Cryptocurrencies have taken the world of finance by storm, and Bitcoin is undoubtedly ruling the roost. Created by the pseudonymous developer Satoshi Nakamoto in 2009, Bitcoin has gained millions of followers, touching a record value of $66,999.00 at Coinbase on October 21, 2021.

Nakamoto or developers working under him created this cryptocurrency to decentralize the control of currency concentrated in the hands of a few institutions. Bitcoin’s design is public and isn’t owned or controlled by anyone. While Satoshi influenced the development of Bitcoin for a long time, users and developers continued to work on the Bitcoin project on its forum. Hence, the collective power rested in the hands of the users running the Bitcoin software.

The history of Bitcoin is just over a decade old, but it has been pretty eventful. It marked the beginning of cryptocurrency, a distinct asset class, and introduced Blockchain, a revolutionary technology. Let’s revisit the evolution of Bitcoin and take a look at the events that shaped its development.

If you’re interested in how cryptocurrency started in 1975, please enjoy the history of cryptocurrency.

August 2008: The Birth of Bitcoin and Blockchain

On 18 August 2008, the domain name bitcoin.org was registered. On 31 October 2008, Satoshi Nakamoto posted the link to the whitepaper he titled Bitcoin: A Peer-to-Peer Electronic Cash System on a cryptography mailing list.1 This marked the birth of Bitcoin. Since there was no actual currency involved, he named it ‘Bit’-coin after the binary digit, the basic computation unit.

In the Bitcoin whitepaper, he described a digital currency that would enable secure, peer-to-peer transactions with no intermediary involvement such as the government, financial institutions, or a central bank.

He further mentioned in the paper that these transactions would be tracked through a blockchain. Blockchain functions as a ledger distributed across a network, with entries secured by cryptographic means and visible to all. The whitepaper further mentioned that there would always be a maximum of 21 million Bitcoin at a time.

Nakamoto implemented the bitcoin software as open-source code and released it in January 2009.

January 2009: The Genesis Block

On January 3, 2009, the bitcoin network officially came into existence as Satoshi Nakamoto mined the genesis block of bitcoin and received 50 bitcoins. The Genesis Block was the first block of cryptocurrency ever mined. Created by Satoshi Nakamoto, Bitcoin’s Genesis Block is also the first proof-of-work blockchain system.2 It also serves as the prototype for all other blocks in its blockchain. He mentioned that those Bitcoins would always remain in the system. These are Bitcoins that can never be used or traded.

Also known as Block 0, the Genesis Block laid the foundation for validating bitcoin transactions and introducing new bitcoins. Interestingly, the next block, or Block 1, was mined six days after the Genesis Block instead of the usual 10 minutes gap. Many believe that Nakamoto spent six days stabilizing the system.

January 2009: The First Test Transaction

Computer scientist Hal Finney, creator of the first reusable proof-of-work system (RPoW) in 2004, was the first receiver of Bitcoin in a test transaction. After downloading the bitcoin software on 12 January 2009, the exact date of its release, Finney received ten bitcoins from Nakamoto. This mock transaction validated that Bitcoin could function as a money network. The transaction recorded in block 170 happened a week after Nakamoto started running the Bitcoin network.3

Later in 2009, Hal Finney was one of the first to make a Bitcoin price prediction. He said that if Bitcoin became a dominant payment system globally, its price would skyrocket due to the innate emission limit of 21 million coins. He mentioned, “With 20 million coins, that gives each coin a value of about $10 million.”

As time passed, several computer scientists, cryptographers, developers, and mathematicians, were introduced to the ecosystem.

October 2009: Formation of the New Liberty Standard

The real value of bitcoin was created on October 5, 2009, as a service to buy and sell bitcoin called the New Liberty Standard was set up.4 The new standard established a value ratio of 1.309,03 BTC for $ 1 as per the energy cost of mining Bitcoin. We can also term it as a sort of compensation for mining blocks as per the price of electricity.

A Finnish software developer, Martti Malmi, sent 5,050 bitcoins for $5.02 to NewLibertyStandard using PayPal. He was one of the regular bitcoin users in the forum.5

February 2010: The First Bitcoin Exchange

In February 2010, dwdollar, a Bitcointalk user, created a Bitcoin market portal in which Bitcoin transactions could be conducted using payment systems like Paypal.7 It was one of the earliest instances of bitcoin users participating in the digital currency’s sale and purchase.

However, On June 4, 2011, Paypal withdrew its support from that market due to reports of fraud related to the bitcoin transactions. Some users claimed that they did not receive anything in exchange for the payment they made for the bitcoins.

May 2010: The Bitcoin Pizza Day

The journey for actual Bitcoin trading finally began in 2010. Until then, only Bitcoin mining was done. There wasn’t any actual trade done; hence no one could determine the value of the cryptocurrency. On May 22, 2010, Florida resident and programmer Laszlo Hanyecz purchased two Papa John’s pizzas for 10,000 Bitcoins worth around $47. In current times, the valuation of the pizzas would be a whopping $365 million.7

He struck a deal on the Bitcointalk chat forum with Jeremy Sturdivant, a 19-year old student from California. The day is still celebrated as “Bitcoin Pizza Day.” Bitcoin value jumped from US$0 to $0.0008, and by the end of 2010, it was $0.83.

2010: Nakamoto Hands Bitcoin Network to Gavin Andersen

Several programmers and developers have worked on the code for Bitcoin, but the contribution of Gavin Andresen was particularly notable. He approached Nakamoto in 2010 and became a dependable resource for him.8

Andersen was a software engineer and worked with the computing company Silicon Graphics for seven years. He had the same vision for Bitcoin as Nakamoto’s. Andresen had immense belief in Nakamoto’s design and saw Bitcoin as a currency outside any governmental control.

Analysts believe that before disappearing in 2010, Nakamoto mined one million Bitcoins and transferred the code repository’s control and the network alert key to Gavin Andresen.

After that, Andresen worked towards decentralizing control. He also launched a website called the Bitcoin Faucet in 2010, which gave five bitcoins to every visitor for completing simple tasks. The objective was to raise awareness about cryptocurrencies which was a new concept then.9 As Bitcoin rose in value, Andresen lowered the size of the handout and eventually shut the site in 2012.

February 2011: The Infamous Silk Road Chapter

Silk Road was a digital black market platform founded in February 2011 by Ross William Ulbricht under the pseudonym “Dread Pirate Roberts.” Ulbricht was a former Penn State graduate student and novice programmer who started this platform dealing with trading narcotics and other illegal substances.

The Silk Road existed for 30 months and accepted Bitcoins as the exclusive mode of payment. During this phase, transactions worth nearly $214 million for 9.9 million Bitcoins were done.10 One of the first items to be listed on the Silk Road was psychedelic mushrooms which Ulbricht cultivated. The site caught people’s attention, and its marketplace thrived on the back of hackers and habitual drug abusers. The Silk Road utilized privacy techniques such as the Tor, Virtual Private Networks, and cryptocurrency to conduct illicit operations.

Bitcoin was in the limelight due to the infamous Silk Road, and its price increased from $1 to over $30. In 2013, the FBI shut the Silk Road, and its founder Ross Ulbricht was sentenced to life imprisonment. When news of Ulbricht’s arrest became public, Bitcoin’s price plunged from $140 to $110 within two hours.11 The incident left a wrong impression about Bitcoin and cryptocurrencies. It propagated a belief that Bitcoins were used to facilitate criminal activities.

February 2011: The Dollar Parity Day

Bitcoin peaked in February 2011, which marked its first bubble. A piece in the tech magazine Slashdot dated February 10, 2011, stated that noted developers like Jeff Garzik and Jed McCaleb joined the bitcoin core team, and this news pushed the price of a Bitcoin to one dollar. Hence, this day is remembered as Dollar Parity Day or Slashdot day.39

September 2012: The Bitcoin Foundation

After Bitcoin had earned a reputation for criminality and fraud, the bitcoin foundation was formed in late 2012, on the lines of the Linux Foundation.40 The foundation was funded through grants made by for-profit companies that depend on Bitcoin technology. Peter Vessenes was the founding Chairman of the board. The foundation hired Former lead Bitcoin developer Gavin Andresen as ‘chief scientist’.

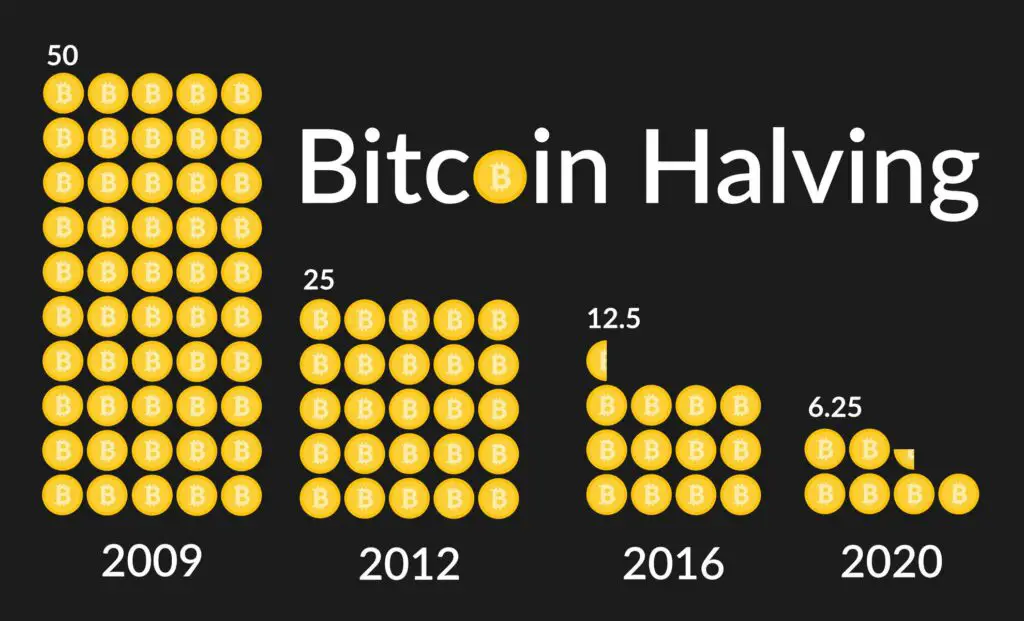

November 2012: First Bitcoin Halving

When Bitcoin was launched in 2009, each block had 50 BTC, but the amount was decided to be reduced by 50% roughly every four years.12 This phenomenon was known as halving. The first halving event happened on November 28, 2012, after 10,500,000 BTC had been mined. Block 210000 was completed, and the block reward became 25 BTC from the original 50 BTC.

The first halving event was a highly anticipated one, and the market was abuzz with discussions around the stability of the network, consequences on mining, and the economic impact of the halving. Bitcoin was trading at $11 at the time. At first, the halving had no remarkable effect on Bitcoin’s price.13 However, at the beginning of 2013, the coin’s value began to grow steadily and reached a correction in April.

2012: Introduction of MilliBitcoins, Microbitcoin, and Satoshis

2012 saw the introduction of three new measurement systems called milliBitcoins (mBTC), microBitcoins (uBTC), and Satoshis.19 In May 2011, millibitcoins were introduced, referred to by the ticker symbol mBTC. A microbitcoin or ‘bit’ is one-millionth of a Bitcoin or 0.000001BTC.

Bitcoin developers stated that microbitcoins are also called ‘bits’ when denoting either a one-millionth of a Bitcoin or 100 satoshis. Satoshi is the smallest Bitcoin unit recorded on the blockchain, one hundred millionths of a single bitcoin (0.00000001 BTC).

Satoshi Nakamoto propagated Bitcoin as a system of 100 million sub-units in November of 2008. Two years later, Bitcoin core developer Ribuck initially proposed that one-hundredth of a Bitcoin be called a Satoshi.14 He revised his proposal after that and suggested that one hundred millionths of a Bitcoin be named a satoshi.

March 2013: Blockchain Fork

In March 2013, the blockchain split into two independent chains with different rules because of a bug in the bitcoin software’s version 0.8.15 The result was a Blockchain fork. The first signs of a bug were reported by Jouke Hofman, a Dutch exchange operator and a miner with the nickname ‘Thermoman.’

The two blockchains operated with their version of the transaction history for six hours simultaneously from the moment it split. The regular operation was restored when most of the network was downgraded to the backward-compatible version of the bitcoin software–version 0.7.

This blockchain became the longest chain, and all participants could participate irrespective of their bitcoin software version. The largest bitcoin exchange, Mt. Gox, briefly halted bitcoin deposits, and the price plunged 23% to $37 before recovering to the previous level.

2013: A Significant Bitcoin Price Bubble

2013 was a landmark year for Bitcoin. The cryptocurrency witnessed an unprecedented price rise, and by December 2013, it reached $1,164. Bitcoin began trading at $13.40 and went through two price bubbles in the same year, and the price shot up by $220 by the beginning of April 2013.

Another rally and a crash after that occurred toward the end of that year. In early October, the digital currency traded at $123.20 but spiked past $1,156.10 in December only to plunge to $760 three days later.39

December 2013: China Imposes Restrictions on Bitcoin Usage

On 5 December 2013, the People’s Bank of China prohibited Chinese financial institutions from using bitcoins as a currency. The decision followed after Alan Greenspan-former US Federal Reserve Chairman termed bitcoin’s unprecedented rise in value a “bubble.”16 PBOC’s notice stated Bitcoins were a “virtual good” that had no legal status and should not be used as a currency.” The notice also clarified that China imposed the ban as bitcoins lacked the backing of any nation or central authority,

According to The New York Times, the government cited concerns about “money laundering” and “threats to financial stability.” After the announcement, the value of bitcoin dropped. 17

The regulations weren’t indicative of a blanket ban. Chinese citizens and businesses were still allowed to participate in Bitcoin commerce. The restrictions imposed by Beijing were an attempt to mitigate unseen risks and check frequent fraud and money laundering occurrences.

January 2014: The Mt. Gox Disaster

In January 2014, one of the largest Bitcoin exchanges in the world, Mt.Gox, based in Shibuya, Tokyo, Japan, suddenly shut down. Mt. Gox or the Magic: The Gathering Online, created by Stellar developer, Jed Mc Caleb, suspended trading. It closed its website and exchange service and filed for bankruptcy protection from creditors.

Along with it, 850,000 Bitcoins worth $460 million also vanished, and the owners couldn’t figure out what exactly happened.18 On 20 March 2014, Mt. Gox reportedly found 199999.99 coins in an old digital bitcoin wallet, after which the total number of lost bitcoins stood at 650,000. Although 200,000 bitcoins could be recovered, the reasons for their disappearance were ambiguous. The possibilities ranged from theft, fraud, mismanagement, or a combination of all.

It was only after April 2015 that Tokyo security company WizSec presented new evidence. The findings led to the conclusion that “most or all of the missing bitcoins were stolen straight out of the Mt. Gox hot cryptocurrency wallet over time, beginning in late 2011. The Mt. Gox disaster highlights the security lapses at exchanges and the investors’ risks in the unregulated sector.

June 2016: SegWit

In June 2016, the Bitcoin Core team released its version 0.13.1 update–the first to implement Segregated Witness transactions (SegWit) in the protocol.20 Conceptualized by bitcoin developer Pieter Wuille, the term SegWit means separating or segregating and witnessing the transaction signatures.21 Wuille suggested separating digital signatures from transaction data to free up the space because the signatures accounted for 65% of the transaction space.

One of the significant advantages of the SeWit phase was the software’s capacity to accommodate almost 2MB of transactions per block. According to estimates, the total block size, with SegWit, was about 1.7MB. Hence, the primary objective was to free up a degree of block space, lower the transaction fees, and expand the maximum transaction capacity of the network. The 0.13.1 release endured extensive testing and research, leading to some delays in its release date.

April 2017: Japan Declares Bitcoin a Legal Currency

In April 2017, Japan passed a law recognizing bitcoin as legal tender with retailers backing the new law.22 Bitcoin’s market capitalization climbed from $18.34 billion at the beginning of the month, to $19.5 billion. Later in September, Japan’s Financial Services Agency officially recognized 11 companies as registered cryptocurrency exchange operators.

A few months later, the National Tax Agency categorized gains on cryptocurrencies as ‘miscellaneous income’ and imposed taxes based on the same.23 Post these regulations, crypto exchanges in Japan have to comply with the standard AML/CFT obligations.

Japan offers one of the most conducive regulatory climates for digital currencies and acknowledges Bitcoin and other cryptocurrencies under the Payment Services Act (PSA).

August 2017: Creation of Bitcoin Cash

As the number of Bitcoin users increased, the confirmation time and transactional fees on bitcoin’s blockchain rose.24 Due to the limitation of 1 MB block size, blocks couldn’t handle the increased transactions. Bitcoin cash came to the rescue and increased the block size in the range of 8 MB and 32 MB. Roger Ver, the affluent bitcoin advocate, propagated the idea of bitcoin cash.

In August 2017, Bitcoin Cash was formed as a result of the hard fork in Bitcoin. Each Bitcoin holder received an equivalent amount of Bitcoin Cash, thus increasing the size of blocks and the number of coins in existence. Bitcoin Cash made its debut on various cryptocurrency exchanges at a price of $900.

However, Coinbase and itBit, are some of the crypto exchanges that have boycotted Bitcoin Cash.

September 2017: China Bans Crypto ICOs

Bitcoin crashed to $3,226 after China banned initial coin offerings on September 4, 2017. The complete ban started on 1 February 2018.25 Beijing cracked down on Bitcoin to protect investors and curb financial risks. The ICO rules also banned cryptocurrency trading platforms from converting legal tender into cryptocurrencies and the other way round.26 The restrictions prompted most of these trading platforms to shut shop with and move offshore. According to the People’s Bank of China, by July 2018, 88 virtual currency trading platforms and 85 ICO platforms withdrew from the markets.

By November 8, bitcoin prices stabilized, and they hit close to $7,500 a coin. The percentage of bitcoin trading in the Chinese Renminbi fell from more than 90% in September 2017 to less than 1% in June 2018.

December 2017: CBOE Launches Bitcoin Futures

On December 17, 2017, Chicago exchange operators Cboe Global Markets Inc and CME Group launched bitcoin futures trading to facilitate mainstream investors to bet on the price of the virtual currency.27 The Cboe Bitcoin Futures Contract uses the ticker XBT and equals one bitcoin, while the CME Bitcoin Futures Contract uses ticker BTC that equals five bitcoins. Both Cboe and CME’s bitcoin futures contracts are settled in US dollars, which permits exposure to the bitcoin without the need to hold the cryptocurrency physically.

While the Cboe’s contract is priced off on the final settlement date on the Gemini cryptocurrency exchange, the CME’s contract will be priced off the CME Bitcoin Reference Rate, an index referencing pricing data from Bitstamp GDAX, itBit, and Kraken.

December 2017: The Third Bitcoin Price Bubble

At the beginning of the year, bitcoin’s price was hovering around the $1,000 price range. After a phase of brief decline, to $975.70 on March 25, the price skyrocketed to $20,089 on December 17, 2017.28 The winning streak that year placed bitcoin in the limelight. The cryptocurrency held onto the higher price zone and didn’t breach $1,000 for over three years after that.

Governments and economists began taking Bitcoin seriously and started developing other digital currencies to compete with Bitcoin. There was a lot of buzz around Bitcoin as analysts discussed its value and future as an asset while some traders made extreme price forecasts.

August 2020: Bitcoin Acceptance by PayPal, MicroStrategy, and Square

In 2020, bitcoin saw a lot of acceptance by corporates. In August, MicroStrategy invested $250 million in bitcoin as a treasury reserve asset.29 It purchased 21,454 bitcoins at an aggregate purchase price of $250 million, including fees and expenses. Michael J. Saylor, the CEO of MicroStrategy, stated, “Our investment in Bitcoin is part of our new capital allocation strategy, which seeks to maximize long-term value for our shareholders.”

In October 2020, Square, Inc. placed nearly 1% of total assets ($50 million) in Bitcoin.30 The company announced that it had purchased nearly 4,709 bitcoins at a purchase price of $50 million. In 2018, the company launched bitcoin trading with Cash App, and in 2019, it also formed Square Crypto, an independent team that focuses solely on working towards bitcoin open-source work.

In October 2020, PayPal announced a new service that enabled its customers to hold and trade cryptocurrency from their PayPal account.31 The company indicated its plans to boost cryptocurrency adoption by empaneling 26 million merchants globally.

These developments led Bitcoin to a new impetus, and on 30 November 2020, its value reached a record high of $19,860, surpassing the previous high of December 2017.

September 2020: Zug Allows Bitcoin for Tax Payments

In September 2020, Switzerland announced that citizens and institutions in the Canton of Zug could start making tax payments up to 100,000 CHF in Bitcoin and Ethereum by February 2021. Local crypto broker and custodian Bitcoin Suisse will be officially responsible for converting cryptocurrency payments into Swiss francs for the Canton tax office.32 Because of its friendly regulation policies towards cryptocurrencies and blockchain, many companies know Zug as the “Crypto Valley”.

February 2021: Elon Musk Endorses Bitcoin

On 8 February 2021 Tesla announced a bitcoin purchase of $1.5 billion, more than its entire quarterly research and development budget. The $1.5 billion held in bitcoin represents about 8% of all the $19.4 billion that Tesla has in cash and liquid assets. It also announced a plan to begin accepting bitcoin as payment for vehicles.34

Crypto traders were euphoric on this announcement by Elon Musk, and Bitcoin price climbed to a record high of $44,141. On 18 February 2021, Elon Musk stated, “owning bitcoin was only a little better than holding conventional cash, but that the slight difference made it a better asset to hold.”

Tesla reversed its stance on May 12, 2021, indicating that it wouldn’t consider Bitcoin any longer amid environmental concerns over bitcoin mining. The price of Bitcoin plunged nearly 12% on May 13. Later in July, Musk suggested that Tesla might help Bitcoin miners to use renewable energy, and if bitcoin mining uses more than 50% of renewable energy during mining, then “Tesla would resume accepting Bitcoin.”33

April 2021: Bitcoin Moves Past $64,000

On April 14, 2021, Bitcoin reached $64,870, backed by institutional buying and the euphoria surrounding the direct listing of Coinbase on NASDAQ. Institutional interest with participation from major companies like Tesla, JPMorgan, and BNY Mellon was a key reason behind the surge of bitcoin. On a broader note, the shutdowns and dwindling global economic situation heightened uncertainty and led to a bitcoin rally during the pandemic.

June 2021: China Bans Bitcoin Mining

China imposed stringent crypto regulations this year. On June 21, the People’s Bank of China urged financial institutions and banks to scrutinize and deactivate individuals’ performances in crypto transactions. (66)

Earlier, the Government authorities also cracked down on Bitcoin mining operations in the Sichuan province. AntPool, F2Pool, Huobi Pool, and Poolin are four of China’s biggest bitcoin mining pools that contributed over 50% of the global bitcoin processing power during the past year. (65) Bitcoin lost 80% of its value from its highest level in April 2021. Not only this, but Bitcoin’s hash rate also dropped about 40% during June and reached its lowest point in 13 months.

Experts believe that China considers the volatile virtual currencies a threat to its economic stability, hence this crackdown. Many also feel that Beijing sees bitcoin as a serious competitor to its digital Renminbi, which is in the pipeline.

June 2021: El Salvador Legalizes Bitcoin

In June 2021, El Salvador passed legislation to make Bitcoin a legal tender alongside the US Dollar, and the law came into effect in September 2021. Bitcoins will be loaded onto digital wallets called Chivo, which the citizens can download using the El Salvador identity. Those who switch to bitcoin will also receive $30 as a government incentive into the wallet.36

The El Salvador government now allows users to make payments for services, trade products, and make bank transfers with a commission waiver. However, if the vendor wishes to receive compensation via the US Dollar, the customer can make conversions directly on the app.

The El Salvador government is reportedly exploring options to mine bitcoin with geothermal power and issue bonds linked to the bitcoin.

September 2021: China Deems ‘Crypto Trading’ Illegal

Crypto trading has been banned in China since 2019, but it has been carried out online through foreign exchanges. However, in 2021, the nation is in a ‘serious crackdown mode.’ After restricting banks and financial institutions from facilitating bitcoin transactions and banning crypto mining, China has now termed crypto transactions illicit. It has warned that those involved in “illegal financial activities” are criminals and will be prosecuted.33

October 2021: The First US Bitcoin ETF Debuts

October 19, 2021, will be remembered as a landmark moment in the history of bitcoin.37 For the first time, an exchange-traded fund of Bitcoin started trading on the New York Stock Exchange. The Proshares Bitcoin strategy ETF started trading on the US stock exchange with the ticker name of BITO. The fund tracks CME bitcoin futures or contracts speculating on the future price of bitcoin rather than the crypto itself.

According to CNBC, in 2017, several asset managers wanted to launch spot bitcoin ETFs, but the Securities and Exchange Commission did not give the nod. However, after Gary Gensler became the Chairman of the SEC, many fund houses began to apply for futures-based ETFs.

But, this is not the first bitcoin ETF globally, as Canada has three bitcoin ETFs. Crypto Analysts believe that the Bitcoin ETF launched on the NYSE signals the virtual currency’s mainstream acceptance. As a result, the bitcoin price has topped its April high and touched $$66,999.00, a new all-time high.38

The Final Block

Bitcoin has been around for more than a decade, and everyone believed that it would bring about a revolution in the financial ecosystem. The central premise behind bitcoin creation was decentralizing power, which is now concentrated in massive bitcoin holders or whales who control its price.

Most of the first decade was marked by controversies, developmental hiccups, and crazy price fluctuations. After 2017, Bitcoin’s price stabilized above $1000, and it saw significant acceptance by large corporations. The ecosystem around the digital currency or bitcoin economy has also strengthened.

Cryptocurrency enthusiasts and investors are pretty optimistic and believe that the upcoming decade will be crucial for Bitcoin. Investors are taking note of Bitcoin’s potential with Goldman Sachs resuming its crypto trading desk. Experts believe that if Bitcoin addresses its energy consumption issues, more corporations will warm up to it.

The next bitcoin halving is expected to occur in 2024 and will see bitcoin block rewards drop to 3.125 bitcoins per block.

Sources: 1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16, 17, 18, 19, 20, 21, 22, 23, 24, 25, 26, 27, 28, 29, 30, 31, 32, 33, 34, 35, 36, 37, 38, 39, 40