The global cryptocurrency or virtual currency market has grown by leaps and bounds. Institutional investors increasingly participate as markets mature, and regulatory authorities are crafting rules specifically for the crypto. Here is a chronicle of the history of the crypto market and the significant events that have led to its evolution.

The cryptocurrency was unheard of three decades back, but today, it has taken over the world by storm and Bitcoin is a household name. The core objective behind cryptocurrency was to create a secure and anonymous mode for currency transfer from one person to another, and its value has skyrocketed since then. But what exactly makes cryptocurrency a unique disruptive force is how it is incorporated into our digitalized world.

Today, crypto trading is not restricted to high net worth or a few selected institutional investors. Retail traders, especially millennials, are particularly excited about crypto trading, given their comfort with the digital world. Due to the widespread adoption in the mainstream, the number of cryptocurrencies continues to multiply, and there is no slowing down.

To assess the growth potential of cryptocurrency and what other use cases it can support, let’s look at the journey of digital currencies to understand better how it has evolved and how it’s going to move.

1975: Stanford University Cryptographers Lay the Foundation

In 1975, two cryptographers from Stanford University, Whitfield Diffie and Martin Hellman conceptualized public key cryptography at Stanford University. They also published their proposals in a 1976 paper called “New Directions in Cryptography.”1. Diffie and Hellman’s attempts to bring cryptography into the mainstream were pathbreaking to make transactions over the internet secure. Both these cryptographers also showed how to create ‘Digital Signature’ and ‘Digital Certificates’.

According to the New York Times: Public-key cryptography is a data scrambling method wherein each party uses a pair of keys to publicly share the message with the intended recipient.2 The public keys are shared, and the private keys are only known to the recipient, which is used to decode the message. This is the concept behind message encryption and also the core concept, which is also the essence behind cryptocurrency.

Stanford professor of computer science and electrical engineering and co-director of the Stanford Cyber Initiative, Dan Boneh, stated, “Billions of people all over the planet use the Diffie-Hellman protocol daily to establish secure connections to their banks, e-commerce sites, e-mail servers, and the cloud.”3

1983: David Chaum and Cryptography

Contrary to the belief that cryptocurrency is a concept that is just a decade old, the history of modern cryptocurrency dates back to 1983. The foundation of digital currencies lies in the works of the cryptographer David Chaum.

David Chaum is a US-based cryptographer and computer scientist. He was one of the biggest proponents of privacy-preserving technologies as well as cryptography.

His 1981 paper, “Untraceable Electronic Mail, Return Addresses, and Digital Pseudonyms,” was the foundation stone for anonymous communications research.4 Also, Chaum’s 1982 dissertation “Computer Systems Established, Maintained, and Trusted by Mutually Suspicious Groups” is known as the first proposal for a blockchain protocol.5 In the same year, Chaum also founded a major institution for research and development of digital cryptography, the International Association for Cryptologic Research (IACR).

1982 also saw Chaum publishing Blind Signatures for Untraceable Payments, in which he presented a standardized system for encrypting payments mathematically.6 This system was the base for digital cash as it enabled anonymous payments. It also implies that in a two-party transaction, the payer is untraceable by banks and the government.

David Chaum is also known for developing an electronic cash application with a transaction system called eCash in 1989. This digital currency aimed to ensure the user’s anonymity and invent various cryptographic protocols such as the blind signature, mix networks, and the dining cryptographers protocol.

Another form of digital currency known as DigiCash followed eCash in 1995.50 Even DigiCash was based on the same principle as its predecessor, eCash. DigiCash was one of the earliest electronic money companies. The critical element of DigiCash and the present-day cryptocurrencies is that the transactions were anonymous and conducted over a public network. The ‘cryptocurrency’ wasn’t officially a term until 1990. However, Chaum’s work in this space established well-structured frameworks for future developments in the cryptocurrency market.

By 1995, DigiCash entered into partnerships with the Mark Twain Bank in St. Louis (now Mercantile Bancorporation). In 1996, the company also struck a deal with Deutsche Bank, Credit Suisse, the Australian bank Advance Bank, Norske Bank, and the Bank Austria. DigiCash conducted business for just a few years, and it couldn’t impress the banks with its technology. As a result, there was a low adoption rate among the banks. He also failed to enter into partnerships with major banks as well as significant technology players. DigiCash was unable to live up to the expectations, and experts believe that Chaum’s perfectionism is to blame for that. The company eventually filed for bankruptcy in 1998.

1997: Adam Back’s “Proof of Work”

In 1997, British cryptographer and cypherpunk Adam Back invented Hashcash, which uses a “proof of work” system to restrict email spam and denial-of-service attacks.7 More recently, it is also the technology that has facilitated Bitcoin mining. Adam Back also promoted satellites and mesh networks to broadcast and receive bitcoin transactions as a backup for the traditional internet.

Besides, Back was also a pioneer in describing the “non-interactive forward secrecy security” property for email. He also stated that any identity-based encryption scheme could also be used to offer non-interactive forward secrecy.

1998: The Origin of B-money and B Gold

The concept of decentralizing currencies is also not new. In 1998, Wei Dai and Nick Szabo, two cryptocurrency enthusiasts, published ideas exploring the prospects of decentralizing currency. Both of them envisioned that digital currency would replace the conventional financial system one day. The regular payment activities through traditional currencies would be conducted through virtual currencies.

While they could not implement their ideas as they planned, both Dai and Szabo conducted in-depth research and laid the early framework for what came to be known as Bitcoin after a decade.

In November 1998, Wei Dai published a proposal for an anonymous, distributed electronic cash system “b-money” on the cypherpunks mailing list. In this proposal, Dai explained two methods to execute his system. As per the first mode, he used Proof of Work (PoW) to create money.8 B-money could also leverage the power of Hashcash to undertake its mining.

Hashcash is a technology that prevents spam on the network. However, this design was not so pragmatic due to the lack of synchronized channels worldwide.

The second proposal was about leveraging a subset of servers for maintaining the accounts. These servers were also meant to verify, publish, and manage transactional information. The participants who carried out the transactions as a part of that network could verify their balances through the same network. The concept was very similar to how Blockchain operates today.

After Wei Dei’s B-Money, Nick Szabo created “bit gold.” Like the current cryptocurrency framework, bit gold was an electronic currency system that called for users to complete a proof of work function with cryptographic solutions being.9 Proposed in 1998, bit gold was one of the first attempts at designing a decentralized virtual currency.

Bit gold combined varied elements of cryptography and currency mining to achieve decentralization. These elements include time-stamped blocks stored in a title registry which the proof-of-work (PoW) strings generate. Szabo aimed to implement a decentralized PoW function stored, transferred, and handled with minimal trust.

There are striking similarities between Bitcoin’s framework and the proposal for bit gold, particularly the technical aspects that are aimed at firming the decentralized network. This process for recording transactions to the network is very similar to Bitcoin and bit gold. Both Bitcoin and bit gold use a Byzantine Fault Tolerant (BFT) peer-to-peer network for implementing the POW function. A cryptographic hash chain is also created to validate blocks of transactions.

2008-2009: Satoshi Nakamoto and the Birth of Bitcoin

On October 31, 2008, an undisclosed “Japanese entity,” Satoshi Nakamoto, published a widely-circulated whitepaper called the Bitcoin – A Peer to Peer Electronic Cash System, unraveling the potential of cryptocurrency.13 Nakamoto also conducted one of the first cryptocurrency transactions with Bitcoin. Before the release of this whitepaper, the domain name bitcoin.org was registered on August 18, 2008.

Satoshi Nakamoto is also the inventor of the blockchain network, which is the underlying technology behind Bitcoin and many other cryptocurrencies. The Bitcoin Foundation calls Blockchain a “triple-entry” bookkeeping system. This is because each time there’s a new transaction, the sender, receiver, and a third party need to confirm and agree on the trade. Being a decentralized platform means there is no single administrator. Instead, there is a public ledger of transactions that can be stored on any computer.

2008: Hal Finney and the Reusable Proof of Work

Following the work of Dai and Szabo, Hal Finney, an alumnus of the California Institute of Technology, created a currency system based on a reusable proof of work.10 Hal Finney was one of the early contributors of Bitcoin, a cypherpunk, and a computer scientist at PGP Corporation.

In 1991, Finney began to contribute to cryptographer Phil Zimmerman’s Pretty Good Privacy software project. Zimmerman later founded the PGP Corporation based on the software in 1996, where Finney became one of its first employees.

Finney’s first reusable proof-of-work system (RPoW) was derived from Adam Back’s Hashcash, which he wished to incorporate in a digital currency system. Bitcoin using a similar decentralized peer-to-peer version of RPoW makes it the first widespread adoption of the system.

Finney operated two remailers or servers which receive messages and send them to recipients on the grounds of anonymity. He also regularly participated in the cryptography mailing list through which the unknown entity, Satoshi Nakamoto, made the first announcement of bitcoin in 2008.11

While others were skeptical about Nakamoto’s idea, Finney saw a lot of potential in it. He began to operate the Bitcoin software days after its release and was one of the few besides Nakamoto.12 Finney was the recipient of the first Bitcoin testnet transaction: 10 bitcoins sent by Nakamoto on January 12, 2009.10

2009: The Launch of Blockchain

Bitcoin used SHA-256, a cryptographic hash function, as its proof-of-work scheme. In the same year, the Bitcoin software was made available to the public for the first time, and its mining officially began. Cryptocurrency mining is the process through which new digital currencies are created. It also involves the recording and verification of transactions on the blockchain. On Jan. 3, 2009, when the blockchain was launched, the first block, named the genesis, was mined.14 After about a week, the first transaction occurred.

In less than two years after the first Bitcoin was mined, miners and coders also started working on other networks such as Ethereum and Litecoin. They also began to work on the code supporting blockchain and also adapting it for diverse applications.

2010: Bitcoin Trading Begins on Exchanges

On May 22, 2010, the first public monetary bitcoin transaction was recorded by Laszlo Hanyecz. For the first time, a monetary value could be attached to a cryptocurrency.15

Hanyecz purchased two Papa John’s pizzas for 10,000 BTC, equivalent to nearly $3.8 billion today. This day set the ball rolling for an official cryptocurrency exchange market that is growing at an exciting pace. Since then, it has been celebrated annually as Bitcoin Pizza Day.

Early days saw transactions with Bitcoin being ‘negotiated’ on online forums wherein people exchanged goods and services for bitcoin.

After Bitcoin was listed on one of the first cryptocurrency exchanges, Mt. Gox, in 2010, it was simpler to trade and store it.16 Because of the exchange listing, the value of Bitcoin could also be expressed in terms of the US dollar. The total transaction value was just $0.99, while Bitcoin’s price traded at $0.04951 at that time.

Bitcoin Price History

However, Bitcoin prices are notoriously volatile. From just a few cents in 2010 to the all-time high of $20,000 in late 2017, Bitcoin came to dominate the cryptocurrency markets.

Between 2011-2013, the popular digital currency witnessed two significant booms and busts — one in 2011 and the other in early 2013.17

It was in February 2011 that bitcoin went past $1 for the first time; however, for the first few years, its price remained below $2. In June 2011, Bitcoin hit $31 and reached bubble territory before plummeting to the single-digit range.

Within the next two years, i.e., in April 2013, Bitcoin reached $266, while by November 2013, it was worth over $1,000.

In the next four years, Bitcoin price rose exponentially and touched $19,650 in mid-December 2017. Bitcoin was in bubble territory due to the surge in Initial Coin Offerings or ICOs during the period. The ICO frenzy pumped billions of dollars into the cryptocurrency market, with participants dreaming of becoming overnight millionaires. However, the bubble burst in early 2018 when the value of coins plunged drastically. What followed was a phase of uncertainty, and the market was disillusioned with cryptocurrencies overall.

However, analysts discovered that the fall of bitcoin’s value brought in a “more mature” cryptocurrency market. Innovative cryptocurrency exchanges institutional players adopting Bitcoin made for a more viable crypto market. A broader application base brought in the sense of trust, and more individuals joined in, boosting Bitcoin’s perceived value

2011: Mt. Gox Is Hacked

2011 was a dark phase in the history of Bitcoin.

Ripple’s founder, Jed McCaleb, who was the founder of another altcoin, Stellar, created the Tokyo-based Mt Gox exchange in 2010.18 He wanted to trade Magic the Gathering Cards on the exchange but later adapted it for bitcoin trading. Eventually, he sold it to Mark Karpeles in March 2011.

McCaleb had to audit MT Gox to ensure that he received a part of the sales profits over the next six months. However, in June 2011, the auditing account was allegedly hacked, and the attackers sold close to 500,000 BTC, which sent the digital currency back to pennies. The hackers thus caused damages worth $8.75 million during that attack.19

This was the most unfortunate event in bitcoin’s history. For the first time, the world sensed it was to steal bitcoins, and the general public wrote off Bitcoin as impractical. In 2014, Mt Gox faced it again when hackers siphoned off $460 million worth of Bitcoins from its accounts.19 In the same year, Mt. Gox went entirely offline, and nearly 850,000 Bitcoins vanished. Eventually, it filed for bankruptcy protection, leaving investors in the lurch.20

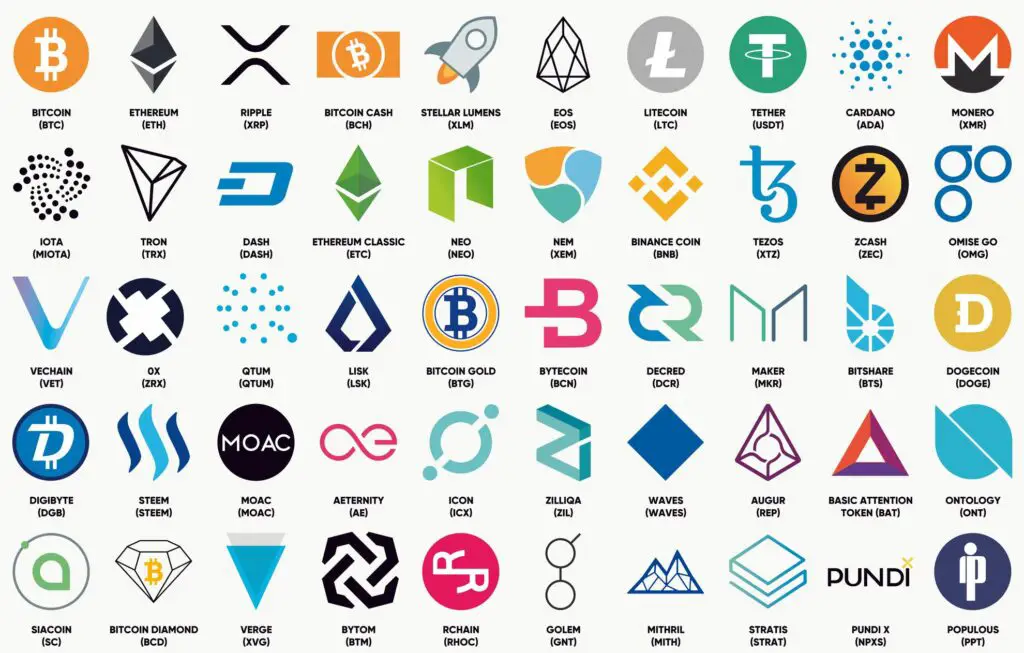

2011: The Launch of Altcoins

The cryptocurrency world is very expansive, and it is continuing to multiply. After Bitcoin’s creation in 2009, a lot of alternative digital currencies began to mushroom. Popularly they are known as Altcoins, and Andrew Chow, a developer, first coined the term.

Given the high cost and processing time of bitcoins, these altcoins are aimed at cheaper and faster transactions. They coexist with Bitcoin as competitors and offer distinguished value additions in terms of coding language, transaction processing, the basis of mining, etc. However, we cannot deny that some altcoins are just hyped and are not based on a broader use case.

The first Altcoin, the Namesake, was launched within just two years of the Bitcoin release.22 The launch of several other altcoins gained massive momentum in 2013 and 2014. With just a handful of altcoins in 2013, over 5,000 digital currencies were operating in more than 2000 markets in 2020.21 The total market cap of these virtual currencies is likely to be around $285 billion. The Bitcoin network commands close to 51% of the total market cap.

The objective behind Namesake was to replace the domain name system in a decentralized manner. Those who wish to register a domain in Namecoin need to record a transaction to the Namecoin system.22

Sometime after the launch of Namecoin, Litecoin was born. For the first couple of years, Litecoin was the second most popular currency after Bitcoin. As opposed to Bitcoin, Litecoin uses a memory-hard mining puzzle. It aimed to be GPU resistant, while Bitcoins only used GPUs after starting with CPUs.

Towards the end of 2012, Peercoin was born, and it uses Proof-of-Stake as its mining puzzle. Peercoin uses a hybrid mining system. It does start with PoW, same as Bitcoin, but at later stages, it switches to PoS, which lessens computational work. Coins acquire more stake over time as long as the miner doesn’t spend them.

Ripple was born in 2012 too, but it was conceptually different from other cryptocurrencies as it aimed to complement banking operations and not replace traditional currencies. Banks and financial services companies can use the Ripple protocol in their systems. It is possible to make payments in XRP (Ripple internal currency) on the Ripple network, and XRP transactions depend on Ripple’s internal distributed ledger. In contrast, for other virtual currencies, it is the owned amount that the ledger records.

2013: The Silk Road Scam

In 2013, another significant setback awaited Bitcoin. The price of Bitcoin plunged sharply after Ross Ulbricht, the alleged founder of Silk Road, was arrested by the FBI. Bitcoin’s price dropped from $145.70 to $ $109.76 in just a day.23

The Silk Road was allegedly an online illegal drugs marketplace hosted on the dark web from 2011 until the FBI brought it down in 2013.24 It also sold illegal weapons and fake identity proofs. The Silk Road only accepted Bitcoin as its currency because the user can remain anonymous. It did so to make it significantly harder for authorities to trace the money trail and unearth the real identities of the participants.25

2013: The Launch of Ethereum

Ethereum is the brainchild of Vitalik Buterin and Gavin Wood. Vitalik Buterin, a Russian-Canadian programmer, was involved in Bitcoin as a programmer during his late teenage years in 2011.26 He was intrigued by blockchain technology and even co-founded Bitcoin Magazine. He saw the difference between Bitcoin and the potential of Blockchain as a technology.

Buterin began to visualize things from a different perspective. He started to imagine a platform that allowed Bitcoin to explore use cases such as real estate and property. Buterin co-authored and released a white paper with eToro CEO Yoni Assia in 2013. He described the nuances of the technology based on general scripting language or Smart Contracts that eventually evolved into Ethereum.27

Ethereum is a more functional and general computation protocol that builds on the concept of Bitcoin and Mastercoin. Ethereum is based on smart contracts, which are computer programs installed on the peer-to-peer network. To operate, they “pay” the computational power through Ether, a token, which acts as a cryptocurrency as well as a contract fuel. Some examples of contracts running on Ethereum are financial markets, domain name registration, crowdfunding platforms, etc.

In 2014, Buterin, alongside other co-founders of Ethereum, launched a crowdsourcing campaign where they sold Ether, the digital currency, and raised more than $18 million.28 It was in July 2015 that Ethereum was launched with the experiential “Frontier.” Since then, the platform has grown exponentially and has the second-largest market capitalization among other cryptocurrencies, after Bitcoin.

One of the most significant propositions of Ethereum is that it supports Defi or Decentralized Finance. Defi is nothing but an ecosystem of crypto assets that eliminates the intermediaries in the financial services ecosystem.

2016: Ethereum DAO Hack

Ethereum is still experiencing teething troubles and faces some of the same issues that Bitcoin does, including security and scalability. In 2016, an anonymous hacker attacked DAO or a Decentralized Autonomous Organization which operated on the Ethereum Blockchain, and stole 11.5 million in Ether valued at around $50 million.29

After the DAO hack incident, there have been several smaller offshoots of the Ethereum community, resulting from constant adaptation and experimentation. This is in sharp contrast with the principle of immutability that we can see in Bitcoin.

Price History of Ethereum

There have been massive fluctuations in the Ether price fluctuations; however, the token’s price grew over 13,000 % in 2017 after it executed the Byzantium Blockchain software upgrade.31 Byzantium was the first version of the Metropolis, Ethereum’s second major update.

The second version was known as Constantinople, which happened in early 2019.35 Constantinople aimed to fix problems arising from Byzantium’s implementation. It also laid the initial framework for the transition from proof-of-work to proof-of-stake to significantly lower the energy consumption for Ethereum.

Ethereum’s Ether witnessed another spurt in price in 2018 due to the popularity of Initial Coin Offerings or ICOs. Over 80% of all ICOs depend on the Ethereum blockchain for virtual currency creation and issuance.32 The ICO is a crowdfunding method for the early stages of a cryptocurrency project which peaked in 2018. During that year, $7.8 billion was raised for more than 1,000 projects.3334

2017: The Bitcoin Split

In August 2017, a “Bitcoin cash hard fork” occurred, splitting Bitcoin into two cryptocurrencies: BTC and Bitcoin Cash.37 The objective behind Bitcoin Cash was to accommodate a larger block size or more transactions at a lower transaction fee as compared to Bitcoin. Despite core differences, Bitcoin Cash and Bitcoin have several technical similarities. The supply for both of them is capped at 21 million.

Some of the prominent advocates of Bitcoin Cash consider it closer to Satoshi Nakamoto’s original vision. They believe that it is better to expand the cryptocurrency’s block size to support payment service applications. The increased block size will enable faster adoption of Bitcoin Cash as a medium for daily transactions and pit it against credit card processing giants.36

In November 2018, Bitcoin Cash again underwent a fork and bifurcated Bitcoin Cash ABC and Bitcoin Cash SV (Satoshi Vision). It is the Bitcoin Cash ABC that is referred to as Bitcoin Cash now.

Onwards: Cryptocurrencies Become Mainstream

Since 2014, trading crypto has started to become mainstream. However, due to its volatility, opportunities to spend cryptocurrencies have been relatively limited.

That said, the number of leading companies accepting Bitcoin payments is on the rise. These companies allow customers to use cryptocurrencies as an official mode of payment for their goods and services.

Here are a few companies that pioneered the acceptance of cryptocurrency payments:

Microsoft: The cloud computing and software behemoth became one of the early adopters of Bitcoin in 2014. It announced that it would begin accepting bitcoin as a mode of payment for apps, games, and other digital content on Windows Phone and Xbox. The virtual currency could be added to fund the Microsoft accounts to be spent on various Microsoft services.38

However, in July 2021, Microsoft stopped accepting Bitcoin as a payment instrument due to its ‘volatility’ and ‘risk’ elements. The company hasn’t withdrawn from the cryptocurrency because customers can still add Bitcoin to their Microsoft account even though they cannot pay for digital content or apps in the cryptocurrency.39

In 2016, Xapo, a Bitcoin wallet and debit card provider, acted as a mediator in the ongoing conflict between the Argentine government and Uber for quite some time. Xapo facilitated cryptocurrency usage in the Uber app and saved the taxi services from getting blocked in Argentina.40

2017: Japan legalized bitcoin as a payment method. The country’s Financial Services Agency (FSA) officially recognized 11 companies as registered cryptocurrency exchange operators.41 These exchanges were governed by regulations to protect investors from fraudulent transactions and also support innovation in financial technology at the same time.

In the same year, Norway’s largest internet-based bank, Skandiabanken, recognized Bitcoin as an investment asset and payment system.42 The company added a new feature to link bitcoin accounts to its web bank platform. As a result, Skandiabanken customers could access their cryptocurrency accounts alongside their savings and checking accounts.

2018: In April 2018, Ripple announced its alliance with Santander Bank.43 Santander bank is one of the biggest European banks. Hence its association with the XRP technology for international money transfers boosted the value of Ripple. It is worth noting that various countries from the European Union also joined forces to cooperate on cryptocurrency regulation.44

December 2018 — One of the largest cryptocurrency payment service providers, BitPay serving in 233 countries, including the UK, Europe, Canada, and Australia, reported $1 billion in transactions processed in 2018.45 The record transactions showed that cryptocurrency had forayed into the B2C and B2B worlds. It is no longer a currency reserved only for peer-to-peer transfers between individuals.

October 2020: PayPal entered the cryptocurrency market and announced that its customers would trade Bitcoin and other virtual currencies using their PayPal accounts.47 Those virtual coins could also be used by US consumers to purchase things from the 26 million sellers who accept PayPal. The other cryptocurrencies that could be stored “directly” within the PayPal digital wallet were Ethereum, Litecoin, and Bitcoin Cash.

PayPal offered to convert the cryptocurrency into the corresponding national currency, so the recipient would only get the right amount of the fiat currencies. PayPal’s step boosted the use of digital assets in everyday commerce.

In 2020, Square purchased Bitcoin worth $170 million, representing about 5% of the company’s total assets as of the end of 2020.48 The investment was a part of Square’s commitment to assess and enhance its aggregate investment in Bitcoin compared to its other investments on an ongoing basis.

In March 2021, One of the largest automakers, Tesla, announced that it had bought $1.5 billion worth of bitcoin.49 In an SEC filing, the company stated that it bought bitcoins to maximize returns on our cash. The company also stated that it would accept payments in bitcoin for the sale of its products. The $1.5 billion worth of bitcoin that Tesla bought would give it cryptocurrency liquidity once it starts getting it for payments.

El Salvador became the first country to officially make bitcoins legal tender, effective September 7, 2021.46 The US Dollar continued to be the country’s primary currency. Still, it stated that the cryptocurrency could be used for any transaction that businesses would accept unless they don’t have the technological support needed to do the transaction.

The Botton Line

Over the last few years, we have witnessed significant developments and achievements in the crypto trading space. However, one of the most important achievements has been the proliferation of digital currencies and their widespread adoption. Many countries have even begun to legalize it.

The governments and the regulatory bodies are working through cryptocurrency regulation, but there is still a long way to go until it’s mainstream like forex or equity trading.

Nonetheless, there is still a lot of promise with the cryptocurrency revolution. While the consensus is that it’ll revolutionize the world of finance, it’s tough to see exactly how just yet.

Sources: 1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16, 17, 18, 19, 20, 21, 22, 23, 24, 25, 26, 27, 28, 29, 30, 31, 32, 33, 34, 35, 36, 37, 38, 39, 40, 41, 42, 43, 44, 45, 46, 47, 48, 49, 50