If you’re looking to understand what swing trading is, this guide is for you. With over a decade analyzing charts and backtesting trading strategies, I’ll explain swing trading in simple terms. You’ll leave grasping the definition, key principles, pros/cons, and whether it could improve your portfolio. Buckle up as we define swing trading, break down core concepts, and provide actionable tips.

Key Takeaways

- Swing trading aims to profit from short-term price swings lasting 1-4 weeks.

- Technical analysis identifies advantageous entry and exit points for trades.

- Strict risk management through proper sizing and stops is mandatory.

- Strategies include breakouts, pullbacks, reversals, and anticipation.

- Patience is critical as ideal setups emerge infrequently.

What Is Swing Trading?

Swing trading is a style of trading that seeks to profit from short to medium-term price swings, typically over a timeframe of 1-4 weeks. The goal is to maximize profits by capitalizing on temporary price movements while minimizing losses through risk management strategies.

Swing trading has been practiced for centuries, with early accounts tracing back to feudal Japan. Well-known swing traders include Jesse Livermore in the early 1900s and Nicolas Darvas in the 1950s, who capitalized on short-term market swings to build their fortunes.

Swing trading aims to take advantage of price momentum while avoiding the quick in-and-out of day trading and the longer time horizons of position trading.

Swing traders identify trading opportunities through technical analysis of price charts and volume indicators. They enter long positions to ride an uptrend or short positions to capitalize on a downtrend.

The holding period for swing trades typically ranges from a few days to a couple weeks. Swing traders close out positions when the price swing runs its course or their profit target is hit, allowing them to compound gains as capital is freed up faster than longer-term trading.

Swing Trading Strategies

Swing traders aim to profit from short-term price momentum using strategies like anticipation, breakouts, pullbacks, and reversals.

Anticipation

Anticipation traders seize range expansion after contraction. If a stock’s average daily range is 5% but it contracts to 1%, it provides a low-risk entry, assuming a stop below the low of the day.

Breakouts

Breakout traders buy when the price breaches a previous swing high or breaks a range, using tools like downtrend lines.

We’ll cover a breakout example for Tesla in the next section.

Pullbacks

Pullback traders buy dips to key moving averages like the 50-day, support areas, or oversold readings, assuming a swing low.

Entering pullbacks allows joining upside momentum with potentially decreased risk compared to chasing breakouts.

Swing Trading Breakout Example

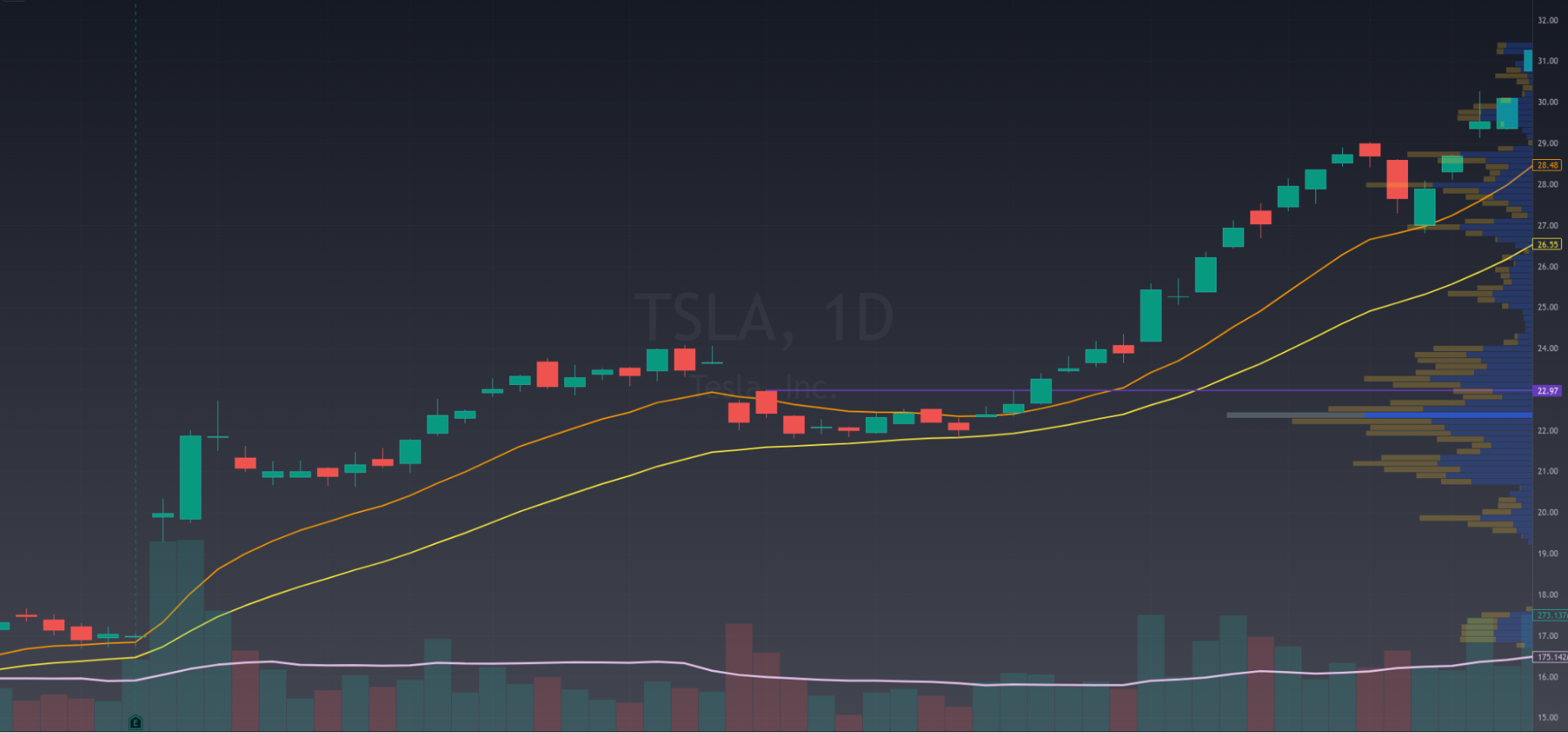

Tesla was charging up for an epic swing trade in late 2019. After reporting blowout Q3 earnings in October, the stock rocketed over 30% higher in three days holding its price earnings gap.

Tesla continued its upward push for three weeks and then started to consolidate, trading tightly between $21-$23 for a fortnight. On Tuesday, December 10th, Tesla staged a high-probability breakout.

The stock surged through the recent range high at $22.97 and cleared psychological resistance at $23. This was the green light to jump in.

You could have entered on the break of the opening range high or $23 psychological, and set your stop under the daily low at $22.62. Just two days later, with Tesla extending its advance, you’d lock in gains by trailing your stop to breakeven.

Over the next several weeks, TSLA continued its meteoric rise all the way up to $64.60. Your breakeven stop would’ve given you a free ride on this parabolic move.

With risk of only around 40 cents per share initially, this trade could have earned you over $41 – a staggering 100x return.

Seize breakout swings like this, with disciplined stops and prudent position sizing, and your account will surge. Tesla shows the incredible power of executing high-probability setups.

Swing Trading Advantages and Limitations

Swing trading offers unique benefits but also has inherent drawbacks to consider. Understanding both allows informed decisions about when it’s the optimal strategy.

Swing Trading Advantages

- Faster compounding than long-term investing with higher trade turnover

- Avoids extended drawdowns from long-term positions

- More flexible than day trading, with trades lasting days not minutes

- Swing trading excels when you want to grow an account more rapidly than classic buy-and-hold investing while assuming less risk.

Swing Trading Limitations and Pitfalls

- Requires extensive screen time and availability

- More emotionally intense than long-term investing

- Risk of overtrading and excessive transaction costs

- Hard to automate or systematize swing selections

- Swing trading can falter during extended trends when giving back open profits is painful.

- Overtrading and lack of a structured process are common pitfalls.

- Requires patience and discipline – prime swing setups may emerge infrequently

Swing Trading Best Practices

Though swing trading tactics vary, certain best practices apply universally:

- Focus on setups with a demonstrable edge

- Employ prudent position sizing to limit risk

- Use disciplined stop losses to exit losing trades quickly

- Limit position size and trade frequency to avoid overtrading

- Align your timeframes and trade in the direction of market momentum

- Remain patient for quality setups

- Adopt optimized routines for your lifestyle

Alternatives to Swing Trading

Swing trading occupies the middle ground between day trading and position trading. Consider which approach best aligns with your personality and temperament.

| Day Trading | Swing Trading | PositionTrading | |

|---|---|---|---|

| Holding Period | Intraday | 1-4 weeks | Weeks to months |

| Number of Trades | High | Moderate | Low |

| Screen Time Needed | High | Moderate | Low |

| Risk Tolerance | Low | Moderate | High |

| Personality | Impatient, high-energy | Patient, analytical | Disciplined, thick-skinned |

| Drawdowns | Avoid extended losses | Withstand some losses | Endure losses |

| Trading Style | Opportunistic, react to volatility | Methodical, match market conditions | Fundamentals-based, long-term view |

| Transaction Costs | High from frequent trades | Moderate | Low from infrequent trades |

| Key Risk | Overtrading | Impatience | Not sticking to trading plan |

Day Trading

Day trading involves holding trades for hours or less. Trades are opened and closed within a single session.

Day traders can always find trades but battle near stop levels daily. Their short timeframes demand intense focus and quick reactions. Day trading suits impatient, high-energy personalities who thrive on volatility.

It risks overtrading and excessive transaction costs. Day traders must match trades to current market conditions.

Position Trading

Position traders seek larger moves lasting weeks to months. Trades may stay open for extended periods.

Position trading requires tolerating drawdowns and filtering noise. Trades rely on long-term trends and fundamentals. This style fits patient, analytical personalities.

Fewer trades reduce costs but require enduring losses. Discipline is mandatory to hold through pullbacks and avoid overtrading.

Comparative Analysis

Swing trading balances day and position trading timeframes. Trades target short to medium swings lasting days to weeks.

This style suits active traders seeking dynamic gains yet unable or unwilling to micromanage day trades. Swing trading requires moderate screen time and analytical skills.

Overtrading is a hazard for impatient personalities. Swing traders must match trades to current conditions and withstand drawdowns. Carefully assess your temperament.

Ultimately, align the trading approach to your personality, skills, and goals. What works for one trader may fail horribly for another. Know yourself before committing.

Swing Trading Next Steps

Swing trading offers traders dynamic short-term profit potential. However, success hinges on methodical analysis, prudent risk management, and patience. As we explored, several core principles pave the path to consistency.

Looking to embark on your swing trading journey? The foundation lies in thoroughly understanding edge-providing strategies. Master reading the tape and chart patterns. Backtest extensively to refine skills. Start small to manage risk. Set stops and targets before trades. Review for continuous improvement.

What concepts resonated as you explored swing trading? Feel ready to start building your strategy arsenal? Share your biggest aha’s and lingering questions below!

Do you think it is better to include multiple strategies like Anticipation, Breakout, and Pullback or just to apply only one of them?

Thank you

That’s a great question, Hector. If you’re just starting out, it’s best to master one setup.

Once you’ve got it done, then explore the others and identify which setup works best in each market regime.