Quantamental refers to an investment strategy that combines quantitative approaches using computers, mathematical models, and big data with fundamental methods that analyze individual company cash flows, growth, and risk to generate better risk-adjusted returns.

The term quantamental is a portmanteau combining “quant”itative and fund”amental” investing.

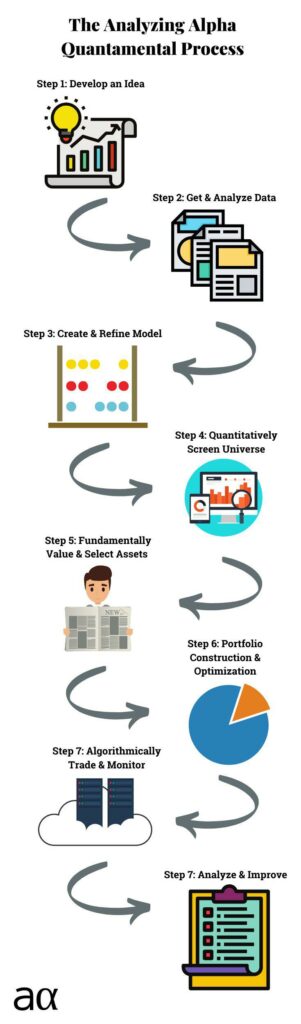

In this post, we will dig further into quantamental investing, the problems it attempts to solve, the expected performance gains when adopting the approach, and review a few examples. I’m even going to show you a high-level overview of my quantamental investing and trading process at the end. But before we dive into the why of quantamental investing, let’s make sure we’re both familiar with the what.

What Is Quantitative Investing?

Quantitative or systematic trading is essentially computer-driven trading. It involves researcher(s) using math, finance, or trading experience to develop an idea about an exploitable market anomaly such as momentum or [price arbitrage/arbitrage). The approach is then validated generally using statistical techniques and either discarded if it doesn’t meet the investment requirements or is turned into a model if it does. Once it’s a model, it’s often programmed on a computer and traded alongside other models automatically; however, some [systematic traders/types-of-trading) place their trades manually.

If this sounds complicated or unfamiliar, review the systematic sector-momentum strategy example.

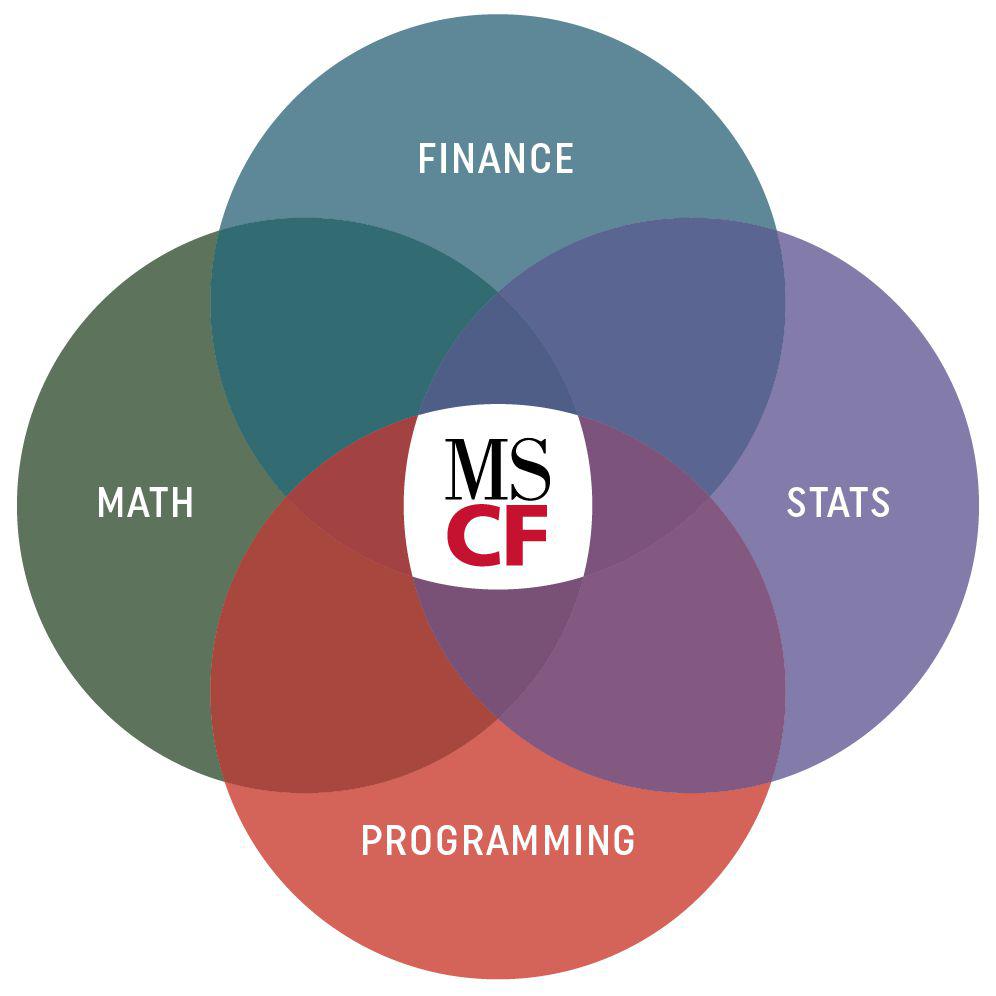

Carnegie Mellon University has a great masters in quantitative finance program and an image showing quantitative finance’s interdisciplinary nature.

Quantitative strategies characteristically hold many securities to take advantage of statistical edges using the law of large numbers and the almost infinite ability to process data.

Quantitative trading is often a team sport due to its interdisciplinary nature. Still, it is becoming more accessible to retail investors and traders due to advances in technology and ease of use. Notable quantitative and systematic trading firms are Renaissance Technologies and Dunn Capital.

What Is Fundamental Investing?

While quantitative investing focuses on the big picture of an asset type such as equities, fundamental investing analyzes the story of a single company.

Fundamental stock investing involves valuing a business by forecasting future cash flows, growth, and risk using financial statements and other sources. These sources may include both quantifiable and non-quantifiable information such as other analyst valuations, economic reports, news events, earnings call transcripts, and perhaps even meeting with management.

Pricing is also part of a fundamental investors toolkit. Pricing a company by comparing it to its peers can help determine if a company is cheap or expensive. A simple example would be comparing the price-to-earnings (P/E) ratio for multiple companies in the same industry. Unlike valuation, pricing can be computed quantitatively if using broad strokes.

Fundamental portfolios, especially where the companies are valued, contain fewer positions due to human data processing limitations, but the company research is often more in-depth.

Stock picking is more accessible than quantitative investing and is often a solo sport but doesn’t have to be. Examples of famous fundamental investors are Warren Buffett and David Tepper.

Why Quantamental?

Not everything can be modeled as markets are incredibly dynamic. How would you model current events where history cannot be a guide or investment opportunities like merger arbitrage where legal ramifications are critically important?

And while models are broken, humans are flawed. Behavioral finance acknowledges that we aren’t perfectly rational and well-informed. Most humans dislike losing more than they enjoy winning; we don’t immediately internalize new data, weigh recent information more heavily than past data, and suffer from other cognitive biases.

Our wetware is often programmed to do precisely the wrong thing at the wrong time when it comes to the markets. Quantitative techniques can help us reduce these biases in several ways, and why I think for this reason alone, algorithmic trading is worth it.

The numbers also back up my experience.

Quantamental Results

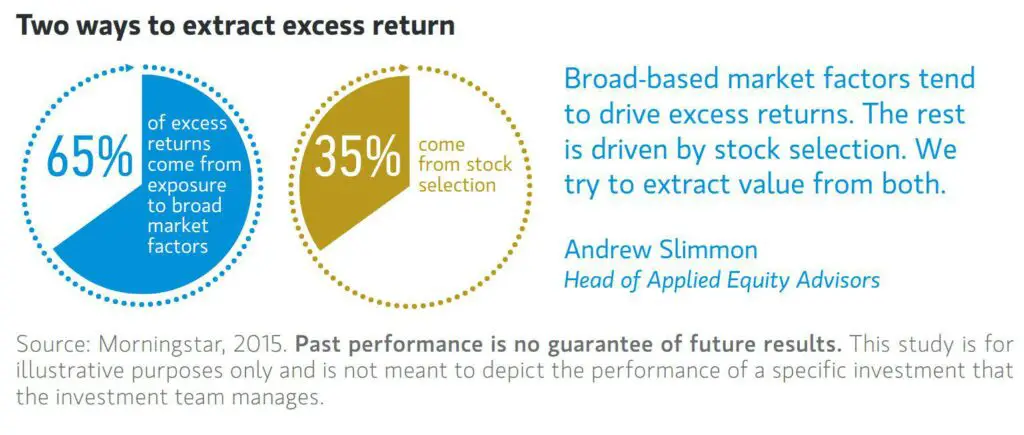

According to Morningstar’s report: Rolling 18-month regression for Global Equity Managers, December 2015, over the past 20 years, broad market factors—such as value, growth, quality, and momentum—have driven about 65% of a global equity manager’s relative returns.

And while the above demonstrates that purely quantitative, factor-based investing is an excellent strategy. It also leaves money on the table — the money from individual security selection.

I’m not sure about you, but I don’t particularly like leaving money on the table, and neither does Merill Lynch.

Merrill also has a quantamental product called alpha surprise that has generated better returns than the S&P500 since 1999 with lower volatility.

Now that we’ve seen that a quantamental approach can improve our chances of making money in the markets let’s look at a few simple examples.

Quantamental Examples

Technology saves us time by enabling us to manipulate financial data much more efficiently, but more importantly, it also allows us to ask new questions about our data.

Here are three examples of how quantitative methods and data science can empower an investor’s research process in new ways:

- Sentiment Analysis – Natural language processing (NLP) can review historical transcripts quickly to determine sentiment or shifts in attitude.

- Alternative Data – Image classifiers to assess changes in car models on a highway to help forecast new car sales.

- Return Analytics – Factor and portfolio analysis can inform a manager of hidden risks such as over-exposure momentum.

It also enables us to overcome cognitive biases.

While this is not an exhaustive list of quantamental benefits, it drives home that quantitative and fundamental investing is better together even though there are risks of adopting a quantamental approach.

Quantamental Risks

While the positives outweigh the negatives according to the data, there are risks to incorporating a quantamental approach.

Fundamental investors introduce the common pitfalls of quantitative trading, such as curve fitting and data mining. Strategies should take an ideas-first approach and exploit a market anomaly that makes sense and not something discovered in the data like “Microsoft moves up on Mondays”. There’s plenty of literature on this site and elsewhere about the risks of overfitting and parameter optimization, so I won’t elaborate on them further here.

Quantitative traders introduce cognitive biases when they start placing companies under the microscope. Like in trading, where market pressures are part of the game, the same goes for valuation, but these pressures are more subtle and come in different forms.

Why I am a Quantamental Investor

In my own experience, fundamental analysis and quantitative techniques are symbiotic and strengthen each other at every step. But perhaps most importantly, I enjoy both. I love valuation and data science, and quantamental investing gives me an outlet for both.

The Quantamental Investing Process

Here’s a high-level quantamental investing and trading process for those of you that are interested. Excuse the lack of artistic skill — I’m more of a numbers guy!