A stock catalyst is any news or event that leads to an increase or decrease in a stock’s price. Hard catalysts affect the company directly, while soft catalysts affect the company’s industry or global economy.

What Is a Stock Catalyst?

A stock catalyst is anything that leads to a substantial change, positive or negative, in the price of a stock.

Examples of stock catalysts could include an earnings report, the announcement of a new product, a press release, a comment from the company’s CEO, or congress passing a piece of legislation. The critical factor among these examples is that the event must be expected to impact the company. Not every CEO’s comment is a stock catalyst, but one that announces that the company will move in a different direction almost certainly will be.

Furthermore, events that may seem mundane on the surface may prove to be stock catalysts when considered in the broader context.

For example, let’s say the CEO of a publicly-traded company fails to attend a significant event. The CEO may have fallen ill, and if there’s no reason to assume anything else is going on, this would likely have little to no impact on the company’s stock price. On the other hand, if rumors of the CEO’s impending resignation had been going around and the CEO had been noticeably absent for the last week or two, the CEO’s failure to attend the event may serve as a news catalyst.

Why Do Catalysts Matter?

Catalysts matter for traders looking to take advantage of changing stock market trends because catalysts affect future cash flows. Familiarity with stock market catalysts benefits traders who wish to profit from movements in the market.

Catalysts also matter because they help traders craft a narrative around their trading decisions. To understand what we mean by this, it’s essential to keep in mind that while catalysts are the events that lead to changes in price action, the catalyst may not be the underlying cause of the move in price movement.

This may, at first glance, seem like a contradiction. If the catalyst is the event that leads to an increase or decrease in price, isn’t it the cause?

To clarify this concept, let’s take a step back and review the definition of a catalyst, which is “an agent that provokes or speeds significant change.” In other words, a catalyst does not create change; it merely makes it happen more quickly.

We could apply this concept to our previous example of the CEO failing to appear at an important event. If there was no reason for concern, this event means little. But if there were already an existing concern, this event may act as a catalyst that causes traders to act on suspicions that something was wrong.

People need reasons to buy and sell stocks. Catalysts are the framework on which traders hang their narratives – if the CEO fails to attend an important event, the story may be that the CEO may soon be ousted from the company or resign, either of which could negatively impact the company.

Since catalysts impact the market, they affect all traders, but they matter more to some traders than others. We’ll now look at why exactly that is.

Catalysts for Investors and Traders

The value a trader or investor places on stock catalysts depend on that individual’s trading strategy, specifically whether it is based more on a value or momentum philosophy.

Traders typically fall somewhere along the spectrum of value and momentum.

On one side, we have a pure value investor. This investor places no value on almost all stock catalysts. A value investor attempts to profit from the market by looking at a company’s fundamentals – operational efficiency, valuation, etc. A value investor might enjoy seeing a price change in reaction to a stock catalyst if the price movement aligns with their previous assumptions – for example, if they believed the value of a company would increase and then the stock price increases in response to a catalyst. But a value investor does not make trading decisions based on stock catalysts.

On the other side of the spectrum, we have a day trader. The trader seeks to take advantage of price action in the market to make a profit, and therefore catalysts play a crucial role in their trading strategy.

While the role of catalysts depends on the individual’s trading strategy, as I said, this is a spectrum. Most people fall between the pure value investor and the pure momentum trader.

For example, a value investor may primarily focus on the fundamentals and look for a catalyst to avoid a value trap.

The application of catalysts is about more than just the trading strategy being used; it’s also about the type of catalyst.

What Are the Different Types of Catalysts?

The two main types of catalysts are hard catalysts and soft catalysts. You can also break down catalysts into bullish and bearish.

We’ll quickly look at what all four mean – hard, soft, bullish, and bearish.

Hard Catalysts

A hard catalyst, also known as a direct catalyst, is a catalyst that is directly related to the stock, typically coming from the company itself.

Company news, such as earnings reports, the announcement of new senior management, a new product launch, a merger, etc., may all be examples of hard catalysts since each of these catalysts relates directly to the company. Hard catalysts typically cause large price movements.

Soft Catalysts

The opposite of a hard catalyst is a soft catalyst. These are catalysts that indirectly impact a company.

An example of a common soft catalyst is regulatory changes. Government regulations do not impact individual companies. Instead, they typically impact entire sectors or companies with a specific framework.

An excellent example that received a lot of media attention around the 2020 election was California Proposition 22. Prop 22 was a ballot measure that exempted “gig economy” companies from a California law that required these companies to treat workers like employees. While it would have impacted many California businesses, there was a lot of discussion on how the proposition would specifically impact Uber and Lyft. Therefore the passing of the proposition acted as a catalyst for Uber and Lyft.

Bullish Catalysts

A catalyst may be either bullish or bearish. If a catalyst is bullish, it leads to an increase in the price of a stock. A bullish catalyst may be either a hard or soft catalyst.

Let’s return to our example of proposition 22. Since the ballot measure passed, it was a bullish catalyst for Uber and Lyft (positively impacting their stock prices). If the proposition had failed to pass, it would likely still have been a catalyst, but it would have been a bearish catalyst (negatively impacting stock prices).

Bearish Catalyst

The opposite of a bullish catalyst is a bearish catalyst. Like a bullish catalyst, a bearish catalyst may be either hard or soft.

A bearish catalyst we’ve become quite well acquainted with is COVID-19 (Covid). Specifically, this macro event is a soft (indirect) catalyst that has negatively impacted many companies and sectors. The pandemic and the subsequent quarantine to slow its spread acted as a bearish catalyst for many companies, including restaurants, event-based companies, and companies whose supply chains were negatively impacted by Covid.

This is not to say that Covid has been a bearish catalyst for all companies. For example, Covid has acted as a bullish catalyst for some companies. This highlights the importance of considering the catalyst’s impact on a company within the broader context. An event that’s a bearish catalyst for one company may serve as a bullish catalyst for another.

What to Look for in Stock Catalysts

As we’ve seen, in the right circumstances, almost any event can be a stock catalyst, but that doesn’t mean every event is a stock catalyst. So, what can you look for to confirm an event is a stock catalyst?

Part of confirming stock catalysts involves understanding the context of the event. This may require an understanding of the company, its operations, its supply chain’s workings, etc. The other part of confirming a catalyst involves employing tools that prove the stock catalyst impacts a price trend.

Two of the most popular tools for confirming and evaluating catalysts are volume and volatility.

Volume

Volume is a crucial factor to consider when evaluating any stock, especially when attempting to confirm or assess a catalyst.

Volume is how much an asset is bought and sold over a given period (usually one trading day). A higher volume level means there’s a higher turnover level (more people buying and selling the asset).

Generally, high volume signifies that a price change is more than just a quick blip and has sufficient momentum to carry a trend. This momentum could lead to either an uptrend (increasing stock price) or a downtrend (decreasing stock price) depending on how the catalyst moves the price.

An excellent recent example of catalysts and increased trading volume is Kodak. Kodak stock saw high levels of volatility in response to a few different news pieces, most notably that Kodak would receive a loan to assist in producing ingredients necessary for potential Covid treatments. Later, the company was under investigation for insider trading.

In December of 2020, the announcement that the investigation of Kodak found no instances of wrongdoing acted as a catalyst for the stock. The stock saw a 1,000% increase in the weeks following the announcement. The day before the announcement, Kodak saw heavy trading volume before the market close. Therefore, the high trading volume acted as a leading indicator for the catalyst in this instance.

Volatility

Another tool traders may use to confirm and evaluate catalysts is volatility.

Volatility is how much an asset’s price fluctuates over a given period. If an asset has a high level of volatility, the price fluctuates fairly consistently and dramatically. If the asset has a low level of volatility, it means that the asset’s price remains relatively steady.

Another way to think about volatility is the level of indecision in the market regarding the price of an asset.

So, is volatility a good thing or a bad thing? It all depends on your goal.

As a general rule, high volatility stocks come with a higher risk level, but they also come with more opportunities to make a profit. Higher volatility stocks, such as penny stocks, have more significant price swings. If a trader can predict a price swing, they can enter a position (either buying the stock or shorting the stock) and then exit the position once the price change occurs.

While a catalyst may impact a stock price regardless of whether the stock is typically highly volatile or not, a highly volatile stock is more likely to see a dramatic response to a catalyst since there is already existing price uncertainty.

Alternative Data

While volume and volatility are excellent tools for confirming catalysts, they’re not the only tools traders have. An increasingly valuable tool is alternative data in our modern, data-driven world.

What is alternative data?

Alternative data is any information that traders could use to gain investing insights that do not come from traditional data sources, such as social media.

Alternative data comes from sources outside of a company and includes everything from employment data to app usage. This data can provide early confirmations of other stock catalysts and act as a stock catalyst.

For example, the volume of online queries, which we can see using Google Trend data, allows us to see the popularity of specific search terms. While this information is not valuable on its own (compared to more traditional data such as earnings releases), it has the potential to provide valuable insights when considered in context.

For instance, if we look at the number of Google searches for the term “facemasks” in the United States, we see a rapid and dramatic increase between March 15th and April 4th, 2020, and then another bump again in July. This provides potential investment research on the acceptance of face masks and the social sentiment regarding the spread and response to a pandemic.

How to Find Stock Catalysts

We’ve looked at tools traders can use to help confirm stock catalysts, but how do traders go about finding stock catalysts?

Anything theoretically can be a stock catalyst, which means there’s a lot of potential for final untapped opportunities (such as alternative data sources). Still, it also means it can be hard to find the events that are stock catalysts.

Furthermore, as previously mentioned, whether an event is a stock catalyst will depend on the context in which the event occurs and the company’s stability. The same event may act as a catalyst for one company but not another.

That being said, there are a few places to start for those interested in finding stock catalysts. We’ll conclude this post by looking at five of the most common places to start looking for catalysts:

- Economic calendars

- Earnings calendars

- Analysts upgrades and downgrades

- FDA approvals

- Social Arbitrage

Economic Calendar

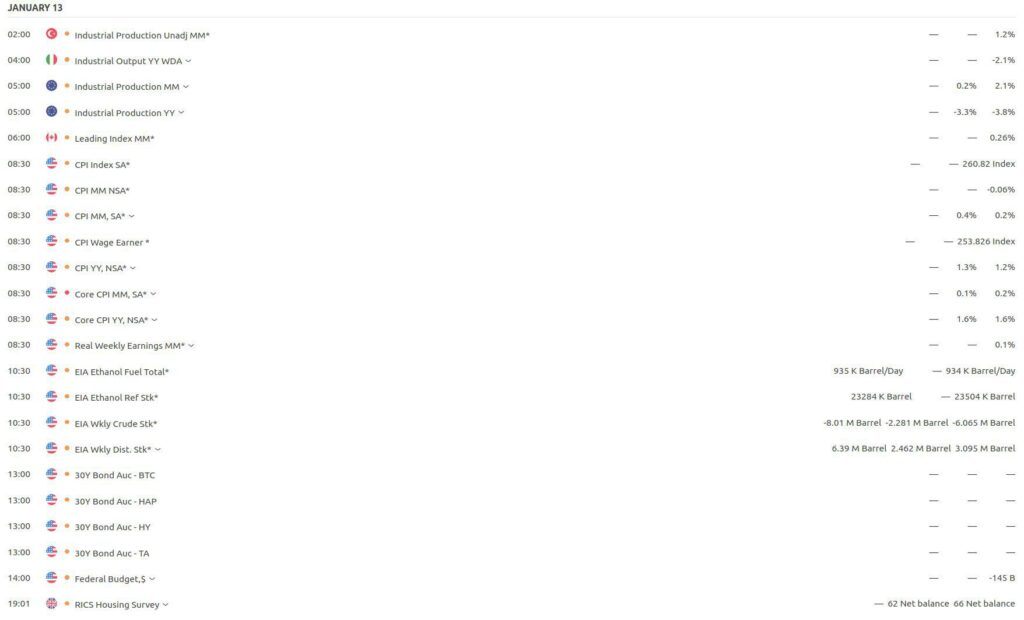

An economic calendar is a calendar that lists out the major economic events expected to occur each day.

Typically, economic calendars include events listed for various countries. While an economic calendar may consist of information for any country, you’re most likely to see events related to the economies of those considered major players in the global economy (Germany, Great Britain, France, Italy, the United States, Canada, China, Japan, Australia, etc.)

What exactly are the sort of events you’ll see listed on an economic calendar?

Most often, economic calendars include the release time and date of reports or data that reflect the current state of that country’s economy.

For example, some of the events you may see listed for the United States include the release of the following reports: Average Earnings, Non-Farm Payrolls, and the Unemployment Rate. All three of these reports provide valuable information on the state of the U.S. economy and are released on Friday mornings. The market often responds to this data, especially if it is higher or lower than expectations.

As you can see, the events on an economic calendar often directly impact the market since they report on the economy’s state and therefore are often a clear example of stock catalysts.

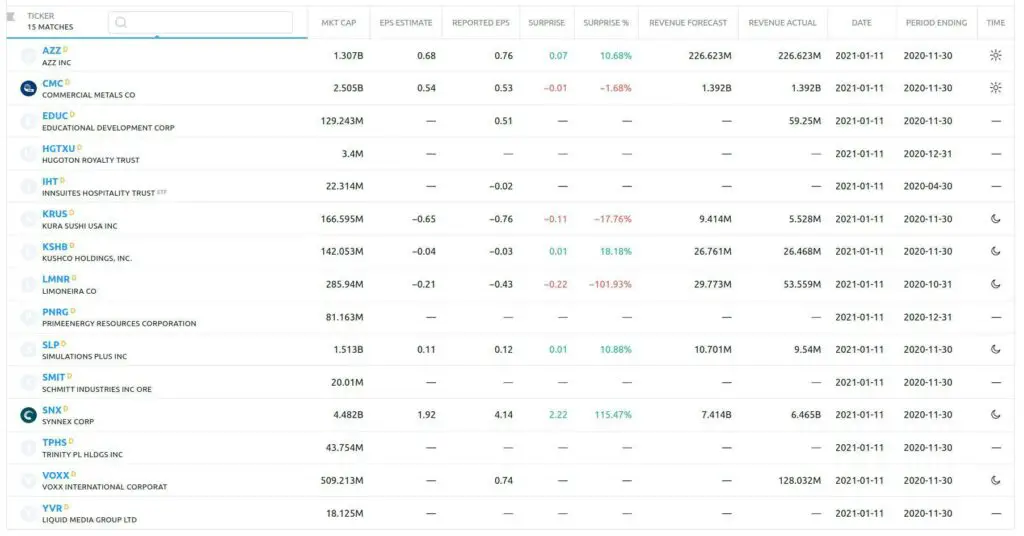

Earnings Calendar

Like an economic calendar, an earnings calendar lists out dates and times for the release of important announcements. Still, the announcements on an earnings calendar refer to when companies publicize their earnings.

The most valuable tool for determining a company’s value is its financials. Earnings announcements provide updated information on the company’s financials. Investors (especially value investors who base their trading on a company’s fundamentals) will often enter or exit a position based on an earnings report.

Earnings announcements may result in either hard or soft catalysts.

First is the more apparent hard catalyst, in which an earnings surprise (results are higher or lower than anticipated) for a specific company results in an increase or decrease in that company’s share price.

Earnings announcements may also act as soft catalysts. For example, an earnings announcement from a Bellwether company means its performance is considered an indicator of the economy’s overall health. A current Bellwether company is Apple. If Apple were to announce earnings dramatically lower than anticipated, this would likely impact Apple’s share price and act as a soft catalyst for other companies.

While earnings announcements happen throughout the year, you’ll notice a few busy weeks shortly after each quarter-end if you look at an earnings calendar. This is referred to as “earnings season“.

Earnings season is an ideal time to watch earnings winners and losers, especially from Bellweather companies. Your trading platform should alert you of upcoming earnings reports, and I highly recommend all traders incorporate some element of an earnings calendar into their trading plan.

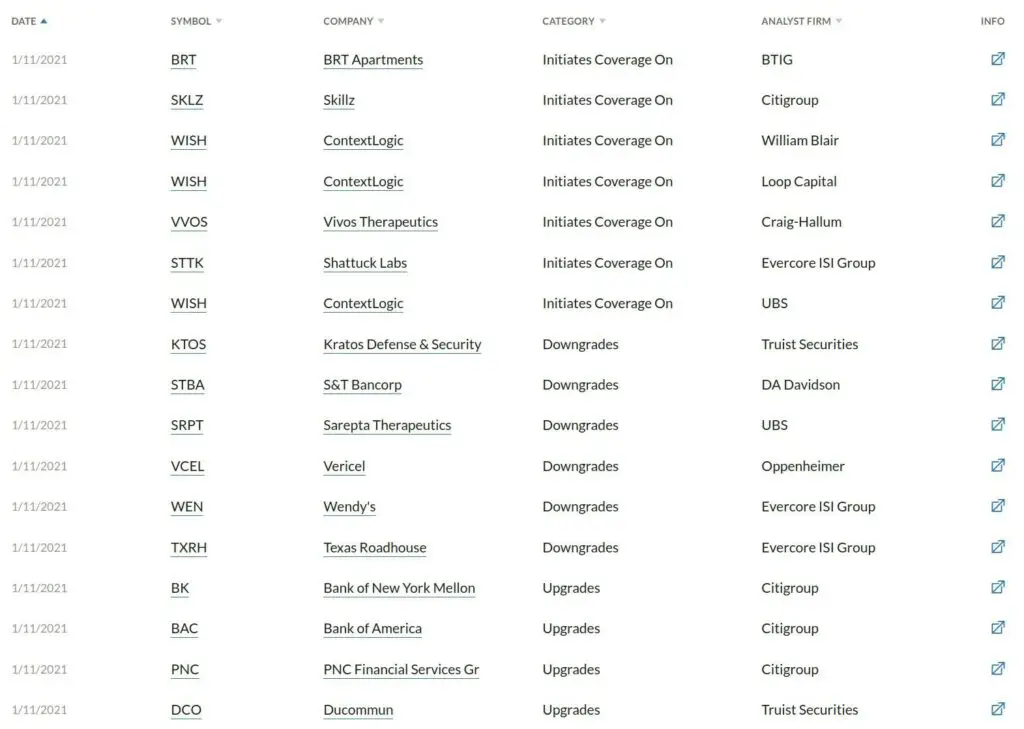

Analyst Upgrades and Downgrades

An analyst upgrade or downgrade is when an analyst changes the stock rating of a specific company.

Analysts have an in-depth, specialized knowledge of a specific stock or industry. Therefore, analyst ratings hold a lot of weight. If an analyst upgrades a stock’s rating (from hold to buy), the company’s share price often increases. Conversely, if the analyst downgrades the stock rating (from hold to sell), the company’s share price often decreases. Analyst ratings from a securities brokerage affect investment decisions and are often stock catalysts.

When do upgrades and downgrades occur?

Analysts continuously update the stock ratings of companies, so they’re constantly changing. This means that, unlike an economic or earnings calendar, you won’t know when the catalyst may occur ahead of time. You can still review an upgrades and downgrades list for a comprehensive inventory of the most recent upgrades and downgrades.

An upgrade and downgrade list will usually include a lot of information, which we’ll quickly go over.

First, we have relatively straightforward information; the date, the stock symbol or ticker (the series of letters by which the company is identified on an exchange), and the company’s name.

You’ll typically find two other pieces of information that may require a bit more explanation: the category and the analyst firm. The analyst firm is the firm from which the analysis is employed. The category is essential since it provides information on any changes to the stock’s rating.

Upgrades and downgrades we’ve already explained, but you may also see “maintains” or “initiates coverage on”. A “maintains” listing comes from a hold recommendation, which is neither a buy nor sell recommendation. A “maintains” listing is better than a downgrade but not as good as an upgrade. Finally, “initiates coverage on” means that the analyst has begun to cover that company and has released an initial report.

FDA Approvals

FDA approvals occur when the FDA has approved a drug for use and are stock catalysts for biotech companies.

Biotech stocks are often highly volatile. A new drug may show a lot of promise, and that company’s stock may shoot up, but if the medicine fails to receive FDA approval, its share price will often decline precipitously.

Since FDA approval is the final stage for a new drug before it is allowed into the market, this is often the most dramatic catalyst, but it is not the only one. New pharmaceutical medicines can make companies massive profits, but the path from promising drugs to FDA approval is fraught. There are multiple stages of clinical trials, competitors, deferred FDA approval reviews, and more.

Those previously less familiar with the biotech industry may have become more familiar with it in 2020 when the race to create a Covid vaccine received a healthy amount of media coverage. The market reacted to each update in the vaccine process, and we saw the share price of the top vaccine contenders increase due to the high demand for the vaccine (every person in the world).

While not every biotech saga is quite as dramatic, the bottom line is that the general process and the announcements which may serve as catalysts remain pretty similar.

The FDA Calendar is a great place to start if you’re looking for a comprehensive list of biotech stocks and their stock catalysts.

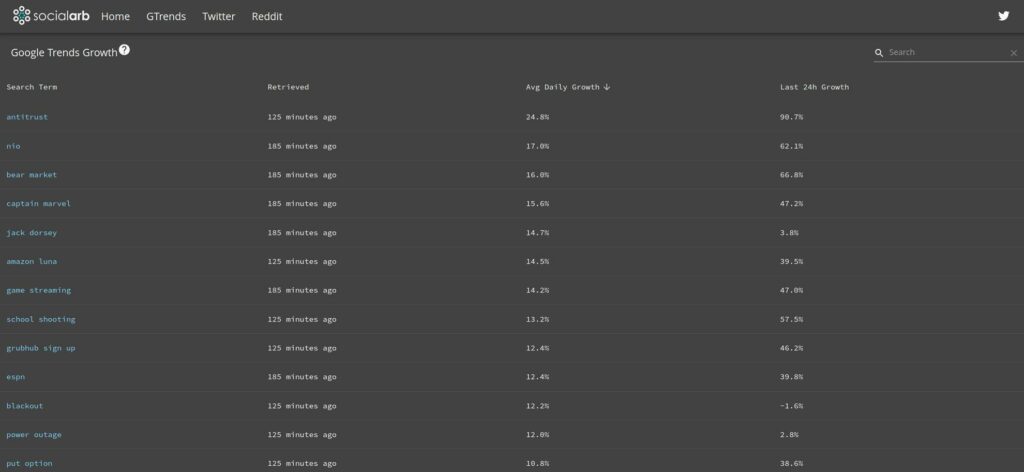

Social Signals

The final catalyst we’ll look at is social signals, all about detecting social trends that will impact the stock market.

Social signals can be either hard or soft catalysts depending upon the nature of the information. In our previous example, using Google Trend data to review the popularity of the search term “facemasks” in the United States would be an example of a soft catalyst.

Discovering on Twitter or a social signal app like SocialArb that Pelaton has a three-month waitlist due to demand is an example of a hard catalyst.

Unlike our previous four common catalysts, social arbitrage is harder to pin down. It requires a more in-depth understanding of the context of the specific trend and its implications for both individual companies and the stock market as a whole.