The morning doji star is a three-bar bullish reversal Japanese candlestick pattern that is best traded using bullish strategies in a multiple decades-long backtest.

If you practice Japanese candlestick charting techniques, you might be surprised to learn the data shows traditional morning doji star trading strategies lose money.

But what if I told you that you could wake up on the right side of the trade every morning by listening to the data?

Keep reading to learn what history says about the best morning doji star trading strategies.

What Is a Morning Doji Star Candlestick Pattern?

The morning doji star is a three-bar bullish reversal candlestick pattern that precedes short-term volatility and is best traded using bullish strategies in all markets tested.

The name comes from the doji candle that appears like the morning sun or star on a candlestick chart.

Let’s learn how to identify this three-bar pattern before we shine a light on the best morning doji star trading strategies.

How to Identify the Morning Doji Star Candlestick Pattern

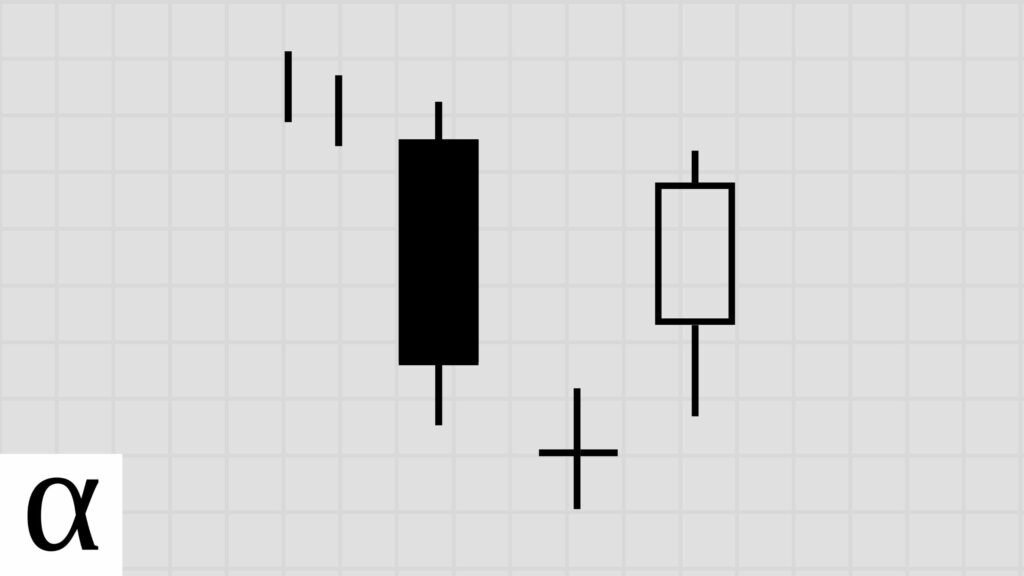

The following are the requirements for a valid morning doji star candlestick pattern:

- The first candle is bearish and long.

- The second candle is a doji that gaps down.

- The third candle is bullish and moves well within the first candle’s real body.

- The morning doji star must occur in a downtrend.

A morning doji star appeared on Alphabet’s (GOOG) daily chart on March 24th, 2020.

There’s a clear downtrend as prices are below the fifty-day simple moving average. The first-day prints a significant bearish candle, the second-day gaps into a doji, and the third day is bullish and moves well past the first day’s body, fulfilling the morning doji pattern requirements.

Now that we understand how to identify the morning doji star pattern, let’s learn how to trade this three-bar pattern on our candlestick charts.

How to Trade the Morning Doji Star Pattern

The morning doji star should be traded using a bullish reversal strategy in the crypto markets, and a bullish mean reversion in the forex and stock markets, according to a 21-year backtest.

Before we discuss the optimal morning doji star candlestick trading strategy, let’s discuss how most traders start the day off wrong and get mixed results with this pattern.

Morning Doji Star Bullish Reversal Trade Setup

The price is below the fifty-day moving average, which we consider a short-term downtrend showing bears are in control. There’s a large bearish red candle followed by a gap down into a doji candle. The third day gives us a significant bullish candle closing within and past the first day’s real body, fulfilling the morning doji star candlestick pattern requirements.

Traditional traders enter long at a break of the third candle’s high and set their stop loss below the doji’s low. Any trader following the conventional trading strategy on the Meta Platforms (META) daily chart on October 3rd, 2019, made real dollars.

The data shows that these traditional trading strategies will break even at best.

A data-driven crypto trader enters long on a break of the close instead of the high, keeping the stop loss below the doji’s low. This improves the risk-reward dynamics.

We saw this dynamic play out on the EOS (EOSUSD) daily chart on November 5th, 2020. A data-driven crypto trader captured profit on the 7th, whereas a traditional entry saw much less success.

Professional forex and stock market traders go in the same direction.

Morning Doji Star Bullish Mean Reversion Trade Setup

Data-driven stock and forex market traders enter long after the price crosses below and then back above the pattern’s low, setting a stop loss of one ATR.

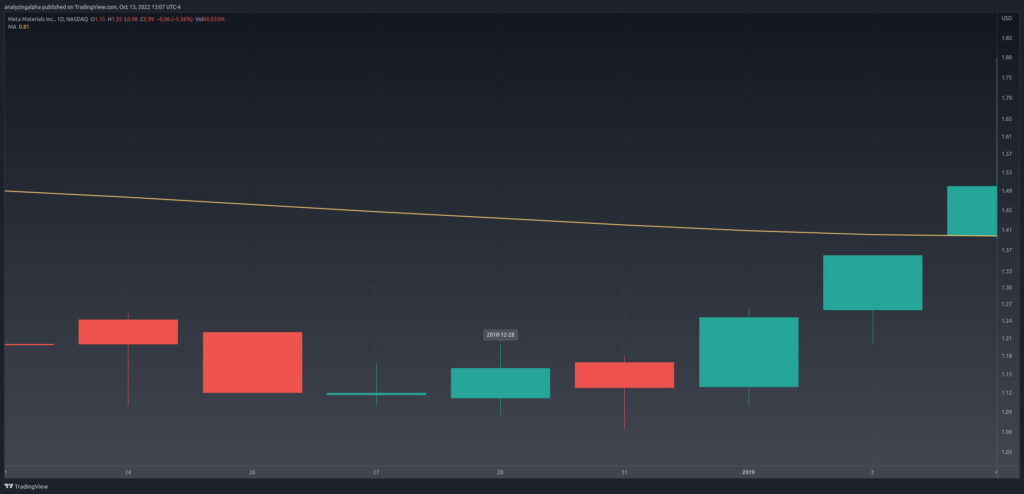

Let’s use the Meta Materials (MMAT) December 28th, 2018, daily chart to harden our understanding.

We see downward momentum as the price is below the fifty-day simple. We see a large bearish candle followed by a doji gapping down. The third candle prints a bullish candle that moves well within the first candle’s real body, completing the pattern.

The pattern’s low occurred on the third candle at $1.09. The price moves below and back above this low the next day, triggering an entry. The price then moved up and to the right in a big way, providing windfall profits for our data-driven trader.

Speaking of profits, what does the historical data tell us about the best morning doji star trading strategies?

Does the Morning Doji Star Candlestick Pattern Work? (Backtest Results)

Using the following rules, I backtested the morning doji star pattern on the daily timeframe in the crypto, forex, and stock markets.

- A close above the 50-day SMA constitutes an uptrend.

- I tested risk-reward ranges from 1 to 5.

- The optimal risk-reward ratio is selected using profit per bar.

- Entry and exits are discussed in the how-to trade section above.

- Confirmation must occur within three days of the pattern signal.

| Id | Pattern | Pattern Bars | Required Trend | Traditional Strategy | Market | Strategy | Setup | RR | Tickers | Signals | Trades | Trade Bars | Edge | Edge Per Bar | Confirm % | Win % | Cons Wins | Cons Losses | Avg. Trade Bars | Avg. Win Bars | Avg. Loss Bars | Details |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 8,061 | morning_doji_star | 3 | downtrend | bullish reversal | crypto | bullish mean reversion | atr-pattern_low | 1 | 22 | 48 | 7 | 34 | 0.424 | 0.14 | 0.15 | 0.71 | 2 | 1 | 4.86 | 6.20 | 1.50 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 8,062 | morning_doji_star | 3 | downtrend | bullish reversal | crypto | bullish mean reversion | atr-pattern_low | 2 | 22 | 48 | 6 | 36 | -0.004 | 0.00 | 0.12 | 0.33 | 0 | 1 | 6.00 | 10.00 | 4.00 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 8,063 | morning_doji_star | 3 | downtrend | bullish reversal | crypto | bullish mean reversion | atr-pattern_low | 3 | 22 | 48 | 6 | 38 | 0.329 | 0.11 | 0.12 | 0.33 | 0 | 1 | 6.33 | 11.00 | 4.00 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 8,064 | morning_doji_star | 3 | downtrend | bullish reversal | crypto | bullish mean reversion | atr-pattern_low | 4 | 22 | 48 | 6 | 43 | -0.162 | -0.05 | 0.12 | 0.17 | 0 | 2 | 7.17 | 12.00 | 6.20 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 8,065 | morning_doji_star | 3 | downtrend | bullish reversal | crypto | bullish mean reversion | atr-pattern_low | 5 | 22 | 48 | 6 | 43 | 0.005 | 0.00 | 0.12 | 0.17 | 0 | 2 | 7.17 | 12.00 | 6.20 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 8,066 | morning_doji_star | 3 | downtrend | bullish reversal | forex | bullish mean reversion | atr-pattern_low | 1 | 221 | 593 | 118 | 469 | 0.321 | 0.11 | 0.20 | 0.66 | 2 | 2 | 3.97 | 3.53 | 4.85 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 8,067 | morning_doji_star | 3 | downtrend | bullish reversal | forex | bullish mean reversion | atr-pattern_low | 2 | 221 | 589 | 115 | 1,186 | 0.326 | 0.11 | 0.20 | 0.44 | 2 | 2 | 10.31 | 10.98 | 9.78 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 8,068 | morning_doji_star | 3 | downtrend | bullish reversal | forex | bullish mean reversion | atr-pattern_low | 3 | 221 | 589 | 115 | 1,824 | 0.080 | 0.03 | 0.20 | 0.27 | 1 | 2 | 15.86 | 17.03 | 15.43 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 8,069 | morning_doji_star | 3 | downtrend | bullish reversal | forex | bullish mean reversion | atr-pattern_low | 4 | 221 | 587 | 115 | 2,528 | -0.134 | -0.04 | 0.20 | 0.17 | 1 | 2 | 21.98 | 25.55 | 21.23 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 8,070 | morning_doji_star | 3 | downtrend | bullish reversal | forex | bullish mean reversion | atr-pattern_low | 5 | 221 | 587 | 115 | 3,010 | 0.040 | 0.01 | 0.20 | 0.17 | 1 | 2 | 26.17 | 49.65 | 21.23 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 8,071 | morning_doji_star | 3 | downtrend | bullish reversal | stock | bullish mean reversion | atr-pattern_low | 1 | 2,904 | 11,212 | 2,375 | 8,590 | 0.197 | 0.07 | 0.21 | 0.60 | 5 | 3 | 3.62 | 3.39 | 3.96 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 8,072 | morning_doji_star | 3 | downtrend | bullish reversal | stock | bullish mean reversion | atr-pattern_low | 2 | 2,904 | 11,190 | 2,368 | 17,170 | 0.232 | 0.08 | 0.21 | 0.41 | 3 | 4 | 7.25 | 8.34 | 6.49 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 8,073 | morning_doji_star | 3 | downtrend | bullish reversal | stock | bullish mean reversion | atr-pattern_low | 3 | 2,904 | 11,179 | 2,360 | 25,598 | 0.323 | 0.11 | 0.21 | 0.33 | 3 | 4 | 10.85 | 15.81 | 8.39 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 8,074 | morning_doji_star | 3 | downtrend | bullish reversal | stock | bullish mean reversion | atr-pattern_low | 4 | 2,904 | 11,171 | 2,353 | 33,423 | 0.354 | 0.12 | 0.21 | 0.27 | 3 | 6 | 14.20 | 24.22 | 10.49 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 8,075 | morning_doji_star | 3 | downtrend | bullish reversal | stock | bullish mean reversion | atr-pattern_low | 5 | 2,904 | 11,167 | 2,349 | 41,474 | 0.395 | 0.13 | 0.21 | 0.23 | 3 | 6 | 17.66 | 34.77 | 12.46 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 8,631 | morning_doji_star | 3 | downtrend | bullish reversal | crypto | bullish reversal | low-high | 1 | 22 | 48 | 36 | 265 | 0.116 | 0.04 | 0.75 | 0.56 | 2 | 2 | 7.36 | 5.10 | 10.19 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 8,632 | morning_doji_star | 3 | downtrend | bullish reversal | crypto | bullish reversal | low-high | 2 | 22 | 48 | 36 | 326 | 0.254 | 0.08 | 0.75 | 0.42 | 2 | 2 | 9.06 | 7.20 | 10.38 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 8,633 | morning_doji_star | 3 | downtrend | bullish reversal | crypto | bullish reversal | low-high | 3 | 22 | 48 | 36 | 442 | 0.228 | 0.08 | 0.75 | 0.31 | 2 | 2 | 12.28 | 8.36 | 14.00 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 8,634 | morning_doji_star | 3 | downtrend | bullish reversal | crypto | bullish reversal | low-high | 4 | 22 | 48 | 36 | 513 | 0.534 | 0.18 | 0.75 | 0.31 | 2 | 2 | 14.25 | 14.82 | 14.00 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 8,635 | morning_doji_star | 3 | downtrend | bullish reversal | crypto | bullish reversal | low-high | 5 | 22 | 48 | 36 | 537 | 0.670 | 0.22 | 0.75 | 0.28 | 2 | 3 | 14.92 | 15.40 | 14.73 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 8,636 | morning_doji_star | 3 | downtrend | bullish reversal | forex | bullish reversal | low-high | 1 | 221 | 590 | 418 | 3,010 | -0.157 | -0.05 | 0.71 | 0.42 | 3 | 4 | 7.20 | 7.80 | 6.76 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 8,637 | morning_doji_star | 3 | downtrend | bullish reversal | forex | bullish reversal | low-high | 2 | 221 | 590 | 416 | 6,093 | -0.250 | -0.08 | 0.71 | 0.25 | 3 | 4 | 14.65 | 21.76 | 12.28 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 8,638 | morning_doji_star | 3 | downtrend | bullish reversal | forex | bullish reversal | low-high | 3 | 221 | 587 | 413 | 8,768 | -0.283 | -0.09 | 0.70 | 0.18 | 3 | 4 | 21.23 | 48.07 | 15.37 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 8,639 | morning_doji_star | 3 | downtrend | bullish reversal | forex | bullish reversal | low-high | 4 | 221 | 587 | 413 | 11,181 | -0.404 | -0.13 | 0.70 | 0.12 | 2 | 5 | 27.07 | 77.20 | 20.32 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 8,640 | morning_doji_star | 3 | downtrend | bullish reversal | forex | bullish reversal | low-high | 5 | 221 | 587 | 412 | 11,913 | -0.345 | -0.12 | 0.70 | 0.11 | 2 | 5 | 28.92 | 92.93 | 21.07 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 8,641 | morning_doji_star | 3 | downtrend | bullish reversal | stock | bullish reversal | low-high | 1 | 2,904 | 11,176 | 8,658 | 66,105 | 0.040 | 0.01 | 0.77 | 0.52 | 8 | 7 | 7.64 | 7.47 | 7.81 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 8,642 | morning_doji_star | 3 | downtrend | bullish reversal | stock | bullish reversal | low-high | 2 | 2,904 | 11,136 | 8,610 | 120,778 | 0.134 | 0.04 | 0.77 | 0.38 | 7 | 8 | 14.03 | 18.53 | 11.30 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 8,643 | morning_doji_star | 3 | downtrend | bullish reversal | stock | bullish reversal | low-high | 3 | 2,904 | 11,112 | 8,578 | 176,313 | 0.206 | 0.07 | 0.77 | 0.30 | 6 | 8 | 20.55 | 31.87 | 15.66 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 8,644 | morning_doji_star | 3 | downtrend | bullish reversal | stock | bullish reversal | low-high | 4 | 2,904 | 11,083 | 8,539 | 225,107 | 0.266 | 0.09 | 0.77 | 0.25 | 5 | 8 | 26.36 | 48.04 | 18.98 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 8,645 | morning_doji_star | 3 | downtrend | bullish reversal | stock | bullish reversal | low-high | 5 | 2,904 | 11,057 | 8,505 | 272,616 | 0.330 | 0.11 | 0.77 | 0.22 | 5 | 8 | 32.05 | 66.09 | 22.35 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 9,486 | morning_doji_star | 3 | downtrend | bullish reversal | crypto | bearish mean reversion | atr-pattern_high | 1 | 22 | 48 | 24 | 97 | -0.082 | -0.03 | 0.50 | 0.46 | 2 | 2 | 4.04 | 4.82 | 3.38 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 9,487 | morning_doji_star | 3 | downtrend | bullish reversal | crypto | bearish mean reversion | atr-pattern_high | 2 | 22 | 47 | 24 | 169 | -0.126 | -0.04 | 0.51 | 0.29 | 1 | 2 | 7.04 | 10.14 | 5.76 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 9,488 | morning_doji_star | 3 | downtrend | bullish reversal | crypto | bearish mean reversion | atr-pattern_high | 3 | 22 | 47 | 24 | 284 | -0.166 | -0.06 | 0.51 | 0.21 | 1 | 2 | 11.83 | 32.60 | 6.37 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 9,489 | morning_doji_star | 3 | downtrend | bullish reversal | crypto | bearish mean reversion | atr-pattern_high | 4 | 22 | 47 | 24 | 337 | -0.380 | -0.13 | 0.51 | 0.13 | 1 | 2 | 14.04 | 49.33 | 9.00 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 9,490 | morning_doji_star | 3 | downtrend | bullish reversal | crypto | bearish mean reversion | atr-pattern_high | 5 | 22 | 47 | 24 | 359 | -0.505 | -0.17 | 0.51 | 0.08 | 1 | 2 | 14.96 | 53.00 | 11.50 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 9,491 | morning_doji_star | 3 | downtrend | bullish reversal | forex | bearish mean reversion | atr-pattern_high | 1 | 221 | 593 | 312 | 1,638 | 0.216 | 0.07 | 0.53 | 0.61 | 3 | 3 | 5.25 | 3.53 | 7.89 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 9,492 | morning_doji_star | 3 | downtrend | bullish reversal | forex | bearish mean reversion | atr-pattern_high | 2 | 221 | 588 | 310 | 3,317 | 0.282 | 0.09 | 0.53 | 0.43 | 3 | 4 | 10.70 | 10.76 | 10.66 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 9,493 | morning_doji_star | 3 | downtrend | bullish reversal | forex | bearish mean reversion | atr-pattern_high | 3 | 221 | 586 | 308 | 5,266 | 0.215 | 0.07 | 0.53 | 0.31 | 3 | 4 | 17.10 | 24.63 | 13.79 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 9,494 | morning_doji_star | 3 | downtrend | bullish reversal | forex | bearish mean reversion | atr-pattern_high | 4 | 221 | 583 | 307 | 6,176 | 0.254 | 0.08 | 0.53 | 0.25 | 3 | 4 | 20.12 | 32.73 | 15.90 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 9,495 | morning_doji_star | 3 | downtrend | bullish reversal | forex | bearish mean reversion | atr-pattern_high | 5 | 221 | 582 | 307 | 8,966 | 0.150 | 0.05 | 0.53 | 0.19 | 2 | 4 | 29.21 | 64.61 | 20.78 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 9,496 | morning_doji_star | 3 | downtrend | bullish reversal | stock | bearish mean reversion | atr-pattern_high | 1 | 2,904 | 11,210 | 6,002 | 24,896 | 0.121 | 0.04 | 0.54 | 0.56 | 6 | 6 | 4.15 | 3.90 | 4.47 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 9,497 | morning_doji_star | 3 | downtrend | bullish reversal | stock | bearish mean reversion | atr-pattern_high | 2 | 2,904 | 11,168 | 5,974 | 49,032 | 0.082 | 0.03 | 0.53 | 0.36 | 5 | 7 | 8.21 | 10.04 | 7.17 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 9,498 | morning_doji_star | 3 | downtrend | bullish reversal | stock | bearish mean reversion | atr-pattern_high | 3 | 2,904 | 11,129 | 5,941 | 72,083 | 0.077 | 0.03 | 0.53 | 0.27 | 5 | 7 | 12.13 | 17.81 | 10.05 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 9,499 | morning_doji_star | 3 | downtrend | bullish reversal | stock | bearish mean reversion | atr-pattern_high | 4 | 2,904 | 11,076 | 5,907 | 101,835 | 0.046 | 0.02 | 0.53 | 0.21 | 5 | 7 | 17.24 | 30.64 | 13.70 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 9,500 | morning_doji_star | 3 | downtrend | bullish reversal | stock | bearish mean reversion | atr-pattern_high | 5 | 2,904 | 11,043 | 5,883 | 127,349 | 0.025 | 0.01 | 0.53 | 0.17 | 5 | 7 | 21.65 | 45.31 | 16.78 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 10,916 | morning_doji_star | 3 | downtrend | bullish reversal | crypto | bearish continuation | high-low | 1 | 22 | 48 | 16 | 18 | -0.878 | -0.29 | 0.33 | 0.06 | 1 | 2 | 1.12 | 1.00 | 1.13 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 10,917 | morning_doji_star | 3 | downtrend | bullish reversal | crypto | bearish continuation | high-low | 2 | 22 | 48 | 16 | 18 | -0.816 | -0.27 | 0.33 | 0.06 | 1 | 2 | 1.12 | 1.00 | 1.13 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 10,918 | morning_doji_star | 3 | downtrend | bullish reversal | crypto | bearish continuation | high-low | 3 | 22 | 48 | 16 | 18 | -0.754 | -0.25 | 0.33 | 0.06 | 1 | 2 | 1.12 | 1.00 | 1.13 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 10,919 | morning_doji_star | 3 | downtrend | bullish reversal | crypto | bearish continuation | high-low | 4 | 22 | 48 | 16 | 33 | -0.692 | -0.23 | 0.33 | 0.06 | 1 | 2 | 2.06 | 16.00 | 1.13 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 10,920 | morning_doji_star | 3 | downtrend | bullish reversal | crypto | bearish continuation | high-low | 5 | 22 | 48 | 16 | 41 | -0.630 | -0.21 | 0.33 | 0.06 | 1 | 2 | 2.56 | 24.00 | 1.13 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 10,921 | morning_doji_star | 3 | downtrend | bullish reversal | forex | bearish continuation | high-low | 1 | 221 | 593 | 181 | 405 | -0.758 | -0.25 | 0.31 | 0.12 | 1 | 3 | 2.24 | 5.18 | 1.83 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 10,922 | morning_doji_star | 3 | downtrend | bullish reversal | forex | bearish continuation | high-low | 2 | 221 | 593 | 181 | 504 | -0.754 | -0.25 | 0.31 | 0.08 | 1 | 3 | 2.78 | 10.53 | 2.08 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 10,923 | morning_doji_star | 3 | downtrend | bullish reversal | forex | bearish continuation | high-low | 3 | 221 | 593 | 181 | 1,155 | -0.775 | -0.26 | 0.31 | 0.06 | 1 | 3 | 6.38 | 16.90 | 5.77 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 10,924 | morning_doji_star | 3 | downtrend | bullish reversal | forex | bearish continuation | high-low | 4 | 221 | 593 | 181 | 1,363 | -0.804 | -0.27 | 0.31 | 0.04 | 1 | 3 | 7.53 | 12.86 | 7.32 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 10,925 | morning_doji_star | 3 | downtrend | bullish reversal | forex | bearish continuation | high-low | 5 | 221 | 593 | 181 | 1,615 | -0.805 | -0.27 | 0.31 | 0.03 | 1 | 3 | 8.92 | 31.00 | 8.17 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 10,926 | morning_doji_star | 3 | downtrend | bullish reversal | stock | bearish continuation | high-low | 1 | 2,904 | 11,224 | 4,229 | 7,300 | -0.657 | -0.22 | 0.38 | 0.17 | 3 | 6 | 1.73 | 2.57 | 1.55 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 10,927 | morning_doji_star | 3 | downtrend | bullish reversal | stock | bearish continuation | high-low | 2 | 2,904 | 11,222 | 4,226 | 10,031 | -0.614 | -0.20 | 0.38 | 0.13 | 3 | 6 | 2.37 | 5.76 | 1.88 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 10,928 | morning_doji_star | 3 | downtrend | bullish reversal | stock | bearish continuation | high-low | 3 | 2,904 | 11,216 | 4,225 | 13,028 | -0.597 | -0.20 | 0.38 | 0.10 | 2 | 6 | 3.08 | 8.59 | 2.47 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 10,929 | morning_doji_star | 3 | downtrend | bullish reversal | stock | bearish continuation | high-low | 4 | 2,904 | 11,211 | 4,223 | 17,160 | -0.588 | -0.20 | 0.38 | 0.08 | 2 | 6 | 4.06 | 11.86 | 3.36 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 10,930 | morning_doji_star | 3 | downtrend | bullish reversal | stock | bearish continuation | high-low | 5 | 2,904 | 11,205 | 4,221 | 19,055 | -0.570 | -0.19 | 0.38 | 0.07 | 2 | 7 | 4.51 | 12.95 | 3.86 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 11,531 | morning_doji_star | 3 | downtrend | bullish reversal | crypto | bullish reversal | low-close | 1 | 22 | 48 | 45 | 241 | 0.242 | 0.08 | 0.94 | 0.62 | 2 | 2 | 5.36 | 3.36 | 8.65 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 11,532 | morning_doji_star | 3 | downtrend | bullish reversal | crypto | bullish reversal | low-close | 2 | 22 | 48 | 45 | 359 | 0.468 | 0.16 | 0.94 | 0.49 | 2 | 2 | 7.98 | 7.23 | 8.70 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 11,533 | morning_doji_star | 3 | downtrend | bullish reversal | crypto | bullish reversal | low-close | 3 | 22 | 48 | 45 | 489 | 0.772 | 0.26 | 0.94 | 0.44 | 2 | 2 | 10.87 | 12.85 | 9.28 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 11,534 | morning_doji_star | 3 | downtrend | bullish reversal | crypto | bullish reversal | low-close | 4 | 22 | 48 | 45 | 516 | 1.108 | 0.37 | 0.94 | 0.42 | 2 | 2 | 11.47 | 14.16 | 9.50 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 11,535 | morning_doji_star | 3 | downtrend | bullish reversal | crypto | bullish reversal | low-close | 5 | 22 | 48 | 45 | 616 | 1.270 | 0.42 | 0.94 | 0.38 | 2 | 3 | 13.69 | 19.24 | 10.32 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 11,536 | morning_doji_star | 3 | downtrend | bullish reversal | forex | bullish reversal | low-close | 1 | 221 | 591 | 573 | 3,386 | -0.085 | -0.03 | 0.97 | 0.46 | 3 | 4 | 5.91 | 5.48 | 6.27 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 11,537 | morning_doji_star | 3 | downtrend | bullish reversal | forex | bullish reversal | low-close | 2 | 221 | 590 | 571 | 5,934 | -0.156 | -0.05 | 0.97 | 0.28 | 3 | 5 | 10.39 | 13.78 | 9.06 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 11,538 | morning_doji_star | 3 | downtrend | bullish reversal | forex | bullish reversal | low-close | 3 | 221 | 588 | 569 | 9,038 | -0.172 | -0.06 | 0.97 | 0.21 | 3 | 5 | 15.88 | 29.07 | 12.47 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 11,539 | morning_doji_star | 3 | downtrend | bullish reversal | forex | bullish reversal | low-close | 4 | 221 | 588 | 567 | 10,921 | -0.258 | -0.09 | 0.96 | 0.15 | 2 | 5 | 19.26 | 44.90 | 14.80 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 11,540 | morning_doji_star | 3 | downtrend | bullish reversal | forex | bullish reversal | low-close | 5 | 221 | 587 | 566 | 13,344 | -0.335 | -0.11 | 0.96 | 0.11 | 2 | 6 | 23.58 | 74.89 | 17.15 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 11,541 | morning_doji_star | 3 | downtrend | bullish reversal | stock | bullish reversal | low-close | 1 | 2,904 | 11,184 | 9,933 | 64,435 | 0.058 | 0.02 | 0.89 | 0.53 | 7 | 7 | 6.49 | 6.22 | 6.78 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 11,542 | morning_doji_star | 3 | downtrend | bullish reversal | stock | bullish reversal | low-close | 2 | 2,904 | 11,139 | 9,877 | 116,812 | 0.144 | 0.05 | 0.89 | 0.38 | 6 | 8 | 11.83 | 15.09 | 9.81 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 11,543 | morning_doji_star | 3 | downtrend | bullish reversal | stock | bullish reversal | low-close | 3 | 2,904 | 11,109 | 9,835 | 168,590 | 0.212 | 0.07 | 0.89 | 0.30 | 6 | 8 | 17.14 | 26.25 | 13.17 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 11,544 | morning_doji_star | 3 | downtrend | bullish reversal | stock | bullish reversal | low-close | 4 | 2,904 | 11,083 | 9,805 | 219,397 | 0.280 | 0.09 | 0.88 | 0.26 | 5 | 8 | 22.38 | 40.43 | 16.19 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 11,545 | morning_doji_star | 3 | downtrend | bullish reversal | stock | bullish reversal | low-close | 5 | 2,904 | 11,059 | 9,767 | 262,603 | 0.325 | 0.11 | 0.88 | 0.22 | 5 | 9 | 26.89 | 54.86 | 18.97 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 12,941 | morning_doji_star | 3 | downtrend | bullish reversal | crypto | bearish continuation | high-close | 1 | 22 | 48 | 48 | 52 | -0.796 | -0.27 | 1.00 | 0.10 | 2 | 3 | 1.08 | 1.80 | 1.00 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 12,942 | morning_doji_star | 3 | downtrend | bullish reversal | crypto | bearish continuation | high-close | 2 | 22 | 48 | 48 | 56 | -0.816 | -0.27 | 1.00 | 0.06 | 2 | 3 | 1.17 | 2.67 | 1.07 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 12,943 | morning_doji_star | 3 | downtrend | bullish reversal | crypto | bearish continuation | high-close | 3 | 22 | 48 | 48 | 77 | -0.834 | -0.28 | 1.00 | 0.04 | 1 | 3 | 1.60 | 13.50 | 1.09 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 12,944 | morning_doji_star | 3 | downtrend | bullish reversal | crypto | bearish continuation | high-close | 4 | 22 | 48 | 48 | 77 | -0.792 | -0.26 | 1.00 | 0.04 | 1 | 3 | 1.60 | 13.50 | 1.09 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 12,945 | morning_doji_star | 3 | downtrend | bullish reversal | crypto | bearish continuation | high-close | 5 | 22 | 48 | 48 | 77 | -0.750 | -0.25 | 1.00 | 0.04 | 1 | 3 | 1.60 | 13.50 | 1.09 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 12,946 | morning_doji_star | 3 | downtrend | bullish reversal | forex | bearish continuation | high-close | 1 | 221 | 593 | 588 | 615 | -0.838 | -0.28 | 0.99 | 0.08 | 2 | 6 | 1.05 | 1.17 | 1.04 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 12,947 | morning_doji_star | 3 | downtrend | bullish reversal | forex | bearish continuation | high-close | 2 | 221 | 593 | 588 | 664 | -0.818 | -0.27 | 0.99 | 0.06 | 2 | 6 | 1.13 | 1.81 | 1.09 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 12,948 | morning_doji_star | 3 | downtrend | bullish reversal | forex | bearish continuation | high-close | 3 | 221 | 593 | 588 | 767 | -0.791 | -0.26 | 0.99 | 0.05 | 2 | 6 | 1.30 | 3.19 | 1.20 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 12,949 | morning_doji_star | 3 | downtrend | bullish reversal | forex | bearish continuation | high-close | 4 | 221 | 593 | 588 | 813 | -0.784 | -0.26 | 0.99 | 0.04 | 2 | 6 | 1.38 | 4.65 | 1.23 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 12,950 | morning_doji_star | 3 | downtrend | bullish reversal | forex | bearish continuation | high-close | 5 | 221 | 593 | 588 | 828 | -0.765 | -0.26 | 0.99 | 0.04 | 2 | 6 | 1.41 | 5.43 | 1.24 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 12,951 | morning_doji_star | 3 | downtrend | bullish reversal | stock | bearish continuation | high-close | 1 | 2,904 | 11,230 | 10,282 | 11,381 | -0.881 | -0.29 | 0.92 | 0.06 | 3 | 11 | 1.11 | 1.54 | 1.08 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 12,952 | morning_doji_star | 3 | downtrend | bullish reversal | stock | bearish continuation | high-close | 2 | 2,904 | 11,230 | 10,282 | 12,065 | -0.848 | -0.28 | 0.92 | 0.05 | 3 | 11 | 1.17 | 2.39 | 1.11 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 12,953 | morning_doji_star | 3 | downtrend | bullish reversal | stock | bearish continuation | high-close | 3 | 2,904 | 11,228 | 10,280 | 12,947 | -0.828 | -0.28 | 0.92 | 0.04 | 3 | 11 | 1.26 | 2.71 | 1.19 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 12,954 | morning_doji_star | 3 | downtrend | bullish reversal | stock | bearish continuation | high-close | 4 | 2,904 | 11,228 | 10,279 | 13,649 | -0.804 | -0.27 | 0.92 | 0.04 | 3 | 11 | 1.33 | 3.85 | 1.23 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| 12,955 | morning_doji_star | 3 | downtrend | bullish reversal | stock | bearish continuation | high-close | 5 | 2,904 | 11,226 | 10,277 | 14,415 | -0.780 | -0.26 | 0.92 | 0.04 | 3 | 11 | 1.40 | 5.33 | 1.26 | https://analyzingalpha.com/morning-doji-star-candlestick-pattern |

| Market | Strategy | Setup | Trades | Edge |

Pattern:

Pattern Bars:

Required Trend:

Traditional Strategy:

Market:

Strategy:

Setup:

RR:

Tickers:

Signals:

Trades:

Trade Bars:

Edge:

Edge Per Bar:

Confirm %:

Win %:

Cons Wins:

Cons Losses:

Avg. Trade Bars:

Avg. Win Bars:

Avg. Loss Bars:

Similar Candlestick Patterns

Technical analysts often confuse the morning doji star with other candlestick patterns. It’s essential to understand the differences when using candlestick pattern technical analysis.

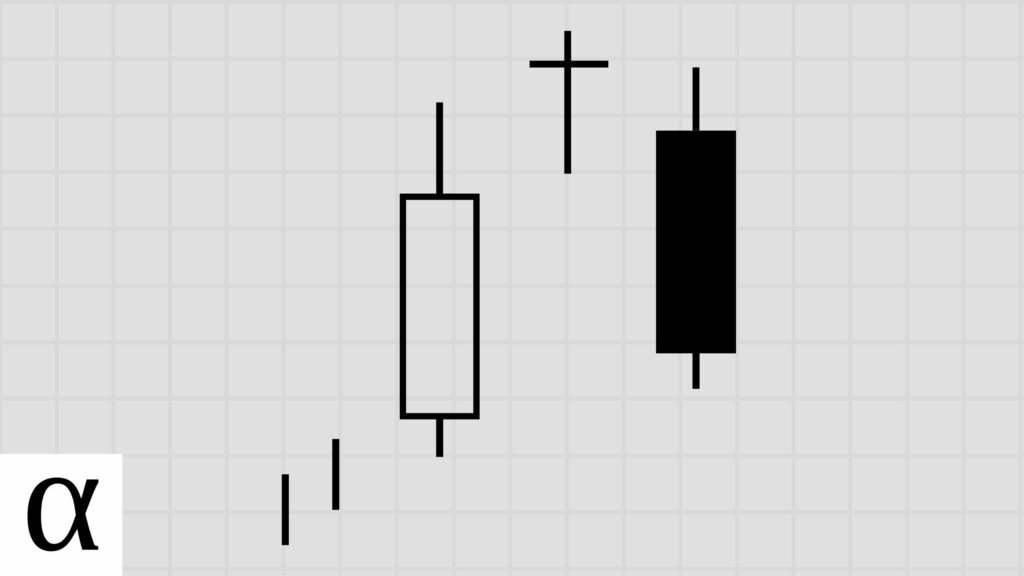

Evening Doji Star vs. Morning Doji Star

The evening doji star candlestick pattern is the mirror opposite of its early-rising sibling. The evening star occurs in an uptrend instead of a downtrend. Its first candle is long and bullish compared to long and bearish. The second is a doji that gaps up instead of down. The final candle is bearish and moves well with the first candle’s real body instead of doing the same thing in the opposite direction.

The data shows that these patterns likely lead to short-term volatility and not reversals.

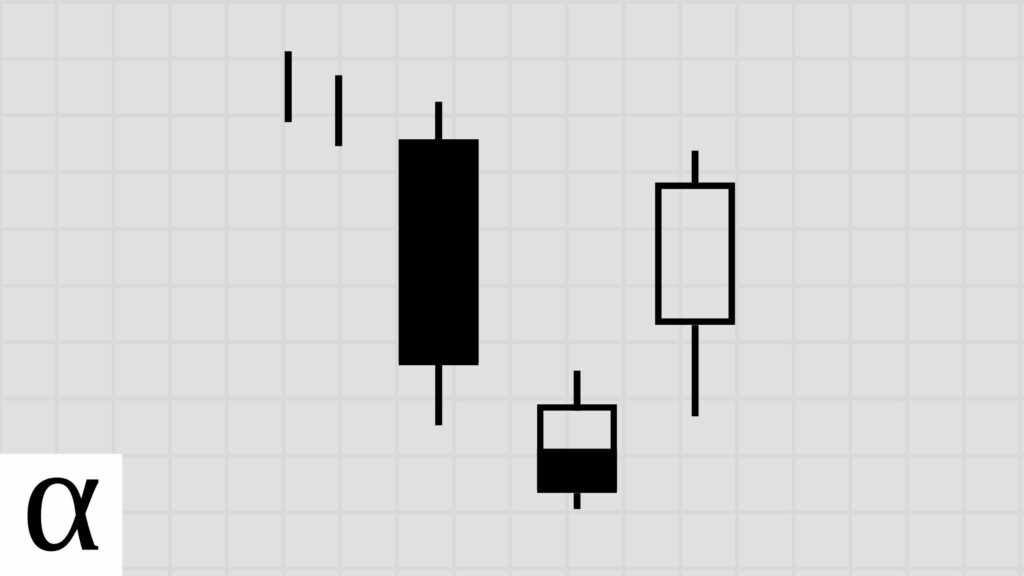

Morning Star vs. Morning Doji Star

The morning star candlestick pattern is almost identical to the morning doji star. The only difference between the morning star and the morning doji star is that the second candle has a small real body in the morning star, whereas the morning doji star requires a doji.

The Bottom Line

The morning doji star candlestick pattern is a three-candle bullish reversal pattern that historically leads to volatility. The data tells us the best way to capture this volatility is to use a modified entry bullish reversal strategy in the crypto markets and a bullish mean reversion strategy in the forex and stock markets.

The data shows us that this pattern resolves bullishly in all markets, which is a trait of the most reliable candle patterns.