The three outside up is a three-bar bearish reversal Japanese candlestick. Backtests show the pattern leads to bullish movement in the stock and crypto markets and volatility in the forex market.

Traders practicing traditional three outside up trading methods leave significant amounts of capital on the table.

Keep reading if you want to think outside the box and make your trading profits go up by learning what history says about the three outside up pattern.

What Is a Three Outside Up Candlestick Pattern?

The three outside up candlestick pattern is a three-bar bullish reversal pattern.

The pattern’s name comes from its appearance on a candle chart. Three candles, with the middle engulfing the prior and then the last pushing up.

Most traders trade the three outside up as a bullish reversal, but the data shows it’s better to capture the volatility first.

Before we optimize our three outside up entries and exits, let’s learn how to identify this three-bar pattern on our candlestick charts.

How to Identify Three Outside Up Candlestick Patterns

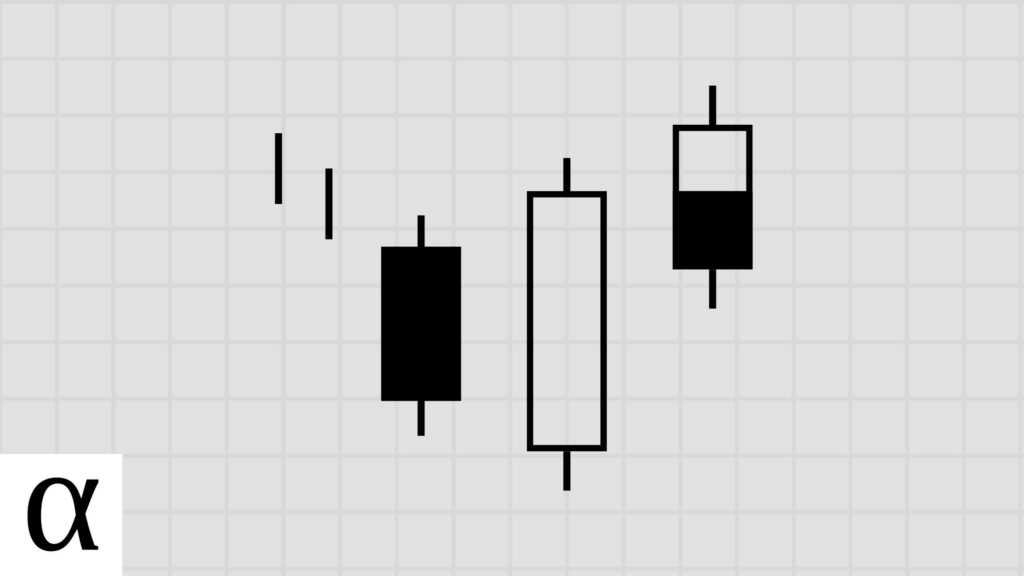

A valid three outside up pattern requires the following:

- The first candlestick is bearish.

- The second candle is bullish and engulfs the first.

- The third candle is bullish and closes higher than the first candle’s open.

- The three outside up must occur during a downtrend.

The three outside up candlestick pattern appeared on the Google (GOOG) daily chart on August 30th, 2017.

The price is in a bearish trend as the final candle’s close is below the fifty-day simple moving average. The first candle is red and bearish. The second is a sizeable bullish candle that engulfs the first, and the final candle closes above the first candle’s open, fulfilling the three outside up pattern requirements.

Now that we can identify this three-candle pattern, let’s learn the best three outside up trading strategies.

How to Trade Three Outside Up Candlestick Patterns

The data shows the best three outside candlestick pattern strategies are a bullish reversal in the crypto market, a bullish reversal in the stock market using a modified entry, and a bullish mean reversion in the forex market.

Let’s understand how traditional traders and data-driven crypto chartists trade this three outside up.

Three Outside Up Bullish Reversal Trade Setup

The pattern is below the fifty-day SMA showing bear confidence and a downtrend.

The first is a bearish candlestick, the second is a long bullish candlestick engulfing the previous, and the third candle is green and closes above the first candle’s open, fulfilling the three outside up pattern requirements.

Traditional and data-driven crypto traders enter long when the price moves above the third candle’s high while placing a stop loss below the second candle’s low.

This played out incredibly well for any Bitcoin traders on July 22nd, 2021.

Stock traders relying on history and not luck do it slightly differently. These data-backed traders enter long when the price pushed above the third candle’s close while keeping the stop loss below the second candle’s low.

The upward bias of the stock market makes early entries profitable by increasing the reward while simultaneously lowering the risk.

The forex market is different, and the best professional traders capture short-term bullish volatility.

Three Outside Up Bullish Mean Reversion Trade Setup

The price is significantly lower than the fifty-day SMA, showing significant bear power. The first candle is bearish, the second is a bullish outside day, and the third closes higher than the previous day, fulfilling the three outside up pattern requirements.

Professional forex traders enter long when the price moves below and back above the pattern’s low, setting a stop loss of one ATR.

Let’s use the Canadian dollar daily chart on November 2nd, 2016, to clarify.

The pattern low occurs on the 1st candle at $0.7448. The price moves below and back above this price on the 16th, causing an entry and a swift, profitable exit two days later.

Talking about profits, what does the data tell us about the best three outside up trading strategies?

Does the Three Outside Up Candlestick Pattern Work? (Backtest Results)

I backtested the three outside up candlestick pattern on the daily timeframe in the crypto, forex, and stock markets using the following rules:

- A close above the 50-day SMA constitutes an uptrend.

- I tested risk-reward ranges from 1 to 5.

- The optimal risk-reward ratio is selected using profit per bar.

- Entry and exits are discussed in the how-to trade section above.

- Confirmation must occur within three days of the pattern signal.

| Id | Pattern | Pattern Bars | Required Trend | Traditional Strategy | Market | Strategy | Setup | RR | Tickers | Signals | Trades | Trade Bars | Edge | Edge Per Bar | Confirm % | Win % | Cons Wins | Cons Losses | Avg. Trade Bars | Avg. Win Bars | Avg. Loss Bars | Details |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 9,206 | three_outside_up | 3 | downtrend | bullish reversal | crypto | bullish mean reversion | atr-pattern_low | 1 | 157 | 999 | 203 | 1,297 | 0.097 | 0.03 | 0.20 | 0.55 | 4 | 3 | 6.39 | 4.05 | 9.21 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 9,207 | three_outside_up | 3 | downtrend | bullish reversal | crypto | bullish mean reversion | atr-pattern_low | 2 | 157 | 995 | 199 | 1,715 | 0.264 | 0.09 | 0.20 | 0.42 | 3 | 6 | 8.62 | 7.38 | 9.52 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 9,208 | three_outside_up | 3 | downtrend | bullish reversal | crypto | bullish mean reversion | atr-pattern_low | 3 | 157 | 985 | 191 | 2,305 | 0.295 | 0.10 | 0.19 | 0.33 | 3 | 6 | 12.07 | 11.19 | 12.49 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 9,209 | three_outside_up | 3 | downtrend | bullish reversal | crypto | bullish mean reversion | atr-pattern_low | 4 | 157 | 983 | 188 | 2,537 | 0.438 | 0.15 | 0.19 | 0.29 | 3 | 6 | 13.49 | 13.54 | 13.48 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 9,210 | three_outside_up | 3 | downtrend | bullish reversal | crypto | bullish mean reversion | atr-pattern_low | 5 | 157 | 979 | 188 | 2,871 | 0.565 | 0.19 | 0.19 | 0.26 | 3 | 6 | 15.27 | 17.53 | 14.47 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 9,211 | three_outside_up | 3 | downtrend | bullish reversal | forex | bullish mean reversion | atr-pattern_low | 1 | 731 | 8,851 | 1,465 | 5,078 | 0.245 | 0.08 | 0.17 | 0.63 | 7 | 5 | 3.47 | 3.57 | 3.29 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 9,212 | three_outside_up | 3 | downtrend | bullish reversal | forex | bullish mean reversion | atr-pattern_low | 2 | 731 | 8,794 | 1,454 | 12,744 | 0.254 | 0.08 | 0.17 | 0.42 | 4 | 5 | 8.76 | 9.73 | 8.07 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 9,213 | three_outside_up | 3 | downtrend | bullish reversal | forex | bullish mean reversion | atr-pattern_low | 3 | 731 | 8,765 | 1,448 | 18,936 | 0.252 | 0.08 | 0.17 | 0.31 | 4 | 7 | 13.08 | 17.97 | 10.84 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 9,214 | three_outside_up | 3 | downtrend | bullish reversal | forex | bullish mean reversion | atr-pattern_low | 4 | 731 | 8,749 | 1,445 | 24,342 | 0.242 | 0.08 | 0.17 | 0.25 | 2 | 7 | 16.85 | 27.35 | 13.39 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 9,215 | three_outside_up | 3 | downtrend | bullish reversal | forex | bullish mean reversion | atr-pattern_low | 5 | 731 | 8,741 | 1,441 | 30,357 | 0.240 | 0.08 | 0.16 | 0.21 | 2 | 7 | 21.07 | 42.52 | 15.50 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 9,216 | three_outside_up | 3 | downtrend | bullish reversal | stock | bullish mean reversion | atr-pattern_low | 1 | 4,824 | 73,348 | 12,832 | 42,401 | 0.180 | 0.06 | 0.17 | 0.59 | 9 | 7 | 3.30 | 3.17 | 3.49 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 9,217 | three_outside_up | 3 | downtrend | bullish reversal | stock | bullish mean reversion | atr-pattern_low | 2 | 4,824 | 72,786 | 12,690 | 81,613 | 0.252 | 0.08 | 0.17 | 0.42 | 9 | 9 | 6.43 | 7.51 | 5.66 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 9,218 | three_outside_up | 3 | downtrend | bullish reversal | stock | bullish mean reversion | atr-pattern_low | 3 | 4,824 | 72,454 | 12,608 | 121,001 | 0.289 | 0.10 | 0.17 | 0.32 | 6 | 11 | 9.60 | 13.30 | 7.83 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 9,219 | three_outside_up | 3 | downtrend | bullish reversal | stock | bullish mean reversion | atr-pattern_low | 4 | 4,824 | 72,282 | 12,555 | 160,844 | 0.316 | 0.11 | 0.17 | 0.26 | 5 | 11 | 12.81 | 20.30 | 10.12 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 9,220 | three_outside_up | 3 | downtrend | bullish reversal | stock | bullish mean reversion | atr-pattern_low | 5 | 4,824 | 72,179 | 12,528 | 197,479 | 0.340 | 0.11 | 0.17 | 0.22 | 5 | 11 | 15.76 | 28.79 | 12.00 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 11,146 | three_outside_up | 3 | downtrend | bullish reversal | crypto | bullish reversal | low-close | 1 | 157 | 970 | 937 | 5,905 | 0.023 | 0.01 | 0.97 | 0.51 | 5 | 3 | 6.30 | 5.53 | 7.11 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 11,147 | three_outside_up | 3 | downtrend | bullish reversal | crypto | bullish reversal | low-close | 2 | 157 | 947 | 915 | 9,007 | 0.198 | 0.07 | 0.97 | 0.40 | 4 | 9 | 9.84 | 11.33 | 8.85 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 11,148 | three_outside_up | 3 | downtrend | bullish reversal | crypto | bullish reversal | low-close | 3 | 157 | 930 | 894 | 11,570 | 0.320 | 0.11 | 0.96 | 0.33 | 4 | 9 | 12.94 | 18.97 | 9.97 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 11,149 | three_outside_up | 3 | downtrend | bullish reversal | crypto | bullish reversal | low-close | 4 | 157 | 924 | 885 | 13,326 | 0.396 | 0.13 | 0.96 | 0.28 | 4 | 17 | 15.06 | 24.40 | 11.44 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 11,150 | three_outside_up | 3 | downtrend | bullish reversal | crypto | bullish reversal | low-close | 5 | 157 | 916 | 875 | 15,351 | 0.505 | 0.17 | 0.96 | 0.25 | 4 | 17 | 17.54 | 32.97 | 12.36 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 11,151 | three_outside_up | 3 | downtrend | bullish reversal | forex | bullish reversal | low-close | 1 | 731 | 8,619 | 8,446 | 76,242 | -0.062 | -0.02 | 0.98 | 0.47 | 9 | 12 | 9.03 | 9.45 | 8.66 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 11,152 | three_outside_up | 3 | downtrend | bullish reversal | forex | bullish reversal | low-close | 2 | 731 | 8,433 | 8,237 | 142,435 | -0.074 | -0.02 | 0.98 | 0.31 | 6 | 20 | 17.29 | 24.34 | 14.16 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 11,153 | three_outside_up | 3 | downtrend | bullish reversal | forex | bullish reversal | low-close | 3 | 731 | 8,259 | 8,035 | 206,805 | -0.089 | -0.03 | 0.97 | 0.23 | 4 | 20 | 25.74 | 43.95 | 20.38 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 11,154 | three_outside_up | 3 | downtrend | bullish reversal | forex | bullish reversal | low-close | 4 | 731 | 8,098 | 7,839 | 258,626 | -0.088 | -0.03 | 0.97 | 0.18 | 4 | 20 | 32.99 | 68.97 | 24.96 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 11,155 | three_outside_up | 3 | downtrend | bullish reversal | forex | bullish reversal | low-close | 5 | 731 | 7,968 | 7,688 | 308,119 | -0.090 | -0.03 | 0.96 | 0.15 | 4 | 20 | 40.08 | 95.83 | 30.12 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 11,156 | three_outside_up | 3 | downtrend | bullish reversal | stock | bullish reversal | low-close | 1 | 4,824 | 71,417 | 64,970 | 509,199 | 0.076 | 0.03 | 0.91 | 0.54 | 11 | 9 | 7.84 | 7.64 | 8.07 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 11,157 | three_outside_up | 3 | downtrend | bullish reversal | stock | bullish reversal | low-close | 2 | 4,824 | 69,472 | 63,062 | 913,042 | 0.150 | 0.05 | 0.91 | 0.39 | 8 | 19 | 14.48 | 18.18 | 12.16 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 11,158 | three_outside_up | 3 | downtrend | bullish reversal | stock | bullish reversal | low-close | 3 | 4,824 | 68,067 | 61,702 | 1,304,501 | 0.234 | 0.08 | 0.91 | 0.31 | 7 | 22 | 21.14 | 32.93 | 15.89 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 11,159 | three_outside_up | 3 | downtrend | bullish reversal | stock | bullish reversal | low-close | 4 | 4,824 | 66,813 | 60,466 | 1,679,646 | 0.296 | 0.10 | 0.91 | 0.26 | 6 | 23 | 27.78 | 51.37 | 19.54 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 11,160 | three_outside_up | 3 | downtrend | bullish reversal | stock | bullish reversal | low-close | 5 | 4,824 | 65,517 | 59,210 | 2,014,139 | 0.345 | 0.12 | 0.90 | 0.23 | 5 | 23 | 34.02 | 71.71 | 23.06 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 11,786 | three_outside_up | 3 | downtrend | bullish reversal | crypto | bullish reversal | low-high | 1 | 157 | 976 | 654 | 5,144 | 0.161 | 0.05 | 0.67 | 0.58 | 6 | 4 | 7.87 | 6.28 | 10.07 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 11,787 | three_outside_up | 3 | downtrend | bullish reversal | crypto | bullish reversal | low-high | 2 | 157 | 957 | 637 | 8,110 | 0.342 | 0.11 | 0.67 | 0.45 | 5 | 9 | 12.73 | 14.10 | 11.63 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 11,788 | three_outside_up | 3 | downtrend | bullish reversal | crypto | bullish reversal | low-high | 3 | 157 | 945 | 622 | 10,439 | 0.455 | 0.15 | 0.66 | 0.37 | 4 | 9 | 16.78 | 21.51 | 14.07 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 11,789 | three_outside_up | 3 | downtrend | bullish reversal | crypto | bullish reversal | low-high | 4 | 157 | 935 | 612 | 12,599 | 0.650 | 0.22 | 0.65 | 0.33 | 4 | 9 | 20.59 | 30.63 | 15.64 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 11,790 | three_outside_up | 3 | downtrend | bullish reversal | crypto | bullish reversal | low-high | 5 | 157 | 924 | 602 | 14,488 | 0.780 | 0.26 | 0.65 | 0.30 | 4 | 9 | 24.07 | 41.24 | 16.86 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 11,791 | three_outside_up | 3 | downtrend | bullish reversal | forex | bullish reversal | low-high | 1 | 731 | 8,614 | 6,094 | 75,615 | -0.097 | -0.03 | 0.71 | 0.45 | 7 | 9 | 12.41 | 13.50 | 11.50 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 11,792 | three_outside_up | 3 | downtrend | bullish reversal | forex | bullish reversal | low-high | 2 | 731 | 8,454 | 5,938 | 142,102 | -0.100 | -0.03 | 0.70 | 0.30 | 5 | 14 | 23.93 | 35.57 | 18.95 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 11,793 | three_outside_up | 3 | downtrend | bullish reversal | forex | bullish reversal | low-high | 3 | 731 | 8,285 | 5,774 | 208,365 | -0.120 | -0.04 | 0.70 | 0.22 | 5 | 18 | 36.09 | 64.13 | 28.18 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 11,794 | three_outside_up | 3 | downtrend | bullish reversal | forex | bullish reversal | low-high | 4 | 731 | 8,105 | 5,619 | 258,326 | -0.134 | -0.04 | 0.69 | 0.17 | 3 | 18 | 45.97 | 94.30 | 35.83 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 11,795 | three_outside_up | 3 | downtrend | bullish reversal | forex | bullish reversal | low-high | 5 | 731 | 7,961 | 5,495 | 301,974 | -0.145 | -0.05 | 0.69 | 0.14 | 3 | 18 | 54.95 | 134.65 | 41.65 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 11,796 | three_outside_up | 3 | downtrend | bullish reversal | stock | bullish reversal | low-high | 1 | 4,824 | 71,154 | 52,836 | 514,663 | 0.062 | 0.02 | 0.74 | 0.53 | 11 | 11 | 9.74 | 9.57 | 9.94 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 11,797 | three_outside_up | 3 | downtrend | bullish reversal | stock | bullish reversal | low-high | 2 | 4,824 | 69,505 | 51,526 | 932,568 | 0.142 | 0.05 | 0.74 | 0.38 | 8 | 15 | 18.10 | 23.33 | 14.88 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 11,798 | three_outside_up | 3 | downtrend | bullish reversal | stock | bullish reversal | low-high | 3 | 4,824 | 68,095 | 50,397 | 1,348,279 | 0.209 | 0.07 | 0.74 | 0.30 | 8 | 17 | 26.75 | 42.50 | 19.89 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 11,799 | three_outside_up | 3 | downtrend | bullish reversal | stock | bullish reversal | low-high | 4 | 4,824 | 66,784 | 49,319 | 1,725,896 | 0.280 | 0.09 | 0.74 | 0.26 | 7 | 19 | 34.99 | 66.41 | 24.21 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 11,800 | three_outside_up | 3 | downtrend | bullish reversal | stock | bullish reversal | low-high | 5 | 4,824 | 65,454 | 48,260 | 2,052,815 | 0.335 | 0.11 | 0.74 | 0.22 | 6 | 21 | 42.54 | 91.82 | 28.40 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 13,136 | three_outside_up | 3 | downtrend | bullish reversal | crypto | bearish continuation | high-close | 1 | 157 | 1,019 | 1,006 | 1,611 | -0.737 | -0.25 | 0.99 | 0.13 | 5 | 16 | 1.60 | 2.25 | 1.50 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 13,137 | three_outside_up | 3 | downtrend | bullish reversal | crypto | bearish continuation | high-close | 2 | 157 | 1,016 | 1,003 | 1,957 | -0.670 | -0.22 | 0.99 | 0.11 | 5 | 16 | 1.95 | 3.35 | 1.78 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 13,138 | three_outside_up | 3 | downtrend | bullish reversal | crypto | bearish continuation | high-close | 3 | 157 | 1,014 | 1,001 | 2,160 | -0.634 | -0.21 | 0.99 | 0.09 | 5 | 17 | 2.16 | 4.48 | 1.92 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 13,139 | three_outside_up | 3 | downtrend | bullish reversal | crypto | bearish continuation | high-close | 4 | 157 | 1,009 | 996 | 2,619 | -0.596 | -0.20 | 0.99 | 0.08 | 4 | 17 | 2.63 | 9.36 | 2.03 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 13,140 | three_outside_up | 3 | downtrend | bullish reversal | crypto | bearish continuation | high-close | 5 | 157 | 1,008 | 995 | 3,201 | -0.585 | -0.20 | 0.99 | 0.07 | 3 | 19 | 3.22 | 14.09 | 2.41 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 13,141 | three_outside_up | 3 | downtrend | bullish reversal | forex | bearish continuation | high-close | 1 | 731 | 8,892 | 8,789 | 10,189 | -0.780 | -0.26 | 0.99 | 0.11 | 7 | 25 | 1.16 | 1.68 | 1.09 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 13,142 | three_outside_up | 3 | downtrend | bullish reversal | forex | bearish continuation | high-close | 2 | 731 | 8,890 | 8,787 | 11,518 | -0.728 | -0.24 | 0.99 | 0.09 | 7 | 30 | 1.31 | 2.41 | 1.20 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 13,143 | three_outside_up | 3 | downtrend | bullish reversal | forex | bearish continuation | high-close | 3 | 731 | 8,884 | 8,781 | 13,160 | -0.692 | -0.23 | 0.99 | 0.08 | 6 | 31 | 1.50 | 4.12 | 1.28 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 13,144 | three_outside_up | 3 | downtrend | bullish reversal | forex | bearish continuation | high-close | 4 | 731 | 8,873 | 8,770 | 14,618 | -0.684 | -0.23 | 0.99 | 0.06 | 6 | 33 | 1.67 | 4.43 | 1.48 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 13,145 | three_outside_up | 3 | downtrend | bullish reversal | forex | bearish continuation | high-close | 5 | 731 | 8,870 | 8,767 | 15,720 | -0.650 | -0.22 | 0.99 | 0.06 | 6 | 33 | 1.79 | 5.26 | 1.58 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 13,146 | three_outside_up | 3 | downtrend | bullish reversal | stock | bearish continuation | high-close | 1 | 4,824 | 74,600 | 68,613 | 77,651 | -0.776 | -0.26 | 0.92 | 0.11 | 10 | 49 | 1.13 | 1.52 | 1.08 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 13,147 | three_outside_up | 3 | downtrend | bullish reversal | stock | bearish continuation | high-close | 2 | 4,824 | 74,533 | 68,541 | 85,670 | -0.700 | -0.23 | 0.92 | 0.10 | 9 | 49 | 1.25 | 2.02 | 1.16 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 13,148 | three_outside_up | 3 | downtrend | bullish reversal | stock | bearish continuation | high-close | 3 | 4,824 | 74,483 | 68,481 | 93,278 | -0.643 | -0.21 | 0.92 | 0.09 | 8 | 49 | 1.36 | 2.58 | 1.24 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 13,149 | three_outside_up | 3 | downtrend | bullish reversal | stock | bearish continuation | high-close | 4 | 4,824 | 74,419 | 68,420 | 101,844 | -0.600 | -0.20 | 0.92 | 0.08 | 7 | 49 | 1.49 | 3.07 | 1.35 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 13,150 | three_outside_up | 3 | downtrend | bullish reversal | stock | bearish continuation | high-close | 5 | 4,824 | 74,371 | 68,374 | 109,416 | -0.565 | -0.19 | 0.92 | 0.07 | 7 | 49 | 1.60 | 3.56 | 1.45 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 13,201 | three_outside_up | 3 | downtrend | bullish reversal | crypto | bearish mean reversion | atr-pattern_high | 1 | 157 | 986 | 518 | 2,528 | 0.057 | 0.02 | 0.53 | 0.53 | 8 | 3 | 4.88 | 5.58 | 4.10 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 13,202 | three_outside_up | 3 | downtrend | bullish reversal | crypto | bearish mean reversion | atr-pattern_high | 2 | 157 | 952 | 494 | 5,199 | -0.048 | -0.02 | 0.52 | 0.32 | 6 | 7 | 10.52 | 13.90 | 8.97 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 13,203 | three_outside_up | 3 | downtrend | bullish reversal | crypto | bearish mean reversion | atr-pattern_high | 3 | 157 | 931 | 479 | 7,687 | -0.046 | -0.02 | 0.51 | 0.24 | 5 | 8 | 16.05 | 29.43 | 11.87 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 13,204 | three_outside_up | 3 | downtrend | bullish reversal | crypto | bearish mean reversion | atr-pattern_high | 4 | 157 | 909 | 465 | 8,469 | -0.054 | -0.02 | 0.51 | 0.19 | 4 | 8 | 18.21 | 34.75 | 14.35 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 13,205 | three_outside_up | 3 | downtrend | bullish reversal | crypto | bearish mean reversion | atr-pattern_high | 5 | 157 | 880 | 447 | 10,785 | -0.110 | -0.04 | 0.51 | 0.15 | 4 | 9 | 24.13 | 44.03 | 20.68 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 13,206 | three_outside_up | 3 | downtrend | bullish reversal | forex | bearish mean reversion | atr-pattern_high | 1 | 731 | 8,778 | 5,241 | 23,211 | 0.280 | 0.09 | 0.60 | 0.64 | 17 | 6 | 4.43 | 3.97 | 5.24 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 13,207 | three_outside_up | 3 | downtrend | bullish reversal | forex | bearish mean reversion | atr-pattern_high | 2 | 731 | 8,616 | 5,132 | 51,657 | 0.252 | 0.08 | 0.60 | 0.42 | 11 | 12 | 10.07 | 11.14 | 9.30 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 13,208 | three_outside_up | 3 | downtrend | bullish reversal | forex | bearish mean reversion | atr-pattern_high | 3 | 731 | 8,455 | 5,024 | 79,316 | 0.234 | 0.08 | 0.59 | 0.31 | 9 | 12 | 15.79 | 21.85 | 13.09 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 13,209 | three_outside_up | 3 | downtrend | bullish reversal | forex | bearish mean reversion | atr-pattern_high | 4 | 731 | 8,291 | 4,905 | 105,358 | 0.180 | 0.06 | 0.59 | 0.24 | 8 | 13 | 21.48 | 37.40 | 16.59 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 13,210 | three_outside_up | 3 | downtrend | bullish reversal | forex | bearish mean reversion | atr-pattern_high | 5 | 731 | 8,156 | 4,819 | 125,314 | 0.160 | 0.05 | 0.59 | 0.19 | 7 | 15 | 26.00 | 53.68 | 19.34 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 13,211 | three_outside_up | 3 | downtrend | bullish reversal | stock | bearish mean reversion | atr-pattern_high | 1 | 4,824 | 73,079 | 43,890 | 168,930 | 0.156 | 0.05 | 0.60 | 0.58 | 22 | 11 | 3.85 | 3.63 | 4.15 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 13,212 | three_outside_up | 3 | downtrend | bullish reversal | stock | bearish mean reversion | atr-pattern_high | 2 | 4,824 | 71,630 | 42,913 | 327,619 | 0.114 | 0.04 | 0.60 | 0.37 | 17 | 13 | 7.63 | 9.06 | 6.79 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 13,213 | three_outside_up | 3 | downtrend | bullish reversal | stock | bearish mean reversion | atr-pattern_high | 3 | 4,824 | 70,238 | 41,968 | 470,293 | 0.108 | 0.04 | 0.60 | 0.28 | 14 | 19 | 11.21 | 16.40 | 9.23 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 13,214 | three_outside_up | 3 | downtrend | bullish reversal | stock | bearish mean reversion | atr-pattern_high | 4 | 4,824 | 68,968 | 41,149 | 610,809 | 0.084 | 0.03 | 0.60 | 0.22 | 12 | 20 | 14.84 | 24.89 | 12.08 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 13,215 | three_outside_up | 3 | downtrend | bullish reversal | stock | bearish mean reversion | atr-pattern_high | 5 | 4,824 | 67,749 | 40,341 | 754,623 | 0.040 | 0.01 | 0.60 | 0.17 | 10 | 21 | 18.71 | 35.24 | 15.22 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 13,676 | three_outside_up | 3 | downtrend | bullish reversal | crypto | bearish continuation | high-low | 1 | 157 | 1,012 | 588 | 1,415 | -0.657 | -0.22 | 0.58 | 0.17 | 4 | 10 | 2.41 | 4.32 | 2.00 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 13,677 | three_outside_up | 3 | downtrend | bullish reversal | crypto | bearish continuation | high-low | 2 | 157 | 1,004 | 584 | 1,955 | -0.616 | -0.21 | 0.58 | 0.13 | 3 | 11 | 3.35 | 7.61 | 2.73 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 13,678 | three_outside_up | 3 | downtrend | bullish reversal | crypto | bearish continuation | high-low | 3 | 157 | 998 | 581 | 2,631 | -0.631 | -0.21 | 0.58 | 0.09 | 3 | 12 | 4.53 | 14.56 | 3.50 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 13,679 | three_outside_up | 3 | downtrend | bullish reversal | crypto | bearish continuation | high-low | 4 | 157 | 988 | 576 | 3,151 | -0.692 | -0.23 | 0.58 | 0.06 | 3 | 13 | 5.47 | 26.75 | 4.05 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 13,680 | three_outside_up | 3 | downtrend | bullish reversal | crypto | bearish continuation | high-low | 5 | 157 | 980 | 570 | 4,167 | -0.720 | -0.24 | 0.58 | 0.05 | 3 | 13 | 7.31 | 34.69 | 6.00 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 13,681 | three_outside_up | 3 | downtrend | bullish reversal | forex | bearish continuation | high-low | 1 | 731 | 8,871 | 4,117 | 8,166 | -0.703 | -0.23 | 0.46 | 0.15 | 6 | 15 | 1.98 | 4.09 | 1.62 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 13,682 | three_outside_up | 3 | downtrend | bullish reversal | forex | bearish continuation | high-low | 2 | 731 | 8,851 | 4,105 | 11,575 | -0.706 | -0.24 | 0.46 | 0.10 | 6 | 17 | 2.82 | 8.02 | 2.26 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 13,683 | three_outside_up | 3 | downtrend | bullish reversal | forex | bearish continuation | high-low | 3 | 731 | 8,841 | 4,102 | 14,064 | -0.717 | -0.24 | 0.46 | 0.07 | 6 | 17 | 3.43 | 13.47 | 2.66 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 13,684 | three_outside_up | 3 | downtrend | bullish reversal | forex | bearish continuation | high-low | 4 | 731 | 8,820 | 4,091 | 16,863 | -0.734 | -0.24 | 0.46 | 0.05 | 5 | 17 | 4.12 | 21.22 | 3.15 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 13,685 | three_outside_up | 3 | downtrend | bullish reversal | forex | bearish continuation | high-low | 5 | 731 | 8,807 | 4,082 | 18,989 | -0.745 | -0.25 | 0.46 | 0.04 | 4 | 17 | 4.65 | 29.59 | 3.52 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 13,686 | three_outside_up | 3 | downtrend | bullish reversal | stock | bearish continuation | high-low | 1 | 4,824 | 73,975 | 40,849 | 63,318 | -0.637 | -0.21 | 0.55 | 0.18 | 9 | 22 | 1.55 | 2.46 | 1.35 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 13,687 | three_outside_up | 3 | downtrend | bullish reversal | stock | bearish continuation | high-low | 2 | 4,824 | 73,777 | 40,716 | 84,313 | -0.602 | -0.20 | 0.55 | 0.13 | 8 | 23 | 2.07 | 4.21 | 1.74 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 13,688 | three_outside_up | 3 | downtrend | bullish reversal | stock | bearish continuation | high-low | 3 | 4,824 | 73,595 | 40,596 | 106,291 | -0.569 | -0.19 | 0.55 | 0.11 | 8 | 29 | 2.62 | 6.49 | 2.15 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 13,689 | three_outside_up | 3 | downtrend | bullish reversal | stock | bearish continuation | high-low | 4 | 4,824 | 73,392 | 40,475 | 125,178 | -0.550 | -0.18 | 0.55 | 0.09 | 7 | 29 | 3.09 | 9.03 | 2.51 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| 13,690 | three_outside_up | 3 | downtrend | bullish reversal | stock | bearish continuation | high-low | 5 | 4,824 | 73,189 | 40,340 | 145,627 | -0.540 | -0.18 | 0.55 | 0.08 | 7 | 29 | 3.61 | 12.07 | 2.92 | https://analyzingalpha.com/three-outside-up-candlestick-pattern |

| Market | Strategy | Setup | Trades | Edge |

Pattern:

Pattern Bars:

Required Trend:

Traditional Strategy:

Market:

Strategy:

Setup:

RR:

Tickers:

Signals:

Trades:

Trade Bars:

Edge:

Edge Per Bar:

Confirm %:

Win %:

Cons Wins:

Cons Losses:

Avg. Trade Bars:

Avg. Win Bars:

Avg. Loss Bars:

Similar Candlestick Patterns

Traders confuse the three outside up patterns with other candlestick patterns.

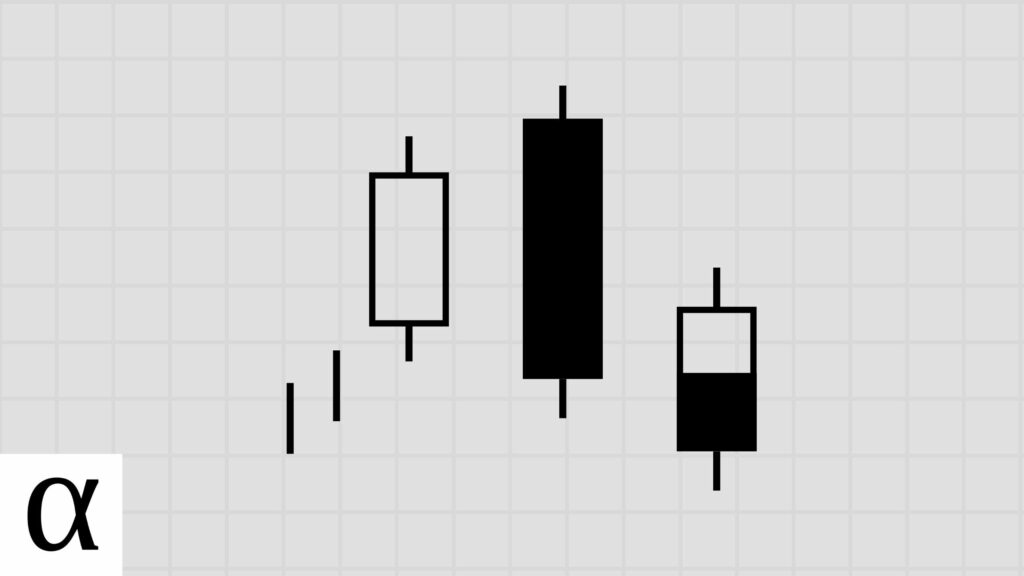

Three Outside Down vs. Three Outside Up

The three outside down candlestick pattern is a three-bar bearish reversal pattern and is the opposite of its bullish sibling. There’s a bullish candle, a large-bodied bearish candle engulfing the first, followed by a bearish candle that closes below the engulfing candle’s close. In contrast, the three outside up have a bearish candle, a significantly bullish outside day, followed by a bullish candle closing higher than the previous.

Three Inside Up vs. Three Outside Up

The three inside up candlestick pattern in a three-bar bullish reversal pattern similar to the three outside up. The pattern consists of a large bearish candle, a small candle engulfed by the first, and a third candle closing higher than the first candle’s open.

The middle candle is engulfed in the inside up and is engulfing in the outside up.

The Bottom Line

The three outside up candlestick pattern is a three-bar bullish reversal pattern where traditional trading lore works. Crypto traders should trade the three outside up as intended, stock traders should enter early to take advantage of the market’s upward bias, and forex traders should capture a quick profit from likely volatility. This is one of the many candlestick patterns every trader should know.