The three white soldiers, also known as the three advancing white soldiers, is a three-bar bullish reversal Japanese candlestick that’s best traded as intended in the stock market and using a bullish mean reversion strategy in forex, according to backtesting spanning multiple decades.

Data-driven crypto traders should pass on this pattern as there are not enough daily data to determine the best three white soldiers trading strategy with any statistical significance.

Unlike cryptocurrency traders, stock and forex can use the data to outperform traditional trading methods significantly.

If you want to arm yourself with the best three white soldiers’ trading strategies, keep reading.

What Are Three White Soldiers Candlestick Patterns?

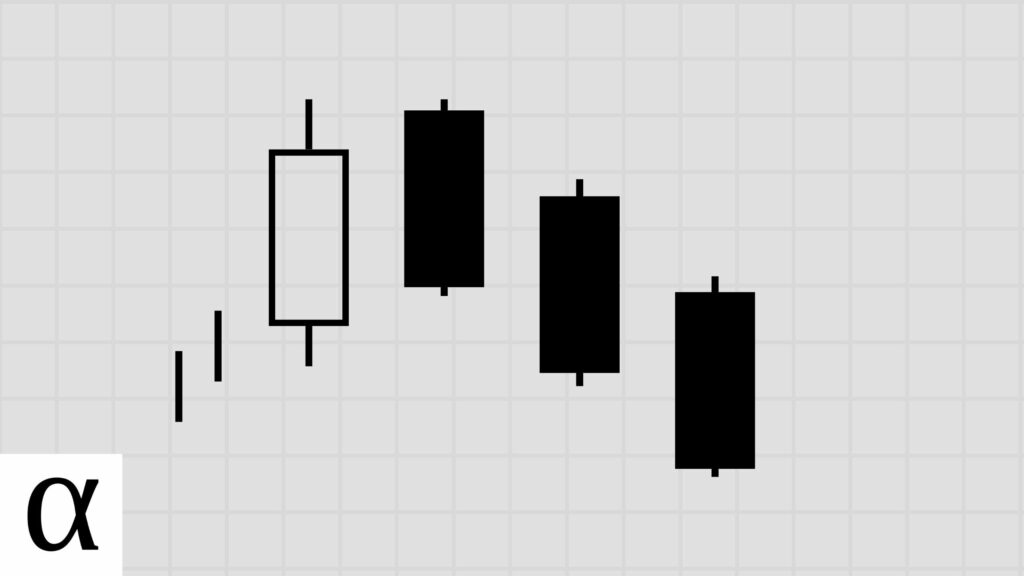

The three white soldiers pattern is a bullish reversal pattern that signals a possible reversal.

The name comes from three white candles, or soldiers, pushing against the downtrend.

The name does help you remember this pattern’s purpose and the likely results. But before we get into optimizing these three white candles, let’s learn how to identify the three white soldiers.

How to Identify Three White Soldiers Candlestick Patterns

A valid three white soldiers pattern requires:

- Three bullish medium to large candlesticks with consecutively higher closes of relatively similar size.

- Each candle must open within or near the previous candle’s real body and close at or near the high of the day.

- The three white solders must occur during a downtrend.

We can see the three white soldiers pattern on the Agilysis (AGYS) daily price chart on July 8th, 2013.

The price is in a downtrend as it’s below the fifty-day SMA. We see three consecutive bullish candlesticks. Each candle opens within or near the previous candle’s real body, with the close very close to the high of the day, fulfilling the three white soldiers’ pattern requirements.

Now that we’re past the identification boot camp, let’s learn how to best use these three candle sticks at war.

How to Trade the Three White Soldiers Candlestick Pattern

The three white soldiers candlestick pattern should be traded as a bullish reversal and a bullish mean reversion strategy in the stock and forex markets, respectively, expecting a sizable move according to the 21-year backtest.

Three White Soldiers Bullish Reversal Trade Setup

Price is in a downtrend as the last three white solder’s candle close is below the fifty-day simple moving average. We then see the prevailing downtrend weaken with the three consecutive bullish candlesticks that open in or near the last candle’s real body and close near the high.

With the three white soldiers pattern identified, how do we trade these three candlesticks?

Professional stock traders go long on a break of the high of the third candlestick with a stop loss set below the first candlestick.

Let’s use the Autodesk chart on October 6th, 2011, to model this in our mind.

The high on the third day is $28.01, with a low on the first day of $24.63. The price moves above the high the next day, and the bulls come out to play.

Forex traders that rely on data need to do it differently.

Three White Soldiers Bullish Mean Reversion Trade Setup

The price is significantly below the fifty-day simple moving average, giving us a solid short-term bear market. Three consecutive medium-to-large bullish candles are opening in or near the last candle’s range and closing higher than the previous, fulfilling our three white soldier’s requirements.

With the pattern identified, fantastic forex traders enter long when the price moves below and above the pattern’s low, setting a stop loss of one ATR.

Let’s use the PhenixfFIX (PFX) chart on February 27nd, 2018, to clarify.

The pattern low occurred on the first candle at $230.80. The price went below and back above the low on March 2nd, with a data-driven trader taking commanding profits a few days later.

Let’s find out what the data says about the best three white soldiers trading patterns.

Does the Three White Soldiers Candlestick Pattern Work? (Backtest Results)

Using the following rules, I backtested three white soldiers candlestick patterns on the daily timeframe in the crypto, forex, and stock markets.

- A close above the 50-day SMA constitutes an uptrend.

- I tested risk-reward ranges from 1 to 5.

- The optimal risk-reward ratio is selected using profit per bar.

- Entry and exits are discussed in the trading section above.

- Confirmation must occur within three days of the pattern signal.

| Id | Pattern | Pattern Bars | Required Trend | Traditional Strategy | Market | Strategy | Setup | RR | Tickers | Signals | Trades | Trade Bars | Edge | Edge Per Bar | Confirm % | Win % | Cons Wins | Cons Losses | Avg. Trade Bars | Avg. Win Bars | Avg. Loss Bars | Details |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 9,356 | three_white_soldiers | 3 | downtrend | bullish reversal | crypto | bullish reversal | low-close | 1 | 18 | 40 | 34 | 255 | -0.059 | -0.02 | 0.85 | 0.47 | 2 | 3 | 7.50 | 4.81 | 9.89 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern |

| 9,357 | three_white_soldiers | 3 | downtrend | bullish reversal | crypto | bullish reversal | low-close | 2 | 18 | 39 | 33 | 370 | 0.088 | 0.03 | 0.85 | 0.36 | 2 | 4 | 11.21 | 9.50 | 12.19 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern |

| 9,358 | three_white_soldiers | 3 | downtrend | bullish reversal | crypto | bullish reversal | low-close | 3 | 18 | 38 | 32 | 407 | 0.123 | 0.04 | 0.84 | 0.28 | 2 | 4 | 12.72 | 10.67 | 13.52 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern |

| 9,359 | three_white_soldiers | 3 | downtrend | bullish reversal | crypto | bullish reversal | low-close | 4 | 18 | 38 | 32 | 457 | 0.096 | 0.03 | 0.84 | 0.22 | 2 | 4 | 14.28 | 10.57 | 15.32 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern |

| 9,360 | three_white_soldiers | 3 | downtrend | bullish reversal | crypto | bullish reversal | low-close | 5 | 18 | 38 | 32 | 469 | 0.315 | 0.11 | 0.84 | 0.22 | 2 | 4 | 14.66 | 12.29 | 15.32 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern |

| 9,361 | three_white_soldiers | 3 | downtrend | bullish reversal | forex | bullish reversal | low-close | 1 | 292 | 2,003 | 1,053 | 12,445 | 0.245 | 0.08 | 0.53 | 0.63 | 10 | 5 | 11.82 | 9.48 | 15.71 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern |

| 9,362 | three_white_soldiers | 3 | downtrend | bullish reversal | forex | bullish reversal | low-close | 2 | 292 | 1,939 | 1,021 | 21,960 | 0.430 | 0.14 | 0.53 | 0.48 | 6 | 10 | 21.51 | 19.49 | 23.33 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern |

| 9,363 | three_white_soldiers | 3 | downtrend | bullish reversal | forex | bullish reversal | low-close | 3 | 292 | 1,920 | 1,003 | 30,153 | 0.606 | 0.20 | 0.52 | 0.40 | 5 | 9 | 30.06 | 30.94 | 29.48 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern |

| 9,364 | three_white_soldiers | 3 | downtrend | bullish reversal | forex | bullish reversal | low-close | 4 | 292 | 1,893 | 991 | 41,493 | 0.788 | 0.26 | 0.52 | 0.36 | 4 | 9 | 41.87 | 57.89 | 32.97 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern |

| 9,365 | three_white_soldiers | 3 | downtrend | bullish reversal | forex | bullish reversal | low-close | 5 | 292 | 1,861 | 977 | 54,685 | 0.875 | 0.29 | 0.52 | 0.31 | 4 | 9 | 55.97 | 73.66 | 47.91 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern |

| 9,366 | three_white_soldiers | 3 | downtrend | bullish reversal | stock | bullish reversal | low-close | 1 | 436 | 945 | 804 | 12,345 | 0.162 | 0.05 | 0.85 | 0.58 | 5 | 3 | 15.35 | 15.88 | 14.62 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern |

| 9,367 | three_white_soldiers | 3 | downtrend | bullish reversal | stock | bullish reversal | low-close | 2 | 436 | 936 | 794 | 23,779 | 0.266 | 0.09 | 0.85 | 0.42 | 5 | 3 | 29.95 | 43.15 | 20.26 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern |

| 9,368 | three_white_soldiers | 3 | downtrend | bullish reversal | stock | bullish reversal | low-close | 3 | 436 | 931 | 791 | 35,645 | 0.332 | 0.11 | 0.85 | 0.33 | 5 | 3 | 45.06 | 69.79 | 32.68 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern |

| 9,369 | three_white_soldiers | 3 | downtrend | bullish reversal | stock | bullish reversal | low-close | 4 | 436 | 928 | 789 | 44,187 | 0.392 | 0.13 | 0.85 | 0.28 | 3 | 4 | 56.00 | 102.80 | 38.02 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern |

| 9,370 | three_white_soldiers | 3 | downtrend | bullish reversal | stock | bullish reversal | low-close | 5 | 436 | 926 | 788 | 51,649 | 0.450 | 0.15 | 0.85 | 0.24 | 3 | 4 | 65.54 | 135.06 | 43.30 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern |

| 10,576 | three_white_soldiers | 3 | downtrend | bullish reversal | crypto | bearish continuation | high-close | 1 | 18 | 40 | 35 | 35 | -1.000 | -0.33 | 0.88 | 0.00 | 0 | 4 | 1.00 | 1.00 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern | |

| 10,577 | three_white_soldiers | 3 | downtrend | bullish reversal | crypto | bearish continuation | high-close | 2 | 18 | 40 | 35 | 35 | -1.000 | -0.33 | 0.88 | 0.00 | 0 | 4 | 1.00 | 1.00 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern | |

| 10,578 | three_white_soldiers | 3 | downtrend | bullish reversal | crypto | bearish continuation | high-close | 3 | 18 | 40 | 35 | 35 | -1.000 | -0.33 | 0.88 | 0.00 | 0 | 4 | 1.00 | 1.00 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern | |

| 10,579 | three_white_soldiers | 3 | downtrend | bullish reversal | crypto | bearish continuation | high-close | 4 | 18 | 40 | 35 | 35 | -1.000 | -0.33 | 0.88 | 0.00 | 0 | 4 | 1.00 | 1.00 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern | |

| 10,580 | three_white_soldiers | 3 | downtrend | bullish reversal | crypto | bearish continuation | high-close | 5 | 18 | 40 | 35 | 35 | -1.000 | -0.33 | 0.88 | 0.00 | 0 | 4 | 1.00 | 1.00 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern | |

| 10,581 | three_white_soldiers | 3 | downtrend | bullish reversal | forex | bearish continuation | high-close | 1 | 292 | 2,029 | 1,344 | 1,349 | -0.999 | -0.33 | 0.66 | 0.00 | 1 | 16 | 1.00 | 1.00 | 1.00 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern |

| 10,582 | three_white_soldiers | 3 | downtrend | bullish reversal | forex | bearish continuation | high-close | 2 | 292 | 2,029 | 1,344 | 1,349 | -0.998 | -0.33 | 0.66 | 0.00 | 1 | 16 | 1.00 | 1.00 | 1.00 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern |

| 10,583 | three_white_soldiers | 3 | downtrend | bullish reversal | forex | bearish continuation | high-close | 3 | 292 | 2,029 | 1,344 | 1,349 | -0.997 | -0.33 | 0.66 | 0.00 | 1 | 16 | 1.00 | 1.00 | 1.00 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern |

| 10,584 | three_white_soldiers | 3 | downtrend | bullish reversal | forex | bearish continuation | high-close | 4 | 292 | 2,029 | 1,344 | 1,349 | -0.996 | -0.33 | 0.66 | 0.00 | 1 | 16 | 1.00 | 1.00 | 1.00 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern |

| 10,585 | three_white_soldiers | 3 | downtrend | bullish reversal | forex | bearish continuation | high-close | 5 | 292 | 2,029 | 1,344 | 1,349 | -0.995 | -0.33 | 0.66 | 0.00 | 1 | 16 | 1.00 | 1.00 | 1.00 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern |

| 10,586 | three_white_soldiers | 3 | downtrend | bullish reversal | stock | bearish continuation | high-close | 1 | 436 | 1,030 | 929 | 939 | -0.982 | -0.33 | 0.90 | 0.01 | 1 | 7 | 1.01 | 1.43 | 1.01 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern |

| 10,587 | three_white_soldiers | 3 | downtrend | bullish reversal | stock | bearish continuation | high-close | 2 | 436 | 1,030 | 929 | 947 | -0.992 | -0.33 | 0.90 | 0.00 | 1 | 7 | 1.02 | 1.75 | 1.02 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern |

| 10,588 | three_white_soldiers | 3 | downtrend | bullish reversal | stock | bearish continuation | high-close | 3 | 436 | 1,030 | 929 | 952 | -0.988 | -0.33 | 0.90 | 0.00 | 1 | 7 | 1.02 | 3.00 | 1.02 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern |

| 10,589 | three_white_soldiers | 3 | downtrend | bullish reversal | stock | bearish continuation | high-close | 4 | 436 | 1,030 | 929 | 960 | -0.984 | -0.33 | 0.90 | 0.00 | 1 | 7 | 1.03 | 5.00 | 1.02 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern |

| 10,590 | three_white_soldiers | 3 | downtrend | bullish reversal | stock | bearish continuation | high-close | 5 | 436 | 1,030 | 929 | 962 | -0.980 | -0.33 | 0.90 | 0.00 | 1 | 7 | 1.04 | 5.50 | 1.02 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern |

| 10,706 | three_white_soldiers | 3 | downtrend | bullish reversal | crypto | bearish mean reversion | atr-pattern_high | 1 | 18 | 38 | 25 | 87 | 0.280 | 0.09 | 0.66 | 0.64 | 2 | 1 | 3.48 | 2.38 | 5.44 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern |

| 10,707 | three_white_soldiers | 3 | downtrend | bullish reversal | crypto | bearish mean reversion | atr-pattern_high | 2 | 18 | 38 | 24 | 207 | 0.500 | 0.17 | 0.63 | 0.50 | 2 | 3 | 8.62 | 10.83 | 6.42 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern |

| 10,708 | three_white_soldiers | 3 | downtrend | bullish reversal | crypto | bearish mean reversion | atr-pattern_high | 3 | 18 | 37 | 23 | 415 | 0.745 | 0.25 | 0.62 | 0.44 | 2 | 3 | 18.04 | 16.20 | 19.46 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern |

| 10,709 | three_white_soldiers | 3 | downtrend | bullish reversal | crypto | bearish mean reversion | atr-pattern_high | 4 | 18 | 36 | 22 | 902 | 0.816 | 0.27 | 0.61 | 0.36 | 2 | 3 | 41.00 | 15.88 | 55.36 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern |

| 10,710 | three_white_soldiers | 3 | downtrend | bullish reversal | crypto | bearish mean reversion | atr-pattern_high | 5 | 18 | 36 | 22 | 1,138 | 0.910 | 0.30 | 0.61 | 0.32 | 1 | 3 | 51.73 | 46.29 | 54.27 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern |

| 10,711 | three_white_soldiers | 3 | downtrend | bullish reversal | forex | bearish mean reversion | atr-pattern_high | 1 | 292 | 1,980 | 445 | 1,360 | 0.198 | 0.07 | 0.22 | 0.60 | 7 | 3 | 3.06 | 2.86 | 3.35 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern |

| 10,712 | three_white_soldiers | 3 | downtrend | bullish reversal | forex | bearish mean reversion | atr-pattern_high | 2 | 292 | 1,979 | 433 | 2,894 | 0.326 | 0.11 | 0.22 | 0.44 | 5 | 3 | 6.68 | 8.11 | 5.55 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern |

| 10,713 | three_white_soldiers | 3 | downtrend | bullish reversal | forex | bearish mean reversion | atr-pattern_high | 3 | 292 | 1,973 | 427 | 4,279 | 0.526 | 0.18 | 0.22 | 0.38 | 5 | 7 | 10.02 | 14.30 | 7.38 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern |

| 10,714 | three_white_soldiers | 3 | downtrend | bullish reversal | forex | bearish mean reversion | atr-pattern_high | 4 | 292 | 1,973 | 427 | 5,655 | 0.584 | 0.19 | 0.22 | 0.32 | 5 | 7 | 13.24 | 21.98 | 9.21 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern |

| 10,715 | three_white_soldiers | 3 | downtrend | bullish reversal | forex | bearish mean reversion | atr-pattern_high | 5 | 292 | 1,968 | 426 | 6,619 | 0.700 | 0.23 | 0.22 | 0.28 | 5 | 7 | 15.54 | 29.12 | 10.15 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern |

| 10,716 | three_white_soldiers | 3 | downtrend | bullish reversal | stock | bearish mean reversion | atr-pattern_high | 1 | 436 | 942 | 570 | 2,144 | 0.142 | 0.05 | 0.61 | 0.57 | 3 | 2 | 3.76 | 3.52 | 4.09 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern |

| 10,717 | three_white_soldiers | 3 | downtrend | bullish reversal | stock | bearish mean reversion | atr-pattern_high | 2 | 436 | 939 | 567 | 4,355 | -0.030 | -0.01 | 0.60 | 0.33 | 2 | 3 | 7.68 | 8.96 | 7.07 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern |

| 10,718 | three_white_soldiers | 3 | downtrend | bullish reversal | stock | bearish mean reversion | atr-pattern_high | 3 | 436 | 938 | 567 | 6,033 | 0.006 | 0.00 | 0.60 | 0.25 | 2 | 4 | 10.64 | 17.01 | 8.49 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern |

| 10,719 | three_white_soldiers | 3 | downtrend | bullish reversal | stock | bearish mean reversion | atr-pattern_high | 4 | 436 | 935 | 565 | 7,890 | -0.020 | -0.01 | 0.60 | 0.20 | 2 | 4 | 13.96 | 29.35 | 10.25 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern |

| 10,720 | three_white_soldiers | 3 | downtrend | bullish reversal | stock | bearish mean reversion | atr-pattern_high | 5 | 436 | 935 | 565 | 9,972 | -0.025 | -0.01 | 0.60 | 0.16 | 2 | 4 | 17.65 | 41.75 | 12.96 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern |

| 10,981 | three_white_soldiers | 3 | downtrend | bullish reversal | crypto | bullish mean reversion | atr-pattern_low | 1 | 18 | 38 | 1 | 1 | 1.000 | 0.33 | 0.03 | 1.00 | 1 | 0 | 1.00 | 1.00 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern | |

| 10,982 | three_white_soldiers | 3 | downtrend | bullish reversal | crypto | bullish mean reversion | atr-pattern_low | 2 | 18 | 38 | 1 | 1 | 2.000 | 0.67 | 0.03 | 1.00 | 1 | 0 | 1.00 | 1.00 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern | |

| 10,983 | three_white_soldiers | 3 | downtrend | bullish reversal | crypto | bullish mean reversion | atr-pattern_low | 3 | 18 | 38 | 1 | 38 | -1.000 | -0.33 | 0.03 | 0.00 | 0 | 1 | 38.00 | 38.00 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern | |

| 10,984 | three_white_soldiers | 3 | downtrend | bullish reversal | crypto | bullish mean reversion | atr-pattern_low | 4 | 18 | 38 | 1 | 38 | -1.000 | -0.33 | 0.03 | 0.00 | 0 | 1 | 38.00 | 38.00 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern | |

| 10,985 | three_white_soldiers | 3 | downtrend | bullish reversal | crypto | bullish mean reversion | atr-pattern_low | 5 | 18 | 38 | 1 | 38 | -1.000 | -0.33 | 0.03 | 0.00 | 0 | 1 | 38.00 | 38.00 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern | |

| 10,986 | three_white_soldiers | 3 | downtrend | bullish reversal | forex | bullish mean reversion | atr-pattern_low | 1 | 292 | 2,012 | 89 | 256 | 0.482 | 0.16 | 0.04 | 0.74 | 3 | 2 | 2.88 | 3.12 | 2.17 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern |

| 10,987 | three_white_soldiers | 3 | downtrend | bullish reversal | forex | bullish mean reversion | atr-pattern_low | 2 | 292 | 2,012 | 89 | 443 | 0.920 | 0.31 | 0.04 | 0.64 | 3 | 2 | 4.98 | 5.56 | 3.94 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern |

| 10,988 | three_white_soldiers | 3 | downtrend | bullish reversal | forex | bullish mean reversion | atr-pattern_low | 3 | 292 | 2,012 | 89 | 684 | 1.114 | 0.37 | 0.04 | 0.53 | 3 | 2 | 7.69 | 9.36 | 5.81 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern |

| 10,989 | three_white_soldiers | 3 | downtrend | bullish reversal | forex | bullish mean reversion | atr-pattern_low | 4 | 292 | 2,012 | 89 | 835 | 1.466 | 0.49 | 0.04 | 0.49 | 3 | 2 | 9.38 | 11.00 | 7.80 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern |

| 10,990 | three_white_soldiers | 3 | downtrend | bullish reversal | forex | bullish mean reversion | atr-pattern_low | 5 | 292 | 2,012 | 89 | 1,030 | 1.895 | 0.63 | 0.04 | 0.48 | 3 | 3 | 11.57 | 15.60 | 7.80 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern |

| 10,991 | three_white_soldiers | 3 | downtrend | bullish reversal | stock | bullish mean reversion | atr-pattern_low | 1 | 436 | 943 | 78 | 230 | 0.056 | 0.02 | 0.08 | 0.53 | 2 | 2 | 2.95 | 2.49 | 3.46 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern |

| 10,992 | three_white_soldiers | 3 | downtrend | bullish reversal | stock | bullish mean reversion | atr-pattern_low | 2 | 436 | 943 | 78 | 379 | 0.194 | 0.06 | 0.08 | 0.40 | 2 | 2 | 4.86 | 5.71 | 4.30 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern |

| 10,993 | three_white_soldiers | 3 | downtrend | bullish reversal | stock | bullish mean reversion | atr-pattern_low | 3 | 436 | 943 | 78 | 698 | -0.028 | -0.01 | 0.08 | 0.24 | 1 | 2 | 8.95 | 12.47 | 7.81 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern |

| 10,994 | three_white_soldiers | 3 | downtrend | bullish reversal | stock | bullish mean reversion | atr-pattern_low | 4 | 436 | 943 | 78 | 884 | -0.104 | -0.03 | 0.08 | 0.18 | 1 | 2 | 11.33 | 21.43 | 9.12 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern |

| 10,995 | three_white_soldiers | 3 | downtrend | bullish reversal | stock | bullish mean reversion | atr-pattern_low | 5 | 436 | 943 | 78 | 1,102 | -0.080 | -0.03 | 0.08 | 0.15 | 1 | 2 | 14.13 | 35.42 | 10.26 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern |

| 11,381 | three_white_soldiers | 3 | downtrend | bullish reversal | crypto | bearish continuation | high-low | 1 | 18 | 38 | 9 | 9 | -1.000 | -0.33 | 0.24 | 0.00 | 0 | 2 | 1.00 | 1.00 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern | |

| 11,382 | three_white_soldiers | 3 | downtrend | bullish reversal | crypto | bearish continuation | high-low | 2 | 18 | 38 | 9 | 9 | -1.000 | -0.33 | 0.24 | 0.00 | 0 | 2 | 1.00 | 1.00 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern | |

| 11,383 | three_white_soldiers | 3 | downtrend | bullish reversal | crypto | bearish continuation | high-low | 3 | 18 | 38 | 9 | 9 | -1.000 | -0.33 | 0.24 | 0.00 | 0 | 2 | 1.00 | 1.00 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern | |

| 11,384 | three_white_soldiers | 3 | downtrend | bullish reversal | crypto | bearish continuation | high-low | 4 | 18 | 38 | 9 | 9 | -1.000 | -0.33 | 0.24 | 0.00 | 0 | 2 | 1.00 | 1.00 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern | |

| 11,385 | three_white_soldiers | 3 | downtrend | bullish reversal | crypto | bearish continuation | high-low | 5 | 18 | 38 | 9 | 9 | -1.000 | -0.33 | 0.24 | 0.00 | 0 | 2 | 1.00 | 1.00 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern | |

| 11,386 | three_white_soldiers | 3 | downtrend | bullish reversal | forex | bearish continuation | high-low | 1 | 292 | 2,012 | 473 | 520 | -0.998 | -0.33 | 0.24 | 0.00 | 1 | 7 | 1.10 | 3.00 | 1.10 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern |

| 11,387 | three_white_soldiers | 3 | downtrend | bullish reversal | forex | bearish continuation | high-low | 2 | 292 | 2,012 | 473 | 520 | -0.996 | -0.33 | 0.24 | 0.00 | 1 | 7 | 1.10 | 3.00 | 1.10 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern |

| 11,388 | three_white_soldiers | 3 | downtrend | bullish reversal | forex | bearish continuation | high-low | 3 | 292 | 2,012 | 473 | 521 | -0.994 | -0.33 | 0.24 | 0.00 | 1 | 7 | 1.10 | 4.00 | 1.10 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern |

| 11,389 | three_white_soldiers | 3 | downtrend | bullish reversal | forex | bearish continuation | high-low | 4 | 292 | 2,012 | 473 | 528 | -1.000 | -0.33 | 0.24 | 0.00 | 0 | 7 | 1.12 | 1.12 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern | |

| 11,390 | three_white_soldiers | 3 | downtrend | bullish reversal | forex | bearish continuation | high-low | 5 | 292 | 2,012 | 473 | 528 | -1.000 | -0.33 | 0.24 | 0.00 | 0 | 7 | 1.12 | 1.12 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern | |

| 11,391 | three_white_soldiers | 3 | downtrend | bullish reversal | stock | bearish continuation | high-low | 1 | 436 | 943 | 326 | 371 | -0.901 | -0.30 | 0.35 | 0.05 | 1 | 3 | 1.14 | 3.38 | 1.02 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern |

| 11,392 | three_white_soldiers | 3 | downtrend | bullish reversal | stock | bearish continuation | high-low | 2 | 436 | 943 | 326 | 504 | -0.908 | -0.30 | 0.35 | 0.03 | 1 | 3 | 1.55 | 1.20 | 1.56 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern |

| 11,393 | three_white_soldiers | 3 | downtrend | bullish reversal | stock | bearish continuation | high-low | 3 | 436 | 943 | 326 | 508 | -0.886 | -0.30 | 0.35 | 0.03 | 1 | 3 | 1.56 | 1.22 | 1.57 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern |

| 11,394 | three_white_soldiers | 3 | downtrend | bullish reversal | stock | bearish continuation | high-low | 4 | 436 | 943 | 326 | 508 | -0.858 | -0.29 | 0.35 | 0.03 | 1 | 3 | 1.56 | 1.22 | 1.57 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern |

| 11,395 | three_white_soldiers | 3 | downtrend | bullish reversal | stock | bearish continuation | high-low | 5 | 436 | 943 | 326 | 511 | -0.855 | -0.29 | 0.35 | 0.03 | 1 | 3 | 1.57 | 1.50 | 1.57 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern |

| 11,471 | three_white_soldiers | 3 | downtrend | bullish reversal | crypto | bullish reversal | low-high | 1 | 18 | 40 | 34 | 258 | -0.059 | -0.02 | 0.85 | 0.47 | 2 | 3 | 7.59 | 5.00 | 9.89 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern |

| 11,472 | three_white_soldiers | 3 | downtrend | bullish reversal | crypto | bullish reversal | low-high | 2 | 18 | 39 | 33 | 369 | 0.088 | 0.03 | 0.85 | 0.36 | 2 | 4 | 11.18 | 9.50 | 12.14 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern |

| 11,473 | three_white_soldiers | 3 | downtrend | bullish reversal | crypto | bullish reversal | low-high | 3 | 18 | 38 | 32 | 448 | 0.000 | 0.00 | 0.84 | 0.25 | 2 | 4 | 14.00 | 9.62 | 15.46 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern |

| 11,474 | three_white_soldiers | 3 | downtrend | bullish reversal | crypto | bullish reversal | low-high | 4 | 18 | 38 | 32 | 462 | 0.096 | 0.03 | 0.84 | 0.22 | 2 | 4 | 14.44 | 11.43 | 15.28 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern |

| 11,475 | three_white_soldiers | 3 | downtrend | bullish reversal | crypto | bullish reversal | low-high | 5 | 18 | 38 | 32 | 470 | 0.315 | 0.11 | 0.84 | 0.22 | 2 | 4 | 14.69 | 12.57 | 15.28 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern |

| 11,476 | three_white_soldiers | 3 | downtrend | bullish reversal | forex | bullish reversal | low-high | 1 | 292 | 2,002 | 1,041 | 11,924 | 0.245 | 0.08 | 0.52 | 0.63 | 10 | 5 | 11.45 | 9.43 | 14.83 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern |

| 11,477 | three_white_soldiers | 3 | downtrend | bullish reversal | forex | bullish reversal | low-high | 2 | 292 | 1,940 | 1,011 | 21,363 | 0.430 | 0.14 | 0.52 | 0.48 | 6 | 10 | 21.13 | 19.48 | 22.62 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern |

| 11,478 | three_white_soldiers | 3 | downtrend | bullish reversal | forex | bullish reversal | low-high | 3 | 292 | 1,922 | 994 | 29,397 | 0.606 | 0.20 | 0.52 | 0.40 | 5 | 9 | 29.57 | 30.59 | 28.89 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern |

| 11,479 | three_white_soldiers | 3 | downtrend | bullish reversal | forex | bullish reversal | low-high | 4 | 292 | 1,894 | 981 | 40,724 | 0.788 | 0.26 | 0.52 | 0.36 | 4 | 9 | 41.51 | 57.85 | 32.45 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern |

| 11,480 | three_white_soldiers | 3 | downtrend | bullish reversal | forex | bullish reversal | low-high | 5 | 292 | 1,863 | 968 | 53,778 | 0.880 | 0.29 | 0.52 | 0.31 | 4 | 9 | 55.56 | 73.78 | 47.21 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern |

| 11,481 | three_white_soldiers | 3 | downtrend | bullish reversal | stock | bullish reversal | low-high | 1 | 436 | 945 | 789 | 12,370 | 0.162 | 0.05 | 0.83 | 0.58 | 5 | 3 | 15.68 | 16.24 | 14.89 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern |

| 11,482 | three_white_soldiers | 3 | downtrend | bullish reversal | stock | bullish reversal | low-high | 2 | 436 | 936 | 779 | 23,857 | 0.280 | 0.09 | 0.83 | 0.43 | 5 | 3 | 30.63 | 44.30 | 20.52 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern |

| 11,483 | three_white_soldiers | 3 | downtrend | bullish reversal | stock | bullish reversal | low-high | 3 | 436 | 931 | 776 | 35,670 | 0.354 | 0.12 | 0.83 | 0.34 | 5 | 3 | 45.97 | 71.11 | 33.15 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern |

| 11,484 | three_white_soldiers | 3 | downtrend | bullish reversal | stock | bullish reversal | low-high | 4 | 436 | 927 | 774 | 44,413 | 0.384 | 0.13 | 0.83 | 0.28 | 3 | 4 | 57.38 | 105.23 | 39.09 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern |

| 11,485 | three_white_soldiers | 3 | downtrend | bullish reversal | stock | bullish reversal | low-high | 5 | 436 | 926 | 773 | 52,028 | 0.450 | 0.15 | 0.83 | 0.24 | 3 | 4 | 67.31 | 138.20 | 44.68 | https://analyzingalpha.com/three-white-soldiers-candlestick-pattern |

| Market | Strategy | Setup | Trades | Edge |

Pattern:

Pattern Bars:

Required Trend:

Traditional Strategy:

Market:

Strategy:

Setup:

RR:

Tickers:

Signals:

Trades:

Trade Bars:

Edge:

Edge Per Bar:

Confirm %:

Win %:

Cons Wins:

Cons Losses:

Avg. Trade Bars:

Avg. Win Bars:

Avg. Loss Bars:

Similar Candlestick Patterns

Traders confuse the three stars in the south patterns with other candlestick patterns.

Three Black Crows vs. Three White Soldiers

The three black crows is a four-candle bearish reversal pattern almost opposite the three white soldiers.

The three black crows have three descending bearish candlesticks consecutively closing lower that open within the last candle’s real body and close near the low–opposite the three white soldiers.

The only reason the three black crows and the three white soldiers aren’t opposites is that the three black crows require the first bearish candle to close under the previous bullish candle’s high.

The Bottom Line

The three advancing white soldiers pattern works as intended. It is a bullish candlestick pattern that alerts traders to manage their existing short positions and prepare for bullish price reversal trading strategies.

By using a data-driven approach to trading, you never have to ask the question, are candlestick patterns reliable?