Global Macro is an investment strategy typically employed by a hedge fund or mutual fund that picks its holdings through informed notions about various countries’ macroeconomic and geopolitical developments. Global Macro funds often invest across asset classes like equities, bonds, currencies, commodities, and treasuries.

What Is Global Macro?

Global Macro is an investment strategy that picks its holdings through informed notions about various countries’ macroeconomic and geopolitical developments. Global macro funds aim to benefit from tectonic shifts in a nation’s economic policies, international trade, or interest rate regime. They also track the major political upheavals across the globe very closely.

The style or strategy of global macro investing differs across fund managers. However, most of them adopt a “top-down” investment approach. They assess the economic landscape objectively and then try to identify imbalances and significant changes in economic trends in the hunt for mispriced assets.

The funds leveraging a global macro strategy are some of the least restricted funds. This implies that they can invest in a broader asset range globally. Such funds’ holdings include currency strategies, long-short positions in equities, commodities, fixed income, and derivatives. George Soros, the famous billionaire investor, has popularized this investing style and has immortalized his name in global macro history.

In 1992, he sold the Pound Sterling in a highly profitable trade applying a global macro strategy. Soros did this transaction ahead of the European Rate Mechanism debacle. After the Asian Monetary Crisis and the devaluation of currencies like the Indonesian Rupiah and the Thai Baht in the late 90s, many traders used global macro strategy to reap the benefits of international economic shifts.

At the Opalesque Roundtable discussion of global macro in 2010, hedge fund manager John Burbank described global macro as “having a reason to be long or short something bigger than a fundamental stock view”. He spoke positively about the rising significance of the global macro strategies and private and institutional investors’ inclination toward it.

How Do Global Macro Strategies Work?

There are various approaches that macro traders use to identify and profit from macro movements. However, most of these strategies have a few factors in common.

Firstly, they invest across sectors and instruments, assessing broader factors like interest rates, currency exchange rates, or trade policies.

Secondly, these macro strategies do not restrict themselves geographically. Global macro investors study global markets worldwide and are aware that major macroeconomic or political events can have a ripple effect throughout the international markets.

Global macro hedge funds place an enormous emphasis on fundamental macroeconomic data and events to generate trading opportunities.

Even though the global macro managers study price movements and deduce technical patterns, they don’t follow the trend blindly. The fundamentals come first, and they attempt to predict price trends. On the contrary, trend-followers respond to price movements.

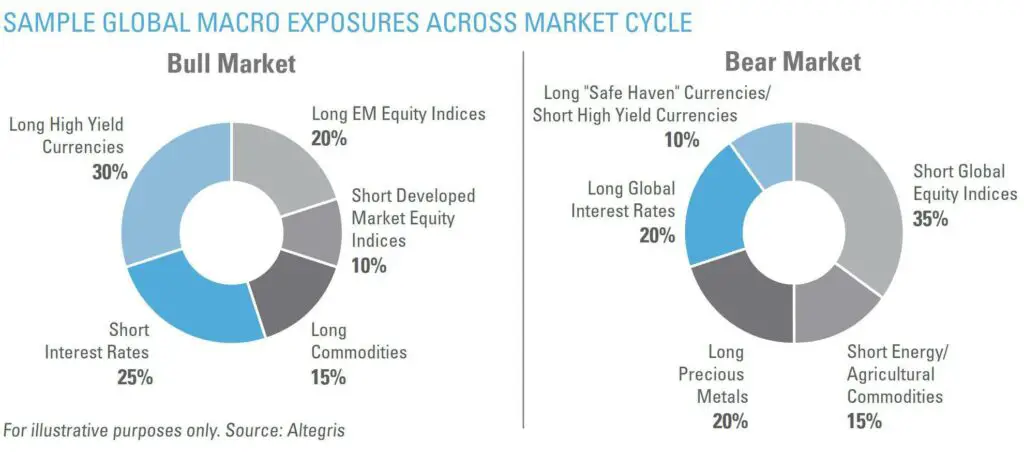

One of the critical requirements of global macro investing is liquidity. Hence, most global macro managers participate in markets with high liquidity, such as currencies, interest rate futures, and equity index futures contracts, with judicious leverage. These are some of the best places for making long and short trades for global macro managers across the market cycle.

The “go-anywhere” approach of global macro managers allows them to produce investments that have a minimal correlation to conventional financial markets.

Types of Global Macro Strategies

Discretionary

Discretionary macro is a trading strategy designed to reap profits from shifts in macroeconomic trends and the imbalances arising from these trends. Discretionary funds are highly flexible, and fund managers invest across asset classes and geographies.

Discretionary fund managers identify investment themes based on their research, including fundamental factors and technical analysis, and then proceed to portfolio construction. This means that the manager has the discretion to make their own decisions only limited by their investment mandate.

Discretionary Hedge Funds

Soros Fund Management

Soros Fund Management is a private investment management firm in the United States. George Soros founded the firm in 1969. The firm’s macro-oriented hedge fund, driven by a global macro strategy, is based on massive speculations on the price movements of currency, commodity, derivatives, stocks, bonds, and other asset classes in line with its macroeconomic analysis.

The company invested in public equity and bond markets globally, currency, commodity, private equity, and venture capital funds. The company also has massive investments in transportation, retail, financial, energy, and other industries.

Due to difficult trading conditions, Soros Fund Management has withdrawn from macro investing, the investment firm’s flagship strategy. In 2018, Dawn Fitzpatrick, the erstwhile Chief Investment Officer at Soros, drastically reduced trades that bet on currency strategies and significant commodity movements.

Fortress Investment Group

Fortress Investment Group, based in New York, was founded in 1998 as a private equity firm by Wesley R. Edens, Randal Nardone, and Rob Kauffman. As of September 2020, the firm has a total asset base of nearly $49.9 billion in alternative assets in private equity, liquid hedge funds, and credit funds.

In 2013, Fortress Investment Group’s Fortress Macro Fund was recognized as “Macro-Focused Hedge Fund of the Year, Discretionary” by Institutional Investor at its 11th Annual Hedge Fund Industry Awards. Fortress Investment Group has developed in-depth tools for deriving value from complex and intricate investments.

In 2015, Fortress Investment Group also shut down its $2 billion flagship macro fund after a continuously poor performance. The macro fund suffered when a bet against the Swiss franc did not turn out as expected after the Swiss central bank removed its currency peg against the euro and its value surged.

Systematic Hedge Funds

Systematic global macro managers select a large quantitative data set, reflecting or predicting meaningful underlying patterns across global economies. This hedge fund strategy aims to systematize the data into a model from which they create trading algorithms. A well-developed model can then present statistically sound depictions of various markets and economies. Managers use this approach to contrast a portfolio within multiple asset classes.

Unfortunately, often with statistical models, the present needs to look similar to the past; otherwise, the models will not perform as expected.

Systematic Firms

AQR Capital

AQR Capital Management’s Global Macro Fund follows a global macro investment strategy across asset classes like equities, bonds, currencies, and commodities deeply rooted in academic research. The fund buys assets whose macroeconomic fundamentals are improving relative or absolute. At the same time, it sells assets with worsening macroeconomic fundamentals.

This fund has exposure to more than 100 markets in over 30 countries. AQR’s global macro fund evaluates macroeconomic trends across various dimensions.

AQR’s Global Macro Fund aims to create uncorrelated investment returns to traditional asset classes.

Bridgewater

Bridgewater is a hedge fund founded in 1975 by Ray Dalio. The Lyxor/Bridgewater Core Global Macro Strategy uses Bridgewater’s market timing experience, capturing risk premiums and portfolio construction.

The strategy is a blend of two of Bridgewater’s flagship strategies- All-Weather and Pure Alpha Major Markets. These strategies infuse into one macro portfolio, which is also highly diversified. The fund follows a systematic process and trades in more than 50 liquid global markets and five asset classes. The fund is also a diversified UCITS investment solution that offers daily liquidity.

The Lyxor/Bridgewater Core Global Macro strategy fund follows a systematic investment approach and an in-depth perception of economies and markets’ operations. It has a track record of providing returns through multiple economic cycles. Bridgewater aims to offer the benefits of its established alpha and beta investment strategies to clients through a single fund.

High-Frequency Trading

High-Frequency Trading strategies use cutting-edge technology to transact a large number of trades at extremely high speeds. Large institutions, hedge funds, and investment banks are the most likely to use these strategies due to their significant technology requirements and expenses.

Not all HFT firms use a global macro strategy, but some firms have found it easy to make quick trades on interest rate changes. High-frequency trades also demonstrate improved price efficiency after critical macroeconomic announcements.

High-Frequency Institutions

Citadel

Citadel Securities, formed in 2002, is a market-making division of Kenneth Griffin’s Citadel LLC. Citadel’s trading strategy products include equities, equity options, and interest rate swaps for retail and institutional clients.

The institution’s fixed income and macro teams aim to generate alpha by investing in fixed-income securities in global markets by leveraging macro and relative value strategies. The investment process combines fundamental research, quantitative analysis, quantitative factors, and well-educated judgment.

Interest rates, currencies, sovereign bonds, and inflation are the primary macroeconomic factors that Citadel tracks.

Citadel also has an in-depth understanding of the central banking system. The fund managers and economists thoroughly evaluate the fiscal and monetary policy, macro views, proprietary and public data.

Two Sigma

In New York, Two Sigma employs various disruptive technologies such as machine learning, artificial intelligence, and distributed computing for its trading strategies. John Overdeck and David Siegel operate the company. In October 2014, Two Sigma gathered $3.3 billion for a global macro hedge fund, executing one of the most significant capital raises since the sub-prime crisis.

The fund aims to deliver non-market-related returns by betting on macroeconomic trends by investing in equities, bonds, currencies, and commodities.

Two Sigma’s investment strategies’ objective is to generate profit in liquid global markets amid various conditions leveraging a disciplined and scientific approach.

Commodity Trading Advisors (CTAs)

Commodity Trading Advisor (CTA) macro fund’s portfolio construction uses price-based trend-following algorithms related to trading in futures contracts, commodity options, and swaps.

Active CTAs

Winton Capital Management

Founded by David Harding, Winton Capital Management is a part of Winton Group, a UK-based investment management firm. It is registered in the United States with the Commodity Futures Trading Commission as a commodity trading advisor.

Winton leverages statistical and mathematical inference and advanced data modeling to track the global futures market patterns, including currencies, commodities, bonds, livestock, and energy. The investment management firm uses both long and short-term strategies. It also uses an uncorrelated method to achieve the best risk-return ratio.

Chesapeake Capital

Chesapeake Capital, founded by Jerry Parker, is a portfolio management and advisory service that offers uncorrelated returns across a broad range of global markets and diverse market conditions. For Chesapeake, Parker follows global macro strategies that reflect Turtle trading principles. Parker is often considered the most successful Turtle, who believes in following a fixed set of trends for entering and exiting the market using trend-following algorithms.

The investment firm typically has 25% of its risk across equities, currencies, commodities, and bonds/interest rates. Over the past three decades, Chesapeake has expanded from nearly 20 markets to over 100 markets presently.

Global Macro Hedge Fund Performance

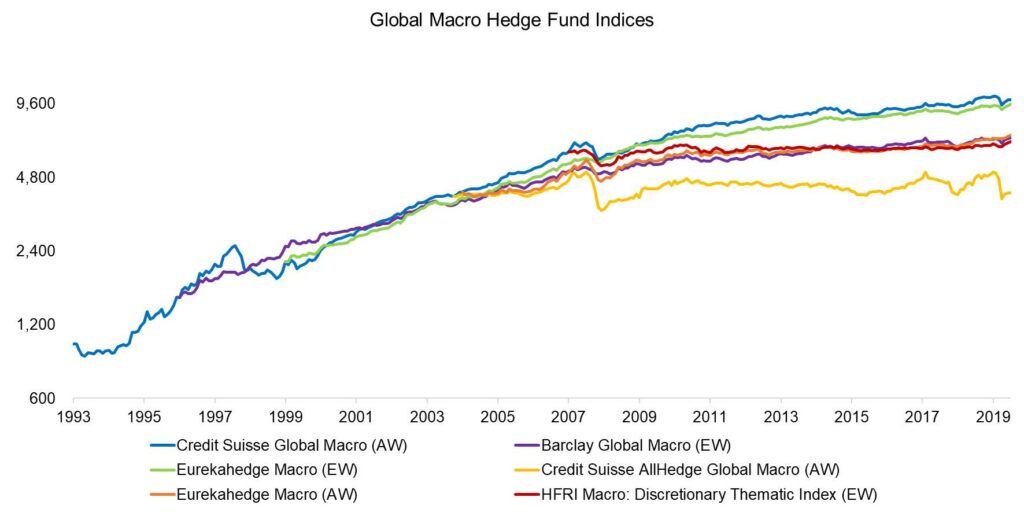

The global macro hedge fund indices are of two kinds: One is equal-weighted, while the other is asset-weighted. According to Factor Research, these indices have demonstrated roughly the same performance between 1993 and 2020 with just minor differences. These indices comprise more than 100 funds. The index from different hedge fund databases depicts that most global macro funds’ growth has plateaued since 2010.

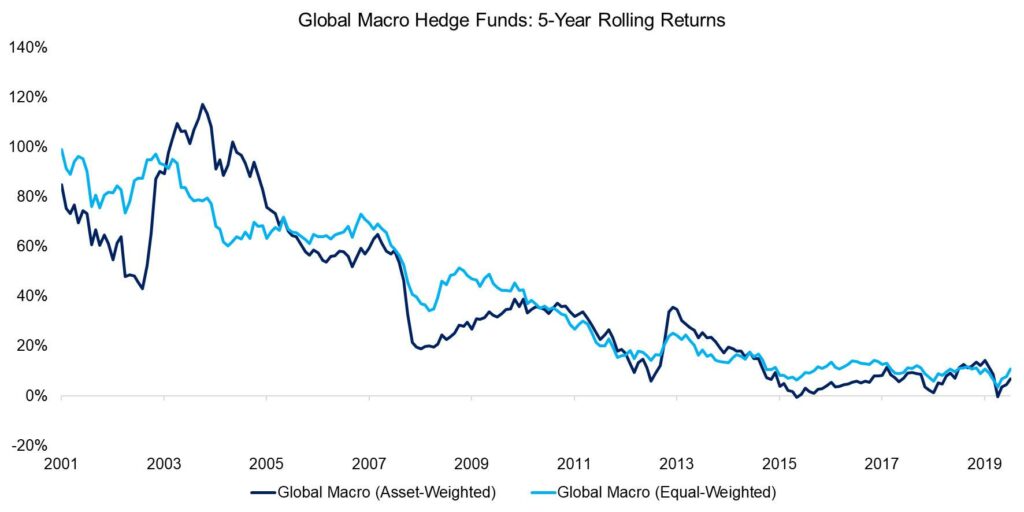

As per the 5-year rolling returns of both equal-weighted and asset-weighted indices, there has been a consistent decline in the performance of global macro hedge funds. The returns have become a minuscule fraction of what it was in the previous years.

Due to the narrowing alpha, allocators haven’t increased their capital allocations to the global macro funds in recent years. From more than 200 billion in 2011, the total assets under management declined to less than 150 billion in 2020.

However, it is noteworthy that the global macro funds’ correlation with traditional markets is still low. This is encouraging and shows that despite weakness in its performance, the long-term prospects of value creation and diversification look healthy.

The S&P Systematic Global Macro Index generated a 15.5% annualized return over the past year. The Global Macro Index’s total returns over the past five years were 4.7% compared to the S&P 500 return of 18% and the S&P 500 bond index at 6.4%.

Global Macro ETFs

Global Macro ETFs are actively managed fund-of-funds that consist of asset classes such as equities, treasuries, currencies, futures, or options. The bets on these assets can be long or short. Global Macro ETFs belong to the liquid Alternative Investment category and usually place massive directional bets on various highly leveraged assets prices.

Global Macro funds’ performance depends heavily on the fund manager’s analytical and management skills, which adds to the riskiness. Thus, Global Macro ETFs are the best way for retail investors looking for global macro asset allocation exposure.

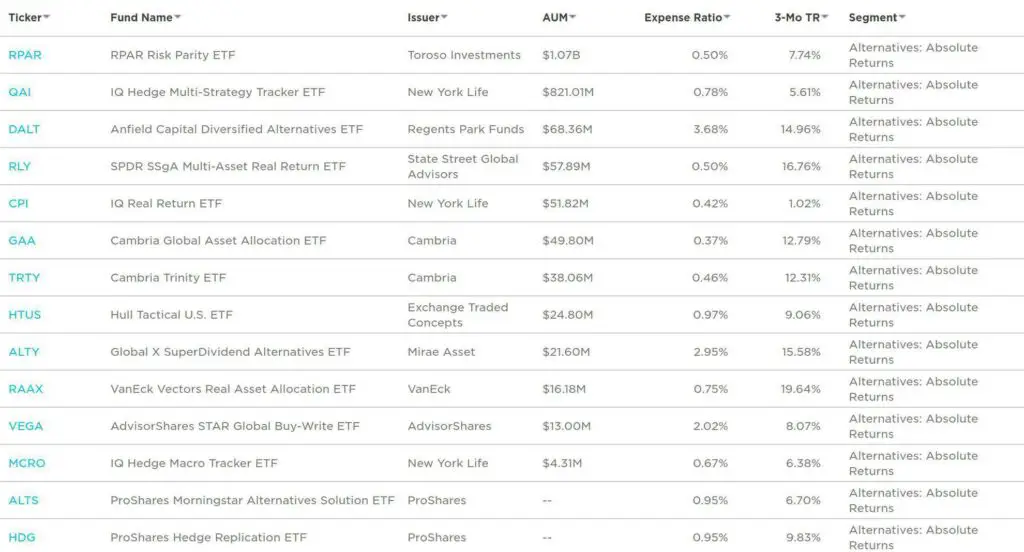

As of 2019, 14 global macro ETFs are traded on the US markets with total management assets of around $2.25 billion.

RPAR Risk Parity ETF (RPAR), issued by Advanced Research Investment Solutions, is perceived as the most significant global macro ETF, with nearly $1.05 billion under management. This fund of funds primarily invests across ETFs in four major asset classes: global equities, treasuries, commodities, and Treasury Inflation-Protected Securities (TIPS).

Below is the list of the top Global Macro ETFs based on their AUM:

The Pros & Cons of Global Macro Trading

Benefits of Global Macro Trading

Global Macro is one of the few hedge fund strategies to have delivered positive returns in challenging situations such as the tech bubble burst, the credit crisis, and the subprime crisis. Many investors also seek exposure to global macro as a potent diversification tool for equity market risks. Besides, Global Macro trading also has many other advantages:

- Macro analysis helps identify long-term trends: Macro analysis allows investors to identify long-term market opportunities across asset classes. Staying attuned to government policies or economic indicators enables you to assess global macro analysis’s efficacy and discover hidden values. Identifying these trends lets the investors spot a directional shift and take a well-defined investment route to avoid risks or losses.

- Evaluating market sentiment: Macro Trading equips the fund manager to understand the market’s pulse through risk assessment. Investors’ willingness to take on market risk tells a lot about the current trading environment and how the market would respond. The currencies that move positively in a high-risk environment yield higher returns. Some of them are the Australian Dollar, New Zealand Dollar, and Canadian Dollar. Similarly, when the markets go low-risk mode, safe havens like the US Dollar, Swiss Franc, or Japanese Yen perform better.

- Effective diversification tool: Global Macro funds have a low correlation and can be an excellent diversification tool. It is an alternative investment strategy that protects the portfolio from direct market-related risks.

Risks of Global Macro Trading

While some global macro funds’ track record has been quite impressive, we must understand that not all macro trades have succeeded. Due to the complex strategies in global macro trading, investors perceive these investments as challenging to understand. Macro hedge funds aim to achieve high returns despite market fluctuations, but the techniques are not always reliable because of the market’s complexity.

At times the actual event is a stark contrast to what the fund managers assess or predict. For instance, in 1994, many managers had projected the European interest rates would decline, and they had placed massive unhedged bets on it. However, what happened was shocking. The Federal Reserve hiked interest rates in the United States and pushed European interest rates higher.

Over the past decade, inherent imbalances in the global economy, near-zero interest rates, and volatility have made it challenging for macro traders to generate alpha, especially with anything other than short positions for their interest rate strategies. Moreover, the global economic data on which the fund managers rely heavily is not standardized and highly anomalous. This creates hurdles for global macro managers to design strategies and reap returns. It might also generate domino effects, wherein poor portfolio construction and inadequate diversification impact the fund.

The onus of the global macro fund’s success lies in the fund managers’ expertise and talent. Notably, the global macro hedge fund industry continuously evolves due to regulatory changes, shifting international markets, and other external factors. Hence, it is a massive challenge for fund managers to fully appreciate all of the variables impacting a fund’s assets.

If the manager fails to do so, the entire effort could be rendered fruitless. The challenge behind successful global macro fund investing is selecting managers who can achieve sustainable alpha while handling portfolio risk management.

How to Learn Global Macro Trading

As an investor, learning the economic concepts, the trading strategies, and in-depth analysis supporting macro trades helps clarify why the market does what it does. I’ve listed some of my favorites resources below:

- RealVision: For the latest videos on the happenings in the macro and fund management space, RealVision is the ideal portal. You can also access interviews with legendary investors and learn about their philosophies. You can also read exclusive analytical articles on trending market developments and themes.

- Global Macro Trading: Profiting in a New World Economy Book by Greg Gliner is a complete guide to Global Macro and includes overviews of equities, currencies, fixed income, and commodity markets.

- Systematic Investor Podcast: This podcast is a precious resource for learning the systematic global macro investing strategy. You can also stay updated on the latest developments in the alternative investment and hedge fund space.

The Bottom Line

Global macro is an investment strategy wherein managers construct a portfolio by taking cues from global macroeconomic developments.

The fund managers follow a top-down approach looking for imbalances and opportunities created by various macroeconomic developments.

Global Macro funds can often invest across asset classes like equities, bonds, currencies, commodities, and treasuries. They can also invest without geographical restrictions depending on their investment mandate.

The four types of Global Macro strategies are Discretionary, Systematic, High-Frequency Trading, and Commodity Trading Advisors (CTAs).

Investors can also invest through Global Macro ETFs, fund-of-funds with exposure across various asset classes.