The bearish tri-star is a rare three-bar bearish reversal Japanese candlestick pattern that is best traded as indented, according to our extensive testing.

And while this is one of the few patterns that work as intended, you can still lose money when following traditional advice.

Keep reading to learn the best tri-star trading strategy according to history.

What Is a Bearish Tri-Star Candlestick Pattern?

The bearish tri-star is a rare three-bar candlestick pattern.

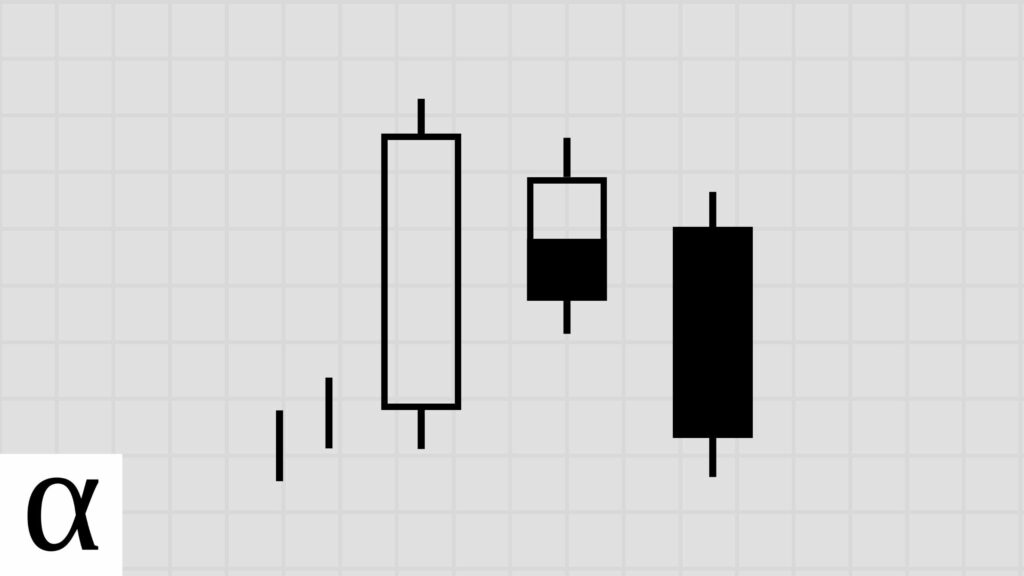

The bearish tri-star gets its name from the distinct three doji candlesticks that comprise the pattern.

The pattern is traditionally considered a bearish reversal pattern, and the data does suggest this is the case.

But before we discuss how to enter this reversal pattern profitably, let’s learn how to identify this tri-star pattern on our candlestick charts.

How to Identify the Bearish Tri-Star Candlestick Pattern

The following are the requirements for a valid bearish tri-star pattern:

- There must be three consecutive doji days.

- The second doji must be a star and gap up above the prior doji.

- The bearish tri-star must occur in an uptrend.

We see the bearish tri-star pattern on the Akamai (AKAM) May 15th, 2018, daily chart.

There’s a current uptrend as the price is above the 50-day moving average. We see three doji candles with the middle doji gapping up, fulfilling the bearish tri-star pattern requirements.

Now that we know how to identify this bearish trend reversal pattern, let’s learn how to trade it.

How to Trade the Bearish Tri-Star Pattern

According to our backtests, this pattern historically precedes a trend reversal. Traders should use a bearish reversal trading strategy expecting a countertrend move.

Let’s look at an example of how to do this optimally.

Bearish Tri-Star Bearish Reversal Trade Setup

Let’s make this successful trading strategy lucid with an example.

While the trend is mixed as it’s moving up and down across a horizontal price level, we see that the price is above the 50-day moving average at the time of the three doji candlesticks fulfilling the uptrend requirement.

Most traders go short at a break of the low of the third doji with a stop loss above the high of the second doji.

But as we know from the data, most traders could be doing significantly better by listening to history.

The optimal way to trade this pattern is to go short when the price moves below the close of the third doji and place the stop loss above the second doji’s high, expecting a more significant reversal using a 1:5 risk-reward ratio.

We can see from the above that the price quickly moves in the opposite direction, and market participants following this strategy would have made significant gains.

But speaking of gains, how profitable is this candle reversal pattern according to history?

Does the Bearish Tri-Star Work? (Backtest Results)

Using the following rules, I backtested the bearish tri-star candlestick pattern on the daily timeframe in the crypto, forex, and stock markets.

- A close above the 50-day SMA constitutes an uptrend.

- I tested risk-reward ranges from 1 to 5.

- The optimal risk-reward ratio is selected using profit per bar.

- Entry and exits are discussed in the how-to trade section above.

- Confirmation must occur within three days of the pattern signal.

| Id | Pattern | Pattern Bars | Required Trend | Traditional Strategy | Market | Strategy | Setup | RR | Tickers | Signals | Trades | Trade Bars | Edge | Edge Per Bar | Confirm % | Win % | Cons Wins | Cons Losses | Avg. Trade Bars | Avg. Win Bars | Avg. Loss Bars | Details |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 7,571 | bearish_three_line_strike | 4 | downtrend | bearish continuation | crypto | bearish continuation | high-close | 1 | 26 | 77 | 76 | 101 | -0.182 | -0.05 | 0.99 | 0.41 | 6 | 3 | 1.33 | 1.55 | 1.18 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 7,572 | bearish_three_line_strike | 4 | downtrend | bearish continuation | crypto | bearish continuation | high-close | 2 | 26 | 76 | 75 | 134 | -0.160 | -0.04 | 0.99 | 0.28 | 6 | 4 | 1.79 | 2.81 | 1.39 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 7,573 | bearish_three_line_strike | 4 | downtrend | bearish continuation | crypto | bearish continuation | high-close | 3 | 26 | 76 | 75 | 175 | 0.071 | 0.02 | 0.99 | 0.27 | 6 | 4 | 2.33 | 4.50 | 1.55 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 7,574 | bearish_three_line_strike | 4 | downtrend | bearish continuation | crypto | bearish continuation | high-close | 4 | 26 | 76 | 75 | 208 | 0.200 | 0.05 | 0.99 | 0.24 | 6 | 4 | 2.77 | 6.28 | 1.67 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 7,575 | bearish_three_line_strike | 4 | downtrend | bearish continuation | crypto | bearish continuation | high-close | 5 | 26 | 76 | 75 | 293 | 0.275 | 0.07 | 0.99 | 0.21 | 6 | 4 | 3.91 | 10.81 | 2.03 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 7,576 | bearish_three_line_strike | 4 | downtrend | bearish continuation | forex | bearish continuation | high-close | 1 | 287 | 856 | 849 | 1,225 | -0.475 | -0.12 | 0.99 | 0.27 | 4 | 8 | 1.44 | 1.24 | 1.51 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 7,577 | bearish_three_line_strike | 4 | downtrend | bearish continuation | forex | bearish continuation | high-close | 2 | 287 | 856 | 849 | 1,530 | -0.342 | -0.09 | 0.99 | 0.22 | 4 | 8 | 1.80 | 1.74 | 1.82 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 7,578 | bearish_three_line_strike | 4 | downtrend | bearish continuation | forex | bearish continuation | high-close | 3 | 287 | 856 | 849 | 1,716 | -0.240 | -0.06 | 0.99 | 0.19 | 4 | 8 | 2.02 | 2.37 | 1.94 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 7,579 | bearish_three_line_strike | 4 | downtrend | bearish continuation | forex | bearish continuation | high-close | 4 | 287 | 855 | 848 | 1,995 | -0.200 | -0.05 | 0.99 | 0.16 | 4 | 8 | 2.35 | 3.46 | 2.14 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 7,580 | bearish_three_line_strike | 4 | downtrend | bearish continuation | forex | bearish continuation | high-close | 5 | 287 | 855 | 847 | 2,242 | -0.170 | -0.04 | 0.99 | 0.14 | 4 | 8 | 2.65 | 4.72 | 2.32 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 7,581 | bearish_three_line_strike | 4 | downtrend | bearish continuation | stock | bearish continuation | high-close | 1 | 702 | 1,709 | 1,578 | 2,481 | -0.356 | -0.09 | 0.92 | 0.32 | 5 | 6 | 1.57 | 1.54 | 1.59 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 7,582 | bearish_three_line_strike | 4 | downtrend | bearish continuation | stock | bearish continuation | high-close | 2 | 702 | 1,708 | 1,577 | 3,041 | -0.136 | -0.03 | 0.92 | 0.29 | 4 | 6 | 1.93 | 2.16 | 1.84 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 7,583 | bearish_three_line_strike | 4 | downtrend | bearish continuation | stock | bearish continuation | high-close | 3 | 702 | 1,708 | 1,576 | 4,162 | 0.034 | 0.01 | 0.92 | 0.26 | 4 | 6 | 2.64 | 4.49 | 2.00 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 7,584 | bearish_three_line_strike | 4 | downtrend | bearish continuation | stock | bearish continuation | high-close | 4 | 702 | 1,708 | 1,576 | 4,744 | 0.154 | 0.04 | 0.92 | 0.23 | 3 | 6 | 3.01 | 4.57 | 2.54 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 7,585 | bearish_three_line_strike | 4 | downtrend | bearish continuation | stock | bearish continuation | high-close | 5 | 702 | 1,708 | 1,575 | 5,278 | 0.275 | 0.07 | 0.92 | 0.21 | 3 | 6 | 3.35 | 5.27 | 2.83 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 7,826 | bearish_three_line_strike | 4 | downtrend | bearish continuation | crypto | bearish continuation | high-low | 1 | 26 | 77 | 20 | 80 | 0.100 | 0.03 | 0.26 | 0.55 | 4 | 1 | 4.00 | 5.55 | 2.11 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 7,827 | bearish_three_line_strike | 4 | downtrend | bearish continuation | crypto | bearish continuation | high-low | 2 | 26 | 76 | 19 | 116 | 0.418 | 0.10 | 0.25 | 0.47 | 3 | 1 | 6.11 | 8.33 | 4.10 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 7,828 | bearish_three_line_strike | 4 | downtrend | bearish continuation | crypto | bearish continuation | high-low | 3 | 26 | 75 | 19 | 258 | 0.268 | 0.07 | 0.25 | 0.32 | 2 | 1 | 13.58 | 17.67 | 11.69 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 7,829 | bearish_three_line_strike | 4 | downtrend | bearish continuation | crypto | bearish continuation | high-low | 4 | 26 | 73 | 18 | 250 | -0.162 | -0.04 | 0.25 | 0.17 | 1 | 4 | 13.89 | 22.67 | 12.13 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 7,830 | bearish_three_line_strike | 4 | downtrend | bearish continuation | crypto | bearish continuation | high-low | 5 | 26 | 73 | 18 | 270 | -0.335 | -0.08 | 0.25 | 0.11 | 1 | 4 | 15.00 | 32.50 | 12.81 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 7,831 | bearish_three_line_strike | 4 | downtrend | bearish continuation | forex | bearish continuation | high-low | 1 | 287 | 856 | 204 | 807 | -0.441 | -0.11 | 0.24 | 0.28 | 2 | 4 | 3.96 | 5.39 | 3.40 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 7,832 | bearish_three_line_strike | 4 | downtrend | bearish continuation | forex | bearish continuation | high-low | 2 | 287 | 855 | 203 | 1,361 | -0.376 | -0.09 | 0.24 | 0.21 | 2 | 4 | 6.70 | 12.17 | 5.28 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 7,833 | bearish_three_line_strike | 4 | downtrend | bearish continuation | forex | bearish continuation | high-low | 3 | 287 | 853 | 201 | 1,920 | -0.428 | -0.11 | 0.24 | 0.14 | 2 | 4 | 9.55 | 16.62 | 8.36 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 7,834 | bearish_three_line_strike | 4 | downtrend | bearish continuation | forex | bearish continuation | high-low | 4 | 287 | 852 | 201 | 2,254 | -0.454 | -0.11 | 0.24 | 0.11 | 2 | 4 | 11.21 | 28.23 | 9.12 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 7,835 | bearish_three_line_strike | 4 | downtrend | bearish continuation | forex | bearish continuation | high-low | 5 | 287 | 852 | 201 | 2,669 | -0.425 | -0.11 | 0.24 | 0.10 | 2 | 4 | 13.28 | 43.84 | 10.09 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 7,836 | bearish_three_line_strike | 4 | downtrend | bearish continuation | stock | bearish continuation | high-low | 1 | 702 | 1,707 | 424 | 3,027 | -0.160 | -0.04 | 0.25 | 0.42 | 2 | 3 | 7.14 | 7.76 | 6.69 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 7,837 | bearish_three_line_strike | 4 | downtrend | bearish continuation | stock | bearish continuation | high-low | 2 | 702 | 1,704 | 424 | 7,001 | -0.158 | -0.04 | 0.25 | 0.28 | 2 | 3 | 16.51 | 28.83 | 11.70 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 7,838 | bearish_three_line_strike | 4 | downtrend | bearish continuation | stock | bearish continuation | high-low | 3 | 702 | 1,701 | 424 | 12,067 | -0.231 | -0.06 | 0.25 | 0.19 | 2 | 3 | 28.46 | 23.84 | 29.57 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 7,839 | bearish_three_line_strike | 4 | downtrend | bearish continuation | stock | bearish continuation | high-low | 4 | 702 | 1,699 | 424 | 16,148 | -0.238 | -0.06 | 0.25 | 0.15 | 2 | 3 | 38.08 | 75.98 | 31.22 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 7,840 | bearish_three_line_strike | 4 | downtrend | bearish continuation | stock | bearish continuation | high-low | 5 | 702 | 1,695 | 421 | 16,235 | -0.215 | -0.05 | 0.25 | 0.13 | 2 | 3 | 38.56 | 79.11 | 32.47 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 9,821 | bearish_three_line_strike | 4 | downtrend | bearish continuation | crypto | bullish reversal | low-high | 1 | 26 | 75 | 54 | 423 | 0.039 | 0.01 | 0.72 | 0.52 | 3 | 3 | 7.83 | 6.18 | 9.62 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 9,822 | bearish_three_line_strike | 4 | downtrend | bearish continuation | crypto | bullish reversal | low-high | 2 | 26 | 72 | 51 | 754 | 0.056 | 0.01 | 0.71 | 0.35 | 2 | 4 | 14.78 | 16.56 | 13.82 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 9,823 | bearish_three_line_strike | 4 | downtrend | bearish continuation | crypto | bullish reversal | low-high | 3 | 26 | 72 | 51 | 908 | 0.252 | 0.06 | 0.71 | 0.31 | 2 | 4 | 17.80 | 25.94 | 14.09 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 9,824 | bearish_three_line_strike | 4 | downtrend | bearish continuation | crypto | bullish reversal | low-high | 4 | 26 | 72 | 51 | 1,099 | 0.466 | 0.12 | 0.71 | 0.29 | 2 | 4 | 21.55 | 39.07 | 14.25 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 9,825 | bearish_three_line_strike | 4 | downtrend | bearish continuation | crypto | bullish reversal | low-high | 5 | 26 | 71 | 51 | 1,295 | 0.535 | 0.13 | 0.72 | 0.26 | 2 | 4 | 25.39 | 56.46 | 14.76 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 9,826 | bearish_three_line_strike | 4 | downtrend | bearish continuation | forex | bullish reversal | low-high | 1 | 287 | 851 | 678 | 6,949 | -0.218 | -0.05 | 0.80 | 0.39 | 4 | 4 | 10.25 | 10.19 | 10.29 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 9,827 | bearish_three_line_strike | 4 | downtrend | bearish continuation | forex | bullish reversal | low-high | 2 | 287 | 850 | 676 | 11,763 | -0.242 | -0.06 | 0.80 | 0.25 | 4 | 6 | 17.40 | 25.60 | 14.60 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 9,828 | bearish_three_line_strike | 4 | downtrend | bearish continuation | forex | bullish reversal | low-high | 3 | 287 | 847 | 673 | 17,130 | -0.243 | -0.06 | 0.79 | 0.19 | 4 | 8 | 25.45 | 41.88 | 21.63 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 9,829 | bearish_three_line_strike | 4 | downtrend | bearish continuation | forex | bullish reversal | low-high | 4 | 287 | 847 | 670 | 21,479 | -0.212 | -0.05 | 0.79 | 0.16 | 2 | 8 | 32.06 | 72.55 | 24.53 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 9,830 | bearish_three_line_strike | 4 | downtrend | bearish continuation | forex | bullish reversal | low-high | 5 | 287 | 847 | 670 | 25,084 | -0.180 | -0.05 | 0.79 | 0.14 | 2 | 8 | 37.44 | 105.02 | 26.82 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 9,831 | bearish_three_line_strike | 4 | downtrend | bearish continuation | stock | bullish reversal | low-high | 1 | 702 | 1,705 | 1,309 | 10,333 | 0.095 | 0.02 | 0.77 | 0.55 | 4 | 3 | 7.89 | 7.62 | 8.22 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 9,832 | bearish_three_line_strike | 4 | downtrend | bearish continuation | stock | bullish reversal | low-high | 2 | 702 | 1,703 | 1,308 | 21,023 | 0.108 | 0.03 | 0.77 | 0.37 | 3 | 4 | 16.07 | 17.78 | 15.07 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 9,833 | bearish_three_line_strike | 4 | downtrend | bearish continuation | stock | bullish reversal | low-high | 3 | 702 | 1,702 | 1,307 | 29,200 | 0.132 | 0.03 | 0.77 | 0.28 | 3 | 4 | 22.34 | 30.42 | 19.14 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 9,834 | bearish_three_line_strike | 4 | downtrend | bearish continuation | stock | bullish reversal | low-high | 4 | 702 | 1,701 | 1,307 | 36,880 | 0.196 | 0.05 | 0.77 | 0.24 | 3 | 4 | 28.22 | 45.86 | 22.66 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 9,835 | bearish_three_line_strike | 4 | downtrend | bearish continuation | stock | bullish reversal | low-high | 5 | 702 | 1,700 | 1,306 | 43,543 | 0.245 | 0.06 | 0.77 | 0.21 | 3 | 4 | 33.34 | 63.99 | 25.35 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 12,181 | bearish_three_line_strike | 4 | downtrend | bearish continuation | crypto | bearish mean reversion | atr-pattern_high | 1 | 26 | 77 | 42 | 173 | 0.478 | 0.12 | 0.55 | 0.74 | 2 | 2 | 4.12 | 4.13 | 4.09 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 12,182 | bearish_three_line_strike | 4 | downtrend | bearish continuation | crypto | bearish mean reversion | atr-pattern_high | 2 | 26 | 75 | 40 | 361 | 0.350 | 0.09 | 0.53 | 0.45 | 2 | 2 | 9.02 | 11.89 | 6.68 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 12,183 | bearish_three_line_strike | 4 | downtrend | bearish continuation | crypto | bearish mean reversion | atr-pattern_high | 3 | 26 | 74 | 39 | 497 | 0.535 | 0.13 | 0.53 | 0.39 | 1 | 2 | 12.74 | 19.20 | 8.71 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 12,184 | bearish_three_line_strike | 4 | downtrend | bearish continuation | crypto | bearish mean reversion | atr-pattern_high | 4 | 26 | 74 | 39 | 615 | 0.662 | 0.17 | 0.53 | 0.33 | 1 | 3 | 15.77 | 24.31 | 11.50 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 12,185 | bearish_three_line_strike | 4 | downtrend | bearish continuation | crypto | bearish mean reversion | atr-pattern_high | 5 | 26 | 74 | 39 | 1,139 | 0.225 | 0.06 | 0.53 | 0.21 | 1 | 3 | 29.21 | 55.00 | 22.55 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 12,186 | bearish_three_line_strike | 4 | downtrend | bearish continuation | forex | bearish mean reversion | atr-pattern_high | 1 | 287 | 855 | 548 | 2,641 | 0.355 | 0.09 | 0.64 | 0.68 | 5 | 3 | 4.82 | 4.12 | 6.27 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 12,187 | bearish_three_line_strike | 4 | downtrend | bearish continuation | forex | bearish mean reversion | atr-pattern_high | 2 | 287 | 853 | 545 | 5,675 | 0.466 | 0.12 | 0.64 | 0.49 | 5 | 3 | 10.41 | 11.84 | 9.05 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 12,188 | bearish_three_line_strike | 4 | downtrend | bearish continuation | forex | bearish mean reversion | atr-pattern_high | 3 | 287 | 849 | 544 | 9,088 | 0.360 | 0.09 | 0.64 | 0.34 | 4 | 4 | 16.71 | 23.12 | 13.40 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 12,189 | bearish_three_line_strike | 4 | downtrend | bearish continuation | forex | bearish mean reversion | atr-pattern_high | 4 | 287 | 847 | 544 | 12,548 | 0.320 | 0.08 | 0.64 | 0.27 | 3 | 4 | 23.07 | 39.36 | 17.20 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 12,190 | bearish_three_line_strike | 4 | downtrend | bearish continuation | forex | bearish mean reversion | atr-pattern_high | 5 | 287 | 843 | 542 | 15,829 | 0.300 | 0.08 | 0.64 | 0.22 | 3 | 4 | 29.20 | 59.94 | 20.74 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 12,191 | bearish_three_line_strike | 4 | downtrend | bearish continuation | stock | bearish mean reversion | atr-pattern_high | 1 | 702 | 1,709 | 1,028 | 4,071 | 0.182 | 0.05 | 0.60 | 0.59 | 4 | 3 | 3.96 | 3.83 | 4.14 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 12,192 | bearish_three_line_strike | 4 | downtrend | bearish continuation | stock | bearish mean reversion | atr-pattern_high | 2 | 702 | 1,705 | 1,026 | 8,225 | 0.164 | 0.04 | 0.60 | 0.39 | 3 | 3 | 8.02 | 10.00 | 6.77 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 12,193 | bearish_three_line_strike | 4 | downtrend | bearish continuation | stock | bearish mean reversion | atr-pattern_high | 3 | 702 | 1,705 | 1,025 | 12,004 | 0.188 | 0.05 | 0.60 | 0.30 | 3 | 3 | 11.71 | 16.66 | 9.63 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 12,194 | bearish_three_line_strike | 4 | downtrend | bearish continuation | stock | bearish mean reversion | atr-pattern_high | 4 | 702 | 1,701 | 1,021 | 17,385 | 0.138 | 0.03 | 0.60 | 0.23 | 3 | 3 | 17.03 | 29.24 | 13.44 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 12,195 | bearish_three_line_strike | 4 | downtrend | bearish continuation | stock | bearish mean reversion | atr-pattern_high | 5 | 702 | 1,697 | 1,018 | 24,878 | 0.120 | 0.03 | 0.60 | 0.19 | 3 | 3 | 24.44 | 43.84 | 20.02 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 12,391 | bearish_three_line_strike | 4 | downtrend | bearish continuation | crypto | bullish reversal | low-close | 1 | 26 | 75 | 74 | 444 | -0.024 | -0.01 | 0.99 | 0.49 | 3 | 2 | 6.00 | 4.64 | 7.29 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 12,392 | bearish_three_line_strike | 4 | downtrend | bearish continuation | crypto | bullish reversal | low-close | 2 | 26 | 72 | 71 | 854 | -0.070 | -0.02 | 0.99 | 0.31 | 2 | 3 | 12.03 | 13.64 | 11.31 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 12,393 | bearish_three_line_strike | 4 | downtrend | bearish continuation | crypto | bullish reversal | low-close | 3 | 26 | 72 | 71 | 955 | -0.043 | -0.01 | 0.99 | 0.24 | 2 | 5 | 13.45 | 20.53 | 11.22 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 12,394 | bearish_three_line_strike | 4 | downtrend | bearish continuation | crypto | bullish reversal | low-close | 4 | 26 | 72 | 71 | 1,088 | 0.196 | 0.05 | 0.99 | 0.24 | 2 | 5 | 15.32 | 28.35 | 11.22 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 12,395 | bearish_three_line_strike | 4 | downtrend | bearish continuation | crypto | bullish reversal | low-close | 5 | 26 | 71 | 70 | 1,279 | 0.280 | 0.07 | 0.99 | 0.21 | 2 | 5 | 18.27 | 42.47 | 11.67 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 12,396 | bearish_three_line_strike | 4 | downtrend | bearish continuation | forex | bullish reversal | low-close | 1 | 287 | 849 | 832 | 7,134 | -0.163 | -0.04 | 0.98 | 0.42 | 4 | 5 | 8.57 | 8.46 | 8.66 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 12,397 | bearish_three_line_strike | 4 | downtrend | bearish continuation | forex | bullish reversal | low-close | 2 | 287 | 847 | 828 | 11,958 | -0.218 | -0.05 | 0.98 | 0.26 | 3 | 6 | 14.44 | 18.81 | 12.90 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 12,398 | bearish_three_line_strike | 4 | downtrend | bearish continuation | forex | bullish reversal | low-close | 3 | 287 | 845 | 826 | 17,280 | -0.215 | -0.05 | 0.98 | 0.20 | 2 | 8 | 20.92 | 30.20 | 18.67 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 12,399 | bearish_three_line_strike | 4 | downtrend | bearish continuation | forex | bullish reversal | low-close | 4 | 287 | 844 | 822 | 21,564 | -0.192 | -0.05 | 0.97 | 0.16 | 2 | 8 | 26.23 | 47.03 | 22.22 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 12,400 | bearish_three_line_strike | 4 | downtrend | bearish continuation | forex | bullish reversal | low-close | 5 | 287 | 844 | 821 | 25,114 | -0.145 | -0.04 | 0.97 | 0.14 | 2 | 8 | 30.59 | 72.56 | 23.62 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 12,401 | bearish_three_line_strike | 4 | downtrend | bearish continuation | stock | bullish reversal | low-close | 1 | 702 | 1,706 | 1,527 | 10,789 | 0.079 | 0.02 | 0.90 | 0.54 | 4 | 4 | 7.07 | 6.57 | 7.65 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 12,402 | bearish_three_line_strike | 4 | downtrend | bearish continuation | stock | bullish reversal | low-close | 2 | 702 | 1,703 | 1,522 | 21,177 | 0.110 | 0.03 | 0.89 | 0.37 | 3 | 5 | 13.91 | 16.01 | 12.69 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 12,403 | bearish_three_line_strike | 4 | downtrend | bearish continuation | stock | bullish reversal | low-close | 3 | 702 | 1,702 | 1,522 | 29,076 | 0.163 | 0.04 | 0.89 | 0.29 | 3 | 5 | 19.10 | 26.91 | 15.90 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 12,404 | bearish_three_line_strike | 4 | downtrend | bearish continuation | stock | bullish reversal | low-close | 4 | 702 | 1,701 | 1,521 | 37,470 | 0.250 | 0.06 | 0.89 | 0.25 | 3 | 5 | 24.64 | 41.47 | 19.03 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 12,405 | bearish_three_line_strike | 4 | downtrend | bearish continuation | stock | bullish reversal | low-close | 5 | 702 | 1,699 | 1,520 | 44,453 | 0.265 | 0.07 | 0.89 | 0.21 | 3 | 5 | 29.25 | 58.00 | 21.55 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 13,306 | bearish_three_line_strike | 4 | downtrend | bearish continuation | crypto | bullish mean reversion | atr-pattern_low | 1 | 26 | 76 | 14 | 73 | 0.000 | 0.00 | 0.18 | 0.50 | 3 | 1 | 5.21 | 5.14 | 5.29 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 13,307 | bearish_three_line_strike | 4 | downtrend | bearish continuation | crypto | bullish mean reversion | atr-pattern_low | 2 | 26 | 76 | 14 | 86 | 0.074 | 0.02 | 0.18 | 0.36 | 1 | 1 | 6.14 | 8.00 | 5.11 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 13,308 | bearish_three_line_strike | 4 | downtrend | bearish continuation | crypto | bullish mean reversion | atr-pattern_low | 3 | 26 | 75 | 14 | 125 | -0.148 | -0.04 | 0.19 | 0.21 | 1 | 3 | 8.93 | 13.00 | 7.82 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 13,309 | bearish_three_line_strike | 4 | downtrend | bearish continuation | crypto | bullish mean reversion | atr-pattern_low | 4 | 26 | 75 | 14 | 147 | 0.066 | 0.02 | 0.19 | 0.21 | 1 | 3 | 10.50 | 20.33 | 7.82 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 13,310 | bearish_three_line_strike | 4 | downtrend | bearish continuation | crypto | bullish mean reversion | atr-pattern_low | 5 | 26 | 75 | 14 | 148 | 0.280 | 0.07 | 0.19 | 0.21 | 1 | 3 | 10.57 | 20.67 | 7.82 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 13,311 | bearish_three_line_strike | 4 | downtrend | bearish continuation | forex | bullish mean reversion | atr-pattern_low | 1 | 287 | 856 | 150 | 486 | 0.183 | 0.05 | 0.18 | 0.59 | 3 | 2 | 3.24 | 3.11 | 3.43 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 13,312 | bearish_three_line_strike | 4 | downtrend | bearish continuation | forex | bullish mean reversion | atr-pattern_low | 2 | 287 | 856 | 150 | 1,133 | 0.236 | 0.06 | 0.18 | 0.41 | 3 | 3 | 7.55 | 8.82 | 6.66 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 13,313 | bearish_three_line_strike | 4 | downtrend | bearish continuation | forex | bullish mean reversion | atr-pattern_low | 3 | 287 | 856 | 150 | 1,506 | 0.280 | 0.07 | 0.18 | 0.32 | 2 | 3 | 10.04 | 13.27 | 8.52 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 13,314 | bearish_three_line_strike | 4 | downtrend | bearish continuation | forex | bullish mean reversion | atr-pattern_low | 4 | 287 | 856 | 149 | 1,954 | 0.308 | 0.08 | 0.17 | 0.26 | 2 | 3 | 13.11 | 17.90 | 11.42 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 13,315 | bearish_three_line_strike | 4 | downtrend | bearish continuation | forex | bullish mean reversion | atr-pattern_low | 5 | 287 | 856 | 149 | 2,811 | 0.325 | 0.08 | 0.17 | 0.22 | 2 | 3 | 18.87 | 28.18 | 16.22 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 13,316 | bearish_three_line_strike | 4 | downtrend | bearish continuation | stock | bullish mean reversion | atr-pattern_low | 1 | 702 | 1,708 | 290 | 1,176 | 0.197 | 0.05 | 0.17 | 0.60 | 3 | 2 | 4.06 | 3.68 | 4.62 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 13,317 | bearish_three_line_strike | 4 | downtrend | bearish continuation | stock | bullish mean reversion | atr-pattern_low | 2 | 702 | 1,706 | 290 | 2,336 | 0.286 | 0.07 | 0.17 | 0.43 | 2 | 2 | 8.06 | 10.09 | 6.54 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 13,318 | bearish_three_line_strike | 4 | downtrend | bearish continuation | stock | bullish mean reversion | atr-pattern_low | 3 | 702 | 1,706 | 290 | 3,445 | 0.468 | 0.12 | 0.17 | 0.37 | 2 | 2 | 11.88 | 17.30 | 8.76 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 13,319 | bearish_three_line_strike | 4 | downtrend | bearish continuation | stock | bullish mean reversion | atr-pattern_low | 4 | 702 | 1,706 | 290 | 4,533 | 0.488 | 0.12 | 0.17 | 0.30 | 2 | 2 | 15.63 | 25.24 | 11.58 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| 13,320 | bearish_three_line_strike | 4 | downtrend | bearish continuation | stock | bullish mean reversion | atr-pattern_low | 5 | 702 | 1,704 | 289 | 6,056 | 0.480 | 0.12 | 0.17 | 0.25 | 2 | 2 | 20.96 | 33.72 | 16.80 | https://analyzingalpha.com/bearish-three-line-strike-candlestick-pattern |

| Market | Strategy | Setup | Trades | Edge |

Pattern:

Pattern Bars:

Required Trend:

Traditional Strategy:

Market:

Strategy:

Setup:

RR:

Tickers:

Signals:

Trades:

Trade Bars:

Edge:

Edge Per Bar:

Confirm %:

Win %:

Cons Wins:

Cons Losses:

Avg. Trade Bars:

Avg. Win Bars:

Avg. Loss Bars:

Similar Candlestick Patterns

While few candlestick patterns look similar to the bearish tri-star due to having three consecutive doji candles, a few similar patterns still confuse technical analysts. Understanding these related patterns and their differences is critical when using candlestick pattern technical analysis.

Bullish Tri-Star vs. Bearish Tri-Star

The bullish tri-star candlestick pattern is the opposite of the bearish tri-star pattern. The bullish tri-star pattern occurs in a downtrend and has three dojis where the middle doji gaps down, whereas, as we’ve just seen, the bearish tri-star occurs in an uptrend with the middle doji gapping up.

Three Inside Down vs. Bearish Tri-Star

The three inside down candlestick pattern, like the bearish tri-star pattern, is a three-bar bearish reversal pattern that only occurs in an uptrend.

The similarities end there, however.

The three inside down pattern requires a bullish first candle, with the second having a small candle engulfed by the first. The third bearish candle closes lower than the first candle’s open.

Additionally, while the bearish tri-star should be traded as intended, the three inside down pattern shouldn’t – instead, it should be traded using a mean reversion strategy.

The Bottom Line

The bearish tri-star is one of the few bearish reversal candlestick patterns that should be traded as intended. According to our backtests, the price trend often reverses into a longer-term bearish move. And while the pattern is profitable, this three-candle reversal pattern is rare.