Open interest is the number of unsettled outstanding derivative contracts. Each contract must have a buyer and a seller. It is considered open when a buyer or seller initiates a contract, but a counterparty does not close it by taking the other side of the transaction.

Since open interest includes the derivative contracts that can be bought and sold, it’s better to gauge potential future buying and selling pressure. Changes in open interest are predictive of future equity returns.

In this post, we’ll cover all of the basics of open interest, including a more in-depth description of what open interest is, how it differs from the trading volume, how to calculate it, and how one might want to incorporate it into a trading strategy.

Derivative Contract Basics

Open interest is a measurement tool used for derivative contracts; therefore, we’ll start by covering derivative basics.

There are many different types of derivatives, but two of the most common are options and futures. When you purchase an option, you have the choice, but not the obligation, to buy or sell (depending on the type of contract) the contract’s underlying asset by a specific date. Futures are similar. The only difference is that you must buy or sell the asset instead of having the option to do so.

Trading derivatives differs from trading stocks or many other assets. When you buy a stock, you find someone willing to sell the stock to you. Conversely, if you’re selling a stock, you find someone interested in buying it. After the transaction occurs, the buyer and sellers go separate ways, with the buyer owning more shares and the seller holding fewer shares.

The process for derivatives is a bit different.

When you trade derivatives, you enter into a contract. Each derivative contract has one buyer and one seller. The agreement is an “open” contract until the rights to sell the underlying asset is exercised or the contract expires. Once either of these occurs, the contract is considered settled.

An Explanation of Open Interest

Open interest is the number of derivative contracts that have not yet been settled. Adding up all of the open contracts provides you with the open interest.

One aspect of open interest that often trips people up is that open interest is about the number of contracts, not buyers and sellers. If a buyer and seller enter into a new contract, open interest increases by one. If a buyer and seller close out a contract, open interest decreases by one. But, if a buyer and seller pass their position on to a new buyer and seller, open interest does not change because the number of open contracts remains the same.

The fact that open interest counts contracts, not trades, separates open interest from trading volume.

A trade occurs when a buyer and seller transfer their derivative contract to a new buyer and seller. Therefore, trading volume is impacted, but no new contract has been opened or settled, so open interest does not change. When a new contract is created or closed, both open interest and trading volume are impacted.

Calculating Open Interest

Open interest is merely the total of all open contracts. Unlike many other financial tools or indicators, calculating open interest requires nothing more than basic addition and subtraction skills. While calculating open interest is quite simple in theory, the application is often more confusing.

Let’s look at an example to see what we mean by this.

Open Interest Example

Stockholder Adam writes six call contracts for SPY as he thinks it will go down, and he wants to collect the option premium. Trader Bob purchases one call contract as he thinks SPY will go up. Trader Cathy buys the remainder of the call contracts. Six open contracts now exist with the stockholder “writing” six call contracts and our two traders buying them.

The next day, SPY moves up. Bob exercises his contract with Adam and purchases SPY at a discount. Adam still collects the option premium but no longer holds the SPY associated with that contract. On the other hand, Cathy sells all five of her in-the-money contracts to Dave. Even though every contract was traded, open interest fell by one as no new contracts were created, and one was settled.

On day three, SPY moves down big. The options expire worthless. They’re worthless because Dave can buy SPY at a lower price in the market than exercising the call contract. Dave loses all of the money he used to purchase the options from Cathy. Adam makes some money as even though he lost money when Bob exercised the right to buy SPY, Dave’s options expired worthless, and Adam is sitting pretty with the option premium, giving him a nice profit.

| Trader | Day One | Day Two | Day Three |

|---|---|---|---|

| Bob | 1 | 0 | 0 |

| Cathy | 5 | 0 | 0 |

| Dave | 5 | 0 | |

| End of Day Open Interest | 6 | 5 | 0 |

Our example is a bit simplistic.

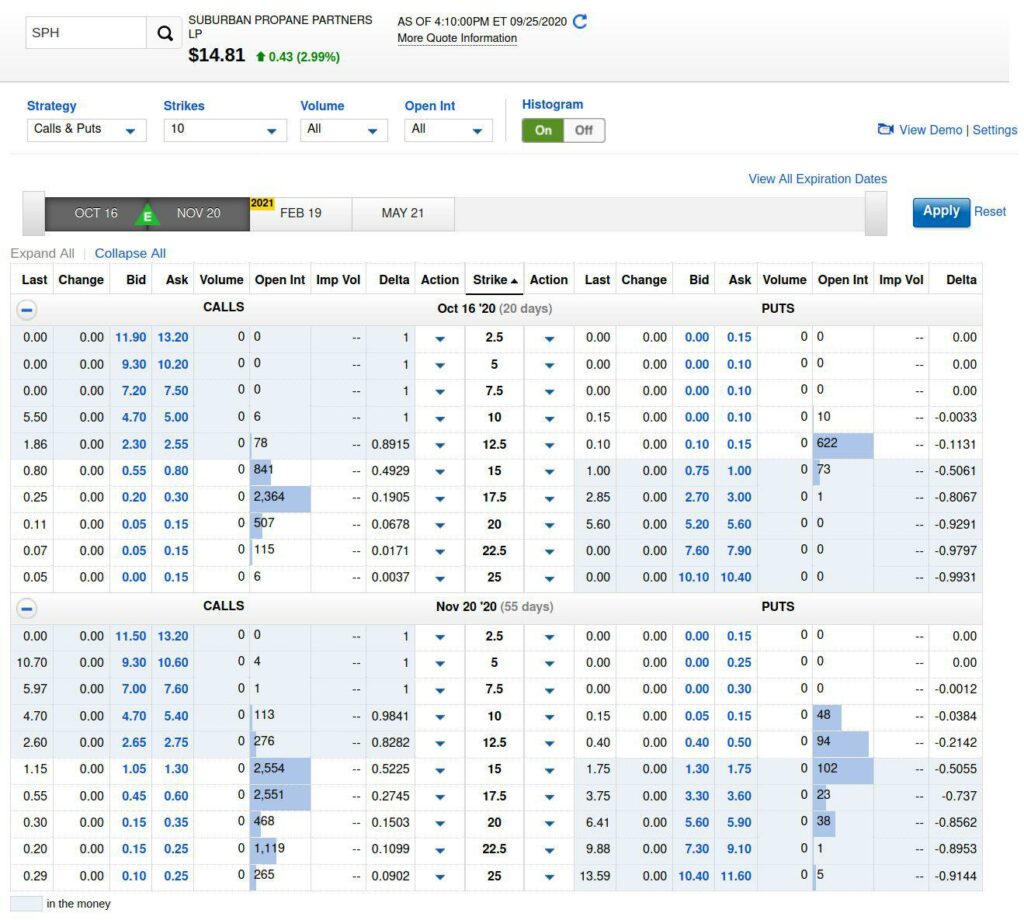

Traders often hold on to contracts for more than a day or two. Real-life numbers are considerably higher, options expire at different times, and option types are tallied separately, as seen in the open interest chart below.

Open Interest Chart

This example does help convey the complex nature of calculating open interest and how open interest may stay low while volume increases.

Open Interest Trading Strategies

Open interest can be used in various ways, but it’s primarily used as a trend strength indicator, which means it’s a tool that can gauge the strength of trends in the derivatives market. This is useful for any trader, especially trend-following traders seeking to find and profit from market trends.

When open interest increases, more money and interest are coming in, which most market technicians believe helps the current trend to continue. When open interest decreases, traders leave and take their money with them. This may be a sign that a trend reversal is about to occur. The more significant and faster the change in open interest (in either direction), the stronger the indicator.

Additionally, there is evidence that open-interest changes foreshadow future equity returns using open interest put/call ratio analysis.

We’ll stick to the traditional use of open interest in confirming the strength of the prevailing trend.

With this in mind, let’s begin by looking at some of the more traditional interpretations of open interest. Before we dive in, though, while the interpretations we’ll look at are common patterns, no matter how clear the indicators, they are patterns, not rules. There is, therefore, no guarantee that a specific trend will abide by the rules of these patterns.

There are four main interpretations when using open interest in conjunction with price to predict trends.

1. Open Interest Increases and Price Increases

When both price and open interest increase, this is often considered a sign that the price’s upward movement is likely to continue. Remember, when open interest increases, it is generally considered an indication that a price trend will continue on its current trajectory.

2. Open Interest Decreases and Price Increases

If open interest decreases while the price increases, this is often a sign that the price’s upward trend will reverse and begin trending down. The decrease in open interest shows that the money and interest fueling this trend have begun to decrease. The timing of when the price will fall depends on many factors and the length of time of the trends you’re considering, but generally, when you see a trend with decreasing open interest and increasing price, the reversal of the trend is not far off.

3. Open Interest Increases and Price Decreases

When the price decreases but open interest increases, this typically means that the price’s downward trend is set to continue. As discussed, increasing open interest generally signifies that a trend will continue, including downward and upward price movements.

4. Open Interest Decreases and Price Decreases

If both price and open interest decrease, this typically means that the downward trend’s strength has weakened. The reduction in open interest means that the trend has lost some of its power, but that doesn’t necessarily mean the price will begin shooting up. Again, we’re dealing with probabilities and not certainties.

The Botton Line

Open interest is a handy tool for gauging changes in buying and selling pressure in the market. Trading on the information content of open interest can be profitable. However, the key to getting the most use out of it rests on using it in conjunction with other indicators, primarily price and volume.