How does one go from getting kicked out of three high schools to managing several hundred million dollars? Meet Jason Shapiro, a maverick trader and unsung market wizard who’s been shaking up the scene since 2003.

In this article, we’ll dive into the unique contrarian trading tactics that make him stand out from the crowd. Plus, we’ll show you how to harness his savvy insights to build your own fortune. If you’re a trader seeking financial freedom, you won’t want to miss this!

Want to learn from Jason Shapiro himself? Check out The Crowded Market Report community.

Key Takeaways

- Jason Shapiro is an American futures trader who has managed hundreds of millions of dollars.

- Shapiro’s trading strategy is contrarian, focusing on going against the grain of mainstream trading tactics and identifying opportunities where others may not.

- He created the Crowded Market Report, a comprehensive tool that helps traders identify crowded trades that are ripe for a reversal.

- Jason Shapiro has achieved a stunning track record of zero losing years for over two decades.

- Shapiro’s approach can be harnessed by other traders, providing a potential pathway to massive wealth.

The Early Days: The Path to Becoming a Market Wizard

Jason Shapiro didn’t magically emerge as a market wizard capable of managing millions. So let’s delve into this maverick trader’s humble beginnings!

His Troubled Teenage Years

Jason Shapiro’s journey is a testament to the power of transformation and second chances. Growing up in an upper-middle-class suburb in New Jersey, Jason was far from your typical teenager.

He was what he himself describes as a “terror show.” School was never a priority for him.

In fact, young Jason hardly attended, and when he did, he didn’t pay attention in class. His disinterest and disruptive behavior ultimately led to him being kicked out of three high schools. And when Jason finally managed to graduate, his GPA was a meager 1.7.

But amidst all this chaos, there was one person who never lost faith in him – his mother.

As a child psychologist, she understood that this was a phase and believed that Jason would grow out of it. She knew that beneath the rebellious exterior lay a potential that was yet to be tapped.

And as we will see, her faith wasn’t misplaced. Jason’s story is not just about his past but also about his remarkable turnaround.

His College Transformation

After completing his high school education, Jason decided to further his studies at the University of South Florida. The school was not particularly challenging to get into, and it offered a major in finance, which aligned with his career aspirations.

However, his journey was not without its hurdles.

During his sophomore year, he found himself on the wrong side of the law, getting arrested for what he now refers to as “drunken stupidity”. This incident served as a wake-up call for Jason, prompting a significant turnaround in his life.

Determined to make amends for his past mistakes, Jason committed himself to academic excellence. His grades improved dramatically, with him consistently achieving straight A’s in his coursework.

His newfound dedication extended beyond his university studies. Jason developed an insatiable appetite for knowledge, devouring a new economics or business book almost every few days.

By senior year, Jason was a top student and budding professional. He balanced his rigorous academic schedule with a nearly full-time job in real estate.

Jason’s ability to juggle his studies and work responsibilities showcased his remarkable work ethic and dedication, traits that would serve him well in his future career.

The Road to Success: Career Highlights

Of course, success isn’t always a smooth ride. In Shapiro’s journey to becoming a powerhouse futures trader, the path was anything but straightforward.

A Rocky Start

After earning his degree, Jason embarked on a new adventure, moving to Japan with his girlfriend. There, he joined HSBC’s executive development program on a misguided notion the job would involve trading.

Of course, this didn’t pan out; Shapiro was fired from the job in a year due to his dwindling interest, reminiscent of his high school days. But despite this setback, Jason’s time at HSBC wasn’t entirely fruitless.

He had begun trading Hang Seng futures, a venture sparked by a fellow American softball player who worked as a broker. This newfound passion for futures markets led Jason to immerse himself in a sea of books and brokerage firms, constantly trading and honing his skills.

And eventually, Jason’s pursuit of knowledge led him to the prestigious London Business School’s Masters in Finance program.

Although his interest in trading Hang Seng and S&P futures often overshadowed his academic commitments, the program provided him with a solid foundation in financial theory. Here’s where Jason first plunged into the world of risk metrics and studied the math behind concepts like ‘value at risk’. We’ll talk about how these insights harnessed his future trading strategy shortly.

After this stint, Jason became a partner in a new CTA based in Hawaii. Talk about being a world traveler! But, always searching for more, it wasn’t long before an enticing job offer from a New York hedge fund pulled Jason away.

In New York, Jason Shapiro developed his skills until he decided to venture out on his own and start a CTA. Yet, it wasn’t long before he found himself yearning for the thrill of trading, and fell into a deep depression.

So what did this contrarian do? He closed his CTA and returned to what he loved most: trading, this time at a place called Bryson Securities.

The Birth of Crowded Market Report

But everything changed when Jason Shapiro launched Crowded Market Report; this vibrant community is a haven for traders eager to connect, learn, and grow together.

Jason operates the educational CMR website, an all-in-one hub for futures trading education. He also steers an interactive Discord channel, a space where everyone has the freedom to exchange ideas and insights.

But his efforts don’t end there: Jason amplifies his educational mission through his YouTube Channel, also named Crowded Market Report.

This channel is a goldmine for futures traders, offering a deep dive into Jason’s unique ability to identify market crowds and turn them into profit opportunities.

Needless to say, the Crowded Market Report community has been a raving success! Jason’s unique contrarian approach to futures trading has garnered the attention of over 12,000 YouTube subscribers as of October 2023.

But per Jason Shapiro’s plea, don’t even think about joining the community if you’re an internet troll or just looking for quick trading tips. He says, “If you want to be in a place where people are actually looking to help each other out, you can check it out.”

Jason Shapiro’s Playbook: His Core Investment Strategies

So, how did Shapiro rise to the top as a trader and even establish his own futures trading dynasty? Let’s dive into his game-changing strategies!

Contrarian Trading: Going Against the Herd

In the trading universe, one philosophy stands out for its unique approach: contrarian trading. This strategy, embraced by Jason Shapiro (and investors like Jim Chanos and David Swensen), is as much about character as it is about numbers.

Shapiro explained in “Unknown Market Wizards” by Jack Schwager, “Being a contrarian is instinctive for me. I’ve been a contrarian since I was a kid. It’s part of my DNA. Fortunately for me, it is a valuable trait to have as a trader.”

But what does it mean to be a contrarian trader? Contrarian trading is like daring to swim upstream. It’s about bucking the trend, snapping up bargains when everyone else is selling, and cashing in when others are buying.

In the words of Warren Buffett, “I will tell you how to become rich. Close the doors. Be fearful when others are greedy. Be greedy when others are fearful.”

Of course, this trading approach requires understanding markets, spotting hidden gems, and the courage to disrupt the status quo.

But you may be wondering: does this strategy really work? Absolutely!

Just look at Shapiro’s time at Garrison, where he increased the company’s portfolio from $50 million to $600 million in two years. How’d he do it? With a contrarian, counter-trend approach!

And even during the 2008 financial crisis, a period marked by plummeting markets and widespread panic, Shapiro managed to stay in the green with his contrarian mindset.

But it doesn’t end there. Over the past two decades, Jason has achieved an impressive track record of zero losing years. This feat is nearly unheard of in the trading world.

His success is a testament to the power of contrarian trading, a strategy that, while not for everyone, can yield significant rewards for those brave enough to go against the grain.

Spotting Crowded Trades and Profit Opportunities

Shapiro’s unique approach to investing is centered around identifying crowded trades and discovering the catalyst that can trigger a shift in such trades.

This strategy forms the essence of his YouTube channel, aptly named the ‘Crowded Market Report.’ Here, Shapiro shares his expertise on identifying crowded markets and the potential opportunities they present.

So how can we identify crowded markets?

Jason looks for markets showing speculators crowded on either the short or long side using data; he then waits for this market to reverse itself. And although a crowded market doesn’t guarantee a reversal, it does hint at the potential for a significant move in the non-crowded direction.

After all, when everyone is crowded on one side, who’s going to join them?

So how do we know when a market is about to reverse?

One crucial factor Jason keeps an eye out for is news failure. This occurs, for example, when the market’s on a downward spiral and the news is all doom and gloom. But then, in a surprising twist, the market flips the script, surges upwards on what should be bad news for the day, and closes on a high note.

This is the market giving the cold shoulder to the news. But, timing is the secret sauce here. You’ve got to pounce right when the market pivots, or it’s all for naught. Jason likes to enter on the close and put his stop loss below the day’s pivot.

Let’s say, for example, that the DOW is crowded to the long side. The employment reports come out significantly better than expected, and the DOW rockets higher. But then, just when you think the DOW is headed for the moon, it pulls a fast one and closes weak on the day. This is your entry, fading everyone on the other side of the trade.

Now, how can you be sure that news failure is happening and it’s time to act? According to Jason, there should be no question; it’ll be incredibly obvious.

But how do we determine when a market is crowded? Read on my future fader.

Using COT Data: A Treasure Trove of Information

Jason Shapiro uses a unique approach to inform his trades; he relies on Commitments of Traders (COT) data.

This data, released by the Commodity Futures Trading Commission, provides a weekly snapshot of the commitments of market participants in the futures market, including large traders, small traders, and producers or users of the physical commodities.

Jason’s first encounter with the COT came after the dizzying heights of the 1999 Nasdaq bull market. He saw the bubble, the over-inflated optimism, and decided to swim against the current. He tried to short the stock, but was ultimately unsuccessful.

Why? Well, going against the tide is no easy task, especially when you don’t have access to the right data.

Luckily, it wasn’t long after this mistake that he stumbled upon the COT. He realized that this treasure trove of data could have been his life raft, guiding him to safer shores and saving him a fortune.

Shapiro recalls, “I started to look at the data and sort of test that data and really start to use that data pretty extensively from that point on.”

Of course, COT data isn’t flawless, and there are times when Jason will pull the trigger on a trade without looking at those numbers.

As he explained to Schwager, “Sometimes, I will put on a non-COT trade. The COT is not a perfect indicator. There has never been and will never be a perfect indicator. But, because I have lost so much money in the market and made such terrible trades, I physically cannot put on a non-contrarian trade.”

This means that even when Jason isn’t relying on COT numbers, he’s still avoiding popular market sentiment. After all, it’s his contrarian approach that has resulted in a winning streak spanning decades.

His success shows that while COT data doesn’t guarantee smooth sailing all the time, it does offer traders a reliable compass to make informed decisions and achieve consistent gains.

But how do you read this treasure trove of data?

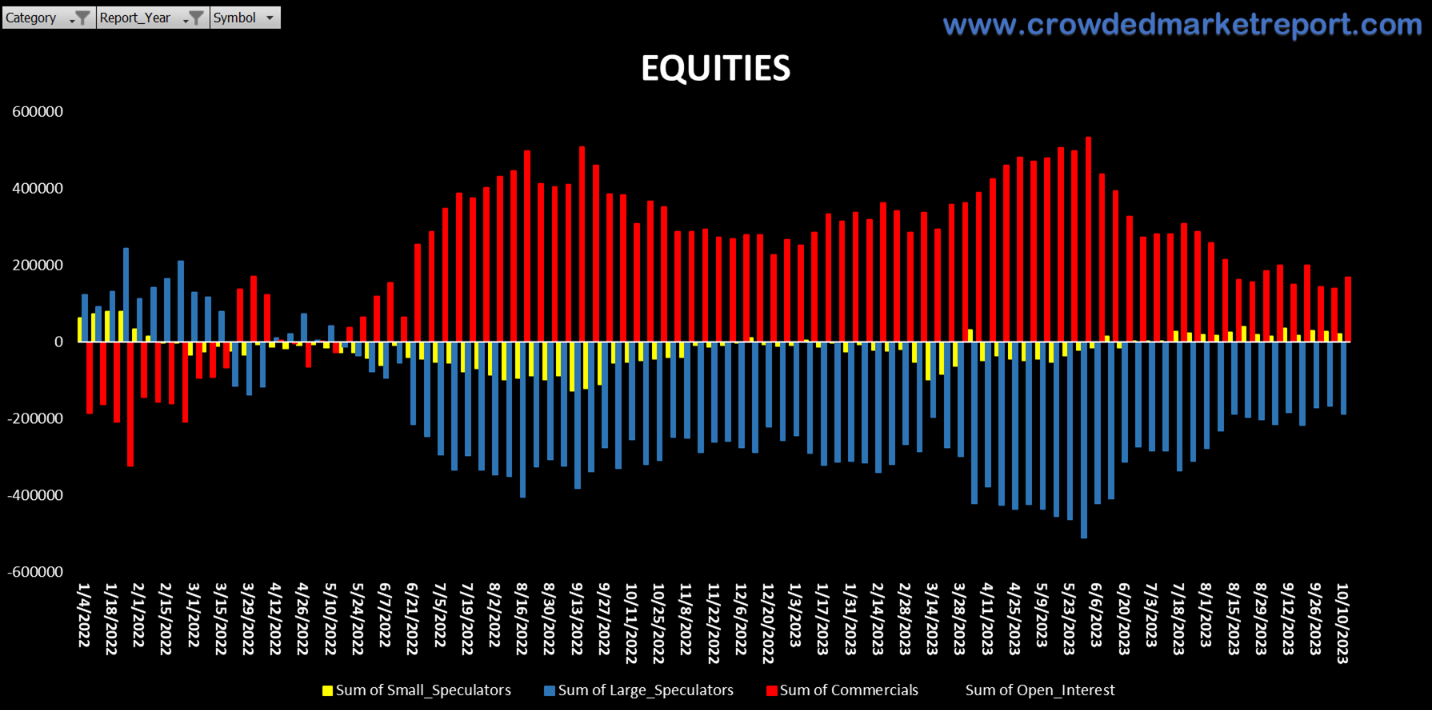

The Commitment of Traders (COT) Index tracks the market positioning of three groups – Commercial Traders (red), Large Speculators (Blue), and Small Speculators (Yello). It is based on weekly COT reports published by the CFTC.

- Commercial Traders are hedgers like producers who short futures to lock in prices. They are considered crowded short when relatively less short than normal.

- Large Speculators are hedge funds and others required to report positions. They provide liquidity by speculating.

- Small Speculators are remaining non-reportable positions after Commercial and Large positions are accounted for.

But that’s not all, Jason turns the COT into an oscillator looking at relative positioning over time to identify crowdedness indicating potential reversals. Jason and his team have wrangled the data to identify the best lookback period for each market.

Risk Management: Avoiding VaR and Losing Big

In the complex trading world, there are many strategies and tools at an investor’s disposal.

One such tool is the ‘Value at Risk’ (VaR), a statistical technique used to measure the level of financial risk within a firm or investment portfolio over a specific time frame.

It’s a bit like a weather forecast for your investments, providing an estimate of the potential loss that could occur from adverse market movements.

However, this tool has its critics, one of whom is Jason Shapiro; he carefully avoids using VaR to inform his trades. His reasoning?

It’s based on historical correlations, which he believes do not necessarily reflect the current risk. It’s like driving a car using only the rearview mirror; by the time VaR adjusts to an abrupt shift in correlations, you’ve already crashed!

Jason argues, “The value at risk will have nothing to do with the current risk. By the time value at risk catches up to reflecting an abrupt shift in correlations, it’s too late.”

So what’s the alternative? Shapiro prefers to be his own risk management. For him, this largely involves:

- relying on COT data

- knowing when to enter or exit a position

Shapiro explains, “You should be able to get where the market’s gonna go up or down right 30% of the time and make money. Because you should make big on the ones you’re right on and you should lose small on the ones you’re wrong on.”

And his strategy seems to work wonders! Since 2003, Shapiro has achieved an impressive average annual return of 15%, with a maximum drawdown of only 5%.

This is a testament to his belief that being actively engaged and responsive to the market’s real-time movements can lead to more successful investing outcomes.

Learning from Past Mistakes: An Important Lesson

Let’s not forget that Shapiro’s journey to success is a testament to the power of resilience and learning from failure.

Shapiro openly admits in “Unknown Market Wizards, “I succeeded because I have failed so many times, and I had an open mind about failure and was able to learn from it. I failed because I sucked, not because the market was wrong or because someone screwed me, or any of the other excuses you hear.”

You see, Shapiro’s story is not one of instant success.

After leaving HSBC, he started trading on his own during a bull market. Initially, things seemed to be going well; Jason made a whopping $700,000 and even bought a shiny new Porsche!

But when the bull market ended, so did his winning streak, and he lost his money. Despite this setback, Shapiro still had his Porsche, and more importantly, he had gained invaluable lessons from his trading mistakes.

So what’s the takeaway for traders like you?

Jason’s experience underlines the importance of understanding the market and learning from its ebbs and flows. It’s akin to a sailor learning to navigate the sea – understanding the tides, the winds, and the currents, and using this knowledge to steer the ship.

The sailor might face a storm and get thrown off course, but each challenge presents a learning opportunity, and with each lesson, the sailor becomes better equipped to navigate the sea.

Conclusion: Learn More from Jason Shapiro

You’ve just met Jason Shapiro, the trader who made over hundreds of millions throughout his career by swimming against the current. By using COT data and embracing his contrarian spirit, this market wizard has spotted countless lucrative opportunities in saturated markets.

But the journey doesn’t end here. Immerse yourself in the wisdom of Shapiro’s thought-provoking trading quotes. Use these pearls of insight to grasp his strategy and infuse his wisdom to grow your bank account!

Frequently Asked Questions

Let’s dive into some frequently asked questions traders like you have about Jason Shapiro and his success!

What is Jason Shapiro’s average return?

Over two decades, Jason Shapiro has averaged 15% annual returns with a maximum 5% drawdown.

Who is Jason Shapiro?

Jason Shapiro is an American trader where he shares his knowledge through the Crowded Market Report and associated YouTube Channel.