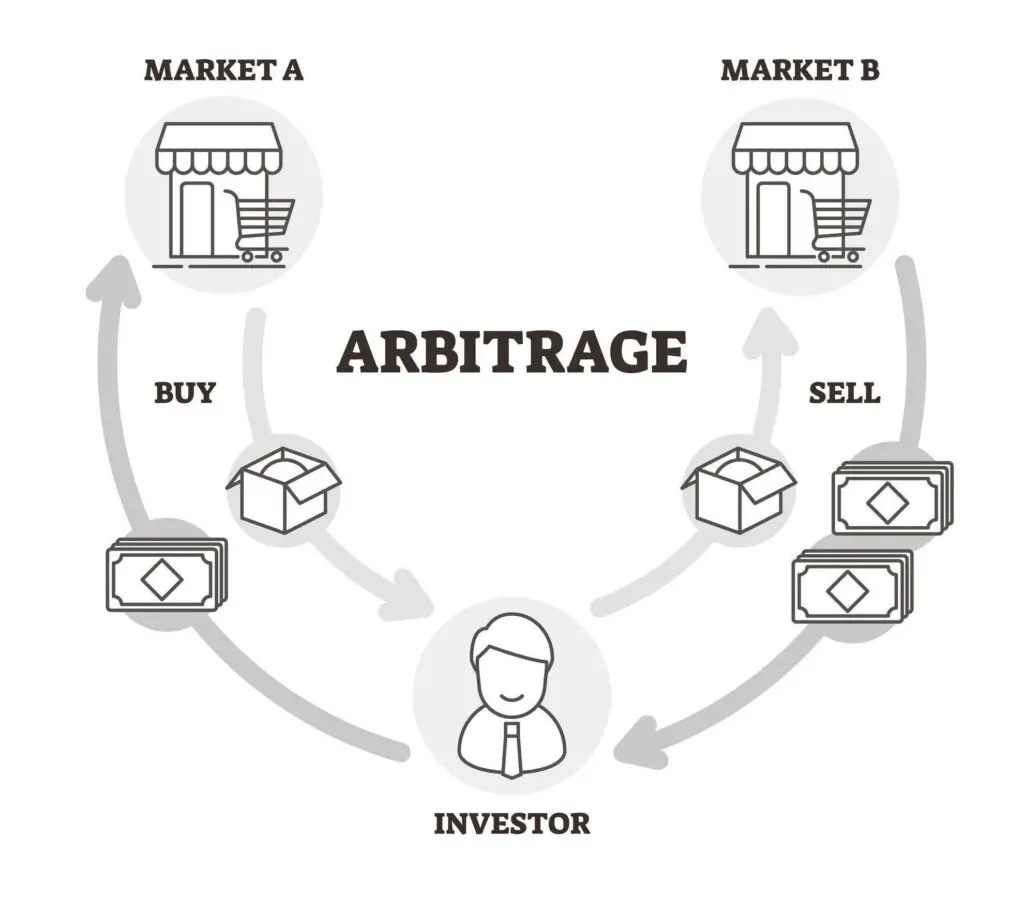

Arbitrage is a trading strategy that exploits an assets’ price or information discrepancies for profit. These differences arise due to market inefficiencies. Market neutral strategies such as buying and selling the same investment on two different exchanges and exploiting the price difference is just one of the many types of arbitrage.

What Is Arbitrage?

Arbitrage is a strategy that lets investors benefit from a price differential between assets and their underlying, identical assets across various markets or market-moving information that is not yet fully appreciated.

When I think of arbitrage, I like to think about it in two forms:

- Price-based arbitrage

- Information-based arbitrage

It’s nothing like Arbitrage, the film based in New York starring Richard Gere, but if you’re interested, you can read more about it on my post regarding the top investing and trading movies.

Price Arbitrage

Priced-based arbitrage is the process of buying a security or its underlying at a lower price and selling it at a higher price. This allows the trader to earn profits out of the temporary difference in prices of equivalent assets. Most price arbitrage varieties fall under the category of Statistical Arbitrage.

Stock market traders can exploit cross-market arbitrage opportunities by buying a stock on an overseas exchange where the equity price is yet to show the impact of exchange rate adjustment. The stock on the overseas foreign exchange is valued lower compared to that on the domestic exchange. This lands the trader in a position to benefit from the price discrepancies. The traders who make use of arbitrage opportunities are known as arbitrageurs.

Information Arbitrage

When most wall street traders discuss arbitrage opportunities, they refer to price arbitrage; however, information arbitrage, while less statistically rigorous, can be every bit as profitable.

An information arbitrageur attempts to identify market-moving information that isn’t well known or fully appreciated by the market in order to profit. This alpha typically comes from alternative data.

For this article, I’ll often call price arbitrage just “arbitrage”, but I will always refer to information arbitrage as “information arbitrage”.

Arbitrage & Efficient Markets

The concept is contrary to the market efficiency theory. According to this theory, every market is perfectly efficient. All information is immediately incorporated into an asset’s price, so no arbitrage opportunities arise. However, this is far from reality. Markets are hardly perfect, and it gives arbitrage traders a lot of opportunities to capitalize on pricing differentials.

Arbitrage finds its roots in the Arbitrage Pricing Theory (APT) propounded by an American economist, Stephen Ross, in 1976. The APT is based on a multi-factor securities pricing model defined by the relationship between an asset’s riskiness and expected return.

In contrast to the Capital Asset Pricing Model (CAPM), which only considers just one level of risk for the market, the APT model considers several [macroeconomic factors/blog/macroeconomic-factors) that combine to determine the asset’s risk profile. The APT attempts to pinpoint the temporary mispricing of the asset in the market.

The asset can be overvalued or undervalued over a brief period due to the market’s inherent inefficiencies. However, the APT also believes that the market action would ultimately create a situation that leads the asset to return to its fair market value.

Nowadays, most traders execute price-based arbitrage trades using an automated system that automatically spots price discrepancies and locks them. We can also say that arbitrageurs stabilize the financial system over the long-term. They act as a catalyst to equalize price through a demand-supply mechanism. Here is an example of how it happens.

When an arbitrageur purchases an asset from a market quoting a lower price and sells the same at dearer markets, the asset’s price in the cheaper market increases. On the other hand, the asset in the costlier market would see increased selling pressure.

If adequate arbitrage trades are completed, the two markets’ asset prices equalize and maximize overall efficiency. When market prices are in equilibrium, there is no potential for arbitrage. It is known as an arbitrage equilibrium. In effect, arbitrage opportunities are often arbitraged away.

How Does Arbitrage Work?

Let’s go over a few arbitrage examples to make the topic more lucid.

A Simple Arbitrage Example

Let us say that Debbie purchases a set of home-decor goods from a wholesale shop at $500. The same collection of goods at a luxury store (physical or online) are sold at $2,500. Debbie utilizes this opportunity and sells the home-decor goods she bought from the luxury shop’s wholesale shop. She earns a profit of $2,000 on that transaction. This is an elementary example of how arbitrage works and how traders can exploit advantages from price differentials of the same goods in different markets.

Cross Market Arbitrage Example

Institutional investors undertake most price-based arbitrage trades due to the technology tools costs and time-sensitivity. You’ll see why in a minute.

Let us say the stock of company A is trading at $40 at NASDAQ. At the same time, it is trading on another market, the London Stock exchange, at $40.06. A trader purchases the stock at NASDAQ and sells it on the LSE simultaneously, earning 6 cents per share. The trader can continue to arbitrage until prices match on both exchanges.

While a profit of just 6 cents per share might seem meager, when the trader conducts the arbitrage transaction of 100,000 shares, they earn $6,000.

This arbitrage strategy only occurs when there are price differences between platforms. These days price differences last only for a few nanoseconds in mature markets. It’s so minuscule that traders won’t earn a substantial profit if they do not invest a sizable amount in the trade. This is the reason, and nowadays, arbitrage is conducted by high-frequency traders or medium-frequency traders. These traders have immense knowledge of various exchanges, use high-speed computers, leverage algorithms, and access high-speed internet connection to quickly conduct high-volume trades.

Cross Asset Arbitrage Example

Another price-based example involves an index and its underlying in one market. The Nasdaq 100 contains the largest technology-focused companies by market cap. If the value of the index components isn’t equal to the Nasdaq 100 ETF, a smart arbitrageur can exploit this difference with the purchase and sale of the constituents and invest to profit.

Currency Arbitrage Example

Triangular arbitrage is an example of a more sophisticated arbitrage strategy. This results from the differential between the three foreign currency pairs or a mismatch between their foreign exchange rates. Such opportunities arise when one of the markets is overvalued and the other is undervalued.

These are scarce opportunities, and traders with highly specialized computer systems can only execute these trades. Sometimes these trades might also be automated. These trades are primarily conducted by international banks who exploit even a nanoscopic discrepancy in currency pairs’ quoted price.

Let’s say Richard Gere has $2 million at his disposal, and he examines three exchange rates:

- USD/GBP=1.5026 EUR/USD=0.8675 EUR/GBP=1.3020

- Sell Dollar for Euros: 2,000,000 * 0.8675= 1,735,000

- Sell Euros for pounds: 1,735,000 / 1.3020= 1,332,565.3

- Sell pounds for dollars: 1,332,565.3 * 1.5026= 2,002,312.60

By capitalizing on the price differentials, Richard could turn his initial $2,000,000 into $2,002,312.60. Thus, he earned a profit of $2,312.60. Notably, even with considerable investment, Richard made a minor profit. I did not account for the transaction cost and taxes for this example. In a real-life scenario, the payoff could be even smaller due to these charges.

Why Do Arbitrage Opportunities Exist?

We’ve already established that arbitrage opportunities exist due to market inefficiencies, but let’s dig a little deeper. Most arbitrage opportunities arise due to one of three factors:

- Market inefficiencies

- Information inefficiencies

- Risk preferences

Market Inefficiency

When an asset’s market price does not match the asset’s actual value, or its prices and its underlying do not meet parity, it is known as inefficiency. The political climate, varied sets of information, speculation, liquidity, or a frenzy driven by external factors can lead to market inefficiency.

Information Inefficiency

The rate of data growth is exponential, leading to fertile ground for information traders. This potential information access disparity, especially in different markets, leads to differing views of future economic values and arbitrage opportunities.

Risk Preferences

Not all decisions in the markets are to make a profit. Many companies hedge their inputs at suboptimal prices to protect their businesses from adverse price movements. Different risk appetites can lead to profits for the arbitrageur hungry to consume it.

Risks – Is Arbitrage Risk-Free?

Usually, the market considers price arbitrage as a low-risk transaction. However, almost all arbitrage strategies involve leverage to improve returns causing significant potential risks for non-standard price moves.

Execution Risk

For many statistical arbitrage strategies, one of the significant conditions is that both the trades need to be executed simultaneously. However, in reality, it may not always be the case. More than two transactions may not be completed at once, and only a part of the deal is executed. This results in less profit than what the trader aimed for.

For instance, an arbitrageur who wants to earn profits out of price discrepancies on the NASDAQ and the London Stock Exchange will buy Apple shares in huge quantities on NASDAQ. However, he may not be able to sell the same amount of Apple stock on the LSE due to certain restrictions. Such a situation results in a risky position for an arbitrageur, which is also unhedged.

The idea behind arbitrage is to execute all the trades in which the price difference still exists, even if it is for a millisecond. If there is a delay in execution, it is a considerable risk for the arbitrageur. Moreover, if the money involved is borrowed, then the financial and reputational loss is even more significant.

Mismatch

If the asset bought and sold during the arbitrage transaction is non-identical, it results in a mismatch risk. Sometimes the market doesn’t allow the same commodity to trade at two different prices simultaneously in foreign markets. The trade then has to be conducted with an assumption or prices of both the assets being correlated. This is also known as the convergence trade wherein the price of a futures contract drifts toward the underlying asset’s spot or cash price over some time.

Counterparty Risk

The arbitrage trades that involve cash transactions in the future are exposed to counterparty risks. This risk entails that the counterparty might fail to complete their transactional obligation. This risk poses a grave issue for the arbitrageurs who have multiple or straightforward trades with the same counterparty. During the sudden financial crisis, when many counterparties fail, arbitrageurs run into massive losses.

Liquidity Risk

The odds of an arbitrage being leveraged are significant. In instances of a non-identical asset or a sudden margin obligation, the trader might run out of capital and resort to borrowed money. The trader faces liquidity risk wherein he might not convert the transaction into cash due to inefficient markets or lack of sellers.

Assessment Risk

While information arbitrage isn’t fettered by the risks of price-based arbitrage discussed above, it suffers from the human element as it relies on the acumen of the trader to appropriately analyze the significance of the underappreciated information.

Types of Arbitrage

There are various kinds of arbitrage trade depending upon the techniques used, securities involved, and the market condition. Here are a few of the types of widely used arbitrage strategies.

Convertible Bond Arbitrage

Convertible bond arbitrage wherein a trader aims to reap benefits from the convertible bonds’ mispricing and the underlying stocks. A convertible bond can be transformed into a different form of security, which could be a common or preferred stock at a specific price in the future.

The process involves taking a long position in the undervalued asset — typically the bond — and simultaneously shorting overvalued — usually the stock. This strategy is relatively risk-free and doesn’t depend on the market condition. A combination of the long-short position allows the arbitrageur to enjoy regular cash flows without worrying about market volatility. The price of a convertible bond heavily depends on the changes in interest rates, the underlying stock’s price, and the issuer’s credit rating. Therefore there is also a type of convertible arbitrage that hedges two of the three conditions to capitalize on the remaining factor at a competitive price point.

Covered Interest Arbitrage

One of the most common types of interest rate arbitrage is the covered interest arbitrage. An arbitrageur capitalizes the interest rate differential between two countries, typically using government bonds. Covered Interest arbitrageurs use forward contracts to restrict the foreign exchange rate risk exposure.

The arbitrageurs exploit the forward premium (or discount) to earn a riskless profit from a difference in both countries’ interest rates. This is because interest rate parity is not a constant phenomenon.

The trader can only earn a profit if his foreign currency investment return exceeds the exchange rate risk and the hedging cost. The transaction cost also needs to be very low to accumulate substantial returns.

Exchanging the domestic currency for the foreign currency at the current spot exchange rate and then buying or selling the foreign currency through a forward contract to hedge the exchange rate risk is how the covered interest arbitrage operates.

Cross Border Arbitrage

Cross-border listing is typical for companies outside the United States, which also wish to be listed on the US stock exchanges. For example, Chinese e-commerce companies like Alibaba.com, JD.com are also listed on the NYSE and NASDAQ, respectively, besides their domestic exchanges such as Shanghai and Hong Kong. Listing on multiple foreign exchanges enables the company to enhance its access to capital and visibility.

The cross-border listing also results in arbitrage opportunities. It also capitalizes on the price differential of the same securities trading in different countries. The variation in pricing can result from a difference in time, trading volume, exchange trade regulations, and technical factors.

Depository Receipts

Securities, when offered as stock in another market, is known as Depository receipts. For instance, when a Chinese or Nordik company is listed on the New York stock exchange, it is known as an American Depository Receipt. It may also be known as a Global Depository receipt if it is listed on any other exchange.

They do so to earn more capital than what the local exchange offers. These depository receipts are viewed as foreign securities and are usually traded at a discount upon their initial listing. In some cases, the depository receipts can also be converted back into the security at the same price. There is a price difference between the actual value and the notional value of the stock in such cases. This creates an arbitrage opportunity.

As the ADR is trading at a lower price point, the trader can buy the asset and sell a quoted security at a higher price. A trader can continue this activity as long as the value converges towards the original. However, if the price of the actual security drops below the ADR, then the arbitrager faces a risk.

Dual-listed Companies

A dual-listing company structure refers to two companies operating as a single entity as a part of the legal equalization business. However, they have distinct legal identities and separate stock market listings. In efficient markets, the stock prices of both companies should move in tandem.

However, in reality, it doesn’t happen, and this creates an arbitrage opportunity. This can be fulfilled by obtaining a long position in the undervalued part of the twin listing and shorting the overvalued component.

Dual listing arbitrage is a double-edged sword wherein the trade might be risky, but at the same time, it is profitable. If the price gap between the stocks widens, the arbitrageur might receive margin calls, because of which they might also have to liquidate the position at a loss.

Examples of dual-listed companies are the BHP Group listed in Australia and the LSE and Investec, listed in Johannesburg and the LSE.

Merger Arbitrage

Merger arbitrage is a trading strategy executed during corporate events such as acquisitions, mergers or bankruptcy. Arbitrageurs can reap profits by investing in merger by purchasing and selling both the merging companies’ stocks.

There is a lot of market inefficiency and uncertainty during mergers and acquisitions. Due to this, the price of the target company is quoted below the acquisition price. This is where the arbitrageur steps in. They buy the target company’s stock before the merger at a lesser cost and sells it when the price rises after the merger.

The merger arbitrageurs place more emphasis on the profitability and probability of the deal under approval than the particular stock. They also assess how long the deal will take to come through. We must note that merger arbitrage also involves a certain degree of risk if the deal doesn’t fructify. Regulatory norms, financial problems, internal issues, or negative tax implications are some of the reasons leading to a deal cancellation. If the deal doesn’t work out, the target company’s stock price declines further.

Municipal Bond Arbitrage

Municipal bond arbitrage is a technique wherein investors exploit the municipal bonds’ tax-exempt status or interest swap of similar maturity and quality to build a highly-leveraged portfolio and reduce the duration and credit risk.

Bondholders face duration risk due to changes in the interest rates that might harm the value of fixed-income investments. To hedge the portfolio from this risk, an investor short-sells an equal number of taxable corporate bonds to yield profit out of the tax rates. Through this arbitrage, an investor can enjoy positive and tax-free returns.

Municipal bond arbitrage is also known as the municipal bond relative value arbitrage or popularly muni arb. This is an appealing option for investors who belong to the high-income tax slabs. The calculation of municipal bond arbitrage includes a lot of complex factors. Moreover, the holders of tax-free municipal bonds are also subject to strict compliance rules.

Regulatory Arbitrage

Regulatory arbitrage aims at exploiting the lacunas to avoid adverse regulatory mechanisms. Relocation to more favorable locations, redesigning the transactions, and financial engineering are ways in which traders can achieve regulatory arbitrage. For instance, a company might relocate to areas that have friendly compliance norms for ease of operations.

In 2009, multinationals like Accenture, Tyco International, Ingersoll-Rand, Covidien, and Foster Wheeler announced plans or moved their headquarters to tax-friendly countries like Ireland, Bermuda, Cayman Islands, or Switzerland to escape the clampdown on tax havens by the Obama administration.

Social Information Arbitrage

Social Information Arbitrage is a technique of creating opportunities with the help of information by identifying the trends before anyone else does and capitalizing on them. Making important predictions about what the customer would want is one of the most important goals of information arbitrage.

This kind of arbitrage has immense profit potential when there is information discrepancy in different markets. When one market has a particular type of information, while the other is privy to a completely different aspect about the same story, it creates an opportunity for information arbitrage. In today’s world, social media and big data analytics play an integral role in supporting this arbitrage technique and earning a profit.

A very recent example of social information arbitrage is the Reddit-fuelled retail frenzy that drove Gamestop shares. On January 11th, members of a Reddit forum, WallStreetBets, collectively bought shares of the drooping video game retailer GameStop and caused its shares to rally nearly 51% in just one day. After, few weeks of ‘short-squeeze’ frenzy, the GameStop bubble burst, and a stock plunged more than 40%.

Spatial Arbitrage

Spatial arbitrage is also known as locational arbitrage. In this, the arbitrageur looks at exploiting price differentials across various platforms or exchanges. This is quite common in the case of forex and cryptocurrency trading. In spatial arbitrage, the crypto coins are bought on one platform at a lower cost and sold on another platform at a higher price.

Using spatial arbitrage, a trader can hedge against the fluctuations in cryptocurrency trading while being open to other market trends. To reap maximum profit out of spatial arbitrage, a trader must have in-depth knowledge about the trends in various platforms, the liquidity of trading, the size of the market, and the platform’s specific rules.

Some of the risks associated with spatial arbitrage are price volatility and fluctuations during the process, which extends the trading time and results in losses.

Statistical Arbitrage

Statistical Arbitrage or Stat Arb is an algorithmic trading technique leveraged by many Wall Street hedge funds and investment banks. In this case, the trading is typically executed within a few hours or few days. Hence, it is different from high-frequency trading. It can be called medium-frequency trading.

Statistical Arbitrage technique exploits pricing anomalies in numerous financial instruments based on algorithms designed based on complex statistical methods and data modeling. It is also one of the most meticulous methods of arbitrage.

Learn how to trade using Statistical Arbitrage

Volatility Arbitrage

Volatility arbitrage aims to exploit the difference between an option’s implied volatility the underlying asset’s actual volatility. Volatility arbitrage is a form of statistical arbitrage. Vol Arb typically works well during periods of heightened uncertainty for traders who are long vol.

Pros and Cons of Arbitrage

Arbitrage trade comes with a unique set of benefits and disadvantages. Before conducting the trade, arbitrageurs must consider all the aspects and weigh in the pros and cons. Here are the main pros and cons of arbitrage trade.

Pros Explained

Unlike buy-and-hold strategies, arbitrage is a safer way to earn returns. In most cases, the trade lets you multiply the money without worrying much about profits. Due to algorithmic systems, arbitrage trade guarantees very streamlined and efficient ways to earn rapid profits.

Lower Risk

One of the most significant advantages of price-based arbitrage trading is that it presents lower-risk opportunities. As most strategies are market netural, the risk is typically limited over the long-term. During periods of heavy market volatility, arbitrage trade offers opportunities to earn profits due to widespread price differentials.

Price-based arbitrage opportunities diversify your portfolio’s return streams, leading to better risk-adjusted-performance. The same goes for information-based arb. If you identify significant market-moving information, your asset can rocket upward even in a downward market.

Good for Everyone

Arbitrage trade results in more efficient markets and increased liquidity. So you can profit and feel good at the same time!

Cons Explained

Leverage

One of the most significant drawbacks of price arbitrage is overconfidence causing the arbitrageur to over lever causing outlying price moves to create long-term capital destruction.

Significant Costs

While calculating profits, traders often miss out on considering transaction costs, taxes, and slippage linked to the purchase and sale of shares. This includes information arbitrage, where data costs can get prohibitively expensive.

Starting Capital

With many arbitrage strategies, the price discrepancy is minuscule and traders can only earn substantial profits if they invest a considerable amount of money combined with leverage with the best possible “institution-only” margin rates.

Notable Arbitrage Examples

The Fall of Long-Term Capital Management

A huge hedge fund with over 126 billion in assets, Long-term Capital Management, almost collapsed in 1998. Investors held its founder, John Meriwether, and principal shareholders, Nobel laureates Myron Scholes and Robert Merton, in high regard. They invested funds to the tune of 10 million, even if it meant a lock-in of three years.

Long-term Capital Management also posted splendid annual returns of nearly 40% in 1995 and 1996. It tasted massive success in the derivatives market and hedged risks even during the Asian Crisis in 1997. However, its hedging strategies also had some limitations regarding the amount of volatility that it could handle. Moreover, LTCM allegedly involved itself in too many high-risk trades.

In 1998 when Russia devalued its currency, markets became extremely volatile. LTCM’s portfolio was highly leveraged, and it saw over 50% of its capital investments wiped away during the crisis. Many the banks and financial institutions which had invested in LTCM were on the brink of bankruptcy.

To avert a major financial crisis, the Federal Reserve Bank of New York President William McDonough brokered the bailout of LTCM. He brought onboard 14 banks to save the hedge fund for $3.5 billion in place of 90% ownership. Experts say that the LTCM crisis was the precursor to the global financial crisis of 2008. However, no one learned their lessons from it.

How This Trader Turned $20K Into 10M in 3 Years

One of the most notable examples of information arbitrage is the case of Chris Camillo. Chris was a simple retail investor with no experience in asset management. In 2007, a year before the subprime crisis rocked the stock markets, he invested 20,000 in equities. Chris went on to garner equity returns worth 10 million in the period between 2007 and 2017. Chris also is the founder of TickerTags, a social data intelligence company. His company famously predicted the Brexit outcome in 2016.

Notably, Chris has a unique approach to investing, and he takes advantage of social data to find out about the actual investing experiences of people at a specific time. According to Chris, the diverse communications and exchanges between many people on various social media platforms present a lot of opportunities and emerging trends. They also helped him to identify the market patterns that were fading off. Chris revealed that he entered into investments when he sensed an imbalance in fruitful social information and exited investments when the social information parity was reached. He believed that the best way to profit in the market is through an information advantage.

For instance, when he discovered a lot of buzz surrounding the Pokemon Go game in 2016. He analyzed the chatter thoroughly and predicted the spectacular success of the game before its release. He also indicated that Nintendo stock would double itself immediately as the game became a smash hit. Similarly, he also used call options to multiply his profits on E.L.F Beauty in 2019 as the stock appreciated 120% after an immensely popular YouTube influencer reviewed its products.

Is Arbitrage Worth It?

Arbitrage trading comes with a unique set of advantages and disadvantages.

While it can be done, it’s difficult for the retail traders to successfully execute a price-based arbitrage opportunity in mature markets; however, many cryptocurrency traders have profitable arbitrage transactions for those willing to stray into different, less regulated markets.

And when discussing information arbitrage, I take the opposite view. I believe social arbitrage is one of the best ways for a retail investor to exploit an information advantage.