Bitcoin is the first decentralized cryptocurrency. Invented in 2009 by Satoshi Nakamoto, Bitcoin is a digital currency that can be sent from one user to another without needing an intermediary. A central bank or administrator does not control Bitcoin; instead, public nodes rewarded in bitcoins process transactions to be stored on a public ledger called a blockchain.

While Bitcoin is now a mainstream term, there are still a lot of questions surrounding it. Where does Bitcoin come from? How do you get them? And if you want to invest in Bitcoin, how do you go about doing so?

This post will provide answers to some of these common questions, as well as many others.

Bitcoin Terminology

When it comes to Bitcoin, one of the major barriers to entry is the lexicon. Let’s start with some of the important terminologies before digging deeper.

First, there’s the term “Bitcoin” itself, which is a bit of a misnomer. A bitcoin is not a coin. In fact, a bitcoin is not a physical object at all. Bitcoin is a digital currency, which means it is entirely digital.

The images you may have seen showing coins with the Bitcoin logo on them are only visual aids.

It’s also worth noting the varying capitalization of the term. While the concept of Bitcoin is capitalized, units of the currency, which may also be referred to as BTC or XBT, is not. Two example sentences:

This section of the post discusses Bitcoin terminology.

- I bought five bitcoins.

- Bitcoins and any Bitcoin transactions exist in a public ledger called the blockchain.

A blockchain can be thought of as precisely what it sounds like – a chain of blocks. In the instance of cryptocurrencies, such as Bitcoin, these “blocks” are transactions. We’ll discuss this concept in more depth later in this post.

Computers that have a copy of the Bitcoin blockchain are known as nodes. Some nodes may also be “miners”.

Bitcoin miners are nodes that use computing resources to process transactions on the blockchain. These miners get paid from newly released bitcoins for their bitcoin mining efforts.

Bitcoin mining is the process of earning newly released Bitcoins. When a node is mining bitcoin, it is essentially verifying transactions across the Bitcoin network.

Two other terms worth discussing, since they’ll be used regularly in this post, are “cryptocurrency” and “digital currency”. These terms are often used interchangeably, but they are not the same thing.

Digital currency is any form of money you can use on the internet to make purchases. A cryptocurrency is a type of digital currency based on cryptography (the art of solving or writing codes). Cryptocurrencies use tokens and are powered by cryptographic algorithms.

Bitcoin is a type of cryptocurrency, which means it is also a digital currency. Necessarily, all cryptocurrencies are digital currencies, but not all digital currencies are cryptocurrencies.

Now that we have the basic terminology down, we can dive into how Bitcoin works.

How Bitcoin Works

The simplest way to understand what Bitcoin is and how it works is to consider what it is not – a typical currency. A standard currency, such as the U.S. dollar, is issued and controlled by the government.

In contrast, cryptocurrencies are decentralized currencies. Unlike regular currencies issued by the government, cryptocurrencies do not have one central authority controlling them. There is no government, entity, or person in control of Bitcoin; instead, every person in the Bitcoin network is part of controlling the system.

We talked about the nodes (computers with the Bitcoin blockchain, some of which engage in Bitcoin mining.). The process in which Bitcoin mining nodes participate is the cryptographic verification of the Bitcoin blockchain (the ledger that tracks all bitcoins and all Bitcoin transactions). In layman’s terms, the nodes look at transactions, make sure they’re legitimate, and spread them to others in the system. These miners earn Bitcoin, but the rate at which they receive bitcoins periodically declines. For every 210,000 blocks mined, the reward for creating a new block of Bitcoin is cut in half. There are currently almost 21 million bitcoins, and only about three million more left to be mined.

The below video can help understand how this beautiful blockchain technology works.

Since there isn’t a centralized authority controlling Bitcoin, you may be wondering how reliable and secure it is. But one of the most exciting aspects of the decentralized nature of blockchain technology is that it’s incredibly secure and stable.

The Security of Bitcoin

The average person may not associate Bitcoin with security. Instead, Bitcoin may call to mind shady deals made by internet criminals. This is a common misconception. Bitcoin’s nature makes it a good option for those looking to commit crimes, but that is not because the system is unreliable or not secure.

The appeal of Bitcoin for criminals is that you can send and receive payments without providing your name or other identifying information. All you need is your wallet ID. This has made it ideal as a source of ransom payments. For example, when hackers install ransomware on your computer, they may require payment in Bitcoin. But only a small percentage of Bitcoin transactions are made illegally.

This does not mean Bitcoin is not secure or reliable. It merely means that, just like with traditional currency, there are ways to use it for criminal activity. Perhaps any illegal activity seems like too much. The problem is that even if a government wanted to shut Bitcoin down, the decentralized nature would make it impossible to do so. The currency is not tied to one country, location, person, group, etc. For example, let’s say the U.S. confiscated every node in the U.S. This would do nothing to stop every person in every other country from continuing to use Bitcoin, and those in the U.S. who wanted to participate could simply create new nodes.

In short, Bitcoin’s not going anywhere. And that’s not necessarily a bad thing. While the decentralized blockchain technology appeals to criminals, it’s because Bitcoin and the blockchain are secure and private by default.

Every computer running the code for Bitcoin has the same list of transactions or “blocks”. Changing it on one machine would not change it on all other computers since there is no one centralized source of the ledger. This is what it means to be “decentralized”. It creates a level of security that can’t exist for centralized information. To make changes to previous sections of the ledger (AKA the blockchain), you would have to operate more than half of all the computers that store the Bitcoin ledger, which is currently more than 10,000 computers. Even if this incredibly unlikely event were to occur, any impact from the attack could be easily nullified.

Though not a perfect comparison, you can think about Bitcoin’s decentralized nature is similar to Wikipedia. No one person is validating the information on Wikipedia. Instead, everyone using Wikipedia verifies the information. If someone attempts to put inaccurate information on a page, someone will soon discover it and correct it.

Bitcoin vs. Other Cryptocurrencies Bitcoin is a type of cryptocurrency, but it is far from the only cryptocurrency. Popular other cryptocurrencies include Etherium, Litecoin, Ripple, and others.

| Bitcoin (BTC) | Litecoin (LTC) | Ripple (XRP) | NEO (NEO) | Ether (ETH) | |

|---|---|---|---|---|---|

| Launch | 2009 | 2011 | 2012 | 2014 | 2015 |

| Circulating supply | >17 million | >58 million | >40 billion | 65 million | >102 million |

| Maximum supply | 21 million | 84 million | 100 billion (pre-mined) | 100 million | No upper limit |

| Current mining/release rate | 12.5 per block | 25 per block | 1 billion per month | Up to 15 million per year | 3 per block |

| Transactions per second maximum) | 7 | 56 | 1500 | 1000 | 20 |

| Network | n/a | n/a | RippleNet | NEO | Ethereum |

| Block time (approximate) | 10 minutes | 2 minutes 30 seconds | Near-instant | 15 seconds | 15 seconds |

The reason you’re probably heard of Bitcoin but may not have heard of these other cryptocurrencies is twofold: The first reason is that Bitcoin was the first cryptocurrency to succeed in gaining mass appeal. The second reason is that Bitcoin is the largest cryptocurrency by market cap.

When it comes to investing in cryptocurrencies (the specifics we’ll dive into later in this post), you’ll want to compare all your options, just as you would when investing in any other asset class.

A useful comparison to cryptocurrencies, in terms of investment potential, would be tech stocks. If you want to invest in tech stocks, you have plenty of options, and more options are always appearing. Currently, Apple has a far larger market cap than any other tech stock, but that doesn’t guarantee Apple’s future. Ten years from now, new technology may result in massive changes to the industry. Perhaps Apple will remain on top, maybe a competitor will overtake it, or maybe a new company will enter that is now unknown. The same applies to Bitcoin. While you could compare stocks in any industry to cryptocurrency, the example of tech stocks is especially relevant because both industries can change rapidly based on the development and implementation of new technology.

While we won’t get into an in-depth comparison of the major cryptocurrencies, it’s useful to know that Bitcoin’s main competitive advantage is that it’s more well-known and tested. Its biggest weakness is that it has slower transaction speeds, lacks some of the features of other cryptocurrencies, and the mining of Bitcoin requires specialized equipment.

The History of Digital Currencies and Bitcoin

Before we look at investing in Bitcoin, let’s take a moment to look at the history of Bitcoin and digital currencies to understand better how Bitcoin has come to have its current level of success and large market cap.

Bitcoin may have been the first successful digital currency, but it was not the first digital currency. The 1990s saw the first iteration of digital currencies, including Benz, Flooz, and DigiCash. For various reasons, all of these digital currencies quickly failed. While the specifics for each company’s failure varied, the problem they all had was how they were set up.

Unlike modern digital currencies, which use decentralized systems, the digital currencies of the 1990s relied on something called the Trusted Third Party approach, which used a company as a third party to verify transactions. After the digital currency failures of the 1990s, the concept of a successful digital currency was largely given. That is until an anonymous individual posted a whitepaper.

In October of 2008, an anonymous individual going by the name of Satoshi Nakamoto posted a link to a whitepaper called “Bitcoin: A Peer-to-Peer Electronic Cash System.” In the paper, Nakamoto explained how a decentralized digital currency would operate. This paper leads to the creation of Bitcoin.

On January 3rd, 2009, the first Bitcoin block was mined. This block is called Block 0 or the “genesis block”. Five days later, an announcement was made that the first Bitcoin software version was available. One day after that, Block 1 was mined. At that point, the Bitcoin system was officially underway.

Who Invented Bitcoin?

The name Satoshi Nakamoto was used by either the person or group of people who released the whitepaper and created the original Bitcoin software. Not surprisingly, many people have come forward since 2009 and claimed to be Satoshi Nakamoto, but Nakamoto’s true identity remains a mystery. While the idea of a solitary genius creating Bitcoin has gained more media attention, it’s far more likely that a group of people worked together to create Bitcoin.

But why would this person or group of people remain anonymous?

Of course, there’s privacy to consider. Whoever created Bitcoin would become well-known all over the world, and the creator or creators may simply enjoy their privacy, but there’s a couple of other reasons why anonymity makes sense.

Bitcoin could disrupt not just the banking industry, but the entire monetary system. While it hasn’t happened yet, there was and is the possibility that Bitcoin (or another digital currency) could threaten existing currencies. If governments knew who had created Bitcoin, they could take legal action against that person or persons.

Finally, there’s safety to consider. In 2009, 32,489 blocks were mined. By 2019, the value of these blocks alone would have been $13.9 billion. Nakamoto would have consequently had a sizable portion of these blocks, making Nakamoto rich enough to become a target of criminal activity.

How to Get Bitcoins

We’ve discussed how new Bitcoins come into existence through mining, but gaining access to bitcoins isn’t limited to those who mine them. Mining bitcoins is only one of four options for accessing bitcoins.

The most obvious way to get bitcoins, beyond mining them, is to get them from someone who has them. You could buy the bitcoins directly or, if you have a business, accept them as a form of payment

Another option is to purchase bitcoins on an exchange. This is a good option if you’re interested in bitcoins as an investment vehicle.

Finally, you can get Bitcoins through a Bitcoin ATM. These look similar to traditional ATMs, but instead of withdrawing cash, a Bitcoin ATM allows you to buy or sell bitcoins. While convenient, Bitcoin ATMs have a few drawbacks. One is that there are only about 3,000 in the U.S. If you don’t live in a big city, you may not have access to one. The other is that Bitcoin ATMs often charge a seven to ten percent fee to buy or sell bitcoins.

How to Use Bitcoin

We’ve looked at how to get bitcoins, but how can you use them once you get them?

Bitcoins are a form of currency, which means you can use them to buy goods and services. The question then becomes – why would you want to?

One of the most significant advantages of using bitcoins for transactions is how much quicker and easier they made international payments. When Bitcoin started in 2009, international bank transfers typically came with fees and a delay. Using bitcoins instead made transactions quicker and cheaper. And while international bank transfers have improved in recent years, bitcoin transactions are still much easier.

There are still a couple of other reasons to use Bitcoins, too. The first is simply as an alternative payment method. Many retailers, both large and small, now accept Bitcoin as payment. If you have the ability and desire to mine bitcoins, you could earn them and then use them to make purchases, just like you would cash.

Some people also use bitcoins not as a way to make purchases, but as a way to store wealth. Since a centralized entity does not control Bitcoin, there is theoretically no authority that can take a portion of that wealth.

Finally, as previously mentioned, Bitcoin also provides an investment opportunity. Many traders have begun speculating on the appreciation of the price of Bitcoin.

How to Store Bitcoin

We’ve talked about how to get bitcoins and how to use them, but once you have them, how do you store them?

Technically speaking, you don’t. The Bitcoin blockchain stores all of the historical Bitcoin transactions. Instead, you create a Bitcoin address, also known as your digital wallet. When creating this digital wallet, you create a password that allows you to unlock your wallet and transact.

One potential area of concern for digital wallets is that since they’re not affiliated with a bank or other established financial institution, the Federal Deposit Insurance Corporation (FDIC) does not cover them.

Why does this matter?

When you have your money in an FDIC-insured bank, your money is insured for up to 250,000. If the bank closes, you still get up to 250,000 of your money. This is not the case for digital wallets. And no matter where you keep your digital wallet, there are ways you could lose your money.

If you keep your bitcoins with a third-party service, a hacker may be able to steal your bitcoins.

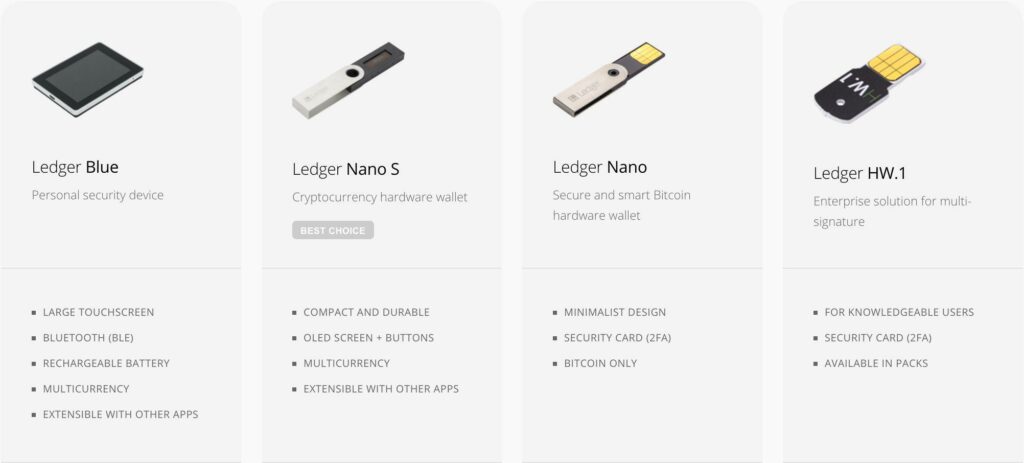

If you store your cryptocurrency yourself (recommended), there’s a chance you could forget your password or private key losing access to your digital assets. Additionally, since cryptocurrency is so valuable, new forms of viruses are designed to steal your bitcoins while transacting on your computer — although this can be largely prevented by using a digital wallet such as a Ledger.

Investing in Bitcoin

There is a lot of money in Bitcoin, which may make you wonder how you can take advantage of this valuable commodity. Of course, you could begin mining bitcoins or buy or sell bitcoins, but making a profit is not limited to these options; you can also invest.

Just like there are exchanges for stocks, there are also exchanges for bitcoins and other cryptocurrencies. These cryptocurrency exchanges allow you to buy or sell bitcoins using various other currencies. Four of the most popular Bitcoin exchanges include Binance, Coinbase, Kraken, and Bitfinex.

One of the first mainstream brokers to give traders the ability to buy and sell bitcoins was Robinhood. While the options for investing in cryptocurrencies are currently relatively limited, that may change soon. You could also invest in Bitcoin futures, which is not the same as direct investments in Bitcoin but is more common among mainstream brokers. TDAmeritrade and E*TRADE both offer Bitcoin futures.

But before you invest, you need a framework of how to value Bitcoin. Rao Pal of RealVision does a great job of thinking through this, and if you’re thinking about investing in Bitcoin, I strongly suggest you watch.

An alternative to investing in Bitcoin is to trade them. The most significant benefit of trading in Bitcoin is also one of the biggest concerns – Bitcoin has incredibly high volatility. The rising and falling prices of Bitcoin provide investors with opportunities to make large amounts of money, but they just as easily can lead to massive losses. To highlight just how volatile Bitcoin is, let’s look at its various bubbles.

The Bitcoin Bubbles

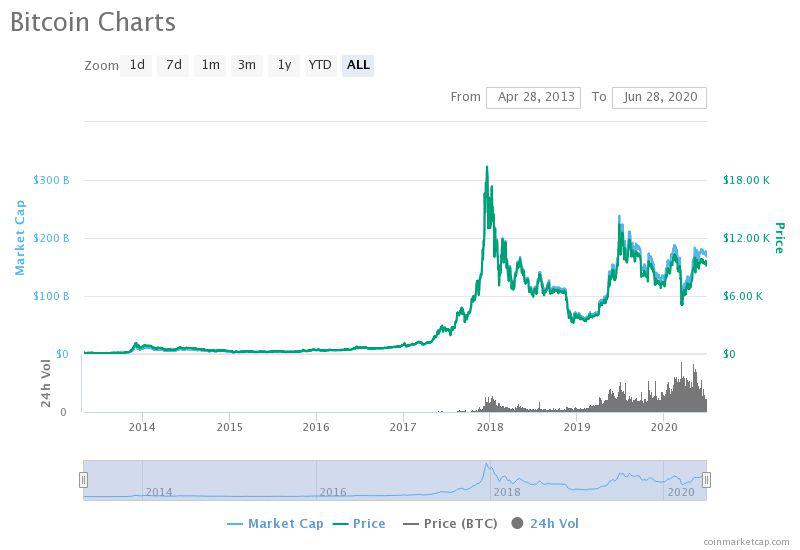

Bitcoin has only existed for a little over a decade, but in that time, it’s already gone through three separate bubbles and their subsequent bursts.

The first Bitcoin bubble occurred near the end of 2013. In a short time, Bitcoin went from 150 to 1,000. When the bubble burst, Bitcoin fell to $400. While this is still a dramatic drop, it was far less than many of the other cryptocurrencies of the time, many of which rose higher and dropped much further on a percentage basis.

The second Bitcoin bubble is the one you may be most familiar with since it reached epic levels. In 2017, three years after the first Bitcoin bubble, Bitcoin finally returned to its value at the peak of the 2013 bubble – 1,000. At this point, the value skyrocketed. By the end of the year, Bitcoin was valued at 19,000. Within a few months, it dropped to $6,000, which was less than one-third of its value at the bubble’s peak.

The third and final Bitcoin bubble occurred in 2019 when Bitcoin’s price rose from 4,000 to almost 14,000. Bitcoin promptly crashed again. As of June 2020, Bitcoin’s value is back up to $9,000.

Risks of Investing in Bitcoin

As we now know, Bitcoin is a highly volatile investment that has had three boom and bust cycles in ten years. The excellent news about highly volatile investments is that they provide opportunities to make a substantial amount of money. The problem is that they come with a high level of risk.

Taking the time to understand an investment before putting any money in it is always a prudent move, but this is arguably even more important when it comes to Bitcoin and other cryptocurrencies. These investments are comparatively new and highly technical. This means the average investor may not understand key aspects of the investment.

This is not to say that Bitcoin or other cryptocurrencies are lousy speculations. But investors just starting may want to avoid this highly volatile investment. Even more, experienced investors should avoid investing a large percentage of their portfolio in Bitcoin or other cryptocurrencies.

Investors should also consider that even though Bitcoin is currently the most well-known cryptocurrency and has the largest market share, that does not mean this will be true in the future. Even if cryptocurrencies were to revolutionize the monetary system, it might be another cryptocurrency that leads to the charge, perhaps one that doesn’t even exist.

The Bottom Line

Bitcoin is much like any other new, and potentially lucrative investment opportunity – both the technology and the idea have a lot of future potential, which makes it an exciting prospective investment. Still, it’s also incredibly technical, complicated, and volatile.

If you plan to invest in Bitcoin, you should develop a framework for understanding its value. If you decide to invest or trade Bitcoin, make sure to keep your bitcoins safe and secure — preferably with a digital wallet — and always double-check the address to which you’re sending your valuable crypto.