Imagine creating a trading strategy that turns $7 million into $175 million in just five years. Sounds like a fantasy? Well, it’s the real deal! This is exactly what trading legend William Eckhardt accomplished with his systematic approach to the stock market.

And the best part? You don’t have to be a Wall Street veteran to emulate his success – all you need is a deep understanding of Eckhardt’s ingenious trading tactics!

In this article, I’ll explain Eckhardt’s journey and unveil the trading strategies that catapulted him to stardom. Stay tuned if you’re tired of your mundane job and yearn for financial freedom. You’ll learn to mirror Eckhardt’s victory and achieve remarkable trading returns.

Key Takeaways

- William Eckhardt rose to fame as a highly successful trader and co-developer of the Turtle Trading System.

- His trading firm, Eckhardt Trading Company, averaged 12.13% returns from 1991-2022, beating the index by an annual 2.65%.

- Along with Richard Dennis, Eckhardt conducted the Turtle Trading Experiment, demonstrating that successful trading could be taught.

- Using Eckhardt’s and Dennis’ strategies, the turtles turned $7-28 million into a whopping $175 million.

- Eckhardt’s strategies emphasize data analysis, trend-following, and risk management and continue to influence modern trading practices.

Early Life and Education

Born in the heart of Chicago in 1944, William Eckhardt was a math prodigy destined to shake up the trading world. His mathematical prowess led him to the prestigious University of Chicago, where he earned a bachelor’s degree in mathematics. This love for numbers and problem-solving became the bedrock of his future trading exploits.

Eckhardt’s scholarly journey didn’t stop there. He set his sights on a Ph.D. in mathematical logic at the same university. Although he didn’t finish, the knowledge he gained became a powerful tool in the real-world trading arena. As his focus shifted from academia to trading, he began to explore the vast disciplines that would support his quest to create innovative trading systems.

Career and Partnership with Richard Dennis

With a daring plunge into the bustling world of commodity and stock markets, Eckhardt harnessed his mathematical skills to carve out a name for himself.

Throughout his illustrious career, Eckhardt juggled many roles. His journey began in 1974, trading for his personal account at the vibrant Mid-America Commodity Exchange. Then, from 1978-1991, he honed his trading skills off-floor.

During these years, William Eckhardt’s account boasted an astonishing annual growth of 62%. Remarkably, he only experienced a single year of loss in 1989. Talk about impressive!

But true power struck in the early 80s when a thrilling alliance was formed between two trading powerhouses – the legendary Richard Dennis and the brilliant mathematician-turned-trader William Eckhardt.

Dennis, renowned for his Midas touch in commodities trading, had transformed a meager $400 into an astonishing $200 million empire. With $1,200 from a $1,600 loan, he secured his place on the prestigious MidAmerica Commodities Exchange and used the remaining funds to build his fortune.

Their partnership is etched in history thanks to their ‘Turtle Trading’ experiment of 1983. Dennis, the eternal optimist, was convinced that anyone could master the art of trading. On the other hand, Eckhardt held a more skeptical view, insisting that trading was a craft reserved for the naturally gifted.

Keen to prove his theory, Dennis gathered a group of trading novices dubbed the ‘Turtle Traders.’ He equipped them with a robust strategy, focusing on systematic trend-following, meticulous risk management, and consistent decision-making.

Fourteen determined visionaries were handpicked to receive funding, each securing between $500,000 and $2,000,000. Over the initial five years, these relentless trailblazers transformed a modest $7-$28 million into a staggering $175 million plus.

These results proved Dennis’s point that trading skills could indeed be taught. Of course, Eckhardt’s invaluable contributions were instrumental to the success of the Turtle Trading experiment. This triumph propelled them to the zenith of the trading world and cemented the Turtle Trading strategy as a formidable approach in the industry.

Today, the indomitable William Eckhardt continues to shape the trading landscape. He established the Eckhardt Trading Company, a testament to the enduring impact of his partnership with Richard Dennis.

Eckhardt Trading Company Performance History

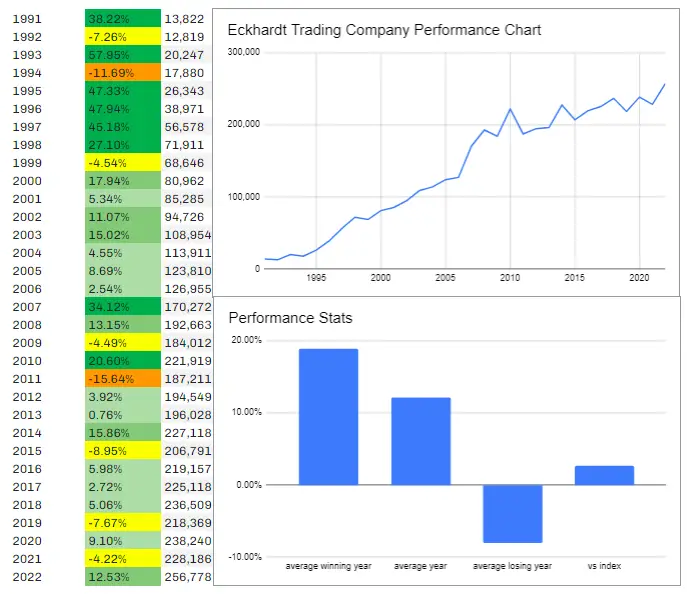

Since 1999, Eckhardt has expertly steered the Eckhardt Trading Company, now boasting a robust Asset under Management (AUM) of a whopping $181,000,000. From 1991 to 2022, he’s managed to yield an impressive average return of 12.13%, outshining the index by 2.65% annually.

See the chart below for a closer look at how this alternative investment management firm performs:

Eckhardt’s Investment Philosophy and Strategies

Now let’s discuss the ingenious strategies that propelled Eckhard to dizzying heights of success!

A Systematic and Quantitative Approach

William Eckhardt has cracked the code to risk management and emotion-free trading. His secret? A razor-sharp, systematic approach that’s rooted in cold, hard numbers.

Eckhardt’s trading philosophy is a masterclass in system development. He crafts intricate trading systems that prioritize risk management and base decisions on quantitative data with no room for gut feelings or emotional whims.

Let’s dive into an example of a trading system from Eckhardt’s renowned Turtle Trading Experiment. We’ll focus on System 1, the more daring, short-term trading system.

So, how did it work? Imagine you’re about to take a long position. You’d make your move and buy when the current price skyrockets past the highest price of the previous twenty days. Now, if you’re eyeing a short position, you’d do the exact opposite. You’d jump in and short when the current price dips below the low of the past twenty days.

But here’s the twist: if the last breakout signal resulted in a triumphant trade, you’d ignore this signal. The exit cue? A ten-day low for long positions, or a ten-day high for short positions.

Of course, that’s not all the participants of the experiment focused on. They were also guided to adopt a scientific method for trading. This method entails:

- Defining the question

- Gathering information

- Forming a hypothesis

- Designing an experiment to test the hypothesis

- Experimenting and collecting data

- Analyzing the data from the experiment

- Interpreting the data

The turtles, in their training, were also taught to pose critical questions to themselves. They would ask questions like, “What’s the current market state?” and “Which equity is on the trading block?” before making trading decisions.

By asking the right questions and harnessing the power of the scientific method, you can eliminate personal biases and execute stellar trades rooted in robust data analysis.

Managing Risk in Trading

Eckhardt also underscores the pivotal role of risk management in the trading world. He encourages traders to abide by the 2% rule: never put more than 2% of your account at stake in any single trade.

Why? It’s simple! According to William, the 2% rule is your safety net. It guarantees that even if a trade plummets, the blow to your account is minimal, allowing you to bounce back even after a series of losses.

But that’s not all: this successful trader also champions the use of stop-loss orders. These nifty tools cap an investor’s loss on a security position. By setting a stop-loss order, you’re commanding your broker to offload a security when it hits a specific price.

Picture this: you purchase a stock at $50 per share and set a stop-loss order at $45. If the stock price tumbles to $45, your shares will be automatically sold, curbing your loss. This is a savvy move to shield yourself from the erratic twists and turns of the stock market.

Diversification in Trading

Diversification isn’t just a trendy term tossed around in trading circles. It’s a lifeline, according to trading legend Richard Eckhardt. He’s weathered the roller coaster ride of the trading floor, experiencing dizzying highs and crushing lows. And he’s learned a crucial lesson: even the most intricate trading strategies can crumble.

Picture this: Your entire capital is wrapped up in one position. It’s a surefire bet, right? Think again. Even the most glittering trades can nosedive, and when that happens, you’re left with zilch. That’s why Eckhardt underscores the crucial role of diversification.

So, how does a trading titan like Eckhardt diversify? It’s straightforward. He doesn’t gamble all his chips on one number.

Instead, he sprinkles his capital across a variety of positions. This way, if one trade tanks, he’s still got other contenders in the ring. It’s a safety cushion, a buffer against the wild and unpredictable world of trading. By diversifying, Eckhardt ensures he’s not overly vulnerable to a single market trend or event.

Following Market Trends

Eckhardt, a Market Wizard and the Godfather of trend-following, crafted his trading systems on the solid foundation of trend-following principles. His faith in the magic of numbers, the allure of statistics, and the rhythm of patterns is unshakeable.

But how does he do it? His trend-following principles are as elegant as they are efficient. Eckhardt is a keen observer of market trends, a detective of patterns, and a strategist who makes his move when the time is right. His method leaves no room for guesswork or gut feelings. It’s all about the cold, hard data.

So, are you ready to dive into the world of the Turtle Trader method? With its laser focus on trends, data, and iron-clad discipline, it’s a method that has stood the test of time, emerging victorious again and again.

The Eckhardt Effect on Modern Investing

Bill Eckhardt, a trading system pioneer, continues molding today’s markets with his innovative approach. His legendary Turtle Traders experiment broke down barriers, proving that anyone could master the trading game with straightforward rules. This revelation demolished the notion that trading success was exclusive to the naturally gifted.

As markets morph and technology surges ahead, traders crave systematic, measurable methods to steer their investments. Eckhardt’s early adoption of this data-centric approach laid the groundwork for the emerging use of machine learning and artificial intelligence in trading and investing.

Inspired by Eckhardt’s groundbreaking work, many traders and investors have adapted his principles to suit their unique trading styles and investment philosophies. Among them is the visionary Nassim Nicholas Taleb, who has catapulted many of Eckhardt’s theories into the mainstream.

Overall, Eckhardt’s disciplined approach and tech-forward innovations continue to resonate with traders across various asset classes. His legacy not only transformed the trading landscape but also sparked a ray of hope for those brave enough to venture into this challenging field.

Eckhardt’s Philanthropic Contributions

William Eckhardt, a trading titan and math wiz, is celebrated not only for his financial acumen but also his philanthropic heart. His generosity, particularly towards his alma mater, the University of Chicago, has made him a beacon in the academic sphere.

Eckhardt’s financial contributions and active involvement have been so impactful that the university honored him by naming one of its buildings the ‘William Eckhardt Research Center.’ This center stands as a shining monument to Eckhardt’s deep commitment to education and research.

The research hub is a hotspot for crafting innovative features and devices at the nanoscale level. It emulates the Institute for Molecular Engineering’s (IME) mission to tackle societal challenges with molecular-sized solutions.

In this sense, Eckhardt’s philanthropy lays the groundwork for future breakthroughs that could revolutionize our world.

Delving Deeper into William Eckhardt’s Resources

Ready to dive deeper into the world of William Eckhardt? Let’s unlock the treasure trove of knowledge straight from the man himself! I’m here to guide you, offering invaluable resources to fuel your learning journey.

Books Featuring Eckhardt

While Eckhardt himself has not penned any books, his remarkable insights have been featured prominently in several influential trading publications.

For example, dive into the captivating world of ‘Market Wizards,’ a masterful book penned by Jack D. Schwager. It offers a front-row seat to the minds of the trading and investing elite, including William Eckhardt.

But that’s not all! His sage insights also illuminate Michael W. Covel’s ‘Trend Following.’ This riveting read reveals the secret to amassing wealth, regardless of the market’s state.

These books, brimming with Eckhardt’s expertise, are essential reads for anyone seeking to navigate the thrilling seas of trading.

Top Podcast Episodes Featuring Eckhardt

Are you more of an audiophile? No problem! Dive into the world of William Eckhardt through captivating podcasts.

Check out the Friendly Bear’s episode The Short Bear’s Excellency Vault Substack, which distills Eckhardt’s wisdom into digestible insights. Or tune into Top Traders Unplugged, where trading titan Jerry Parker, one of Eckhardt’s original turtles, shares the mic.

These podcasts not only entertain but also enlighten, transforming your daily commute into a thrilling journey through the realm of systematic trading.

Notable Interviews with Eckhardt

Eckhardt’s interviews are another goldmine for those seeking financial success.

Delve into William Eckhardt: The Man Who Launched 1,000 Systems, a riveting dialogue by Futures Magazine. It unveils Eckhardt’s relentless pursuit of robust trading systems.

Next, immerse yourself in The Robust Trader’s piece, How William Eckhardt Turned a $1,000 Investment into Millions. It’s a fascinating journey tracing how Eckhardt transformed a humble investment into a staggering fortune.

Lastly, don’t miss out on Macro Ops’ deep dive into William Eckhardt’s Market Wizard Trading Strategy Explained. It’s a thrilling exploration of the mastermind’s ingenious trading strategy.

These resources are your ticket to understanding the trading tactics and philosophy that propelled Eckhardt to the pinnacle of trading success. They’re not just informative but inspirational, lighting the path toward your trading triumphs.

Conclusion

Study the trading strategies of William Eckhardt, and you’ll discover a goldmine of techniques that could catapult you toward financial independence. Forget emotional decisions; Eckhardt’s trading systems are grounded in solid facts and cold, hard data.

So, why not borrow a page from Eckhardt’s playbook? Embrace data analysis and diversification. Eckhardt’s insights are pure gold if you’re aiming for smarter trading choices that pave the way to financial freedom

Frequently Asked Questions

Let’s dive into some frequently asked questions traders have about the elusive William Eckhardt!

How much is William Eckhardt worth?

It is estimated that William Eckhardt has a net worth of millions of dollars.

How did William Eckhardt make his money?

William Eckhardt is a renowned American trader who became successful through his data-driven, trend-following trading strategies.

How old is William Eckhardt?

As of 2023, William Eckhardt is 68 years old.

Who is the godfather of trend-following?

William Eckhardt is recognized as the godfather of trend-following.

What was Eckhardt’s role in the Turtles experiment?

William Eckhardt founded the Turtle Trading method with Richard Dennis.

Where did William Eckhardt go to college?

William Eckhardt attended the University of Chicago.