Is stock trading gambling? Yes and no. Stock trading is gambling in the sense that certainty is not guaranteed. At the same time, assuming you’re investing in a financially savvy way, stock trading is nothing like gambling since, unlike gambling, the odds favor the investor, and it’s not a zero-sum game.

Let’s start by looking at why stock trading and gambling are often compared.

The Uncertainty of Stock Trading and Gambling

When people compare stock trading to gambling, they are often referring to the uncertainty that comes with stock trading. You can’t purchase a stock for $100 and know that this time next year that it will be worth precisely $107. Instead, you should buy a stock with the belief, based on solid fundamentals or a sound trading strategy, that the value of the stock will increase, but accept that you could be wrong.

Uncertainty is also not limited to individual stocks. You also can’t know precisely how the market will perform. Attempting to base financial decisions on when you think the ups and downs of the market will occur is known as timing the market and is hard to do and costs most investors money. Some of the market’s best days have happened during bear markets. When you pull your money out of the market, you miss out on much of the rebound that has historically occurred.

While both stock trading and gambling have some uncertainty, a key difference is that though stock trading does not come with specific guarantees, it’s also not pure chance. It’s about calculating the level of risk and reward.

Investing vs. Speculating

Perhaps the biggest misconception about the stock market rests on a misunderstanding of risk. All investing involves risk. But the level of risk depends mainly on how you choose to invest. Much like how casinos have some games with better odds than others, some stock trading has better odds.

We can think of stock trading as falling into two main buckets, which we’ll call investing and speculating. The most significant difference is that investing takes a calculated approach and speculating does not. What do I mean by calculated? I mean basing investment decisions on specific metrics, such as past performance, a company’s balance sheet, and other quantitative measures using your risk tolerance and time horizon. This calculated approach isn’t foolproof, but it has very little in common with high-stakes gambling.

The other type of stock trading we’ll refer to is speculating. This type of trading pays little mind to the calculated approach and is much closer to gambling. Speculative trading can occur in various ways, but what all speculative trading has in common is that it’s based on emotion instead of reason.

An investor who is jealous of friends with more money and decides to put his entire retirement savings into an incredibly high-risk investment is speculating. An investor who is terrified by the stock market crash and pulls all her money out of the market is speculating. An investor who buys the overpriced, hot new stock because he doesn’t want to miss out is speculating.

It’s often not the decision itself that defines speculative investing; the lack of any calculated approach and, instead, a reliance on emotions makes these decisions speculative investing. These are the decisions that have far more in common with gambling. On the other hand, investing takes a more calculated approach that balances risk and reward.

Can You Avoid Risk Completely?

Even using a calculated approach, many people feel uncomfortable with any level of uncertainty regarding their money. They would prefer not to invest and avoid any uncertainty or risk, but this strategy backfires. Even if you keep your money hidden under a mattress, you’re still taking risks. For example, thanks to inflation, you would have less purchasing power, which means you could purchase less with the same amount of money. Thought about it this way, you would have lost money by attempting to protect it.

It’s human nature to fear the unknown, but choosing not to invest at all because you fear uncertainty is like speculative investing; it’s two heads of the same coin—both base financial decisions on emotions instead of logic.

We accept risk and uncertainty in every other aspect of our lives, and investing should be no different. Every time we get in a car, walk down the stairs, or eat take-out, we risk getting in a car accident, falling down the stairs, or getting sick. Eliminating risk is impossible, but just as in life, there are ways to mitigate risk.

One of the best ways to limit investment risk is to create a diversified portfolio or trading strategy. This keeps you from putting all your eggs in one proverbial basket. Investing in various companies, industries, asset classes, geographic locations, or quantitative factors and timeframes can help limit your risk exposure. This allows you to avoid missing out on investing opportunities while also helping to minimize drops in the value of your portfolio if a company, region, or even asset class is impacted.

We’ve seen that investors can’t avoid risk altogether, but this doesn’t mean that an investor faces the same level of risk as a gambler. This is large because the odds favor the calculated investor or trader. Let’s look at the stock market’s historical returns to see what kind of odds investors are working with.

The Odds of the Stock Market

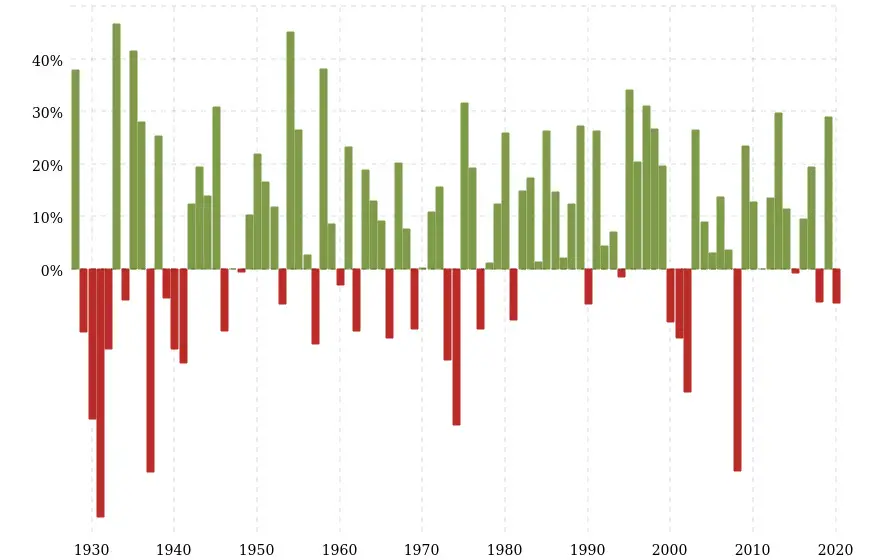

The stock market refers to the entire universe of stocks on the market. But when investors or commentators refer to the stock market’s performance, they’re typically referring to a market index. One of the indices used most often to measure the stock market is the S&P 500. The S&P 500 has been in existence since 1929. Between 1929 and 2019, its annual average return was over 7% (not including dividends). What this means is that the stock market has historically trended upward.

Seven percent over time adds up. If you invested 10,000 and made zero additional contributions, with an annual rate of return of 7%, after 30 years, you would have 76,123. Increasing your money by seven-fold is not a reflection of the gains of an investor who had incredible luck or picked top-performing stocks. It’s literally what the average investor would have made.

What does this tell us about the odds of investing vs. gambling? Unlike at a casino where the odds favor the house when you’re investing, the odds are in your favor. But perhaps an even more significant difference between stock trading and gambling is that gambling is a zero-sum game, and stock trading is not.

Gambling is a Zero-Sum Game – Investing is Not

When gambling, whether at a casino, horse track, or even with friends, some people win, and others lose, but the net benefit is zero. This is what is known as a zero-sum game. Stock trading is not a zero-sum game. We can think about this at both the individual company level and the level of the stock market as a whole.

When you purchase a stock, you’re buying a small piece of a company. When that company does well, you do well. And while some companies may do better than others, there is not some finite amount of profit that companies must share. Just because one company does well does not mean another company must do poorly. Competition among companies can drive productivity and growth for all involved.

The market as a whole is also not a zero-sum game. As we’ve seen, the annual average return of the market has been about seven percent. When you invest in stocks, you have the opportunity to take advantage of this growth.

The Bottom Line

High-risk speculative investing is often compared to gambling. The problem is that financially savvy investing isn’t speculative. Furthermore, gambling is a zero-sum game with the odds stacked against you. This isn’t the case with calculated investing or trading.