There’s a lot of misinformation on the types of traders and trading styles. I’m here to clear the confusion. A trading type depends on the trader’s activity discretion, concentration, data used, position quantity, and trade frequency.

| Type | Determining Factor |

|---|---|

| Active vs. Passive | Trade Activity |

| Systematic vs. Discretionary | Trade Discretion |

| Concentrated vs. Diversified | Traded Portfolio |

| Stocks vs. Commodities vs. Forex | Traded Asset |

| Technical, Fundamental, Macro, and Quantitative | Trade Data |

| Scalping, Day Trading, Swing Trading, Position Trading | Trade Frequency |

Active vs. Passive Trading

Active traders try to beat the market by developing a trading strategy and executing that strategy through buying and selling activity.

Passive traders try to match the market by regular investments in an index or a group of indices using dollar-cost averaging and keeping fees low.

| Class | Description |

|---|---|

| Active | Hands-on approach. Tries to beat the market through buying and selling. |

| Passive | Uninvolved approach. Tries to match the market through low fees and dollar-cost averaging. |

What Is Better: Active or Passive Investing?

I am an active trader but wouldn’t suggest active management unless you have a passion for trading and investing. Beating the market is extremely challenging, and most active managers fail to beat their benchmark.

Discretionary vs. Systematic Trading

Active traders generally use either a systematic or discretionary approach. Passive traders also can be classified as systematic or discretionary depending upon when they purchase a passively managed asset.

| Type | Description |

|---|---|

| Discretionary | Intuitive approach. An individual completes trading. |

| Systematic | Rules-based approach. A computer or an individual can execute trading |

| Algorithmic | Rules-based approach. A computer executes the trading. |

Discretionary investors spend significant time learning about a handful of individual companies and investing in their best ideas. Common examples of these types of investors are Warren Buffett and Peter Lynch.

Systematic traders spend time researching and developing trading systems and then carrying out their strategy. The strategy can be executed by a trader or by a computer. An example systematic strategy would be to buy on a golden cross (when the 50-period simple moving average crosses above the 200-period moving average) and to sell a death cross (when the 50-period simple moving average crosses below the 200-period simple moving average). The turtle trader legends Richard Dennis and William Eckhardt were systematic traders.

Algorithmic traders use algorithms or predictive models to determine asset selection and perform trade execution. You can think of an algorithmic trader as a systematic trader using computers to scale both research and trade execution. Cliff Asness of AQR is an algorithmic trader.

What Is Better: Discretionary or Systematic Trading?

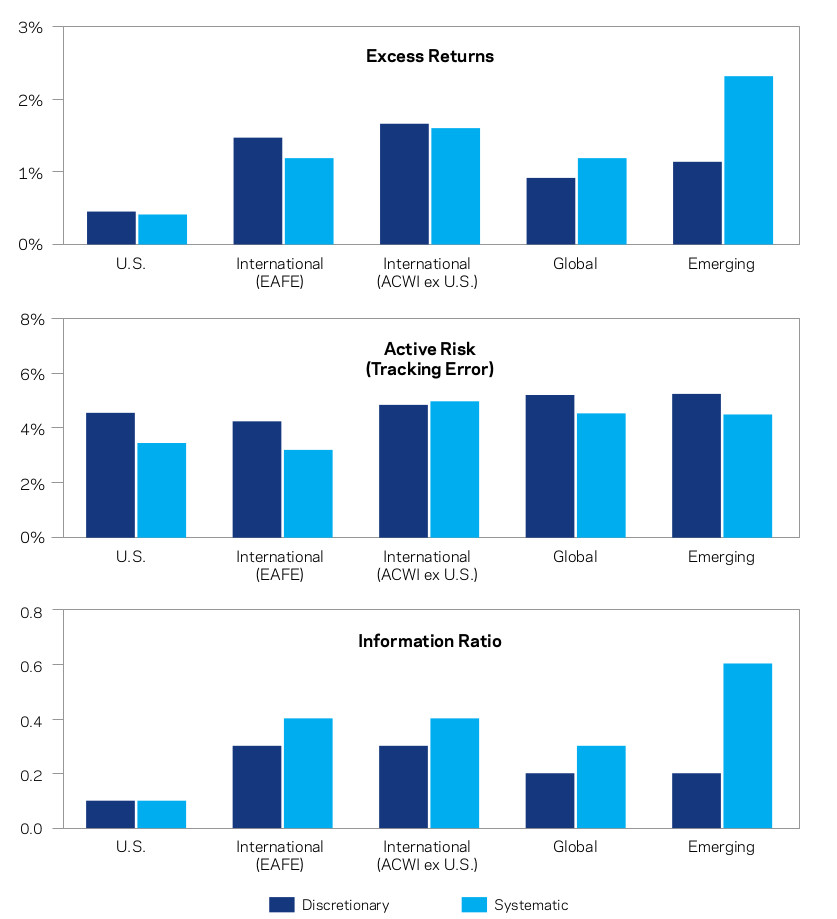

AQR shows below that neither approach is better for total returns, but systematic managers tend to provide those returns with lower volatility. This is generally due to being more diversified.

Concentrated vs. Diversified Trading

As stated previously, discretionary managers tend to know a few companies very well. This leads to concentrated portfolios. On the other hand, systematic managers tend to exploit statistically significant factors in the market, such as value or momentum premia. This requires systematic managers to hold a more substantial number of positions.

What Is Better? Concentrated or Diversified Trading

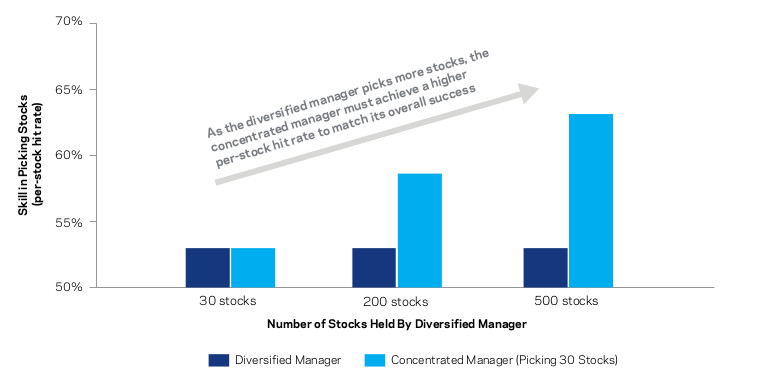

There’s an inverse relationship between absolute returns and portfolio risk. Great stock pickers can earn outsized returns on a few stocks but have difficulty reducing volatility through diversification, as shown below by AQR.

Market Traders

Traders can also be classified by the asset they trade. The below is not an exhaustive list but a summary of the most common markets traders use.

| Market | Description |

|---|---|

| Stocks | Trades stock shares |

| Options | Trades stock options |

| Futures | Trades commodities and other assets |

| Forex | Trades currency pairs |

Trading laws are different for each market, so before developing a day trading system for stocks, make sure you understand the requirements. For instance, the minimum required starting capital, under U.S. law, for day trading stocks is $25,000.

Additionally, each market has different characteristics, and a strategy in one market often does not work in another market. As an example, the stock market means reverts more than other markets. Additionally, more capitalized markets tend to trend longer than smaller markets.

Trading Styles

The data source dictates the investment style, and they’re not mutually exclusive.

| Style | Data | Example Use |

|---|---|---|

| Fundamental | Company data | Trading around a company merger |

| Technical | Price and volume | Stop-loss at a technical price support level |

| Global Macro | Economic data | Using economic data to predict a recession |

| Quantitative | Mathematical models | Developing derivative pricing models |

Fundamental traders focus on company-specific events to determine which asset to buy and when. A common example would be merger arbitrage. Trading on fundamentals is more closely associated with swing and position trade durations than scalping or day trading.

Technical traders use price and volume patterns to understand underlying supply and demand economics. These patterns are often used to time buy and sell entries and exits. An example pattern would be selling an asset if it breaks through a technical support level. Technical traders use all trading frequencies.

Global macro traders use economic datasets to predict where the market is headed. An example would be a trader who uses unemployment or manufacturing production data to aid in their decision-making. Global macro traders generally are position traders as an economic thesis can take time to play out.

Quantitative finance traders or ‘quants’ use mathematical models to predict asset prices. An example of a quantitative finance approach would be creating derivative pricing models.

What’s the Best Trading Style?

There is no best style. Each trading style works for different reasons, and they can be used together. For instance, a fundamental investor can use technical price levels to better time the market.

Trading Frequencies

Scalping, day trading, swing trading, and position trading are classified by their trading frequency.

| Group | Trade Duration | Capital Limitation | Return Potential |

|---|---|---|---|

| Scalp Traders | Minutes | Very high | Very high |

| Day Traders | Hours | High | High |

| Swing Traders | Weeks | Medium | Medium |

| Position Traders | Months | Low | Low |

Scalping traders trade intraday full-time and take tiny profits repeatedly. Trades last from seconds to minutes. Scalp traders will place tens to hundreds of trades in a single day believing small price moves are more accessible than larger ones. They do not hold positions overnight. Scalping traders have a high return potential but have difficulty growing the account after trading accounts grow more than six figures. Most scalpers use leverage to magnify the returns generated from small price movements.

Day traders also trade full-time and buy and sell on the same day. The difference between traders and scalpers is that day traders usually hold their positions from minutes to hours, trying to catch a more significant move. They generally do not hold positions overnight and close out all trades before the market closes. Most day traders use leverage.

With scalping and day trading, fees can add up quickly due to trade frequency. Both scalpers and traders want significant volatility. Day traders generally look for more volume and often trade in the open market.

Swing traders try to capture more significant, multi-day moves. They can trade full-time but also have the ability to trade part-time as they’re not as concerned with intraday moves. The return characteristics are slightly lower than for traders with a higher frequency, but swing traders are not as limited by account size and transaction fees.

Position traders try to capture the longer-duration moves in an individual investment. Position trading affords the most flexibility as day-to-day fluctuations are not as relevant. This trading frequency incurs the lowest fees and allows for the largest account sizes but suffers from lower annual return potential than the higher frequency traders.

Which Is the Best Trading Frequency?

The return potential of each group is inversely related to the capital size. For instance, it’s not unheard of for a scalper or day trader to earn 100% annually on small account sizes; however, these returns will decrease over time as the account size grows larger due to slippage. Position trading strategies have longevity compared to day trading or scalping strategies. Also, scalping and day trading is getting more and more competitive due to high-frequency trading.