A security is an ownership or debt with value and may be bought and sold. Many types of securities can be broadly categorized into equity, debt, and derivatives. A stock is a type of security that gives the holder ownership, or equity, of a publicly-traded company.

But what is a stock? Are there other types of securities? In this post, we’ll address all these questions and more.

Definition of a Security

Let’s start by defining the term security.

The Securities and Exchange Commission (SEC) provides a long paragraph defining the term security, which can be summarized as – ownership or debt that has value and may be sold. A security represents an investment, and the person holding the security does so to make a profit. Most securities can be bought and sold on an exchange or a secondary market.

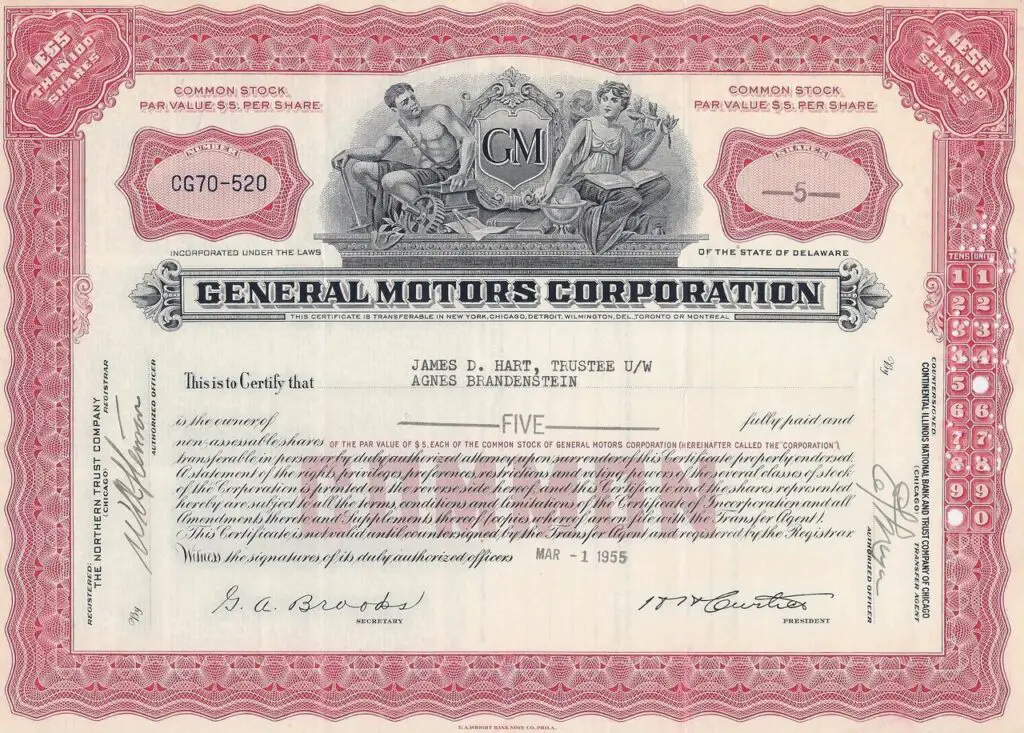

Before investing became almost entirely electronic, the security holder proved ownership through a piece of paper. Now, proof of ownership occurs more commonly through a computer file.

Definition of Stock

A stock is a type of security that gives the holder ownership of a publicly-traded company. At the simplest level, a stock is a way for an investor to profit from a publicly-traded company’s success. Another term you’ll often hear referring to stocks is shares. A share is “the smallest denomination of a company’s stock,” meaning a share is a unit of the company’s stock.

We’ll look at an example to see both of these terms in action and how they function when it comes to investing.

Let’s say you think Company XYZ has high growth potential, and the value of its stock will soon increase, so you purchase shares. You now own a tiny amount of Company XYZ. If you were correct and the stock price rose, you could sell your shares and profit. If you were incorrect and the stock price decreased, you would lose money.

Another important note on owning stock is that when you are a shareholder (you hold shares of a company), you have the right to vote on issues relating to the company. Some of the matters where shareholders may have the opportunity to vote include board of director elections, proposed mergers and acquisitions, whether or not a stock split will occur, and executive compensation.

While stock is a type of security, there are also many other types of securities.

Other Types of Securities

The different securities can be broken down into three types:

- equity

- debt

- derivatives

We’ll take a quick look at each type, including how to define them and what kind of investments are within each category.

Equity Securities

Equity securities are securities that represent ownership in an entity. Stocks fall within this category.

The benefit of equity securities compared to debt securities is that they often have the potential for higher returns than other types of securities. One of the biggest concerns of investing in equity securities is that they come with more risk. This risk is two-fold. First, if the value of the shares drops, the investor can lose money. The second risk arises in the case of bankruptcy. If a company goes bankrupt, shareholders are the last to receive anything.

Debt Securities

A debt security is any security that represents a loan. Debt securities have stipulated terms regarding the loan amount, the interest on the loan, and the maturity date. With debt securities, the investor is loaning the money to an entity, and the issuing entity must pay back the loan with interest. Examples of debt securities include corporate bonds, government bonds, and certificates of deposit (CDs).

All debt securities are either secured or unsecured debt. Secured debt means the loan is backed by collateral, while unsecured loans are not. Unsecured debt typically comes with more risk, but higher interest rates indicate a higher return for investors.

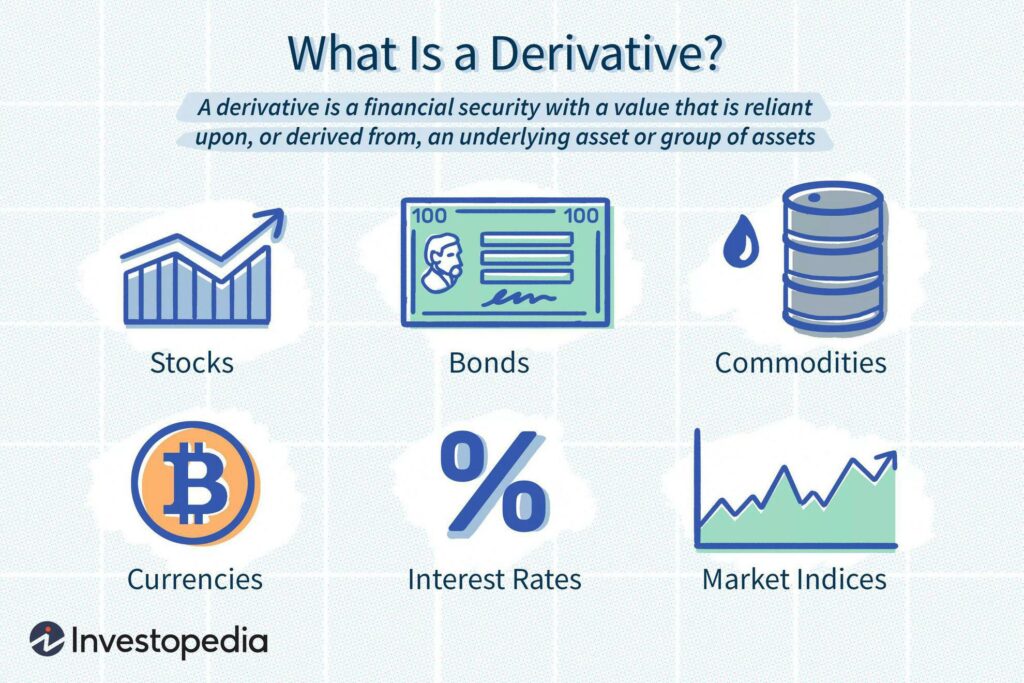

Derivative Securities

The third and final category of securities is derivative securities. A derivative security is any security that consists of an agreement to buy or sell an asset at a specified price by a specified date. The underlying asset may be a commodity, property, or other security. Derivative securities include futures contracts, mortgage-backed securities, swaps, forward contracts, and options.

Investors typically use derivatives as a form of hedging, an investing strategy to help offset financial risk or loss, or for speculation when an investor aims to profit off the variance of prices.

Stocks Vs. Other Types of Securities

If there are so many different types of securities, why are stocks mentioned so much more? And how do stocks differ from all the other types of securities?

One of the reasons you may hear more about stocks is that the stock market is often used as an economic indicator. This means that when the news wants to make claims about the economy’s health, it may do so by referencing the movements of the stock market. Specific categories of stocks can also be used as economic indicators in particular industries or geographic locations. For example, tech stocks can be used as an indicator of the tech industry.

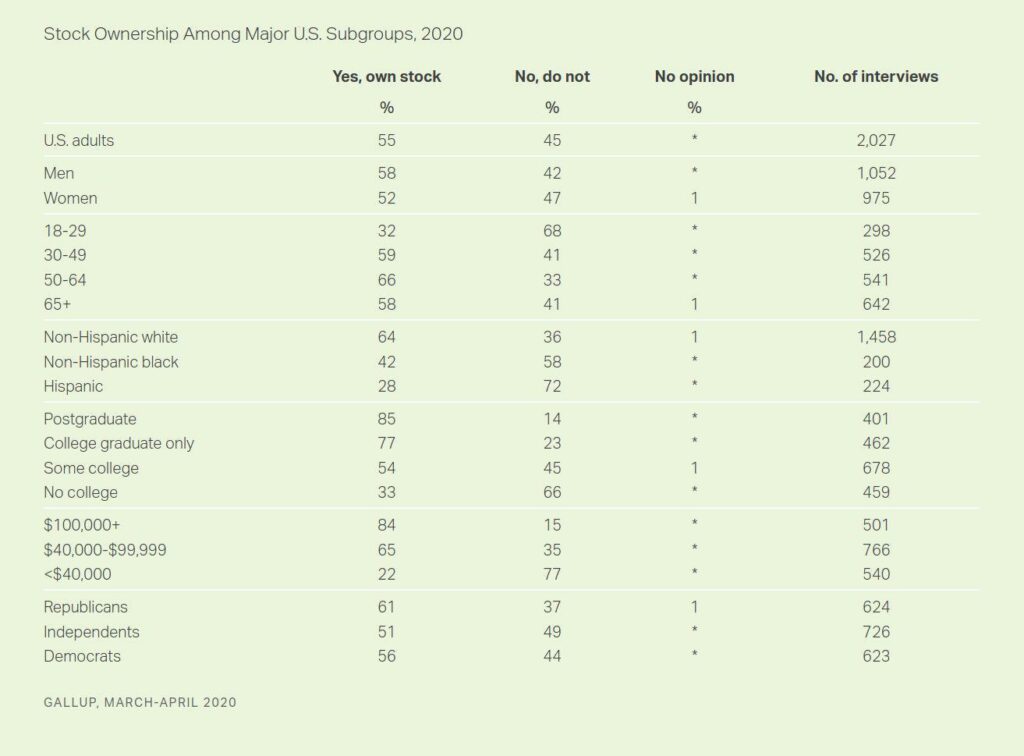

The other reason stocks may come up more than other securities is simply because more people own stocks. According to a Gallup poll conducted in March and April 2020, 55% of Americans say they own stock. This makes news relating to stocks applicable to a more significant number of people, more than half of all Americans, compared to more complex and less well-known security, such as mortgage-backed securities.

Trading Securities

Investors have two main options for trading securities; through exchanges or over-the-counter. Exchanges are typically more liquid and more regulated than over-the-counter trading. While exchanges may be the form of trading more investors are familiar with, in recent years, trading over-the-counter, which is when securities are traded directly between investors, has gained popularity.

The exact place and way securities are traded depends on which type of security is being traded.

For equity securities, stock exchanges are the primary way to trade. These exchanges, especially those in the United States, are highly regulated. The largest stock exchange in the world is the New York Stock Exchange (NYSE). The other largest stock exchanges include the NASDAQ, American Stock Exchange (AMEX), Japan Exchange Group, and Shanghai Stock Exchange.

Debt securities, such as bonds, tend to be traded over-the-counter instead of in a central location such as stock exchanges. This makes it harder for individual investors to invest in bonds. Individuals looking to invest in bonds must typically do so through an asset manager who manages a bond fund.

Finally, derivative securities are traded both through exchanges and over-the-counter. Some of the most popular exchange-traded derivatives include futures and options. Exchanges where you can buy derivatives, include the Chicago Mercantile Exchange (CME), International Securities Exchange (ISE), and the London International Financial Futures and Options Exchange (LIFFE).

Issuing Securities

One of the final questions we’ll answer in this post is why entities issue securities. From an investor standpoint, securities offer a way to make money, but how do issuing entities benefit? Securities provide the issuing entity with a way to raise capital.

For equity, this capital is raised when investors pay the company to purchase shares of that company. This occurs through an Initial Public Offering (IPO), which can be highly lucrative for companies. The largest-ever IPO occurred in 2019 when Saudi Aramco premiered with a $2 trillion IPO. Debt securities are relatively similar in that they also allow the issuing entity to raise capital without going to a bank for a loan.

Derivative securities function a bit differently. Derivatives are agreements between investors and therefore do not have an issuing entity like equity and debt securities. At their simplest, derivatives can be thought of as bets between investors. As previously mentioned, these exist as hedging tools and as a form of speculation for traders.

The Bottom Line

Finance is a complicated field, partly because of the many different terms investors must know. While differences in terminology may appear minor, making informed investment decisions can be incredibly difficult if you’re unclear about the language being used.