I analyzed over seven hundred million Japanese candlestick pattern trades in the crypto, forex, and stock market spanning multiple decades to determine what works and doesn’t.

Isn’t data science cool?

If you’re a trader struggling to make money with candlestick patterns or if you’re just interested in learning about this ancient Japanese art, you’ve found the holy grail.

Almost all traders use candlestick patterns incorrectly, but I’ve created a solution.

I believe it’s 100x better than anything else out there. I hope you agree and enjoy learning about these candlestick patterns as much as I enjoy profiting from them.

You’ll learn everything you need to know about trading candlestick patterns, like Homma Munehisa, the ancient Japanese rice farmer who discovered candlestick patterns leading to untold riches.

But let’s slice through the pleasantries and get right to business.

This article is massive and is continually updated with new content and data (I will update the candlestick results every year). You should read this article from start to finish if you’re a beginner. If you’re an experienced trader, feel free to jump to exactly what you’re looking for:

Let me know in the comments below if you enjoy this article or have any suggestions for improvement. You can also run your own analysis, as I’ve listed the summary backtest results on GitHub.

What Are Candlestick Charts?

Candlestick charts are a technical analysis tool traders use to understand past market moves to profit from future price action.

Our human brains are notoriously bad at understanding large data sets, but more on that shortly.

Candlestick charts are aptly named because when the price is grouped into periods, such as a day or an hour, it forms a candle shape, which we’ll see in a second.

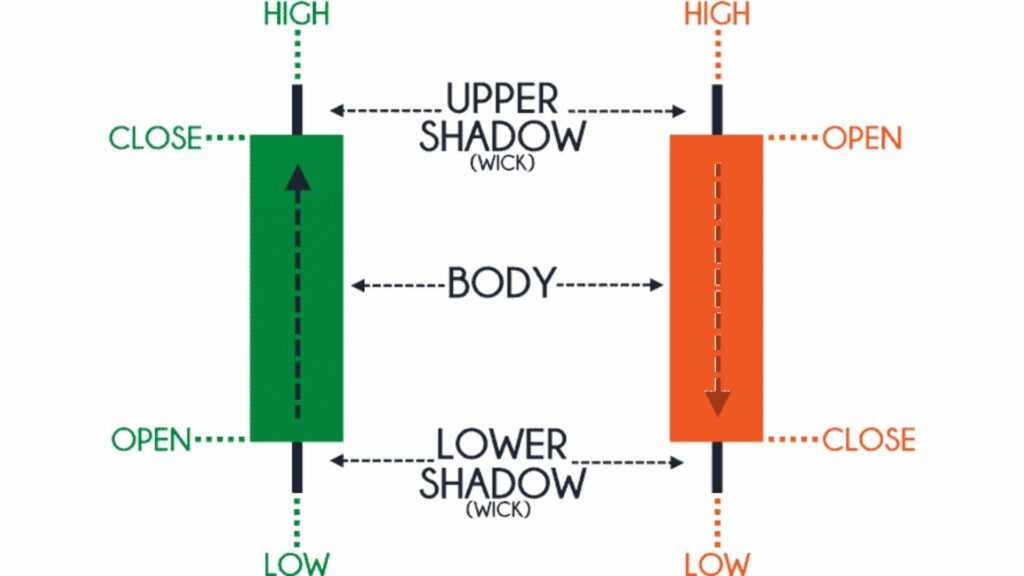

Each period has an opening price (first price), a high (highest price), a low (lowest price), and a closing price (last price), as seen in the image below.

Green candles are bullish, meaning that the price closed higher than the open. Red candles are bearish, where the price closed lower than where it started. The real body groups all of the price action between the open and the close. The wicks, also known as the shadows, show the price action above and below the real body price action.

You can color your candlestick charts however you want, but green/white are the most common colors for bullish, while red/black are typical bearish colors.

Why are candlesticks called bullish and bearish?

The terms come from how bulls and bears fight their enemies. Bullish thrust their horns in the air while a bear strikes their prey in a downward motion.

Why Are Candlestick Charts Important?

Prices move due to supply and demand. Supply and demand move based on fundamentals and human emotion. Understanding how prices moved in the past gives traders an insight into how prices will likely move in the future.

Traders who can read price action and shift the probabilities in their favor can make millions in the markets.

The problem is that, unlike computers, humans are terrible at digesting large datasets.

Take a look at Apple’s minute prices for the first hour of trading on December 31st, 2021.

There are 390 minutes in a standard stock market trading day and much more in other markets. Imagine trying to decipher prices for 390 minutes each day, let alone for a week or a month of data.

Candlesticks help tease out the important prices for that period and help us visualize it.

You can turn any duration into a period. All you need to know is the OHLC values, which are the shorthand for open, high, low, and close prices.

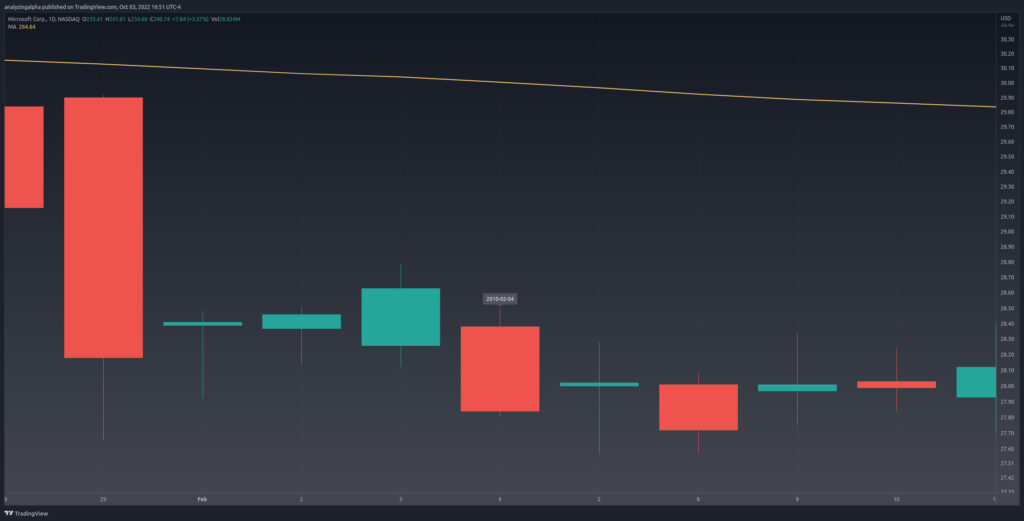

Notice the Microsoft candlestick charts below:

The chart on the left shows the daily price action for Microsoft, while the prices on the right are hourly bars. You can use any period you would like, even 90 minutes or 45-minutes, but the most common are:

- Weekly

- Daily

- Hourly

- 15-minute

- 5-minute

- 1-minute

Henceforth, we’ll use the daily period for all of our candlestick charts.

What Are Candlestick Patterns?

Candlestick patterns are a technical trading tool used for centuries to help predict price moments. Each candlestick pattern has a distinct name and a traditional trading strategy.

A picture is worth a thousand words, so let’s use a few to shine a light on candlesticks.

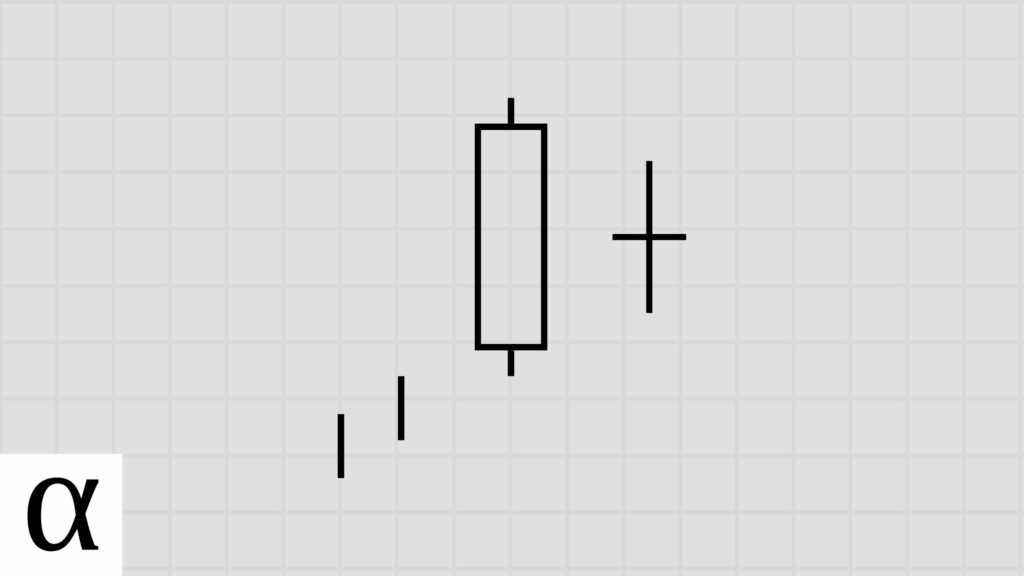

Let’s look at a single candle pattern named the bullish closing marubozu.

A candlestick must meet the following to be a valid bullish closing marubozu:

- A long white body.

- A close price very close to the high. (A tiny upper shadow)

While we might not have the 390-minute data points and know the exact path price took, we understand that price moved lower than the open and then reversed and went bullish in a big way closing near the high.

The bullish closing marubozu is said to lead to further bull action, but data-driven traders understand that profit-taking in the near term is the likely result of this pattern.

Don’t worry, I’ll show you the optimal strategy for every pattern in the future. For now, let’s practice identifying a more complex, three-bar pattern.

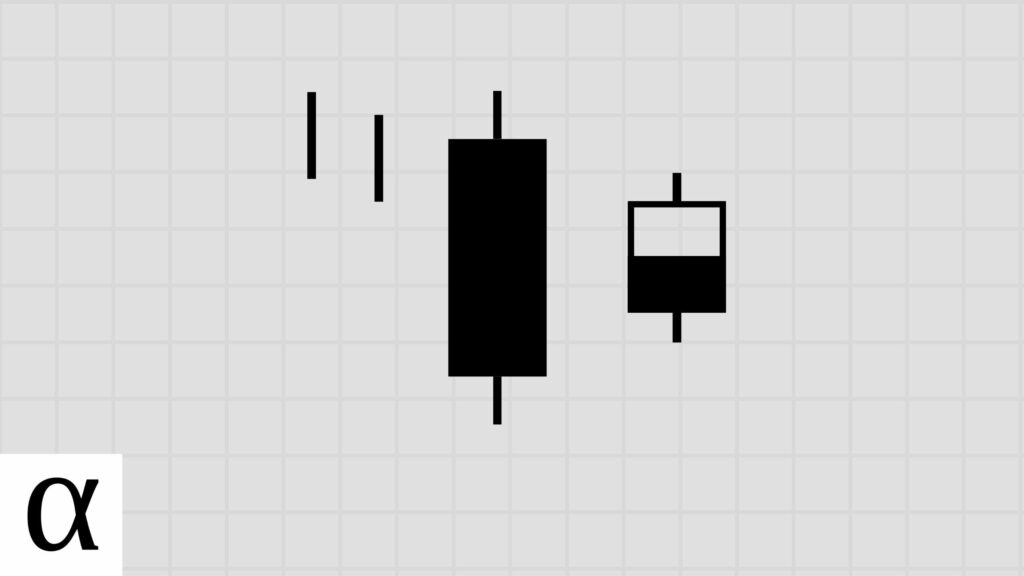

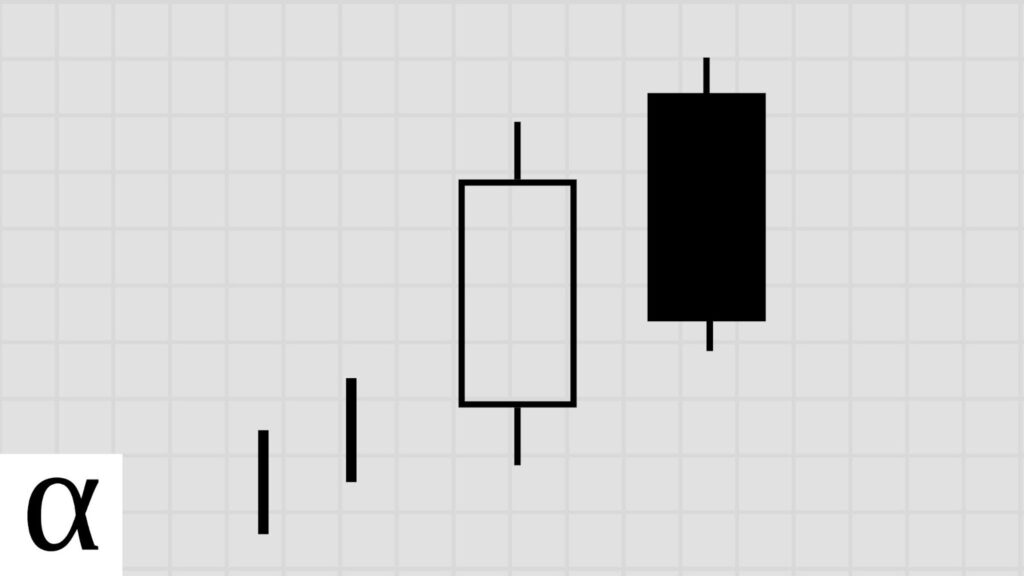

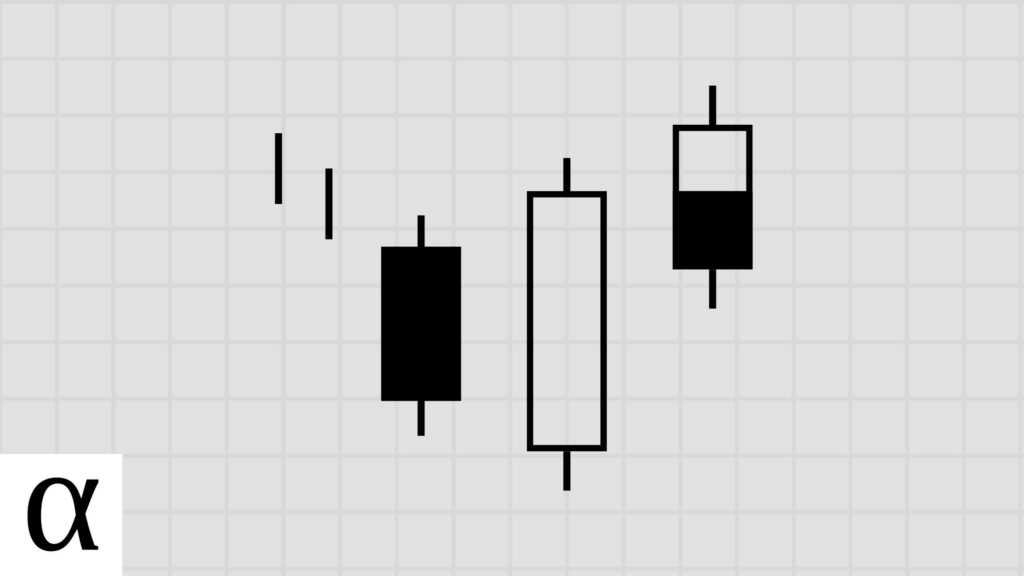

The three white soldiers is a three-bar pattern. It’s said the three white soldiers are three white knights fighting against the darkness. Do you think they’ll prevail? We’ll discuss that shortly, for now, let’s understand that three white soldiers occur in a downtrend and requires the following:

- Three bullish medium to large candlesticks with consecutively higher closes of relatively similar size.

- Each candle must open within or near the previous candle’s real body and close at or near the high of the day.

A downtrend is a series of lower highs and lows. Determining if the candlestick pattern appears in a downtrend is a mix of art and science.

To keep things simple, we’ll use the 50-day moving average as our guide. If the price is above the 50-day simple moving average, it’s in an uptrend; otherwise, the price is in a downtrend.

What do you think is most likely to happen with three consecutive bullish days in a downtrend? And even if you knew the likely direction, how would you go about trading it? That’s what’s up next.

How to Trade Candlestick Patterns

We’re going to keep it simple and not talk about support and resistance areas, volume, or any other technical analysis tools used in conjunction with candlestick patterns. The goal is to isolate the best candlestick patterns and teach you how to trade them according to the data.

To become a candlestick samurai, you need to understand three elements:

- What we can trade: possible setups

- What we should trade: highest edge

- How much to trade: optimal sizing

Let’s start off with what to trade in the context of candlestick patterns.

What We Can Trade: Bull, Bear & Fish?

Prices can go up, down, or move sideways. That’s it. When in the context of a trend, the price movements can either continue the trend or reverse it.

This leads us to the following potential trade setups:

- Bullish Continuation – Bull move in an uptrend

- Bearish Continuation – Bearish move in a downtrend

- Bullish Reversal – Bull move in a downtrend

- Bearish Reversal – Bearish move in an uptrend

- Bullish Mean Reversion – Going bullish in sideways action

- Bearish Mean Reversion – Going bearish in sideways action

This gives us six potential pattern classifications. Understanding this is essential so let’s make this concrete with examples.

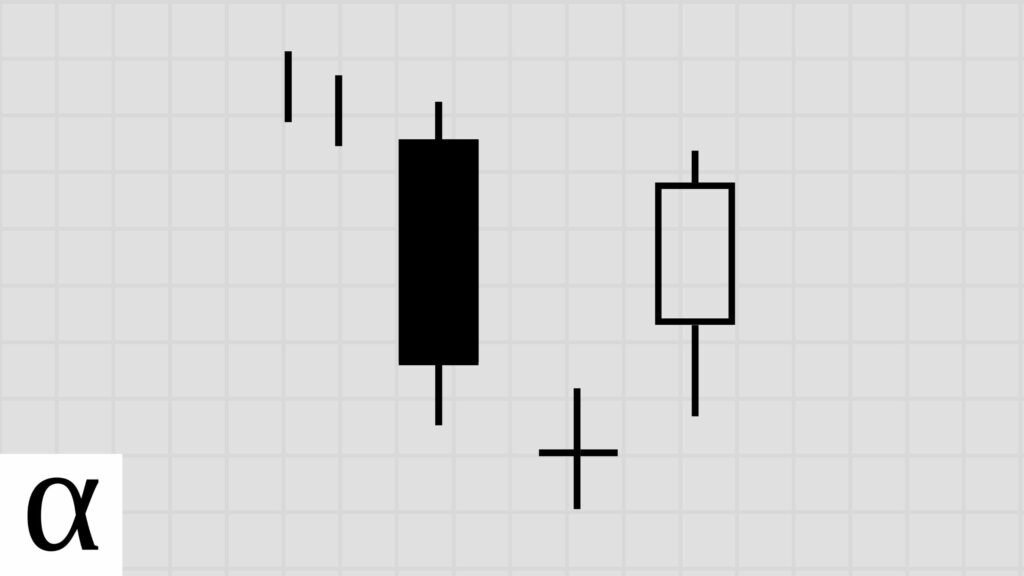

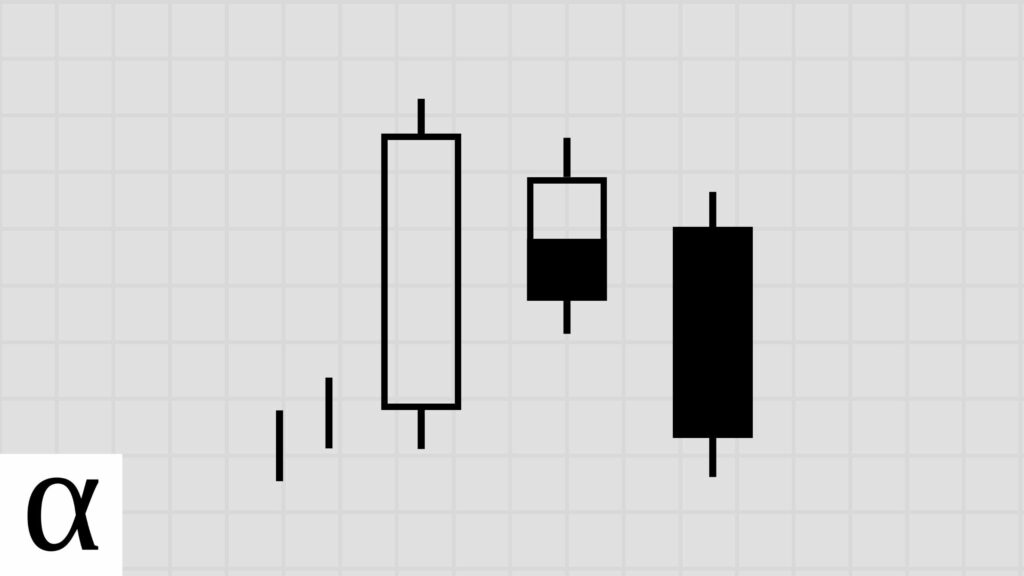

Bullish Continuation

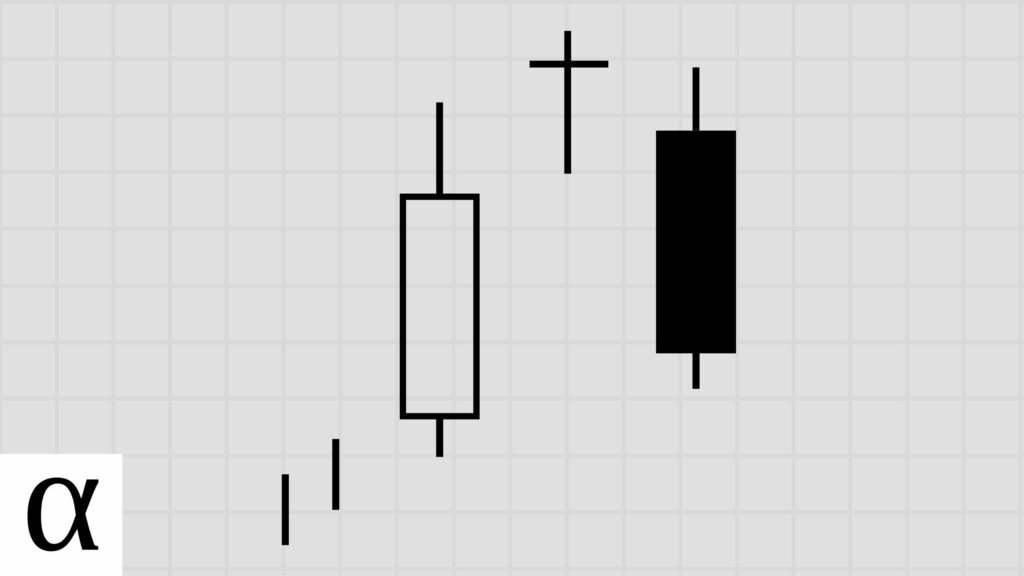

The upside tasuki gap is a three-bar pattern. It’s considered a bullish continuation as it occurs in an uptrend, and the price is expected to continue upward after pattern identification.

We’ll learn a better way to trade this pattern than what’s traditionally taught, but for now, just understand a bullish continuation pattern expects the bullish trend to continue.

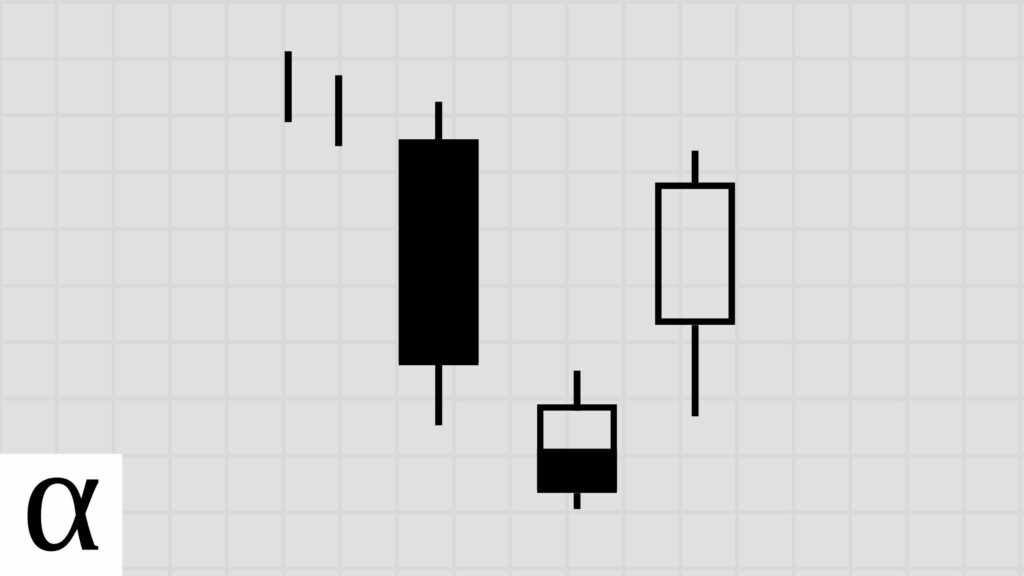

Bearish Continuation

The downside tasuki gap is the mirror opposite of the upside tasuki gap. It occurs in a downtrend, and traditional traders expect prices to fall after this pattern forms.

With the bullish and bearish continuation patterns under our belt, let’s look at reversing the trend.

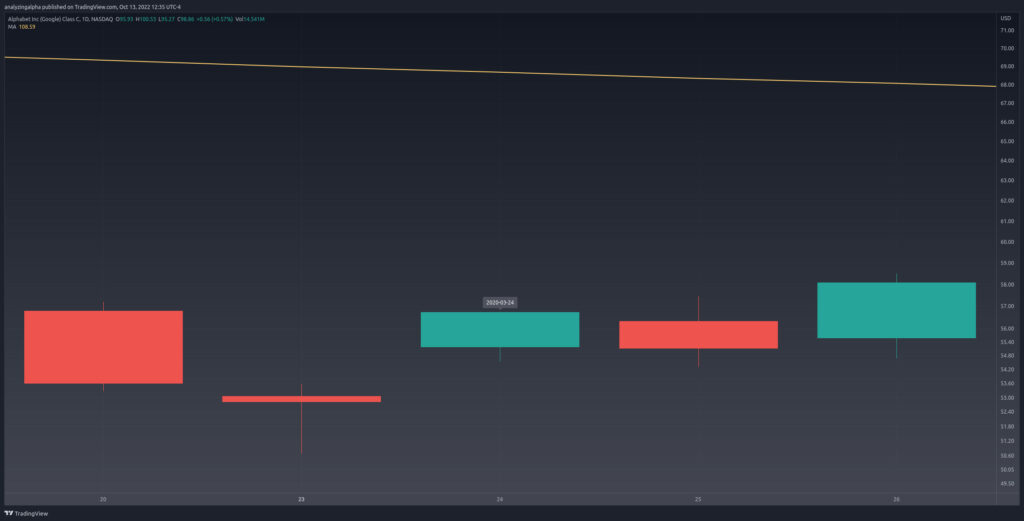

Bullish Reversal

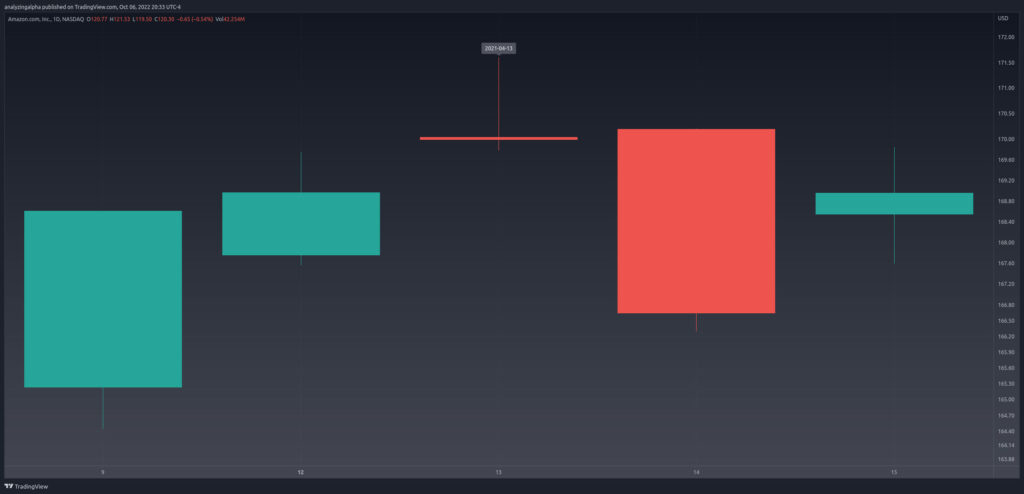

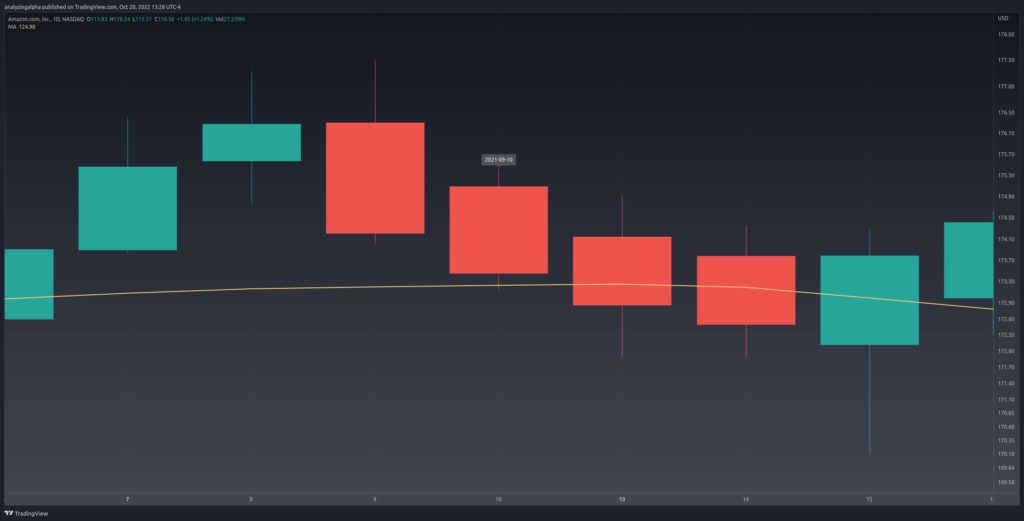

Let’s use our charting software to get us more comfortable with these candlestick patterns.

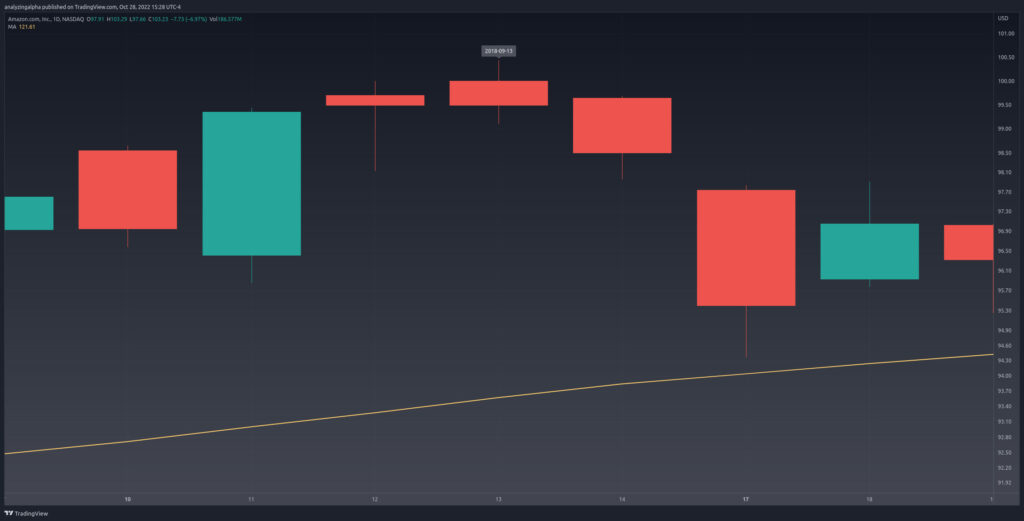

We see that the last close of the three white soldiers is below the 50-day simple moving average, giving us a downtrend. The price moves up and to the right after pattern identification, leading to a profitable bullish reversal trade.

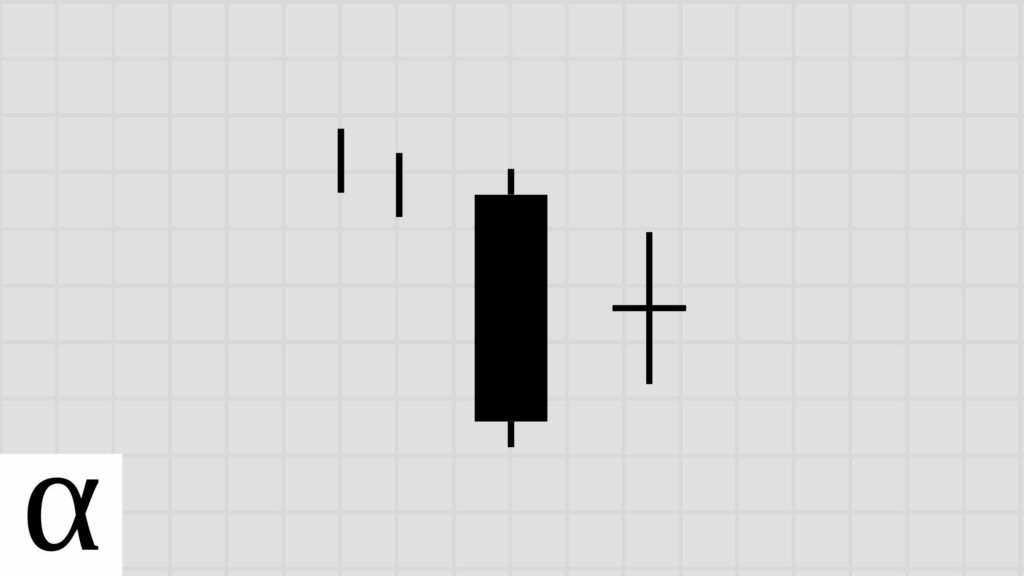

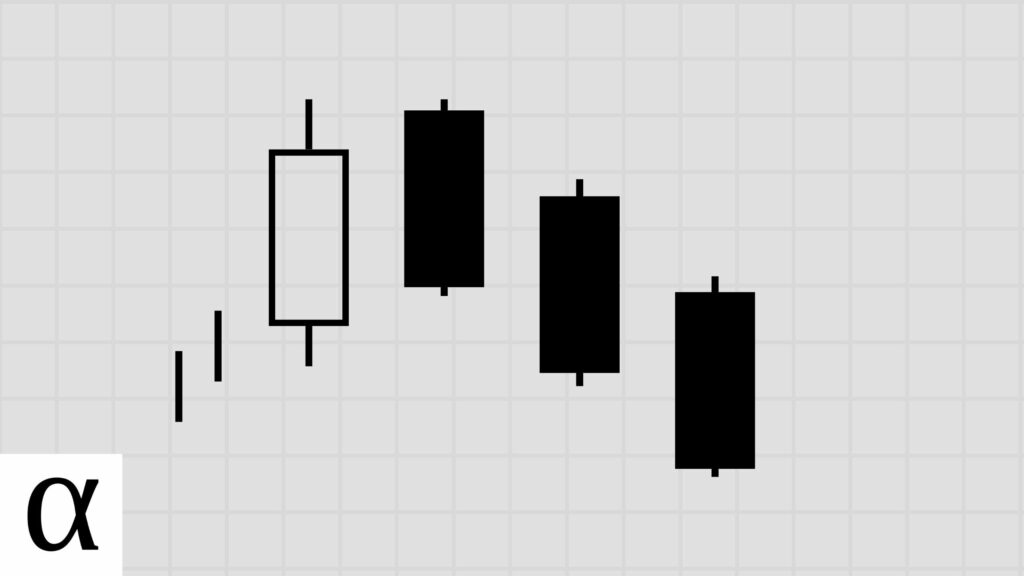

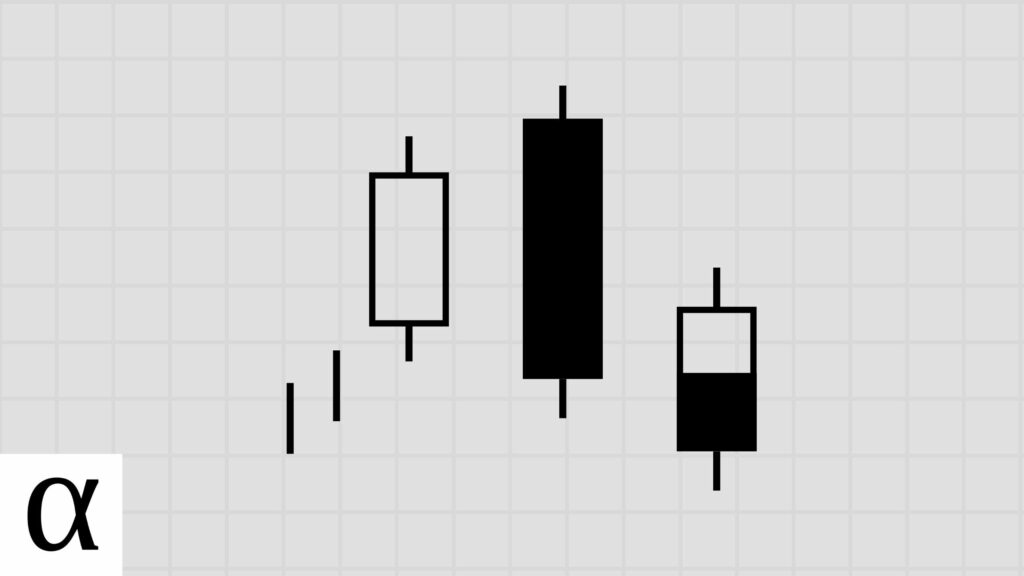

Bearish Reversal

The three black crow’s last close is above the 50-day moving average, giving us a bullish trend. The three black crows is a bearish reversal, meaning traders expect prices to reverse the bullish trend and move downward.

Easy enough, right?

Continuations continue the trend, and reversals reverse it. Traders expect bullish patterns to move upward and bearish patterns to push prices downward.

Now let’s cover sideways price action.

Bullish Mean Reversion

Some patterns don’t lead to bullish or bearish action but to sideways volatility. We can profit from this volatility by using mean reversion strategies.

Here are the steps in a bullish mean reversion trade:

- Identify the pattern

- Wait for the pattern to cross below the pattern’s low.

- Go long if the price moves above the pattern low within a confirmation period, typically three bars.

- Set a stop loss using a volatility measure, such as the average true range (ATR).

We see the three white soldier’s forms on the PhenixFin February 27th, 2018, daily chart. A mean reversion trader waits for the price to move below and back above the low that occurred on the first three white soldier’s candlestick. This occurs on the third day after pattern formation and leads to a profitable trade.

The bearish version is exactly the same in the opposite direction.

Bearish Mean Reversion

We saw the three black crows on the daily chart for Avis on July 19th, 2004. Bearish mean reversion traders expect prices to resolve to the downside. These traders wait for prices to move up above and back below the three black crow pattern high, setting a stop loss of one ATR. We see this happen the day after pattern formation. Prices move higher but never reach the stop loss and move heavily toward the downside for a large bearish gain.

You must understand the six possible trading setups to trade candlestick patterns optimally. Reread this section if you don’t.

What We Should Trade: Understanding Edge

An edge occurs when your expected payout is greater than the money you put in.

Let’s think about an American roulette wheel at a casino.

There are eighteen red, eighteen black, and two green spaces. If you bet red, you’ll have a 47% chance to win. The casino owns the other side of the bet with a 53% chance. The difference between the odds is a positive edge for the casino and a negative edge for you.

Sure, the casino will lose sometimes, but over time that positive edge will add up, and they’ll take your money.

In other words, be the casino.

Never make a bet without an edge. You will lose. You will lose often. But if you have a positive edge, you will make money.

Now that we understand what an edge is and why it’s essential, let’s learn optimal bet sizing.

How Much To Trade: Optimal Sizing

When we make a bet, we will do it in terms of risk. We will always set a stop loss. The risk is how much we’ll lose if our stop loss is hit.

If a stock is $100 and we place our stop loss at $90, we’ll be risking $10. Those of you who are more advanced or quantitative can argue with this measure of risk — rightfully so, but for now, it’ll do.

If we take a profit at $110, we’ll be risking $10 to make $10. This is fine if we’re like the casino exploiting its roulette wheel edge above and have a greater than 50% win rate.

When we risk $10 to make $10, we have a 1:1 risk-reward ratio. If we risk $10 to make $20, we’ll have a 1:2 risk-reward ratio.

If we have a 1:2 risk-reward ratio, our win percentage can go down and still be profitable since we make twice as much as we risk. To be precise, if we win greater than 33% of the time with a 1:2 risk-reward ratio, we’ll end up in the money. One win out of three total bets gets us to break even.

Here’s the formula for those interested:

- Expectancy = Average Win * WinPercent – AverageLoss * LossPercent

- .1 = $20 * X – $10 * (1-X)

So how do we determine the optimal risk-reward ratio systematically?

You can code up an algorithm to test every pattern in multiple markets using every setup we discussed earlier with various entry and exit points and iterate through each risk-reward ratio to determine the optimal setup — or you can just use the table below because I’ve done all the heavy lifting for you.

The Best Candlestick Patterns

As you’ll soon find out, different candlestick patterns work in different markets. This is because each market has its own personality. Take a look at the historical performance of the stock market vs. the commodity market.

The stock market has an upward bias that data-driven traders exploit.

A trading “guru” that tells you the best candlestick patterns to trade without providing a market is either uneducated or worse.

But again, I will solve all of this for you and make the data public.

Additionally, some of the candlestick patterns occur infrequently, leading to statistically insignificant returns. And as mentioned previously, good traders don’t trade without a well-defined statistical edge.

So instead, feel free to use the interactive table below to analyze what patterns work best for the market you’re trading.

Here are the three steps you’ll want to take to determine the best setups for your market:

- Select the market you trade.

- Select the required trend. It’s an uptrend if the market is above the 50-day moving average.

- Select the minimum number of traders desired. I suggest 100+

Each row contains the optimum trading strategy, risk-reward, and set up for the pattern. You can click on each row to review the details.

| Id | Market | Required Trend | Pattern | Pattern Bars | Traditional Strategy | Strategy | RR | Setup | Tickers | Signals | Trades | Trade Bars | Edge | Edge Per Bar | Confirm % | Win % | Cons Wins | Cons Losses | Avg. Trade Bars | Avg. Win Bars | Avg. Loss Bars | Details |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 7,375 | stock | downtrend | unique_three_river_bottom | 3 | bullish reversal | bullish mean reversion | 5 | atr-pattern_low | 2,778 | 10,193 | 3,980 | 65,378 | 0.39 | 0.13 | 0.39 | 0.23 | 4 | 6 | 16.43 | 31.69 | 11.82 | https://analyzingalpha.com/unique-three-river-bottom-candlestick-pattern |

| 7,380 | crypto | uptrend | bearish_harami | 2 | bearish reversal | bullish mean reversion | 5 | atr-pattern_low | 206 | 1,964 | 706 | 11,829 | 0.67 | 0.34 | 0.36 | 0.28 | 4 | 9 | 16.75 | 23.87 | 14.02 | https://analyzingalpha.com/bearish-harami-candlestick-pattern |

| 7,390 | stock | uptrend | bearish_harami | 2 | bearish reversal | bullish mean reversion | 5 | atr-pattern_low | 5,382 | 247,256 | 98,125 | 1,596,838 | 0.40 | 0.20 | 0.40 | 0.23 | 5 | 27 | 16.27 | 30.56 | 11.94 | https://analyzingalpha.com/bearish-harami-candlestick-pattern |

| 7,420 | forex | none | long_legged_doji | 1 | indecision | bearish | 5 | high-close | 1,220 | 336,852 | 318,685 | 1,344,783 | 0.39 | 0.39 | 0.95 | 0.23 | 1,619 | 50 | 4.22 | 6.28 | 3.60 | https://analyzingalpha.com/long-legged-doji-candlestick-pattern |

| 7,435 | crypto | downtrend | down_gap_side_by_side | 3 | bearish continuation | bullish reversal | 5 | low-close | 11 | 26 | 25 | 58 | 1.88 | 0.63 | 0.96 | 0.48 | 2 | 2 | 2.32 | 2.58 | 2.08 | https://analyzingalpha.com/down-gap-side-by-side-candlestick-pattern |

| 7,440 | forex | downtrend | down_gap_side_by_side | 3 | bearish continuation | bullish reversal | 5 | low-close | 200 | 751 | 698 | 4,237 | 1.09 | 0.36 | 0.93 | 0.35 | 6 | 9 | 6.07 | 2.10 | 8.18 | https://analyzingalpha.com/down-gap-side-by-side-candlestick-pattern |

| 7,465 | crypto | uptrend | dark_cloud_cover | 2 | bearish reversal | bearish reversal | 5 | high-low | 1 | 2 | 2 | 49 | 2.00 | 1.00 | 1.00 | 0.50 | 1 | 0 | 24.50 | 44.00 | 5.00 | https://analyzingalpha.com/dark-cloud-cover-candlestick-pattern |

| 7,480 | crypto | downtrend | matching_low | 2 | bullish reversal | bullish reversal | 5 | low-close | 236 | 4,265 | 4,054 | 13,786 | 1.06 | 0.53 | 0.95 | 0.34 | 8 | 20 | 3.40 | 4.19 | 2.99 | https://analyzingalpha.com/matching-low-candlestick-pattern |

| 7,485 | forex | downtrend | matching_low | 2 | bullish reversal | bullish reversal | 5 | low-close | 1,193 | 59,071 | 57,532 | 188,912 | 0.80 | 0.40 | 0.97 | 0.30 | 106 | 131 | 3.28 | 3.58 | 3.16 | https://analyzingalpha.com/matching-low-candlestick-pattern |

| 7,490 | stock | downtrend | matching_low | 2 | bullish reversal | bullish reversal | 5 | low-close | 5,670 | 154,436 | 142,463 | 458,668 | 0.45 | 0.22 | 0.92 | 0.24 | 8 | 32 | 3.22 | 5.07 | 2.63 | https://analyzingalpha.com/matching-low-candlestick-pattern |

| 7,510 | crypto | none | rickshaw_man | 1 | indecision | bullish | 5 | atr-pattern_low | 251 | 10,966 | 6,666 | 71,786 | 0.39 | 0.39 | 0.61 | 0.23 | 2 | 19 | 10.77 | 18.07 | 8.57 | https://analyzingalpha.com/rickshaw-man-candlestick-pattern |

| 7,520 | stock | none | rickshaw_man | 1 | indecision | bullish | 5 | atr-pattern_low | 6,025 | 814,858 | 482,729 | 4,949,451 | 0.34 | 0.34 | 0.59 | 0.22 | 4 | 25 | 10.25 | 19.27 | 7.65 | https://analyzingalpha.com/rickshaw-man-candlestick-pattern |

| 7,608 | forex | uptrend | evening_doji_star | 3 | bearish reversal | bearish mean reversion | 3 | atr-pattern_high | 297 | 890 | 160 | 2,808 | 0.48 | 0.16 | 0.18 | 0.37 | 2 | 3 | 17.55 | 26.12 | 12.54 | https://analyzingalpha.com/evening-doji-star-candlestick-pattern |

| 7,680 | stock | downtrend | stick_sandwich | 3 | bullish reversal | bearish continuation | 5 | high-close | 3,042 | 12,308 | 12,111 | 51,432 | 1.38 | 0.46 | 0.98 | 0.40 | 8 | 10 | 4.25 | 4.26 | 4.24 | https://analyzingalpha.com/stick-sandwich-candlestick-pattern |

| 7,707 | forex | uptrend | bullish_separating_lines | 2 | bullish continuation | bearish mean reversion | 2 | atr-pattern_high | 913 | 7,008 | 4,102 | 63,136 | 0.34 | 0.17 | 0.59 | 0.45 | 21 | 10 | 15.39 | 17.06 | 14.06 | https://analyzingalpha.com/bullish-separating-lines-candlestick-pattern |

| 7,777 | stock | none | bearish_kicking | 2 | bearish | bearish | 2 | atr-pattern_high | 176 | 508 | 74 | 719 | 0.54 | 0.27 | 0.15 | 0.51 | 2 | 2 | 9.72 | 10.29 | 9.11 | https://analyzingalpha.com/bearish-kicking-candlestick-pattern |

| 7,795 | stock | downtrend | homing_pigeon | 2 | bullish reversal | bullish mean reversion | 5 | atr-pattern_low | 5,103 | 94,059 | 47,602 | 845,411 | 0.44 | 0.22 | 0.51 | 0.24 | 5 | 20 | 17.76 | 33.41 | 12.84 | https://analyzingalpha.com/homing-pigeon-candlestick-pattern |

| 7,960 | stock | downtrend | thrusting | 2 | bearish continuation | bullish mean reversion | 5 | atr-pattern_low | 4,471 | 50,017 | 20,602 | 416,671 | 0.38 | 0.19 | 0.41 | 0.23 | 5 | 14 | 20.22 | 38.19 | 14.88 | https://analyzingalpha.com/thrusting-candlestick-pattern |

| 8,025 | crypto | none | bullish_short_line | 1 | indecision | bearish | 5 | high-close | 257 | 28,755 | 24,447 | 40,962 | 0.79 | 0.79 | 0.85 | 0.30 | 82 | 43 | 1.68 | 1.86 | 1.60 | https://analyzingalpha.com/bullish-short-line-candlestick-pattern |

| 8,030 | forex | none | bullish_short_line | 1 | indecision | bearish | 5 | high-close | 1,276 | 619,384 | 557,225 | 643,027 | 0.93 | 0.93 | 0.90 | 0.32 | 498 | 52 | 1.15 | 1.21 | 1.13 | https://analyzingalpha.com/bullish-short-line-candlestick-pattern |

| 8,035 | stock | none | bullish_short_line | 1 | indecision | bearish | 5 | high-close | 6,574 | 1,275,995 | 1,106,449 | 1,771,269 | 0.56 | 0.56 | 0.87 | 0.26 | 401 | 70 | 1.60 | 2.07 | 1.43 | https://analyzingalpha.com/bullish-short-line-candlestick-pattern |

| 8,040 | crypto | none | bullish_closing_marubozu | 1 | bullish | bearish | 5 | high-close | 239 | 17,905 | 16,707 | 18,631 | 1.26 | 1.26 | 0.93 | 0.38 | 177 | 46 | 1.12 | 1.15 | 1.09 | https://analyzingalpha.com/bullish-closing-marubozu-candlestick-pattern |

| 8,045 | forex | none | bullish_closing_marubozu | 1 | bullish | bearish | 5 | high-close | 1,284 | 328,958 | 283,662 | 323,116 | 1.86 | 1.86 | 0.86 | 0.48 | 593 | 67 | 1.14 | 1.14 | 1.14 | https://analyzingalpha.com/bullish-closing-marubozu-candlestick-pattern |

| 8,050 | stock | none | bullish_closing_marubozu | 1 | bullish | bearish | 5 | high-close | 6,448 | 1,217,570 | 1,116,973 | 1,340,142 | 0.68 | 0.68 | 0.92 | 0.28 | 382 | 49 | 1.20 | 1.38 | 1.13 | https://analyzingalpha.com/bullish-closing-marubozu-candlestick-pattern |

| 8,067 | forex | downtrend | morning_doji_star | 3 | bullish reversal | bullish mean reversion | 2 | atr-pattern_low | 221 | 589 | 115 | 1,186 | 0.33 | 0.11 | 0.20 | 0.44 | 2 | 2 | 10.31 | 10.98 | 9.78 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 8,075 | stock | downtrend | morning_doji_star | 3 | bullish reversal | bullish mean reversion | 5 | atr-pattern_low | 2,904 | 11,167 | 2,349 | 41,474 | 0.40 | 0.13 | 0.21 | 0.23 | 3 | 6 | 17.66 | 34.77 | 12.46 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 8,132 | forex | uptrend | up_gap_side_by_side | 3 | bullish continuation | bearish mean reversion | 2 | atr-pattern_high | 515 | 2,211 | 1,218 | 16,310 | 0.41 | 0.14 | 0.55 | 0.47 | 11 | 7 | 13.39 | 14.11 | 12.75 | https://analyzingalpha.com/up-gap-side-by-side-candlestick-pattern |

| 8,207 | forex | downtrend | downside_gap_three_methods | 3 | bearish continuation | bearish mean reversion | 2 | atr-pattern_high | 454 | 2,189 | 828 | 8,399 | 0.28 | 0.09 | 0.38 | 0.43 | 5 | 3 | 10.14 | 11.41 | 9.20 | https://analyzingalpha.com/downside-gap-three-methods-candlestick-pattern |

| 8,280 | crypto | uptrend | three_outside_down | 3 | bearish reversal | bullish mean reversion | 5 | atr-pattern_low | 142 | 841 | 455 | 7,045 | 0.33 | 0.11 | 0.54 | 0.22 | 2 | 7 | 15.48 | 20.44 | 14.07 | https://analyzingalpha.com/three-outside-down-candlestick-pattern |

| 8,290 | stock | uptrend | three_outside_down | 3 | bearish reversal | bullish mean reversion | 5 | atr-pattern_low | 4,709 | 101,187 | 60,577 | 979,791 | 0.40 | 0.13 | 0.60 | 0.23 | 7 | 22 | 16.17 | 29.48 | 12.12 | https://analyzingalpha.com/three-outside-down-candlestick-pattern |

| 8,295 | crypto | uptrend | upside_gap_three_methods | 3 | bullish continuation | bullish mean reversion | 5 | atr-pattern_low | 78 | 256 | 112 | 1,518 | 0.45 | 0.15 | 0.44 | 0.24 | 2 | 4 | 13.55 | 22.15 | 10.82 | https://analyzingalpha.com/upside-gap-three-methods-candlestick-pattern |

| 8,305 | stock | uptrend | upside_gap_three_methods | 3 | bullish continuation | bullish mean reversion | 5 | atr-pattern_low | 3,320 | 23,240 | 10,673 | 180,695 | 0.40 | 0.13 | 0.46 | 0.23 | 4 | 11 | 16.93 | 31.88 | 12.38 | https://analyzingalpha.com/upside-gap-three-methods-candlestick-pattern |

| 8,327 | forex | uptrend | evening_star | 3 | bearish reversal | bearish mean reversion | 2 | atr-pattern_high | 544 | 2,766 | 431 | 3,720 | 0.40 | 0.13 | 0.16 | 0.47 | 4 | 3 | 8.63 | 10.72 | 6.81 | https://analyzingalpha.com/evening-star-candlestick-pattern |

| 8,410 | crypto | downtrend | hammer | 1 | bullish reversal | bearish continuation | 5 | high-close | 238 | 4,411 | 4,217 | 8,236 | 0.55 | 0.55 | 0.96 | 0.26 | 17 | 22 | 1.95 | 2.50 | 1.76 | https://analyzingalpha.com/hammer-candlestick-pattern |

| 8,415 | forex | downtrend | hammer | 1 | bullish reversal | bearish continuation | 5 | high-close | 1,193 | 64,778 | 61,780 | 100,056 | 0.23 | 0.23 | 0.95 | 0.21 | 73 | 81 | 1.62 | 2.30 | 1.44 | https://analyzingalpha.com/hammer-candlestick-pattern |

| 8,420 | stock | downtrend | hammer | 1 | bullish reversal | bearish continuation | 5 | high-close | 5,886 | 208,980 | 190,149 | 389,372 | 0.44 | 0.44 | 0.91 | 0.24 | 63 | 37 | 2.05 | 2.89 | 1.78 | https://analyzingalpha.com/hammer-candlestick-pattern |

| 8,430 | stock | downtrend | on_neck | 2 | bearish continuation | bullish mean reversion | 5 | atr-pattern_low | 3,699 | 21,789 | 10,912 | 180,912 | 0.36 | 0.18 | 0.50 | 0.23 | 5 | 9 | 16.58 | 31.52 | 12.23 | https://analyzingalpha.com/on-neck-candlestick-pattern |

| 8,495 | crypto | uptrend | bearish_harami_cross | 2 | bearish reversal | bullish mean reversion | 5 | atr-pattern_low | 130 | 621 | 215 | 4,189 | 0.73 | 0.37 | 0.35 | 0.29 | 3 | 5 | 19.48 | 23.87 | 17.71 | https://analyzingalpha.com/bearish-harami-cross-candlestick-pattern |

| 8,505 | stock | uptrend | bearish_harami_cross | 2 | bearish reversal | bullish mean reversion | 5 | atr-pattern_low | 4,784 | 99,585 | 37,470 | 556,322 | 0.40 | 0.20 | 0.38 | 0.23 | 4 | 18 | 14.85 | 27.92 | 10.85 | https://analyzingalpha.com/bearish-harami-cross-candlestick-pattern |

| 8,520 | forex | none | doji | 1 | indecision | bearish | 5 | high-close | 1,285 | 733,323 | 635,089 | 1,656,767 | 0.91 | 0.91 | 0.87 | 0.32 | 668 | 51 | 2.61 | 2.91 | 2.47 | https://analyzingalpha.com/doji-candlestick-pattern |

| 8,530 | crypto | none | bearish_closing_marubozu | 1 | bearish | bullish | 5 | low-close | 247 | 19,255 | 17,814 | 20,775 | 1.26 | 1.26 | 0.93 | 0.38 | 16 | 62 | 1.17 | 1.22 | 1.13 | https://analyzingalpha.com/bearish-closing-marubozu-candlestick-pattern |

| 8,535 | forex | none | bearish_closing_marubozu | 1 | bearish | bullish | 5 | low-close | 1,279 | 333,203 | 288,313 | 320,640 | 2.01 | 2.01 | 0.87 | 0.50 | 88 | 43 | 1.11 | 1.08 | 1.14 | https://analyzingalpha.com/bearish-closing-marubozu-candlestick-pattern |

| 8,540 | stock | none | bearish_closing_marubozu | 1 | bearish | bullish | 5 | low-close | 6,434 | 1,140,569 | 1,056,137 | 1,228,935 | 0.64 | 0.64 | 0.93 | 0.27 | 10 | 30 | 1.16 | 1.29 | 1.11 | https://analyzingalpha.com/bearish-closing-marubozu-candlestick-pattern |

| 8,560 | crypto | uptrend | bearish_counterattack | 2 | bearish reversal | bullish mean reversion | 5 | atr-pattern_low | 7 | 18 | 10 | 143 | 0.80 | 0.40 | 0.56 | 0.30 | 1 | 4 | 14.30 | 33.00 | 6.29 | https://analyzingalpha.com/bearish-counterattack-candlestick-pattern |

| 8,595 | forex | downtrend | bullish_tri_star | 3 | bullish reversal | bearish continuation | 5 | high-close | 67 | 230 | 221 | 1,531 | 0.46 | 0.15 | 0.96 | 0.24 | 12 | 16 | 6.93 | 7.61 | 6.71 | https://analyzingalpha.com/bullish-tri-star-candlestick-pattern |

| 8,620 | crypto | none | gravestone_doji | 1 | indecision | bullish | 5 | low-close | 242 | 7,943 | 7,599 | 9,384 | 1.06 | 1.06 | 0.96 | 0.34 | 11 | 24 | 1.23 | 1.26 | 1.22 | https://analyzingalpha.com/gravestone-doji-candlestick-pattern |

| 8,625 | forex | none | gravestone_doji | 1 | indecision | bullish | 5 | low-close | 1,190 | 88,914 | 83,987 | 105,840 | 1.62 | 1.62 | 0.94 | 0.44 | 177 | 44 | 1.26 | 1.16 | 1.34 | https://analyzingalpha.com/gravestone-doji-candlestick-pattern |

| 8,630 | stock | none | gravestone_doji | 1 | indecision | bullish | 5 | low-close | 6,104 | 336,640 | 311,916 | 395,573 | 0.75 | 0.75 | 0.93 | 0.29 | 14 | 35 | 1.27 | 1.42 | 1.21 | https://analyzingalpha.com/gravestone-doji-candlestick-pattern |

| 8,710 | crypto | uptrend | upside_tasuki_gap | 3 | bullish continuation | bullish mean reversion | 5 | atr-pattern_low | 4 | 8 | 4 | 59 | 2.00 | 0.67 | 0.50 | 0.50 | 1 | 1 | 14.75 | 23.00 | 6.50 | https://analyzingalpha.com/upside-tasuki-gap-candlestick-pattern |

| 8,720 | stock | uptrend | upside_tasuki_gap | 3 | bullish continuation | bullish mean reversion | 5 | atr-pattern_low | 3,065 | 18,861 | 6,871 | 106,473 | 0.44 | 0.15 | 0.36 | 0.24 | 4 | 8 | 15.50 | 30.62 | 10.75 | https://analyzingalpha.com/upside-tasuki-gap-candlestick-pattern |

| 8,722 | forex | uptrend | bearish_breakaway | 5 | bearish reversal | bearish reversal | 2 | high-low | 1 | 2 | 1 | 1 | 2.00 | 0.40 | 0.50 | 1.00 | 1 | 0 | 1.00 | 1.00 | https://analyzingalpha.com/bearish-breakaway-candlestick-pattern | |

| 8,734 | crypto | uptrend | advance_block | 3 | bearish reversal | bullish mean reversion | 4 | atr-pattern_low | 178 | 1,094 | 144 | 2,691 | 0.66 | 0.22 | 0.13 | 0.33 | 2 | 2 | 18.69 | 27.27 | 14.40 | https://analyzingalpha.com/advance-block-candlestick-pattern |

| 8,745 | stock | uptrend | advance_block | 3 | bearish reversal | bullish mean reversion | 5 | atr-pattern_low | 4,086 | 58,824 | 6,135 | 87,596 | 0.44 | 0.15 | 0.10 | 0.24 | 4 | 8 | 14.28 | 26.01 | 10.60 | https://analyzingalpha.com/advance-block-candlestick-pattern |

| 8,808 | forex | uptrend | bullish_three_line_strike | 4 | bullish continuation | bearish mean reversion | 3 | atr-pattern_high | 471 | 2,106 | 454 | 5,517 | 0.32 | 0.08 | 0.22 | 0.33 | 3 | 4 | 12.15 | 14.72 | 10.88 | https://analyzingalpha.com/bullish-three-line-strike-candlestick-pattern |

| 8,855 | forex | uptrend | stalled | 3 | bearish reversal | bearish reversal | 5 | high-close | 961 | 7,303 | 5,836 | 14,504 | 1.80 | 0.60 | 0.80 | 0.47 | 24 | 11 | 2.49 | 2.13 | 2.80 | https://analyzingalpha.com/stalled-candlestick-pattern |

| 8,867 | forex | none | bearish_spinning_top | 1 | indecision | bearish | 2 | atr-pattern_high | 1,087 | 178,187 | 94,110 | 849,993 | 0.20 | 0.20 | 0.53 | 0.40 | 98 | 16 | 9.03 | 10.67 | 7.93 | https://analyzingalpha.com/bearish-spinning-top-candlestick-pattern |

| 8,910 | forex | downtrend | on_neck | 2 | bearish continuation | bearish continuation | 5 | high-low | 3 | 6 | 3 | 93 | 3.01 | 1.50 | 0.50 | 0.67 | 1 | 1 | 31.00 | 39.00 | 15.00 | https://analyzingalpha.com/on-neck-candlestick-pattern |

| 8,945 | stock | none | long_legged_doji | 1 | indecision | bullish | 5 | atr-pattern_low | 6,472 | 1,031,959 | 587,487 | 6,887,151 | 0.34 | 0.34 | 0.57 | 0.22 | 5 | 34 | 11.72 | 22.53 | 8.62 | https://analyzingalpha.com/long-legged-doji-candlestick-pattern |

| 8,980 | crypto | none | bearish_spinning_top | 1 | indecision | bullish | 5 | atr-pattern_low | 250 | 9,589 | 5,411 | 93,389 | 0.49 | 0.49 | 0.56 | 0.25 | 4 | 19 | 17.26 | 30.45 | 12.94 | https://analyzingalpha.com/bearish-spinning-top-candlestick-pattern |

| 8,990 | stock | none | bearish_spinning_top | 1 | indecision | bullish | 5 | atr-pattern_low | 5,895 | 703,725 | 410,370 | 6,071,340 | 0.37 | 0.37 | 0.58 | 0.23 | 4 | 24 | 14.79 | 28.40 | 10.77 | https://analyzingalpha.com/bearish-spinning-top-candlestick-pattern |

| 9,008 | forex | downtrend | thrusting | 2 | bearish continuation | bearish mean reversion | 3 | atr-pattern_high | 57 | 142 | 22 | 362 | 0.83 | 0.41 | 0.15 | 0.46 | 1 | 1 | 16.45 | 13.40 | 19.00 | https://analyzingalpha.com/thrusting-candlestick-pattern |

| 9,053 | forex | none | bullish_spinning_top | 1 | indecision | bearish | 3 | atr-pattern_high | 1,126 | 162,136 | 95,099 | 1,275,338 | 0.23 | 0.23 | 0.59 | 0.31 | 101 | 31 | 13.41 | 18.86 | 11.01 | https://analyzingalpha.com/bullish-spinning-top-candlestick-pattern |

| 9,065 | crypto | uptrend | stalled | 3 | bearish reversal | bullish continuation | 5 | low-close | 77 | 228 | 210 | 1,292 | 0.49 | 0.16 | 0.92 | 0.25 | 2 | 8 | 6.15 | 11.06 | 4.54 | https://analyzingalpha.com/stalled-candlestick-pattern |

| 9,090 | stock | downtrend | concealing_baby_swallow | 4 | bullish reversal | bullish reversal | 5 | low-close | 4 | 8 | 8 | 11 | 0.50 | 0.13 | 1.00 | 0.25 | 2 | 2 | 1.38 | 1.00 | 1.50 | https://analyzingalpha.com/concealing-baby-swallow-candlestick-pattern |

| 9,130 | stock | downtrend | piercing | 2 | bullish reversal | bullish mean reversion | 5 | atr-pattern_low | 3,541 | 21,214 | 6,765 | 153,566 | 0.43 | 0.22 | 0.32 | 0.24 | 3 | 8 | 22.70 | 43.48 | 16.23 | https://analyzingalpha.com/piercing-candlestick-pattern |

| 9,135 | crypto | uptrend | bearish_engulfing | 2 | bearish reversal | bullish mean reversion | 5 | atr-pattern_low | 211 | 1,982 | 1,189 | 19,861 | 0.58 | 0.29 | 0.60 | 0.26 | 3 | 17 | 16.70 | 23.64 | 14.23 | https://analyzingalpha.com/bearish-engulfing-candlestick-pattern |

| 9,145 | stock | uptrend | bearish_engulfing | 2 | bearish reversal | bullish mean reversion | 5 | atr-pattern_low | 5,246 | 214,991 | 134,351 | 2,317,605 | 0.38 | 0.19 | 0.62 | 0.23 | 5 | 32 | 17.25 | 32.38 | 12.75 | https://analyzingalpha.com/bearish-engulfing-candlestick-pattern |

| 9,164 | crypto | downtrend | downside_tasuki_gap | 3 | bearish continuation | bearish continuation | 4 | high-low | 3 | 6 | 1 | 50 | 4.00 | 1.33 | 0.17 | 1.00 | 1 | 0 | 50.00 | 50.00 | https://analyzingalpha.com/downside-tasuki-gap-candlestick-pattern | |

| 9,195 | crypto | uptrend | bullish_harami_cross | 2 | bullish reversal | bullish mean reversion | 5 | atr-pattern_low | 168 | 860 | 423 | 8,749 | 0.31 | 0.15 | 0.49 | 0.22 | 2 | 7 | 20.68 | 46.32 | 13.56 | https://analyzingalpha.com/bullish-harami-cross-candlestick-pattern |

| 9,205 | stock | uptrend | bullish_harami_cross | 2 | bullish reversal | bullish mean reversion | 5 | atr-pattern_low | 5,305 | 102,763 | 49,179 | 811,760 | 0.42 | 0.21 | 0.48 | 0.24 | 5 | 23 | 16.51 | 31.22 | 12.00 | https://analyzingalpha.com/bullish-harami-cross-candlestick-pattern |

| 9,270 | crypto | uptrend | evening_star | 3 | bearish reversal | bullish mean reversion | 5 | atr-pattern_low | 68 | 185 | 80 | 1,409 | 0.66 | 0.22 | 0.43 | 0.28 | 2 | 3 | 17.61 | 30.32 | 12.79 | https://analyzingalpha.com/evening-star-candlestick-pattern |

| 9,280 | stock | uptrend | evening_star | 3 | bearish reversal | bullish mean reversion | 5 | atr-pattern_low | 3,972 | 37,082 | 20,155 | 366,216 | 0.39 | 0.13 | 0.54 | 0.23 | 5 | 14 | 18.17 | 33.40 | 13.57 | https://analyzingalpha.com/evening-star-candlestick-pattern |

| 9,370 | stock | downtrend | three_white_soldiers | 3 | bullish reversal | bullish reversal | 5 | low-close | 436 | 926 | 788 | 51,649 | 0.45 | 0.15 | 0.85 | 0.24 | 3 | 4 | 65.54 | 135.06 | 43.30 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern |

| 9,410 | crypto | downtrend | falling_three_methods | 5 | bearish continuation | bullish mean reversion | 5 | atr-pattern_low | 4 | 8 | 3 | 346 | 1.00 | 0.20 | 0.38 | 0.33 | 1 | 1 | 115.33 | 334.00 | 6.00 | https://analyzingalpha.com/falling-three-methods-candlestick-pattern |

| 9,413 | forex | downtrend | falling_three_methods | 5 | bearish continuation | bullish mean reversion | 3 | atr-pattern_low | 83 | 184 | 130 | 1,322 | 0.51 | 0.10 | 0.71 | 0.38 | 2 | 4 | 10.17 | 16.80 | 6.16 | https://analyzingalpha.com/falling-three-methods-candlestick-pattern |

| 9,426 | forex | downtrend | bullish_engulfing | 2 | bullish reversal | bearish mean reversion | 1 | atr-pattern_high | 856 | 26,895 | 17,282 | 83,114 | 0.28 | 0.14 | 0.64 | 0.64 | 40 | 6 | 4.81 | 4.44 | 5.48 | https://analyzingalpha.com/bullish-engulfing-candlestick-pattern |

| 9,455 | stock | none | bullish_kicking | 2 | bullish | bullish | 5 | low-close | 216 | 605 | 349 | 19,398 | 0.93 | 0.46 | 0.58 | 0.32 | 4 | 4 | 55.58 | 91.92 | 38.41 | https://analyzingalpha.com/bullish-kicking-candlestick-pattern |

| 9,465 | forex | uptrend | dark_cloud_cover | 2 | bearish reversal | bullish mean reversion | 5 | atr-pattern_low | 32 | 72 | 29 | 1,113 | 0.66 | 0.33 | 0.40 | 0.28 | 1 | 2 | 38.38 | 81.25 | 22.05 | https://analyzingalpha.com/dark-cloud-cover-candlestick-pattern |

| 9,470 | stock | uptrend | dark_cloud_cover | 2 | bearish reversal | bullish mean reversion | 5 | atr-pattern_low | 3,834 | 30,976 | 16,379 | 331,221 | 0.42 | 0.21 | 0.53 | 0.24 | 6 | 13 | 20.22 | 37.90 | 14.75 | https://analyzingalpha.com/dark-cloud-cover-candlestick-pattern |

| 9,645 | forex | downtrend | three_stars_in_the_south | 3 | bullish reversal | bearish mean reversion | 5 | atr-pattern_high | 10 | 32 | 9 | 290 | 1.66 | 0.55 | 0.28 | 0.44 | 2 | 2 | 32.22 | 62.00 | 8.40 | https://analyzingalpha.com/three-stars-in-the-south-candlestick-pattern |

| 9,720 | stock | downtrend | bullish_belt_hold | 1 | bullish reversal | bullish mean reversion | 5 | atr-pattern_low | 6,466 | 372,105 | 133,186 | 3,120,788 | 0.42 | 0.42 | 0.36 | 0.24 | 6 | 36 | 23.43 | 45.02 | 16.78 | https://analyzingalpha.com/bullish-belt-hold-candlestick-pattern |

| 9,742 | forex | uptrend | bearish_engulfing | 2 | bearish reversal | bearish mean reversion | 2 | atr-pattern_high | 847 | 29,711 | 8,453 | 73,790 | 0.25 | 0.13 | 0.28 | 0.42 | 19 | 12 | 8.73 | 10.35 | 7.57 | https://analyzingalpha.com/bearish-engulfing-candlestick-pattern |

| 9,755 | crypto | uptrend | bearish_belt_hold | 1 | bearish reversal | bullish continuation | 5 | low-close | 236 | 6,157 | 5,685 | 23,969 | 0.80 | 0.80 | 0.92 | 0.30 | 4 | 17 | 4.22 | 6.09 | 3.41 | https://analyzingalpha.com/bearish-belt-hold-candlestick-pattern |

| 9,760 | forex | uptrend | bearish_belt_hold | 1 | bearish reversal | bullish continuation | 5 | low-close | 1,259 | 124,053 | 104,185 | 324,193 | 1.27 | 1.27 | 0.84 | 0.38 | 36 | 34 | 3.11 | 2.80 | 3.30 | https://analyzingalpha.com/bearish-belt-hold-candlestick-pattern |

| 9,768 | forex | downtrend | piercing | 2 | bullish reversal | bearish mean reversion | 3 | atr-pattern_high | 22 | 51 | 25 | 762 | 0.92 | 0.46 | 0.49 | 0.48 | 2 | 1 | 30.48 | 36.17 | 25.23 | https://analyzingalpha.com/piercing-candlestick-pattern |

| 9,840 | stock | downtrend | ladder_bottom | 5 | bullish reversal | bullish reversal | 5 | low-close | 2,331 | 8,433 | 7,661 | 233,093 | 0.44 | 0.09 | 0.91 | 0.24 | 4 | 9 | 30.43 | 62.41 | 20.35 | https://analyzingalpha.com/ladder-bottom-candlestick-pattern |

| 9,870 | stock | uptrend | stalled | 3 | bearish reversal | bullish mean reversion | 5 | atr-pattern_low | 3,365 | 25,999 | 2,364 | 34,515 | 0.46 | 0.15 | 0.09 | 0.24 | 2 | 6 | 14.60 | 26.92 | 10.65 | https://analyzingalpha.com/stalled-candlestick-pattern |

| 9,900 | stock | downtrend | downside_tasuki_gap | 3 | bearish continuation | bullish mean reversion | 5 | atr-pattern_low | 3,270 | 17,043 | 6,090 | 121,678 | 0.52 | 0.17 | 0.36 | 0.25 | 4 | 7 | 19.98 | 42.66 | 12.29 | https://analyzingalpha.com/downside-tasuki-gap-candlestick-pattern |

| 9,934 | forex | uptrend | three_inside_down | 3 | bearish reversal | bearish mean reversion | 4 | atr-pattern_high | 498 | 2,112 | 267 | 6,566 | 0.28 | 0.09 | 0.13 | 0.26 | 2 | 3 | 24.59 | 58.59 | 12.97 | https://analyzingalpha.com/three-inside-down-candlestick-pattern |

| 10,032 | forex | downtrend | bullish_counterattack | 2 | bullish reversal | bearish mean reversion | 2 | atr-pattern_high | 127 | 465 | 150 | 6,525 | 0.40 | 0.20 | 0.32 | 0.47 | 4 | 5 | 43.50 | 41.87 | 44.92 | https://analyzingalpha.com/bullish-counterattack-candlestick-pattern |

| 10,065 | crypto | downtrend | takuri | 1 | bullish reversal | bearish continuation | 5 | high-close | 229 | 4,206 | 4,053 | 5,180 | 1.29 | 1.29 | 0.96 | 0.38 | 178 | 24 | 1.28 | 1.36 | 1.22 | https://analyzingalpha.com/takuri-candlestick-pattern |

| 10,070 | forex | downtrend | takuri | 1 | bullish reversal | bearish continuation | 5 | high-close | 1,173 | 63,306 | 60,921 | 77,493 | 0.97 | 0.97 | 0.96 | 0.33 | 1,052 | 59 | 1.27 | 1.35 | 1.23 | https://analyzingalpha.com/takuri-candlestick-pattern |

| 10,075 | stock | downtrend | takuri | 1 | bullish reversal | bearish continuation | 5 | high-close | 5,963 | 172,648 | 158,347 | 207,031 | 0.86 | 0.86 | 0.92 | 0.31 | 162 | 32 | 1.31 | 1.49 | 1.23 | https://analyzingalpha.com/takuri-candlestick-pattern |

| 10,105 | stock | downtrend | bullish_abandoned_baby | 3 | bullish reversal | bullish reversal | 5 | low-high | 30 | 63 | 41 | 1,203 | 0.76 | 0.25 | 0.65 | 0.29 | 3 | 2 | 29.34 | 54.00 | 19.14 | https://analyzingalpha.com/bullish-abandoned-baby-candlestick-pattern |

| 10,110 | stock | downtrend | bullish_breakaway | 5 | bullish reversal | bullish reversal | 5 | low-close | 37 | 73 | 67 | 2,814 | 0.97 | 0.19 | 0.92 | 0.33 | 2 | 2 | 42.00 | 70.18 | 28.22 | https://analyzingalpha.com/bullish-breakaway-candlestick-pattern |

| 10,186 | crypto | uptrend | rising_three_methods | 5 | bullish continuation | bullish continuation | 1 | low-close | 1 | 2 | 2 | 31 | 1.00 | 0.20 | 1.00 | 1.00 | 2 | 0 | 15.50 | 15.50 | https://analyzingalpha.com/rising-three-methods-candlestick-pattern | |

| 10,220 | crypto | none | bullish_spinning_top | 1 | indecision | bullish | 5 | atr-pattern_low | 253 | 9,679 | 5,119 | 88,400 | 0.49 | 0.49 | 0.53 | 0.25 | 3 | 18 | 17.27 | 29.17 | 13.37 | https://analyzingalpha.com/bullish-spinning-top-candlestick-pattern |

| 10,230 | stock | none | bullish_spinning_top | 1 | indecision | bullish | 5 | atr-pattern_low | 6,203 | 829,243 | 443,803 | 6,190,567 | 0.37 | 0.37 | 0.54 | 0.23 | 7 | 49 | 13.95 | 26.48 | 10.26 | https://analyzingalpha.com/bullish-spinning-top-candlestick-pattern |

| 10,285 | crypto | uptrend | bearish_doji_star | 2 | bearish reversal | bullish mean reversion | 5 | atr-pattern_low | 126 | 514 | 145 | 2,102 | 0.86 | 0.43 | 0.28 | 0.31 | 2 | 4 | 14.50 | 19.09 | 12.43 | https://analyzingalpha.com/bearish-doji-star-candlestick-pattern |

| 10,295 | stock | uptrend | bearish_doji_star | 2 | bearish reversal | bullish mean reversion | 5 | atr-pattern_low | 4,834 | 119,856 | 29,339 | 409,954 | 0.40 | 0.20 | 0.24 | 0.23 | 5 | 15 | 13.97 | 25.89 | 10.35 | https://analyzingalpha.com/bearish-doji-star-candlestick-pattern |

| 10,310 | stock | downtrend | falling_three_methods | 5 | bearish continuation | bearish mean reversion | 5 | atr-pattern_high | 103 | 220 | 22 | 396 | 0.64 | 0.13 | 0.10 | 0.27 | 1 | 2 | 18.00 | 24.67 | 15.50 | https://analyzingalpha.com/falling-three-methods-candlestick-pattern |

| 10,345 | crypto | uptrend | up_gap_side_by_side | 3 | bullish continuation | bullish continuation | 5 | low-high | 34 | 85 | 51 | 939 | 0.76 | 0.25 | 0.60 | 0.29 | 1 | 4 | 18.41 | 22.40 | 16.75 | https://analyzingalpha.com/up-gap-side-by-side-candlestick-pattern |

| 10,355 | stock | uptrend | up_gap_side_by_side | 3 | bullish continuation | bullish continuation | 5 | low-high | 4,120 | 39,114 | 22,581 | 547,060 | 0.50 | 0.17 | 0.58 | 0.25 | 5 | 17 | 24.23 | 45.21 | 17.27 | https://analyzingalpha.com/up-gap-side-by-side-candlestick-pattern |

| 10,361 | forex | uptrend | bearish_doji_star | 2 | bearish reversal | bearish mean reversion | 1 | atr-pattern_high | 692 | 7,113 | 3,863 | 20,075 | 0.32 | 0.16 | 0.54 | 0.66 | 33 | 7 | 5.20 | 4.66 | 6.25 | https://analyzingalpha.com/bearish-doji-star-candlestick-pattern |

| 10,400 | crypto | downtrend | inverted_hammer | 1 | bullish reversal | bullish reversal | 5 | low-close | 176 | 1,019 | 987 | 1,153 | 0.76 | 0.76 | 0.97 | 0.29 | 6 | 11 | 1.17 | 1.19 | 1.16 | https://analyzingalpha.com/inverted-hammer-candlestick-pattern |

| 10,405 | forex | downtrend | inverted_hammer | 1 | bullish reversal | bullish reversal | 5 | low-close | 697 | 4,447 | 4,327 | 8,389 | 0.76 | 0.76 | 0.97 | 0.29 | 19 | 30 | 1.94 | 2.20 | 1.83 | https://analyzingalpha.com/inverted-hammer-candlestick-pattern |

| 10,410 | stock | downtrend | inverted_hammer | 1 | bullish reversal | bullish reversal | 5 | low-close | 5,725 | 178,745 | 167,397 | 248,124 | 0.68 | 0.68 | 0.94 | 0.28 | 5 | 30 | 1.48 | 1.78 | 1.37 | https://analyzingalpha.com/inverted-hammer-candlestick-pattern |

| 10,460 | crypto | uptrend | bearish_tri_star | 3 | bearish reversal | bearish reversal | 5 | high-low | 4 | 11 | 6 | 135 | 1.00 | 0.33 | 0.55 | 0.33 | 1 | 2 | 22.50 | 48.00 | 9.75 | https://analyzingalpha.com/bearish-tri-star-candlestick-pattern |

| 10,693 | crypto | downtrend | unique_three_river_bottom | 3 | bullish reversal | bullish reversal | 3 | low-high | 7 | 14 | 9 | 108 | 1.23 | 0.41 | 0.64 | 0.56 | 2 | 2 | 12.00 | 15.40 | 7.75 | https://analyzingalpha.com/unique-three-river-bottom-candlestick-pattern |

| 10,790 | stock | downtrend | down_gap_side_by_side | 3 | bearish continuation | bullish mean reversion | 5 | atr-pattern_low | 3,417 | 38,239 | 11,357 | 126,016 | 0.25 | 0.08 | 0.30 | 0.21 | 3 | 20 | 11.10 | 21.79 | 8.29 | https://analyzingalpha.com/down-gap-side-by-side-candlestick-pattern |

| 10,795 | crypto | uptrend | dark_cloud_cover | 2 | bearish reversal | bearish reversal | 5 | high-close | 1 | 2 | 2 | 17 | 2.00 | 1.00 | 1.00 | 0.50 | 1 | 0 | 8.50 | 12.00 | 5.00 | https://analyzingalpha.com/dark-cloud-cover-candlestick-pattern |

| 10,905 | crypto | downtrend | bullish_tri_star | 3 | bullish reversal | bullish mean reversion | 5 | atr-pattern_low | 10 | 23 | 12 | 572 | 1.51 | 0.50 | 0.52 | 0.42 | 1 | 2 | 47.67 | 99.20 | 10.86 | https://analyzingalpha.com/bullish-tri-star-candlestick-pattern |

| 10,955 | stock | uptrend | bearish_belt_hold | 1 | bearish reversal | bullish mean reversion | 5 | atr-pattern_low | 5,825 | 334,837 | 206,551 | 4,694,609 | 0.39 | 0.39 | 0.62 | 0.23 | 5 | 32 | 22.73 | 43.58 | 16.42 | https://analyzingalpha.com/bearish-belt-hold-candlestick-pattern |

| 10,958 | forex | downtrend | in_neck | 2 | bearish continuation | bearish mean reversion | 3 | atr-pattern_high | 2 | 4 | 1 | 4 | 3.00 | 1.50 | 0.25 | 1.00 | 1 | 0 | 4.00 | 4.00 | https://analyzingalpha.com/in-neck-candlestick-pattern | |

| 10,982 | crypto | downtrend | three_white_soldiers | 3 | bullish reversal | bullish mean reversion | 2 | atr-pattern_low | 18 | 38 | 1 | 1 | 2.00 | 0.67 | 0.03 | 1.00 | 1 | 0 | 1.00 | 1.00 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern | |

| 10,990 | forex | downtrend | three_white_soldiers | 3 | bullish reversal | bullish mean reversion | 5 | atr-pattern_low | 292 | 2,012 | 89 | 1,030 | 1.90 | 0.63 | 0.04 | 0.48 | 3 | 3 | 11.57 | 15.60 | 7.80 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern |

| 11,001 | forex | downtrend | homing_pigeon | 2 | bullish reversal | bearish mean reversion | 1 | atr-pattern_high | 380 | 1,901 | 625 | 2,777 | 0.32 | 0.16 | 0.33 | 0.66 | 14 | 4 | 4.44 | 4.07 | 5.16 | https://analyzingalpha.com/homing-pigeon-candlestick-pattern |

| 11,120 | crypto | none | bullish_high_wave | 1 | indecision | bullish | 5 | atr-pattern_low | 249 | 7,713 | 4,138 | 71,025 | 0.48 | 0.48 | 0.54 | 0.25 | 2 | 15 | 17.16 | 29.72 | 13.06 | https://analyzingalpha.com/bullish-high-wave-candlestick-pattern |

| 11,130 | stock | none | bullish_high_wave | 1 | indecision | bullish | 5 | atr-pattern_low | 6,159 | 654,201 | 358,472 | 4,875,542 | 0.37 | 0.37 | 0.55 | 0.23 | 6 | 44 | 13.60 | 25.69 | 10.05 | https://analyzingalpha.com/bullish-high-wave-candlestick-pattern |

| 11,135 | crypto | none | doji | 1 | indecision | bullish | 5 | low-close | 259 | 32,125 | 27,127 | 94,885 | 0.75 | 0.75 | 0.84 | 0.29 | 11 | 21 | 3.50 | 4.34 | 3.15 | https://analyzingalpha.com/doji-candlestick-pattern |

| 11,145 | stock | none | doji | 1 | indecision | bullish | 5 | low-close | 6,600 | 1,800,984 | 1,545,762 | 6,027,624 | 0.44 | 0.44 | 0.86 | 0.24 | 15 | 33 | 3.90 | 6.24 | 3.16 | https://analyzingalpha.com/doji-candlestick-pattern |

| 11,160 | stock | downtrend | three_outside_up | 3 | bullish reversal | bullish reversal | 5 | low-close | 4,824 | 65,517 | 59,210 | 2,014,139 | 0.35 | 0.12 | 0.90 | 0.23 | 5 | 23 | 34.02 | 71.71 | 23.06 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 11,165 | crypto | downtrend | homing_pigeon | 2 | bullish reversal | bullish reversal | 5 | low-close | 97 | 328 | 309 | 1,665 | 0.48 | 0.24 | 0.94 | 0.25 | 3 | 11 | 5.39 | 4.58 | 5.65 | https://analyzingalpha.com/homing-pigeon-candlestick-pattern |

| 11,230 | forex | none | rickshaw_man | 1 | indecision | bearish | 5 | atr-pattern_high | 1,116 | 147,232 | 89,988 | 1,012,842 | 0.27 | 0.27 | 0.61 | 0.21 | 287 | 108 | 11.26 | 20.84 | 8.69 | https://analyzingalpha.com/rickshaw-man-candlestick-pattern |

| 11,255 | stock | uptrend | bullish_three_line_strike | 4 | bullish continuation | bullish mean reversion | 5 | atr-pattern_low | 1,015 | 2,617 | 1,669 | 27,837 | 0.38 | 0.09 | 0.64 | 0.23 | 3 | 5 | 16.68 | 29.76 | 12.78 | https://analyzingalpha.com/bullish-three-line-strike-candlestick-pattern |

| 11,259 | crypto | uptrend | evening_doji_star | 3 | bearish reversal | bullish mean reversion | 4 | atr-pattern_low | 23 | 50 | 20 | 297 | 0.50 | 0.17 | 0.40 | 0.30 | 2 | 2 | 14.85 | 30.17 | 8.29 | https://analyzingalpha.com/evening-doji-star-candlestick-pattern |

| 11,260 | crypto | uptrend | evening_doji_star | 3 | bearish reversal | bullish mean reversion | 5 | atr-pattern_low | 23 | 50 | 20 | 312 | 0.50 | 0.17 | 0.40 | 0.25 | 1 | 2 | 15.60 | 32.80 | 9.87 | https://analyzingalpha.com/evening-doji-star-candlestick-pattern |

| 11,270 | stock | uptrend | evening_doji_star | 3 | bearish reversal | bullish mean reversion | 5 | atr-pattern_low | 3,034 | 13,605 | 7,387 | 125,543 | 0.35 | 0.12 | 0.54 | 0.23 | 4 | 11 | 17.00 | 32.93 | 12.38 | https://analyzingalpha.com/evening-doji-star-candlestick-pattern |

| 11,275 | crypto | downtrend | bullish_engulfing | 2 | bullish reversal | bullish mean reversion | 5 | atr-pattern_low | 222 | 2,389 | 770 | 14,603 | 0.33 | 0.17 | 0.32 | 0.22 | 3 | 11 | 18.96 | 37.23 | 13.75 | https://analyzingalpha.com/bullish-engulfing-candlestick-pattern |

| 11,285 | stock | downtrend | bullish_engulfing | 2 | bullish reversal | bullish mean reversion | 5 | atr-pattern_low | 5,580 | 173,575 | 51,006 | 897,339 | 0.39 | 0.20 | 0.29 | 0.23 | 7 | 21 | 17.59 | 33.74 | 12.71 | https://analyzingalpha.com/bullish-engulfing-candlestick-pattern |

| 11,335 | crypto | downtrend | thrusting | 2 | bearish continuation | bearish continuation | 5 | high-close | 3 | 6 | 6 | 101 | 1.00 | 0.50 | 1.00 | 0.33 | 1 | 2 | 16.83 | 16.50 | 17.00 | https://analyzingalpha.com/thrusting-candlestick-pattern |

| 11,396 | crypto | uptrend | rising_three_methods | 5 | bullish continuation | bearish mean reversion | 1 | atr-pattern_high | 1 | 2 | 1 | 4 | 1.00 | 0.20 | 0.50 | 1.00 | 1 | 0 | 4.00 | 4.00 | https://analyzingalpha.com/rising-three-methods-candlestick-pattern | |

| 11,415 | crypto | none | bullish_long_line | 1 | bullish | bearish | 5 | high-close | 245 | 20,817 | 19,747 | 27,939 | 0.80 | 0.80 | 0.95 | 0.30 | 64 | 51 | 1.41 | 1.59 | 1.34 | https://analyzingalpha.com/bullish-long-line-candlestick-pattern |

| 11,420 | forex | none | bullish_long_line | 1 | bullish | bearish | 5 | high-close | 1,273 | 317,098 | 294,151 | 392,540 | 1.17 | 1.17 | 0.93 | 0.36 | 490 | 37 | 1.33 | 1.40 | 1.30 | https://analyzingalpha.com/bullish-long-line-candlestick-pattern |

| 11,425 | stock | none | bullish_long_line | 1 | bullish | bearish | 5 | high-close | 6,449 | 1,459,096 | 1,336,824 | 1,811,548 | 0.45 | 0.45 | 0.92 | 0.24 | 303 | 46 | 1.36 | 1.70 | 1.24 | https://analyzingalpha.com/bullish-long-line-candlestick-pattern |

| 11,447 | forex | uptrend | upside_gap_two_crows | 3 | bearish reversal | bullish mean reversion | 2 | atr-pattern_low | 6 | 12 | 2 | 71 | 2.00 | 0.67 | 0.17 | 1.00 | 1 | 0 | 35.50 | 35.50 | https://analyzingalpha.com/upside-gap-two-crows-candlestick-pattern | |

| 11,450 | forex | uptrend | upside_gap_two_crows | 3 | bearish reversal | bullish mean reversion | 5 | atr-pattern_low | 6 | 12 | 2 | 367 | 2.00 | 0.67 | 0.17 | 0.50 | 1 | 1 | 183.50 | 98.00 | 269.00 | https://analyzingalpha.com/upside-gap-two-crows-candlestick-pattern |

| 11,455 | stock | uptrend | upside_gap_two_crows | 3 | bearish reversal | bullish mean reversion | 5 | atr-pattern_low | 825 | 2,104 | 500 | 8,470 | 0.57 | 0.19 | 0.24 | 0.26 | 2 | 3 | 16.94 | 27.82 | 13.08 | https://analyzingalpha.com/upside-gap-two-crows-candlestick-pattern |

| 11,461 | forex | uptrend | bearish_harami_cross | 2 | bearish reversal | bearish mean reversion | 1 | atr-pattern_high | 714 | 6,985 | 3,395 | 14,829 | 0.30 | 0.15 | 0.49 | 0.65 | 28 | 5 | 4.37 | 4.04 | 4.99 | https://analyzingalpha.com/bearish-harami-cross-candlestick-pattern |

| 11,485 | stock | downtrend | three_white_soldiers | 3 | bullish reversal | bullish reversal | 5 | low-high | 436 | 926 | 773 | 52,028 | 0.45 | 0.15 | 0.83 | 0.24 | 3 | 4 | 67.31 | 138.20 | 44.68 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern |

| 11,530 | stock | downtrend | morning_star | 3 | bullish reversal | bullish reversal | 5 | low-close | 4,034 | 30,525 | 27,133 | 847,077 | 0.37 | 0.12 | 0.89 | 0.23 | 5 | 17 | 31.22 | 65.16 | 21.25 | https://analyzingalpha.com/morning-star-candlestick-pattern |

| 11,535 | crypto | downtrend | morning_doji_star | 3 | bullish reversal | bullish reversal | 5 | low-close | 22 | 48 | 45 | 616 | 1.27 | 0.42 | 0.94 | 0.38 | 2 | 3 | 13.69 | 19.24 | 10.32 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 11,580 | crypto | uptrend | bullish_three_line_strike | 4 | bullish continuation | bullish continuation | 5 | low-high | 19 | 44 | 15 | 248 | 1.40 | 0.35 | 0.34 | 0.40 | 1 | 2 | 16.53 | 17.33 | 16.00 | https://analyzingalpha.com/bullish-three-line-strike-candlestick-pattern |

| 11,596 | forex | uptrend | bearish_harami | 2 | bearish reversal | bearish mean reversion | 1 | atr-pattern_high | 830 | 21,414 | 9,075 | 39,318 | 0.28 | 0.14 | 0.42 | 0.64 | 36 | 5 | 4.33 | 3.89 | 5.12 | https://analyzingalpha.com/bearish-harami-candlestick-pattern |

| 11,610 | crypto | uptrend | shooting_star | 1 | bearish reversal | bullish mean reversion | 5 | atr-pattern_low | 100 | 341 | 253 | 3,108 | 1.09 | 1.09 | 0.74 | 0.35 | 4 | 5 | 12.28 | 17.43 | 9.54 | https://analyzingalpha.com/shooting-star-candlestick-pattern |

| 11,620 | stock | uptrend | shooting_star | 1 | bearish reversal | bullish mean reversion | 5 | atr-pattern_low | 4,631 | 95,153 | 61,841 | 929,151 | 0.38 | 0.38 | 0.65 | 0.23 | 5 | 21 | 15.02 | 28.66 | 10.96 | https://analyzingalpha.com/shooting-star-candlestick-pattern |

| 11,655 | crypto | none | dragonfly_doji | 1 | indecision | bearish | 5 | high-close | 235 | 7,137 | 6,904 | 8,549 | 1.23 | 1.23 | 0.97 | 0.37 | 172 | 37 | 1.24 | 1.30 | 1.20 | https://analyzingalpha.com/dragonfly-doji-candlestick-pattern |

| 11,660 | forex | none | dragonfly_doji | 1 | indecision | bearish | 5 | high-close | 1,198 | 115,148 | 110,567 | 147,301 | 1.28 | 1.28 | 0.96 | 0.38 | 1,589 | 64 | 1.33 | 1.40 | 1.29 | https://analyzingalpha.com/dragonfly-doji-candlestick-pattern |

| 11,665 | stock | none | dragonfly_doji | 1 | indecision | bearish | 5 | high-close | 6,133 | 379,937 | 351,320 | 455,731 | 0.83 | 0.83 | 0.92 | 0.31 | 286 | 42 | 1.30 | 1.49 | 1.21 | https://analyzingalpha.com/dragonfly-doji-candlestick-pattern |

| 11,730 | crypto | downtrend | bearish_separating_lines | 2 | bearish continuation | bullish mean reversion | 5 | atr-pattern_low | 191 | 2,125 | 823 | 20,348 | 0.42 | 0.21 | 0.39 | 0.24 | 3 | 13 | 24.72 | 52.31 | 16.21 | https://analyzingalpha.com/bearish-separating-lines-candlestick-pattern |

| 11,732 | forex | downtrend | bearish_separating_lines | 2 | bearish continuation | bullish mean reversion | 2 | atr-pattern_low | 1,239 | 70,969 | 29,872 | 274,902 | 0.35 | 0.17 | 0.42 | 0.45 | 8 | 15 | 9.20 | 9.66 | 8.83 | https://analyzingalpha.com/bearish-separating-lines-candlestick-pattern |

| 11,740 | stock | downtrend | bearish_separating_lines | 2 | bearish continuation | bullish mean reversion | 5 | atr-pattern_low | 4,213 | 38,591 | 19,951 | 376,021 | 0.34 | 0.17 | 0.52 | 0.22 | 6 | 16 | 18.85 | 36.39 | 13.80 | https://analyzingalpha.com/bearish-separating-lines-candlestick-pattern |

| 11,745 | crypto | downtrend | bullish_belt_hold | 1 | bullish reversal | bearish continuation | 5 | high-close | 249 | 6,856 | 6,255 | 38,489 | 0.70 | 0.70 | 0.91 | 0.28 | 28 | 31 | 6.15 | 4.99 | 6.61 | https://analyzingalpha.com/bullish-belt-hold-candlestick-pattern |

| 11,750 | forex | downtrend | bullish_belt_hold | 1 | bullish reversal | bearish continuation | 5 | high-close | 1,280 | 129,540 | 107,823 | 339,061 | 1.30 | 1.30 | 0.83 | 0.38 | 193 | 48 | 3.14 | 3.27 | 3.07 | https://analyzingalpha.com/bullish-belt-hold-candlestick-pattern |

| 11,790 | crypto | downtrend | three_outside_up | 3 | bullish reversal | bullish reversal | 5 | low-high | 157 | 924 | 602 | 14,488 | 0.78 | 0.26 | 0.65 | 0.30 | 4 | 9 | 24.07 | 41.24 | 16.86 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 11,810 | crypto | uptrend | bullish_separating_lines | 2 | bullish continuation | bullish mean reversion | 5 | atr-pattern_low | 143 | 529 | 180 | 4,435 | 0.76 | 0.38 | 0.34 | 0.29 | 2 | 4 | 24.64 | 38.45 | 18.87 | https://analyzingalpha.com/bullish-separating-lines-candlestick-pattern |

| 11,820 | stock | uptrend | bullish_separating_lines | 2 | bullish continuation | bullish mean reversion | 5 | atr-pattern_low | 3,616 | 24,055 | 5,197 | 91,562 | 0.49 | 0.24 | 0.22 | 0.25 | 4 | 7 | 17.62 | 31.39 | 13.11 | https://analyzingalpha.com/bullish-separating-lines-candlestick-pattern |

| 11,890 | forex | uptrend | two_crows | 3 | bearish reversal | bearish mean reversion | 5 | atr-pattern_high | 4 | 8 | 2 | 85 | 2.00 | 0.67 | 0.25 | 0.50 | 1 | 1 | 42.50 | 84.00 | 1.00 | https://analyzingalpha.com/two-crows-candlestick-pattern |

| 11,950 | forex | uptrend | bearish_counterattack | 2 | bearish reversal | bearish reversal | 5 | high-close | 92 | 402 | 372 | 5,094 | 0.78 | 0.39 | 0.93 | 0.30 | 10 | 12 | 13.69 | 14.15 | 13.50 | https://analyzingalpha.com/bearish-counterattack-candlestick-pattern |

| 11,960 | crypto | downtrend | bullish_doji_star | 2 | bullish reversal | bullish mean reversion | 5 | atr-pattern_low | 147 | 678 | 345 | 7,161 | 0.63 | 0.32 | 0.51 | 0.27 | 2 | 7 | 20.76 | 38.24 | 14.21 | https://analyzingalpha.com/bullish-doji-star-candlestick-pattern |

| 11,961 | forex | downtrend | bullish_doji_star | 2 | bullish reversal | bullish mean reversion | 1 | atr-pattern_low | 694 | 5,890 | 3,129 | 14,589 | 0.24 | 0.12 | 0.53 | 0.62 | 22 | 9 | 4.66 | 4.59 | 4.77 | https://analyzingalpha.com/bullish-doji-star-candlestick-pattern |

| 12,035 | crypto | uptrend | three_inside_down | 3 | bearish reversal | bullish mean reversion | 5 | atr-pattern_low | 66 | 193 | 113 | 2,376 | 1.02 | 0.34 | 0.59 | 0.34 | 3 | 4 | 21.03 | 34.29 | 14.31 | https://analyzingalpha.com/three-inside-down-candlestick-pattern |

| 12,045 | stock | uptrend | three_inside_down | 3 | bearish reversal | bullish mean reversion | 5 | atr-pattern_low | 3,832 | 37,529 | 23,705 | 424,254 | 0.45 | 0.15 | 0.63 | 0.24 | 5 | 16 | 17.90 | 33.58 | 12.90 | https://analyzingalpha.com/three-inside-down-candlestick-pattern |

| 12,065 | forex | uptrend | bearish_tri_star | 3 | bearish reversal | bearish reversal | 5 | high-close | 63 | 259 | 249 | 1,121 | 0.76 | 0.25 | 0.96 | 0.29 | 13 | 21 | 4.50 | 3.59 | 4.88 | https://analyzingalpha.com/bearish-tri-star-candlestick-pattern |

| 12,070 | stock | uptrend | bearish_tri_star | 3 | bearish reversal | bearish reversal | 5 | high-close | 2,141 | 9,920 | 7,580 | 83,573 | 0.38 | 0.13 | 0.76 | 0.23 | 10 | 10 | 11.03 | 14.50 | 9.99 | https://analyzingalpha.com/bearish-tri-star-candlestick-pattern |

| 12,075 | crypto | none | bearish_marubozu | 1 | bearish | bullish | 5 | low-close | 240 | 11,558 | 10,359 | 12,743 | 1.54 | 1.54 | 0.90 | 0.42 | 14 | 22 | 1.23 | 1.30 | 1.18 | https://analyzingalpha.com/bearish-marubozu-candlestick-pattern |

| 12,080 | forex | none | bearish_marubozu | 1 | bearish | bullish | 5 | low-close | 1,246 | 233,923 | 192,055 | 214,393 | 2.56 | 2.56 | 0.82 | 0.59 | 56 | 42 | 1.12 | 1.07 | 1.19 | https://analyzingalpha.com/bearish-marubozu-candlestick-pattern |

| 12,085 | stock | none | bearish_marubozu | 1 | bearish | bullish | 5 | low-close | 6,299 | 553,338 | 503,377 | 630,444 | 0.76 | 0.76 | 0.91 | 0.29 | 9 | 33 | 1.25 | 1.42 | 1.18 | https://analyzingalpha.com/bearish-marubozu-candlestick-pattern |

| 12,092 | forex | uptrend | three_outside_down | 3 | bearish reversal | bearish mean reversion | 2 | atr-pattern_high | 691 | 10,104 | 1,560 | 11,580 | 0.22 | 0.07 | 0.15 | 0.41 | 6 | 7 | 7.42 | 8.36 | 6.78 | https://analyzingalpha.com/three-outside-down-candlestick-pattern |

| 12,184 | crypto | downtrend | bearish_three_line_strike | 4 | bearish continuation | bearish mean reversion | 4 | atr-pattern_high | 26 | 74 | 39 | 615 | 0.66 | 0.17 | 0.53 | 0.33 | 1 | 3 | 15.77 | 24.31 | 11.50 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 12,187 | forex | downtrend | bearish_three_line_strike | 4 | bearish continuation | bearish mean reversion | 2 | atr-pattern_high | 287 | 853 | 545 | 5,675 | 0.47 | 0.12 | 0.64 | 0.49 | 5 | 3 | 10.41 | 11.84 | 9.05 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 12,261 | forex | downtrend | unique_three_river_bottom | 3 | bullish reversal | bearish mean reversion | 1 | atr-pattern_high | 100 | 332 | 100 | 354 | 0.50 | 0.17 | 0.30 | 0.75 | 5 | 3 | 3.54 | 3.32 | 4.20 | https://analyzingalpha.com/unique-three-river-bottom-candlestick-pattern |

| 12,262 | forex | downtrend | unique_three_river_bottom | 3 | bullish reversal | bearish mean reversion | 2 | atr-pattern_high | 100 | 329 | 100 | 1,268 | 0.50 | 0.17 | 0.30 | 0.50 | 4 | 3 | 12.68 | 12.84 | 12.52 | https://analyzingalpha.com/unique-three-river-bottom-candlestick-pattern |

| 12,291 | forex | uptrend | bullish_harami_cross | 2 | bullish reversal | bearish mean reversion | 1 | atr-pattern_high | 705 | 6,986 | 1,959 | 8,486 | 0.30 | 0.15 | 0.28 | 0.65 | 20 | 5 | 4.33 | 4.10 | 4.76 | https://analyzingalpha.com/bullish-harami-cross-candlestick-pattern |

| 12,340 | stock | uptrend | two_crows | 3 | bearish reversal | bullish mean reversion | 5 | atr-pattern_low | 1,665 | 4,884 | 1,987 | 30,456 | 0.34 | 0.11 | 0.41 | 0.22 | 2 | 5 | 15.33 | 28.09 | 11.67 | https://analyzingalpha.com/two-crows-candlestick-pattern |

| 12,384 | forex | uptrend | rising_three_methods | 5 | bullish continuation | bullish mean reversion | 4 | atr-pattern_low | 12 | 27 | 7 | 73 | 1.15 | 0.23 | 0.26 | 0.43 | 1 | 1 | 10.43 | 15.67 | 6.50 | https://analyzingalpha.com/rising-three-methods-candlestick-pattern |

| 12,390 | stock | uptrend | rising_three_methods | 5 | bullish continuation | bullish mean reversion | 5 | atr-pattern_low | 146 | 315 | 40 | 627 | 0.80 | 0.16 | 0.13 | 0.30 | 2 | 2 | 15.68 | 21.00 | 13.39 | https://analyzingalpha.com/rising-three-methods-candlestick-pattern |

| 12,428 | stock | uptrend | bearish_breakaway | 5 | bearish reversal | bearish mean reversion | 3 | atr-pattern_high | 77 | 164 | 32 | 245 | 0.88 | 0.18 | 0.20 | 0.47 | 2 | 2 | 7.66 | 11.07 | 4.65 | https://analyzingalpha.com/bearish-breakaway-candlestick-pattern |

| 12,499 | forex | uptrend | upside_tasuki_gap | 3 | bullish continuation | bearish mean reversion | 4 | atr-pattern_high | 50 | 114 | 32 | 980 | 0.88 | 0.29 | 0.28 | 0.38 | 1 | 2 | 30.62 | 68.92 | 7.65 | https://analyzingalpha.com/upside-tasuki-gap-candlestick-pattern |

| 12,508 | stock | uptrend | bearish_abandoned_baby | 3 | bearish reversal | bearish reversal | 3 | high-close | 36 | 87 | 59 | 1,063 | 0.43 | 0.14 | 0.68 | 0.36 | 3 | 2 | 18.02 | 16.29 | 18.97 | https://analyzingalpha.com/bearish-abandoned-baby-candlestick-pattern |

| 12,575 | crypto | uptrend | bearish_counterattack | 2 | bearish reversal | bullish continuation | 5 | low-close | 7 | 21 | 20 | 46 | 0.80 | 0.40 | 0.95 | 0.30 | 1 | 5 | 2.30 | 1.17 | 2.79 | https://analyzingalpha.com/bearish-counterattack-candlestick-pattern |

| 12,585 | stock | uptrend | bearish_counterattack | 2 | bearish reversal | bullish continuation | 5 | low-close | 1,806 | 5,734 | 4,995 | 18,577 | 0.42 | 0.21 | 0.87 | 0.24 | 4 | 10 | 3.72 | 6.21 | 2.96 | https://analyzingalpha.com/bearish-counterattack-candlestick-pattern |

| 12,610 | stock | downtrend | in_neck | 2 | bearish continuation | bullish mean reversion | 5 | atr-pattern_low | 3,123 | 13,308 | 6,179 | 106,471 | 0.34 | 0.17 | 0.46 | 0.22 | 3 | 7 | 17.23 | 34.35 | 12.33 | https://analyzingalpha.com/in-neck-candlestick-pattern |

| 12,680 | crypto | downtrend | three_inside_up | 3 | bullish reversal | bullish mean reversion | 5 | atr-pattern_low | 70 | 208 | 48 | 606 | 0.38 | 0.13 | 0.23 | 0.23 | 2 | 3 | 12.62 | 18.09 | 11.00 | https://analyzingalpha.com/three-inside-up-candlestick-pattern |

| 12,681 | forex | downtrend | three_inside_up | 3 | bullish reversal | bullish mean reversion | 1 | atr-pattern_low | 507 | 2,137 | 280 | 864 | 0.26 | 0.09 | 0.13 | 0.63 | 3 | 4 | 3.09 | 3.02 | 3.20 | https://analyzingalpha.com/three-inside-up-candlestick-pattern |

| 12,690 | stock | downtrend | three_inside_up | 3 | bullish reversal | bullish mean reversion | 5 | atr-pattern_low | 4,279 | 41,668 | 7,510 | 129,083 | 0.47 | 0.16 | 0.18 | 0.25 | 4 | 9 | 17.19 | 31.16 | 12.64 | https://analyzingalpha.com/three-inside-up-candlestick-pattern |

| 12,720 | stock | downtrend | bullish_tri_star | 3 | bullish reversal | bullish reversal | 5 | low-close | 2,137 | 10,751 | 7,763 | 75,224 | 0.55 | 0.18 | 0.72 | 0.26 | 5 | 13 | 9.69 | 15.06 | 7.83 | https://analyzingalpha.com/bullish-tri-star-candlestick-pattern |

| 12,750 | crypto | none | bearish_long_line | 1 | bearish | bullish | 5 | low-close | 250 | 23,125 | 21,759 | 30,979 | 0.78 | 0.78 | 0.94 | 0.30 | 12 | 31 | 1.42 | 1.62 | 1.34 | https://analyzingalpha.com/bearish-long-line-candlestick-pattern |

| 12,755 | forex | none | bearish_long_line | 1 | bearish | bullish | 5 | low-close | 1,273 | 323,962 | 300,735 | 387,801 | 1.22 | 1.22 | 0.93 | 0.37 | 56 | 31 | 1.29 | 1.25 | 1.31 | https://analyzingalpha.com/bearish-long-line-candlestick-pattern |

| 12,760 | stock | none | bearish_long_line | 1 | bearish | bullish | 5 | low-close | 6,448 | 1,478,970 | 1,371,434 | 1,845,370 | 0.44 | 0.44 | 0.93 | 0.24 | 10 | 38 | 1.35 | 1.67 | 1.24 | https://analyzingalpha.com/bearish-long-line-candlestick-pattern |

| 12,809 | crypto | downtrend | bullish_counterattack | 2 | bullish reversal | bullish reversal | 4 | low-close | 6 | 24 | 22 | 275 | 0.82 | 0.41 | 0.92 | 0.36 | 3 | 2 | 12.50 | 2.00 | 18.50 | https://analyzingalpha.com/bullish-counterattack-candlestick-pattern |

| 12,843 | forex | none | bullish_high_wave | 1 | indecision | bearish | 3 | atr-pattern_high | 1,113 | 126,611 | 73,489 | 978,264 | 0.21 | 0.21 | 0.58 | 0.30 | 65 | 34 | 13.31 | 18.97 | 10.86 | https://analyzingalpha.com/bullish-high-wave-candlestick-pattern |

| 12,877 | forex | downtrend | bullish_harami | 2 | bullish reversal | bearish mean reversion | 2 | atr-pattern_high | 839 | 20,437 | 6,568 | 64,090 | 0.26 | 0.13 | 0.32 | 0.42 | 16 | 13 | 9.76 | 11.05 | 8.82 | https://analyzingalpha.com/bullish-harami-candlestick-pattern |

| 12,890 | crypto | uptrend | hanging_man | 1 | bearish reversal | bearish reversal | 5 | high-close | 204 | 2,891 | 2,786 | 3,586 | 1.45 | 1.45 | 0.96 | 0.41 | 31 | 13 | 1.29 | 1.32 | 1.27 | https://analyzingalpha.com/hanging-man-candlestick-pattern |

| 12,895 | forex | uptrend | hanging_man | 1 | bearish reversal | bearish reversal | 5 | high-close | 1,175 | 83,811 | 81,293 | 116,329 | 1.09 | 1.09 | 0.97 | 0.35 | 500 | 50 | 1.43 | 1.56 | 1.36 | https://analyzingalpha.com/hanging-man-candlestick-pattern |

| 12,900 | stock | uptrend | hanging_man | 1 | bearish reversal | bearish reversal | 5 | high-close | 5,365 | 251,679 | 235,131 | 363,848 | 0.75 | 0.75 | 0.93 | 0.29 | 129 | 36 | 1.55 | 1.87 | 1.41 | https://analyzingalpha.com/hanging-man-candlestick-pattern |

| 12,965 | forex | uptrend | shooting_star | 1 | bearish reversal | bearish mean reversion | 5 | atr-pattern_high | 494 | 2,446 | 1,184 | 20,995 | 0.37 | 0.37 | 0.48 | 0.23 | 6 | 6 | 17.73 | 32.49 | 13.39 | https://analyzingalpha.com/shooting-star-candlestick-pattern |

| 12,980 | forex | uptrend | advance_block | 3 | bearish reversal | bearish reversal | 5 | high-close | 1,072 | 20,296 | 18,917 | 68,857 | 0.60 | 0.20 | 0.93 | 0.27 | 24 | 35 | 3.64 | 4.62 | 3.28 | https://analyzingalpha.com/advance-block-candlestick-pattern |

| 13,010 | crypto | downtrend | morning_star | 3 | bullish reversal | bullish reversal | 5 | low-high | 62 | 180 | 120 | 1,716 | 0.45 | 0.15 | 0.67 | 0.24 | 3 | 5 | 14.30 | 22.97 | 11.54 | https://analyzingalpha.com/morning-star-candlestick-pattern |

| 13,025 | crypto | downtrend | downside_gap_three_methods | 3 | bearish continuation | bullish mean reversion | 5 | atr-pattern_low | 87 | 306 | 83 | 2,054 | 0.95 | 0.32 | 0.27 | 0.33 | 2 | 3 | 24.75 | 40.52 | 17.14 | https://analyzingalpha.com/downside-gap-three-methods-candlestick-pattern |

| 13,035 | stock | downtrend | downside_gap_three_methods | 3 | bearish continuation | bullish mean reversion | 5 | atr-pattern_low | 3,631 | 22,691 | 6,234 | 110,680 | 0.37 | 0.12 | 0.27 | 0.23 | 3 | 8 | 17.75 | 35.15 | 12.65 | https://analyzingalpha.com/downside-gap-three-methods-candlestick-pattern |

| 13,055 | crypto | none | bearish_short_line | 1 | indecision | bullish | 5 | low-close | 253 | 24,558 | 23,074 | 37,109 | 0.46 | 0.46 | 0.94 | 0.24 | 5 | 30 | 1.61 | 1.94 | 1.50 | https://analyzingalpha.com/bearish-short-line-candlestick-pattern |

| 13,060 | forex | none | bearish_short_line | 1 | indecision | bullish | 5 | low-close | 1,269 | 276,065 | 256,993 | 338,025 | 0.48 | 0.48 | 0.93 | 0.25 | 32 | 204 | 1.32 | 1.43 | 1.28 | https://analyzingalpha.com/bearish-short-line-candlestick-pattern |

| 13,065 | stock | none | bearish_short_line | 1 | indecision | bullish | 5 | low-close | 6,326 | 1,035,656 | 952,151 | 1,430,453 | 0.34 | 0.34 | 0.92 | 0.22 | 7 | 34 | 1.50 | 1.98 | 1.36 | https://analyzingalpha.com/bearish-short-line-candlestick-pattern |

| 13,090 | crypto | none | bullish_marubozu | 1 | bullish | bearish | 5 | high-close | 225 | 10,126 | 9,120 | 10,639 | 1.60 | 1.60 | 0.90 | 0.43 | 57 | 28 | 1.17 | 1.17 | 1.16 | https://analyzingalpha.com/bullish-marubozu-candlestick-pattern |

| 13,095 | forex | none | bullish_marubozu | 1 | bullish | bearish | 5 | high-close | 1,259 | 222,286 | 179,751 | 208,851 | 2.51 | 2.51 | 0.81 | 0.59 | 486 | 36 | 1.16 | 1.13 | 1.20 | https://analyzingalpha.com/bullish-marubozu-candlestick-pattern |

| 13,100 | stock | none | bullish_marubozu | 1 | bullish | bearish | 5 | high-close | 6,251 | 561,791 | 507,105 | 670,108 | 0.86 | 0.86 | 0.90 | 0.31 | 282 | 44 | 1.32 | 1.56 | 1.22 | https://analyzingalpha.com/bullish-marubozu-candlestick-pattern |

| 13,110 | crypto | downtrend | bullish_harami | 2 | bullish reversal | bullish mean reversion | 5 | atr-pattern_low | 229 | 2,410 | 1,038 | 20,895 | 0.27 | 0.13 | 0.43 | 0.21 | 3 | 14 | 20.13 | 40.85 | 14.59 | https://analyzingalpha.com/bullish-harami-candlestick-pattern |

| 13,120 | stock | downtrend | bullish_harami | 2 | bullish reversal | bullish mean reversion | 5 | atr-pattern_low | 5,851 | 255,080 | 114,478 | 2,042,596 | 0.42 | 0.21 | 0.45 | 0.24 | 5 | 26 | 17.84 | 33.78 | 12.93 | https://analyzingalpha.com/bullish-harami-candlestick-pattern |

| 13,155 | crypto | uptrend | bearish_tri_star | 3 | bearish reversal | bullish mean reversion | 5 | atr-pattern_low | 4 | 11 | 3 | 58 | 1.00 | 0.33 | 0.27 | 0.33 | 1 | 1 | 19.33 | 48.00 | 5.00 | https://analyzingalpha.com/bearish-tri-star-candlestick-pattern |

| 13,206 | forex | downtrend | three_outside_up | 3 | bullish reversal | bearish mean reversion | 1 | atr-pattern_high | 731 | 8,778 | 5,241 | 23,211 | 0.28 | 0.09 | 0.60 | 0.64 | 17 | 6 | 4.43 | 3.97 | 5.24 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 13,221 | forex | downtrend | morning_star | 3 | bullish reversal | bullish mean reversion | 1 | atr-pattern_low | 506 | 2,169 | 397 | 1,433 | 0.28 | 0.09 | 0.18 | 0.64 | 4 | 3 | 3.61 | 3.51 | 3.79 | https://analyzingalpha.com/morning-star-candlestick-pattern |

| 13,275 | stock | downtrend | bullish_doji_star | 2 | bullish reversal | bullish reversal | 5 | low-close | 5,259 | 104,735 | 95,509 | 409,068 | 0.52 | 0.26 | 0.91 | 0.25 | 8 | 34 | 4.28 | 6.89 | 3.40 | https://analyzingalpha.com/bullish-doji-star-candlestick-pattern |

| 13,319 | stock | downtrend | bearish_three_line_strike | 4 | bearish continuation | bullish mean reversion | 4 | atr-pattern_low | 702 | 1,706 | 290 | 4,533 | 0.49 | 0.12 | 0.17 | 0.30 | 2 | 2 | 15.63 | 25.24 | 11.58 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 13,365 | stock | downtrend | bullish_counterattack | 2 | bullish reversal | bearish continuation | 5 | high-close | 1,534 | 4,964 | 4,385 | 15,420 | 0.62 | 0.31 | 0.88 | 0.27 | 11 | 8 | 3.52 | 4.46 | 3.17 | https://analyzingalpha.com/bullish-counterattack-candlestick-pattern |

| 13,372 | forex | uptrend | upside_gap_three_methods | 3 | bullish continuation | bearish mean reversion | 2 | atr-pattern_high | 469 | 2,696 | 651 | 5,178 | 0.26 | 0.09 | 0.24 | 0.42 | 6 | 5 | 7.95 | 9.39 | 6.90 | https://analyzingalpha.com/upside-gap-three-methods-candlestick-pattern |

| 13,422 | forex | downtrend | downside_tasuki_gap | 3 | bearish continuation | bearish mean reversion | 2 | atr-pattern_high | 28 | 60 | 21 | 194 | 0.57 | 0.19 | 0.35 | 0.52 | 2 | 1 | 9.24 | 13.82 | 4.20 | https://analyzingalpha.com/downside-tasuki-gap-candlestick-pattern |

| 13,460 | crypto | none | long_legged_doji | 1 | indecision | bullish | 5 | low-close | 256 | 23,412 | 21,947 | 89,701 | 0.43 | 0.43 | 0.94 | 0.24 | 10 | 23 | 4.09 | 6.05 | 3.48 | https://analyzingalpha.com/long-legged-doji-candlestick-pattern |

| 13,535 | crypto | none | bearish_high_wave | 1 | indecision | bullish | 5 | atr-pattern_low | 246 | 7,349 | 4,163 | 71,887 | 0.47 | 0.47 | 0.57 | 0.25 | 3 | 16 | 17.27 | 28.81 | 13.52 | https://analyzingalpha.com/bearish-high-wave-candlestick-pattern |

| 13,545 | stock | none | bearish_high_wave | 1 | indecision | bullish | 5 | atr-pattern_low | 5,703 | 505,604 | 291,547 | 4,260,365 | 0.38 | 0.38 | 0.58 | 0.23 | 5 | 30 | 14.61 | 28.11 | 10.60 | https://analyzingalpha.com/bearish-high-wave-candlestick-pattern |

| 13,602 | forex | none | bearish_high_wave | 1 | indecision | bearish | 2 | atr-pattern_high | 1,059 | 123,303 | 67,197 | 643,247 | 0.21 | 0.21 | 0.54 | 0.40 | 75 | 21 | 9.57 | 11.34 | 8.37 | https://analyzingalpha.com/bearish-high-wave-candlestick-pattern |

| 13,770 | forex | uptrend | identical_three_crows | 3 | bearish reversal | bearish mean reversion | 5 | atr-pattern_high | 518 | 6,425 | 548 | 16,484 | 0.47 | 0.16 | 0.09 | 0.25 | 5 | 7 | 30.08 | 57.31 | 21.27 | https://analyzingalpha.com/identical-three-crows-candlestick-pattern |

| 13,774 | stock | uptrend | identical_three_crows | 3 | bearish reversal | bearish mean reversion | 4 | atr-pattern_high | 121 | 237 | 37 | 600 | 1.02 | 0.34 | 0.16 | 0.41 | 2 | 2 | 16.22 | 27.93 | 8.23 | https://analyzingalpha.com/identical-three-crows-candlestick-pattern |

| 13,860 | crypto | uptrend | identical_three_crows | 3 | bearish reversal | bullish mean reversion | 5 | atr-pattern_low | 75 | 185 | 95 | 1,634 | 0.83 | 0.28 | 0.51 | 0.31 | 3 | 3 | 17.20 | 22.41 | 14.91 | https://analyzingalpha.com/identical-three-crows-candlestick-pattern |

| 13,876 | crypto | uptrend | three_black_crows | 4 | bearish reversal | bearish mean reversion | 1 | atr-pattern_high | 1 | 5 | 3 | 10 | 0.34 | 0.08 | 0.60 | 0.67 | 2 | 1 | 3.33 | 4.50 | 1.00 | https://analyzingalpha.com/three-black-crows-candlestick-pattern |

| 13,882 | stock | uptrend | three_black_crows | 4 | bearish reversal | bearish mean reversion | 2 | atr-pattern_high | 87 | 185 | 23 | 131 | 0.31 | 0.08 | 0.12 | 0.44 | 2 | 2 | 5.70 | 7.20 | 4.54 | https://analyzingalpha.com/three-black-crows-candlestick-pattern |

| Market | Required Trend | Traditional Strategy | Strategy | Setup | Trades | Edge |

Market:

Required Trend:

Pattern:

Pattern Bars:

Traditional Strategy:

Strategy:

RR:

Setup:

Tickers:

Signals:

Trades:

Trade Bars:

Edge:

Edge Per Bar:

Confirm %:

Win %:

Cons Wins:

Cons Losses:

Avg. Trade Bars:

Avg. Win Bars:

Avg. Loss Bars:

Details:

To make things easier, I’ve created a table for each market showing the best candlestick patterns sorted by edge with at least 100 trades.

The Best Stock Market Candlestick Patterns

| Id | Market | Required Trend | Pattern | Pattern Bars | Traditional Strategy | Strategy | RR | Setup | Tickers | Signals | Trades | Trade Bars | Edge | Edge Per Bar | Confirm % | Win % | Cons Wins | Cons Losses | Avg. Trade Bars | Avg. Win Bars | Avg. Loss Bars | Details |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 7,375 | stock | downtrend | unique_three_river_bottom | 3 | bullish reversal | bullish mean reversion | 5 | atr-pattern_low | 2,778 | 10,193 | 3,980 | 65,378 | 0.39 | 0.13 | 0.39 | 0.23 | 4 | 6 | 16.43 | 31.69 | 11.82 | https://analyzingalpha.com/unique-three-river-bottom-candlestick-pattern |

| 7,390 | stock | uptrend | bearish_harami | 2 | bearish reversal | bullish mean reversion | 5 | atr-pattern_low | 5,382 | 247,256 | 98,125 | 1,596,838 | 0.40 | 0.20 | 0.40 | 0.23 | 5 | 27 | 16.27 | 30.56 | 11.94 | https://analyzingalpha.com/bearish-harami-candlestick-pattern |

| 7,490 | stock | downtrend | matching_low | 2 | bullish reversal | bullish reversal | 5 | low-close | 5,670 | 154,436 | 142,463 | 458,668 | 0.45 | 0.22 | 0.92 | 0.24 | 8 | 32 | 3.22 | 5.07 | 2.63 | https://analyzingalpha.com/matching-low-candlestick-pattern |

| 7,520 | stock | none | rickshaw_man | 1 | indecision | bullish | 5 | atr-pattern_low | 6,025 | 814,858 | 482,729 | 4,949,451 | 0.34 | 0.34 | 0.59 | 0.22 | 4 | 25 | 10.25 | 19.27 | 7.65 | https://analyzingalpha.com/rickshaw-man-candlestick-pattern |

| 7,680 | stock | downtrend | stick_sandwich | 3 | bullish reversal | bearish continuation | 5 | high-close | 3,042 | 12,308 | 12,111 | 51,432 | 1.38 | 0.46 | 0.98 | 0.40 | 8 | 10 | 4.25 | 4.26 | 4.24 | https://analyzingalpha.com/stick-sandwich-candlestick-pattern |

| 7,777 | stock | none | bearish_kicking | 2 | bearish | bearish | 2 | atr-pattern_high | 176 | 508 | 74 | 719 | 0.54 | 0.27 | 0.15 | 0.51 | 2 | 2 | 9.72 | 10.29 | 9.11 | https://analyzingalpha.com/bearish-kicking-candlestick-pattern |

| 7,795 | stock | downtrend | homing_pigeon | 2 | bullish reversal | bullish mean reversion | 5 | atr-pattern_low | 5,103 | 94,059 | 47,602 | 845,411 | 0.44 | 0.22 | 0.51 | 0.24 | 5 | 20 | 17.76 | 33.41 | 12.84 | https://analyzingalpha.com/homing-pigeon-candlestick-pattern |

| 7,960 | stock | downtrend | thrusting | 2 | bearish continuation | bullish mean reversion | 5 | atr-pattern_low | 4,471 | 50,017 | 20,602 | 416,671 | 0.38 | 0.19 | 0.41 | 0.23 | 5 | 14 | 20.22 | 38.19 | 14.88 | https://analyzingalpha.com/thrusting-candlestick-pattern |