Macroeconomics is a branch of economics concerned with large-scale or general economic concepts. Inflation, Unemployment, International Trade, Gross Domestic Product, National Income, and Price Determination are some of Macroeconomics’ primary macroeconomic factors. The two primary Macroeconomic tools that a nation uses to control the economy are Monetary Policy and Fiscal Policy.

What Is Macroeconomics

Macroeconomics is a branch of economics that studies the overall economy’s structure, behavior, performance, and functioning. This concept is a sharp contrast to microeconomics which only deals with individual entities in the economy. These individuals could be people, organizations, or even industries.

Interest rates, inflation rate, unemployment levels, Gross Domestic Product (GDP), and sectoral growth are phenomena that macroeconomics analyzes. It is a critical tool to explore how an economy is performing, the loopholes, how we expect it to fare in the future, and how to improve its performance. The government of countries and other larger corporations use macroeconomic models to formulate economic policies and various business strategies.

Origins of Macroeconomics

The origin of Macroeconomics cannot be traced back to a single source. It has evolved over the years through generations of economists. Aspects like unemployment, growth rate, prices, and trade have been analyzed in economic studies in the 20th and 21st centuries. Several works of classical economists like Adam Smith and John Stuart Mill reflect the core concepts of macroeconomics.

In the 1930s, John Maynard Keynes, a Cambridge University Economist, opposed these classical theories. Classical economists mostly believed there was no need for monetary or fiscal policies to correct the economy in crisis times. However, Keynes propagated that the government must introduce various budgetary policies and regulations to save the economy in times of crisis.

Later, an economist from the University of Chicago, Milton Friedman, found loopholes in the primarily accepted Keynesian philosophies. He discovered that monetary and not fiscal policies have a more considerable impact on aggregate demand. Thus, Friedman popularized the concept and importance of monetary policy for the betterment of the economy.

Thus, Macroeconomics has been an evolving concept since the 20th century. Each theory made way for the other and helped the holistic development of this branch of economics.

Macroeconomic Philosophies

Classical

The classical theory finds its roots in the 18th and 19th centuries, where self-regulation of the economy was the defining principle. The emphasis is on restricting federal intervention to allow markets to remain free of hurdles to their efficient functioning. The 1776 book Adam Smith, Wealth of Nations, highlighted the significant elements and developments in Classical economics. This economic theory shortly followed the onset of western capitalism and the Industrial Revolution.

This theory’s foundation is based on two major convictions-Say’s Law and flexibility of prices, wages, and interest rates. Say’s Law propagates that an economy is always capable of generating enough income to purchase its output. In other words, the economy is naturally capable of attaining the level of real GDP.

Keynesian

John Maynard Keynes’ book called The General Theory of Employment, Interest, and Money, published in 1936 laid the framework for the Keynesian Theory of Economics. As opposed to the Classical theory, Keynesians believe that the economy can operate below total capacity for an extended period because of imperfect markets. Keynesians have argued in favor of expansionary fiscal policy or government intervention to counter the recession. Keynes’s concepts became the dominant thought process during World War II in Europe. It also played a critical role in formulating public economic policy under Theodore Roosevelt.

The classical doctrine assumed that the free economy’s pricing system is efficient enough to adjust supply and demand across markets automatically. This is also applicable to the labor market. However, Keynes argued that every economy had inherent inefficiencies wherein the supply of goods does not always meet the demand. This leads to capital wastage resulting in unemployment, monetary losses, and eventually, recession. Keynes believed that a reduction in wages and high savings during recessionary periods could also be detrimental to an economy in the long run.

Monetarist

The monetarist theory focuses on central banking’s role in an economic system and its overall impact on the money supply. In 1945, Clark Warburton drafted an analytical argument favoring monetarism. Later in 1956, this concept was further popularized by Milton Friedman. This theory believes that the money supply is the most critical factor determining the rate of economic growth and the business cycle’s performance. More money flow in the system means increased spending and vice versa. The money supply would also help the economy to gain some control over aggregate demand.

The formula MV = PQ depicts monetarism, in which M = Money supply, V = Velocity of money, P = Price of goods, Q = Quantity of goods and services.

Central banks can influence economic growth rates by controlling monetary policies. Historically, the monetarist policy also correlated with inflation rate control and enhanced economic performance.

New Classical

Thorstein Veblen introduced the term neoclassical economics in his 1900 article ‘Preconceptions of Economic Science. Neoclassical economics is a theory that propagates that demand and supply are the invisible forces driving the production, pricing, and consumption of goods and services.

The neoclassical theory also spoke about the efficient allocation of limited resources and their growth in the long term. It emphasizes that the key to achieving efficient resource allocation is the market equilibrium driven by demand and supply. Thus, governments must focus on market equilibrium as one of the priorities for a nation’s economic well-being. Neoclassical economics assumes that utility to consumers, not the production cost, determines the value of a product or service.

In 1933, neoclassical economics created the imperfect competition models, which featured tools like the indifference curves and marginal revenue curves — this theory forms the basis of the Law of Diminishing Marginal Utility.

New Keynesian

Noted economists partially developed new Keynesian economics to respond to the critics of Keynesian theory. It is a branch that offers a microeconomic foundation for Keynesian economics. New Keynesians propagated that prices and wages are “sticky,” which implied that they respond very slowly to economic fluctuations in the short term. Besides sticky wages, New Keynesian Economics assumes that imperfect competition can include monopolies, cartels, duopolies, and collusion.

This imperfect competition also explains why different companies in the same industry see varied impacts of the government’s budgetary policies. Another primary assumption of the New Keynesian policy is that people and firms behave rationally and have rational expectations.

Austrian

Ludwig von Mises and Friedrich A. Hayek are two principal Austrian economists from the 20th century. Both of them demonstrated that it is impossible to plan a layered economy rationally due to the absence of actual market prices. Thus, all the critical information required for centralized planning is challenging to obtain.

Austrian economics also applied the theory of marginal utility to production and consumption. Another noted Austrian economist, Friedrich von Wieser, argued that productive resources’ value is based on their quantum of contribution to the final product. This also implied that the changes in one resource would also impact the productivity of other resources.

Wieser also pioneered the concept of opportunity cost. He proved that the production factor’s utility in some alternative use—i.e., a forgone opportunity would determine its worth. The idea of Opportunity Cost is still widely used in economic analysis even today.

Areas of Macroeconomic Research

Economic Growth

An increase in the production of goods and services over a specific time horizon is known as Economic growth. This growth is adjusted for the effects of inflation. The best way to measure economic growth is with the gross domestic product (GDP). GDP accounts for the nation’s entire economic output, which comprises all goods and services that the country manufactures for sale. The sale can be domestic or overseas.

When we refer to the “rate of economic growth”, it implies the annual rate of GDP growth between the first and the last year in a specific period. Economists argue that more efficient use of inputs leads to increased economic development. Efficient use means increased labor productivity or more physical capital. Additionally, as the country develops new goods and services, it spurs economic growth.

In a nutshell, increasing demand and expansion in productive capacity causes economic growth.

The equation denotes rising aggregate demand:

AD =(C+I+G+X-M) wherein

- C = A rise in consumption,

- I = Investment,

- G = Government spending,

- X-M= Exports – imports.

On the other hand, an increase in aggregate supply (AS) refers to the rise in capital, investment, and higher labor productivity.

The tool to measure economic growth varies across nations. Notably, the World Bank prefers gross national income or GNI, not GDP, to measure economic growth. This includes income remitted to the country by citizens employed overseas. Many emerging countries use GNI as a determinant for Economic Growth.

Economic growth is not just a concept, but it has multiple benefits for the country. Higher income for the working population and increased tax revenue are the two most significant advantages. A rise in tax revenue automatically helps the government lower its tax burden. Economic growth also helps in employment generation and encourages firms to boost investment.

Economic growth is a dynamic macroeconomic idea. A government would always look for ways to boost economic growth. The primary step is to add more capital goods to the economy. This would also boost the productivity of labor. Besides, increasing the labor force can also lead the country to produce more goods and services. Technological advancement is the second most viable way to boost economic growth. Another way to generate economic growth is to grow the labor force. Lastly, a country can also enhance economic development by investing in human capital. This can happen by making the laborers more skilled through intensive training or practice.

Business Cycles

Also known as the trade cycle or economic cycle, business cycles denote the expansion and contraction phases in aggregate economic activity. The business cycle is the increase and decrease of economic growth that naturally happens over a time horizon. A business cycle’s length or duration is when an economy takes to complete a series of expansion and contractions. A business cycle is critical for analyzing economic efficiency and making better financial decisions.

The four business cycle phases are expansion, contraction, peak, and trough, not necessarily in this order. An expansion happens when the economy performs to its maximum capacity and the output increases.

The second phase is the peak. It is the turning point between the expansion and the contraction. This usually follows in mature economies soon after the GDP growth rate exceeds 3%, and the Inflation rate is over 2% or double digits. During the peak, output stops rising and begins to fall.

Contraction marks the third phase that begins at the peak and culminates at the trough. This phase of the business cycle denotes weak economic growth. During contraction, GDP growth declines to a sub- 2% level. In case the GDP growth becomes negative, economists call it a recession.

The government tackles the business cycle and uses budgetary policies to control the economy. If they want to deal with a recession, they use expansionary fiscal policy to pump in the stimulus or lower interest rates. On the other hand, when the economy gets overheated, the government resorts to contractionary budgetary policy or hikes the benchmark rate.

Basic Macroeconomic Concepts

Output and Income

Output and income are one of the most critical concepts of macroeconomics. The national output is the aggregate amount of the goods and services a nation produces at a specific time. Subsequently, when these organizations sell whatever they make, they generate a specified income. An increase in capital, advanced technology, cutting-edge equipment, and multiplying the number of production units can increase national output and income. However, market factors like recession or government fiscal policies can substantially impact income and production.

Interestingly, every output that a country generates an equal amount of income. Income is the money or something equivalent in value that an individual or business obtains in exchange for offering a product or a service. Wages or salary are the ways through which individuals most often earn income. At the same time, businesses earn income by selling goods or services at a margin over their production cost. A country can also generate revenue by reaping returns by investing capital.

In most countries, business income is taxed by the government even before they receive it. An individual’s income from salary, wages, business income, interest, dividends, and capital gains obtained during a particular period is taxable. The income that remains in people’s hands after paying taxes is disposable income. Individuals then use this disposable income to spend on food and other necessities. The government uses the tax revenue to finance many of its projects and programs formulated by the state or federal budgets.

Unemployment

Unemployment refers to a situation wherein employable individuals seek a job but cannot find one. It is one of the most crucial indicators of the economic status of a country. Unemployment is measured by the unemployment rate, obtained by dividing the number of unemployed people by the total workforce. However, people who are not actively looking for a job in the past four consecutive weeks due to many reasons such as a sabbatical, higher education, personal issues, or disability are excluded from calculating the unemployment rate.

There can be various causes for unemployment, such as on the demand side: there aren’t enough jobs, or on the supply side, there are not enough skilled employees. High-interest rates, recession, or a global financial crisis are some of the demand-side factors.

Unemployment causes workers to suffer financial difficulties that may lead to emotional distress. When it happens, consumer spending, one of an economy’s key drivers of growth, goes down, leading to a recession or even a depression when left unaddressed.

Unemployment also leads to lower purchasing power and consumption. Thus, businesses see lower sales and profits, and it resorts to budget cuts and workforce reductions. It creates a vicious cycle that continues forever.

Inflation and Deflation

Inflation is a phenomenon that denotes an increase in the prices of goods and services. Inflation happens when more dollars chase goods and services. This imbalance in demand and supply cause the prices to rise. Consumer Price Index, or CPI, is the most common measure of inflation used. CPI stands for a hypothetical basket of goods that comprises consumer goods and services, health care services, and transportation costs.

On the other hand, when the prices of goods and services decline, it is known as deflation. Deflation indicates that the economic conditions of a country are worsening following massive unemployment and low productivity. Sometimes, people confuse the term “Deflation” with “disinflation.” However, both concepts are different. While deflation implies a decrease in the price levels, disinflation suggests a slower pace of inflation or a gradual increase in prices.

Based on price changes’ underlying reasons and pace, inflation and deflation can damage the economy. The central bank keeps a tab on the basket components’ price movement to gauge the purchasing power of the nation’s currency. By tracking the level of inflation or deflation, the government can take steps to curb them at the right time through fiscal policies.

Economic Indicators and The Business Cycle

Measures used to evaluate the overall state of the economy are known as Economic indicators. Government agencies or private think tanks generate economic indicators through sampling and analyzing data. Some of the widely used economic indicators are Gross Domestic Product, Purchasing Managers Index Or PMI Manufacturing & Services, Consumer Price Index, Minutes of the Central Bank, and Unemployment data. These indicators have a specific release date so that individuals or organizations tracking them can be prepared ahead.

There are two types of economic indicators, Leading and Lagging. A leading indicator pertains to a future event or upcoming trends in the business or market. They give a clue about the direction of the economy. Consumer Confidence Index, initial jobless claims, and Purchasing Managers Index are some of the critical leading indicators.

On the other hand, Lagging indicators only provide signals after a significant event. These indicators only depict broader trends but do not project anything. The unemployment rate, GDP, trade balance, interest rates, and corporate profits are some instances of lagging indicators.

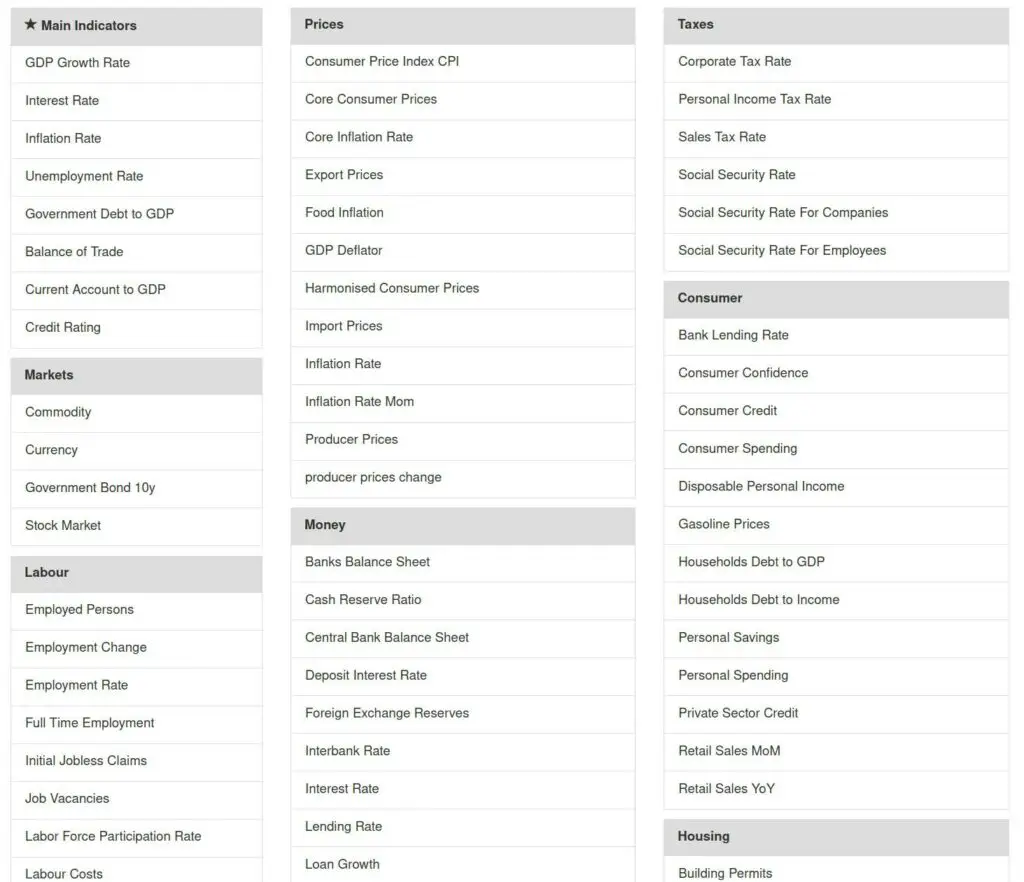

Trading Economics has a great list of economic indicators, which you can see a snippet of below.

National Income and Price Determination

One of the simplest ways to explain the National income and price determination is Keynes’ two-sector model. He assumed an economy where the government and foreign trade do not play a role. In other words, it is a closed economy that has no government intervention. The two sectors include households and firms.

Keynes believed that two significant factors determining the national income are Aggregate Supply (AS) and Aggregate Demand (AD) of goods and services. He also thought that the equilibrium level of national income happens when the AD becomes equal to AS. Thus, the equilibrium level of national income is when the economy’s plans for purchasing and creating goods and services are in harmony.

This occurs when the aggregate demand (C + I) schedule intersects with the aggregate supply (C + S) schedule. National income equilibrium is also a situation where total injections are equal to the leakages. Thus, injection implies an autonomous investment in a closed economy with no government, whereas leakage implies savings.

Long-run Consequences of Stabilization Policies

A stabilization policy is a strategy enacted by a government or its central bank to maintain healthy economic growth with minimal price fluctuations. The decision-makers need to monitor the business cycle and recalibrate benchmark rates to sustain stabilization to curb abnormal demand variations. Preventing the economy from “overheating” or drastically “slowing down” is the key to stabilization policies.

Let us look at some of the long-run consequences of the stabilization policies:

The country assumes that the economy always operates at any point on the short-run Philips curve and adjusts itself accordingly over the period. A short-run Philips curve illustrates the inverse relationship between unemployment and inflation. Anything that doesn’t change the economy’s structure is temporary and will be seen as a change in the short-run Phillips curve.

According to the quantity theory of money, an increase in the money supply will only affect nominal interest rates. During self-adjustment, inflation would eventually lead to a decrease in short-run aggregate supply (SRAS). The decline in SRAS brings back the economy to full employment and a new, permanently higher price level.

Crowding out can cause capital investment to decrease, reducing future potential output. Thus, a possible long-run impact of deficits and debts is economic slowdown as the deficit crows out the private investment.

When the government’s expenses exceed its income and tax revenue, it ends up in a budget deficit during the expansionary monetary policy. A government then has to borrow money to finance this deficit, increasing government debt.

Economic growth is not equal to an increase in real GDP growth. Growth only occurs when there’s an increase in the capacity to produce. Production depends on the quantum of labor, capital, natural resources, and technology available.

Khan Academy provides an excellent tutorial on the consequences of stabilization policies.

International Trade

The sale or purchase of capital, goods, and services across international borders is known as International trade. Countries can expand their goods and services markets beyond domestic barriers through international trade. The transaction of goods across borders results in competitive pricing and increased buying options for domestic consumers. When goods or services produced domestically are sold outside the country, it is known as export. Similarly, when a domestic consumer buys an overseas product or service, it is an import. Export and import are critical components of the current account.

Political economists like Adam Smith and David Ricardo recognized that International trade is the stepping stone to a global economy. International trade exposes domestic consumers to foreign countries’ products and allows homegrown industries to expand overseas markets. Countries involved in international trade are more likely to flourish, innovate, and create employment. As a result of cheaper imports, lower-income households can also get affordable alternatives. However, on the flipside, cheaper overseas products can also threaten smaller industries in the country.

Net exports or Exports-Imports is known as the Balance of Trade. A favorable trade balance is desirable for an economy as it means more overseas income. Many factors impact International Trade, such as trade policies, foreign currency reserves, inflation, exchange rates, and demand.

Contemporary Macroeconomic Issues

Six major macroeconomic issues are:

- Employment and Unemployment: Unemployment is when the workforce is sitting idle due to insufficient opportunities. When the issue persists, the actual economic output is below the potential output. It is the government’s responsibility to ensure full employment at all times.

- Inflation: Persistent rise in the prices of commodities and factors of production is known as inflation. The reverse situation or a decline in prices is known as deflation. Both of them are undesirable situations and impact the distribution of income. Hence, a government must formulate policies to control such cases and aim at price stability.

- Trade Cycle: The fluctuations in business activities or the alternating levels of economic output and employment are known as Trade cycles. Boom refers to high output and high employment periods, while a slump period refers to low output levels and declining employment. Macroeconomics studies the causes behind the trade cycles and suggests remedial measures.

- Stagflation: Stagflation is a situation that is a combination of a stagnant economy, inflation, and unemployment. Balancing inflation and unemployment is quite a challenge for nations, and they are relying on macroeconomic models to find a solution for this.

- Economic Growth: A positive trend in the nation’s total economic output over a sustained period is economic growth. Even though there are alternating trade cycles in a nation’s economy, the most advanced countries always aim for an upward trend in the output. Increased capital formation, rise in the labor force, and technological progression are the key factors driving economic growth.

- Exchange rate and Balance of Payment: The record of transactions between a country and the rest of the world is the Balance of Payments. The exchange rate primarily impacts the balance of payments. It is the rate at which the nation’s domestic products or services are sold internationally.

Macroeconomic Models

Aggregate demand

Aggregate demand is the total demand for all finished goods and services that an economy produces. In other words, it is the amount of money that consumers spend on buying these goods and services at a particular price level and a stipulated time. We can also say that Aggregate demand is the demand for a country’s gross domestic product.

The standard equation of Aggregate demand is AD = C + I + G + (X – M), as mentioned above. Except for imports, all AD components are inversely proportional to prices. They all have different elasticities concerning the price level, implying that they respond to prices differently. The AD curve depicts the relationship between AD and the price level. Standard assumptions state that the AD curve slopes downwards from left to right as all the components, except imports, have an inverse relationship with prices. Notably, changes in the money supply or a rise and fall in tax rates can cause the AD curve to shift.

Some of the factors that can affect Aggregate Demand are Income and Wealth, alteration in inflation expectations, and exchange rate fluctuations. As the per capita income of an economy rises, it creates a positive environment for consumption and boosts demand. On the other hand, if the income reduces, people tend to postpone their purchases leading to lower demand. Similarly, if people expect changes in inflation levels or the prices to rise sooner, they make purchases immediately. This leads to higher demand and vice-versa.

When the currency rate fluctuates and leads the US Dollar to rise, imports become cheaper. This also means the domestic goods would become more expensive, thus resulting in lower demand for them. Similarly, when the US Dollar declines in value, the situation becomes reversed.

IS-LM

IS-LM stands for “investment savings-liquidity preference-money supply.” Also known as the Hicks–Hansen model, IS-LM is a two-pronged macroeconomic tool that illustrates the connection between interest rates and the asset market. The asset market includes services, physical goods, and financial assets like stocks, gold, money, or bonds. John Hicks developed the IS-LM model in 1937. Later, Alvin Hansen extended the theory, a standard graphic representation of the General theory propounded by JM Keynes.

Source: https://www.economics.utoronto.ca/jfloyd/modules/islm.html

The IS curve slopes downward from left to right. It indicates an equilibrium when the total production in an economy equals the total demand for goods (consumption+ investment+ public spending) at a specific price point. Thus, the model studies the short-run scenario when prices are fixed or sticky, with no inflation impact.

The LM curve slopes upward from left to right. It represents the relationship between liquidity and money. It assumes that the money supply is constant. Thus, when output increases, the demand for money also rises. However, as the money supply is stable, the interest rate increases. An increase in the interest rate lowers the demand for money, and an increase in income boosts it. Thus, to maintain equilibrium or equate the demand for money to a constant money supply as the interest rate rises, the income level must continue to increase.

The Central banks can shift the LM curve outward by printing money. As more money is printed, banks can be slightly relaxed to attract interest rates for attracting deposits. However, printing more money results in a higher rate of inflation. Higher inflation results in the inward shift of the IS curve and causes interest rates to rise again, followed by a slowing economy. Thus, if the central banks aren’t judicious in printing money, the decision can be counterproductive and lead to high inflation and low GDP growth.

Growth Models

The six most widely followed models of economic growth are:

- The Aggregate Production Function: The aggregate production function explains how an economy’s real GDP or gross domestic product depends on the availability of physical capital, technological advancements, production facilities, and the quantum of labor.

- Endogenous Growth Model: Endogenous growth model maintains that internal forces drive economic growth. The model propagates that human capital would lead to economic growth due to advancements in technology and production efficiency.

- The Harrod-Domar Growth Model: The Harrod–Domar model is a Keynesian economic growth model. It has a special place in developmental economics, where it depicts that a nation’s economic growth depends on saving and capital. The growth rate at which the economy slips into a recession or does not expand indefinitely is the Warranted growth rate.

- Joan Robinson: In her 1956 book, The Accumulation of Capital, Joan Robinson publicized a growth model explaining the functioning of a pure capitalist economy. According to the model, the net national income depends on entrepreneurs’ total profit and the wage bill.

- The Neo-Classical Growth Models: Robert Solow and Trevor Swan first introduced this growth model in 1956. Therefore, the Solow-Swan model is the most popular version of the neo-classical model. The theory propagates that long-term economic growth depends on labor, technology, and capital. The model emphasized the influence of technological advancement on economic growth.

- The Kaldor Model: Propagated by Nicholas Kaldor, this growth model follows the Keynesian approach and Harrod’s principles. This growth model seeks to explain the nature of non-economic variables and their role in determining the difference in growth pace between societies.

Macroeconomic Policy

Monetary Policy

Monetary policy refers to a country’s central bank’s actions to achieve sustainable economic growth and control the money supply. A central bank’s tools include open market operations, bank reserve requirements, direct lending to banks, and emergency lending programs. There are three primary objectives behind the monetary policies undertaken by the Central banks. An essential purpose of monetary policy is to manage inflation. Secondly, Central Banks can use monetary policy to reduce unemployment after curbing inflation. The third aim is to foster a climate of moderate interest rates over the long term.

We can classify monetary policy broadly as expansionary or contractionary. When exercising expansionary monetary policy, central banks increase the money supply by reducing interest rates, buying government securities in open markets, and reducing reserve requirements. An expansionary policy aims to boost economic growth by curbing unemployment and stimulating business and consumption.

Contractionary monetary policy, on the other hand, helps control an overheated economy. It reduces the flow of money in the economy by raising interest rates, increasing the reserve requirements for banks, and selling government bonds. The contractionary policy is beneficial when the government intends to curb high inflation.

Fiscal Policy

Fiscal policy includes various tax policies and government spending to control different macroeconomic conditions such as unemployment, inflation, and economic growth. Keynes propagated the concept of fiscal policy. He believed that the government could regulate the economic output or keep boom and bust cycles in check by altering taxation or federal spending. Such budgetary policies play a massive role in compensating for the deficiencies in the private sector. It also helps to boost economic growth during the recession. Fiscal policies also help in curbing inflation.

When governments want to increase money flow, it uses budgetary tools to boost spending and lower taxes. This would boost consumer spending and disposable income. However, expansionary or loose fiscal policy would result in a government budget deficit, prompting it to go for increased borrowing.

This leads the government to adopt the contractionary or tighter fiscal policy now. This implies lesser government spending and increased taxes, improving the government budget deficit.

Monetary vs. Fiscal Policy

Monetary and fiscal policy both are macroeconomic tools for managing or stimulating the economy. Monetary policy is controlled by a central bank and deals with the interest rates and money supply. The central bank can boost consumer spending through lower interest rates and making borrowing cheaper.

On the other hand, fiscal policy government legislation generally addresses taxation and government spending. As the government is involved in the fiscal policy, it can have more significant supply-side effects on the broader economy.

For instance, the government may raise taxes and lower its spending to reduce inflation. However, it may not be easy to take these measures to impact consumer spending.

Both fiscal and monetary policy impact personal and household finances directly and indirectly. As the Central Bank sets monetary policy, it is free from political influence. Thus, it is a relatively unbiased tool.

Macroeconomics vs. Micro Economics

Macroeconomics analyzes the decisions made by governments and central banks. At the same time, microeconomics is a branch of economics that studies individuals’ and businesses’ decisions. Macroeconomics finds answers to external issues such as economic and fiscal policies, while Microeconomics seeks solutions to internal problems like investment decisions for an individual or a company.

Macroeconomics analyzes issues like national income, unemployment, distribution, price level, money supply, and inflation Microeconomics handles aspects like demand, supply, production, consumption, pricing of products, and pricing of factors of production.

Microeconomics adopts a bottom-up approach that focuses on the forces of supply and demand to determine price levels. Macroeconomics opts for a top-down approach and analyzes the economy as a whole. It attempts to determine the course and nature of the economy. Investors may use microeconomics to make their investment decisions. In contrast, macroeconomics can be used to craft critical economic and fiscal policy.

Macroeconomics and Microeconomics are not opposing concepts but complementary. They both go hand in hand and need to be used in tandem to seek solutions to various problems.

Economics vs. Finance

Economics is a branch of social science that analyzes the production and consumption of goods and services and their factors.

Finance is a subset of economics that studies the behavior of money. It analyzes the functions of saving and lending money, cash at hand, considering the time frame and risk involved. Finance focuses more on the techniques and tools for managing money.

Personal, business and public finance are the key areas of finance. Personal finance deals with the income and expenditure of individuals and families. It also includes the analysis of debts and other financial commitments. Public finance pertains to the income and expenditure of government and administrative authorities. On the other hand, Business finance or corporate finance includes the study of managing an organization’s funds, maximizing its wealth, and enhancing its stock value.

Economics and finance are co-related branches that analyze the way companies and investors evaluate risk and return. There are also a lot of common areas between the two that impact each other. Fundamentally, both tackle different aspects but are crucial for investors and the economy.

The Pros & Cons of Macroeconomics

Benefits of Macroeconomics

- Macroeconomics primarily empowers the government and other financial bodies to maintain economic stability in the country. It is the core tool to understand unemployment, inflation, low output, and economic imbalance and formulate various economic policies. The analysis of macroeconomic models allows economists to understand the country’s issues and find solutions. Macroeconomics gives a holistic view of not just economics but also social problems troubling a country. Hence, those who want to change society and solve socio-economic problems must also study macroeconomics.

- An economy is dynamic, and individual variables like national income, employment, aggregate supply, and aggregate demand are subject to significant changes from time to time. With its specialized models, Macroeconomics helps to analyze these dynamic aspects of the economy very effectively. Macroeconomics is particularly useful for closely studying the behavior and complexities of individual units. For example, it is essential to understand the anomalies in aggregate demand and the economy’s average cost conditions to study individual firms’ pricing mechanisms. Macroeconomics is well-equipped to explain these phenomena.

Limits of Macroeconomics

- Macroeconomics is based on the assumption that individual units are homogenous or uniform. However, individual units may differ in their functioning and description, which may not yield the desired results when compiled into an aggregate value.

- If Macro Economics is not applied correctly, it may mislead and confuse the economists trying to find a solution to a particular problem. Extensive use of macroeconomic concepts can be irrelevant when analyzing a single issue.

- Macroeconomics is based on aggregate values. However, when seen at a granular level, the individual’s behavior may not add to what the macroeconomic theories deduce in a broader aspect. When the individual data are represented in different units, it leads to conceptual and statistical complexities. Aggregating it becomes a cumbersome and futile effort.

- There may be certain situations wherein an economic scenario analysis may require the analysis of individual units. However, macroeconomics, which always deals with aggregate values, might face certain limitations in addressing such issues.

How to Learn More About Macroeconomics

There are plenty of online resources that offer an in-depth explanation of the various aspects of macroeconomics. The modules are extensive yet entirely engaging. I have listed my favorite resources that would help you to learn more about Macroeconomics: