Commodities are physical resources and foods that come from the Earth. Stocks represent a claim on the future cash flows of specific companies. Both can be bought and sold as investments, but each has unique trading aspects and forces that drive their prices.

In this post, we will discuss what commodities are, how they differ from stocks, and how you can potentially profit from this asset class.

What Are Commodities?

Commodities are a broad group of raw materials used as production inputs. Literally and figuratively, they are the fuel that drives economic activity. Stocks are not tangible items that we can touch with our hands but financial products. They are shares of companies that often rely on commodities like oil. Speaking of oil, let’s drill in and explore the differences between these two unique markets.

Classifying Commodities

Commodities are sub-classified as hard commodities or soft commodities.

- Hard commodities are natural resources that are mined or otherwise extracted from the Earth.

They can be further categorized as energy and metals:

- Energy: Crude Oil, Natural Gas, Gasoline, Ethanol, Coal, Electricity, Propane

- Metals: Gold, Silver, Copper, Platinum, Aluminum, Steel, Uranium

Soft commodities are typically grown or raised on farms.

They are categorized as livestock or agricultural goods:

- Livestock: Live Cattle, Lean Hogs, Feeder Cattle

- Agricultural Goods: Corn, Wheat, Rice, Soybean, Oats, Milk, Cheese, Butter, Lumber, Coffee, Sugar, Cotton

All these commodities and others are investment options. Yes, aside from buying that gallon of Tropicana, you can even invest in orange juice!

Stocks are categorized in many ways, including geography, company size, and economic sector.

What Drives Commodity Prices?

Commodity prices are affected by the health of the global economy. The economy’s business activity level increases the demand for raw materials. A healthy economic environment supports commodity prices, while a weak economy is often associated with low commodity prices.

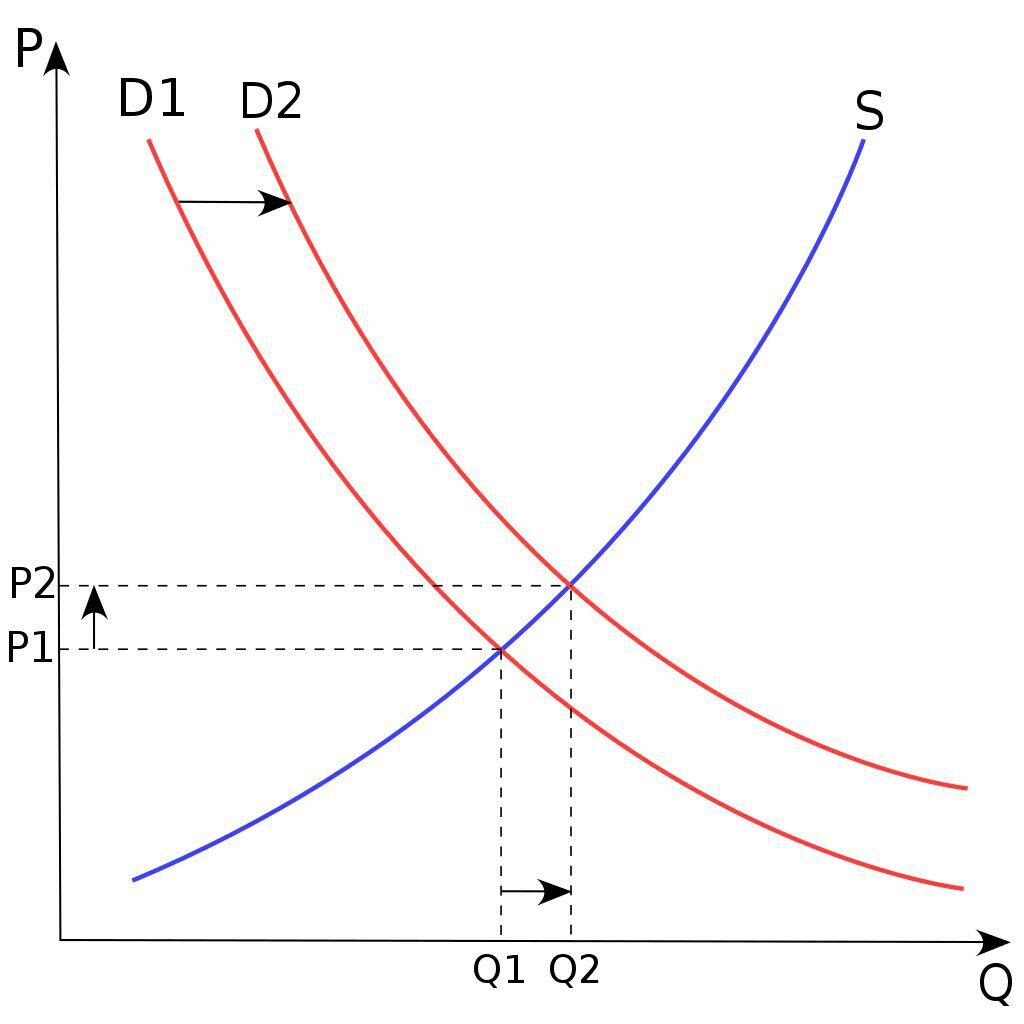

This relates to that good old ‘law of supply and demand’ lesson we learned in economics class. If you hit the snooze button in that one, the price of any asset is determined by the supply-demand relationship. Robust demand or low supply can drive up a commodity’s price. Soft demand or oversupply of an item reduces its price.

This can be seen below where price increases when demand goes up or supply shifts down.

Developing countries like China, Brazil, and India need to invest in commodities like steel, oil, and cotton for manufacturing and infrastructure. They also need to purchase large amounts of food-related commodities to support the appetite of their burgeoning middle classes. This aggregate demand is a crucial determinant of commodity prices. Similarly, higher demand for a company’s stock pushes up the stock’s price.

Natural disasters can significantly impact commodity prices. Hurricanes, floods, and other catastrophic events can wipe out large portions of commodity supply. With lower supply and demand held constant, prices go up. Conversely, an unexpectedly large yield can lead to oversupply conditions and lower prices.

The value of the US dollar also drives commodity performance. Most commodities are denominated in dollars, as dollars are the pricing benchmark due to being the world’s reserve currency. A strong dollar raises the price of a dollar-denominated commodity for those holding nondollar currencies. This may negatively weigh on commodity demand. Typically, there is an inverse relationship between the strength of the dollar and the price of a commodity.

Different Markets, Different Exchanges

Ok, so we know why commodity prices change, but how does this translate to an investment? Enter the wise commodities trader.

There are significant differences in how stocks and commodities trade in the capital markets. Commodities trade as futures. This may sound rather space age, but the term futures refers to a standardized contract to buy or sell an asset at a pre-determined price in the investment world.

Futures are aptly named because the agreement stipulates that the transaction occurs at a specific date in the future. Futures contracts exist for both stocks and commodities but are the most popular mechanism of commodity trading.

When trading commodities in the US, you’re likely to be using the CME Group, but there are many futures exchanges globally.

Stocks trade on various stock exchanges, such as the New York Stock Exchange (NYSE). There isn’t that same element of time with stocks as we see in the commodities market. When we buy or sell a stock, we agree to do so on that day. The trade is executed, and the deal is done. We can choose our investment time horizon. Unless we’re talking options, we don’t have a specific date circled on our calendar that will determine our profitability fate.

From Wall Street to the Dinner Table

Farmers and companies involved in agricultural production often engage in commodity futures trading. Since items like corn and coffee beans take time to grow, there is uncertainty about how much value they will fetch come harvest time. We know that a commodities future contract stipulates that the parties must execute the transaction at a specified price and date. Therefore, an agriculture company will often pay a small premium to enter a futures contract so they can sell their yield at a known price.

For example, a corn farmer may enter an eight-month contract to sell 5,000 bushels of corn for $3.46 per bushel. As the commodity futures seller, the farmer would forego any potential increases in the price of corn over the next eight months but gain the peace of mind that a fair, known price has been locked in.

Conversely, the commodity futures buyer takes on the downside risk in hopes of a profit in the future. It is important to note that today’s commodity futures contracts are typically settled in cash. So don’t worry; you won’t see a delivery truck full of soybeans roll down your street.

Also, few investors buy-and-hold commodities as they do with stocks. Traders want to take advantage of perceived mispricing in a commodity, and businesses wish to hedge their exposure to a commodity price.

On the other hand, stocks are both traded and held for the long term. Like commodity traders, stock traders attempt to profit from price dislocations. Stock investors, however, often buy-and-hold shares of a company for both price appreciation and dividend income.

One of the attractions of investing in commodities is that the asset class tends to have a low to negative correlation with the stock market. Higher commodity prices mean higher costs for many manufacturers leading to lower profits and share prices, with non-manufacturing companies being less impacted.

Because commodity prices are primarily uncorrelated with stock performance, commodities can be considered a way to diversify a traditional stock-bond portfolio.

There are indeed times when stocks and commodities move together. When central banks intervene to stimulate a weakened economy, they often choose to lower interest rates. This boosts stocks because companies can borrow money at a lower rate and operate at lower costs. Low-interest rates also help commodity producers because raw materials can be extracted or harvested at lower expenses.

In times of great economic stress, everything moves together in the opposite direction as traders reduce leverage and lower economic expectations.

Ways to Invest in Stocks and Commodities

So maybe you’re thinking, investing in commodities sounds interesting, but I don’t know or want to trade futures. Are there other ways to invest in commodities?

The answer is yes. ETFs may be easier to gain commodity exposure for the less experienced investor. There are exchange-traded funds (ETFs) that are designed to track the performance of a broad commodity index.

The iShares S&P GSCI Commodity-Indexed Trust (GSG) is one such option. It provides exposure to energy, agriculture, and industrial metal prices by investing in futures contracts.

There are also more specialized ETFs and mutual funds that aim to replicate the performance of a commodity. The United States Brent Oil Fund (BNO) tracks the daily movement of Brent crude oil spot prices. The Invesco DB Agriculture Fund (DBA) focuses on commodities like coffee, corn, live cattle, sugar, and wheat.

Another approach is investing in companies directly impacted by commodity prices, either because of the products they sell or their use of commodities as production inputs. Energy companies like Exxon Mobil and Chevron generally ebb and flow with oil prices because that is their primary revenue source. Thinking a bit outside the (cereal) box, a company like General Mills is directly affected by the price of corn because it is an ingredient in many of its breakfast products. If we thought corn prices were heading lower, we could potentially invest in this stock as an example.

The CTA Way

Another avenue for commodities exposure is through a commodity trading advisor (CTA). A CTA is a registered professional or firm that offers personalized guidance on trading commodity futures, options, and foreign exchange contracts. Regulated by the National Futures Association, these companies buy and sell various commodities, most commonly using a momentum trading strategy. This strategy is designed to capitalize on market trends by going long (buying) when a commodity is going up and selling or going short when there is downward momentum.

We can connect with a CTA like we can engage a financial advisor. The CTA acts in the same advisory capacity, just with a specialization in commodities. Since commodities investing uses leverage to enhance returns, particular expertise is required to execute profitable trades and avoid significant losses.

Novice investors interested in commodities should consider researching and contacting a CTA firm. These companies establish a hedge fund, or CTA fund, that invests in different commodities futures contracts and profits from long and short trades. They often use a combination of fundamental analysis and systematic trading techniques to uncover money-making opportunities in a wide array of commodities. They may also invest in stock index futures, government bond futures, and foreign exchange futures.

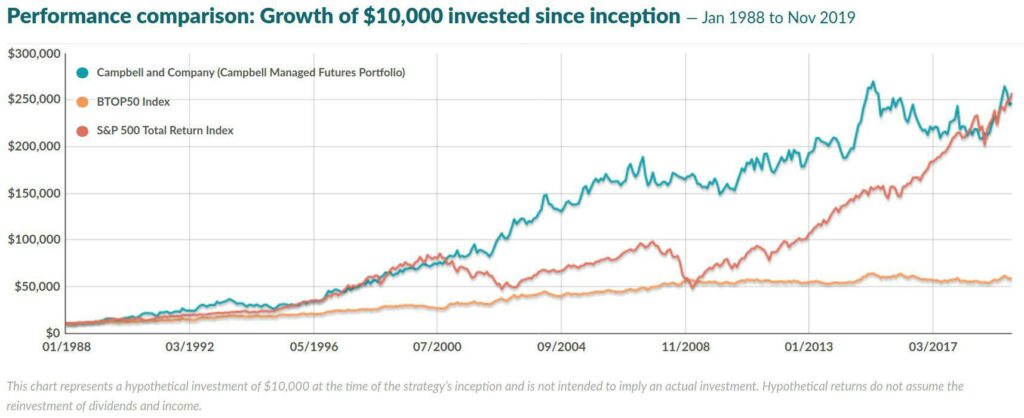

So, how have these CTA funds performed? There can be a wide range of returns like stock funds, but managed futures have fared relatively well over the long haul as a group. For example, since 1988, one of the most significant managed futures funds run by Campbell & Company has produced an annualized return of 10.6% through November 2019.

An essential aspect of investing in a CTA fund is that the asset class’s returns are primarily uncorrelated with stock and bond market returns. The Campbell & Company fund correlation with the S&P 500 stock index was almost zero from January 1988 to November 2019. This makes it an excellent way to diversify and reduce volatility in your portfolio.

The Bottom Line

Stocks and commodities have market prices and can be traded speculatively or as long-term investments. Stocks are financial instruments, while commodities are raw materials.

Producers and consumers commonly use commodity futures in several industries to hedge their commodity price exposure. Still, they can also be traded by retail and institutional investors that form an opinion on the future direction of a commodity’s price.

CTA funds are an excellent way for investors to get exposure to managed commodities futures. These funds are managed by commodity trading professionals who use advanced proprietary trading systems. The performance can be pretty good and uncorrelated with traditional asset class returns. Investors seeking diversification can benefit from investing in CTA programs.