Up Gap Side-by-Side White Lines Explained & Backtested (2026)

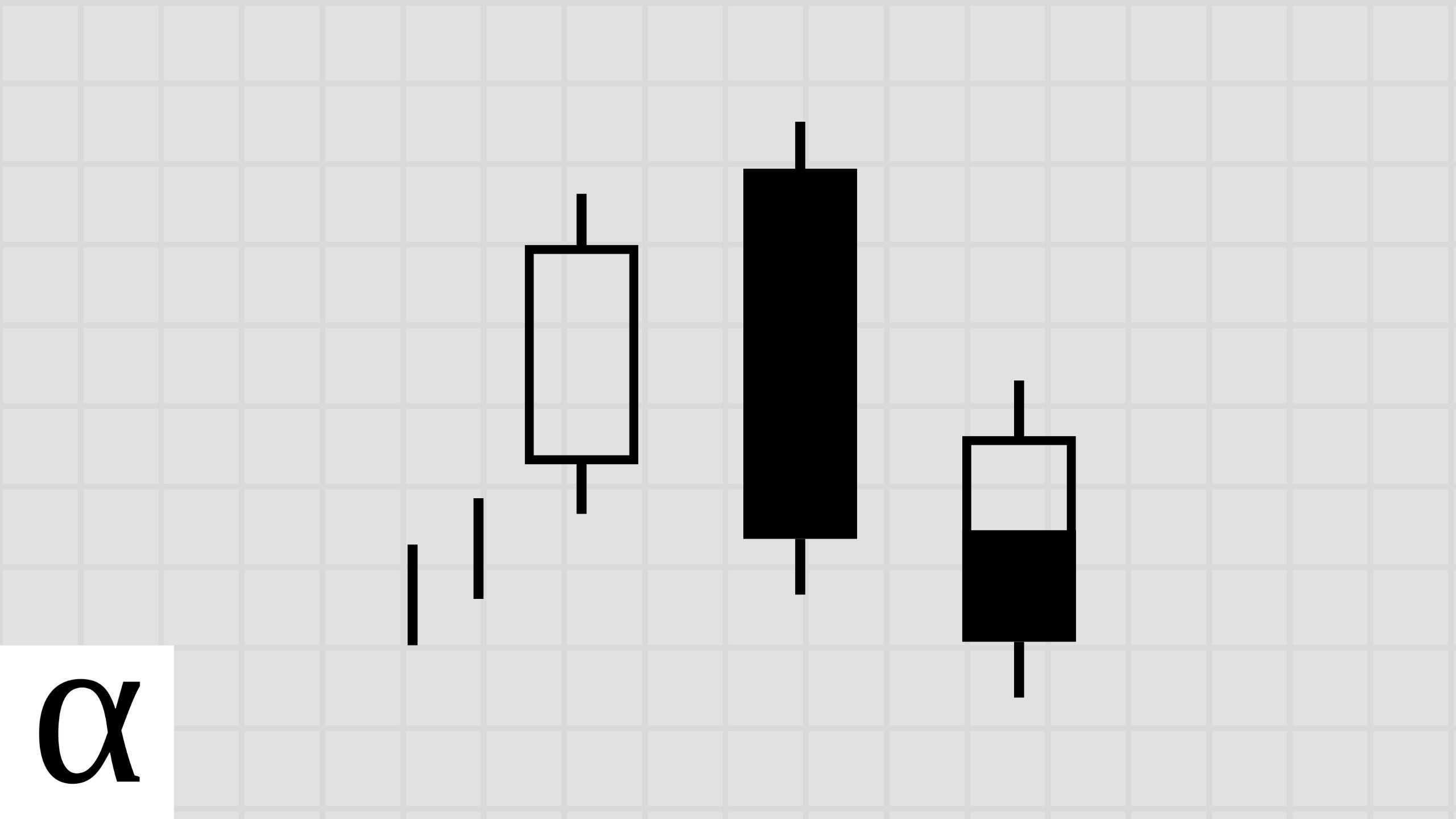

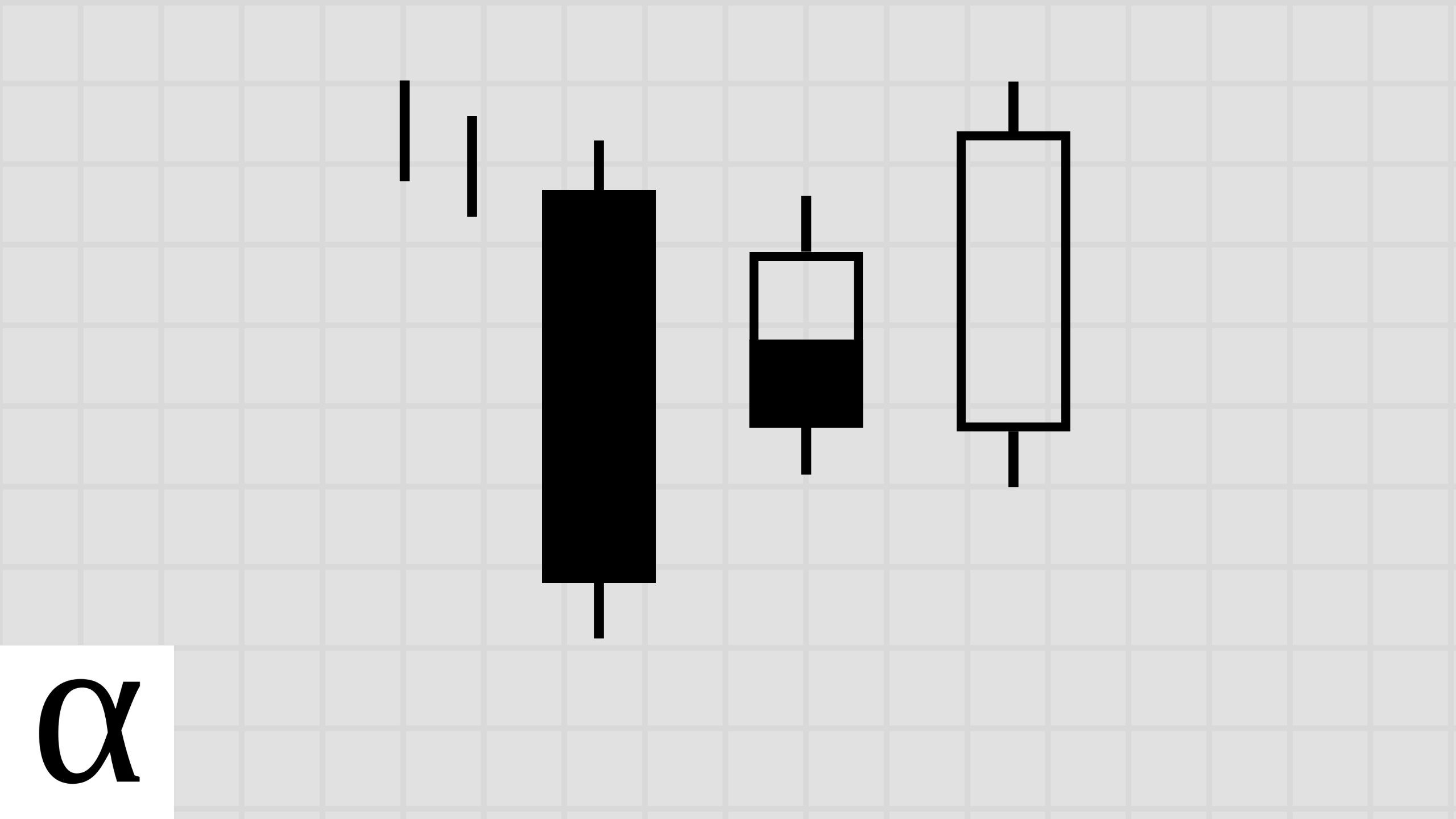

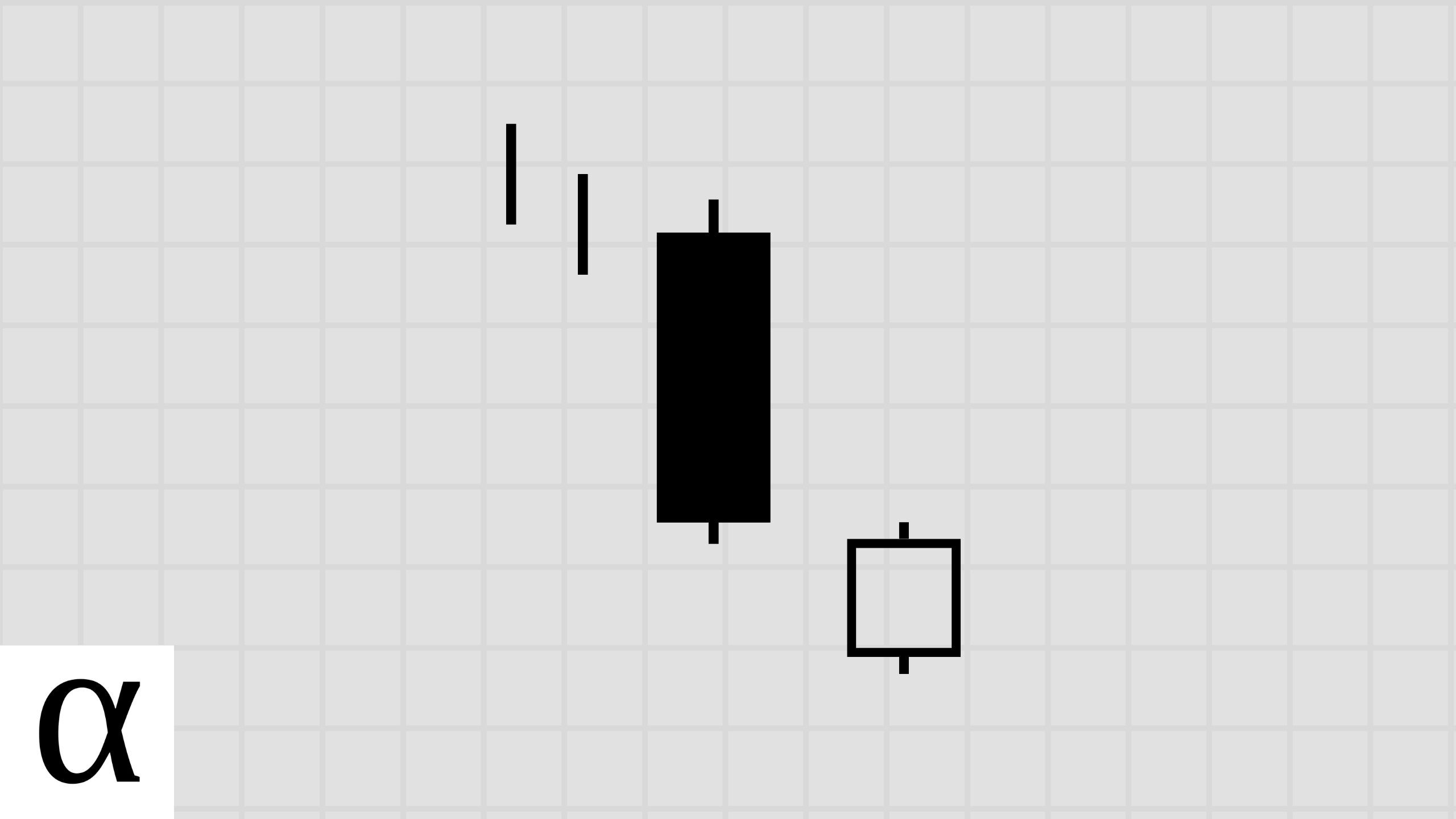

The bullish side-by-side white lines, also known as the up gap side-by-side white lines, is a three-bar bullish continuation Japanese candlestick pattern that is best traded as intended in the stock market and for a quick short in the forex …