Zendesk is a fast-growing software-as-a-service (SaaS) business that has made a name for itself with small businesses looking for customer support software.

I think the market has high hopes for Zendesk yet has still underestimated its “long-tail” potential. It follows a similar trajectory as Salesforce and just made some intelligent moves putting its competition in a “minor” innovators dilemma.

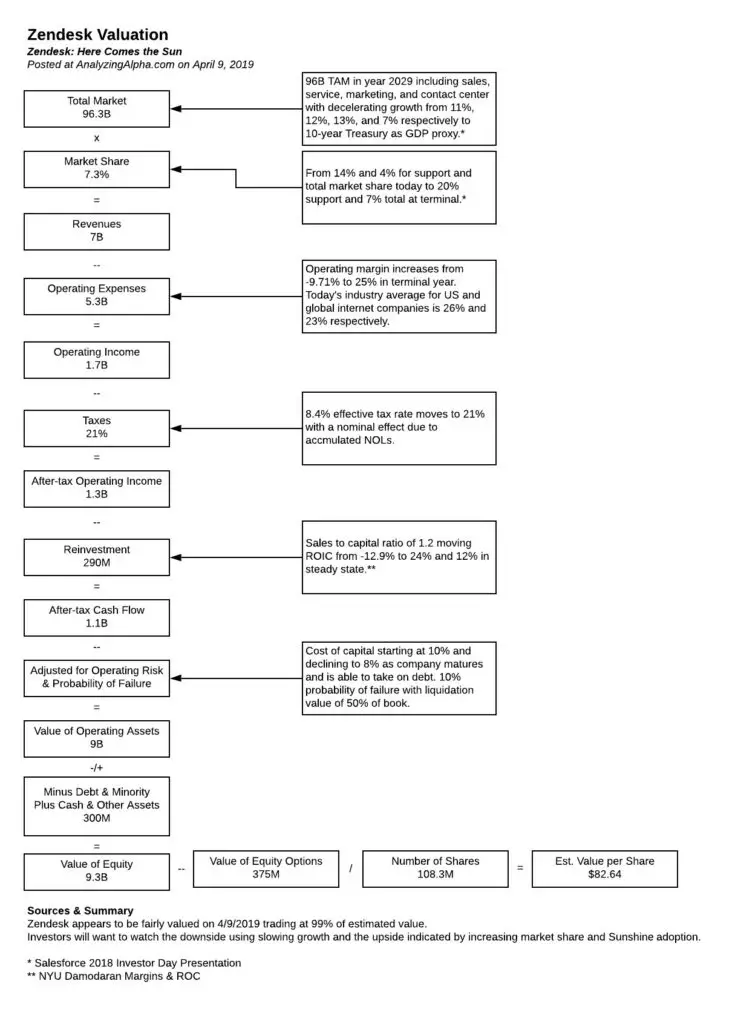

With fast-growing, money-losing companies, most of the value comes from the terminal value. Over 90% of Zendesk’s value comes after year ten. This property of fast-growing companies means we should focus our time on the Zendesk story, and more specifically, on three numbers at maturity as they drive the majority of value: – The total addressable market – The market share of Zendesk – The profit margin.

The Industry

The Total Addressable Market

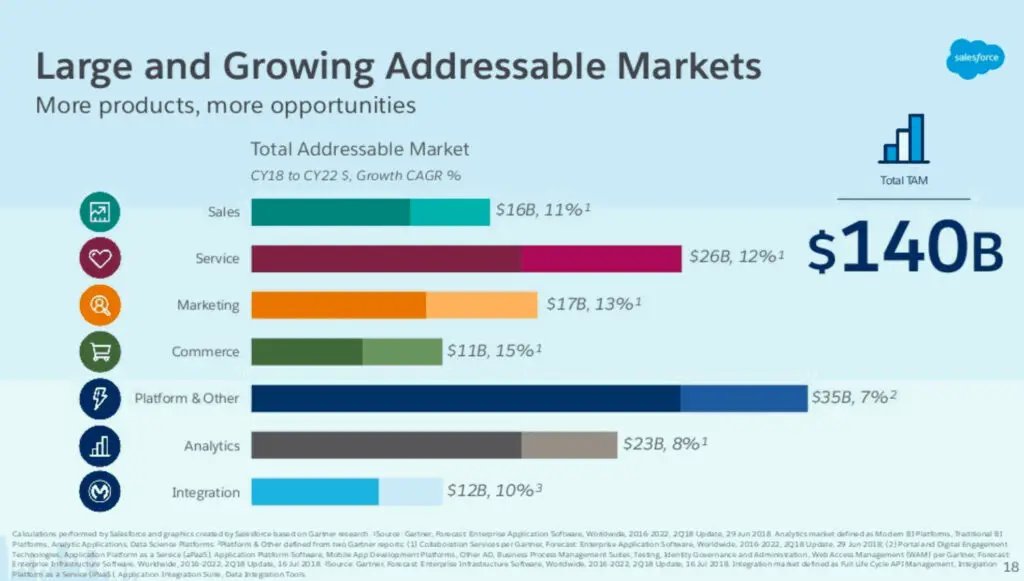

Both Zendesk and Salesforce, the undisputed leader in the space, offer similar stories on the total addressable market (TAM). The images below are sourced from their respective investor presentations.

For the Zendesk valuation, I’m forecasting ten years of cash flows and then calculating a terminal value at year eleven, 2029. Unfortunately, the above market forecasts do not predict out that far. I created the following with what I believe to be reasonable assumptions about the growth of the markets that Zendesk currently serves, giving me a 96.3B total addressable market, assuming it doesn’t expand into adjacent markets not listed in their investor presentation. As you can see, Salesforce estimates its 2022 TAM at $140B.

If Zendesk increases its market share to 5%, 20%, 5%, and 5%, that’ll give them a revenue of 7B in 10 years growing at 39.5% for the next five years and scaling to the growth rate of the economy at year ten. In truth, I think their growth rate will be a little slower but will persist longer due to cross-selling opportunities, but it doesn’t matter as it’s all about where Zendesk ends up in perpetuity.

| Sales | 11% | 9.9% | 8.9% | 8.0% | 7.2% | 6.5% | 5.8% |

|---|---|---|---|---|---|---|---|

| Customer Service | 12% | 10.8% | 9.7% | 8.7% | 7.9% | 7.1% | 6.4% |

| Marketing | 13% | 11.7% | 10.5% | 9.5% | 8.5% | 7.7% | 6.9% |

| Contact Center | 7% | 6.3% | 5.7% | 5.1% | 4.6% | 4.1% | 3.7% |

The SaaS Model

There’s a lot to like about SaaS businesses. The businesses attract customers who pay them regularly for many years. They can also innovate more quickly than on-premise software vendors as they’re working with one codebase, and they don’t have to spend up to 90% of their R&D ensuring that their software works across different platforms. If you’re interested in learning more about why SaaS companies are compelling, you can read about them at Leading Edge Capital. Although, I believe it’s reasonable to assume the 25-30% margins cited by Leading Edge Capital will likely be competed down in the short term, evidenced by Patrick Campbell of Price Intelligently’s keynote on Lessons Learned from 3000 SaaS Companies.

My story for the industry is that there will only be a handful of companies with meaningful market share over the long run.

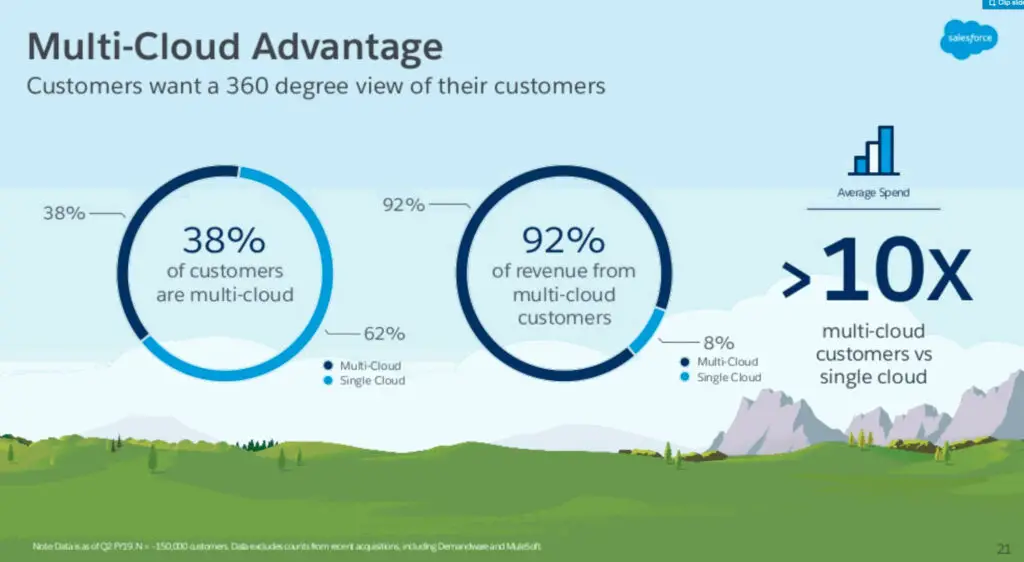

The thought process behind the industry consolidation is that smaller entrants will not have the ability to spend on artificial intelligence and other capabilities that will significantly impact the productivity of its users. Also, multi-platform companies that can manage the entire customer lifecycle will have more significant profit opportunities by increasing R&D spending to further their competitive advantages. Salesforce exemplifies this cross-selling opportunity today.

Here is the innovator’s dilemma playing out. Salesforce started offering cloud software where the competition only began offering it as a strategic response to being disrupted. These were logical choices as it would be challenging for any of the large incumbents to scrap their on-premise, market-leading software in favor of the cloud, which was only serving small businesses and was unproven at the time — especially over those slow internet connections!

The Business

Now that we’ve talked about the industry and the business model, what’s different about Zendesk, and why do I think they’re executing a “mini” innovators dilemma?

The History

When you want to understand a business, go back to its roots. The past can tell you where the future is likely to head. It’s also tough, if not impossible, to change a company culture once it reaches a critical mass. This cultural advantage is why companies like Starbucks continue to hold a market-leading position and why other airlines have difficulty competing against Southwest.

By looking at Zendesk’s past, I believe it’ll be able to successfully enter into the CRM space for two reasons built into its culture:

- Simplicity

- Proximity

Zendesk has succeeded because it provides a great customer experience for small business support staff. Unlike sales, where user adoption is “optional” and a significant issue, support staff software is not optional, and every click counts. Zendesk focuses on making things extremely simple for its users, which is pervasive through its culture and evidenced by its product names. Zendesk’s strength with simplicity will combat one of the most significant issues facing enterprise software today: user adoption.

The other competitive advantage is that its employees and hiring pool are in proximity to Salesforce. While an “osmosis effect” may not help it compete directly against its San Francisco peers, it will work versus the likes of Microsoft, Oracle, SAP, et. al.

The Strategy

I’ve laid out a story where Zendesk enters into new markets and takes market share from incumbents due to its culture of simplicity and relentless customer focus. But that’s not what piqued my curiosity about this company. “Here Comes the Sun” is a song written by George Harrison first released on the Beatles’ 1969 album Abbey Road. Zendesk may have this one on repeat at their headquarters due to Zendesk Sunshine.

Much like how Salesforce has succeeded due to being a platform company, Zendesk is in the early days of creating its platform. The difference is that while Salesforce’s platform is a traditional closed system, Zendesk’s Sunshine platform is an open system built on Amazon Web Services.

This open strategy platform is significant due to the rapidly more complex nature of today’s customer journey:

- Customers are demanding better customer experiences, and they’re using:

- Exponentially more data sources such as TVs, cars, and everything else the Internet of Things promises to bring:

- Enabling big data technology and AI to improve upselling and cost-cutting initiatives.

It’s not about big data anymore. It’s about integrated, meaningful “smart” data.

If you’re a Salesforce customer, you have to pay expensive consultants to develop and integrate your data. You also are locked into the Salesforce platform, which won’t experience the same level of innovation that Amazon’s public cloud will. If you’re a Zendesk customer using Sunshine, your programmers can already use the tools they love while getting the benefits of using AWS. Using AWS also enables Zendesk to focus on developing their products and less on developing the platform backend. In short, it’ll be more productive and cheaper to develop on Sunshine than using a closed platform CRM, and the economic delta between closed and open systems will expand over time.

So why is this an innovator’s dilemma?

I think it’s easy to see that using a public cloud is just a better strategy than using a closed platform. But with the amount of investment, patents, and work put into developing their closed platforms, It’s next to impossible for Salesforce et al. to transition their entire business to the public cloud.

The Value

I write these as I value the company. So while I am bullish on Zendesk’s future, I was a little disappointed to see it was trading at fair value. I was hoping for a repeat of the Twilio valuation where it was trading at 25% of my estimated value, which was enough for me to pull the trigger even though, like Twilio, there’s a substantial amount of uncertainty due to it being a “terminal value” valuation, but I digress. I may buy Zendesk on a pullback. Until then, there are easier profits to make.

For those who believe Zendesk will have higher terminal margins or market share than I’ve given them, which is highly possible, there is a catalyst on the horizon.

Desk.com, a significant Zendesk competitor acquired by Salesforce in September 2011, will be shut down on March 13, 2020. I believe that many disgruntled Desk.com users will find their way to Zendesk as its story is getting a whole heck of a lot sunnier.