Are you ready to hop into the world of high-stakes investing and uncover the secrets behind one of Wall Street’s most successful figures? Meet David Einhorn, the mastermind investor who has built a reputation for his ability to spot opportunities and risks in the market. With a career spanning over decades, Einhorn’s journey and investment strategies have been the subject of much admiration.

In this must-read article, we’ll delve into the life of this financial wizard, exploring his humble beginnings, his meteoric rise to success, and the unique investment strategies that have earned him a place among the greats. Discover how Einhorn’s razor-sharp instincts have led to his remarkable achievements, and learn how to apply these valuable insights to your investing career.

So, if you’re looking for success similar to David Einhorn, don’t miss out on this opportunity to learn from the best. Read on and unlock the secrets to a prosperous financial future!

David Einhorn’s Background and Early Life

Born in New Jersey in November of 1968, David Einhorn was destined for financial greatness from the get-go. His father founded and presided over Einhorn & Associates, a consulting firm, and Capital Midwest Fund, a venture capital powerhouse.

Growing up, David absorbed the value of hard work and the secrets to achieving monetary triumph. Einhorn even learned financial wisdom from his Grandpa Ben, who shared insights on the gold standard and the prospect of inflation in the markets.

Of course, David’s education also played a significant role in shaping his illustrious career. At the tender age of seven, David’s family whisked him away to Wisconsin, where he attended Nicolet High School, graduating in 1987 with flying colors.

Eager to continue his education, Einhorn pursued a Bachelor of Arts degree at the prestigious Cornell University, graduating summa cum laude in 1991. During his time at Cornell, Einhorn continued to relentlessly pursue knowledge and hone his financial skills. These educational achievements set the groundwork for his future career and success as an investor and entrepreneur.

David Einhorn’s Career Achievements

Now let’s take a look at David Einhorn’s crowning career achievement: the establishment of Greenlight Capital!

The Birth of Greenlight Capital

In 1996, the ambitious and visionary David Einhorn, alongside his partner Jeffrey Keswin, embarked on a mission to revolutionize the investment world. With a mere $900,000 in seed capital, they launched the trailblazing hedge fund Greenlight Capital.

This firm’s investment philosophy involves seeking out undervalued companies with robust fundamentals and investing in them for the long haul. Furthermore, Greenlight Capital is renowned for its bold short-selling strategy, betting against overvalued companies or those with dubious business practices.

This ingenious blend of long and short positions propelled Greenlight Capital to deliver jaw-dropping returns in its early years, rapidly cementing Einhorn’s status as a wise investor. By 2000, the fund’s assets under management had soared to over $300 million.

Now let’s look at some shining examples of Greenlight Capital’s thrilling victories!

Taking on the Lehman Brothers

The firm’s legendary short position against Lehman Brothers in 2008 is one for the history books. He sounded the alarm on the investment bank’s excessive leverage and precarious investments months before its downfall, earning himself and the company massive profits.

Going Against Green Mountain Coffee Roasters

Another remarkable short position was against Green Mountain Coffee Roasters in 2011, where Einhorn exposed the company’s questionable accounting practices and cast doubt on its growth potential, triggering a steep plunge in its stock price.

Einhorn’s unwavering faith in his investment approach and adaptability has allowed the fund to rebound and persist in delivering outstanding returns for its investors.

Greenlight Capital Historical Performance

Greenlight Capital boasts a remarkable legacy of success, delivering awe-inspiring annualized returns for years. Yet, like any titan in the investing realm, the fund has also weathered its share of underperformance storms.

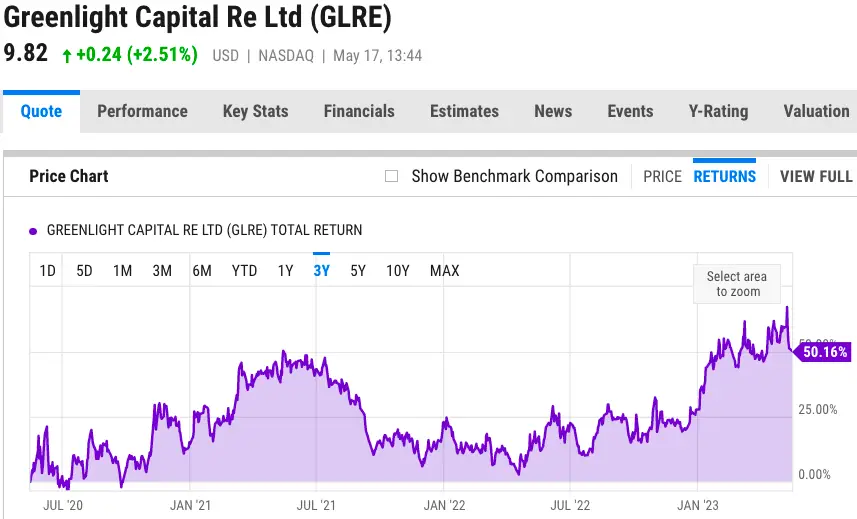

The following chart shows Greenlight Capital’s historical performance over the last three years:

Image Source: YCharts

As you can see, the fund’s journey has been a rollercoaster ride, with periods of both strong and weak performance. However, over the long term, the hedge fund has generated impressive returns for its investors and continues to grow.

Unraveling the David Einhorn Investing Strategy

Let’s discuss Einhorn’s core investment strategies that have skyrocketed his bank account and contributed to the success of his hedge fund!

Embrace the Long-Short Equity Strategy

David Einhorn’s successful long-short equity strategy is a masterclass in striking the perfect balance between potential gains and losses. By taking both long and short positions, Einhorn profits from the rise and fall of stock prices while mitigating risk. Here’s how it works!

When Einhorn spots undervalued stocks, he pounces, taking a long position. He buys shares of these hidden gems and waits for their prices to soar over time.

For instance, in 2020, Einhorn struck gold with his long position in homebuilder Green Brick Partners. The market had underestimated this company’s worth, but Einhorn’s keen eye saw its potential. His investment paid off, as the stock price grew by over 100% within a year.

Conversely, Einhorn also identifies overvalued stocks and takes short positions. In this daring move, he sells shares he doesn’t own, expecting the stock price to plummet. If the stock price does nosedive, he can buy back the shares at a bargain price and pocket the difference.

However, Einhorn’s high-stakes balancing act between long and short positions is not without its challenges. Timing is everything, as entering or exiting a position too early or late can lead to painful losses. Additionally, the market environment can impact the performance of the long-short equity strategy. For example, short positions may falter during a bull market, while long positions may flounder in a bear market.

So before diving into the world of long-short equity strategies, make sure you’re armed with a rock-solid grasp of the market and a razor-sharp intuition for valuing stocks!

Deep Dive into Value Investing

This brings us to value investing: a powerful strategy created by the famous Benjamin Graham that uncovers hidden gems in the stock market. It’s all about seeking out undervalued stocks, buying them low, and holding on tight until they reach their true potential. David Einhorn, a master of this craft, has amassed a fortune by pinpointing these diamonds in the rough and profiting from their rise.

But what’s the secret? It’s all about intrinsic value – an asset’s genuine, underlying worth. Imagine peering into the future and estimating a company’s cash flow, then bringing that value back to the present day. That’s intrinsic value.

When a stock is trading below its intrinsic value, it’s like finding a treasure chest buried in the sand. Value investors like Einhorn know that, eventually, the market will wake up and see the true worth of these stocks, sending their prices soaring and rewarding those who bought in at a steal.

Take David Einhorn’s notable investment in General Motors (GM) as an example. In 2017, he unveiled that his firm, Greenlight Capital, held a significant stake in the automaker, convinced that the stock was a hidden gem. And, boy, was he right!

Since Einhorn’s investment, GM’s stock price has climbed, proving his value investing expertise. Sure, the stock has had its ups and downs, but overall, it’s been on an upward trajectory, delighting patient value investors who knew its intrinsic value all along.

So, the next time you’re sizing up a potential investment, ask yourself: is it trading at a discount to its intrinsic value? If the answer is yes, you might just have found the key to unlocking massive profits.

Predict Market Bubbles

Ever been curious about how certain investors possess an almost supernatural ability to spot market bubbles (i.e., Jeremy Grantham the Bubble Hunter)?

Well, famed investor David Einhorn has made a fortune doing just that, and his secret recipe for success is simple: relentless research and the patience to wait for the perfect moment.

Einhorn’s firm, Greenlight Capital, devotes tireless hours to dissecting financial statements and delving deep into the inner workings of companies that catch their eye. They hunt for signs of overvaluation and other warning signals that a bubble might be brewing. Once they’ve pinpointed a potential bubble, they bide their time. And wait. And wait even more. Timing is everything, and Einhorn knows that bubbles can take a long time to burst.

Finally, when the stars align and the moment is just right, David Einhorn employs his short-selling strategy to rake in profits as the overvalued stock plummets. Ultimately, this maneuver requires a rock-solid understanding of how to value stocks accurately and master the art of shorting, so remember to do your homework!

Stay Within the Margin of Safety

Investing always comes with a level of uncertainty. No one can predict the future; even the most well-researched investment decisions can go awry. That’s where the margin of safety swoops in to save the day. By investing only in stocks or assets with a significant margin of safety, investors can shield themselves from the wild twists and turns of the market.

David Einhorn has a thoughtful approach to determining a sufficient margin of safety. He firmly believes in the power of thorough research and analysis, where he zeroes in on a company’s:

- Financial statements

- Industry trends

- Price-to-value-ratio

- Discount rate

- Market volatility

- Regulatory changes

Ultimately, David Einhorn only invests in stocks with a sky-high margin of safety and a low-risk profile. A prime example of Einhorn’s genius margin of safety approach is his investment in Apple Inc. (AAPL). In 2016, Einhorn’s hedge fund Greenlight Capital (along with investing genius Warren Buffett) snapped up a significant stake in Apple, pointing to the company’s undervalued stock price and promising growth prospects.

At the time, Apple’s stock was trading at a price-to-earnings ratio far below the industry average. This provided a substantial margin of safety, which has since paid off handsomely as Apple’s stock price has more than doubled.

The Importance of Deep Research

Of course, researching a company goes far beyond calculating its margin of safety. Einhorn’s investigative process is both exhaustive and precise, honing in on the critical aspects of a company’s business model. This pivotal step empowers him to pinpoint the essential drivers of a company’s triumphs and potential vulnerabilities.

We’ve already delved into how David Einhorn scrutinizes a company’s financial records, so let’s dive headfirst into his approach to finding competitive advantages.

Finding a stock’s competitive advantage requires an examination of the competitive landscape and a thorough understanding of its position within the industry. Einhorn investigates the company’s primary competitors and evaluates their strengths and weaknesses.

Moreover, Einhorn places importance on a company’s management team when conducting his research. After all, a company’s success hinges on the people steering the ship. He assesses the management team’s track record, aptitude for executing the business plan, and overall compatibility with the company.

By conducting comprehensive research and analysis, Einhorn has consistently made intelligent investment decisions, resulting in a substantial boon for his hedge fund and bank account.

Active Management and Frequent Trading

David Einhorn boasts yet another brilliant strategy for maximizing returns in the stock market: frequent trading!

Frequent trading, as the name implies, consists of making multiple trades within a short time period. This savvy approach allows investors like Einhorn to seize opportunities from market fluctuations and short-term trends, boosting their chances of reaping profits.

Key elements of frequent trading include:

- Lightning-fast decision-making

- Robust risk management skills

- Deep market knowledge

Einhorn’s frequent trading tactic meshes seamlessly with his long-short equity strategy. This powerful combo offers a diversified portfolio, reduced risk, and amplified returns.

To master this approach, David Einhorn advises staying abreast of market news, trends, and analysis to pinpoint opportunities and make well-informed decisions. Investors must be decisive, as frequent trading demands swift decision-making and a readiness to adapt to ever-changing market conditions.

Maintain a Concentrated Portfolio

According to Business Insider, David Einhorn maintains a highly focused portfolio (just like the legendary Bill Ackman), with his top five stocks often accounting for 30-60% of his investments. While he dabbles in various industries to spread his assets and minimize risk, Einhorn firmly believes in putting his eggs in just a few carefully chosen baskets.

Why? Because uncovering the stocks with the most exceptional potential is no easy feat, and it’s wiser to pour all your energy and time into discovering these hidden gems.

As we know, this demands extensive research into a company’s fundamentals. And if you’re juggling a jam-packed portfolio, there’s simply no way you can conduct thorough market research for each stock or actively manage every single investment or trade.

So, take a leaf out of Einhorn’s book and keep your focus sharp – your portfolio will thank you for it.

Einhorn’s Track Record and Reputation: A Critic of Wall Street Excesses

A Powerhouse Performance

The proof is in the pudding! Since its birth in 1996, David Einhorn’s Greenlight Capital has been a true investment juggernaut. With a jaw-dropping average annual return of 16.5%, it’s clear that Einhorn knows a thing or two about making money.

Let’s put that into perspective: the S&P 500 Index has only managed to muster an average annual return of around 10% over the same period. That means Greenlight Capital has consistently outshined the market by a considerable margin!

Taking on Wall Street

But Einhorn isn’t just known for his awe-inspiring investment prowess; he’s also revered for his fearless critiques of Wall Street’s excesses. He’s made a name for himself by calling out companies for accounting fraud and unethical behavior, earning him a well-deserved reputation as a guardian of corporate America.

Case in point: in 2002, Einhorn accused Allied Capital, a private equity firm, of accounting fraud. His allegations were later proven correct, and the company was slapped with a hefty fine by the SEC.

Einhorn’s critiques have profoundly impacted the investing community and Wall Street culture. His calls for greater transparency and accountability have struck a chord with countless investors who are fed up with corporate greed and shady behavior.

Learning from David Einhorn: Recommended Resources

Still craving insider knowledge on David Einhorn’s game-changing investment strategies? Look no further, because we’ve got you covered!

Einhorn’s Must-Read Book

Check out Einhorn’s gripping book, “Fooling Some of the People All of the Time.” Dive headfirst into Einhorn’s brilliant mind as he takes you on a thrilling journey, unmasking the deceptive practices of Allied Capital – the company he believed was entangled in a web of fraud and deceit.

But why bother checking this book out? Well, since hitting the shelves in 2008, “Fooling Some of the People All of the Time” has sent shockwaves through the investment community. This eye-opening exposé has not only heightened awareness of financial fraud but also sparked regulatory reforms and emboldened whistleblowers to step forward and shine a light on the murky underbelly of the financial sector.

Einhorn’s Auditory Gems

But if you’re not an avid reader, no worries! David Einhorn has also appeared on numerous podcasts, including Invest Like the Best with Patrick O’Shaughnessy. Here, he delves into his thrilling evolution as an investor and shares priceless insights to investors looking to follow in his footsteps.

And for an extra dose of inspiration, catch Einhorn’s captivating interview with Bloomberg Television, where he unveils his value investing strategy and offers expert investing advice.

So don’t wait; dive into these resources to expand your knowledge and spark your passion for investing!

The Influence of David Einhorn on the Investing Community

Prominent Investors Inspired by David Einhorn

Let’s dive deep into the world of investors who utilize David Einhorn’s investment strategies to achieve unparalleled success:

- Bill Ackman: As the founder and CEO of Pershing Square Capital Management, Bill Ackman is renowned for his bold, high-profile bets and short-selling strategies, much like the legendary David Einhorn.

- Whitney Tilson: The brilliant mind behind Kase Capital Management, Whitney Tilson is celebrated for her value investing prowess and insightful market commentary. As a mentee and close friend of Einhorn, she embodies a similar investing spirit.

- Guy Spier: Steering Aquamarine Capital Management as its founder and managing partner, Guy Spier is a value investing virtuoso who channels David Einhorn’s approach in his quest for promising stocks.

Einhorn’s Dedication to Philanthropy

David Einhorn is renowned not just for his investment genius, but also for his dedication to giving back to society. One of his most notable philanthropic endeavors is the Einhorn Family Charitable Trust (EFCT). Established in 2002, the trust’s inspiring mission is to “help people get along better.”

The EFCT’s primary focus lies in education and youth development. By cultivating empathy and social skills in children, the trust aims to empower them to become compassionate and responsible adults, making the world a better place.

Another significant cause close to Einhorn’s heart is the Michael J. Fox Foundation for Parkinson’s Research. As a generous contributor and active board member, Einhorn is committed to supporting the foundation’s vital mission: finding a cure for Parkinson’s disease and enhancing the lives of those affected by it.

But that’s not all! Einhorn also serves on the board of the Robin Hood Foundation to help eradicate poverty in New York City and provide equal opportunities to people of all incomes.

Of course, this investing guru’s benevolence goes beyond his philanthropic trusts and foundations. For example, in 2006, he participated in the World Series of Poker main event and donated his winnings—over $650,000—to charity.

By championing empathy, kindness, and cooperation, Einhorn inspires fellow investors and contributes to a more compassionate and inclusive world for all.

Conclusion

In conclusion, David Einhorn’s life and investment strategies are an inspiration for investors seeking long-term success in the volatile world of finance. His long-short equity strategy, commitment to value investing, and active management style have been the bedrock of his impressive achievements.

By adhering to core principles such as thorough research, patience, and a willingness to challenge conventional wisdom, investor David Einhorn has carved out a reputation as one of the most respected investors of his generation.

Ultimately, David Einhorn’s life and investment strategies demonstrate that, with determination, intelligence, and a commitment to one’s core principles, it is possible to navigate the complex world of finance and emerge as a successful investor. His story is a powerful reminder that in the world of investing, patience, persistence, and a strong belief in one’s convictions can indeed pay off.