Jim Simons Trading Strategy returned 66% annually over a thirty-year span from 1988 to 2018 causing him to become the wealthiest hedge fund manager in America. Jim used quantitative models to capitalize on market inefficiencies and earn profits for his Rennaisance Technologies. This post digs into the highly profitable trading strategies of the legendary Jim Simons.

Equity trading has completely metamorphosed over the past few years globally. Machines, algorithms, and vast data sets have replaced human perception. According to Mordor Intelligence, about 60-73% of the overall U.S. stock market trading in 2021 was algorithmic. A huge credit for this goes to Jim Simons.

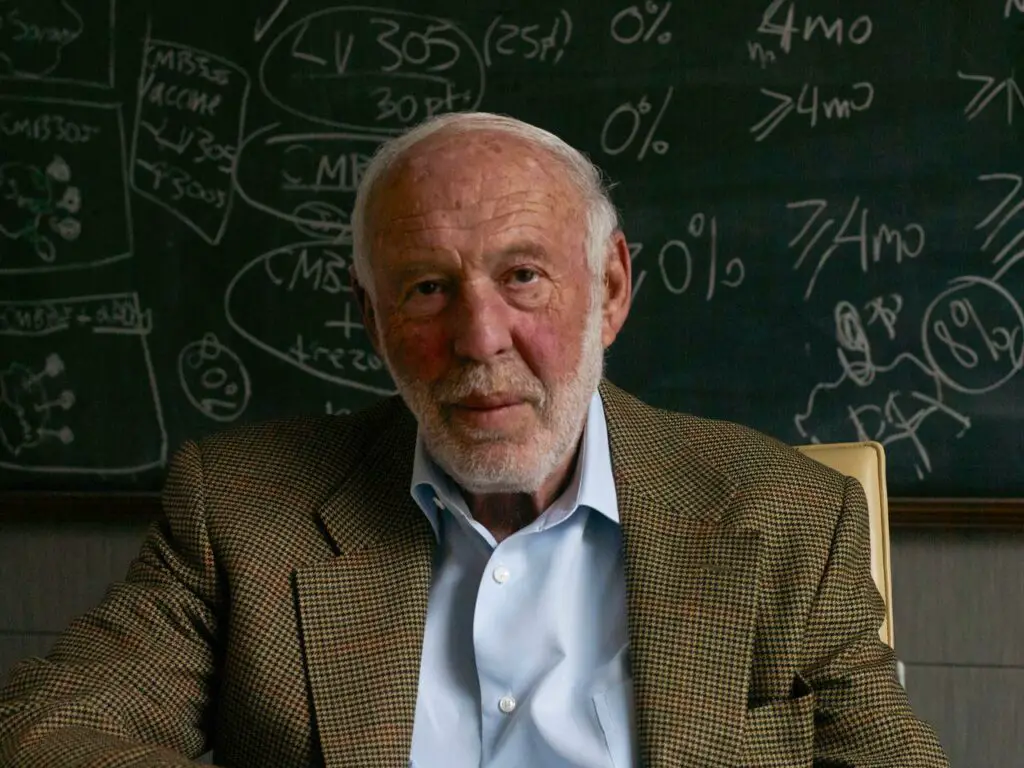

The legendary hedge fund manager, James Simons or Jim Simons, played a critical role in laying the foundation of quant trading three decades ago. According to Forbes, 83-year-old Jim Simons has been America’s wealthiest hedge fund manager for four consecutive years.

His Renaissance Technologies forayed into quant trading in the mid-70s when the concept was unheard of. With assets of over $75 billion, Renaissance is a trendsetter in the industry for massive returns and has a unique method of functioning.

However, the hedge fund is more famous for its Medallion funds, which averaged 40% annual returns after fees from 1988 through 2018. On a gross basis, the fund returned an average of 66.1% gross before fees from 1988 until 2018. The Medallion Fund is one of the most successful hedge funds in history. It is so profitable that it charges enormous fees to the unit owners. The fund has a stunning track record and has grown significantly faster than Warren Buffet’s portfolio.

Computer algorithms help Medallion fund make innumerable split-second trades in the equities and futures markets. On the other hand, Renaissance holds stocks for several weeks or months to beat the S&P 500 with less volatility. So, what’s so unique about the Jim Simons trading strategy? How did he build such a massive quant empire and emerge as the Quant-King? Let’s find out in this article.

How Did Jim Simons Achieve All of This?

What Renaissance and its flagship Medallion fund have achieved is no mean feat. Jim Simons employed intelligent trading strategies and risk management measures to deliver the past performance.

Let’s take a look at the reasons and the investment strategies that helped Jim Simons Renaissance and Medallion fund to scale to such heights:

1. Pioneer In Quant Trading

Jim Simons only relies on quantitative analysis to decide the trades he needs to enter based on market inefficiencies. Team Simons uses historical data to detect these anomalies and inefficiencies occurring repeatedly.

There is limited information about the exact strategies Jim Simons used because it is a closely guarded trade secret. However, there have been a lot of experts trying to decode his trading strategies.

According to mathematician James Baker, Jim Simons broadly used portfolio-level statistical arbitrage to conduct his trades. This strategy involves statistical and econometric techniques to profit with an element of market risk reduction.

In his book, ‘The Man Who Solved the Market,’ Gregory Zuckerman stated that Medallion earned profits from ‘trending and reversion-predicting signals,’ especially a one called Deja Vu. Instead of simple pairs, Medallion funds involved complex signals and equity trades.

During the mid-1980s, a top researcher of the Simons’ team began identifying “ghost patterns” in market prices. The project was based on similar code-cracking that Simons and his team had done for the Pentagon. The core idea was to look for patterns others failed to detect.

Launched in 1988, the Medallion Fund was a blend of the trend-following fund and quant fund. Simons relaunched the fund in the 1990s with a total focus on the quant side and earned 56% in its first year. The Medallion Fund features a collection of a minimum of 8,000 signals based on the short-term patterns of the entire batch of scientists who work for Renaissance Technologies.

To create the magic, Medallion Fund then leveraged these signals to trade in the markets innumerable times per day, with a trading reach that covers exchanges around the globe.

2. Unique Capital Management Approach

In 1990, Renaissance clocked in a gain of $1 million in a single day for the first time. Later it became a common phenomenon in the fund house. John Meriwether’s Long-Term Capital Management and a few more arbitrage firms popularized “convergence trading”, but Renaissance adopts a different approach.

Convergence traders determine the price of financial instruments based on complex mathematical models. They find two different instruments–one cheap and the other expensive on a relative basis. After that, they buy one and sell the other with expectations of the price converging to their proper level.

On the other hand, the Renaissance approach requires that trades pay off in a limited, specified time frame. Moreover, Renaissance traders do not manipulate the models. Based on these models, 20 of Medallion’s traders conduct rapid-fire trading of many U.S. and international futures contracts, including significant physical commodities, financial instruments, and essential currencies besides equities and mortgage derivatives.

3. Trendsetter For Electronic Trading

Renaissance was a pioneer of electronic trading. After launching its platform, its subsidiary installed a direct trading link to the German futures exchange

when its competitors were not even thinking about it. According to the New York Times, “It marked an early triumph of the “quants” — quantitative analysts who use advanced math to guide investments — and foreshadowed the ascendency of Big Data.”

Another reason behind the success of the Medallion Fund is that it is tough to replicate because of the infrastructure that operates such a high-precision operation.

In 2016, Jim Simons’ firm filed a 16-page technical document with the U.S. Patent and Trademark Office to “execute synchronized trades in multiple exchanges” hush-hush way. The concept involved atomic clocks, the world’s most high-precision time instruments, to lower the speed of the order transmissions to a few billionths of a second.

4. Flexible Trading Model

Jim Simons’s team developed a flexible trading system to adapt and execute trades. Therefore, instead of creating a new trading model for separate asset classes, Henry Laufer, the Vice President of Research at Renaissance Technologies, decided on a single big model for all asset classes.

This single model would allow them to leverage the humungous data sets and model correlations across asset classes. Laufer also designed the system to easily include future ideas in the model with a core understanding of stock trading and price movements. This model can also be replicated for asset classes with shorter trading history.

5. A Highly Specialized Team

We can attribute a large portion of the success of Renaissance Technology and Medallion to Jim Simons’s super-efficient and secretive team that designs all of these path-breaking strategies.

“We don’t hire people from business schools. We don’t hire people from Wall Street,” says Simons. “We hire people who have done good science.” Jim Simons could not escape the most common trading biases, though. After receiving a lukewarm response in the early 80s, he was keen on onboarding quant specialists in his team instead of generic business graduates.

Instead of hiring people with a typical Wall Street experience, Simons hired programmers, cryptographers, and scientists who gathered financial data and used complex models to predict and trade in global markets.

With no finance background, the team members considered financial data as the scientific/text data for experimentation. It’s also intriguing that Simons has been keen on hiring computational linguists with experience building speech-recognizing computers.

The key team members of Jim Simon’s team included talented scientists and mathematicians like Lenny Baum, James Ax, Elwyn Berlekamp, Henry Laufer, Peter Brown, and Mercer.

Who Is Jim Simons?

Simons studied mathematics at MIT and got his Ph.D. because of his sharp ability to break codes for the U.S. National Security Agency (NSA) during the cold war. However, he was evicted from the Soviet code-cracking team at the Institute for Defense Analyses because he was against the Vietnam war.

The Renaissance founder was elected to the National Academy of Sciences (NSA) in 2014 for his contribution to math and finance. NSA is an elite body founded by Congress under President Abraham Lincoln to advise the federal government. From 1968 to 1978, Jim Simons was a mathematics professor and chair of the mathematics department at Stony Brook University.

In 1976, Simons was honored with the American Mathematics Society’s Veblen Prize, the world’s highest honor in Geometry, awarded every five years. He won accolades for his work in the fascinating field of differential geometry. His flagship work — the Chern-Simons theory, a theorem that he crafted with renowned geometrician Shiing-Shen Chern has received critical acclaim from the scientific community.

Jim Simons is renowned for his stellar performance as a hedge fund manager more than his mathematical contributions. Simons is the quant-king who devoted significant efforts to designing and developing quantitative models to predict the markets.

In 1978 he quit his academia to found Monemetrics, a hedge fund. Quant trading was an unknown concept back then, and Simons’ fund employed fundamental and technical approaches. He was successful to an extent but wasn’t sure if he wanted to continue trading.

After three years, Simons changed Monemetrics’ name to Renaissance Technologies Corporation and decided to leverage a purely systematic approach to avoid the emotional rollercoasters he experienced in the initial years.

Renaissance Technologies handles four funds:

- Renaissance Institutional Equities Fund

- Renaissance Institutional Diversified Alpha

- Renaissance Institutional Diversified Global Equity Fund

- Medallion Fund

Of all these, Medallion Funds has garnered maximum attention.

Jim Simons had to shut the Medallion fund to external investors as the capital under management inflated to a massive scale due to compounding. Due to its size, the fund had trouble scaling the market signals, and it could not handle the volume without any volatility in its price.

In his book, ‘The Man Who Solved the Market,’ Gregory Zuckerman stated, “Since 1988, his flagship Medallion fund has generated average annual returns of 66% before charging hefty investor fees—39% after fees—racking up trading gains of more than $100 billion.

No one in the investment world comes close. Warren Buffett, George Soros, Peter Lynch, Steve Cohen, and Ray Dalio fall short.”

Simons has an immense influence on science and co-founded the Simons Foundation alongside his wife, Marilyn Simons, in 1994. Scientific research, education, and health were the major causes that the Simons Foundation supported.

Jim Simons Faced Failures Too

Although Jim Simon has an unprecedented record, it is not without flaws. During the coronavirus pandemic in 2020, computer models at Renaissance Technologies failed to produce results as the volatility surged.

It also contributed to a first-quarter loss at its most prominent hedge fund. In a March 30 filing, Renaissance said, “The beta models, which help determine portfolio exposure at funds for outside investors, “in recent volatile markets have not performed as expected.” However, Simons believes that “The things we are doing will not go away. We may have bad years; we may have a terrible years sometimes. But the principles we’ve discovered are valid.”

2020 was not the first instance when this happened. Renaissance’s Institutional Equities Fund suffered similarly during 2007-2008. This was the period when the subprime mortgage crisis heavily impacted quantitative firms.

Due to the problematic situation, institutional funds were compelled to sell assets at rock-bottom prices to lower leverage and reduce losses. The quant models found it hard to factor in complex events like widening credit spreads amid a plunge in housing prices.

In 2021, investors of Renaissance Technologies pulled out capital of about $11 billion-$15 billion from the hedge fund in seven months as the low return disillusioned them.

According to Bloomberg, clients redeemed more than a quarter of Renaissance’s externally-managed funds. Clients pulled or asked to remove about $5 billion from the funds from December to February. Then they pulled out $6 billion more through June. The redemptions were the highest in April but slowed in May and June.

Lessons For Investors

There are many important lessons that we can learn from the successful trading strategies and failure of Jim Simons. One of the biggest things we can conclude from his quant models is the predictability of human behavior. Renaissance analyzes the past because it believes investors will behave according to their past preferences. Traders are people who create patterns based on their emotions and opinions. Price patterns can repeat, so investors must learn to trade on these patterns and get an edge.

Parallelly, Jim Simons’s trading strategy adopts the scientific method to counter biases—cognitive and emotional. They propose hypotheses, then test and use them or review them to achieve their pre-determined output.

Renaissance has demonstrated that traders can decipher many latent forces impacting the security price movement with adequate data, computational power, and modeling experience, which would escape the investor’s eyes. Backtesting past historical price data is crucial as it can offer you an edge in trading the existing price action.

A critical takeaway from Jim Simons’s trading strategy is to avoid illiquid stocks, options, futures, and cryptocurrencies as you could lose money in the bid/ask spreads. You could also face volume issues and may not be able to exit a given position when you want. Also, be careful to choose liquid asset classes and watch trading signals across all liquid asset classes.

It would be best if you also aimed to trade various signals on multiple asset classes.

Lastly, Jim Simons didn’t just restrict himself to the quest for spectacular returns. But, he determined his success by building a highly-efficient system and an immensely collaborative team of top-notch researchers and mathematicians.