The Doji Japanese candlestick pattern is a class of one-bar indecision patterns whose open and close are nearly identical.

But what if I told you that you could trade these patterns profitably according to backtests spanning multiple decades?

Would you be interested?

If so, read on to learn how to make a trade decision when faced with these indecision candlestick patterns.

What Is a Doji Candlestick Pattern

A doji candlestick pattern is a single-bar pattern that supposedly represents indecision.

The name comes from the word “doji” (どうじ 同事), which means the same thing in Japanese.

There are multiple types of doji candlestick patterns, including the common, long-legged, dragonfly, and gravestone doji.

Technical analysts use the doji term to refer to all of the above patterns but specifically call out a doji by its proper name when they want to be more specific, e.g., a dragonfly doji.

I’ll cover the common doji pattern in this post. And for the sake of brevity, I’ll refer to the common doji sometimes as just the doji candlestick, and I’ll provide links and backtest results to the other similar doji patterns below.

How to Identify the Doji Candlestick Pattern

The following are the requirements for a valid common doji pattern:

- The open and close must be equal or very similar.

- The open and close price must not be near the high or low.

- The candle’s range must be similar to prior trading ranges.

- The doji does not require a trend.

In other words, a common doji must not close near the high or low, and the range must be the same or smaller than prior candles. Changes to these requirements would make it a different type of doji.

Let’s look at an example of a common doji on our candlestick charts.

Doji Candlestick Pattern on the Apple (AAPL) July 21st, 2021 daily chart

We can see the doji candlestick chart pattern on the Apple (AAPL) daily chart on July 21st, 2021.

The opening and closing prices are almost identical, occurring near the midpoint of the day’s price action.

With the doji pattern identified, what type of trading strategy do data-driven traders employ for this single bar pattern?

How to Trade the Doji Candlestick Pattern

History tells us that a doji pattern is best traded bullishly in the stock and crypto markets and bearishly in the forex markets using the low-close or high-close as entries, respectively.

In other words, data-driven trading strategies expect reversals around these key doji formations.

Let’s take a look at the best doji trading strategies for the stock and crypto markets according to history.

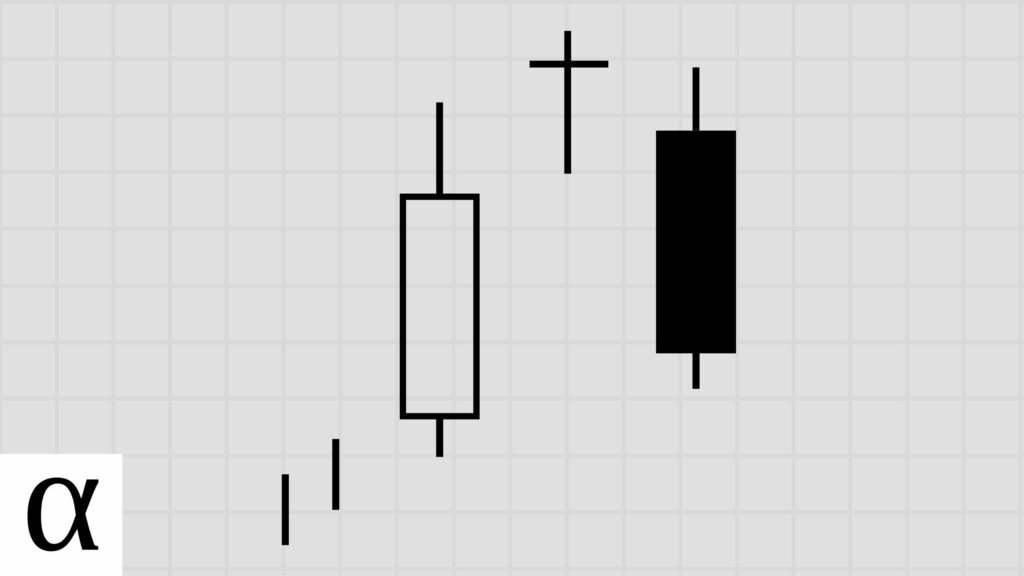

Doji Bullish Candlestick Trade Setup

We can see the doji candlestick pattern on the Alphabet (GOOG) daily chart on November 16th, 2021.

The opening price is roughly equal to the closing price, appearing near the midpoint of the day’s price range.

One could say that there are two doji candlesticks in a row, but you could also argue that the second is a spinning top or short line – there’s some discretion when identifying candlesticks.

Regardless, with the doji pattern identified, smart traders enter long on a break of the doji’s close with a stop loss set just below the low.

In the above example, savvy traders would have entered on open as the price was above the close, setting the stop loss below the low of the doji candlestick, which turned into a nice profit the next day.

But what about forex traders?

They should do the same but in the opposite direction.

Doji Bearish Candlestick Trade Setup

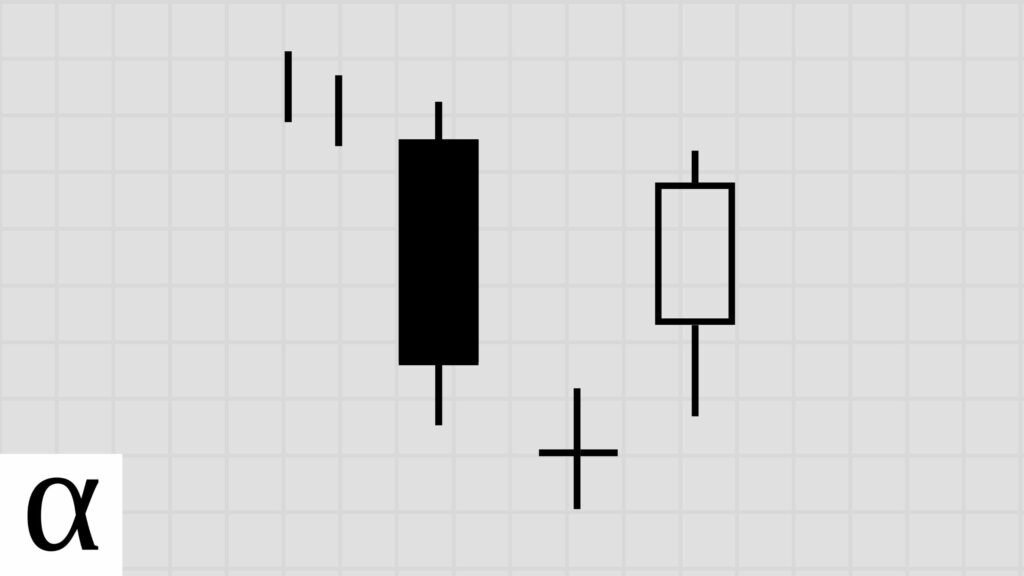

We see a perfect example of a Doji on the Markel (MKL) on the September 5th, 2021, daily chart.

Historically-guided traders will go bearish when the price falls below the doji’s close, setting a stop loss just above the doji candle’s high.

In the above Markel example, the doji candle occurs on the 5th triggering an entry on the 8th with a profitable exit on the 9th, depending upon your risk-reward levels.

Speaking of profitable exits, what does history tell us about these best doji trading strategies?

Does the Doji Candlestick Pattern Work? (Backtest Results)

Using the following rules, I backtested the doji candlestick pattern on the daily timeframe in the crypto, forex, and stock markets.

- A close above the 50-day SMA constitutes an uptrend.

- I tested risk-reward ranges from 1 to 5.

- The optimal risk-reward ratio is selected using profit per bar.

- Entry and exits are discussed in the how-to trade section above.

- Confirmation must occur within three days of the pattern signal.

| Id | Pattern | Pattern Bars | Required Trend | Traditional Strategy | Market | Strategy | Setup | RR | Tickers | Signals | Trades | Trade Bars | Edge | Edge Per Bar | Confirm % | Win % | Cons Wins | Cons Losses | Avg. Trade Bars | Avg. Win Bars | Avg. Loss Bars | Details |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 7,546 | doji | 1 | none | indecision | crypto | bearish | high-low | 1 | 259 | 30,528 | 19,403 | 65,862 | -0.139 | -0.14 | 0.64 | 0.43 | 76 | 19 | 3.39 | 3.21 | 3.54 | https://analyzingalpha.com/doji-candlestick-pattern |

| 7,547 | doji | 1 | none | indecision | crypto | bearish | high-low | 2 | 259 | 24,905 | 15,759 | 91,146 | 0.012 | 0.01 | 0.63 | 0.34 | 60 | 21 | 5.78 | 5.74 | 5.81 | https://analyzingalpha.com/doji-candlestick-pattern |

| 7,548 | doji | 1 | none | indecision | crypto | bearish | high-low | 3 | 259 | 19,342 | 12,162 | 104,693 | 0.123 | 0.12 | 0.63 | 0.28 | 58 | 23 | 8.61 | 8.75 | 8.55 | https://analyzingalpha.com/doji-candlestick-pattern |

| 7,549 | doji | 1 | none | indecision | crypto | bearish | high-low | 4 | 259 | 15,960 | 9,946 | 113,705 | 0.238 | 0.24 | 0.62 | 0.25 | 56 | 36 | 11.43 | 11.80 | 11.31 | https://analyzingalpha.com/doji-candlestick-pattern |

| 7,550 | doji | 1 | none | indecision | crypto | bearish | high-low | 5 | 259 | 13,031 | 8,047 | 118,730 | 0.325 | 0.33 | 0.62 | 0.22 | 56 | 36 | 14.75 | 13.89 | 15.00 | https://analyzingalpha.com/doji-candlestick-pattern |

| 7,551 | doji | 1 | none | indecision | forex | bearish | high-low | 1 | 1,285 | 796,493 | 587,327 | 1,051,157 | -0.260 | -0.26 | 0.74 | 0.37 | 427 | 27 | 1.79 | 1.94 | 1.70 | https://analyzingalpha.com/doji-candlestick-pattern |

| 7,552 | doji | 1 | none | indecision | forex | bearish | high-low | 2 | 1,285 | 730,966 | 538,584 | 1,294,973 | 0.018 | 0.02 | 0.74 | 0.34 | 424 | 116 | 2.40 | 2.68 | 2.26 | https://analyzingalpha.com/doji-candlestick-pattern |

| 7,553 | doji | 1 | none | indecision | forex | bearish | high-low | 3 | 1,285 | 681,368 | 500,668 | 1,487,940 | 0.295 | 0.30 | 0.73 | 0.33 | 423 | 61 | 2.97 | 3.33 | 2.80 | https://analyzingalpha.com/doji-candlestick-pattern |

| 7,554 | doji | 1 | none | indecision | forex | bearish | high-low | 4 | 1,285 | 640,924 | 469,505 | 1,636,071 | 0.584 | 0.58 | 0.73 | 0.32 | 423 | 94 | 3.48 | 3.87 | 3.31 | https://analyzingalpha.com/doji-candlestick-pattern |

| 7,555 | doji | 1 | none | indecision | forex | bearish | high-low | 5 | 1,285 | 607,439 | 443,786 | 1,757,820 | 0.870 | 0.87 | 0.73 | 0.31 | 421 | 91 | 3.96 | 4.38 | 3.77 | https://analyzingalpha.com/doji-candlestick-pattern |

| 7,556 | doji | 1 | none | indecision | stock | bearish | high-low | 1 | 6,600 | 1,952,129 | 1,314,182 | 3,331,742 | -0.159 | -0.16 | 0.67 | 0.42 | 401 | 20 | 2.54 | 2.77 | 2.36 | https://analyzingalpha.com/doji-candlestick-pattern |

| 7,557 | doji | 1 | none | indecision | stock | bearish | high-low | 2 | 6,600 | 1,760,407 | 1,184,597 | 4,568,870 | -0.064 | -0.06 | 0.67 | 0.31 | 388 | 27 | 3.86 | 4.92 | 3.37 | https://analyzingalpha.com/doji-candlestick-pattern |

| 7,558 | doji | 1 | none | indecision | stock | bearish | high-low | 3 | 6,600 | 1,608,252 | 1,080,900 | 5,536,469 | 0.025 | 0.03 | 0.67 | 0.26 | 379 | 41 | 5.12 | 7.33 | 4.37 | https://analyzingalpha.com/doji-candlestick-pattern |

| 7,559 | doji | 1 | none | indecision | stock | bearish | high-low | 4 | 6,600 | 1,476,333 | 991,110 | 6,329,959 | 0.092 | 0.09 | 0.67 | 0.22 | 370 | 45 | 6.39 | 9.92 | 5.40 | https://analyzingalpha.com/doji-candlestick-pattern |

| 7,560 | doji | 1 | none | indecision | stock | bearish | high-low | 5 | 6,600 | 1,369,369 | 918,068 | 6,949,658 | 0.155 | 0.16 | 0.67 | 0.19 | 368 | 61 | 7.57 | 12.60 | 6.37 | https://analyzingalpha.com/doji-candlestick-pattern |

| 8,446 | doji | 1 | none | indecision | crypto | bullish | low-high | 1 | 259 | 34,637 | 21,254 | 51,172 | -0.122 | -0.12 | 0.61 | 0.44 | 12 | 16 | 2.41 | 2.49 | 2.35 | https://analyzingalpha.com/doji-candlestick-pattern |

| 8,447 | doji | 1 | none | indecision | crypto | bullish | low-high | 2 | 259 | 31,938 | 19,475 | 66,678 | 0.080 | 0.08 | 0.61 | 0.36 | 6 | 29 | 3.42 | 3.94 | 3.13 | https://analyzingalpha.com/doji-candlestick-pattern |

| 8,448 | doji | 1 | none | indecision | crypto | bullish | low-high | 3 | 259 | 30,091 | 18,311 | 77,583 | 0.280 | 0.28 | 0.61 | 0.32 | 6 | 28 | 4.24 | 5.10 | 3.83 | https://analyzingalpha.com/doji-candlestick-pattern |

| 8,449 | doji | 1 | none | indecision | crypto | bullish | low-high | 4 | 259 | 28,666 | 17,429 | 86,246 | 0.480 | 0.48 | 0.61 | 0.30 | 6 | 27 | 4.95 | 6.06 | 4.48 | https://analyzingalpha.com/doji-candlestick-pattern |

| 8,450 | doji | 1 | none | indecision | crypto | bullish | low-high | 5 | 259 | 27,712 | 16,795 | 92,604 | 0.680 | 0.68 | 0.61 | 0.28 | 6 | 36 | 5.51 | 6.87 | 4.99 | https://analyzingalpha.com/doji-candlestick-pattern |

| 8,451 | doji | 1 | none | indecision | forex | bullish | low-high | 1 | 1,285 | 780,132 | 576,272 | 1,119,706 | -0.338 | -0.34 | 0.74 | 0.33 | 125 | 65 | 1.94 | 2.12 | 1.86 | https://analyzingalpha.com/doji-candlestick-pattern |

| 8,452 | doji | 1 | none | indecision | forex | bullish | low-high | 2 | 1,285 | 714,243 | 526,398 | 1,364,774 | -0.094 | -0.09 | 0.74 | 0.30 | 125 | 125 | 2.59 | 2.88 | 2.47 | https://analyzingalpha.com/doji-candlestick-pattern |

| 8,453 | doji | 1 | none | indecision | forex | bullish | low-high | 3 | 1,285 | 666,282 | 489,515 | 1,549,737 | 0.163 | 0.16 | 0.73 | 0.29 | 125 | 125 | 3.17 | 3.59 | 2.99 | https://analyzingalpha.com/doji-candlestick-pattern |

| 8,454 | doji | 1 | none | indecision | forex | bullish | low-high | 4 | 1,285 | 628,616 | 460,065 | 1,694,575 | 0.420 | 0.42 | 0.73 | 0.29 | 125 | 125 | 3.68 | 4.19 | 3.48 | https://analyzingalpha.com/doji-candlestick-pattern |

| 8,455 | doji | 1 | none | indecision | forex | bullish | low-high | 5 | 1,285 | 597,222 | 435,512 | 1,800,173 | 0.695 | 0.70 | 0.73 | 0.28 | 125 | 125 | 4.13 | 4.71 | 3.91 | https://analyzingalpha.com/doji-candlestick-pattern |

| 8,456 | doji | 1 | none | indecision | stock | bullish | low-high | 1 | 6,600 | 1,971,499 | 1,341,239 | 3,292,005 | -0.140 | -0.14 | 0.68 | 0.43 | 12 | 26 | 2.45 | 2.67 | 2.29 | https://analyzingalpha.com/doji-candlestick-pattern |

| 8,457 | doji | 1 | none | indecision | stock | bullish | low-high | 2 | 6,600 | 1,796,815 | 1,219,573 | 4,523,648 | -0.012 | -0.01 | 0.68 | 0.33 | 8 | 26 | 3.71 | 4.82 | 3.16 | https://analyzingalpha.com/doji-candlestick-pattern |

| 8,458 | doji | 1 | none | indecision | stock | bullish | low-high | 3 | 6,600 | 1,660,189 | 1,123,595 | 5,501,803 | 0.108 | 0.11 | 0.68 | 0.28 | 9 | 26 | 4.90 | 7.32 | 3.98 | https://analyzingalpha.com/doji-candlestick-pattern |

| 8,459 | doji | 1 | none | indecision | stock | bullish | low-high | 4 | 6,600 | 1,547,764 | 1,044,223 | 6,294,490 | 0.212 | 0.21 | 0.67 | 0.24 | 8 | 31 | 6.03 | 10.04 | 4.74 | https://analyzingalpha.com/doji-candlestick-pattern |

| 8,460 | doji | 1 | none | indecision | stock | bullish | low-high | 5 | 6,600 | 1,452,524 | 977,316 | 6,961,795 | 0.320 | 0.32 | 0.67 | 0.22 | 8 | 44 | 7.12 | 12.95 | 5.47 | https://analyzingalpha.com/doji-candlestick-pattern |

| 8,511 | doji | 1 | none | indecision | crypto | bearish | high-close | 1 | 259 | 35,857 | 31,600 | 68,700 | -0.103 | -0.10 | 0.88 | 0.45 | 270 | 12 | 2.17 | 2.05 | 2.27 | https://analyzingalpha.com/doji-candlestick-pattern |

| 8,512 | doji | 1 | none | indecision | crypto | bearish | high-close | 2 | 259 | 29,727 | 26,110 | 88,807 | 0.118 | 0.12 | 0.88 | 0.37 | 240 | 25 | 3.40 | 3.06 | 3.60 | https://analyzingalpha.com/doji-candlestick-pattern |

| 8,513 | doji | 1 | none | indecision | crypto | bearish | high-close | 3 | 259 | 24,842 | 21,728 | 103,781 | 0.295 | 0.30 | 0.87 | 0.33 | 221 | 27 | 4.78 | 4.43 | 4.94 | https://analyzingalpha.com/doji-candlestick-pattern |

| 8,514 | doji | 1 | none | indecision | crypto | bearish | high-close | 4 | 259 | 21,200 | 18,573 | 110,319 | 0.446 | 0.45 | 0.88 | 0.29 | 208 | 35 | 5.94 | 5.78 | 6.01 | https://analyzingalpha.com/doji-candlestick-pattern |

| 8,515 | doji | 1 | none | indecision | crypto | bearish | high-close | 5 | 259 | 18,472 | 16,023 | 115,445 | 0.605 | 0.61 | 0.87 | 0.27 | 202 | 45 | 7.20 | 6.53 | 7.45 | https://analyzingalpha.com/doji-candlestick-pattern |

| 8,516 | doji | 1 | none | indecision | forex | bearish | high-close | 1 | 1,285 | 926,112 | 816,206 | 1,155,473 | -0.218 | -0.22 | 0.88 | 0.39 | 876 | 34 | 1.42 | 1.49 | 1.37 | https://analyzingalpha.com/doji-candlestick-pattern |

| 8,517 | doji | 1 | none | indecision | forex | bearish | high-close | 2 | 1,285 | 860,855 | 755,340 | 1,313,709 | 0.080 | 0.08 | 0.88 | 0.36 | 810 | 40 | 1.74 | 1.87 | 1.67 | https://analyzingalpha.com/doji-candlestick-pattern |

| 8,518 | doji | 1 | none | indecision | forex | bearish | high-close | 3 | 1,285 | 807,201 | 704,747 | 1,444,960 | 0.357 | 0.36 | 0.87 | 0.34 | 745 | 40 | 2.05 | 2.23 | 1.96 | https://analyzingalpha.com/doji-candlestick-pattern |

| 8,519 | doji | 1 | none | indecision | forex | bearish | high-close | 4 | 1,285 | 767,660 | 667,596 | 1,556,091 | 0.634 | 0.63 | 0.87 | 0.33 | 698 | 40 | 2.33 | 2.56 | 2.22 | https://analyzingalpha.com/doji-candlestick-pattern |

| 8,520 | doji | 1 | none | indecision | forex | bearish | high-close | 5 | 1,285 | 733,323 | 635,089 | 1,656,767 | 0.910 | 0.91 | 0.87 | 0.32 | 668 | 51 | 2.61 | 2.91 | 2.47 | https://analyzingalpha.com/doji-candlestick-pattern |

| 8,521 | doji | 1 | none | indecision | stock | bearish | high-close | 1 | 6,600 | 2,294,900 | 1,998,359 | 3,285,479 | -0.162 | -0.16 | 0.87 | 0.42 | 533 | 26 | 1.64 | 1.75 | 1.57 | https://analyzingalpha.com/doji-candlestick-pattern |

| 8,522 | doji | 1 | none | indecision | stock | bearish | high-close | 2 | 6,600 | 2,123,029 | 1,843,634 | 4,105,572 | 0.026 | 0.03 | 0.87 | 0.34 | 420 | 26 | 2.23 | 2.62 | 2.02 | https://analyzingalpha.com/doji-candlestick-pattern |

| 8,523 | doji | 1 | none | indecision | stock | bearish | high-close | 3 | 6,600 | 1,983,840 | 1,719,169 | 4,809,340 | 0.166 | 0.17 | 0.87 | 0.29 | 401 | 37 | 2.80 | 3.57 | 2.48 | https://analyzingalpha.com/doji-candlestick-pattern |

| 8,524 | doji | 1 | none | indecision | stock | bearish | high-close | 4 | 6,600 | 1,868,194 | 1,616,108 | 5,425,057 | 0.288 | 0.29 | 0.87 | 0.26 | 396 | 36 | 3.36 | 4.59 | 2.93 | https://analyzingalpha.com/doji-candlestick-pattern |

| 8,525 | doji | 1 | none | indecision | stock | bearish | high-close | 5 | 6,600 | 1,765,679 | 1,525,117 | 5,949,704 | 0.380 | 0.38 | 0.86 | 0.23 | 391 | 61 | 3.90 | 5.62 | 3.39 | https://analyzingalpha.com/doji-candlestick-pattern |

| 10,171 | doji | 1 | none | indecision | crypto | bullish | atr-pattern_low | 1 | 259 | 27,878 | 14,509 | 56,476 | -0.082 | -0.08 | 0.52 | 0.46 | 14 | 16 | 3.89 | 4.73 | 3.18 | https://analyzingalpha.com/doji-candlestick-pattern |

| 10,172 | doji | 1 | none | indecision | crypto | bullish | atr-pattern_low | 2 | 259 | 23,600 | 12,066 | 79,526 | -0.004 | 0.00 | 0.51 | 0.33 | 8 | 32 | 6.59 | 9.52 | 5.13 | https://analyzingalpha.com/doji-candlestick-pattern |

| 10,173 | doji | 1 | none | indecision | crypto | bullish | atr-pattern_low | 3 | 259 | 21,465 | 10,803 | 93,804 | 0.055 | 0.06 | 0.50 | 0.27 | 3 | 32 | 8.68 | 14.86 | 6.45 | https://analyzingalpha.com/doji-candlestick-pattern |

| 10,174 | doji | 1 | none | indecision | crypto | bullish | atr-pattern_low | 4 | 259 | 20,396 | 10,109 | 101,303 | 0.104 | 0.10 | 0.50 | 0.22 | 3 | 36 | 10.02 | 19.26 | 7.39 | https://analyzingalpha.com/doji-candlestick-pattern |

| 10,175 | doji | 1 | none | indecision | crypto | bullish | atr-pattern_low | 5 | 259 | 19,622 | 9,573 | 107,079 | 0.140 | 0.14 | 0.49 | 0.19 | 3 | 36 | 11.19 | 23.66 | 8.27 | https://analyzingalpha.com/doji-candlestick-pattern |

| 10,176 | doji | 1 | none | indecision | forex | bullish | atr-pattern_low | 1 | 1,285 | 716,958 | 442,055 | 859,305 | -0.599 | -0.60 | 0.62 | 0.20 | 7 | 199 | 1.94 | 3.67 | 1.51 | https://analyzingalpha.com/doji-candlestick-pattern |

| 10,177 | doji | 1 | none | indecision | forex | bullish | atr-pattern_low | 2 | 1,285 | 623,432 | 378,039 | 1,195,248 | -0.608 | -0.61 | 0.61 | 0.13 | 4 | 199 | 3.16 | 8.53 | 2.35 | https://analyzingalpha.com/doji-candlestick-pattern |

| 10,178 | doji | 1 | none | indecision | forex | bullish | atr-pattern_low | 3 | 1,285 | 575,043 | 343,698 | 1,408,339 | -0.609 | -0.61 | 0.60 | 0.10 | 3 | 199 | 4.10 | 14.28 | 3.00 | https://analyzingalpha.com/doji-candlestick-pattern |

| 10,179 | doji | 1 | none | indecision | forex | bullish | atr-pattern_low | 4 | 1,285 | 538,402 | 317,834 | 1,562,162 | -0.608 | -0.61 | 0.59 | 0.08 | 3 | 242 | 4.92 | 20.45 | 3.60 | https://analyzingalpha.com/doji-candlestick-pattern |

| 10,180 | doji | 1 | none | indecision | forex | bullish | atr-pattern_low | 5 | 1,285 | 509,741 | 296,948 | 1,682,349 | -0.615 | -0.62 | 0.58 | 0.07 | 3 | 242 | 5.67 | 27.52 | 4.14 | https://analyzingalpha.com/doji-candlestick-pattern |

| 10,181 | doji | 1 | none | indecision | stock | bullish | atr-pattern_low | 1 | 6,600 | 1,774,081 | 966,760 | 2,858,446 | 0.057 | 0.06 | 0.54 | 0.53 | 16 | 14 | 2.96 | 3.01 | 2.89 | https://analyzingalpha.com/doji-candlestick-pattern |

| 10,182 | doji | 1 | none | indecision | stock | bullish | atr-pattern_low | 2 | 6,600 | 1,567,037 | 846,870 | 4,332,990 | 0.142 | 0.14 | 0.54 | 0.38 | 8 | 17 | 5.12 | 6.31 | 4.38 | https://analyzingalpha.com/doji-candlestick-pattern |

| 10,183 | doji | 1 | none | indecision | stock | bullish | atr-pattern_low | 3 | 6,600 | 1,420,879 | 762,106 | 5,461,621 | 0.206 | 0.21 | 0.54 | 0.30 | 6 | 19 | 7.17 | 10.55 | 5.70 | https://analyzingalpha.com/doji-candlestick-pattern |

| 10,184 | doji | 1 | none | indecision | stock | bullish | atr-pattern_low | 4 | 6,600 | 1,306,039 | 695,545 | 6,345,967 | 0.258 | 0.26 | 0.53 | 0.25 | 6 | 23 | 9.12 | 15.66 | 6.92 | https://analyzingalpha.com/doji-candlestick-pattern |

| 10,185 | doji | 1 | none | indecision | stock | bullish | atr-pattern_low | 5 | 6,600 | 1,213,674 | 641,805 | 7,049,192 | 0.315 | 0.32 | 0.53 | 0.22 | 5 | 26 | 10.98 | 21.46 | 8.05 | https://analyzingalpha.com/doji-candlestick-pattern |

| 10,516 | doji | 1 | none | indecision | crypto | bearish | atr-pattern_high | 1 | 259 | 31,443 | 15,799 | 44,742 | -0.144 | -0.14 | 0.50 | 0.43 | 78 | 28 | 2.83 | 3.37 | 2.44 | https://analyzingalpha.com/doji-candlestick-pattern |

| 10,517 | doji | 1 | none | indecision | crypto | bearish | atr-pattern_high | 2 | 259 | 25,923 | 12,706 | 72,020 | -0.156 | -0.16 | 0.49 | 0.28 | 46 | 45 | 5.67 | 8.20 | 4.67 | https://analyzingalpha.com/doji-candlestick-pattern |

| 10,518 | doji | 1 | none | indecision | crypto | bearish | atr-pattern_high | 3 | 259 | 21,442 | 10,260 | 94,344 | -0.203 | -0.20 | 0.48 | 0.20 | 29 | 57 | 9.20 | 15.02 | 7.75 | https://analyzingalpha.com/doji-candlestick-pattern |

| 10,519 | doji | 1 | none | indecision | crypto | bearish | atr-pattern_high | 4 | 259 | 17,659 | 8,335 | 107,737 | -0.266 | -0.27 | 0.47 | 0.15 | 19 | 57 | 12.93 | 21.35 | 11.48 | https://analyzingalpha.com/doji-candlestick-pattern |

| 10,520 | doji | 1 | none | indecision | crypto | bearish | atr-pattern_high | 5 | 259 | 15,374 | 7,122 | 111,206 | -0.340 | -0.34 | 0.46 | 0.11 | 16 | 57 | 15.61 | 32.17 | 13.57 | https://analyzingalpha.com/doji-candlestick-pattern |

| 10,521 | doji | 1 | none | indecision | forex | bearish | atr-pattern_high | 1 | 1,285 | 700,803 | 427,340 | 904,842 | -0.562 | -0.56 | 0.61 | 0.22 | 258 | 203 | 2.12 | 4.12 | 1.56 | https://analyzingalpha.com/doji-candlestick-pattern |

| 10,522 | doji | 1 | none | indecision | forex | bearish | atr-pattern_high | 2 | 1,285 | 603,761 | 362,578 | 1,246,975 | -0.558 | -0.56 | 0.60 | 0.15 | 136 | 203 | 3.44 | 9.20 | 2.45 | https://analyzingalpha.com/doji-candlestick-pattern |

| 10,523 | doji | 1 | none | indecision | forex | bearish | atr-pattern_high | 3 | 1,285 | 552,227 | 326,548 | 1,461,752 | -0.560 | -0.56 | 0.59 | 0.11 | 98 | 203 | 4.48 | 14.69 | 3.21 | https://analyzingalpha.com/doji-candlestick-pattern |

| 10,524 | doji | 1 | none | indecision | forex | bearish | atr-pattern_high | 4 | 1,285 | 513,063 | 299,308 | 1,616,282 | -0.558 | -0.56 | 0.58 | 0.09 | 77 | 246 | 5.40 | 21.22 | 3.88 | https://analyzingalpha.com/doji-candlestick-pattern |

| 10,525 | doji | 1 | none | indecision | forex | bearish | atr-pattern_high | 5 | 1,285 | 483,287 | 278,462 | 1,725,775 | -0.565 | -0.57 | 0.58 | 0.07 | 56 | 377 | 6.20 | 28.38 | 4.45 | https://analyzingalpha.com/doji-candlestick-pattern |

| 10,526 | doji | 1 | none | indecision | stock | bearish | atr-pattern_high | 1 | 6,600 | 1,779,276 | 970,893 | 2,843,011 | 0.043 | 0.04 | 0.55 | 0.52 | 226 | 15 | 2.93 | 2.91 | 2.94 | https://analyzingalpha.com/doji-candlestick-pattern |

| 10,527 | doji | 1 | none | indecision | stock | bearish | atr-pattern_high | 2 | 6,600 | 1,560,608 | 845,861 | 4,389,634 | 0.088 | 0.09 | 0.54 | 0.36 | 137 | 19 | 5.19 | 6.06 | 4.69 | https://analyzingalpha.com/doji-candlestick-pattern |

| 10,528 | doji | 1 | none | indecision | stock | bearish | atr-pattern_high | 3 | 6,600 | 1,393,867 | 751,670 | 5,564,291 | 0.105 | 0.11 | 0.54 | 0.28 | 102 | 28 | 7.40 | 10.14 | 6.37 | https://analyzingalpha.com/doji-candlestick-pattern |

| 10,529 | doji | 1 | none | indecision | stock | bearish | atr-pattern_high | 4 | 6,600 | 1,269,056 | 681,159 | 6,434,181 | 0.092 | 0.09 | 0.54 | 0.22 | 90 | 51 | 9.45 | 14.82 | 7.95 | https://analyzingalpha.com/doji-candlestick-pattern |

| 10,530 | doji | 1 | none | indecision | stock | bearish | atr-pattern_high | 5 | 6,600 | 1,160,430 | 620,578 | 7,133,517 | 0.080 | 0.08 | 0.53 | 0.18 | 75 | 51 | 11.49 | 20.42 | 9.53 | https://analyzingalpha.com/doji-candlestick-pattern |

| 11,131 | doji | 1 | none | indecision | crypto | bullish | low-close | 1 | 259 | 41,367 | 35,692 | 60,270 | -0.119 | -0.12 | 0.86 | 0.44 | 11 | 8 | 1.69 | 1.79 | 1.61 | https://analyzingalpha.com/doji-candlestick-pattern |

| 11,132 | doji | 1 | none | indecision | crypto | bullish | low-close | 2 | 259 | 37,699 | 32,283 | 73,537 | 0.134 | 0.13 | 0.86 | 0.38 | 11 | 12 | 2.28 | 2.53 | 2.12 | https://analyzingalpha.com/doji-candlestick-pattern |

| 11,133 | doji | 1 | none | indecision | crypto | bullish | low-close | 3 | 259 | 35,319 | 30,081 | 82,293 | 0.351 | 0.35 | 0.85 | 0.34 | 11 | 14 | 2.74 | 3.15 | 2.53 | https://analyzingalpha.com/doji-candlestick-pattern |

| 11,134 | doji | 1 | none | indecision | crypto | bullish | low-close | 4 | 259 | 33,425 | 28,338 | 89,151 | 0.554 | 0.55 | 0.85 | 0.31 | 11 | 15 | 3.15 | 3.80 | 2.85 | https://analyzingalpha.com/doji-candlestick-pattern |

| 11,135 | doji | 1 | none | indecision | crypto | bullish | low-close | 5 | 259 | 32,125 | 27,127 | 94,885 | 0.750 | 0.75 | 0.84 | 0.29 | 11 | 21 | 3.50 | 4.34 | 3.15 | https://analyzingalpha.com/doji-candlestick-pattern |

| 11,136 | doji | 1 | none | indecision | forex | bullish | low-close | 1 | 1,285 | 876,879 | 765,342 | 1,232,615 | -0.297 | -0.30 | 0.87 | 0.35 | 125 | 46 | 1.61 | 1.64 | 1.59 | https://analyzingalpha.com/doji-candlestick-pattern |

| 11,137 | doji | 1 | none | indecision | forex | bullish | low-close | 2 | 1,285 | 808,660 | 701,401 | 1,408,191 | -0.040 | -0.04 | 0.87 | 0.32 | 125 | 50 | 2.01 | 2.09 | 1.97 | https://analyzingalpha.com/doji-candlestick-pattern |

| 11,138 | doji | 1 | none | indecision | forex | bullish | low-close | 3 | 1,285 | 759,371 | 655,585 | 1,553,111 | 0.209 | 0.21 | 0.86 | 0.30 | 125 | 79 | 2.37 | 2.53 | 2.30 | https://analyzingalpha.com/doji-candlestick-pattern |

| 11,139 | doji | 1 | none | indecision | forex | bullish | low-close | 4 | 1,285 | 720,581 | 619,180 | 1,671,335 | 0.462 | 0.46 | 0.86 | 0.29 | 125 | 90 | 2.70 | 2.89 | 2.62 | https://analyzingalpha.com/doji-candlestick-pattern |

| 11,140 | doji | 1 | none | indecision | forex | bullish | low-close | 5 | 1,285 | 689,867 | 590,202 | 1,766,701 | 0.720 | 0.72 | 0.86 | 0.29 | 125 | 93 | 2.99 | 3.25 | 2.89 | https://analyzingalpha.com/doji-candlestick-pattern |

| 11,141 | doji | 1 | none | indecision | stock | bullish | low-close | 1 | 6,600 | 2,288,897 | 1,987,663 | 3,291,035 | -0.162 | -0.16 | 0.87 | 0.42 | 14 | 20 | 1.66 | 1.77 | 1.58 | https://analyzingalpha.com/doji-candlestick-pattern |

| 11,142 | doji | 1 | none | indecision | stock | bullish | low-close | 2 | 6,600 | 2,124,793 | 1,838,963 | 4,123,692 | 0.028 | 0.03 | 0.87 | 0.34 | 12 | 22 | 2.24 | 2.69 | 2.01 | https://analyzingalpha.com/doji-candlestick-pattern |

| 11,143 | doji | 1 | none | indecision | stock | bullish | low-close | 3 | 6,600 | 1,998,132 | 1,724,273 | 4,852,537 | 0.191 | 0.19 | 0.86 | 0.30 | 9 | 32 | 2.81 | 3.78 | 2.41 | https://analyzingalpha.com/doji-candlestick-pattern |

| 11,144 | doji | 1 | none | indecision | stock | bullish | low-close | 4 | 6,600 | 1,893,044 | 1,629,035 | 5,474,899 | 0.316 | 0.32 | 0.86 | 0.26 | 11 | 32 | 3.36 | 4.96 | 2.79 | https://analyzingalpha.com/doji-candlestick-pattern |

| 11,145 | doji | 1 | none | indecision | stock | bullish | low-close | 5 | 6,600 | 1,800,984 | 1,545,762 | 6,027,624 | 0.440 | 0.44 | 0.86 | 0.24 | 15 | 33 | 3.90 | 6.24 | 3.16 | https://analyzingalpha.com/doji-candlestick-pattern |

| Market | Strategy | Setup | Trades | Edge |

Pattern:

Pattern Bars:

Required Trend:

Traditional Strategy:

Market:

Strategy:

Setup:

RR:

Tickers:

Signals:

Trades:

Trade Bars:

Edge:

Edge Per Bar:

Confirm %:

Win %:

Cons Wins:

Cons Losses:

Avg. Trade Bars:

Avg. Win Bars:

Avg. Loss Bars:

Similar Candlestick Patterns

There are multiple types of doji candlestick patterns. Let’s look at some of the differences between these one-bar patterns.

Long-Legged Doji vs. Common Doji Candlestick Pattern

The long-legged doji candlestick pattern is almost identical to the common doji candlestick pattern. The only difference is that the long-legged doji pattern requires a trading range more significant than the average trading range of prior candles.

Dragonfly Doji vs. Common Doji

The dragonfly doji candlestick pattern is also similar to the common doji pattern. The only difference is that the opening and closing price ends up near the high of the day.

Another difference between the dragonfly doji and the common doji is that the dragonfly doji is supposed to be a reversal pattern in a downtrend and an indecision pattern in an uptrend.

Gravestone Doji vs. Common Doji

The gravestone doji candlestick pattern, sometimes called the tombstone pattern, is the opposite of a dragonfly doji.

The open and close price of the gravestone doji pattern ends near the trading range’s low.

Evening Doji Star vs. Common Doji

The evening doji star is a three-candle bearish reversal pattern that contains a doji. This star doji has a long white candle, followed by a gap up doji, followed by a gap down bearish candle. The doji is said to be a star doji as there’s a gap on both sides, and it’s an evening because it portends darkness or bearish price action.

Morning Doji Star vs. Common Doji

The morning star doji, like the evening star, gets its name by containing a doji. The pattern supposedly acts as a bullish reversal where the first candle is a large black candle in the direction of the trend, followed by a gap down doji, and then the next day is a gap up.

Like the evening star doji, the morning star doji gets its name from the gap down doji.

Spinning Top vs. Common Doji

The spinning top is the same as a common doji, except that the spinning top has a small real body, whereas the doji should have little to no real body.

Short Line vs. Common Doji

The short line is almost a doji. It doesn’t require a trend and can open and close anywhere in the daily price range. The big difference is that it must have a small real body. It also sounds very similar to the previously mentioned spinning top. A short line can be a spinning top if the real body is in the middle of the range.

The Bottom Line

Understanding how to identify a doji candlestick is critical when using candlestick pattern analysis, as they occur frequently. Doji patterns are often a component of larger candlestick patterns such as the evening or morning star doji.

And you now also know that this indecision pattern is often a sign of volatility contraction, ready to break up or down for your profit.

According to history, these supposed indecision candlesticks can be some of the strongest candlestick patterns.