Have you ever ordered an Uber, signed up for Netflix, booked a stay at an Airbnb, ordered a pizza on the Dominos mobile app, or received a text message after entering a password to verify it is you? If so, you have used Twilio.

Twilio’s mission is to fuel the future of communications. Founded in March of 2008, Twilio provides a platform for developers to integrate voice easily, video, messaging, and email into their apps. Before Twilio and other communications-as-a-service companies, developers would have to set up servers, networking infrastructure and develop agreements with telephone companies to route data, which is incredibly complex and capital intensive. Much akin to how Amazon Web Services (AWS) allows easy deployment and scale of applications, Twilio enables easy deployment and scale of communications.

Twilio’s Story

Twilio is a story stock. It is a young company with first-mover advantages going after a massive market with two great leaders at the helm. The most significant challenge with this valuation is determining where Twilio’s story goes: Is this an API company that focuses on basic, low-margin messaging services that are easily replicable, or is this a sticky communications disruptor with massive potential ahead of it? I believe the market misunderstood Twilio as the former when it lost a portion of Uber’s business and is only starting to recognize Twilio’s real potential. I think the release of Twilio Flex is the first step in a long journey of disruption.

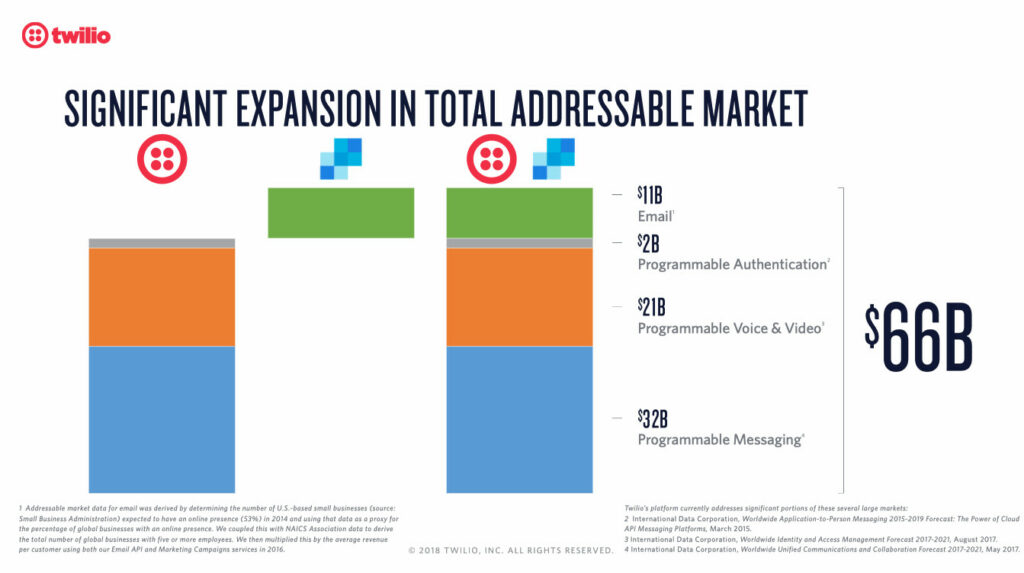

So What’s Twilio’s Opportunity? Twilio does not fit neatly into an existing market as it is disrupting multiple current communications markets. According to Twilio, their total addressable market is $66B, subcategorized into email, programmable authentication, programmable voice & video, and programmable messaging as per their SendGrid acquisition investor presentation.

The following was found looking for other perspectives on Twilio’s TAM:

- Market Research Engine predicts the global telecom API market will grow at a CAGR of 24% from 2015 to 2022 and is expected to reach $325 billion by 2022.

- Markets and Markets expects the global telecom API market to grow from 93.69 billion in 2016 to 231.86 billion by 2021 at a CAGR of 19.87%

- Zion Market Research expects that the global telecom API market was capitalized at almost USD 66.37 billion in 2016 and is likely to cross nearly USD 218.84 billion by 2022, developing at a CAGR of almost 22% from 2017 to 2022.

Or Segmented:

- Unified Communications: 35-96 billion by 2023

- Contact Centers & Customer Care 20 billion by 2022

- Internet of Things: (470 billion)

- 7 billion by 2020 from IDC

- 470 billion by 2020 from Bain & Company

- 32 trillion by 2025 from General Electric (Link Removed)

Twilio Post-Merger Valuation

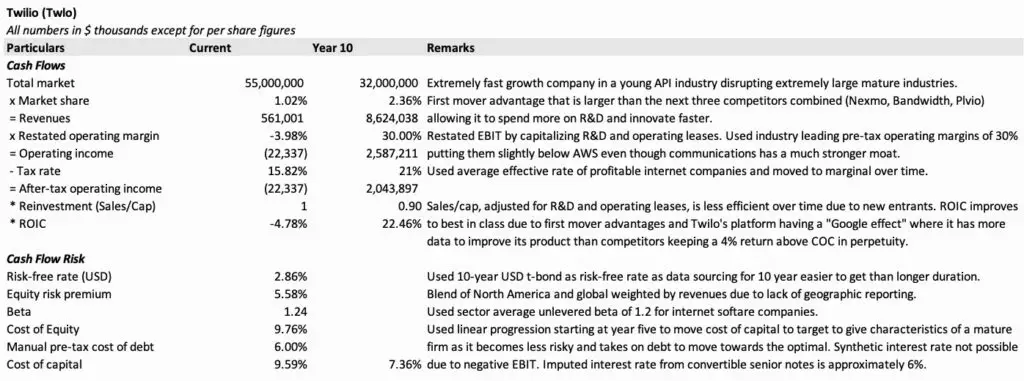

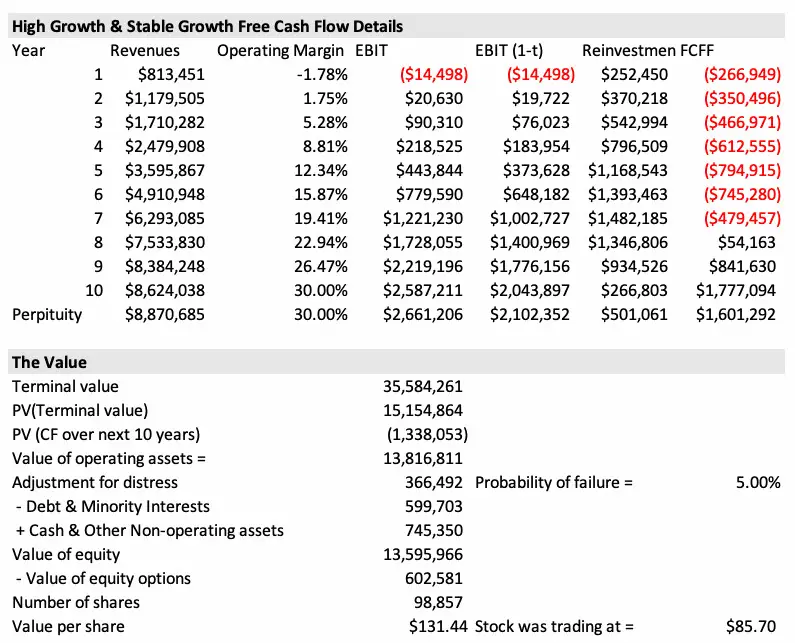

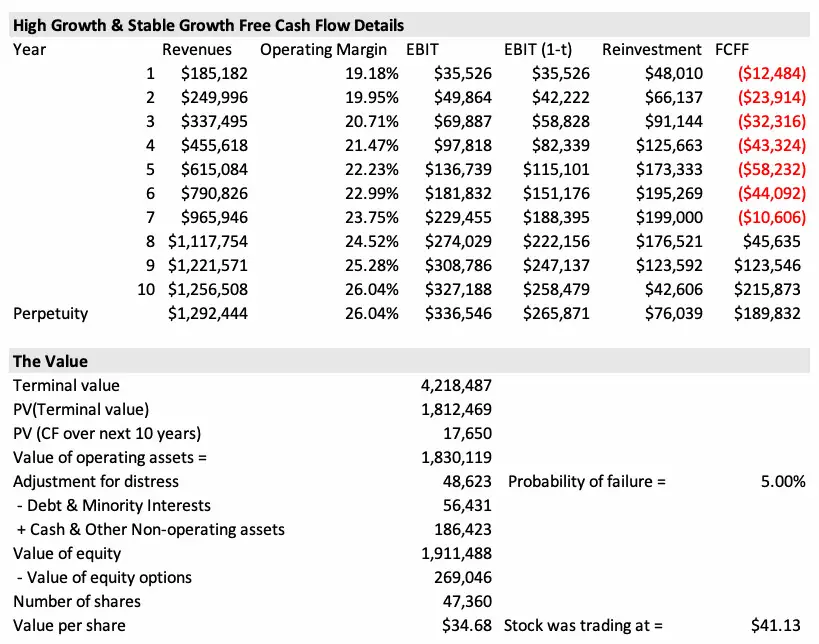

Twilio Valuation

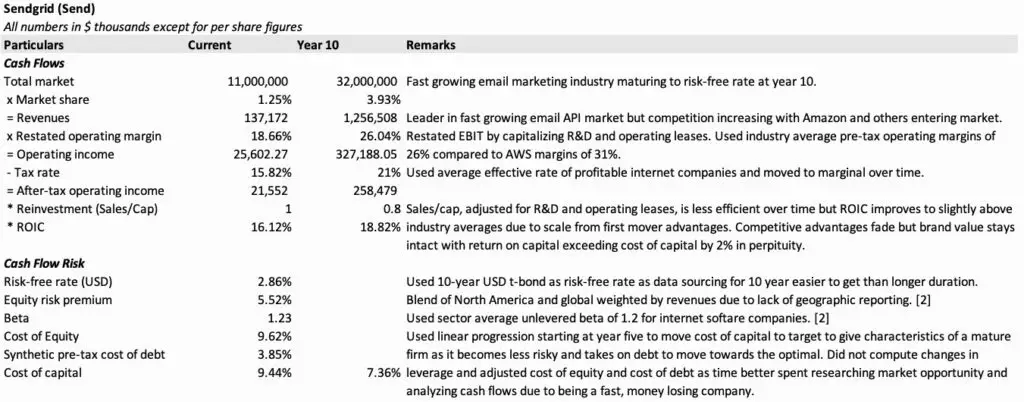

SendGrid Valuation

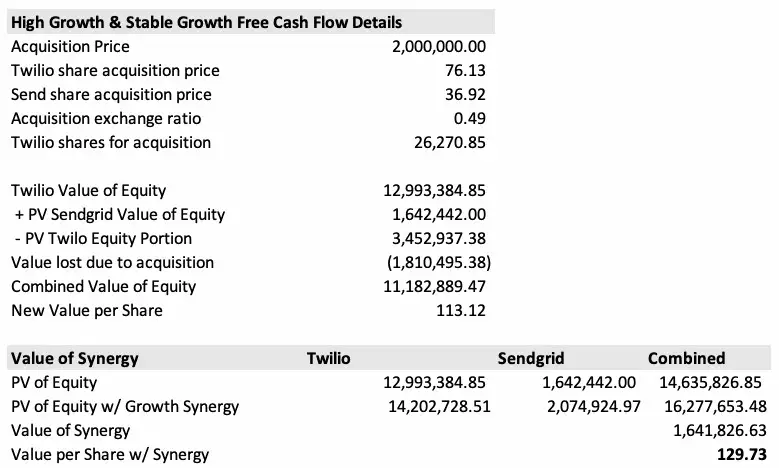

The Combined Company Valuation

Twilio is still undervalued even after paying too much for SendGrid, including cross-selling synergies increasing growth by 5%, 3%, and 1% for the next three years.

The Pricing

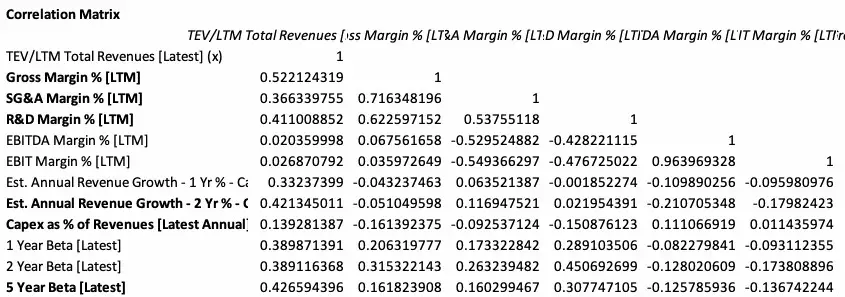

Twilio should be valued against its peers on an EV/Sales basis due to the lack of profits from most high-technology firms. Data was collected from S&P Capital IQ, referencing 181 of its publicly traded peers with a market capitalization higher than a billion and within the internet software and application software industries. The key drivers of the EV/Sales multiple are deconstructed using a stable growth model.

𝐸𝑛𝑡𝑒𝑟𝑝𝑟𝑖𝑠𝑒𝑉𝑎𝑙𝑢𝑒=𝐹𝐶𝐹𝐹𝑁𝑒𝑥𝑡𝑌𝑒𝑎𝑟(𝐶𝑜𝑠𝑡𝑂𝑓𝐶𝑎𝑝𝑖𝑡𝑎𝑙–𝐺𝑟𝑜𝑤𝑡ℎ)

𝐸𝑛𝑡𝑒𝑟𝑝𝑟𝑖𝑠𝑒𝑉𝑎𝑙𝑢𝑒𝑆𝑎𝑙𝑒𝑠=𝐴𝑓𝑡𝑒𝑟𝑇𝑎𝑥𝑂𝑝𝑒𝑟𝑎𝑡𝑖𝑛𝑔𝑀𝑎𝑟𝑔𝑖𝑛∗(1+𝐺𝑟𝑜𝑤𝑡ℎ)∗(1–𝑅𝑒𝑖𝑛𝑣𝑒𝑠𝑡𝑚𝑒𝑛𝑡𝑅𝑎𝑡𝑒)(𝐶𝑜𝑠𝑡𝑂𝑓𝐶𝑎𝑝𝑖𝑡𝑎𝑙–𝐺𝑟𝑜𝑤𝑡ℎ)

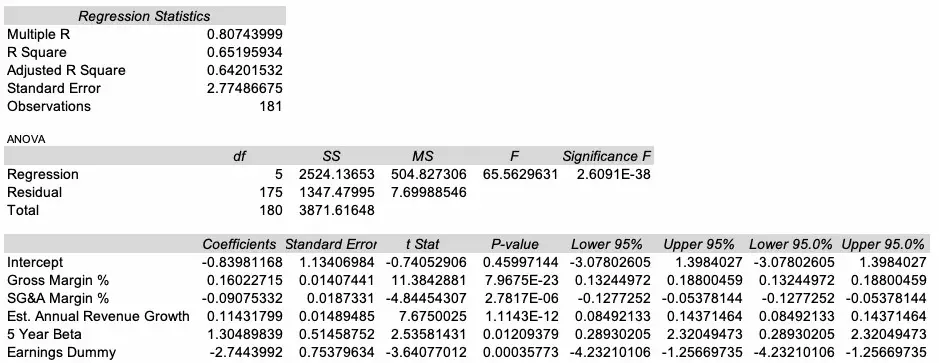

A significant regression where the 𝑟2 was within an acceptable range could not be created with the above. Expanding ATOM into gross margin, SG&A margin, R&D margin, and the effective tax rate; and adding an earnings dummy gave the regression more to work with. A correlation matrix was run to determine the best-suited variables highlighted in bold. The regression and regression equation is shown below, with the names in the regression equation shortened for readability.

𝑃𝑟𝑒𝑑𝑖𝑐𝑡𝑒𝑑𝐸𝑉𝑆𝑎𝑙𝑒𝑠=−0.839+0.160∗𝐺𝑟𝑜𝑠𝑠–0.090∗𝑆𝐺&𝐴+0.114∗𝐺𝑟𝑜𝑤𝑡ℎ+1.305∗𝐵𝑒𝑡𝑎–2.744∗𝐸𝑎𝑟𝑛𝑖𝑛𝑔𝑠𝐷𝑢𝑚𝑚𝑦 Note: Percentages to be entered as integers. 10% should be entered as 10.

Twilio has a predicted EV/Sales of 10.39 with an actual value of 17.4. SendGrid has a predicted EV/Sales of 10.32 with an actual value of 6.

The Conclusion

Both the valuation and pricing tell a different story. So while it would be nice to see both tools pointing in the same direction, I am firmly in the intrinsic value camp, and I am a buyer of Twilio at the current levels with a close eye on cash usage while looking for changes in the narrative.