Global Tactical Asset Allocation (GTAA) is an investment strategy powered by global macro and quantitative research. GTAA primarily invests across asset classes and geographies, leveraging diversification and sophisticated risk management to generate alpha even during volatile conditions.

This article will get into how a GTAA strategy works and how it will perform in the future.

What Is Global Tactical Asset Allocation?

The Global Tactical Asset Allocation (GTAA) is a strategy that aims to identify and capitalize on the inefficiencies between regions, markets, countries, and sectors, leveraging a top-down global macro investment approach.

The rationale behind the Global Tactical Asset Allocation investment strategy is discretionary and driven by fundamentals, but it is backed extensively by quantitative research. The GTAA invests across global asset classes, such as stocks, bonds, currencies, and commodities. The primary objective of global tactical asset allocation is to deliver alpha via asset allocation and diversification instead of just individual security selection.

GTAA investment strategy is flexible across several dimensions and allows managers to dynamically shift the portfolio across various asset classes and instruments. This tactical allocation aims to deliver enticing risk-adjusted returns and simultaneously manage risk and control drawdowns.

Most Global Tactical Asset Allocation funds adopt various strategies ranging from global macro to thematic and multi-asset investing for portfolio management. They focus on significant macroeconomic and structural transformations that lead to inefficiencies and risk/ reward opportunities.

Origin Of Global Tactical Asset Allocation

The 1980s and 1990s were bull markets. Pension funds enjoyed high equity returns and believed the markets would go up forever. The European pension funds did not opt for GTAA and focused excessively on plain equities.

In the late 1980s, GTAA began to be used by the US pension funds to reap advantages from the new opportunities in the emerging nations and the increasing popularity of the global asset classes. The increase in market liquidity and growth of the foreign futures market also boosted the popularity of the GTAA strategy.

In 1990, Fischer Black and Robert Litterman developed the Black-Litterman model at Goldman Sachs to address common portfolio managers’ issues.1 The model’s asset allocation based on “Universal Hedging” defined the global market equilibrium and strengthened the foundation of the Global Tactical Asset Allocation.

Things were going well until the stock market crash of 2000. The approach to allocating assets only to equities backfired, and investors desired excess returns. This was when hedge funds and GTAA garnered much attention from institutional investors and fund houses.7

Investors sought more global diversification, which was challenging to achieve without professional guidance. As some people understood the importance of tactical selection between asset classes and alpha, more GTAA products were launched.

Advantages Of GTAA Over Traditional Allocation

Propagated by William Fouse of Wells Fargo in 1976, Tactical Asset Allocation or TAA garnered much attention in the 1980s. Traditional tactical asset allocation was used to add value through market timing but was largely unsuccessful. Here’s how GTAA overcomes this weakness of the conventional asset allocation:

1 – Vast Investment Universe

Grinold and Kahn’s “fundamental law of active management states that the potential information ratio for an investment approach rises when there are more possible independent decisions involved.

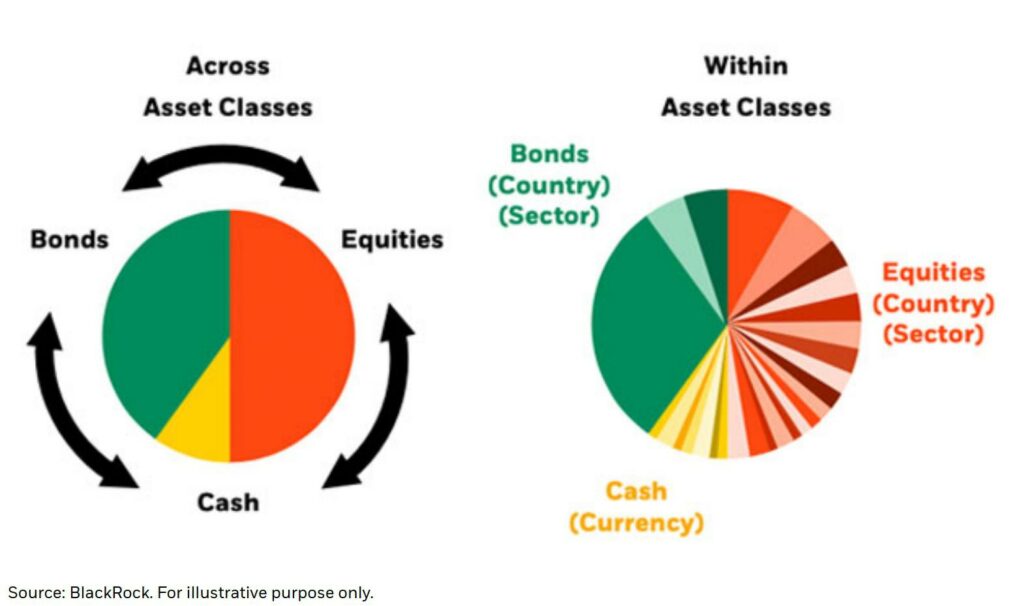

The traditional method requires allocation decisions across a few simple asset classes (equities, bonds, cash) and regions like the United States, Canada, or Europe. On the other hand, GTAA vastly increases the number of possible allocation decisions.

2 – Lower Trading Costs

GTAA is best implemented using liquid derivative instruments such as futures and forward contracts because it is available in most major markets and asset classes. The size of futures contracts is significantly larger than an average stock, but the commission on trading liquid futures is less than 10% of the equity trading commission.7

Also, the bid/ask spread on futures is lower, and so is the market impact of the trades. This means that the total cost of trading in liquid futures is generally just about 25% of the cost of similar trading in the physical markets.

3 – Increased Execution Speed

Traditional asset allocation often involves a committee with representatives of various asset classes, resulting in overanalysis. It is challenging to reach a consensus, and the focus is seldom on achieving alpha.

On the contrary, in GTAA, the investment manager is wholly focused on the research and decision-making process necessary to generate extra returns.2 Most successful GTAA portfolio managers include several uncorrelated elements, such as independent execution teams or autonomous quantitative models. This can be a benefit assuming the investment view isn’t myopic.

Drawbacks Of Global Tactical Asset Allocation

1 – Manager Risk

GTAA strategy relies heavily on the expertise of a single manager, which makes it slightly risky. Any misjudgment or miscalculation by the manager could prevent the portfolio from delivering excess returns.

2 – Foreign Market Risk

Secondly, a manager who doesn’t know a foreign market as much as their local market would not be able to design an effective GTAA strategy.

3 – Replication Difficulty

GTAA can be challenging to implement as an actively managed strategy, and new investors often have to depend on skilled managers to use GTAA.

How Is GTAA Implemented?

According to the Hedge Fund Journal, a typical GTAA process comprises four main independent approaches to trading over 40 assets3:

- Asset class selection: At this stage, the fund managers plan the positions, long or short, in global stocks, global bonds, and cash. The portfolio’s global stocks or bonds distribution replicates the world indices and is not weighted as per market capitalization. The components may be equally weighted or can also be based on the nation’s GDP.

- Stock country selection: This approach compares the performance of the stock markets of one country to each other resulting in a dollar-neutral long-short portfolio of global stocks.

- Bond country selection: The funds also follow a similar approach for international bonds. They compare the bond markets of various countries and construct an optimal portfolio for tactical allocation.

- Tactical currency allocation: The manager then recommends long and short positions in currencies to add up to zero. Some of the factors considered during tactical currency allocations are the ratio of weightage between international and domestic exposure, the quantum of currency volatility, the impact of volatility on the returns, and the investors’ expectations over long-term currency returns.

Sometimes emerging markets are also added to the mix. According to Hedge Fund Journal, up to 13 developed equity markets, 7-8 bond markets, and 9-10 currencies can be comfortably traded without extending the capacity.3 These global relative-value decisions form the core principle of GTAA and distinguish itself from traditional market timing. GTAA is offered to institutional investors in funds with various underlying assets, managed accounts, total return swaps, or structured notes. GTAA is associated with a rebalancing strategy to lower accidental asset class risk in the portfolio.

GTAA products are usually driven by quantitative models based on various factors, which could be fundamental, technical, or both. These factors help detect the magnitude of mispricing prevailing in the financial markets. After this, an optimizer uses this information to design an optimal portfolio.

Besides, there are also plenty of formalized and systematic risk management procedures involved that help mitigate market risk, equity risk, and interest rate risk. Leading GTAA houses have strong teams of researchers who specialize in quantifying inefficiencies and constructing optimal portfolios. The responsibilities of the researchers are not just confined to model development; executing the strategies well is pretty much as necessary.

Several managers look at Sharpe’s ratio when evaluating GTAA approaches. Many consultants and advisors oppose using the Sharpe ratio because they reason that upside volatility is of no importance to investors who are more concerned with downside risk.

Though the Sharpe ratio doesn’t distinguish between upside and downside volatility, experts have observed the occurrence of volatility clusters in markets. Some days of the largest market uptrends are immediately followed by days of extreme downtrends.

Thus, several portfolio managers prefer to use Sortino’s ratio, Calmer’s ratio, or Pain ratio to evaluate the asset allocation approaches as they are more suited to accounting for downside risks.

What Are The Main Strategies Involved In GTAA?

The contemporary global tactical asset allocation program mainly comprises two separate strategies:1 Strategic rebalancings and2 overlay (capturing excess returns). This also results in a better information ratio.

The strategic rebalancing element removes any unintentional asset allocation risk caused by the value of underlying portfolio holdings moving away from the strategic benchmark due to differences in asset class returns.

It can also be caused due to changes in asset valuation, cash holdings, and currency deviations from stock selection. Other factors include unintentional country deviations within underlying stock/bond portfolios, manager of benchmark transitions, and contributions to and redemptions from the portfolio.

On the other hand, the overlay element of the GTAA program captures excess return through well-planned, advantageous, long, and short positions in several asset classes and countries.

Benefits Of Global Tactical Asset Allocation

1 – Ideal for managing risk and reducing volatility

GTAA is best suited for highly turbulent markets. Investors seek unconventional investment strategies to lower risk and volatility while offering positive returns. GTAA strategy provides the potential to create wealth in a constantly changing market environment by being adaptable enough. In a nutshell, it is risk management and volatility reduction while aiming for attractive returns.

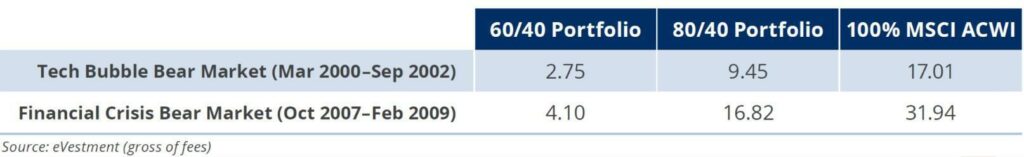

According to an analysis by Balentine, a Portfolio Management Company, GTAA strategies have historically performed best in severe bear markets like the subprime crisis and the tech bubble.

2 – Flexible Implementation

The strategy invests in many global asset classes through exchange-traded funds (ETFs). The assessment and valuation of global equity, bond, currency, and commodity markets are backed by fundamental and technical market research to achieve optimal weighting of asset class investments.

A single asset class benchmark does not limit the allocations. They are dynamically adjusted, allowing for flexible active allocation across assets based on the opportunities and risks of the prevailing market environment. This strategy aims to deliver attractive risk-adjusted returns while preserving capital during high-risk environments and limiting drawdowns.

3 – Safeguards Against SCCARS Risk

It is necessary to diversify to avoid Single Country, Single Currency, Single Asset Risk (SCCARS), a term used by CEO Shankar Sharma of India-based First Global Portfolio Management Company. Just buying a single country ETF could lead investors to more significant problems. The GTAA strategy helps investors diversify globally across markets, asset classes, and currencies and generate alpha even in volatile situations.

Difference Between Strategic Asset Allocation (SAA) And GTAA

Strategic Asset Allocation | Global Tactical Asset Allocation | |

|---|---|---|

| Objective | Strategic asset allocation primarily focuses on constructing “efficient” portfolios that maintain the optimal mix between different asset classes to maximize returns for a given level of risk. | Global Tactical asset allocation capitalizes on the mispricings between different markets to create a portfolio with a mix of assets according to an investor’s risk tolerance. |

| Importance | Strategic asset allocation aligns the asset mix with its long-term investment goals and objectives. | Global tactical allocation potentially amplifies returns, reduces portfolio risk, and enhances diversification. It caters to immediate and shorter-term horizons and is highly flexible. |

| Process | Strategic asset allocation establishes allocation targets for each component of the portfolio component (stocks, bonds, and other asset classes). Principal inputs include risk tolerance, investment goals, and time horizon. | Tactical asset allocation actively shifts portfolio allocations to take advantage of market trends, economic conditions, or inefficiencies in asset classes or investments. |

| Applicability | Strategic asset allocation is a practical approach, but it requires that investors be consistent in the process. Strategic Asset Allocation can be challenging in volatile market environments. | Tactical asset allocation works by actively rebalancing portfolio allocations to capitalize on market trends and generate alpha even in volatile market conditions. |

How Do Various Fund Houses Implement Global Tactical Asset Allocation?

Nowadays, leading institutions offer GTAA funds in different forms. Some of these funds are customized for investors, while others have standardized offerings.

| Name of the Fund | Strategy |

|---|---|

| Northern Trust | The fund invests primarily in shares of underlying mutual funds and exchange-traded funds (“ETFs”). The asset allocation model is adjusted depending on changing market conditions. The fund invests significantly in companies presented in diversified foreign indices.4 |

| Blackrock | The strategies of BlackRock’s Global Tactical Asset Allocation (GTAA) strategies were highly diversified. They invested across a vast opportunity of global equities, bonds, and currencies, taking positions across multiple geographies and time horizons. 5The fund has a data-driven approach that incorporates discretionary and systematic processes. It also diversifies to the broad market, security selection, and factor returns. |

| Morgan Stanley | Morgan Stanley applies a global macro and thematic approach to multi-asset class investing. The focus remains on major macroeconomic shifts and structural transformations, which leads to asymmetric risk/ reward opportunities.6Instead of individual security selection, the fund invests in opportunities at the asset class, country, sector, and thematic levels. |

The Bottom Line

The global tactical asset allocation evolution has seen a growth in asset class coverage over the past two decades. During the tech bubble in 2000, asset allocation was concentrated in stocks and government bonds. However, early 2000 saw several new opportunities that included emerging market stocks, regional bonds, and broader sector coverage.

This expanded to various investing strategies, including multi-asset class and FX strategies. It also comprised the G10 developed currencies and emerging markets, and commodities. The global tactical asset allocation process covers all primary equity, commodity, and currency markets designed to identify mispriced opportunities.

2020, the year of the pandemic, was a test of resilience for the asset management industry, just like other business sectors. It has completely altered the investment landscape. In the post-pandemic world, we can see that some of these alterations would permanently redefine the way the asset management industry functions. The fund managers would have to be extra cautious in selecting the asset universe and consider the market, liquidity, forex, and credit risks.

Besides, the world is constantly evolving, and fund houses adopting the GTAA strategy will likely employ technology for advanced risk management, asset allocation, and portfolio construction. Artificial intelligence (AI) and machine learning will play a significant role in the future of asset management.

Global Tactical Asset Allocation is all about intelligent diversification, and to achieve that, managers would also need to experiment with several investing styles or a combination of all.