Hedge funds are an alternative form of investment for high-net-worth investors. It is estimated that there are more than 10,000 hedge funds globally.

This article explores the history of hedge funds and how hedge funds have evolved.

Hedge funds are alternative investment funds that have expanded exponentially over the years. Today, there are over 3,691 hedge funds in the US, accounting for 75% of the Assets Under Management (AuM).1

The hedge fund market has drawn tremendous interest in the investment arena and has led several traders and fund managers to launch new hedge funds. The current hedge fund industry is growing and is now used as a strategic tool for all types of companies and investors. Companies increasingly use hedge funds to manage their risk, liquidity, volatility, and performance.

Unlike mutual funds, which are highly regulated investment vehicles, hedge funds cover a broad spectrum of asset classes and investment strategies. They have a wide range of tools and techniques, including derivatives trading, investing in illiquid markets, and taking short positions.

The hedge fund industry is a vast market used for different purposes and in different ways. Hedge funds have been around for a long time. They have a long history dating back to the early 1950s. So, in this article, we run through the brief history of hedge funds and understand how it has evolved.

1926: The Graham-Newman Corp

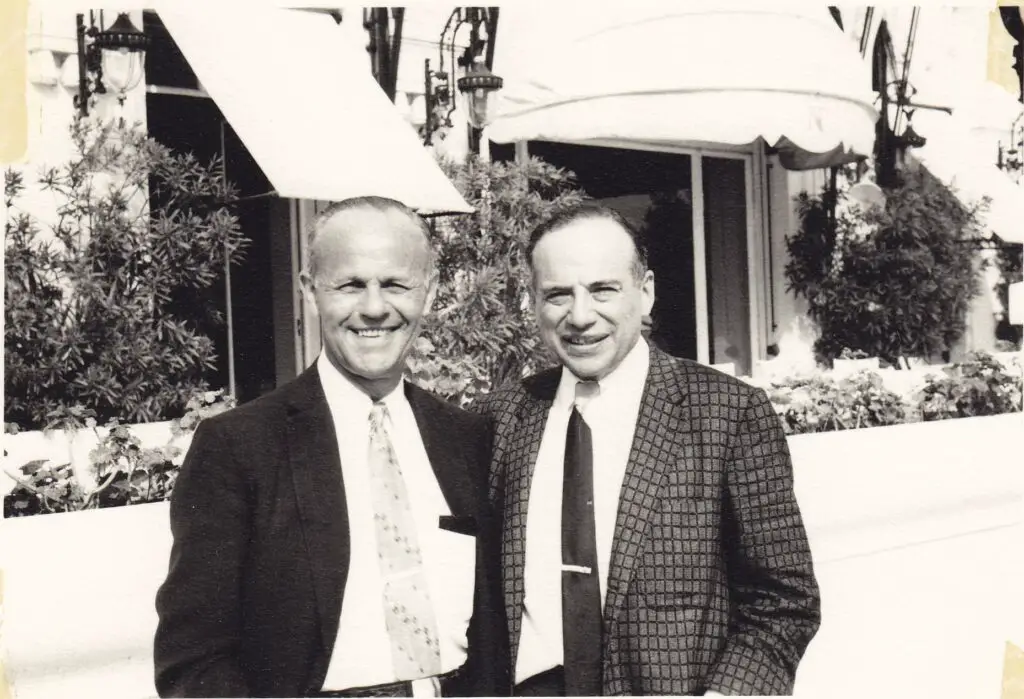

During the bull market of the 1920s in the US, several wealthy private investment vehicles emerged. The Graham-Newman Partnership was the best known, founded by Benjamin Graham and Jerry Newman, his long-time business partner.

In 1926, Graham entered into an investment partnership with Jerome Newman and began to fine-tune his deep-value investment strategy. They saw a lot of success until 1929, but the market crash wiped off a big chunk of their profits during that year. Graham-Newman landed in colossal debt.

The depression taught many lessons to Graham, and he began to take positions in securities with a low risk of permanent capital loss. They due used deep value investment tactics to recover most of their losses by 1937.2

After 1936, the Graham-Newman partnership transformed into the Graham-Newman Corporation and operated as a mutual fund. The company posted earnings per share for the year, besides net asset value and dividends.

However, many deem the corporation’s operating style akin to hedge funds. Warren Buffet, in his 2006 letter to the Museum of American Finance, stated, “The esteemed investor and writer Benjamin Graham managed a hedge fund as early as the mid-1920s.” 3

1949: The ‘Market-Neutral’ Hedging Strategy Is Born

The market regards Alfred Winslow Jones as the creator of the first hedge fund strategy in 1949. He founded the fund through his company A.W Jones with a capital of $100,000. Jones, an Australian investor and sociologist, aimed to separate the overall market risk and specific equity risk by creating a market-neutral portfolio. 4

Jones created market neutrality by purchasing assets whose value he thought would rise compared to the overall market performance and selling short assets whose price he expected to decline. Jones also resorted to leveraging to enhance the returns of his fund.

His portfolio’s performance depended on choosing the correct stock instead of focussing on the market direction. His portfolio was ‘hedged’ against market movements; it was called a ‘Hedged-fund’.

1950s: Fees And Leverage Are Born

In 1952, Jones converted his fund from a general partnership to a limited partnership. This was the first pooled investment vehicle in the hedge fund industry that combined a hedged strategy.

Jones’ hedge fund had two critical elements-leverage and fees. He borrowed money to leverage his bets when he expected certain stocks to rise. Jones also introduced the 20% plus 2% performance fee, in which many hedge fund managers received a portion of profit instead of a salary.

According to Alexander Ineichen’s Absolute Returns, the year after he formed the fund, it earned 17.3%, and during the next decade, it outperformed every mutual fund by 87%.5

Jones claimed his fee structure was inspired by the Phoenician merchant ships keeping 20% of profits from a successful voyage. This was done to avoid the top IRS marginal rate of 91% on the profit and keep the capital gains rate at 25 % instead.

1966: Rise Of The Hedge Fund

An article in Fortune magazine in 1966 highlighting the excellent performance of Alfred W. Jones’s investment vehicle elevated the hedge fund industry to another level.

The article described Jones as “the best professional money manager” of the era and reported that it had outperformed the top-performing Dreyfus Fund by 87% over ten years. Over the prior-five years, it had beaten the fund’s performance by 44%, even after accounting for the fee.

The article’s author, Carol Loomis, elaborated that Jones operated two partnership businesses with slightly different investment objectives. However, in each case, the underlying investment strategy was the fund’s capital being both leveraged and “hedged.” Loomis also coined the term ‘Hedge-funds.” 6 There are about 60 investors in each of the two funds, and their average investment then stood at $460,000.

1968: 140 Hedge Funds Enter Markets

After 1968, a US Securities and Exchange Commission survey enlisted 215 investment partnerships, of which 140 were classified as hedge funds.7 These funds, with a total asset base of $1.3 billion, focussed on corporate equity investments and were speculative. The median number of speculative funds was 3250, and the average account size was $3787.8

As the market climbed upwards, hedge fund managers resorted to leveraging, as hedging a portfolio with short sales was challenging and expensive. As a result, managers played with hedge fund strategies such as token hedging, which placed the funds at risk of the market downturn after 1968.

After this period, many prominent fund managers launched their hedge funds, including Michael Steinhardt and George Soros. However, as the hedge fund industry expanded, it started moving away from Alfred’s strategy to maximize profits. They started taking long positions with leverage instead of hedging positions through short-selling.

Consequently, there were massive losses during the period between 1969 and 70. In the bear market period between 1973 and 74, many hedge fund houses went out of business.

1969: Fund Of Hedge Funds Launched

In 1969, Leveraged Capital Holdings, created by Georges Karlweis, the veteran Edmond de Rothschild banker, was the first fund of hedge funds. The fund was launched in Geneva, Switzerland. The second was the US-based Grosvenor Partners, founded by Richard Elden in 1971.9

Notably, the credit for conceptualizing the Fund of Funds goes to Bernie Cornfield in 1962.10. However, the one Cornfield launched was related to American mutual funds and not hedge funds. A “fund of funds” (FOF) is a strategy that involves holding a portfolio of other funds (mutual funds or hedge funds) instead of stocks, bonds, or other securities. This investing is often referred to as a multi-manager investment. The fund of funds may invest in hedge funds of the same investment house or different investment houses.

Back then, the idea behind the fund of funds was to invest in the best managers, such as George Soros and Michael Steinhardt.

No matter how brilliant, a hedge fund manager can make an erroneous judgment that can impact the fund’s performance. Fund of Funds was thus created to homogenize the returns through diversification.

Though this was the formal fund of funds structure, many believe that the first multi-manager program came into existence when Alfred Jones started allocating assets to external managers in 1954.

1970: The First Hedge Fund Crash

The recession of 1969-1970 and the stock market crashes of 1973-1974 resulted in many hedge fund closures as the industry struggled against market risks. From June 1969 through May 1970, small stocks fell more than larger stocks, which is one of the primary reasons hedge fund performance was particularly affected.

In a piece in Fortune in 1970, Hard times come to the hedge funds, journalist Carol Loomis stated, “During June, when the market, as measured by the Big Board’s composite average, dropped by 6.9 percent, eight hedge funds on which Hartwell collected data (his own two were included) dropped on the average by 15.3 percent.

In July, when the market fell 6.4 percent, the funds were down by an average of 10 percent. And in August, when the market bounced back briefly, the seven funds for which Hartwell had data averaged only a 4.2 percent gain, compared to a 4.5 percent gain for the composite average.” 11

Jones’s fund lost more than 10% more than the S&P in the 12 months ending May 31, 1970. Interestingly, Jones incurred losses in only three years of its life span over three decades.

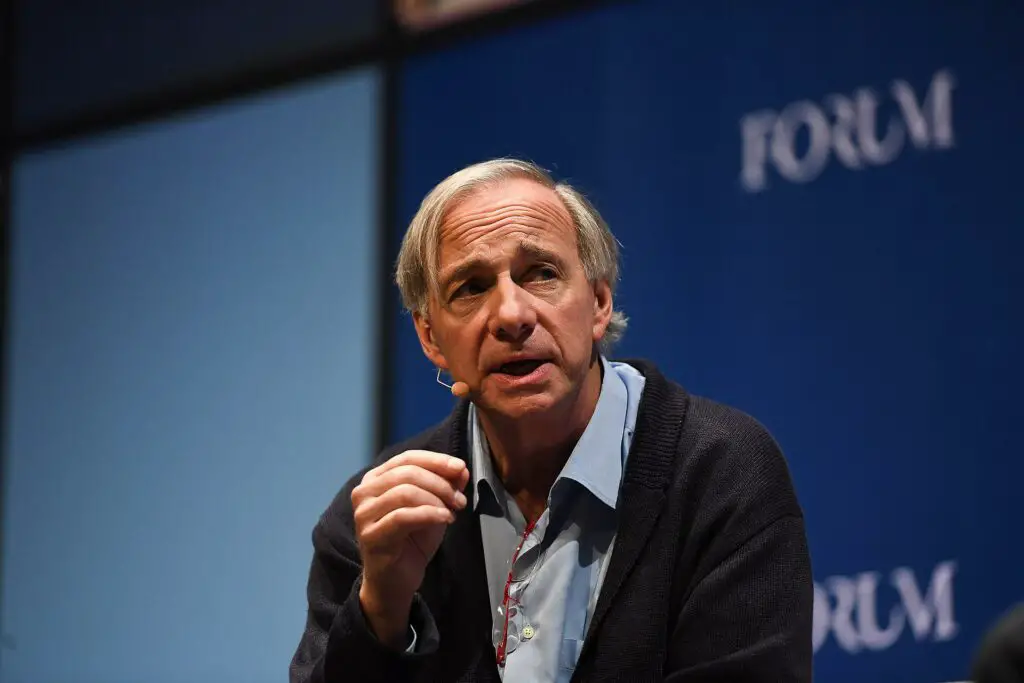

1975: The Rise Of Ray Dalio’s Bridgewater Associates

In 1975, Ray Dalio established Bridgewater Associates out of his two-bedroom apartment in New York City to offer institutional investors currency and bond advisory services. World Bank, Mc Donalds, and Eastman Kodak were some of the revered clients of the Bridgewater advisory firm.

In 1982, Dalio confidently but wrongly predicted that the global economy would witness a depression, and he placed his trades accordingly.12

Much to everyone’s surprise, the stock market saw a big bull run, and the US economy enjoyed the most significant noninflationary growth period in its history for nearly two decades. Ray Dalio suffered a huge misfortune and went broke within eight years of launching his investment firm. Due to the quantum of the losses, Dalio was compelled to release all his employees and seek financial help from his family.

The 1980s: The Revival Of Hedge Funds

The 1980s contributed majorly to the evolution of hedge funds. Several hedge funds experienced extraordinary growth thanks to the strong performance and rise in interest from wealthy investors.

The evolving markets of the 1980s offered many new opportunities for hedge funds. They could experiment with fresh investment styles, use leverage instruments, and build hedge fund strategies based on large movements in the currency and commodity markets, offering enormous returns for investors.

The hedge funds of the 1980s were small in structure but generated significant returns. It was almost similar to equities as the industry was agile, had freedom of operation, and was away from the glare of media, regulators, and investors.

1980 was also when Julian Robertson and Thorpe McKenzie started Tiger Fund, a hedge fund that attracted a lot of attention.13 Launched with $8 million, the fund’s worth climbed over $22 billion, making it the largest hedge fund at that time. The fund collapsed in early 2000 during the dot com bubble, and the legacy of Tiger Fund continued. After Robertson’s employees went out of their way, they launched some of the top-performing funds in the industry. Together this group is called the ‘Tiger Cubs.’

The 1990s: The Genuine Hedge Fund Boom

Hedge funds grew extraordinarily in the 1980s, but this sector boomed in the 1990s.

In this decade, several dominant funds were launched. Steve Cohen’s SAC Capital Advisors (today called Point72 Asset Management), David Tepper and Jack Walton’s Appaloosa Management, John Paulson’s Paulson & Co., and Daniel Och’s Och-Ziff Capital Management (now OZ Management) are a few of them.

Bridgewater Associates also rose to prominence in the 1990s. In 1991 Bridgewater launched Pure Alpha with portable alpha strategies that call for investing in assets uncorrelated to the market and adequately leveraged to maximize returns.15

In 1996, Dalio launched All-Weather, a fund that was the first to leverage a steady, low-risk strategy that later became famous as risk parity. Today, it is one of the most significant hedge funds globally.15

This era saw the emergence of brilliant hedge fund managers and the entry of new strategies in the hedge fund sector. The hedge fund assets universe covered a broad group of asset classes and styles of investments from the usual long and short equity positions. The new hedge fund investment strategies were Arbitrage, macro, distressed investments, activism, and multi-strategy began to dominate over the decade.

1992: George Soros Broke The “Bank Of England.”

September 16, 1992, is remembered as the day of “breaking the Pound.” England, then was a part of the European Exchange Rate Mechanism, a fixed-exchange-rate agreement between several European countries. The other countries began to pressure England to devalue its currency or exit the system.16

After resisting the devaluation for some time, England floated its currency, leading the Pound to drop. George Soros’s Quantum Investment Fund leveraged and took a $10 billion short position on the Pound, which earned him $1 billion on a single day. The assets under management expanded from $3.3 billion in mid-October 1992 to $11 billion by 1993.

Other hedge funds also cashed in and earned big time. Kovner’s Caxton Corp earned close to $300 million, while Jones’ funds made $250 million.

The largely speculative move drove Britain to exit the Exchange Rate Mechanism and spiked interest rates by 5% in just a few hours. The UK Treasury estimated that the fateful day is, also known as “Black Wednesday,” cost Britain £3.4 billion, or about $6 billion according to currency conversions in 1992. Thus, Soros became known as the man who “Broke the Bank of England.”

Soon after, the prime minister of Malaysia blamed Soros for causing the Asian Financial Crisis and called him a ‘rogue speculator.’

1994: Steinhardt Partners Incurs Massive Losses

In February 1994, the Fed suddenly introduced the first rate hike of one-quarter of a percentage point, causing a decline in the US Treasuries’ value and a drain on market liquidity.17

The dual instances led institutional investors to press the panic button, which proved a significant disaster for Steinhardt Partners, leading to losses of 31%. Also, in 1994, Steinhardt’s firm agreed to pay $40 million as a settlement against federal regulators’ allegations of the firm being part of a group that violated antitrust and securities laws in 1991 by helping to corner the market in an issue of two-year Treasury notes.

The fund was able to recover the losses partly by the end of 1995, but Michael Steinhardt retired from the hedge fund industry in the same year.

1998: Long Term Capital Management (LTCM) Collapse

One of the most significant events of the 1990s was the near-collapse of Long Term Capital Management (LTCM), which could have snowballed into a global financial crisis if not for the timely bailout by Wall Street and the Fed.18

The hedge fund industry expanded without regulation until the LTCM collapse in 1998. LTCM was a hedge fund with assets under management of $126 billion, and it witnessed spectacular annual returns to the tune of 40% in 1995 and 1996.

Owing to its size, it began too big to fail, and the US Federal Reserve had to step in to bail it out. This led to regulatory authorities seeking to make more sense of the hedge fund industry.

In 1998, Long Term Capital Management (LTCM), a hedge fund in Greenwich, Connecticut, managed assets worth $120 billion. The fund specializes in betting over narrow interest-rate spreads, dealing in bonds, swaps, options, stocks, and derivatives.19

The fund, launched in 1994 by John Meriwether, tasted success for the first three years, but disaster struck after the Asian Financial Crisis of 1997 and the Russian financial crisis of 1998. Due to heavy leverage and substantial exposure to these markets, LTCM suffered a massive loss of $4.6 billion in two days. The losses represented 90% of the hedge fund’s equity.

The Federal Reserve Bank of New York feared LTCM’s collapse and its impact on the global markets. Hence, it designed a rescue plan with 14 other financial institutions by agreeing on a $3.6 billion recapitalization under its guidance.

In return, the participating banks got a 90% share in the fund, alongside promises of establishing a supervisory board. Though termed a bailout, the rescue program was technically not so. The transaction led to a systematic liquidation of the positions that LTCM held alongside creditor involvement and supervision by the Federal Reserve Bank.

2007: Hedge Fund Replication (Synthetic Hedge Fund)

2007 saw the launch of a synthetic hedge fund which is nothing but a mutual fund and exchange-traded funds that track hedge fund indices. Also known as a synthetic exchange-traded fund (ETF) is a pooled investment vehicle that parks money in derivatives and swaps instead of physical securities.20

Instead, the synthetic hedge fund managers agree with a counterparty, an investment bank in most cases, to ensure that the fund receives the benchmark return.

Investment banks such as Goldman Sachs and Merrill Lynch have also launched “synthetic” hedge funds to emulate hedge fund returns that leverage historical hedge fund data while tracking up to 15 indexes of equity.

2008: The Aftermath Of The Subprime Crisis

By 2008 the global hedge fund industry had $1.93 trillion in assets under management (AUM).21 However, the Global Financial Crisis in 2008 proved to turn the tide for many hedge funds, and their popularity faded. Hedge funds were labeled the main culprit of the subprime crisis as they saddled the banking sector with excessive risk. Irrespective of the role that hedge funds have played in the problem, it impacted them severely.

Many funds closed after witnessing heavy losses, and there was a significant decline in AUMs. Investors had pulled out $1 trillion during the year since June 2008 and lost close to 19% in 2008. Some individual funds even suffered declines of 50% or more.

On average, the industry losses of close to 15 to 20% looked nominal compared to the 40-50% declines that the equity market has seen during the same period. After the GFC, the hedge funds were subjected to several new regulations to improve investor protection, ensure market integrity and reduce systemic risks.

2008: The Madoff Crisis

The discovery and subsequent collapse of the multi-billion dollar Ponzi scheme run by Bernie Madoff in late 2008 was one of the biggest highlights of the past decade.22 Bernie Madoff was the former NASDAQ chairman and founder of Bernard L. Madoff Investment Securities, who led the largest Ponzi scheme in history.

Although it was not a hedge fund, the $65 billion fraud shook the investment fraternity. While pleading guilty, Bernard L. Madoff admitted not doing any trading since the early 1990s and fabricating all his returns. The whistleblower, Harry Markopolos, estimated that at least $35 billion were reported as fictional profits by Madoff to his clients.

He was sentenced to 150 years in prison and was ordered to make restitution of $170 billion in total. Investors pressed the panic button and demanded higher governance standards focussing on independent validation of positions and valuations. In a nutshell, the Madoff scandal led to drastic changes in the monitoring and control of hedge funds.

2009: Moving Into The Mainstream Investment Arena

Hedge funds moved into the mainstream investment arena by 2009. Many institutional investors like pension funds, insurance companies, and sovereign wealth funds showed interest in alternative avenues and started investing in hedge fund products post the losses in the dot com bubble.

As a result, the hedge fund asset under management crossed rose in December and reached $2.037 trillion by 2009.21

During that period, another research firm, Hedge Fund Research, stated that hedge funds returned 18.80% since January 2008 and were on track to post their best returns in a decade.

2010-2013: Strong Regulatory Mechanisms Enforced

The 2010s introduced significant changes in the regulation of the hedge fund industry, which had been unregulated for ages. For instance, Jones did not comply with the Investment Company Act of 1940, a rule for regulating mutual funds, by restricting the number of investors in his limited partnership to 99 or less.

Under the Investment Company Act of 1940, the minimum requirement for banks and corporate entities is $5,000,000 in total assets. For several investors in more considerable hedge funds, a “qualified purchaser” criterion is to have $5,000,000 in investments for individuals and $25,000,000 in assets for pension plans and companies. 24

Hedge funds are also prohibited by the Investment Company Act of 1940 from making public offerings. They are subject to the anti-fraud provisions enlisted in the Securities Act of 1933 and Securities Exchange Act of 1934.

The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 came into effect as a direct response to the global financial crisis, emphasizing more critical compliance requirements for registering and reporting to the Securities and Exchange Commission.25

In the US, many hedge funds fall under the purview of the Commodity Futures Trading Commission (CFTC), which includes advisors registered as Commodity Pool Operators (CPO) and Commodity Trading Advisors (CTA). The hedge fund investing governed by the CFTC is regulated by the requirements set in the Commodity Exchange Act.

Some hedge funds are restricted under Regulation D (Reg D) of the Securities Act of 1933. Securities and Exchange Commission Reg D allows raising capital solely in non-public offerings and only from “accredited investors.” These are individuals with a minimum net worth of $1,000,000 or a minimum income of $200,000 in each of the last two years. The mandate also sets a reasonable expectation of touching the same income level in the current year.

In Europe, the European Union law of Alternative Investment Fund Manager Directive (AIFMD) or the Directive 2011/61/EU mandates hedge funds, private equity funds, and real estate funds. The primary objective of the AIFMD is to safeguard investors and lower the systemic risk that these alternative investment funds can expose the EU economy too.23

Alternative Investment Fund Managers (AIFMs) were mandated to comply with the requirements since July 22, 2013, covering governance, conflicts of interest identification and management, and minimum capital.

At the same time, the Volcker Rule prohibited banks from certain investment activities from engaging in proprietary trading or investing in or sponsoring hedge funds or private equity funds.26

In a nutshell, these regulations created barriers to entry, leading to institutionalism and professionalism of the Hedge fund industry.

2015: Numerai: The First AI-Powered Hedge Fund

In October 2015, South African technologist Richard Craib launched Numerai is, an AI-run, crowd-sourced hedge fund. An AI-run determines Numerai’s trades by a network of 30,000 anonymous data scientists worldwide. These data scientists work actively in improving the fund’s machine learning-led investment strategy.27

With an open-sourced approach to hedge fund investing, Numerai has a unique operational model. It has been able to stand out even in the turmoil of 2020 and distinguished itself from the other blue-chip quant hedge funds. Numerai also exposed that most of these established funds have high exposure to risk.

In 2021, Numerai became the first AI-based hedge fund to reward its collaborators with its native cryptocurrency called Numeraire.

2020-2021: COVID-19 and Hedge Funds

The COVID-19 disaster showed that alternative investments were beneficial in an investor’s portfolio during market volatility and business uncertainty phases. In the first half of 2020, when the market volatility was at its peak, hedge funds’ losses were half that of the equity markets and balanced portfolios. Also, when markets corrected sharply, hedge fund performance was better than other asset classes, demonstrating its risk-minimizing abilities.

According to Bloomberg, after the initial bout of losses, hedge funds have bounced back and gained 35% from March 2020 until September 2021. Data compiled by eVestment shows that investors pumped $38 billion into hedge funds in 2021 and pushed assets to record levels.28

The Bottom Line

Cut to 2021, and many hedge funds are still standing strong after facing the COVID-19-led market debacle. The coronavirus-led pandemic has wholly altered the way hedge fund managers operate. They curtailed a lot of processes, including due diligence, portfolio construction, investor engagement, and recruitment, as the business environment’s vigor faded. Because of this, investment managers began to rely on digitalization, automation, outsourcing, and other disruptive technologies to cater to clients.

Tom Kehoe, Global Head of Research and Communications for the Alternative Investment Management Association (AIMA), foresees emerging trends regarding hedge funds. The first is that hedge funds will incorporate ESG elements like sustainability, climate change, and social responsibilities to enhance accountability among investors and policymakers. In the future, hedge funds are likely to have a robust operational setup with solid governance and risk management procedure. 29

The second trend is that disruptive technology like Artificial Intelligence, Big Data, and Machine Learning will become a critical part of a hedge fund. We could also see the fund houses increasingly adopting ultra-high frequent trading (HFT).

Sources: 1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16, 17, 18, 19, 20, 21, 22, 23, 24, 25, 26, 27, 28, 29