Survivorship bias is the risk of analyzing investment performance using only “surviving” constituents of a selected investment universe instead of incorporating all current and historical constituents over the performance period.

Survivorship bias artificially increases long performance and detracts from short-selling results. It is a logical error that is a form of selection bias that is sometimes called survival bias.

Survivorship Bias in Benchmarks

Foot Locker was removed from the S&P500 index on August 9th, 2019. Its price went down by roughly -30% over the last five years, whereas the S&P500 went up by 51%.

If the S&P 500 is your benchmark and you do not have Foot Locker in your dataset, your trading strategy has zero chance of selecting Foot Locker as an investment. Foot Locker’s negative performance would be captured in the S&P 500 benchmark but missing from potential selection in your strategy. This logical error will likely lead you to believe your stock trading strategy is better than it is and could cost you money.

Survivorship Bias in Fund Performance

Survivorship bias risk can also occur when published investment return data is deceivingly high because underperforming funds are not disclosed. Funds close for various reasons such as restructuring, mergers, acquisitions, or poor financial performance. Consider the below listing of fund performance.

| Fund | Status | Historical Return |

|---|---|---|

| A | Active | 20% |

| B | Active | 10% |

| C | Closed | -10% |

| D | Closed | -20% |

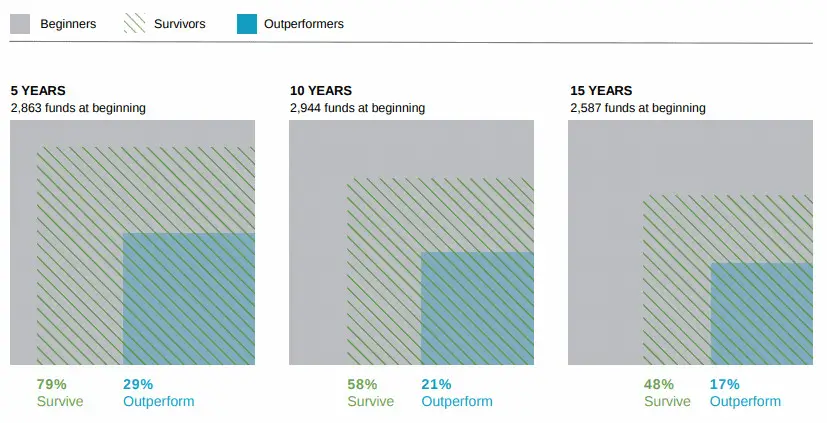

If we only incorporate the active funds in accessing returns, it appears as though the average return is 15%. If we consider active and closed funds, the average return drops to 0%! Even though this is an example, it’s not far from the truth. A study performed by Commerce Financial Planning shows that after 15 years, only 48% of funds survived, and 17% beat their benchmark. If we don’t include closed funds in the performance metrics shown in grey, we would mistakenly believe that over 35% outperformed their benchmark. This has disastrous implications for fund investors.

Survivorship Bias in Industry Data

Survivorship bias can occur when studies on industry profitability and other metrics fail to include financial information about acquired or bankrupt companies. Financial analysts mistakenly let survivorship bias into their calculations. Another typical example is using a price-to-earnings multiple to determine how relatively expensive or inexpensive the market is, using the S&P 500 as a proxy. Often, money-losing companies are omitted from the benchmark’s average P/E ratio.

Protect Yourself Against Survivorship Bias

It’s essential to consider if survivorship bias has crept into your data.

If you’re developing an investment or trading strategy, obtaining survivorship bias-free data is critical. It’s so important that I have dedicated an entire article on how to get a survivorship bias-free S&P500 dataset.

If you’re an investor, consider if you should invest directly or hire an investment professional. And if you decide to hire an investment professional, make sure to review the manager’s historical marketing material for undisclosed funds.