ETF Arbitrage is a strategy through which traders earn a profit by exploiting the price discrepancy between an ETF and its underlying assets or related securities. This process eventually results in an equilibrium price as the ETF shares’ value converges with its NAV as the arbitrage ends. ETF Arbitrage manifests itself through various NAV Arbitrage and Pairs Trading strategies.

What Is ETF Arbitrage?

ETF Arbitrage or ETF Arb is a trading strategy that exploits the ETF price’s discrepancies and the underlying securities’ value. The ETF may trade at a premium or discount to its NAV. The ETF share price should be proportionally identical to its underlying portfolio in an efficient market because both the assets have the same fundamental value.

The continuous creation and redemption of new shares of ETFs or Exchange Traded Funds facilitates arbitrage opportunities. Arbitrageurs capitalize on the mispricings and ensure that the ETF price doesn’t diverge substantially from its net asset value (NAV). In the process, they earn a risk-free profit.

The arbitrage opportunities in the ETF can happen due to two main reasons. Firstly, it could be due to minor differences in each ETF’s composition or proportion of basket securities. Secondly, it could be due to irrational pricing of the underlying securities from the beginning.

Another form of ETF Arbitrage is Pairs Trading, wherein a trader takes a long position in one ETF and a short position in another highly-correlated ETF simultaneously.

How ETF Arbitrage Works

ETFs or Exchange Traded Funds are securities tracking an index, bond, commodity, or a mix of assets such as an index fund. What distinguishes an ETF from a mutual fund is that it can trade just like a stock on an exchange. This is why ETF prices fluctuate throughout the day as traders indulge in buying and selling. As a result, ETFs enjoy transparent pricing and liquidity.

| Mutual Funds | ETFs | Stocks | |

|---|---|---|---|

| Investment Minimum | Most mutual funds require a minimum initial investment of $500 or more. | One share | With fractional share trading, typically, $1 or $5. |

| Trades Executed | Once per day, after market close | Throughout the trading day and during extended hours. | Throughout the trading day and during extended hours. |

| Settlement Period | 1 to 2 business days | Three trading days | Three trading days |

| Limit and Stop Orders | No | Yes | Yes |

| Short Sales | No | Yes | Yes |

| Fees | Sales loads, short-term redemption fees, and others. | Some brokerages may charge commissions. | Some brokerages may charge commissions. |

However, ETFs also witness mispricings during intraday trade because the trading value can deviate from the underlying net asset value. This creates an ETF Arbitrage opportunity through which traders can earn profits. Eventually, the arbitrage levels the playing field and brings the ETF price at par with the underlying net asset value.

Let us take an example of an ETF that consists of five stocks. Each equity trades at $50, while the actual ETF trades at $250 or (5*50). The ETF tracks an index consisting of the same equities. However, the index has three shares of each equity. Hence it is trading at (5*50*3) $750.

Thus, if the underlying stocks move up or down, it would impact the ETF index because of the direct correlation. However, markets are not perfect, and not every movement is in tandem with each other. What if the stock prices move faster than the ETF or the index?

Let’s assume that the equities we discussed in the example above fall by $8 each and now trade at $42. Ideally, the ETF should trade at $630, and the index should trade at $210. However, ETF and Index may stand at $600 and $200 each. This is when the arbitrageurs come into the picture. They act swiftly and sell the overpriced index and ETF and buy the underlying stock to earn risk-free profit.

ETF Creation Redemption Process

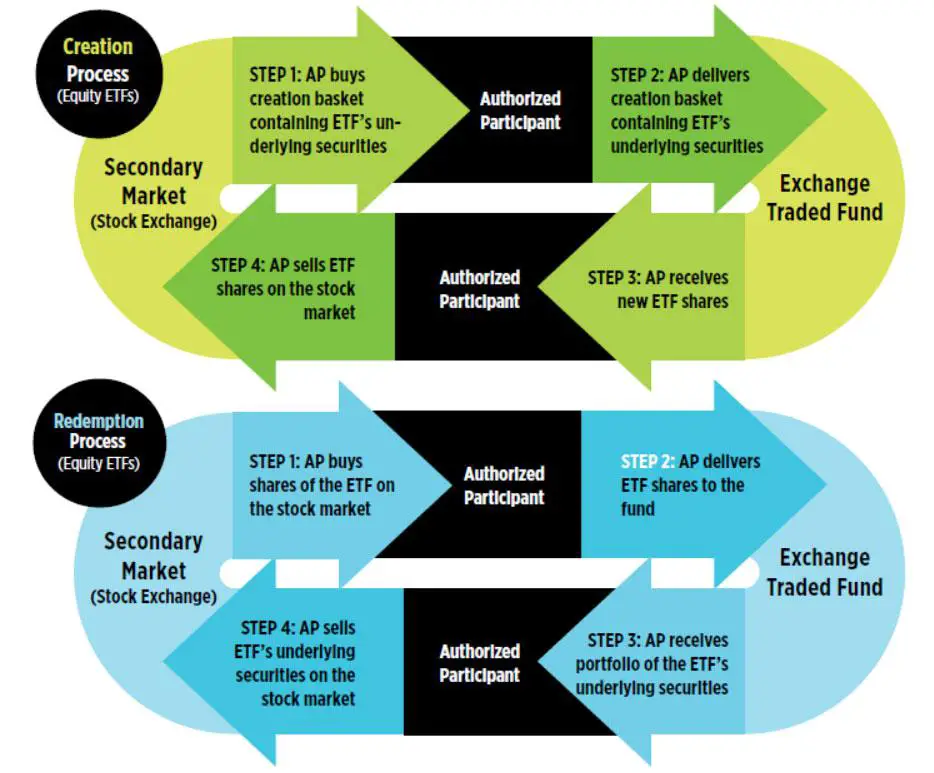

Creation

Whenever a fund house issuing an ETF intends to create a new ETF or offload extra shares of an existing ETF, they approach an authorized participant (AP). A large financial institution usually acts as an authorized participant. These APs could also be large investors, brokers, or dealers.

The AP’s primary responsibility is to purchase securities in optimum proportions to replicate the index that the ETF issuer is planning to target. The AP receives the shares of the ETF instead of the underlying securities.

Let us understand the creation redemption process with an example. Say, for instance, an ETF is designed to replicate the Dow Jones Industrial Average. The AP will purchase shares of all the Dow Jones Industrial Average constituents corresponding to their index weight. In the next step, AP delivers those shares to the ETF provider, who gives it a chunk of ETF shares that are equally valued. This is called a creation unit. The AP can then sell the creation units to the open market.

The exchange-traded funds function on a fair-value basis. When the AP delivers a specific amount of underlying stocks, they receive the same value in the ETF shares. These shares would be priced based on the net asset value (NAV) instead of the market value the ETF is currently trading to avoid any price discrepancy. See below for a fantastic visual representation from ETF.com of the ETF creation and redemption mechanism.

Redemption

Investors can sell their ETF holdings through two methods. The first one allows them to sell the shares in an open market. Retail investors usually choose this option.

On the other hand, the second option is followed mainly by institutional investors. It entails collecting many ETF shares to design a creation unit that he can exchange for underlying securities. When these shares are redeemed, the creation unit is dismantled, post which the redeemer gets these securities.

Creation & Redemption Mechanism Benefits

The creation and redemption process takes place at the backend. However, it is incredibly crucial. It offers numerous benefits for ETF investors, including lower fees, liquidity, and tax efficiency.

Unlike Mutual Funds, ETFs have a bid/ask spread. However, they still charge low fees because APs manage their transactions instead of portfolio managers.

The creation and redemption feature can help ETF investors to limit their tax liabilities. Investors can purchase and sell shares among themselves on the exchange and not with the ETF. Thus, there is no cash involved and no distribution of capital gains.

Here is a video that clearly explains the advanced strategy that shows the role of creation redemption in the ETF arbitrage process:

ETF Arbitrage Opportunities

Arbitrage Fund Flows

ETF fund flows are critical. Smart traders can arbitrage the ETF share prices with the constituent assets.

Additionally, market participants systematically miss time the markets, and savvy investors can take advantage of this error.

A research paper titled ETF Arbitrage, Non-Fundamental Demand, and Return Predictability by David C. Brown, Shaun Davies, and Matthew C. Ringgenberg offers empirical evidence of the theory.

It says that a portfolio of short high-flow exchange funds and long low exchange flow funds earn excess returns of 1% to 4% every month, consistent with non-fundamental demand, which distorts asset prices away from fundamental values. The non-fundamental demand also imposes non-trivial costs on ETF investors, which results in underperformance. In other words, when the money flows in, it often pays to be a contrarian.

Bond ETF Arbitrage

Bond ETFs have grown exponentially over the past decade and currently manage more than $1.2 trillion of assets worldwide. The Arbitrage mechanism keeps Bond ETFs’ prices in tune with the underlying assets’ Net Asset Value (NAV). In its report titled The anatomy of bond ETF arbitrage, The Bank for International Settlements (BIS) highlighted that bond ETFs acted as a stabilization factor and protected the broader market from systematic risks.

While the underlying philosophy is the same, Bond ETF Arbitrage is slightly different because of inherent differences between bonds and equities. Traders enjoy price transparency and asset liquidity for stocks continuously trading in the open markets. On the other hand, bonds are comparatively illiquid, and it isn’t easy to know their correct pricing.

Also, bonds trade less frequently than stocks; hence the last traded price might not be the latest updated one. The bonds also do not trade on an exchange. They trade as “over the counter” agreements between two mutually consenting parties. On the contrary, shares are tradable securities, and their last sold price represents their current market value.

The minimum trading size of bonds is relatively large as compared to equities. Thirdly, bonds trade with a finite maturity, but equities do not have any such hindrances. Hence, the bond ETFs’ illiquid nature, there can be a severe asset-liability mismatch in bond ETFs. The Arbitrage mechanism for bond ETF is different in various aspects and has three unique features:

Firstly, bond ETFs’ creation and redemption baskets are different from actual holdings. Secondly, the composition of baskets changes following the changes in relative liquidity and availability of various bonds. Lastly, the distinguishing factor is creation redemption. Creation baskets and redemption baskets for bond ETFs differ in liquidity and maturity.

Pair Trade Arbitrage

When discussing ETF Arbitrage, traders assume arbitraging the pricing discrepancy between the ETF and the underlying assets; however, this is not the only form of ETF Arbitrage. Pairs trading is a popular trading strategy that involves taking a long position in an ETF trading at a discount, and taking a short position in a similar ETF priced at a premium simultaneously. This creates a statistical arbitrage opportunity.

Most ETFs are a portfolio of stocks. Hence, they have the edge over single stocks in pair trades. They are less prone to sudden external developments or news related to a single stock and can handle significant trading volume without much slippage.

Since there has been a high positive correlation between the prices of the ETF pairs in the past, there is a high probability that both the securities also share a correlation in fundamental return.

A slight fleeting development could throw this correlation between the securities out of the track, leading to a statistical arbitrage opportunity.

Pairs trading is truly a dynamic strategy and has multiple applications. Most traders adopt it as a risk-mitigation mechanism during highly volatile trading conditions. At the same time, others also use Pairs Trading when struck between two investment options. They could choose one option but are also aware of the trade’s odds of not giving desired results. In such cases, traders resort to the Pairs trading strategy to hedge their bet.

Usually, two assets with high correlation are involved in Pairs trading. For example, Gold (GLD) and gold miners (GDX) move in the same direction due to a high correlation. However, over the short term, they deviate, and pairs traders try to spot these deviations to capitalize on them.

This act of taking a long and short position isn’t about the assets’ direction but a belief that the assets would come back to their original relationship. In the process, pair traders earn a profit. If you’re interested in learning more about how to create a pairs trading strategy, you can read about it at my pairs trading walkthrough.

Pros & Cons of ETF Arbitrage

An arbitrage opportunity between ETFs has a lot of impact on the market. While it does allow traders to enjoy arbitrage profits, the strategy is not devoid of fundamental risk factors. Let us try to understand them in detail.

ETF Arbitrage Benefits

Maintains Price Equilibrium

The primary benefit that the market derives from ETF arb is that it ensures price equilibrium in the long run. Arbitrageurs exploit the ETF share price discrepancy, eventually converging with its NAV, and there are no more pricing inefficiencies.

Arbitrageurs Earn Lower-Risk Profits

One of the most significant advantages of any arbitrage strategy is to earn profits out of the asset mispricings in two markets, and ETF Arb is no exception. Traders involved in ETF arbitrage make profits while driving price fluctuations to efficient levels. The Grossman and Stiglitz model in 1980 explained this phenomenon, stating that “who expend resources to obtain information do receive compensation.”

ETF Arbitrage Risks

Extra Costs Eats Into Returns

Every investment involves risks that include the potential loss of principal, brokerage commissions, or other added costs to eat into the returns. There is a cost known as the Creation fee when the APs want to exchange a securities basket for an ETF unit. Some countries like the United Kingdom and Hong Kong have stamp taxes, while South Korea and Taiwan have sales taxes. Additionally, there could be extra expenses for holding the ETFs for a considerable period.

No Guarantee of Active Trading of ETFs

We know that ETFs can be traded like stocks, and there can be many fluctuations in the price. There is no certainty that an active trading market for ETF will continue or the listing will remain unchanged forever. Also, changes in market conditions might disrupt the ETF trading or trade significantly below its fair value during the downturn phase.

Propagates Liquidity Shocks Across Asset Classes

A research paper titled ETFs, Arbitrage, and Contagion by Itzhak Ben-David, Francesco Franzoni, and Rabih Moussawi in 2012 suggests that the underlying assets are exposed to inherent shocks. Simultaneously, as the ownership of the ETF increases, the non-fundamental shock of the ETF markets also impacts them. As a result, there is an increase in the volatility of the underlying securities. The study also finds evidence that arbitrage between ETFs leads to contagion risks across asset classes and can also jeopardize market stability over the long run.

The Bottom Line

ETF arbitrage offers a distinct set of benefits for the market and the trader. The ETF arbitrage mechanism helps the trader lock in the spread profit as the ETF prices converge with its NAV.

However, as the ETF arbitrage mechanism emphasizes the asset’s mispricing, it might increase the underlying assets’ volatility. Hence, if arbitrageurs employ the strategy judiciously, they can capitalize on the temporary price differential between share price and NAV.

Before ending the discussion, I want to emphasize that ETFs look appealing, but be sure to conduct thorough research before making any trades. Study the historical performance of the ETF, understand its underlying risk factors, and analyze its performance in various market conditions.