But don’t worry, because I’m here to help! With over a decade of trading and investing experience, I’m thrilled to present my in-depth analysis of Intrinio, a market data API powerhouse that goes above and beyond your average financial data provider.

In this Intrinio review, I’ll cover everything you need to know about this platform, from its seamless API integrations to its high data quality. Stick with me as we uncover the essential information to help you determine if Intrinio is the game-changing solution you’ve been searching for.

Intrinio Key Features

First, let’s dive into Intrinio’s key features to understand better what this market data provider has to offer:

- High-quality data for all U.S. stocks, options, ETFs, ESGs, and over 100,000 globally traded securities: Intrinio delivers stock market data and fundamentals, empowering traders and analysts with reliable data they can trust.

- High-quality REST APIs: This data partner provides real-time, delayed, end-of-day, and historical data through easy-to-access REST APIs and delivers responses in readable JSON format.

- Scalable infrastructure: Intrinio’s standard enterprise solution boasts an impressive request limit of 2,000 calls per minute and 600 calls per data feed subscription.

After an exhaustive analysis of these features (and more), I gave Intrinio an impressive 4.5 out of 5 stars. This score showcases the platform’s exceptional offerings while recognizing areas that could benefit from enhancement.

Curious about the criteria behind my best financial market data API evaluations? Check out my extensive Market Data API Buying Guide! Brimming with priceless insights on the factors that shaped my assessment, this guide empowers you to make smarter decisions tailored to your unique trading or research needs.

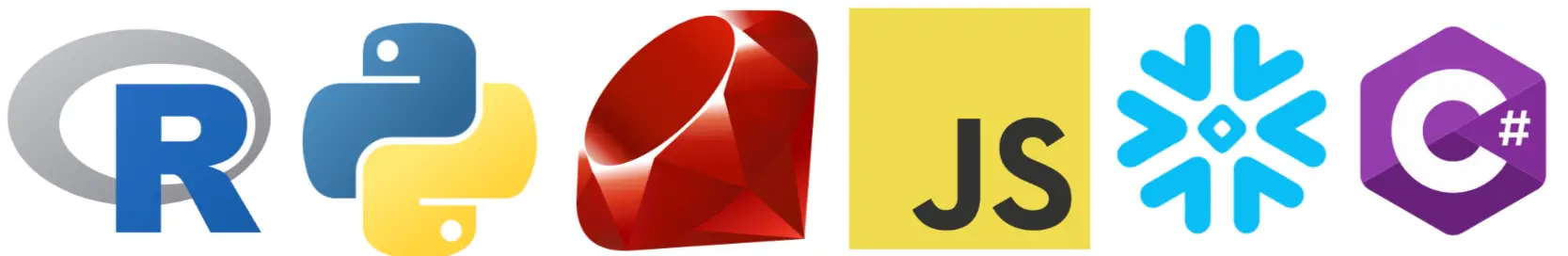

Intrinio API Integrations

Intrinio boasts an impressive array of financial data feeds, expertly curated from their proprietary systems and a diverse range of data vendors. The user-friendly Intrinio API is perfect for traders, analysts, third-party app developers, integrators, and Excel spreadsheet aficionados, thanks to its intuitive HTTPS verbs and streamlined RESTful endpoint structure.

I’ve found that authentication is a breeze with URL Parameter Authentication, and the API serves up responses in the ultra-convenient JSON format. You can also put Intrinio’s API keys to the test via your browser, command line, or SDKs.

Here are the market data APIs Intrinio lets you integrate with:

- R

- Python

- JavaScript

- Ruby

- Java

- C#

- WebSocket API

- Snowflake direct database access

With Intrinio’s seamless market data API integration, you’ll be inspired to dive deep into the data supply chain and make better financial decisions.

How Intrinio’s API Stands Out From the Competition

Intrinio truly stands out from the competition, thanks to its exceptional market data APIs that make it incredibly easy to use. That’s why I’ve awarded this live market data provider a stellar 4.8 rating for usability.

You see, Intrinio’s savvy implementation of REST APIs is not something that every other platform offers. I believe REST APIs are essential for traders and analysts searching for data intelligence. They provide a sleek, scalable, and high-performance gateway to access precise and up-to-the-minute market data, which is vital for making well-informed decisions.

Another way Intrinio sets itself apart from other market data API providers is with its unparalleled customer service. While their market coverage may not be as extensive as some competitors, the customer service team makes up for it by connecting you with alternative market data sources for assets beyond their scope.

Overall, Intrinio’s unwavering dedication to customer satisfaction and cutting-edge API technology positions them as a top contender for fundamental market data API solutions.

Pros and Cons of Intrinio

Now let’s look at the pros and cons I found while testing out Intrinio’s API!

Intrinio Pros

- Easy-to-use APIs: Harness the immense power of REST APIs to effortlessly tap into databases brimming with up-to-date information.

- Access to high volumes of data: Execute a vast number of API requests simultaneously, all thanks to Intrinio’s incredibly advanced infrastructure.

- High-speed access: Surpass the competition with Intrinio’s lightning-fast latency rates around ~20ms, empowering you to tap into real-time data at breakneck speeds.

- Accurate databases: Experience the power of precision with Intrinio’s NBBO-backed data, delivered to you with only a 15-minute delay. You can also access real-time and last-sale data sourced from multiple exchanges.

- Reasonable pricing: Discover top-notch data without emptying your wallet, thanks to Intrinio’s budget-friendly options starting at $150.

Intrinio Cons

- Limited market coverage: Intrinio offers less variety in terms of asset types and market coverage compared to some other data providers.

- 15-minute delay for NBBO data: Intrinio’s real-time NBBO data comes with a $10k monthly exchange fee, so most users use a substitute.

- No cryptocurrency data: While Intrinio doesn’t directly supply crypto data reports, their team will connect you with a provider’s sales team who does.

Are you convinced that the benefits outweigh the drawbacks? If so, it’s time for us to talk about pricing!

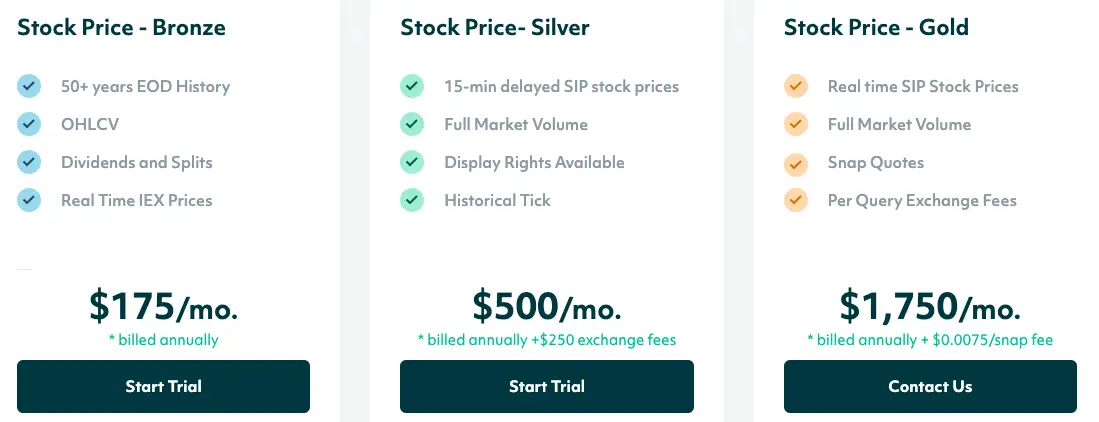

Pricing: Choosing an Intrinio Package

Intrinio boasts an impressive array of data packages tailored to suit various asset types and budgets. With options covering stock prices, fundamentals, options, ETFs, and ESGs, there’s something for everyone.

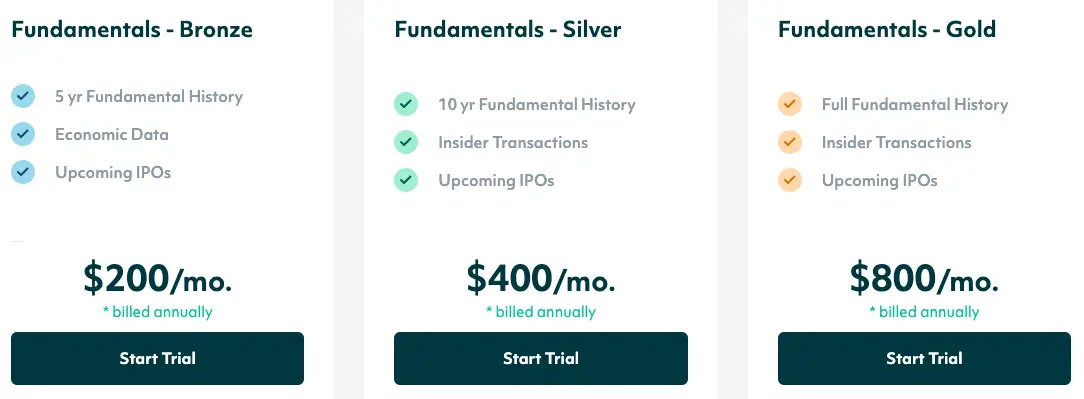

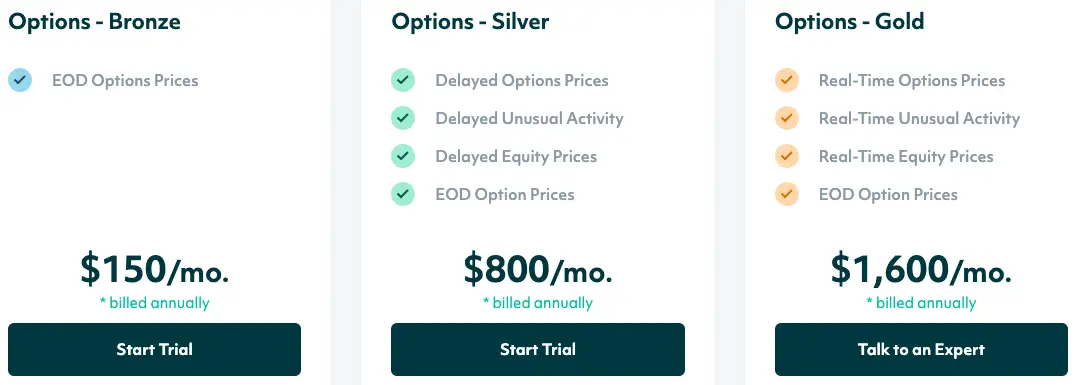

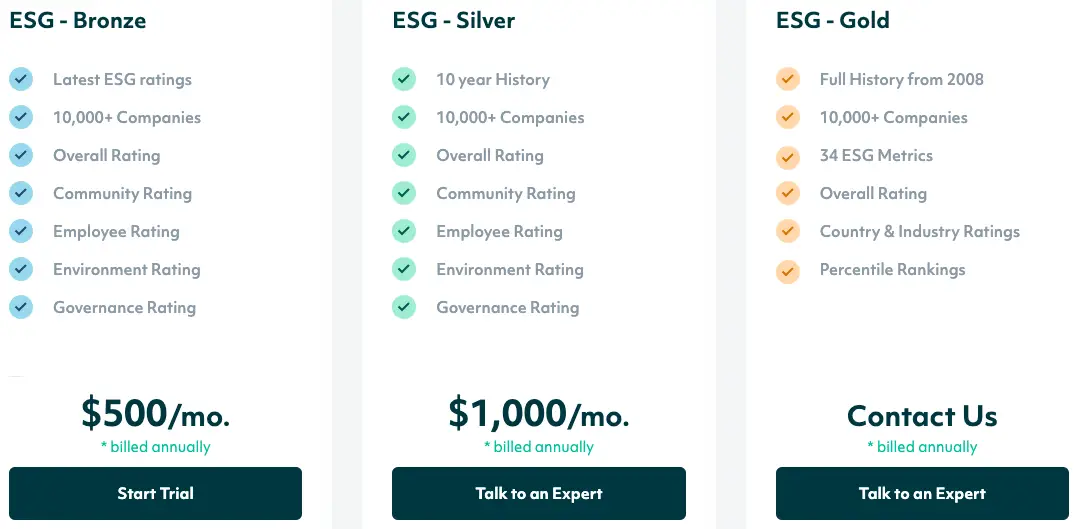

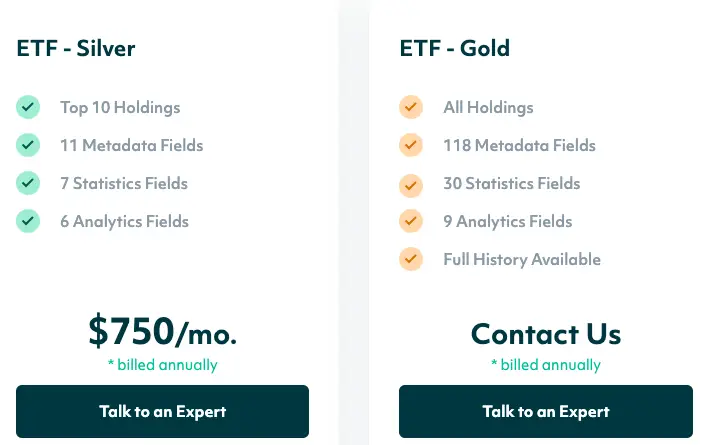

Plus, their tiered pricing structure means you can choose from bronze, silver, or gold plans, each offering a unique blend of API developer tools, dedicated customer support, and more.

Let’s break down Intrinio’s financial data packages:

- Stock Prices Packages: Access crucial stock pricing data with Bronze, Silver, & Gold Plans

- Fundamentals Packages: Access valuable fundamental data with Bronze, Silver, & Gold Plans

- Options Packages: Access comprehensive options data with Bronze, Silver, & Gold Plans

- ETF Packages: Access exchange-traded funds (EFT) data with Silver & Gold Plans

- ESG Packages: Access environmental, social, and governance data with Bronze, Silver, & Gold Plans

Intrinio’s pricing is relatively competitive, so I’ve ranked it a 4.7 in this category. Their diverse range of plans ensures a perfect fit for everyone, catering to various needs and budgets.

See below for photos of their plans and prices directly from their website:

A Guide to Getting Started with Intrinio

Ready to dive into Intrinio but unsure where to start? Look no further! I’ve tested out Intrinio myself and crafted this all-inclusive Intrinio Python API guide to help you populate your equity backtesting database with stock market data from Intrinio. You’ll learn how to harness the power of their open-source Python SDK, making your data-importing journey a breeze.

In this comprehensive guide, I’ll walk you through the entire process of signing up for Intrinio, installing the Intrinio Python SDK, and accessing the data you need. By the end of this adventure, you’ll be an Intrinio whiz, ready to conquer the world of stock market data.

I’ve also had the pleasure of writing several insightful blog posts for Intrinio, diving deep into how their cutting-edge platform can revolutionize your trading strategies. So if you’re hungry for more resources, look no further than my helpful Intrinio Blog Posts!

Intrinio’s Customer Support and Resources

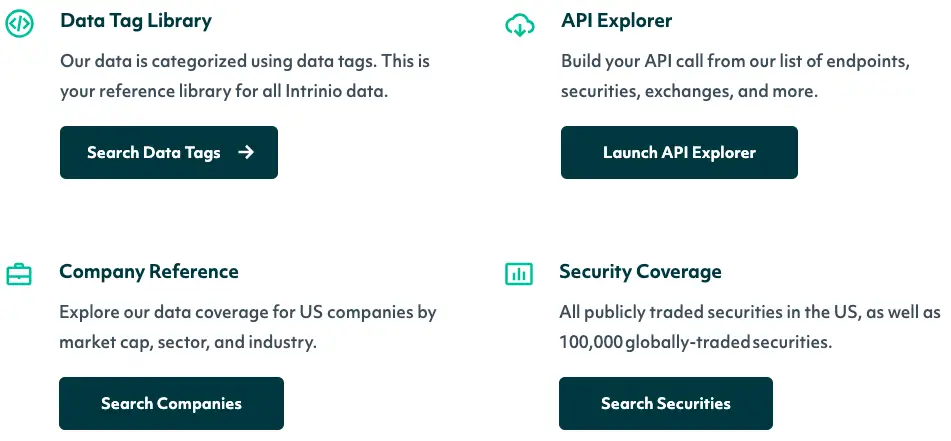

Intrinio excels when it comes to customer service, ensuring users experience nothing short of satisfaction. Their website boasts a comprehensive Help Center, offering multiple avenues for users to connect with the team. Whether it’s submitting a support request ticket, engaging in live-chat, or sending an email to customer support, Intrinio has you covered.

I put their live-chat feature to the test myself and was delighted with the prompt, friendly responses from an actual human being. Some market data API providers connect you with a robot, which can be incredibly frustrating. The representative I chatted with even followed up the next day, asking if I needed further assistance.

But the Help Center doesn’t stop there; it also provides Intrinio Data Tools such as a Data Tag Library and an API Explorer, among others. These invaluable tools are entirely free for all Intrinio users, making navigation through their software a breeze.

But what truly sets Intrinio apart is its commitment to go the extra mile for its users. If you need a database for assets they don’t have, like crypto or indices, Intrinio won’t leave you hanging. Instead, their team will leverage their resources and connections to find a company that can fulfill your needs.

In my opinion, Intrinio’s unwavering dedication to customer satisfaction and resourcefulness make them an exceptional choice for financial data solutions.

Community Insights: Real Experiences from Intrinio’s Users

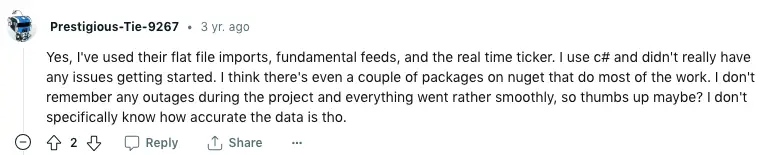

But don’t just rely on my opinion! Let’s dive into the thoughts and experiences of real traders and analysts who have used Intrinio to elevate their game!

One Intrinio enthusiast shared their delightful experience of seamlessly accessing real-time fundamental data, which contributed to the smooth sailing of their project.

Another Intrinio user shared their outstanding experience, applauding the platform’s seamless integration of REST APIs, which makes data access a walk in the park.

Naturally, not everyone shares the same positive thoughts on Intrinio. One Reddit user has avoided the platform, as some of their data packages require you to to contact the team before receiving a pricing estimate.

One ex-Intrinio user says that the platform’s fundamental data was flawed, but conceded that this was years ago and it may have improved since (which I’ve found to be the case).

While no market data API platform is perfect, Intrinio delivers an impressive array of advantages at a competitive price, making it challenging to beat!

Boost Your Trading Performance with Intrinio

Curious about Intrinio’s offerings but hesitant to take the plunge? Fear not! Intrinio provides a two-week free trial for any of their products – a fantastic feature that I really appreciate.

Plus, they offer a whopping 20% discount for users who choose an annual subscription and utilize Plaid for ACH payments. So, if you’re on the hunt for even more budget-friendly options, this is an unbeatable deal to seize!

Frequently Asked Questions (FAQ)

Now let’s answer frequently asked questions that traders and quant analysts have about Intrinio’s API!

What is Intrinio’s rate limit?

Intrinio’s standard enterprise solution request limit is 2,000 calls a minute and 600 calls per data feed plan.

Is Intrinio API free?

No, the Intrinio API isn’t free, with prices spanning from $150-1,175. However, they offer a two-week free trial where users can access any data package.

What are alternatives to Intrinio?

Alternatives to Intrinio include Nasdaq Data Link, Twelve Data, Tradier, and Polygon.io.

Who owns Intrinio?

Rachel Carpenter is the co-founder & CEO of Intrinio.

Market Data Industry: How Intrinio Adapts to Trends & Challenges

As the financial industry and stock market continue to evolve at breakneck speed, market data API providers must stay agile to keep up with modern data technologies. Intrinio is no exception, and they’ve embraced this challenge by creating some of the best APIs in the market. Intrinio’s REST APIs allow for simple and efficient data retrieval, ensuring a smooth user experience. Plus, Intrinio offers the option to access real-time data more quickly through WebSockets technology.

However, there’s always room for growth. I believe that Intrinio could expand its adaptability by broadening its market coverage. At present, they don’t offer assets such as cryptocurrencies, indices, or international market data.

Another area where Intrinio could elevate their game is by delivering better fundamental data. Take Sharadar, for instance – when I first used their data in 2020, I found it superior to Intrinio, thanks to their team’s meticulous adjustments and verification processes. I found that Intrinio, on the other hand, relies more on algorithmic data scraping, making it slightly less accurate.

By enhancing the quality and accuracy of their fundamental data, Intrinio will not only become a formidable competitor but also an irresistible choice for users seeking the best financial data experience.

Conclusion: Enhance Your Performance with Intrinio

Overall, Intrinio’s market data API solution emerges as a powerhouse for traders and quantitative analysts in search of excellent financial data quality. With its robust REST APIs, remarkable scalability, and easy-to-use interface, Intrinio has established itself as a top-tier data provider for trading and investment research and quantitative analysis.

While I admit that there is room for improvement, such as broadening its market coverage, the platform’s unwavering dedication to customer satisfaction and ongoing innovation make it a formidable player in the market data arena. Boasting a wealth of features and competitive pricing, Intrinio is a must-consider option for anyone looking to elevate their trading prowess and make well-informed decisions in the financial markets.