Interested in improving your trading with the right journal? A trading journal is essential for traders to refine skills and see better results. I’ve explored various journals over the years, and in this article, I’ll guide you through the various types of trading journals and their advantages and drawbacks. Discover the best formats, features, and how to use them effectively.

By the end, you’ll know which journal aligns with your trading style and goals. After using a journal, I noticed a marked boost in my performance and discipline, a sentiment echoed by many top traders.

Read on to find the ideal trading journal for you, or if you’re just starting out, check out what is a trading journal.

Why Do You Need A Trading Journal?

There are plenty of ways a trading journal can help you.

- Learning from Mistakes: Have you ever heard the saying “you learn more from failure than success”? The same goes for trading, too! By documenting unsuccessful trades along with successful ones – guess what?! You’ve got yourself some valuable lessons right there.

- Spotting Patterns: Over time, as you fill up those pages (or spreadsheets), patterns will start appearing– both good and bad- which can help improve future decisions.

- Keeps Emotions Under Check: Hard data helps prevent emotional responses during turbulent market conditions by focusing on facts rather than feelings.

- Performance Tracking: Just like tracking calories can help you lose weight or gain muscle mass depending on your fitness goals, tracking every detail about each trade enables traders to measure their growth trajectory easily.

So let me ask again: Why wouldn’t anyone want such a fantastic tool?

From my experience using trading journals, I realized that having solid evidence about my past performances helped me manage my risk better and stick to my trading plan. I knew that my strategies were based on data and analysis, not on emotions or guesses.

But a question arises: Given the various types and characteristics of trading journals, which type should you choose? I will provide an answer to this question in the upcoming sections.

Types of Trading Journals

There are multiple types of trading journals based on different criteria, such as:

- Medium: What platform does the journal use? Is it digital (like an online tool) or physical (such as paper notebooks)?

- Format: This refers to how the journal is structured or laid out – whether it follows a grid-based layout, uses bullet points or checklists, etc.

- Features & Functionality: Some journals have additional features like analytics tools, charting capabilities, and automatic trade import, which help traders analyze their strategies better.

Drawing from my trading experience, I can attest that the choice of a journal primarily hinges on its medium, as the format, features, and functionalities vary based on the journal’s medium. In the following section, I will provide a detailed explanation of the different types of trading journals.

Paper Trading Journals

Consider a paper trading journal as your financial diary. It’s an old-school but effective method of recording all your trades, strategies, and outcomes in one place – on good old pen and paper!

Here’s how it works: Each time you execute a trade or develop a new strategy, jot down important details such as the date, asset type (stocks, forex, etc.), entry price, exit price, or any notable market conditions. Over time, this information can provide valuable insights into what’s working for you and, perhaps more importantly – what isn’t.

Pros and Cons of Paper Trading Journals

Let’s dive deeper to understand some pros and cons of paper trading journals.

Paper Trading Journal Pros:

- Simplicity: The beauty lies in its simplicity; no fancy algorithms required here!

- Accessibility: Your journal is always with you without needing online connectivity— at home or on the go.

- Privacy: Unlike online platforms where data privacy may be questionable, with a physical notebook, there are no prying eyes peeping into your precious investment secrets.

- Customization: You’re free to design the layout that suits you best! Consider it like bullet-journaling but for traders!

But every rose has its thorns!

Paper Trading Journal Cons:

- Manual Entry: All transactions must be written by hand, which could get tedious if dealing with multiple investments daily.

- Lack of Automation: While simplicity is beautiful, so too is efficiency; unfortunately, manual journals lack automatic calculations/analysis provided by digital tools.

An Example of A Paper Trading Journal

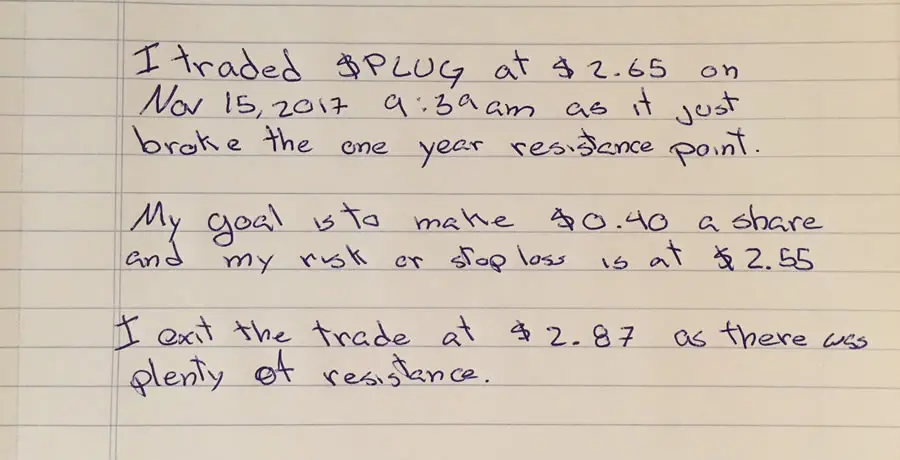

A paper trading journal entry can be as simple as a few lines of text or a handcrafted table. For instance, the following screenshot from Tradersync illustrates an example of a paper trading journal entry.

Image Source: Tradersync

A paper trading journal entry may consist of a handcrafted table with columns for Date, Stock Symbol, Buy/Sell indicators, Price per share sold/bought, and Profit/Loss. You can also include notes explaining the rationale behind the trade, such as why Jack bought Beanstalk shares. Perhaps he had dreams of golden eggs?

In summary, while paper trading journals are the simplest way to document your trading activities, they may not be the most efficient. This brings us to our next type of trading journal, spreadsheet trading journals.

Spreadsheet Trading Journals

Unlike paper trading journals, you maintain spreadsheet trading Journals via spreadsheet software programs, such as Microsoft Excel, Google Sheets, etc. They offer an organized way to track all your trades, performance metrics, strategies, and emotions involved in trading. It’s like a digital ledger where you actively record details such as entry point, exit point, and number of shares bought or sold – essentially, everything about each trade.

They’re flexible and free, which is why I created a guide on creating a trading journal using Google Sheets.

Pros and Cons of Spreadsheet Trading Journals

While spreadsheet trading journals offer more features than simple paper trading journals, they have pros and cons.

Spreadsheet Journal Pros:

- Flexibility: Customize columns based on what matters most to you.

- Analysis Powerhouse: Detailed tracking means insightful analysis—spot trends faster!

- Cost-Efficient: No need for expensive subscriptions; basic Excel skills will do just fine!

Spreadsheet Journal Cons:

- Manual Entry Required (sometimes): Most spreadsheets do not automatically connect to brokerage accounts.

- Backup Needed Often: Without regular backups, you risk losing valuable data.

- Extra Effort needed: Requires commitment to updating after every trade consistently.

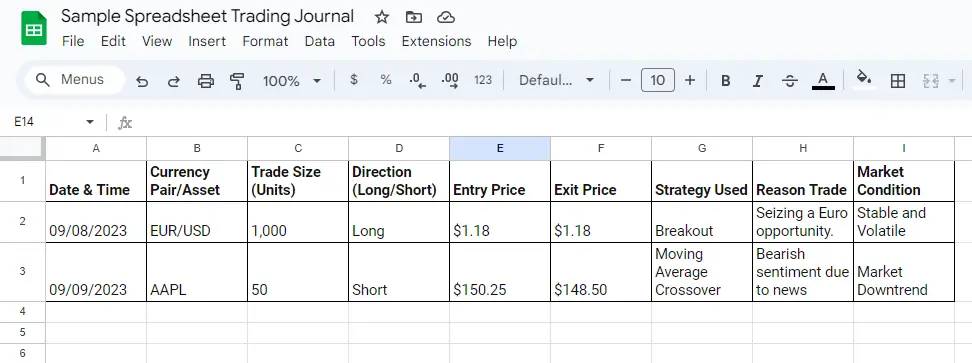

Example of a Spreadsheet Trading Journal

The following screenshot shows a spreadsheet trading journal template. You can see entries such as stock symbol, direction, entry price, exit price, reason for trade, market condition, etc.

It is evident that while spreadsheet trading journals require very little data entry knowledge, they need a lot of manual and tedious work.

For those hungry for more powerful trading tools than spreadsheets can offer, all while keeping your trading journal right on your local machine, journaling software emerges as the perfect choice.

Journaling Software

A journaling software is a trading journal that usually runs from your local machine and can work as a stand-alone application. Journaling software may connect to various online services for additional functionality.

Pros and Cons of Journaling Software

Journaling software offers the following advantages.

Journaling Software Pros:

- Local storage: Unlike cloud-based journals, which require internet connectivity all the time, these applications periodically store everything locally – so no worries about data connectivity, at least for previously stored data.

- Security: Since the data is stored locally, you don’t have to worry about security breaches.

Journaling Software Cons:

- Requires download: Since they’re not browser-based tools, you’ll need some disk space.

- Limited access: You cannot access them everywhere, unlike their Cloud counterparts

Examples of Journaling Software

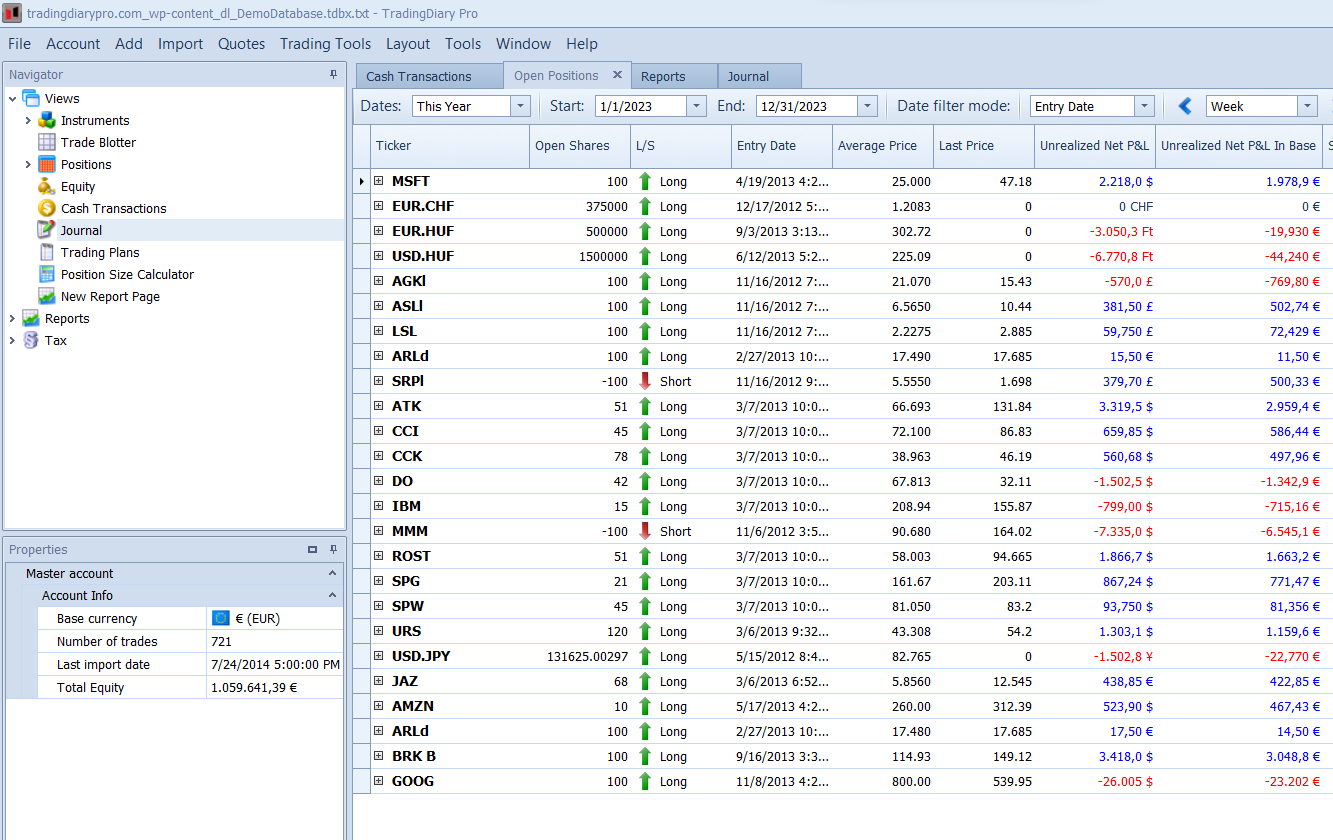

One popular example is TradingDiary Pro, a desktop platform you can install on a computer. With TradingDiary Pro, traders can keep a detailed account of all their good and bad trades. The software helps traders review their mistakes and successes, monitor their decision-making patterns, and control their emotions. You can access all these features from the desktop application.

Chartlog, Trademetria, and Stonk Journal are other examples of journaling software you can download and install locally on your computer.

While journaling software can be valuable, especially for individual traders, some journaling software may not be as efficient regarding team collaboration and integrating data from online sources. Online trading journals offer a solution to this challenge.

Online Trading Journals

Online trading journals are web-based and app platforms that operate in cloud environments. They offer distinct advantages over traditional journaling software due to their cloud-based nature, allowing accessibility from anywhere via a simple browser or a mobile app, and their ability to create data backups.

Features of these modern marvels include trade tracking over multiple markets (forex, stocks), automated input integration, detailed analytics, and even collaborative features where you can share strategies with other traders.

Pros and Cons of Online Trading Journals

Online Trading Journal Pros:

1. Convenience: No more manually scribbling down entries or formulas; everything is automatically recorded.

2. Integration: Sync your broker account directly for real-time updates.

3. Collaboration: Share ideas & learn from fellow traders across borders!

4. Accessibility: Accessible anywhere as long as there’s internet connectivity.

Online Trading Journal Cons:

Something this fantastic must have some drawbacks, too.

1. Security risks: Any potential data breach could compromise sensitive information for web-based online trading journals.

2 . Dependence on Internet Connectivity: If Wi-Fi goes out, so does access to essential data

Let’s explore two common types of online trading journals: those accessible through mobile apps and those accessible via web browsers. It’s important to note that some trading journals provide access through both mediums.

Web-based Trading Journals

While desktop software typically offers more robust features (think complex chart analysis), they’re restricted by hardware compatibility – sorry Mac users! Mobile apps provide convenience but lack in-depth functionality due to limited screen size. However, web-based platforms have found their sweet spot between these extremes.

Web-based trading journals are a subtype of online trading journals that run on browsers like Google Chrome or Safari without needing an individual software installation or mobile app download.

Following are some of the reasons you will love web-based trading journals.

- Integration: With API integration capabilities, you can connect directly with most brokerages for real-time data.

- Collaboration: Share insights easily with fellow traders through cloud storage.

- Accessibility: Use it anywhere there’s an Internet connection!

Of course, nothing is perfect.

- Connectivity Requirements: These applications typically require a stable internet connection for access. Offline use is limited.

- Premium Subscription Fees: While some options are free, premium services may come with recurring subscription fees.

While many web-based online trading journals are available online, each with its own set of features, I recommend using TradeZilla and Tradervue.

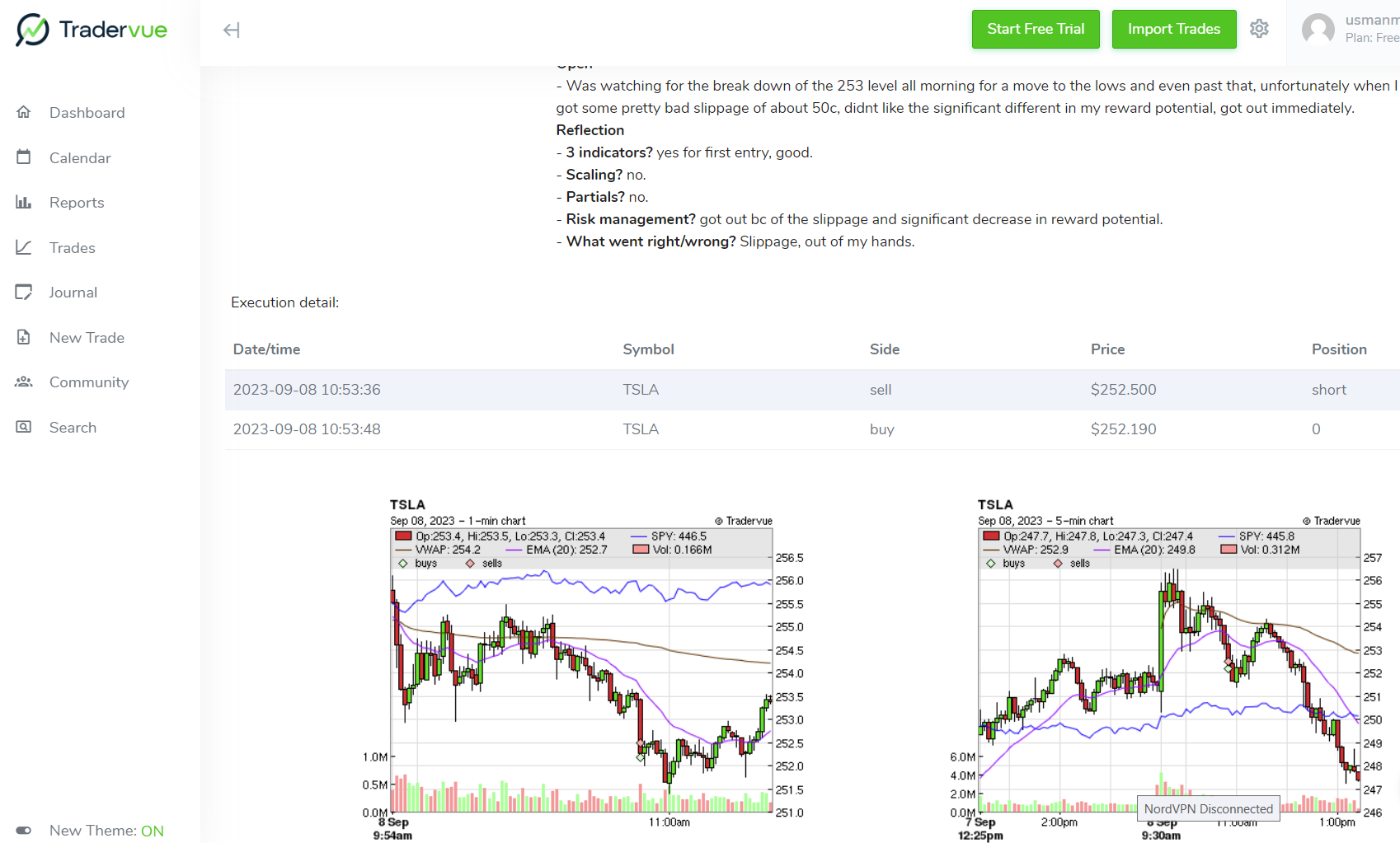

Tradervue offers a range of features, including journaling, performance analysis, broker importing support, and access to a trading community. SMB traders favor it for its simplicity, speed, and robust capabilities in supporting stocks, futures, and forex trading.

Tradervue Dashboard

Mobile Apps

Like its web or desktop counterparts, a mobile app-based trading journal is a digital tool designed for traders to record their transactions. But here’s the kicker – it lives right inside your smartphone! With just one tap, you can access various features ranging from tracking trades live, analyzing past performances with intricate statistics tools, syncing data across devices, setting reminders, and so much more.

Not everything about these apps is rosy, though. Let’s balance this equation by dissecting some pros and cons:

Mobile Trading Journal App Pros:

- Mobility: Trade anywhere at any time – even while sipping mojitos poolside.

- Convenience: Everything in one place; no juggling multiple platforms anymore!

- Data Syncing: Switch between devices without losing any progress.

- Mobile Reminders & Alerts: Never miss out on significant market movements.

Mobile Trading Journal App Cons:

- Functionality Limitations: Some complex tasks might require larger screens or advanced software unavailable on phones.

- Security Concerns: Vulnerable if not adequately protected against malware attacks.

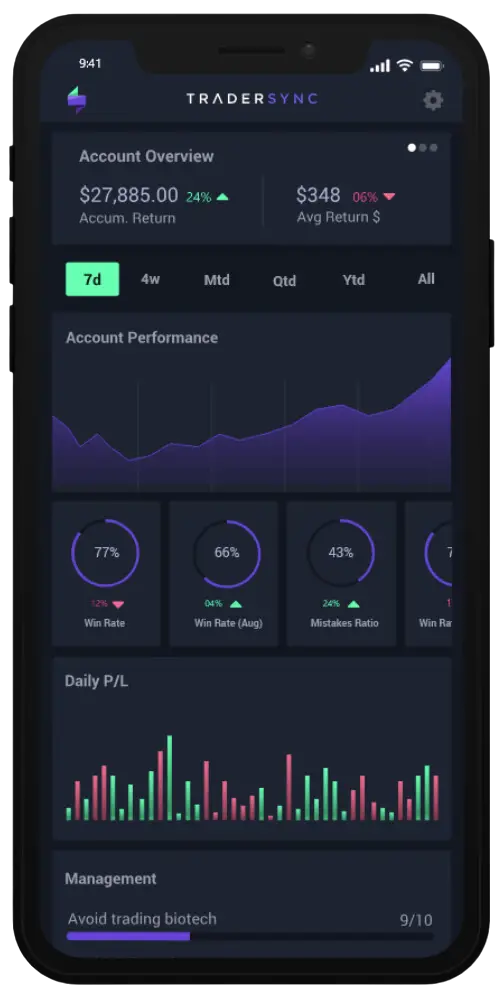

Many online trading journals, such as Tradersync, Kinfo, and TradesViz, provide mobile apps for convenient platform access.

Tradersync Mobile App (Source: Tradersync)

So what’s the best type of trading journal? Each type comes bearing its pros-and-cons gift basket. You need to dig deep into personal needs—convenience vs. complexity, cost-effectiveness vs. depth—to ensure that the chosen tool fits snugly around the desired goal.

In the upcoming section, we’ll explore exactly how you can choose the best type of trading journal suited ideally for YOU. Remember, folks—it’s not about finding ‘the best,’ but discovering YOUR best.

How to Choose the Best Type of Trading Journal for You

Choosing the best type of trading journal for your needs depends on various factors, such as your budget, preferences, goals, trading style, and experience level. You can use the following table to compare and contrast different types of trading journals based on various criteria.

| Type | Cost | Ease of use | Features | Functionality |

|---|---|---|---|---|

| Paper | Low | High | Low | Low |

| Spreadsheet | Low-Medium | Medium-High | Medium | Medium-High |

| Software | Medium-High | Medium-Low | High | High |

| Online | Medium-High | High | High | High |

Some guidelines and tips on how to choose the best type of trading journal for your trading style and objectives are:

- Budget: Opt for paper or spreadsheet journals if on a tight budget, as they’re more cost-effective. However, consider the trade-off in features compared to software or online options.

- Preferences: Choose paper journals for a traditional, personal touch, or go for software/online journals for automated tracking, real-time data, and analysis.

- Goals: To enhance trading performance and learn from mistakes, opt for software or online journals offering tools, indicators, and effective progress tracking. Paper or spreadsheet journals may not provide these features as effectively.

- Features: For more comprehensive features like charts, graphs, statistics, and reports, select software or online journals that offer deeper insights into your trading behavior. Paper or spreadsheet journals have limited functionality in comparison.

- Functionality: If you need flexibility across devices and platforms, go for an online journal accessible from anywhere with an internet connection. Software may require device-specific installation and updates, while paper/spreadsheet journals lack compatibility with all devices and platforms.

Overall, I recommend using online trading journals in almost all scenarios. They provide advanced features, support team collaboration, and seamless online integration, which are increasingly essential in today’s trading landscape. However, if you prefer a more straightforward approach, paper and spreadsheet trading journals are reliable options.

Conclusion

So, what have we uncovered? We journeyed through the diverse world of trading journals, spotlighting four primary types: paper, spreadsheet, journaling software, and online platforms. Each offers unique strengths and challenges, all detailed in a user-friendly table for your reference. As you weigh factors like cost, functionality, and security, it’s essential to align with your personal trading style and objectives.

Ready to dive deeper? Evaluate your needs and explore our best trading journals reviewed page for more insights. And as you embark on this journey, remember the wise words from “The Richest Man In Babylon”: “A part of all I earn is mine to keep.” You’re one step closer to safeguarding that hard-earned money with the right trading journal.

Frequently Asked Questions

What is the difference between an academic journal and trading journal?

An academic journal is a periodical publication that publishes scholarly research on a specific academic discipline. A trading journal records a trader’s activities, strategies, and performance in the financial markets.

How do I make my own trading journal?

You can make your trading journal using any of the journal types discussed in this article, i.e., paper trading journals, spreadsheet trading journals, journaling software, or online trading journals.

Does TradingView have a trading journal?

TradingView does not have a dedicated trading journal feature.

What are some disadvantages of trading journals?

Disadvantages of trading journals include time-consuming upkeep, organizational challenges, and occasional bias or inaccuracy.