a specific fund would have to look at the current securities in the portfolio and make assumptions about the fund. There are two significant problems with this. First of all, this requires more investment knowledge than the average investor may have. Secondly, there is no guarantee that the portfolio will look similar to how it does now in the future without an investment mandate.

For example, a portfolio may currently have a relatively low level of risk and volatility. Still, without an investment mandate, the investment manager may decide that higher-risk investments are preferable and begin increasing the portfolio’s risk profile, making it inappropriate for those currently invested. An investment mandate helps to keep this from happening.

We can see how investment mandates help investors, but they also help investment managers. An investment mandate clarifies the expectations of the investment manager. It lets the investment manager know where they have flexibility, where they must abide by specific parameters, the benchmark their performance will be measured against, etc.

Investment Mandate Examples

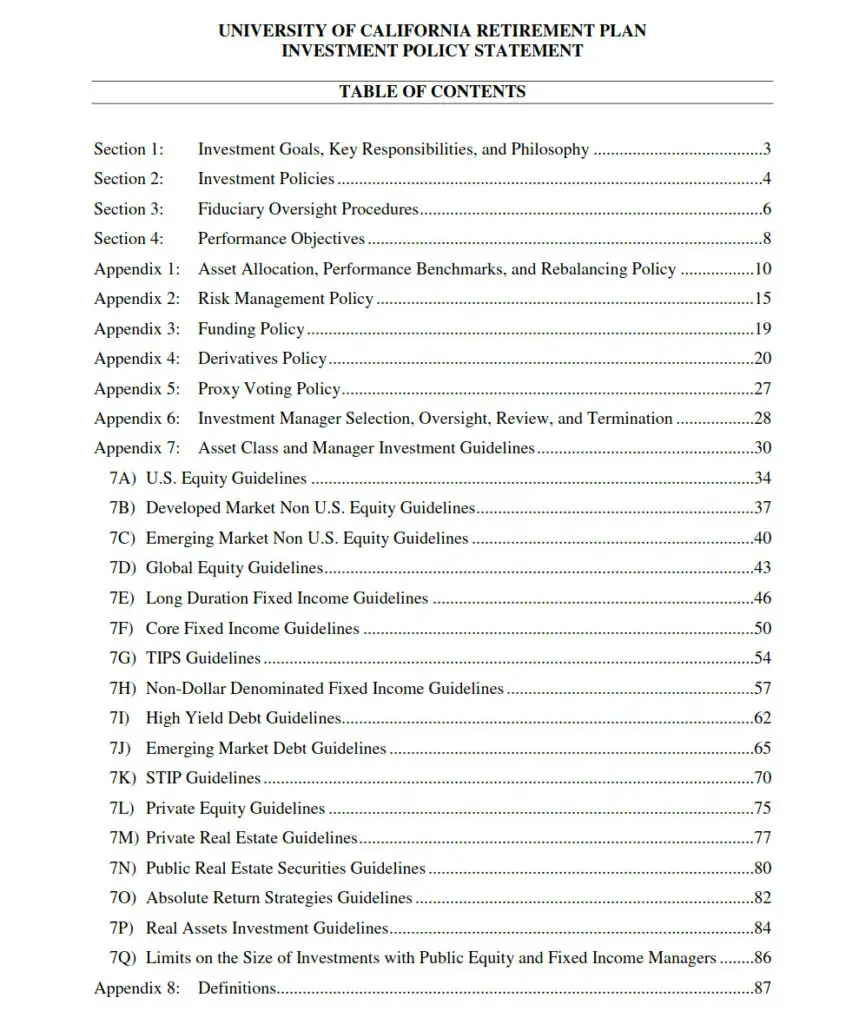

To better understand what’s included investment mandate, look at the table contents below.

Not all investment mandates are this complex, however. Norges Bank’s mandate is only four pages. I’ve included both of the investment mandates linked as PDFs below for those interested.

- Norges Bank Investment Mandate

- The University of California Retirement Plan Investment Policy Statement.

Investment Mandates for Individuals vs. Funds

Investment mandates generally fall into two different scenarios:

- When an individual works with an investment manager

- There is a pooled investment vehicle

When the investment mandate is for an individual working with a financial planner or investment manager, the individual may stipulate that the capital be invested specifically. Often, the investment mandate has less to do with particular investments and more to do with the individual’s circumstances or priorities.

For example, suppose the individual plans to use a large percentage of their current capital to purchase a home one year in the future. In that case, the individual may have an investment mandate based on capital preservation (where the goal is to preserve capital instead of risk the capital by attempting to grow it). In this case, the investment manager would seek out investments with low levels of risk and volatility for the client’s portfolio.

When investment mandates are employed for pooled investment vehicles, such as mutual funds, ETFs, or endowments for universities, the mandate applies to the entire pooled vehicle, not a specific individual’s needs. This is beneficial for both the current investors and the manager as it helps ensure that both parties agree on the funds that will be managed.

Investment mandates also help prospective investors choose between funds based on the investment mandate of that fund. In the next section, we’ll see how you can use an investment mandate to help you pick a fund.

Using an Investment Mandate to Pick a Fund

There is an almost limitless number of options for the specific instructions addressed in an investment mandate, including the asset class, geographic area, industry, sector, and strategy. As an investor, the number of options may seem overwhelming. But you don’t have to have opinions on every aspect of the investment mandate; instead, you can use it to help guide your decisions if there is something you’re looking for specifically.

Let’s look at how you could use investment mandates to help you make investment decisions.

You’re looking for a fund to add to your portfolio. You’re looking for high return potential. Your risk tolerance is relatively high, and since you have a long time horizon (you won’t need the money for a while), you’re okay with a high volatility investment. You’re therefore looking for a fund with high risk and high reward.

You’ve heard good things about a specific fund, but you find that the fund’s goal is capital preservation when you look at the fund’s investment mandate. This is not an ideal fund for you.

You find another fund whose investment mandate includes, among other things, requirements that the fund is invested in at least fifty percent low-risk bonds and the remaining percentage invested in large-cap stocks. Again, also not an ideal fund based on your investment goals.

Finally, you find a fund with an investment mandate for small-cap, high-growth stocks (typically considered a high-risk, high-volatility investment). The investment mandate allows for a high level of risk, and the fund’s goal is to increase returns. This is a far better fit for you than the two previous funds based on the investment mandate.

This is not to say that high-reward, high-volatility investments are better. In fact, for many investors, they’re not appropriate at all. The point is that whatever your situation, an investment mandate can help you find a fund that’s a suitable fit.

Types of Investment Mandates

While there are many options for the specific instructions an investment mandate may contain, a few types of mandates are more common than others. We’ll quickly look at some of the types of investment mandates you’re most likely to see, all of which may be employed by individual investors or funds.

Small-Capitalization Stock

A small-capitalization stock investment mandate requires that only firms that fall below a certain market cap may be included. The definition for small-cap stocks varies, so different funds may specify different market caps as their cut-off.

Global

A global investment mandate requires stocks from both the home country and abroad. These mandates may include parameters on the number of international stocks that must be included or may have instructions about the included stocks’ location, industry, sector, etc.

International

An international investment mandate differs from a global investment mandate. While global mandates include investments in the home country and abroad, international mandates typically limit the portfolio to securities based outside the home country. Funds with an international mandate may be a good option for those looking to diversify their portfolio beyond their own country.

Low-Turnover

A low-turnover investment mandate restricts the amount of turnover in the portfolio in a given year. Typically, the mandate instructs a maximum turnover rate of between three and five percent per year.

Long-Term Growth

A long-term growth investment mandate specifies that the long-term growth of capital is to be prioritized over other potential objectives, such as current income or minimizing the risk of volatility. A portfolio with a long-term growth investment mandate is typically mostly of stocks.

Income

An income investment mandate is on the opposite end of the spectrum to long-term growth. While long-term growth may also be a goal, the priority of a portfolio with an income investment mandate is to provide passive income.

Environmental, Social, and Governance (ESG)

Once a more niche option, ESG investment mandates are growing in popularity, and the expectation is that their popularity will only continue to grow.

The goal of portfolios with an ESG investment mandate is to limit investments to securities that are ethical, sustainable, or prioritize social issues. There are many different ESG investment mandates, and they often prioritize various matters.

For example, the priority of one ESG fund may be investing in renewable energy sources. In contrast, the focus of another may be only investing in securities involved in furthering social justice.

With the rising popularity of ESG, Aswath Damodaran provides an interesting point of view where he answers three big questions:

- How does ESG affect a firm’s operations?

- How does the market price ESG?

- Do investors in ESG companies make excess returns?

The Bottom Line

Investment mandates specify to a manager the requirements of how money is to be managed for both pooled capital and individual investor portfolios. Mandates also help prospective investors determine what funds meet their objectives.

Mandates are a fundamental component of fund investing. The better you understand them, the easier it is to create a portfolio that meets your financial needs.