Information arbitrage identifies market-moving information and trades on it before the financial markets recognize its impact. The disparity in knowledge across markets and its timing creates information arbitrage opportunities. Information arbitrageurs discover market-moving information from offbeat sources of alternative data.

What Is Information Arbitrage

Information arbitrage is a technique for creating profit-making opportunities wherein arbitrageurs spot market-moving information before others and take appropriate actions. Making accurate predictions about the asset’s price based on that information is a critical aspect of information arbitrage.

A research paper in 1980 titled “On the Impossibility of Informationally Efficient Markets” by Sanford Grossman and Joseph E. Stiglitz proved that there is a prolonged phase of disequilibrium in competitive markets. Because of this, prices often reflect only partial information. Thus the arbitrageurs who leverage their resources and foresight to obtain price-moving information are rewarded through profits.

Information arbitrage also finds its roots in the Efficient Market Hypothesis (EMH). According to the hypothesis, Strong-form EMH reflects an efficient market. In this, the asset prices reflect all the available information, whether public or private. Thus, there is no scope for arbitrage here. An investor would not be able to reap excess returns or ‘alpha’ in this situation.

In a semi-strong form of the efficient market, the current share price only reflects publicly available information. An investor can still earn excess profits in this case if he uses price-impacting information that is not available in the public domain.

Lastly, weak-form efficiency, also known as the Random Walk Theory, propagates that past performances or historical data do not impact security prices. The theory believes that share prices are random, and it is impossible to predict price movement based on any information and earn profit from it.

However, financial markets are hardly efficient, and market participants can always find an arbitrage opportunity to spot market-moving trends and predict price differentials.

Thus, information arbitrage in financial markets arises due to asymmetrical information flowing through the market. This asymmetry can be due to limited access to information, lack of accuracy, uncertainty over the prevailing data, or lack of interest to seek more profound knowledge. It can also arise when investors do not realize the value of such information.

Information arbitrage opportunities arise when investors look beyond traditional sources to identify meaningful information. This information could be in the form of the latest diet or fashion trend or an offbeat travel destination found on a blog, social media chat room, or YouTube video. The smart arbitrageurs can use these nuggets of information to foresee trends and understand the direct beneficiaries. They predict the security price movements of the companies involved in the value chain and profit from it.

Is Information Arbitrage Illegal?

Information arbitrage in the United States for non-insiders is not unlawful; however, if a particular source of information leads to volatility in the financial markets, it comes under scrutiny. As the Reddit community, with more than 5 million users, pushed the GameStop security to sky-high levels, several experts condemned it. They oppose the idea that social media comments manipulate the financial markets and create volatility by illegally inflating fundamentally weaker companies’ prices.

However, the issue divides legal experts. According to Reuters, Harvard Law School professor Jesse Fried stated that the security trading forums come across as “purely legal behavior: irrationally exuberant buying by amateur investors.” In contrast, the University of California, Berkeley law professor Stavros Gadinis indicated that filing a criminal suit against social media users for misleading investors is challenging but not impossible. He also added that social media companies must have a moderator to avoid marketplace manipulation.

Examples of Information Arbitrage

The Reddit-GameStop Saga, 2021

The GameStop stock’s recent gyrations are among the best examples of social information arbitrage. GameStop soared to dizzying heights in January 2021 after Reddit’s popular r/wallstreetbets community turned bullish on it. On January 11, 2021, GameStop lost 3% after discussing sales weakness due to the pandemic.

The company also revealed that Ryan Cohen, a founder of the online pet store, Chewy, is set to join its board of Directors. Two days later, the security jumped nearly 57% after the Reddit group highlighted Cohen’s letter to the company dated November 16, 2020. The day traders began buying its shares, forcing Wall Street short sellers to cover, and its price skyrocketed that day onwards until January 27, 2021, after which it cooled down. Regardless, the not-so-popular Gamestop stock has already soared more than 170% in just a month.

Roaring Kitty gave his reasons for adding the company to his investments, significantly increasing his net worth and social capital level.

EntreMed Stock, 1998

Back in 1998, a similar example was witnessed for EntreMed’s stock. In May 1998, a piece in the Sunday New York Times highlighted a potential development of new cancer-curing drugs and that EntreMed had the licensing rights to the breakthrough. The news hardly mentioned any details, and the share price jumped over 600% following the announcement. However, it is interesting that the same story already appeared in a publication called Nature with essential details about the research and EntreMed’s licensing rights. However, the company only gained 28% following that news. After the Times prominently covered the information, more investors took note of it and immediately acted upon the investment opportunity.

Bristol Myers Squib Acquisition, 2019

Bristol-Myers Squibb acquired another pharma company, Celgene, for $74 billion on January 3, 2019. The development led to an immediate 31.8% rise in the latter’s security. Many investors failed to spot the trends around this acquisition and missed out on the gains. Many biopharmaceutical stocks directly or indirectly connected to Celgene, such as Agios Pharmaceuticals, Epizyme, and Aduro Biotech, also rose in value post the acquisition. These companies have collaborated with Celgene to develop a cure for cancer.

However, their stock price gains came many months post the development. Also, the quantum of profits depicted that it didn’t price in Celgene’s acquisition sufficiently. The investors lost out on the information arbitrage opportunity in this case. The delay also shows another example of how slowly market participants absorb and react to new information.

Sources of Information to Arbitrage

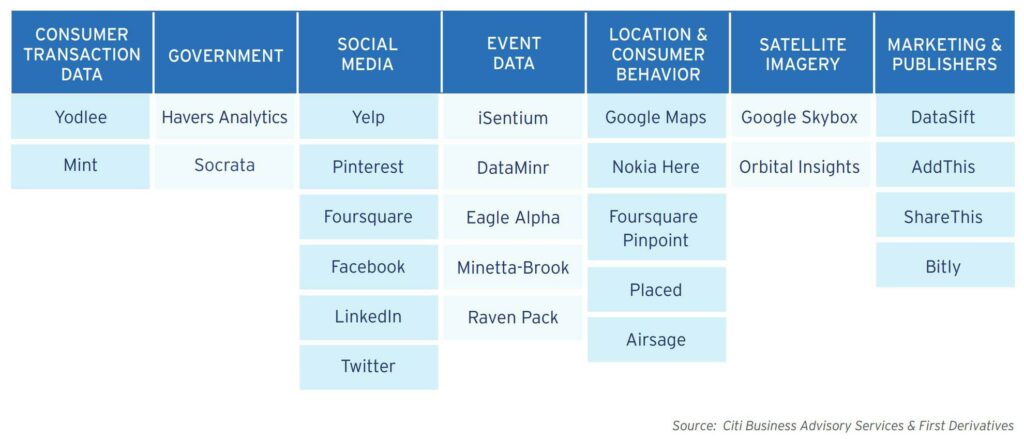

When we talk about information arbitrage, the source of information plays a critical role. New York hedge funds and other venture investors scrutinize traditional information heavily, leaving very little alpha behind. On the other hand, alternative data is harder to analyze as it’s more subjective, allowing a nimble retail investor to invest before market prices reflect the new information. Additionally, with the exponential rate of data growth, more — not less — information arbitrage opportunities exist in the marketplace.

Social Media Platforms

Social media platforms are the best ways to sense the social sentiment or the masses’ overall feeling about a particular stock, trend, or investment. Social data is often a signal of future buying intent. Data from social media posts, videos, feeds, news or Twitter interactions are a few common ways of gauging the overall sentiment. Many times, Twitter interactions, retweets, blog posts, or viral videos can be the goldmine for information arbitrage opportunities. Traders who know how to use this information smartly can earn millions. Chris Camillo, Dave Hanson, and Jordan McClain’s DumbMoney is a classic example.

New age software firms like Eagle Alpha and DataMinr primarily analyze Tweet patterns and parse Twitter feeds on a real-time basis to identify global events specific to the security. iSentium’s iSense is another application that filters Twitter interactions by analyzing United States stocks, commodities, or ETFs. It also scans millions of social media portals, communities, and blogs to perform Sentiment analysis.

Mobile Apps

There are apps for everything these days, and most of the time, it is also privy to the user’s critical data. Companies have begun to use mobile analytics to predict consumer behavior and drive conversions. Companies are continually tracking data points like pageviews, watch time, location, number of sessions, device used, etc., to identify emerging trends to stay ahead of the game.

Innovative companies like the insurance provider Lemonade track their users’ every action and adjust the insurance risk based on even the most minute detail, such as what time they log in.

Credit Card Transactions

One of the best ways to predict consumer spending patterns is to analyze credit card transactions. It is challenging to get your hands on such confidential information, and it is also expensive to obtain it. However, it’s an excellent instrument to identify trends and is of immense importance to retailers and many other businesses.

Location Data of Consumers

Tracking customers’ locations have been a popular method of extracting relevant information through smart devices. By analyzing the places a customer visits and their frequency, a company can extract value and identify emerging trends. By far, Google Maps has been the go-to application for location tracking. However, some other independent location data providers, Foursquare and Placed have also become immensely popular.

Natural Language Processing

Advanced techniques like Natural Language Processing and Natural Language Understanding to capture information have become widespread. NLPs and NLUs are also helpful in processing correlation matrix datasets for data obtained from traditional sources and other sources such as research reports, patent sites, scientific literature, social media communities, and many more.

Online Marketplaces for Data:

There are many marketplaces for alternative datasets, and this space is only increasing. Companies like Quandl, S&P, and others provide multiple “traditional” alternative products. Similarly, companies like Fetch.ai provide decentralized IoT (Internet of Things) data collection and sharing. Meanwhile, firms like Vectorspace AI and Cindicator benefit from information arbitrage opportunities arising in cryptocurrency trading. You don’t have to be a venture fund or a sophisticated hedge fund to use these alternative data sources, as the prices are reasonable even for the retail investor.

If you’re interested, review alternative data sources.

Information Arbitrage Strategies

When developing an information arbitrage strategy, you have two options:

- A big data, algorithmic approach

- A narrow data, discretionary approach

And while developing an algorithmic info arb model is outside the scope of this post, I plan on adding information arbitrage example resources to analyzingalpha.com over time as it’s one of the most requested topics by my readers. With this in mind, let’s briefly discuss algorithmic information arbitrage, and then II’lldetail a recent information arbitrage play.

Algorithmic Information Arbitrage

Algorithmic traders with access to the data and technical know-how can create algorithms to incorporate massive datasets into their qualitative models. These algorithms can either be a source for quantamental investment ideas or part of an algorithmic trading strategy that executes automatically.

The advanced arbitrage models using large data sets give traders an edge over their peers who primarily rely on traditional techniques. Datafication, or the process of converting qualitative information into data variables, is nothing short of a revolution.

Slowly, firms using a more traditional model will feel the pressure to explore and incorporate big data principles into investment research. This might yield information arbitrage, giving early adopters an advantage over late adopters until widespread adoption of these techniques across organizations. Many investment firms are yet to adopt big data for information arbitrage due to the lack of institutional support, technological infrastructure, necessary capabilities, and requisite skill sets.

Quantitative information arbitrage isn’t without its issues. A comment regarding Anne Hathaway moved Berkshire HHathway’sstock price on multiple occasions. This comical yet costly error shows how complex it is to develop alternative sentiment models despite a team of quantitative analysts.

However, building advanced algorithms like the aforementioned isn’t feasible for most retail investors. Instead, savvy discretionary traders need to explore other alternatives for their portfolio construction.

Discretionary Information Arbitrage

You don’t have to build quantitative models or be an angel investor to turn $20,000 into $10 million in three years.

Like Chris Camillo, savvy discretionary information-based traders can use social trends and scuttlebutt to gain an information advantage for those familiar with Phil Fisher.

Options are the preferred instrument to trade information arbitrage ideas as there is a time element to leverage. The best way to understand this arbitrage opportunity is through an example.

Information Arbitrage Example

Last week, the historic Texas freeze led some businesses to be blazing hot. For instance, most Texans don’t winterize their pools. This has led to landmark pool damage when the need for future safe, pandemic-free outdoor recreation is highest. If one were to scuttlebutt and call a Leslie’s Pool location, they would find out that demand is unprecedented.

Lucky for us, Chris Camillio did just that.

Now the question becomes, has the market fully appreciated the situation? To analyze this, we don’t need to scour Texas real estate; we need to look at the chart.

As we can see, the price of Leslie’s moved lower during the freeze, which means either we’re not analyzing market-moving information or the market doesn’t appreciate it. If the security moved up recently, I would be concerned the financial markets had already subsumed this information, and market efficiency had its way.

Next, we’ll want to use technical analysis to set our risk levels. Leslie’sapproached oversold relative strength levels, giving us a good entry point on the 18th with a stop-loss level slightly below that day’s low.

That’s it. If we’ve discovered market-moving information, it’ll go up from here. If we haven’t, our stop-loss level will limit our capital loss. Information traders will sell when the data is fully reflected in the security, likely after earnings or a large media enterprise runs the story.

Alternatively, we could trade options to leverage our investment as we know the information will present itself by the next earnings release.

What about company valuation or market prices? Most information traders believe in a delayed semi-strong form of EMH, meaning there’s reason to value companies as share prices always represent fair value except during periods where market-moving information has yet to be absorbed.

The Bottom Line

Information arbitrage identifies underappreciated market-moving information from both familiar and alternative data sources. Information arbitrageurs don’t care about valuation or a company’s long-term fundamentals; they focus on discovering and trading unappreciated market-moving information.